Liberty Broadband (LBRDK)

We see potential in Liberty Broadband, but the state of its balance sheet makes us slightly uncomfortable.― StockStory Analyst Team

1. News

2. Summary

Why Liberty Broadband Is Not Exciting

Operating across the United States, Liberty Broadband (NASDAQ:LBRDK) is a provider of high-speed internet, cable television, and telecommunications services across various markets.

- Negative free cash flow raises questions about the return timeline for its investments

- Push for growth has led to negative returns on capital, signaling value destruction

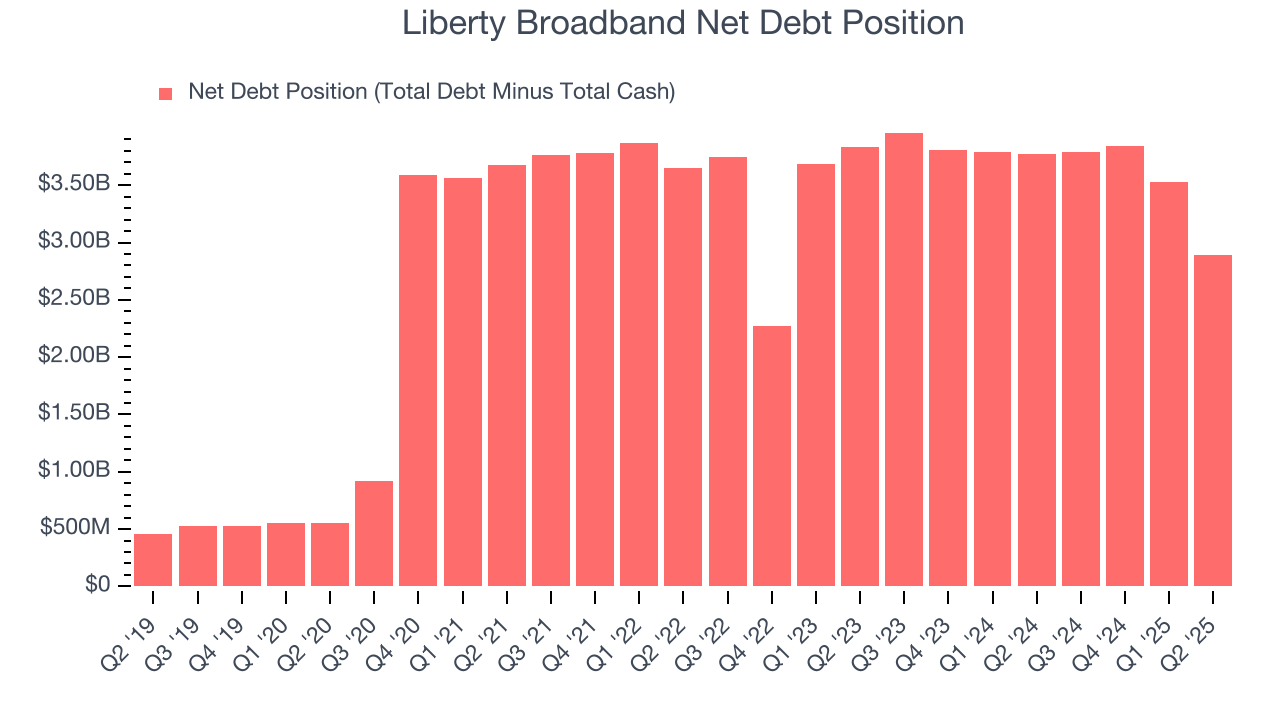

- High net-debt-to-EBITDA ratio of 29× increases the risk of forced asset sales or dilutive financing if operational performance weakens

Liberty Broadband has some noteworthy aspects, but we’d refrain from investing until its EBITDA can comfortably support its debt.

Why There Are Better Opportunities Than Liberty Broadband

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Liberty Broadband

Liberty Broadband’s stock price of $46.37 implies a valuation ratio of 1.2x forward EV-to-EBITDA. The current valuation may be appropriate, but we’re still not buyers of the stock.

It’s better to pay up for high-quality businesses with strong long-term earnings potential rather than buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Liberty Broadband (LBRDK) Research Report: Q2 CY2025 Update

Telecommunications and cable service provider Liberty Broadband (NASDAQ:LBRDK) announced better-than-expected revenue in Q2 CY2025, with sales up 6.1% year on year to $261 million. Its GAAP profit of $2.68 per share increased from $1.36 in the same quarter last year.

Liberty Broadband (LBRDK) Q2 CY2025 Highlights:

- Revenue: $261 million vs analyst estimates of $251.7 million (6.1% year-on-year growth, 3.7% beat)

- Adjusted EBITDA: $113 million vs analyst estimates of $78.9 million (43.3% margin, 43.2% beat)

- Operating Margin: 15.7%, up from 8.5% in the same quarter last year

- Free Cash Flow was $37 million, up from -$35 million in the same quarter last year

- Market Capitalization: $8.54 billion

Company Overview

Operating across the United States, Liberty Broadband (NASDAQ:LBRDK) is a provider of high-speed internet, cable television, and telecommunications services across various markets.

Liberty Broadband was established as part of the Liberty Media Corporation's strategy to focus on its broadband operations. The company recognized the increasing importance of reliable telecommunications in personal and professional spheres, and its creation was a response to the need for robust infrastructure to support the burgeoning internet and cable TV markets.

The company primarily provides high-speed internet services, cable television, and telecommunications solutions. By offering a range of packages and services, Liberty Broadband caters to a large customer base, from individual households to businesses, all requiring different levels of service and connectivity.

Liberty Broadband's revenue is primarily derived from its internet and cable service subscriptions, and its offerings appeal to consumers seeking comprehensive, reliable, and efficient telecommunications services.

As you will see in our report, Liberty Broadband's historical financials are distorted due to its merger with GCI Liberty in December 2020. GCI Liberty’s assets consisted of its subsidiary GCI Holdings (GCI) and interests in Liberty Broadband and Charter Communications (NASDAQ:CHTR). According to the company, "GCI is Alaska’s largest communications provider, providing data, wireless, video, voice, and managed services to consumer and business customers throughout Alaska and nationwide". Regarding Liberty Broadband's interest in Charter Communications, the two companies hold a close relationship as Liberty invested $5 billion into Charter in 2016.

4. Advertising & Marketing Services

The sector is on the precipice of both disruption and growth as AI, programmatic advertising, and data-driven marketing reshape how things are done. For example, the advent of the Internet broadly and programmatic advertising specifically means that brand building is not a relationship business anymore but instead one based on data and technology, which could hurt traditional ad agencies. On the other hand, the companies in the sector that beef up their tech chops by automating the buying of ad inventory or facilitating omnichannel marketing, for example, stand to benefit. With or without advances in digitization and AI, the sector is still highly levered to the macro, and economic uncertainty may lead to fluctuating ad spend, particularly in cyclical industries.

Competitors in the broadband internet and cable services industry include Comcast (NASDAQ:CMCSA) and WideOpenWest (NYSE:WOW). Charter Communications (NASDAQ:CHTR) could also be considered a competitor, but we are excluding it because Liberty Broadband holds an equity interest in the company.

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $1.05 billion in revenue over the past 12 months, Liberty Broadband is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

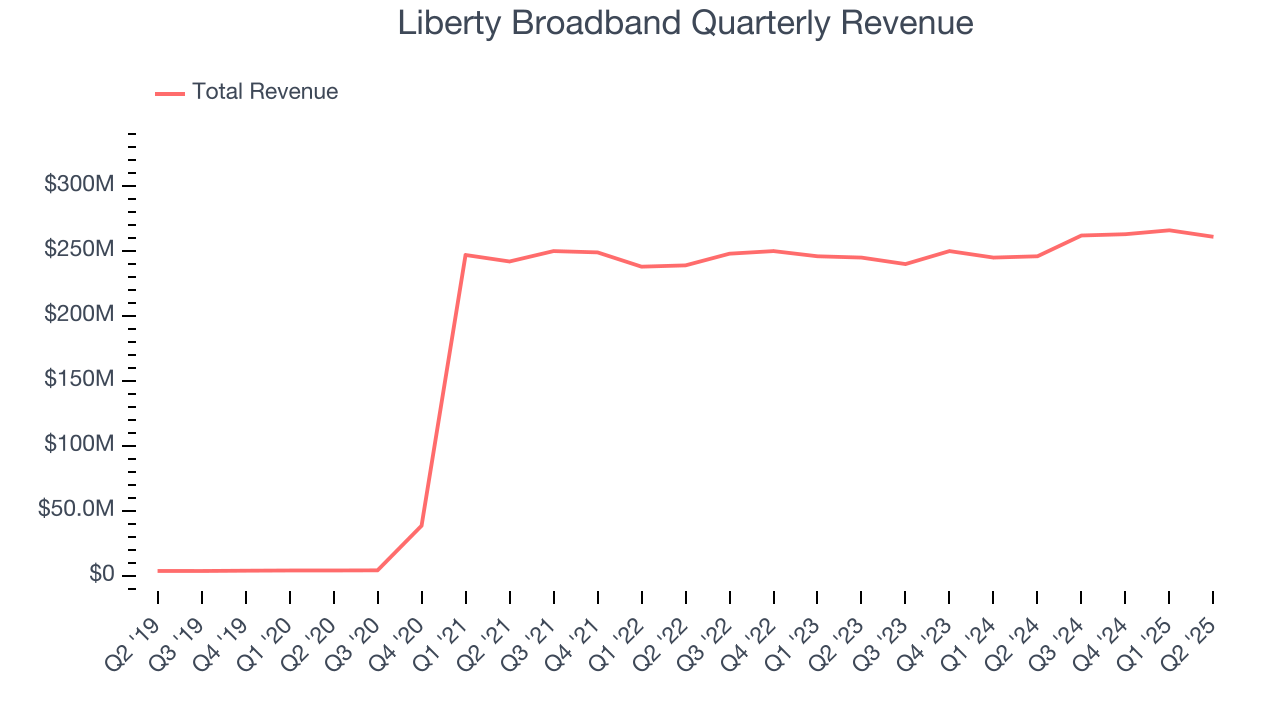

As you can see below, Liberty Broadband grew its sales at an incredible 131% compounded annual growth rate over the last five years. This shows it had high demand, a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Liberty Broadband’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 3.1% over the last two years was well below its five-year trend.

This quarter, Liberty Broadband reported year-on-year revenue growth of 6.1%, and its $261 million of revenue exceeded Wall Street’s estimates by 3.7%.

Looking ahead, sell-side analysts expect revenue to grow 3% over the next 12 months, similar to its two-year rate. This projection is underwhelming and implies its newer products and services will not accelerate its top-line performance yet.

6. Operating Margin

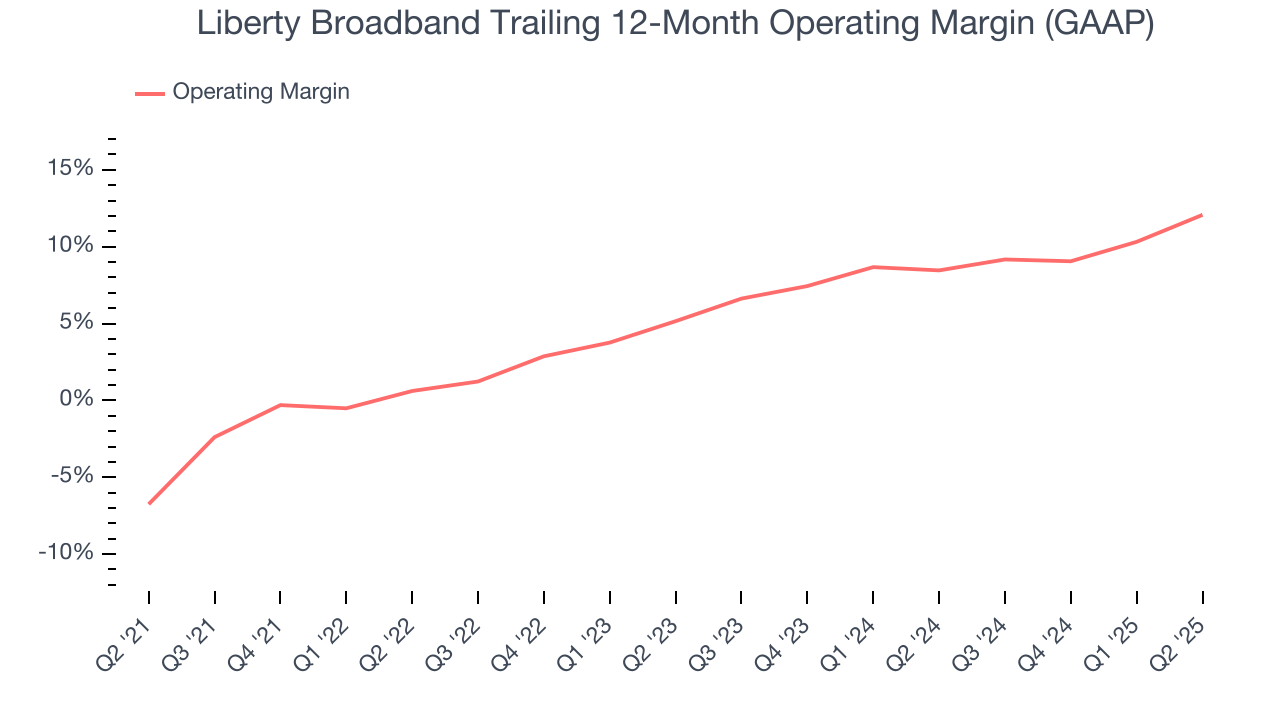

Liberty Broadband was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.1% was weak for a business services business.

On the plus side, Liberty Broadband’s operating margin rose by 18.8 percentage points over the last five years, as its sales growth gave it immense operating leverage.

This quarter, Liberty Broadband generated an operating margin profit margin of 15.7%, up 7.2 percentage points year on year. This increase was a welcome development and shows it was more efficient.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

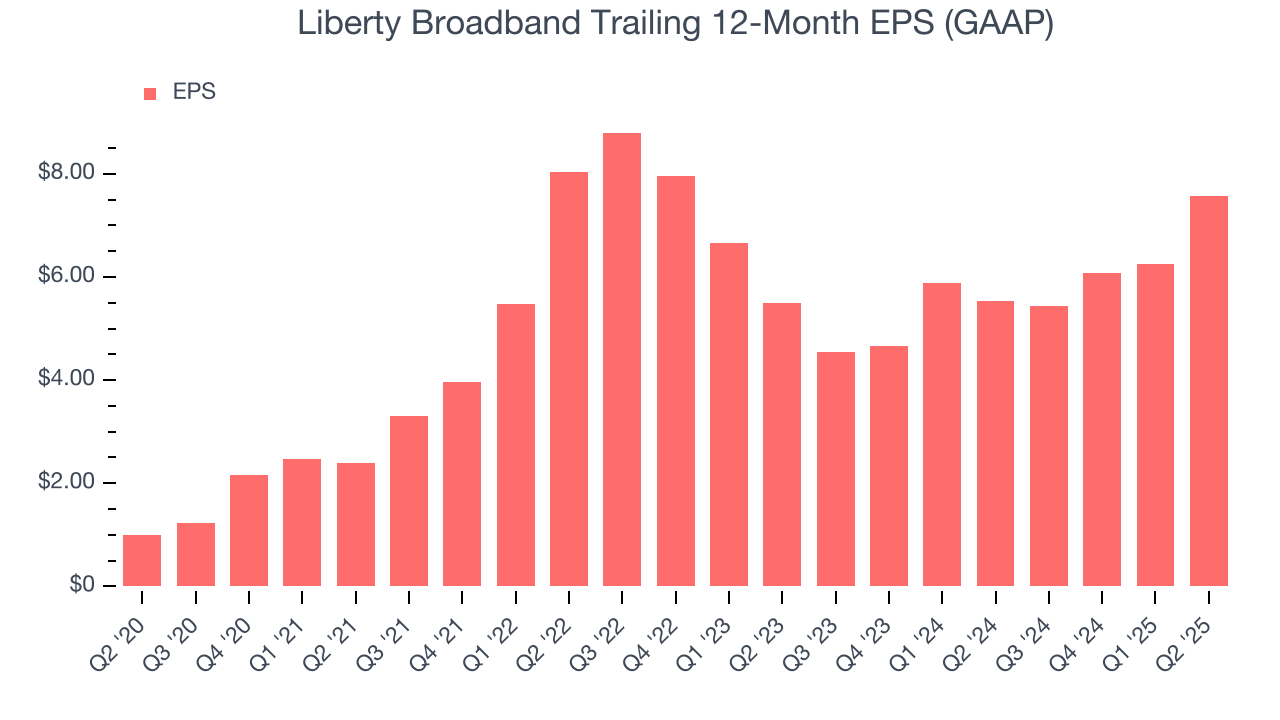

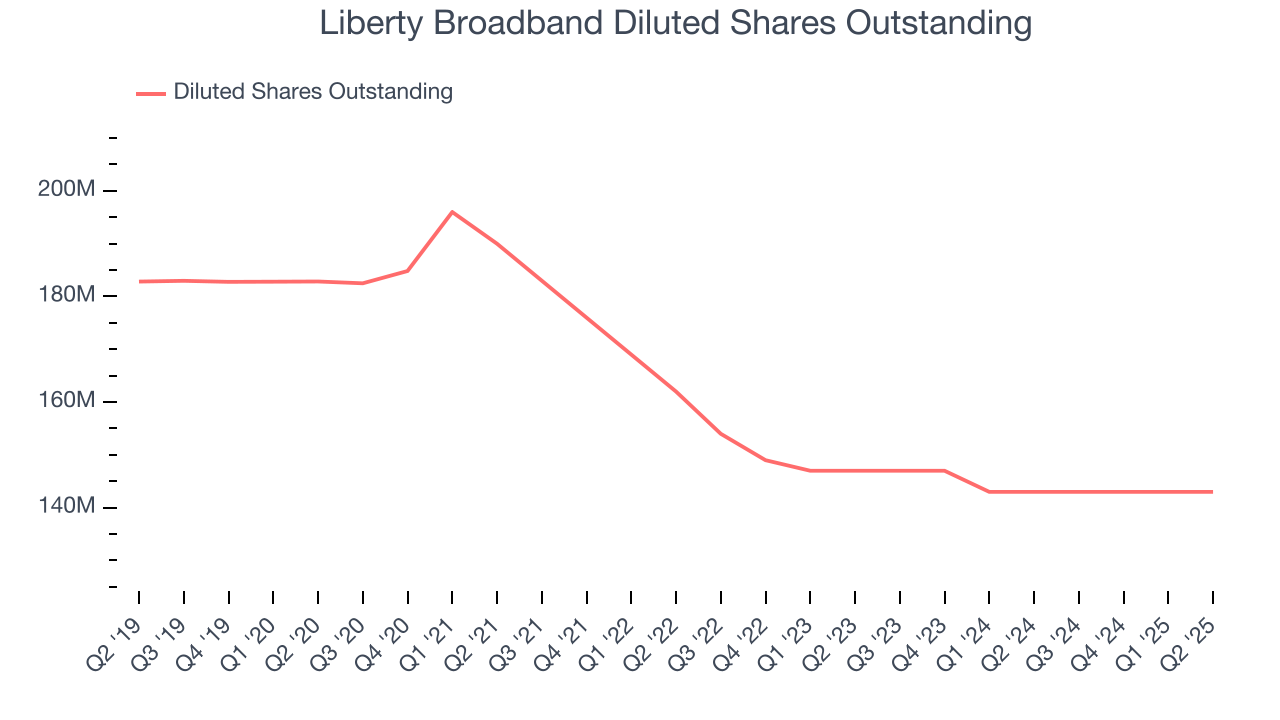

Liberty Broadband’s EPS grew at an astounding 49.9% compounded annual growth rate over the last five years. Despite its operating margin improvement and share repurchases during that time, this performance was lower than its 131% annualized revenue growth, telling us the delta came from reduced interest expenses or taxes.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Liberty Broadband’s two-year annual EPS growth of 17.4% was great and topped its 3.1% two-year revenue growth.

We can take a deeper look into Liberty Broadband’s earnings to better understand the drivers of its performance. Liberty Broadband’s operating margin has expanded by 6.3 percentage points over the last two yearswhile its share count has shrunk 2.7%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q2, Liberty Broadband reported EPS at $2.68, up from $1.36 in the same quarter last year. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

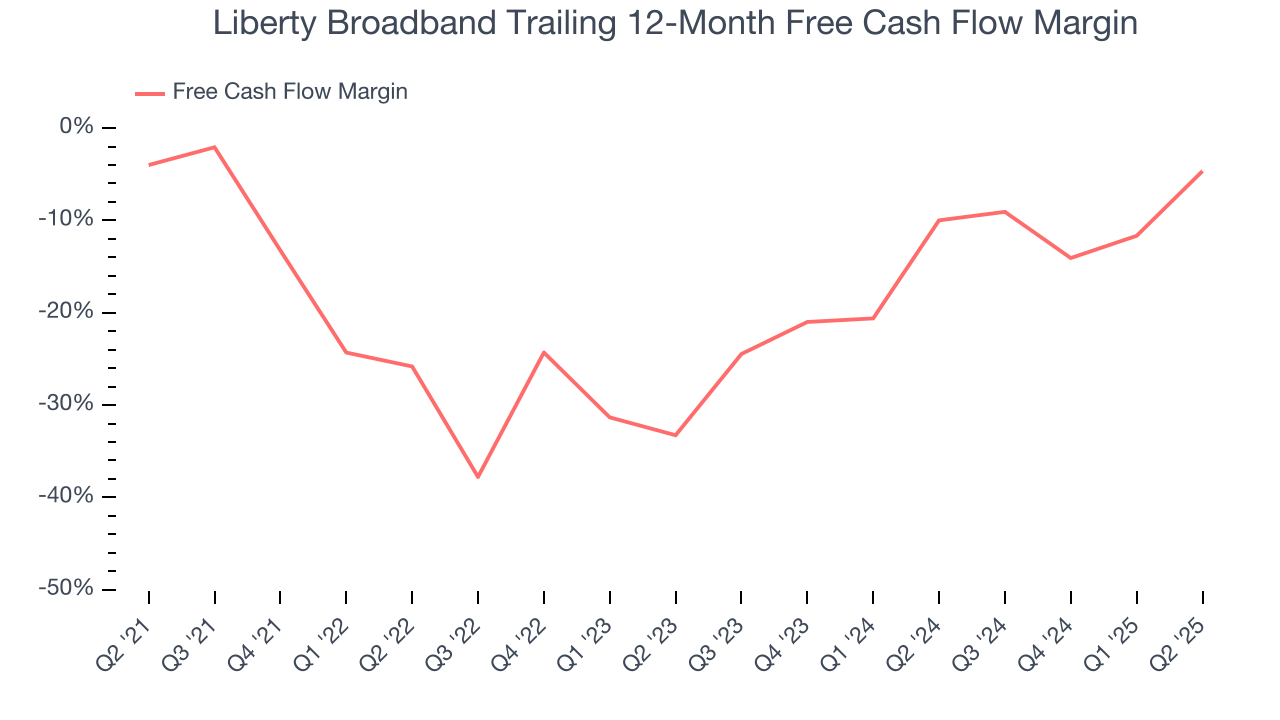

While Liberty Broadband posted positive free cash flow this quarter, the broader story hasn’t been so clean. Liberty Broadband’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 16.5%, meaning it lit $16.54 of cash on fire for every $100 in revenue.

Liberty Broadband’s free cash flow clocked in at $37 million in Q2, equivalent to a 14.2% margin. Its cash flow turned positive after being negative in the same quarter last year

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Liberty Broadband’s five-year average ROIC was negative 0.9%, meaning management lost money while trying to expand the business. Its returns were among the worst in the business services sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Liberty Broadband’s ROIC has stayed the same over the last few years. If the company wants to become an investable business, it must improve its returns by generating more profitable growth.

10. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Liberty Broadband burned through $49 million of cash over the last year, and its $3.07 billion of debt exceeds the $180 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Liberty Broadband’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Liberty Broadband until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

11. Key Takeaways from Liberty Broadband’s Q2 Results

We enjoyed seeing Liberty Broadband beat analysts’ revenue expectations this quarter. Zooming out, we think this was a good print with some key areas of upside. The market seemed to be hoping for more, and the stock traded down 1.5% to $58.67 immediately after reporting.

12. Is Now The Time To Buy Liberty Broadband?

Updated: October 30, 2025 at 10:59 PM EDT

Before deciding whether to buy Liberty Broadband or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Liberty Broadband is a pretty decent company if you ignore its balance sheet. First off, its revenue growth was exceptional over the last five years. And while Liberty Broadband’s relatively low ROIC suggests management has struggled to find compelling investment opportunities, its expanding operating margin shows the business has become more efficient.

Liberty Broadband’s EV-to-EBITDA ratio based on the next 12 months is 43.3x. All that said, we aren’t investing at the moment because its balance sheet makes us balk. Interested in this company and its prospects? We recommend you wait until its debt load falls or its profits increase.

Wall Street analysts have a consensus one-year price target of $99 on the company (compared to the current share price of $54.13).