Littelfuse (LFUS)

We’re wary of Littelfuse. Its weak sales growth and declining returns on capital show its demand and profits are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think Littelfuse Will Underperform

The developer of the first blade-type automotive fuse, Littelfuse (NASDAQ:LFUS) provides electrical protection and control components for the automotive, industrial, electronics, and telecommunications industries.

- A bright spot is that its strong free cash flow margin of 14% gives it the option to reinvest, repurchase shares, or pay dividends, and its improved cash conversion implies it’s becoming a less capital-intensive business

Littelfuse fails to meet our quality criteria. We’re redirecting our focus to better businesses.

Why There Are Better Opportunities Than Littelfuse

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Littelfuse

Littelfuse is trading at $296.20 per share, or 23.9x forward P/E. The current valuation may be appropriate, but we’re still not buyers of the stock.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. Littelfuse (LFUS) Research Report: Q4 CY2025 Update

Electronic component provider Littelfuse (NASDAQ:LFUS) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 12.2% year on year to $593.9 million. On top of that, next quarter’s revenue guidance ($635 million at the midpoint) was surprisingly good and 3.5% above what analysts were expecting. Its non-GAAP profit of $2.69 per share was 6.2% above analysts’ consensus estimates.

Littelfuse (LFUS) Q4 CY2025 Highlights:

- Revenue: $593.9 million vs analyst estimates of $582.1 million (12.2% year-on-year growth, 2% beat)

- Adjusted EPS: $2.69 vs analyst estimates of $2.53 (6.2% beat)

- Adjusted EBITDA: $121.6 million vs analyst estimates of $119 million (20.5% margin, 2.2% beat)

- Revenue Guidance for Q1 CY2026 is $635 million at the midpoint, above analyst estimates of $613.4 million

- Adjusted EPS guidance for Q1 CY2026 is $2.80 at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: -37.5%, down from -6.9% in the same quarter last year

- Free Cash Flow Margin: 0%, down from 25.5% in the same quarter last year

- Market Capitalization: $7.38 billion

Company Overview

The developer of the first blade-type automotive fuse, Littelfuse (NASDAQ:LFUS) provides electrical protection and control components for the automotive, industrial, electronics, and telecommunications industries.

Littelfuse originally focused on manufacturing fuses for the automotive industry when it was founded in 1927. Its first pivotal acquisition, Teccor Electronics, enabled it to expand into the circuit protection market. Other acquisitions such as Heinrich Industries and IXYS expanded its market presence, offerings, and capabilities in different markets.

Today, Littelfuse's products cater to the automotive, industrial, electronics, and telecommunication industries, specializing in providing components for electrical protection and control. Its product portfolio includes fuses, circuit breakers, power semiconductors, and sensors that are sold to a consumer base ranging from manufacturers to utility providers.

Littelfuse sells its products through direct sales and distribution channels. The company engages in various types of contracts, including agreements with original equipment manufacturers (OEMs), distributors, and end-users. These contracts often involve long-term supply agreements (pricing agreements and volume commitments) to ensure consistent availability of products for manufacturing processes and ongoing operations. Littelfuse also offers volume discounts to OEMs as an incentive to purchase larger quantities of products, helping both parties cut costs.

4. Electronic Components

Like many equipment and component manufacturers, electronic components companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include data centers and telecommunications, which can benefit companies whose optical and transceiver offerings fit those markets. But like the broader industrials sector, these companies are also at the whim of economic cycles. Consumer spending, for example, can greatly impact these companies’ volumes.

Competitors offering similar products include Eaton (NYSE:ETN), ON Semiconductor (NASDAQ:ON), and Bourns (private).

5. Revenue Growth

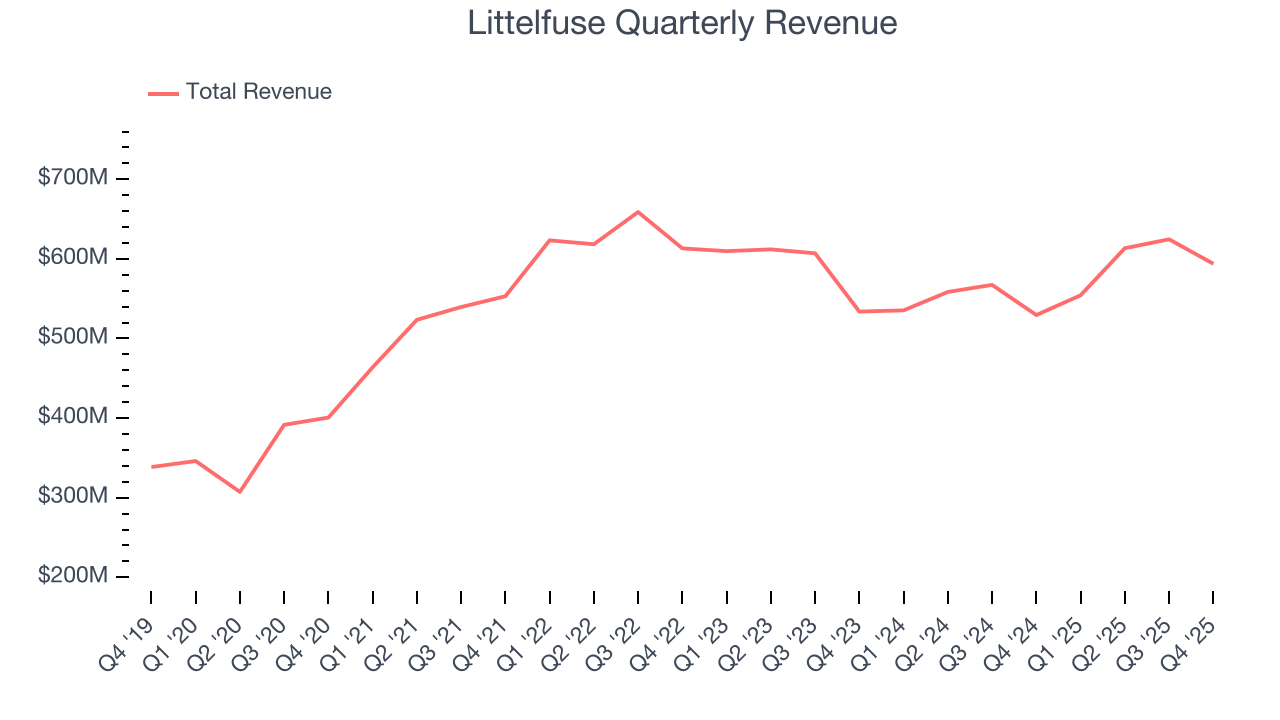

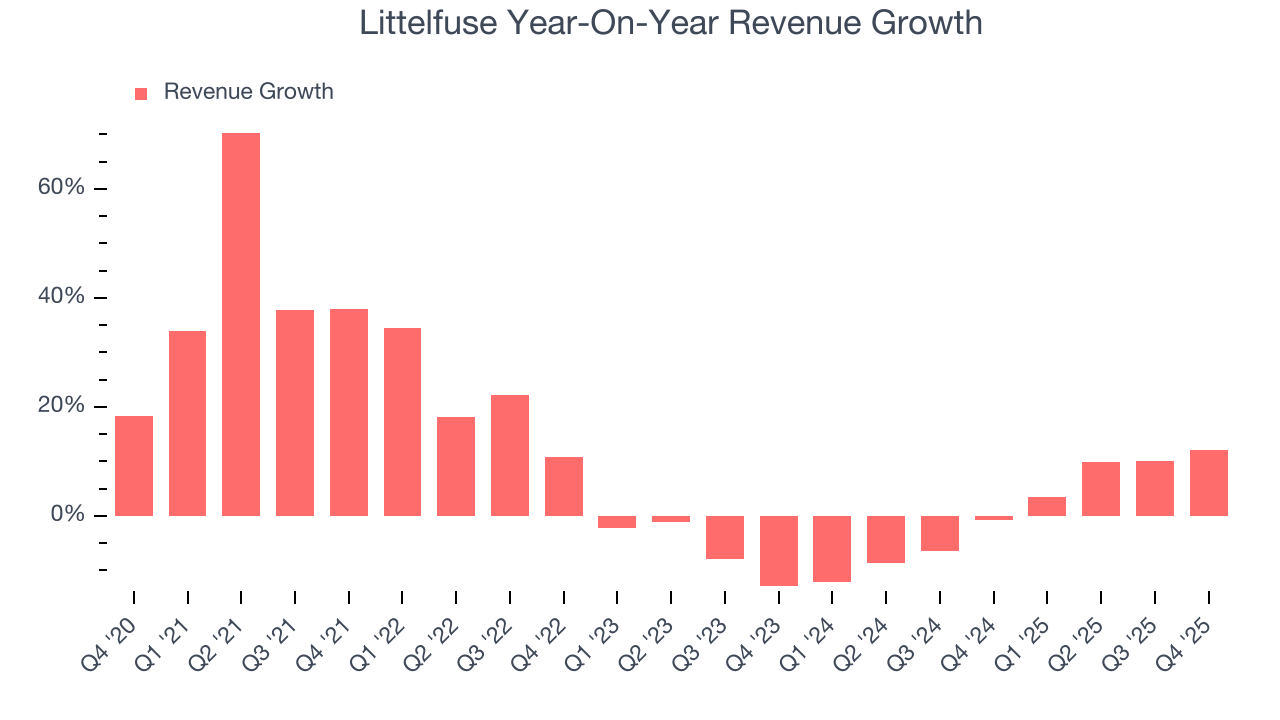

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Littelfuse’s 10.5% annualized revenue growth over the last five years was impressive. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Littelfuse’s recent performance shows its demand has slowed significantly as its revenue was flat over the last two years.

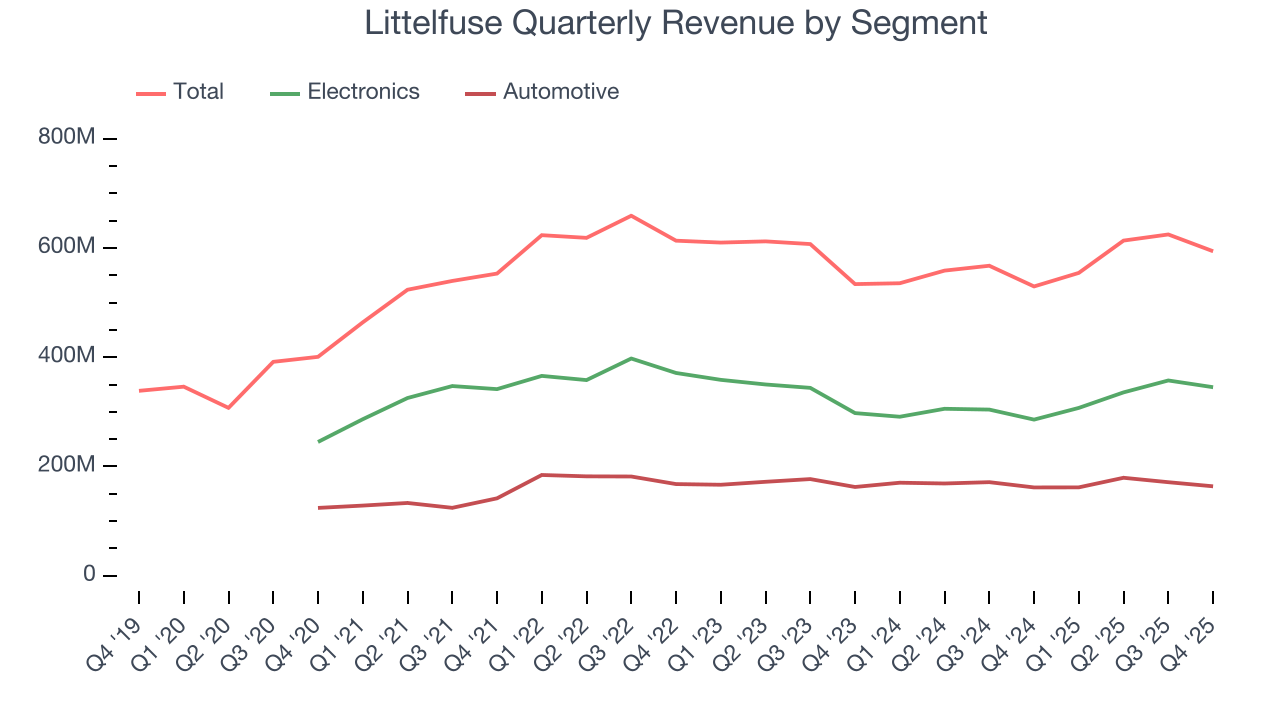

We can dig further into the company’s revenue dynamics by analyzing its most important segments, Electronics and Automotive, which are 58.1% and 27.6% of revenue. Over the last two years, Littelfuse’s Electronics (fuses and switches) and Automotive (trucks, commercial machinery, marine) revenues were flat.

This quarter, Littelfuse reported year-on-year revenue growth of 12.2%, and its $593.9 million of revenue exceeded Wall Street’s estimates by 2%. Company management is currently guiding for a 14.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and suggests its newer products and services will catalyze better top-line performance.

6. Gross Margin & Pricing Power

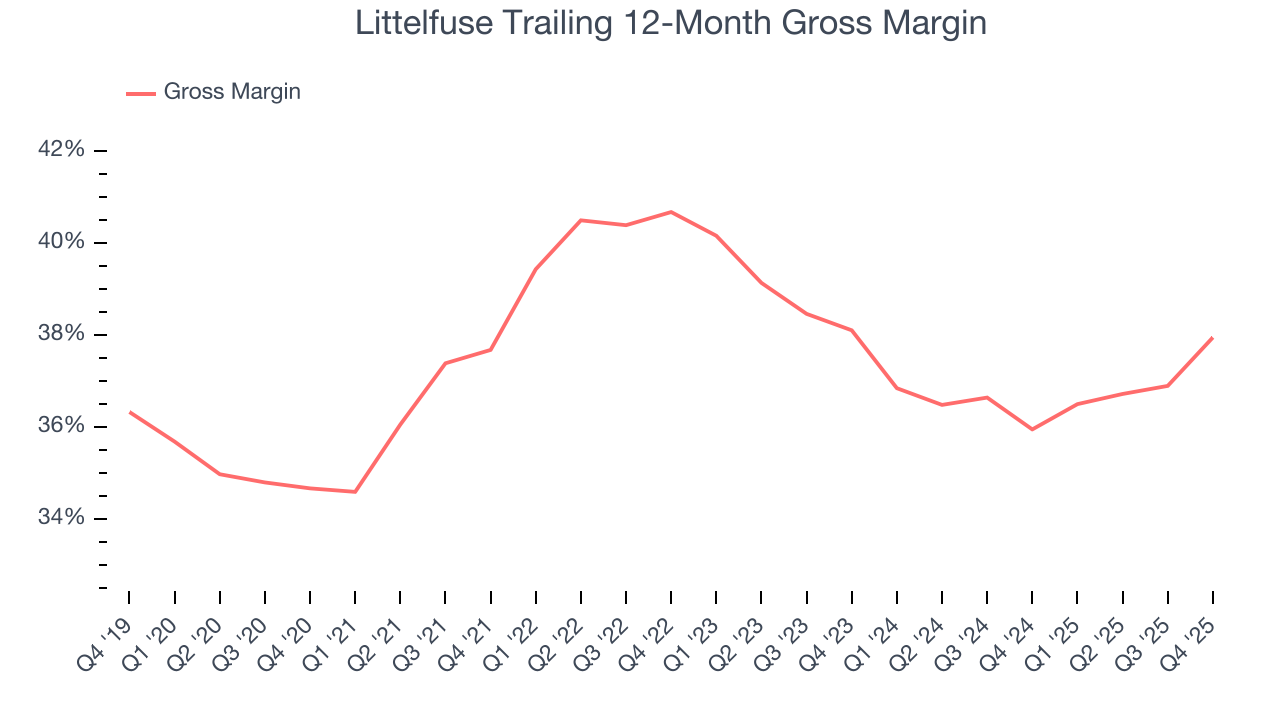

Littelfuse’s unit economics are great compared to the broader industrials sector and signal that it enjoys product differentiation through quality or brand. As you can see below, it averaged an excellent 38.1% gross margin over the last five years. Said differently, roughly $38.15 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

Littelfuse’s gross profit margin came in at 38% this quarter, up 4.6 percentage points year on year. Littelfuse’s full-year margin has also been trending up over the past 12 months, increasing by 2 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

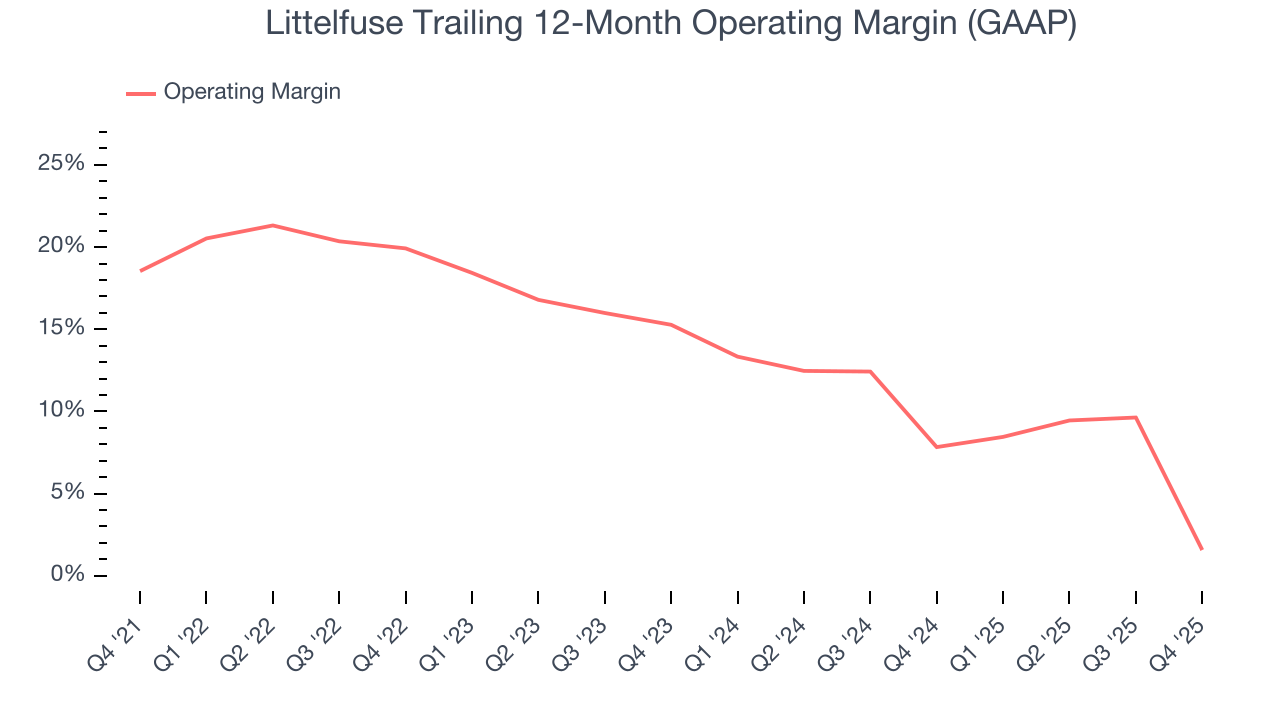

7. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Littelfuse has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 12.6%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Littelfuse’s operating margin decreased by 17 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Littelfuse generated an operating margin profit margin of negative 37.5%, down 30.6 percentage points year on year. Conversely, its revenue and gross margin actually rose, so we can assume it was less efficient because its operating expenses like marketing, R&D, and administrative overhead grew faster than its revenue.

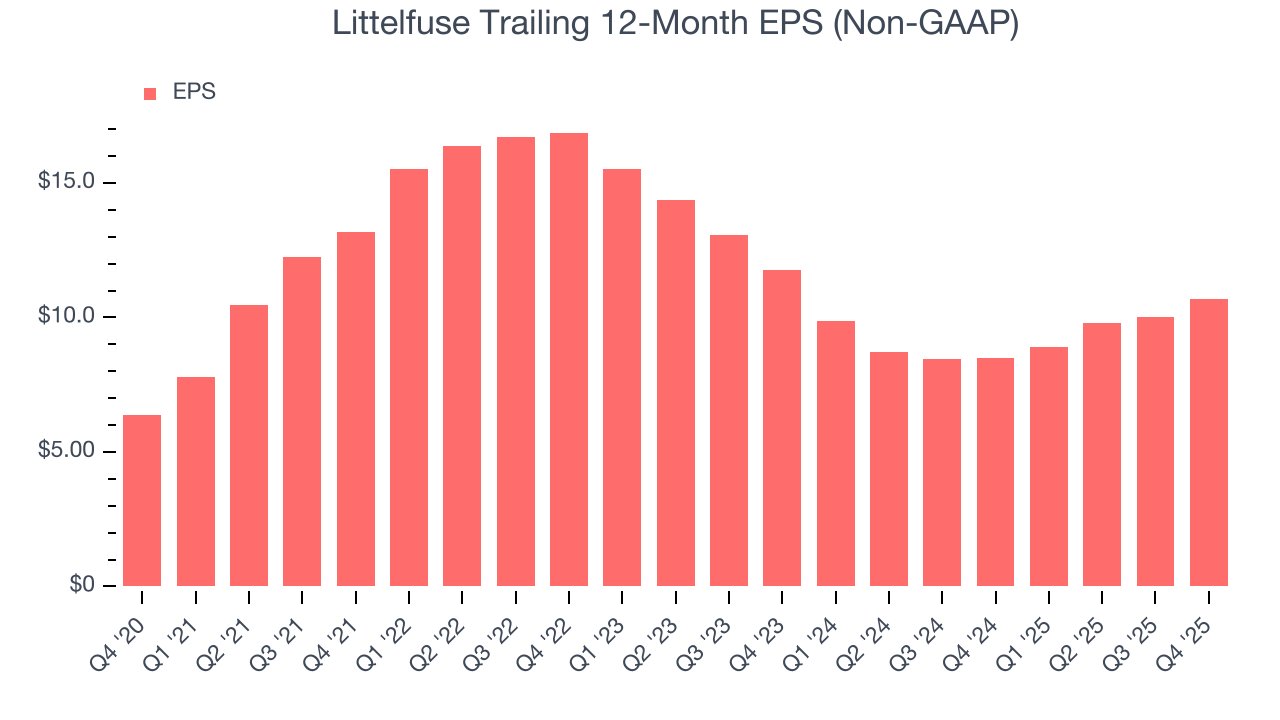

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Littelfuse’s solid 10.8% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Littelfuse’s two-year annual EPS declines of 4.7% were bad and lower than its flat revenue.

Diving into the nuances of Littelfuse’s earnings can give us a better understanding of its performance. Littelfuse’s operating margin has declined over the last two years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Littelfuse reported adjusted EPS of $2.69, up from $2.04 in the same quarter last year. This print beat analysts’ estimates by 6.2%. Over the next 12 months, Wall Street expects Littelfuse’s full-year EPS of $10.68 to grow 18.3%.

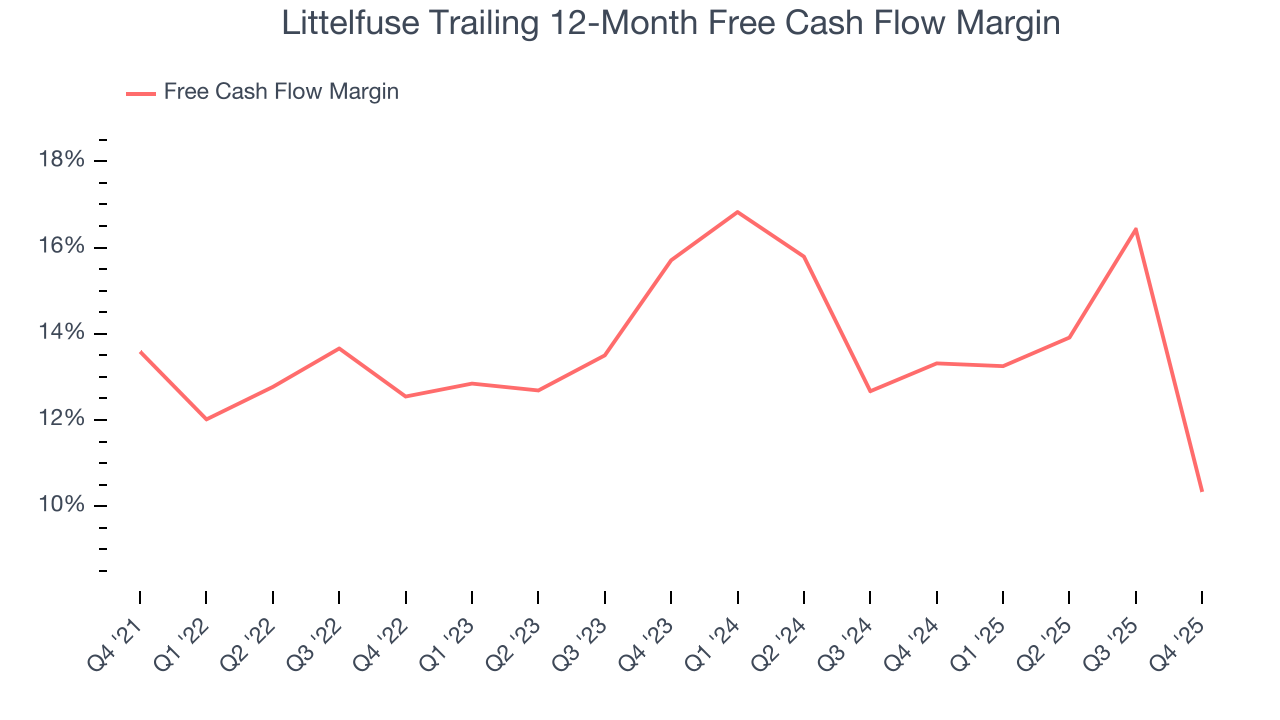

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Littelfuse has shown robust cash profitability, enabling it to comfortably ride out cyclical downturns while investing in plenty of new offerings and returning capital to investors. The company’s free cash flow margin averaged 13.1% over the last five years, quite impressive for an industrials business.

Taking a step back, we can see that Littelfuse’s margin dropped by 3.3 percentage points during that time. Continued declines could signal it is in the middle of an investment cycle.

Littelfuse broke even from a free cash flow perspective in Q4. The company’s cash profitability regressed as it was 25.4 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

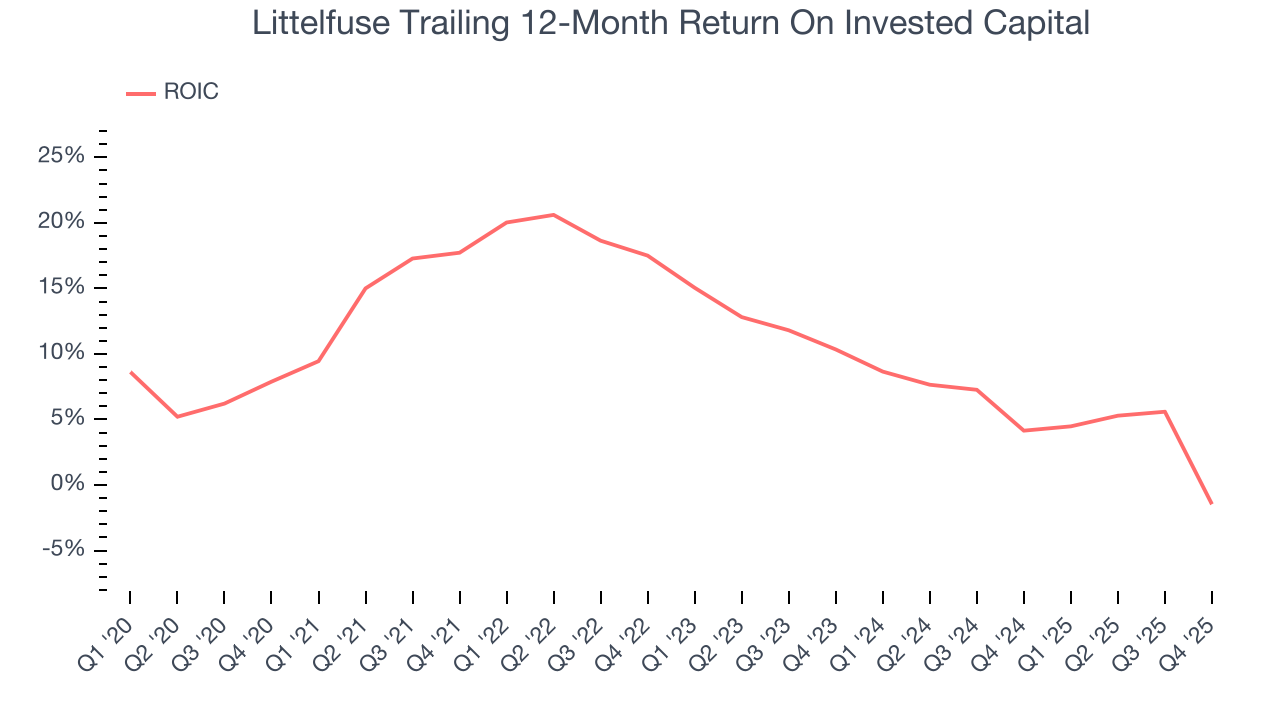

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Littelfuse historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 9.7%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Littelfuse’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

11. Balance Sheet Assessment

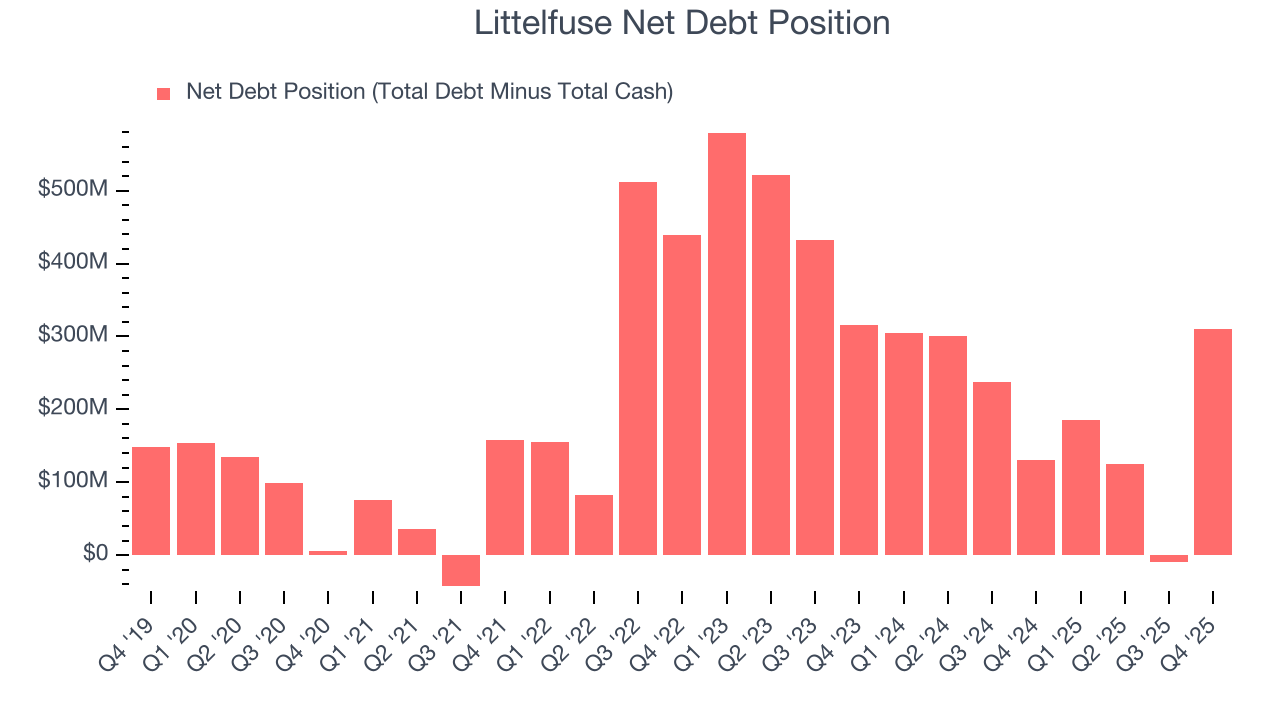

Littelfuse reported $563.7 million of cash and $874.4 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $498.5 million of EBITDA over the last 12 months, we view Littelfuse’s 0.6× net-debt-to-EBITDA ratio as safe. We also see its $17.74 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Littelfuse’s Q4 Results

We were impressed by how significantly Littelfuse blew past analysts’ Electronics revenue expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock remained flat at $296.20 immediately after reporting.

13. Is Now The Time To Buy Littelfuse?

Updated: January 28, 2026 at 7:25 AM EST

Before deciding whether to buy Littelfuse or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

We see the value of companies helping their customers, but in the case of Littelfuse, we’re out. Although its revenue growth was impressive over the last five years, it’s expected to deteriorate over the next 12 months and its diminishing returns show management's prior bets haven't worked out. And while the company’s projected EPS for the next year implies the company’s fundamentals will improve, the downside is its declining operating margin shows the business has become less efficient.

Littelfuse’s P/E ratio based on the next 12 months is 23.4x. This multiple tells us a lot of good news is priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $321.25 on the company (compared to the current share price of $296.20).