LGI Homes (LGIH)

LGI Homes keeps us up at night. Not only is its demand weak but also its falling returns on capital suggest it’s becoming less profitable.― StockStory Analyst Team

1. News

2. Summary

Why We Think LGI Homes Will Underperform

Based in Texas, LGI Homes (NASDAQ:LGIH) is a homebuilding company specializing in constructing affordable, entry-level single-family homes in desirable communities across the United States.

- Sales tumbled by 2.9% annually over the last five years, showing market trends are working against its favor during this cycle

- Earnings per share decreased by more than its revenue over the last five years, showing each sale was less profitable

- Limited cash reserves may force the company to seek unfavorable financing terms that could dilute shareholders

LGI Homes doesn’t satisfy our quality benchmarks. More profitable opportunities exist elsewhere.

Why There Are Better Opportunities Than LGI Homes

High Quality

Investable

Underperform

Why There Are Better Opportunities Than LGI Homes

LGI Homes’s stock price of $59.80 implies a valuation ratio of 15.8x forward P/E. LGI Homes’s valuation may seem like a bargain, especially when stacked up against other industrials companies. We remind you that you often get what you pay for, though.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. LGI Homes (LGIH) Research Report: Q4 CY2025 Update

Affordable single-family home construction company LGI Homes (NASDAQ:LGIH) missed Wall Street’s revenue expectations in Q4 CY2025, with sales falling 15% year on year to $474 million. Its non-GAAP profit of $0.97 per share was 6.2% above analysts’ consensus estimates.

LGI Homes (LGIH) Q4 CY2025 Highlights:

- Revenue: $474 million vs analyst estimates of $477.7 million (15% year-on-year decline, 0.8% miss)

- Adjusted EPS: $0.97 vs analyst estimates of $0.91 (6.2% beat)

- Operating Margin: 3.9%, down from 8.2% in the same quarter last year

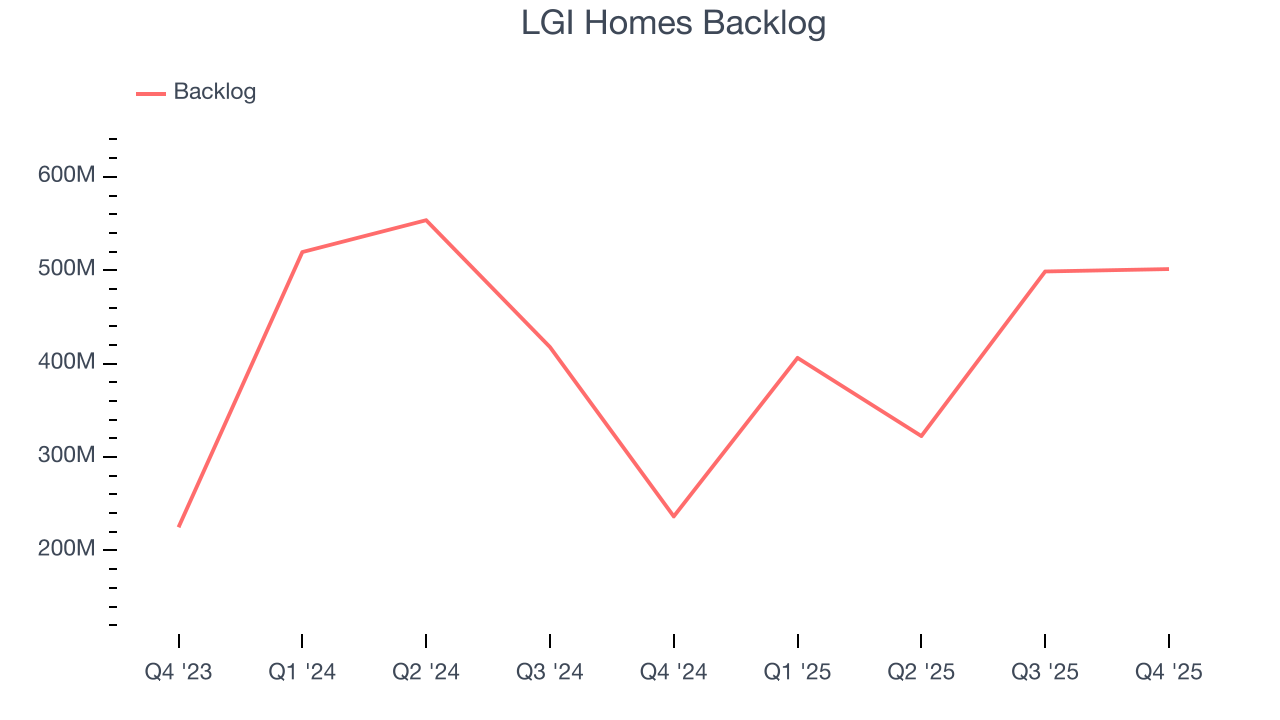

- Backlog: $501.3 million at quarter end, up 112% year on year

- Market Capitalization: $1.40 billion

Company Overview

Based in Texas, LGI Homes (NASDAQ:LGIH) is a homebuilding company specializing in constructing affordable, entry-level single-family homes in desirable communities across the United States.

LGI Homes, Inc. is a residential homebuilder focused on entry-level and active adult offerings across 30+ markets in 20+ states. The company constructs and sells attached and detached single-family homes, townhomes, and luxury homes under the LGI Homes and Terrata Homes brands.

Leveraging an efficient, streamlined construction process, LGI provides move-in ready homes with standardized features and finishes. The company's even-flow methodology enables rapid home turnaround, with average completion times of 108-150 days in 2023. LGI targets first-time and active adult buyers with compelling value propositions through affordable pricing and amenity-rich communities.

The company pursues a flexible land strategy, acquiring finished lots and raw land for residential development in high-growth markets. Geographic diversification across entry-level and move-up price segments reduces exposure to regional housing cycles. LGI's wholesale business constructs homes for bulk sale to rental operators.

LGI Homes primarily generates revenue through the sale of new single-family homes, with the bulk of payment received at closing when ownership is transferred. They don't rely on long-term contracts or milestone payments. A small deposit may be collected when a sales contract is signed, but most revenue is recognized at closing. Additional income streams include mortgage and insurance services through joint ventures and wholesale home sales to institutional investors for rental properties.

4. Home Builders

Traditionally, homebuilders have built competitive advantages with economies of scale that lead to advantaged purchasing and brand recognition among consumers. Aesthetic trends have always been important in the space, but more recently, energy efficiency and conservation are driving innovation. However, these companies are still at the whim of the macro, specifically interest rates that heavily impact new and existing home sales. In fact, homebuilders are one of the most cyclical subsectors within industrials.

Competitors in the residential home construction sector include D.R. Horton (NYSE:DHI), PulteGroup (NYSE:PHM), and Meritage Homes (NYSE:MTH).

5. Revenue Growth

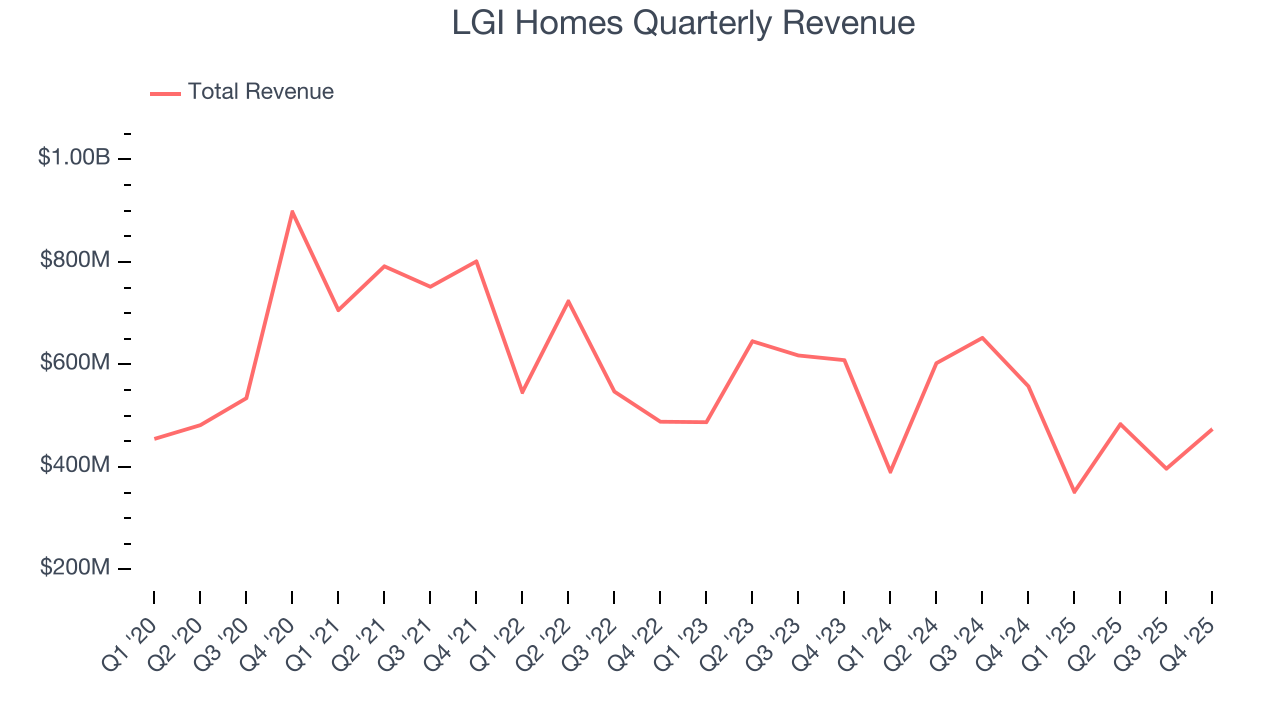

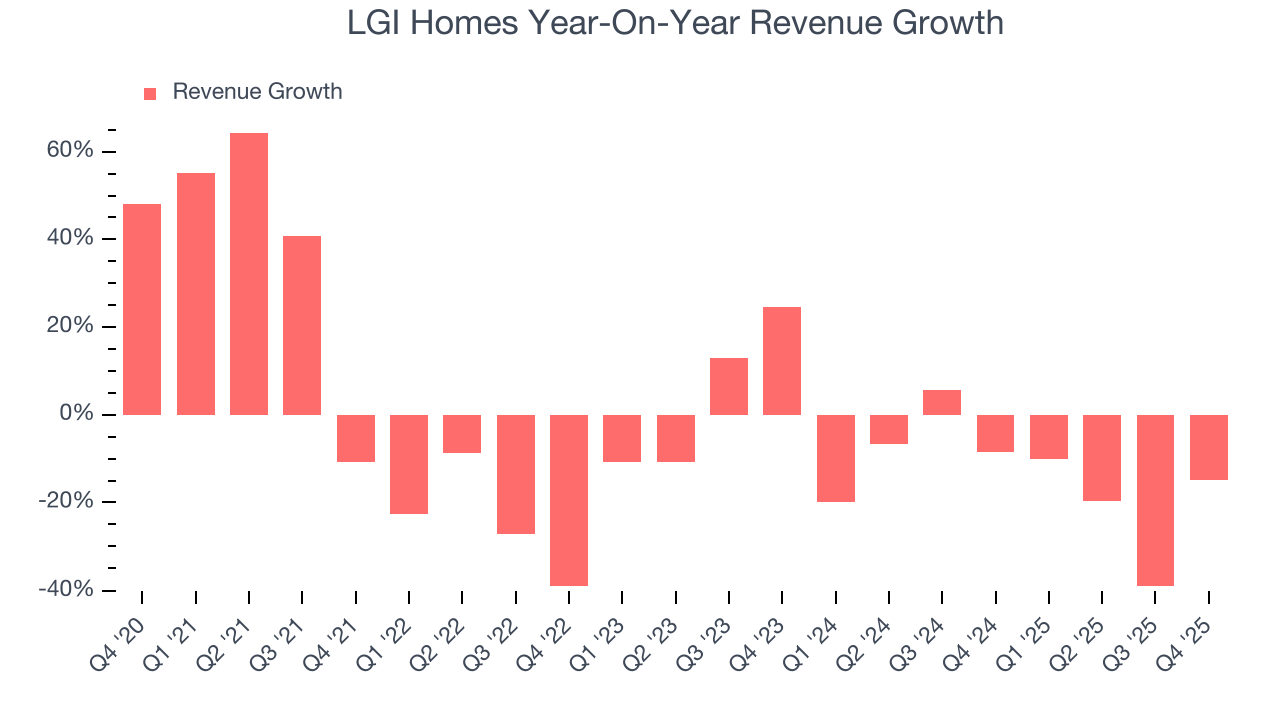

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, LGI Homes’s demand was weak and its revenue declined by 6.4% per year. This wasn’t a great result and suggests it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. LGI Homes’s recent performance shows its demand remained suppressed as its revenue has declined by 15% annually over the last two years.

We can better understand the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. LGI Homes’s backlog reached $501.3 million in the latest quarter and averaged 14.6% year-on-year growth over the last two years. Because this number is better than its revenue growth, we can see the company accumulated more orders than it could fulfill and deferred revenue to the future. This could imply elevated demand for LGI Homes’s products and services but raises concerns about capacity constraints.

This quarter, LGI Homes missed Wall Street’s estimates and reported a rather uninspiring 15% year-on-year revenue decline, generating $474 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 4.5% over the next 12 months. While this projection implies its newer products and services will spur better top-line performance, it is still below average for the sector.

6. Gross Margin & Pricing Power

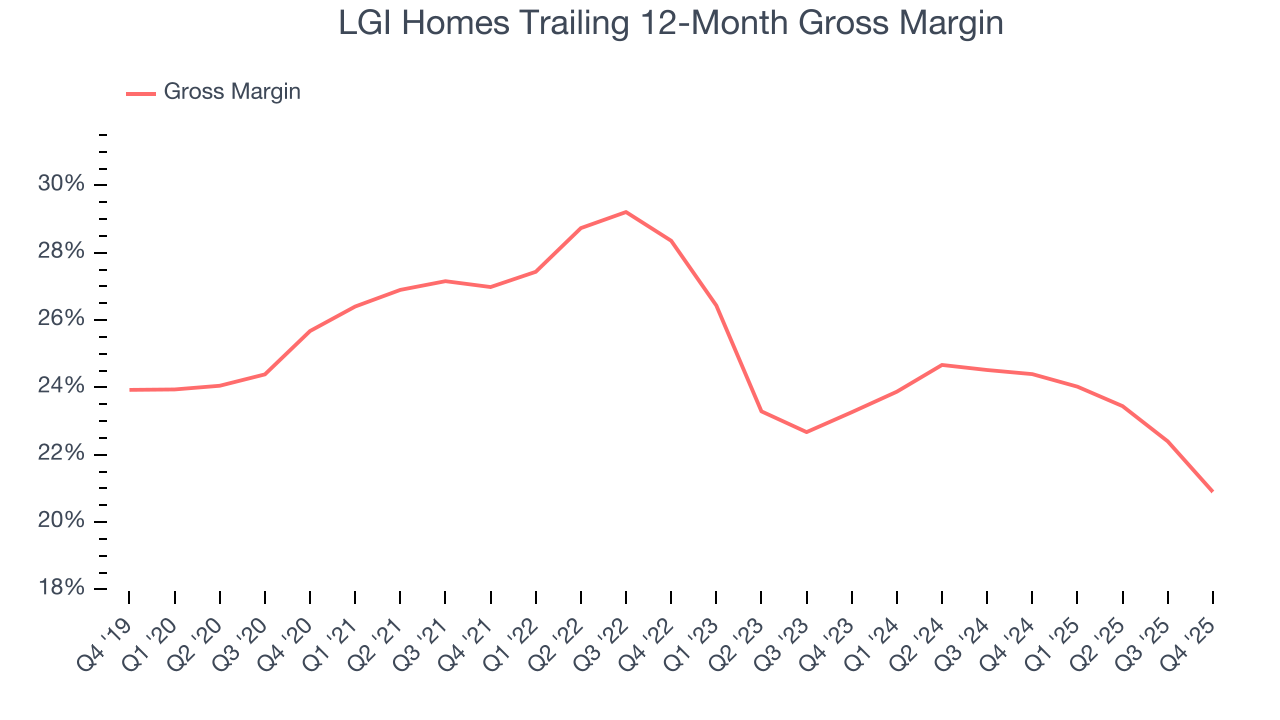

LGI Homes has bad unit economics for an industrials company, giving it less room to reinvest and develop new offerings. As you can see below, it averaged a 25.1% gross margin over the last five years. Said differently, LGI Homes had to pay a chunky $74.88 to its suppliers for every $100 in revenue.

LGI Homes produced a 17.7% gross profit margin in Q4, down 5.3 percentage points year on year. LGI Homes’s full-year margin has also been trending down over the past 12 months, decreasing by 3.5 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

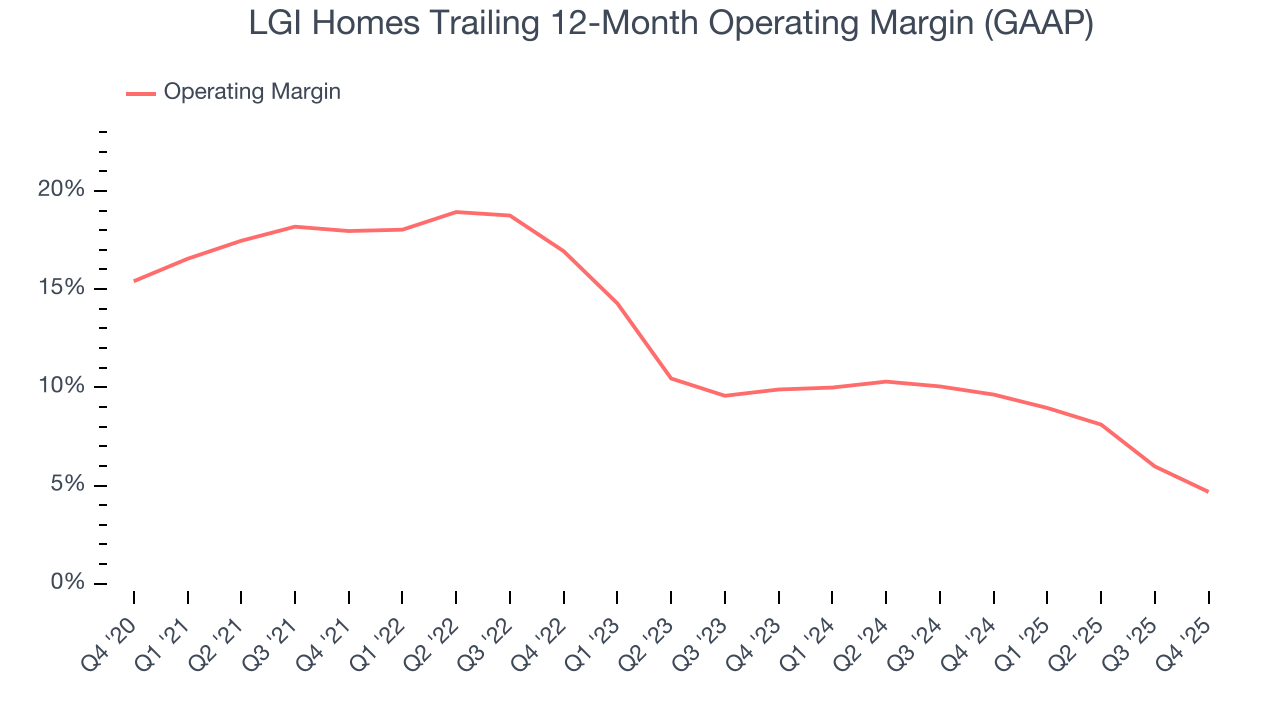

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

LGI Homes has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 12.6%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, LGI Homes’s operating margin decreased by 13.3 percentage points over the last five years. Even though its historical margin was healthy, shareholders will want to see LGI Homes become more profitable in the future.

In Q4, LGI Homes generated an operating margin profit margin of 3.9%, down 4.3 percentage points year on year. Since LGI Homes’s gross margin decreased more than its operating margin, we can assume its recent inefficiencies were driven more by weaker leverage on its cost of sales rather than increased marketing, R&D, and administrative overhead expenses.

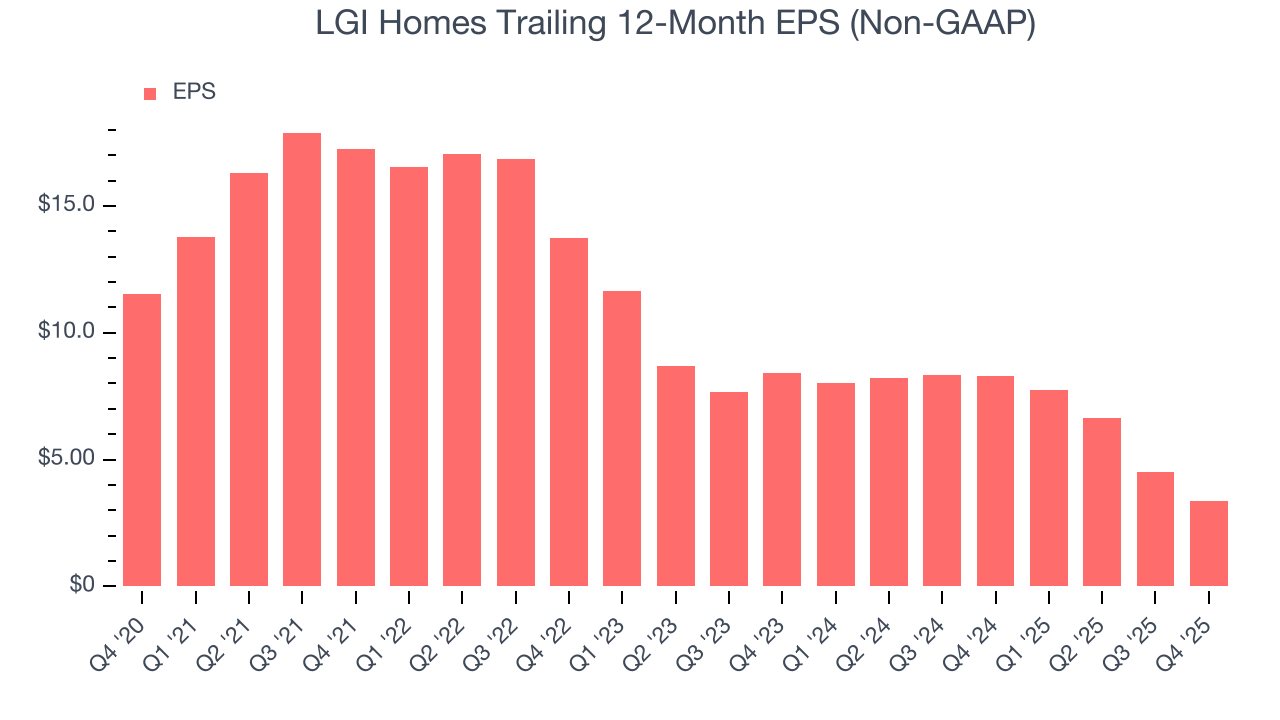

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for LGI Homes, its EPS declined by 21.9% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

We can take a deeper look into LGI Homes’s earnings to better understand the drivers of its performance. As we mentioned earlier, LGI Homes’s operating margin declined by 13.3 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For LGI Homes, its two-year annual EPS declines of 36.9% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, LGI Homes reported adjusted EPS of $0.97, down from $2.15 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 6.2%. Over the next 12 months, Wall Street expects LGI Homes’s full-year EPS of $3.35 to grow 29%.

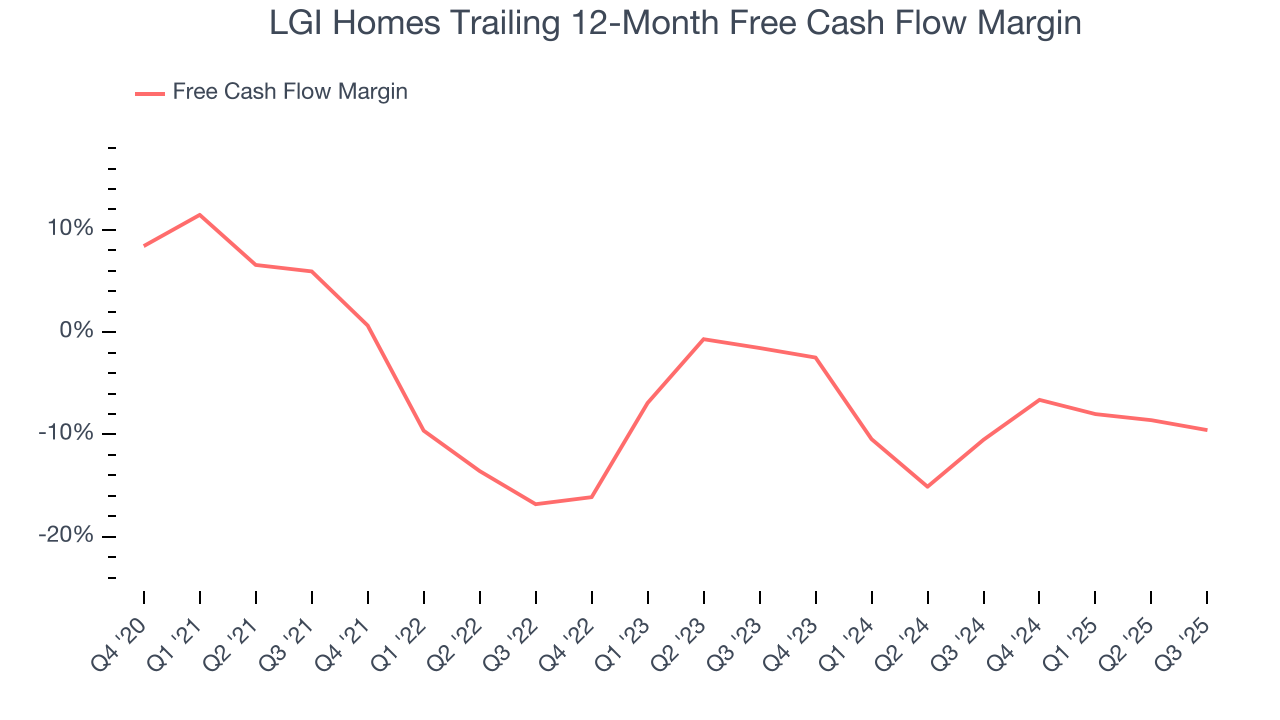

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

LGI Homes’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 7%, meaning it lit $7.03 of cash on fire for every $100 in revenue. This is a stark contrast from its operating margin, and its investments in working capital/capital expenditures are the primary culprit.

Taking a step back, we can see that LGI Homes’s margin dropped by 22.9 percentage points during that time. Almost any movement in the wrong direction is undesirable because it is already burning cash. If the trend continues, it could signal it’s becoming a more capital-intensive business.

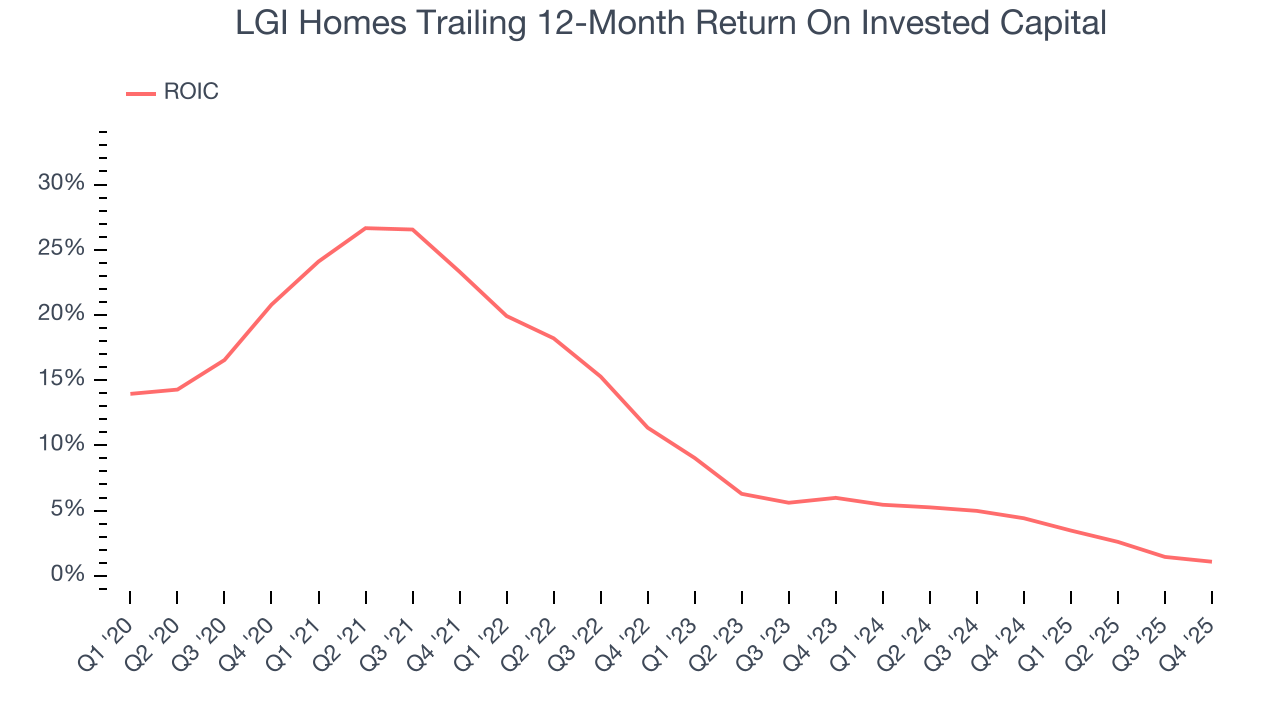

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

LGI Homes historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 9.2%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, LGI Homes’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

11. Key Takeaways from LGI Homes’s Q4 Results

It was good to see LGI Homes beat analysts’ EPS expectations this quarter. On the other hand, its revenue slightly missed. Overall, this quarter could have been better. The stock traded down 3.1% to $58.95 immediately after reporting.

12. Is Now The Time To Buy LGI Homes?

Updated: February 17, 2026 at 8:09 AM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

LGI Homes doesn’t pass our quality test. To kick things off, its revenue has declined over the last five years. While its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its declining EPS over the last five years makes it a less attractive asset to the public markets.

LGI Homes’s forward price-to-sales ratio is 0x. The market typically values companies like LGI Homes based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy.

Wall Street analysts have a consensus one-year price target of $67.50 on the company (compared to the current share price of $58.95).