Grand Canyon Education (LOPE)

Grand Canyon Education keeps us up at night. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Grand Canyon Education Will Underperform

Founded in 1949, Grand Canyon Education (NASDAQ:LOPE) is an educational services provider known for its operation at Grand Canyon University.

- 5.9% annual revenue growth over the last five years was slower than its consumer discretionary peers

- Earnings growth over the last five years fell short of the peer group average as its EPS only increased by 7.4% annually

- Poor free cash flow generation means it has few chances to reinvest for growth, repurchase shares, or distribute capital

Grand Canyon Education’s quality doesn’t meet our hurdle. We believe there are better businesses elsewhere.

Why There Are Better Opportunities Than Grand Canyon Education

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Grand Canyon Education

Grand Canyon Education is trading at $162.18 per share, or 16.8x forward P/E. This multiple is lower than most consumer discretionary companies, but for good reason.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Grand Canyon Education (LOPE) Research Report: Q4 CY2025 Update

Higher education company Grand Canyon Education (NASDAQ:LOPE) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 5.3% year on year to $308.1 million. The company expects next quarter’s revenue to be around $333.8 million, coming in 7.9% above analysts’ estimates. Its GAAP profit of $3.14 per share was in line with analysts’ consensus estimates.

Grand Canyon Education (LOPE) Q4 CY2025 Highlights:

- Revenue: $308.1 million vs analyst estimates of $308.1 million (5.3% year-on-year growth, in line)

- EPS (GAAP): $3.14 vs analyst expectations of $3.13 (in line)

- Adjusted EBITDA: $123.3 million vs analyst estimates of $123.8 million (40% margin, in line)

- Revenue Guidance for Q1 CY2026 is $333.8 million at the midpoint, above analyst estimates of $309.3 million

- EPS (GAAP) guidance for the upcoming financial year 2026 is $9.86 at the midpoint, beating analyst estimates by 2%

- Operating Margin: 35.1%, in line with the same quarter last year

- Free Cash Flow Margin: 39.9%, down from 43.1% in the same quarter last year

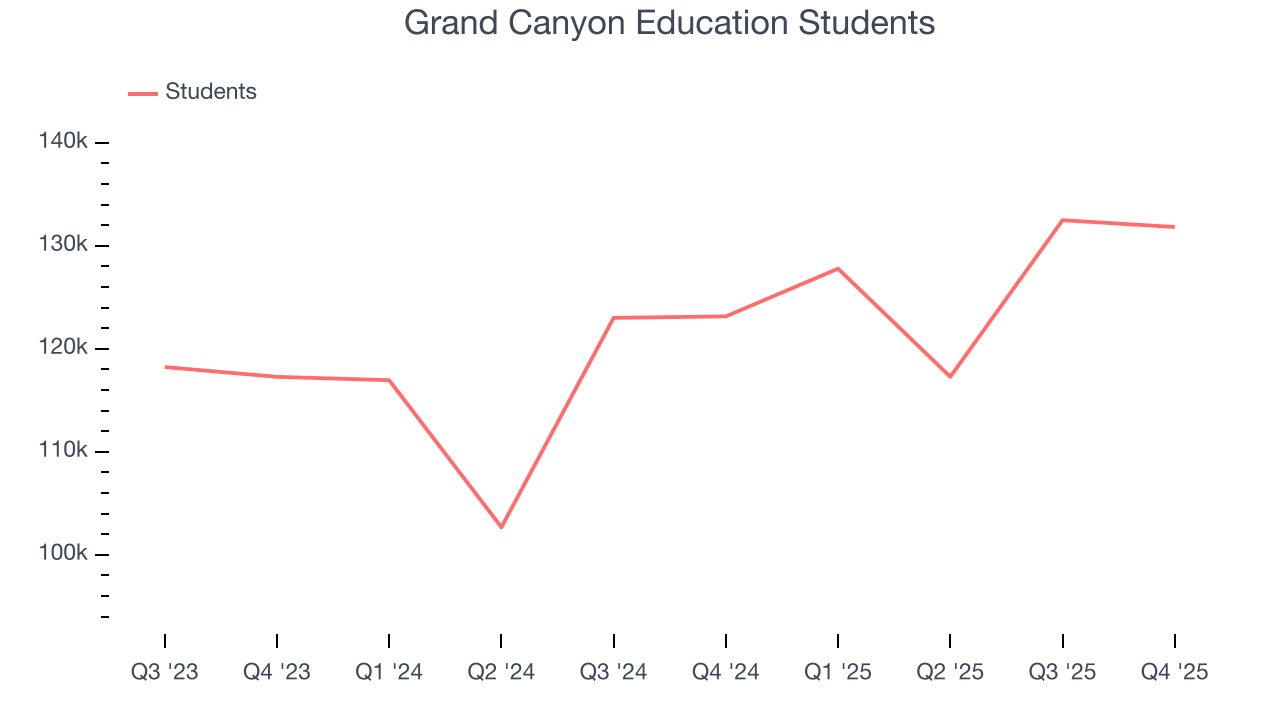

- Students: 131,826, up 8,677 year on year

- Market Capitalization: $4.49 billion

Company Overview

Founded in 1949, Grand Canyon Education (NASDAQ:LOPE) is an educational services provider known for its operation at Grand Canyon University.

The company provides a range of services including academic program development, technological support, faculty recruitment, admissions, financial aid, counseling, marketing, and administrative services. Its primary service is operating Grand Canyon University (GCU), a for-profit Christian university.

GCU offers a comprehensive range of degree programs both online and on its Phoenix, AZ campus. The university's programs cover various fields such as business, education, nursing, health sciences, liberal arts, and STEM. GCU is known for its flexible learning options, catering to traditional students, professionals, and online learners, making higher education accessible to a broader demographic.

The company invests in online learning experiences to make remote education engaging, interactive, and effective. This focus has been pivotal in growing GCU’s online student population, making it one of the largest online education providers in the United States.

4. Consumer Discretionary - Education Services

The Consumer Discretionary sector, by definition, is made up of companies selling non-essential goods and services. When economic conditions deteriorate or tastes shift, consumers can easily cut back or eliminate these purchases. For long-term investors with five-year holding periods, this creates a structural challenge: the sector is inherently hit-driven, with low switching costs and fickle customers. As a result, only a handful of companies can reliably grow demand and compound earnings over long periods, which is why our bar is high and High Quality ratings are rare.

Education services companies provide postsecondary instruction, professional certifications, test preparation, and corporate training, both online and in-person. Tailwinds include lifelong-learning demand driven by rapid technological change, employer-sponsored upskilling programs, and growing acceptance of online credentials. Headwinds are substantial: heavy regulatory oversight—particularly around student-loan eligibility and enrollment practices—can abruptly alter business models. Reputational risk from scrutiny over student outcomes and debt burdens constrains marketing strategies. Competition from free or low-cost digital alternatives (MOOCs, employer-built academies) pressures pricing.

Grand Canyon Education primary competitors include Apollo Global Management (NYSE:APO), Laureate Education (NASDAQ:LAUR), Strayer Education (NASDAQ:STRA), Capella Education (owned by Strategic Education NASDAQ:STRA), and American Public Education (NASDAQ:APEI).

5. Revenue Growth

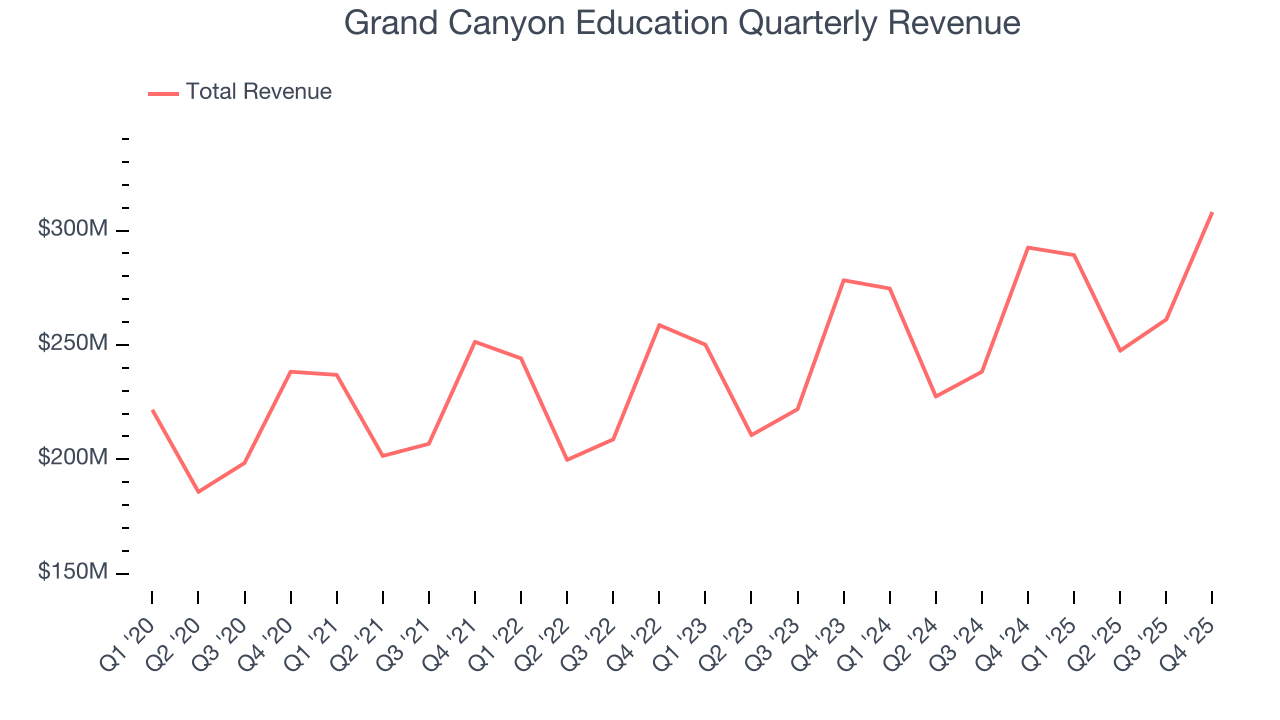

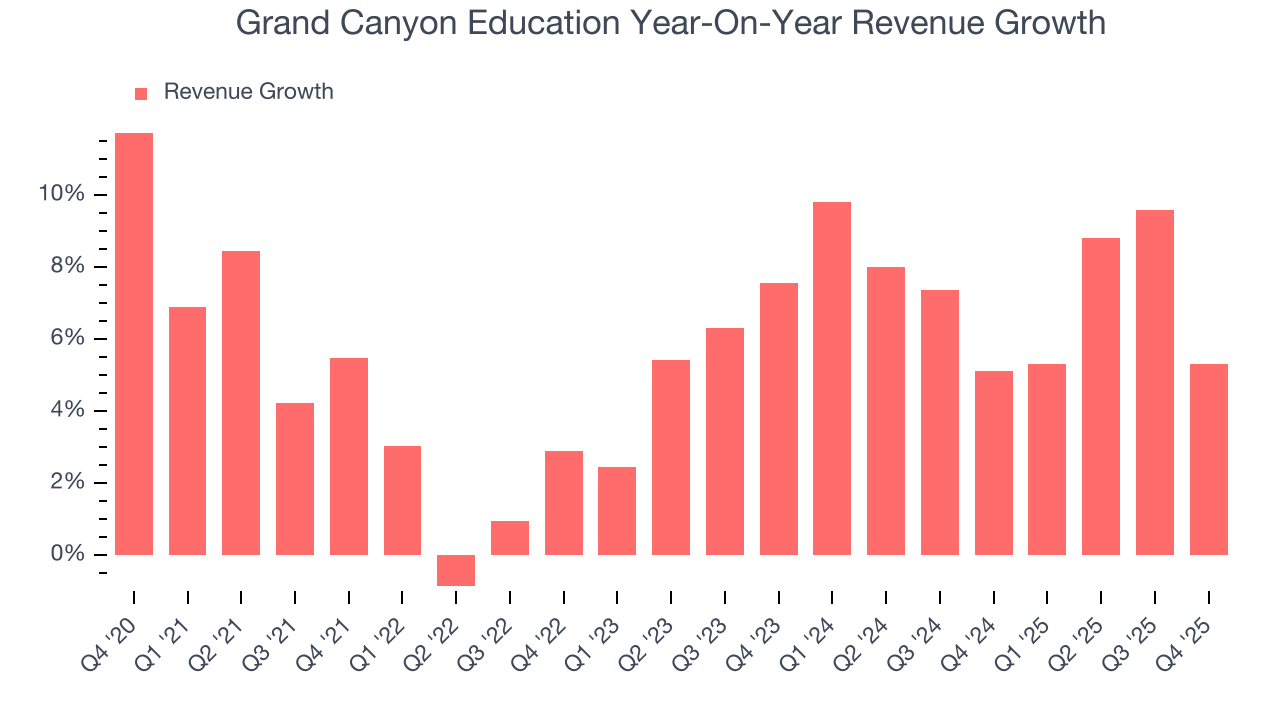

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Grand Canyon Education’s 5.6% annualized revenue growth over the last five years was weak. This was below our standard for the consumer discretionary sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Grand Canyon Education’s annualized revenue growth of 7.3% over the last two years is above its five-year trend, which is encouraging.

We can better understand the company’s revenue dynamics by analyzing its number of students, which reached 131,826 in the latest quarter. Over the last two years, Grand Canyon Education’s students averaged 7.9% year-on-year growth. Because this number aligns with its revenue growth during the same period, we can see the company’s monetization was fairly consistent.

This quarter, Grand Canyon Education grew its revenue by 5.3% year on year, and its $308.1 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 15.4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6.8% over the next 12 months, similar to its two-year rate. This projection is underwhelming and indicates its newer products and services will not catalyze better top-line performance yet.

6. Operating Margin

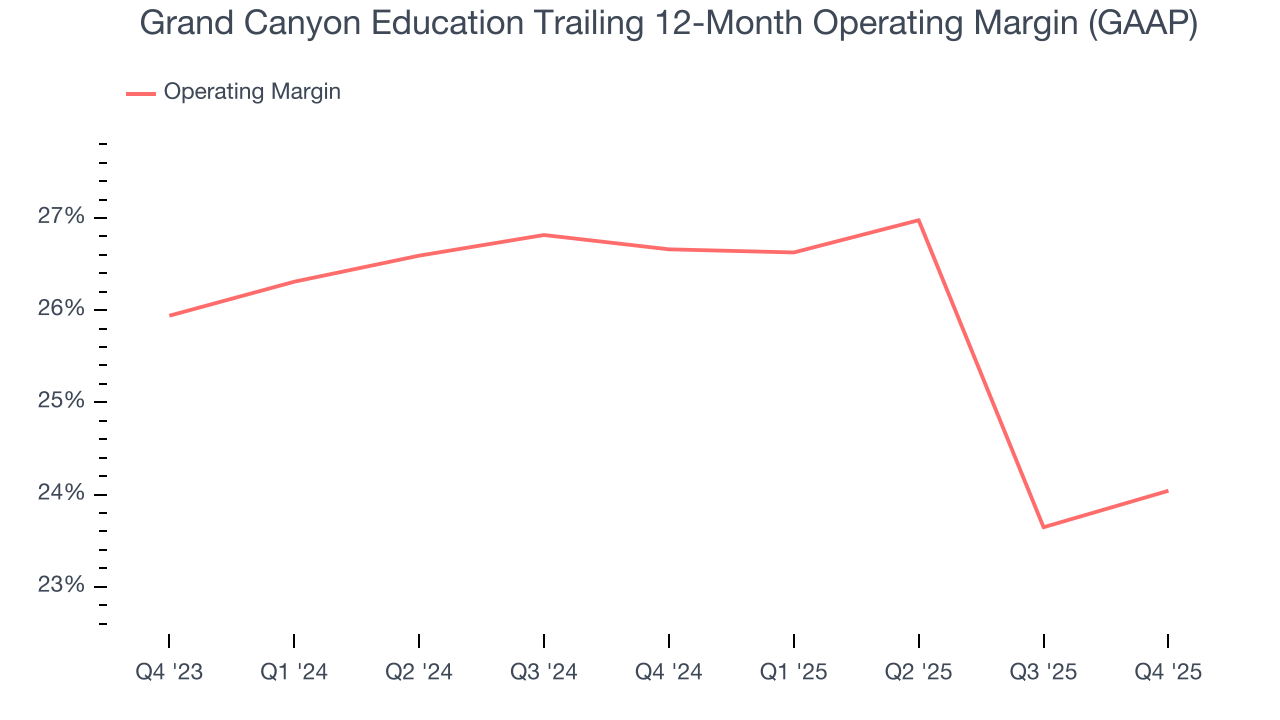

Grand Canyon Education’s operating margin has shrunk over the last 12 months and averaged 25.3% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

In Q4, Grand Canyon Education generated an operating margin profit margin of 35.1%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

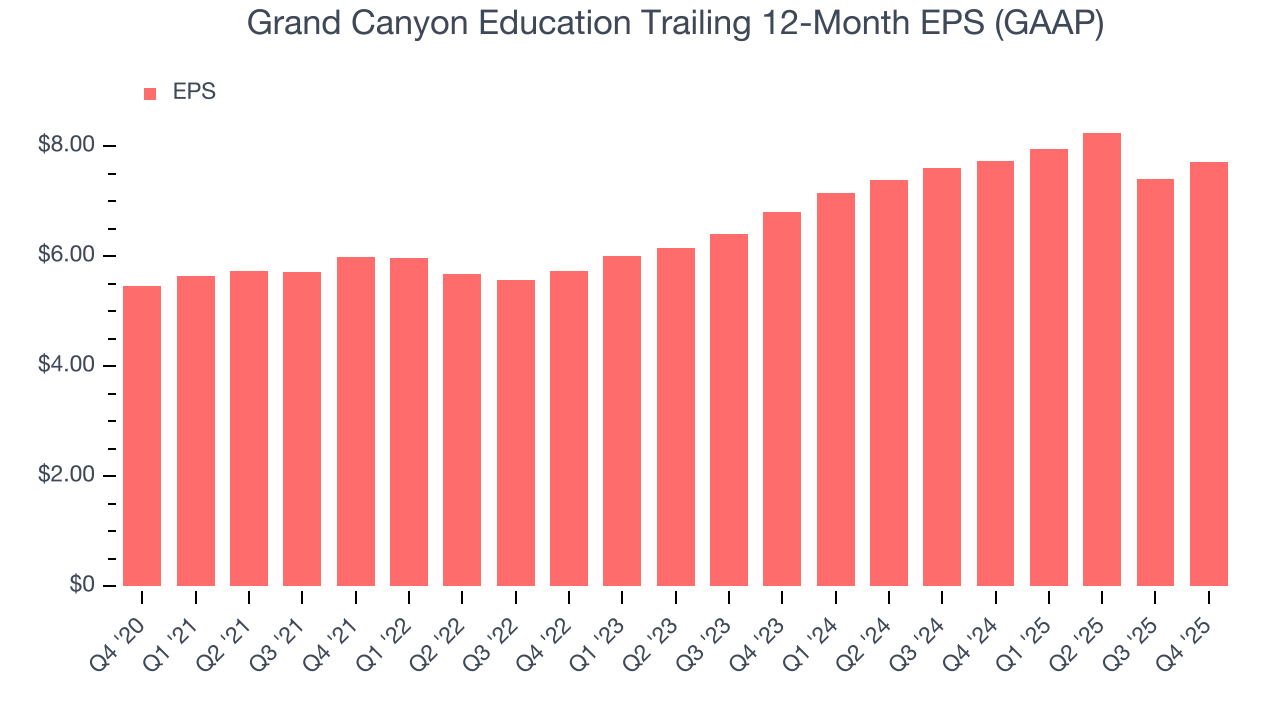

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Grand Canyon Education’s weak 7.2% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

In Q4, Grand Canyon Education reported EPS of $3.14, up from $2.84 in the same quarter last year. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

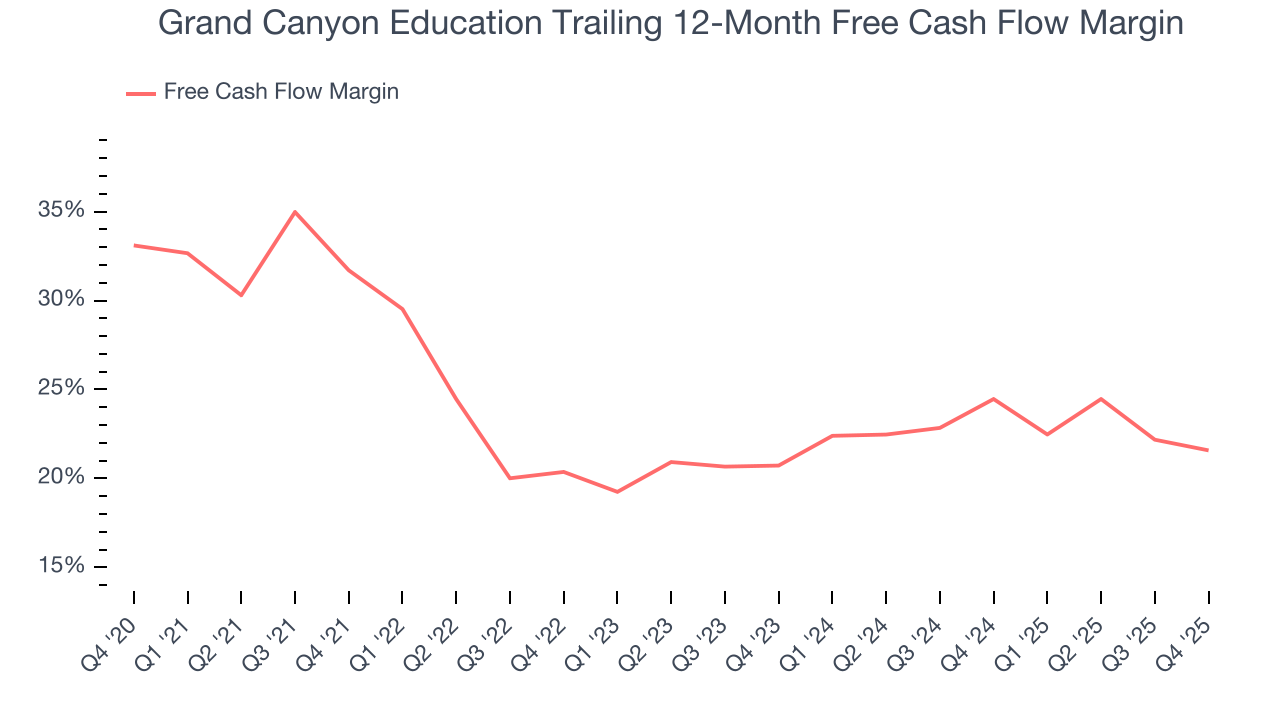

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Grand Canyon Education has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 23%, lousy for a consumer discretionary business.

Grand Canyon Education’s free cash flow clocked in at $122.9 million in Q4, equivalent to a 39.9% margin. The company’s cash profitability regressed as it was 3.2 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t put too much weight on this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends carry greater meaning.

Over the next year, analysts predict Grand Canyon Education’s cash conversion will slightly improve. Their consensus estimates imply its free cash flow margin of 21.6% for the last 12 months will increase to 23.2%, giving it more flexibility for investments, share buybacks, and dividends.

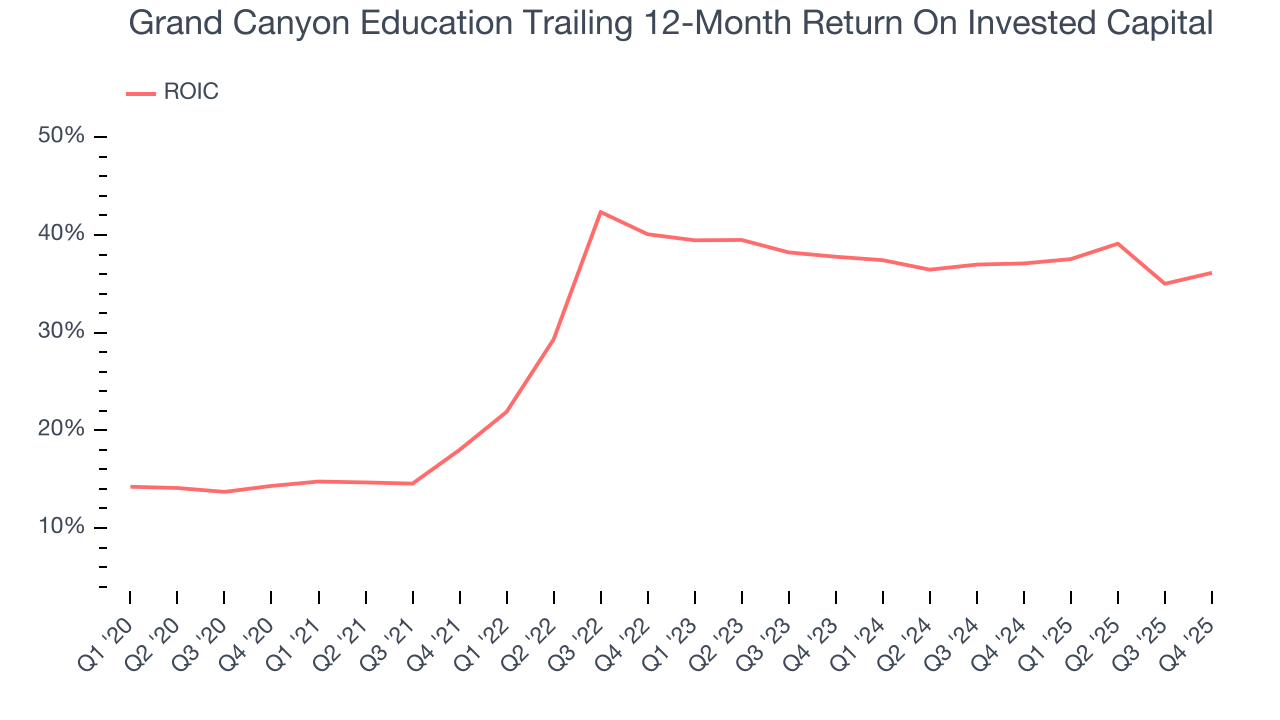

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Grand Canyon Education historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 33.8%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Grand Canyon Education’s ROIC has increased. This is a good sign, and we hope the company can continue improving.

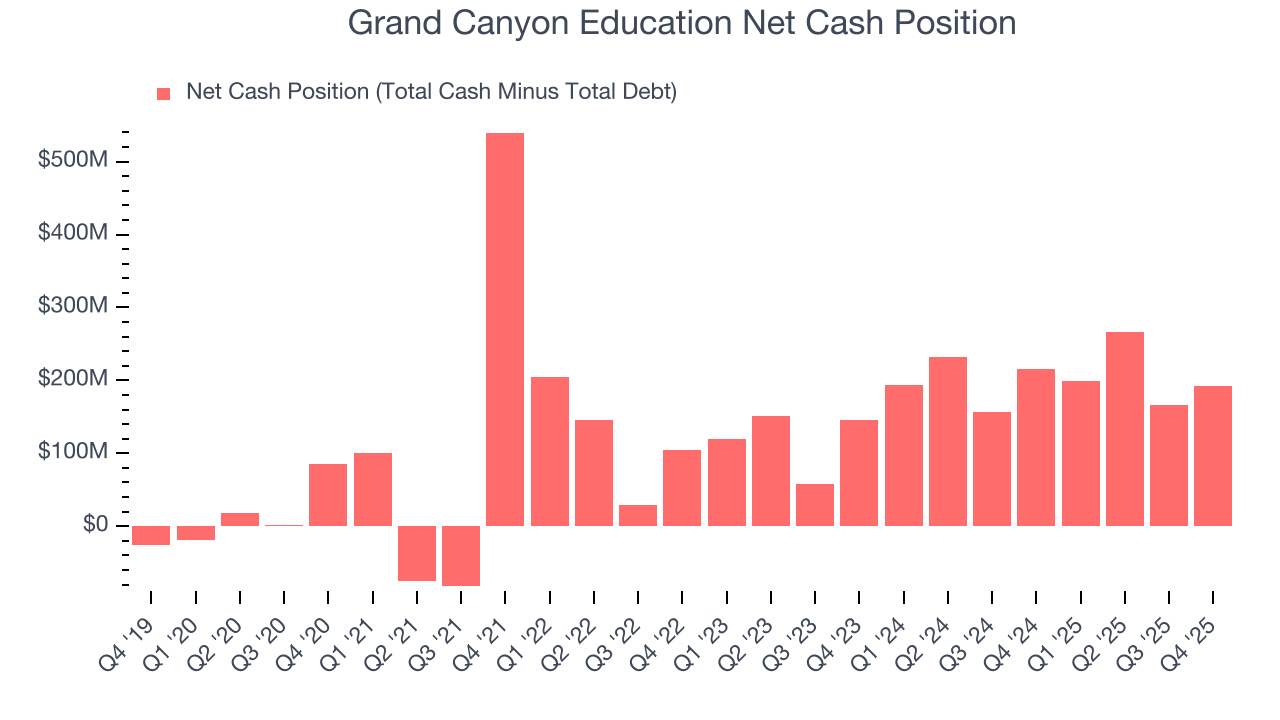

10. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

Grand Canyon Education is a profitable, well-capitalized company with $300.1 million of cash and $107.3 million of debt on its balance sheet. This $192.8 million net cash position is 4.3% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Grand Canyon Education’s Q4 Results

We were impressed by Grand Canyon Education’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also glad its revenue guidance for next quarter trumped Wall Street’s estimates. Overall, this print had some key positives. Investors were likely hoping for more, and shares traded down 3.2% to $162.50 immediately following the results.

12. Is Now The Time To Buy Grand Canyon Education?

Updated: February 18, 2026 at 4:18 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Grand Canyon Education, you should also grasp the company’s longer-term business quality and valuation.

Grand Canyon Education doesn’t pass our quality test. On top of that, Grand Canyon Education’s number of students has disappointed, and its Forecasted free cash flow margin suggests the company will have more capital to invest or return to shareholders next year.

Grand Canyon Education’s P/E ratio based on the next 12 months is 17.1x. While this valuation is reasonable, we don’t see a big opportunity at the moment. There are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $213 on the company (compared to the current share price of $162.50).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.