LPL Financial (LPLA)

LPL Financial is a special business. Its exceptional revenue growth and returns on capital show it can expand quickly and profitably.― StockStory Analyst Team

1. News

2. Summary

Why We Like LPL Financial

As the nation's largest independent broker-dealer with no proprietary products of its own, LPL Financial (NASDAQ:LPLA) provides technology, compliance, and business support services to independent financial advisors and institutions who manage investments for retail clients.

- Annual revenue growth of 26.4% over the past two years was outstanding, reflecting market share gains this cycle

- Industry-leading 38.5% return on equity demonstrates management’s skill in finding high-return investments

- Incremental sales over the last five years have been highly profitable as its earnings per share increased by 23.7% annually, topping its revenue gains

LPL Financial is a remarkable business. The price seems reasonable relative to its quality, and we think now is a good time to buy the stock.

Why Is Now The Time To Buy LPL Financial?

High Quality

Investable

Underperform

Why Is Now The Time To Buy LPL Financial?

At $372.56 per share, LPL Financial trades at 16.4x forward P/E. This price is justified - even cheap depending on how much you believe in the bull case - for the business fundamentals.

Entry price matters far less than business fundamentals if you’re investing for a multi-year period. But if you can get a bargain price it’s certainly icing on the cake.

3. LPL Financial (LPLA) Research Report: Q4 CY2025 Update

Independent financial services firm LPL Financial (NASDAQ:LPLA) reported revenue ahead of Wall Streets expectations in Q4 CY2025, with sales up 40.4% year on year to $4.93 billion. Its non-GAAP profit of $5.23 per share was 6.8% above analysts’ consensus estimates.

LPL Financial (LPLA) Q4 CY2025 Highlights:

- Assets Under Management: $2.4 trillion vs analyst estimates of $2.34 trillion (44% year-on-year growth, 2.5% beat)

- Revenue: $4.93 billion vs analyst estimates of $4.88 billion (40.4% year-on-year growth, 1.1% beat)

- Pre-tax Profit: $397.6 million (8.1% margin)

- Adjusted EPS: $5.23 vs analyst estimates of $4.90 (6.8% beat)

- Market Capitalization: $29.37 billion

Company Overview

As the nation's largest independent broker-dealer with no proprietary products of its own, LPL Financial (NASDAQ:LPLA) provides technology, compliance, and business support services to independent financial advisors and institutions who manage investments for retail clients.

LPL Financial serves as the backbone for more than 22,000 financial advisors who collectively manage approximately 8.3 million client accounts. These advisors operate through various business models: as independent practitioners running their own branded businesses, as employees within LPL's employee advisor model, as part of approximately 1,100 financial institutions (like banks and credit unions), or as one of roughly 570 independent Registered Investment Advisor (RIA) firms that use LPL for custody and clearing services.

The company's revenue comes primarily from two sources: fees based on assets under management and transaction-based commissions. LPL provides a comprehensive platform that includes technology solutions, compliance oversight, practice management support, and access to investment products. Unlike traditional Wall Street firms, LPL doesn't create its own investment products or provide investment banking services, which eliminates potential conflicts of interest when advisors make recommendations to clients.

For example, a community bank might partner with LPL to offer wealth management services to its customers. The bank's financial advisors would use LPL's technology platform to open accounts, execute trades, and manage client portfolios, while LPL handles the regulatory compliance, back-office operations, and provides access to thousands of investment options.

LPL's self-clearing platform allows it to process transactions in-house rather than paying third parties, giving the company greater control over client data and enabling it to offer more streamlined services. The company also provides specialized services including trust administration through its subsidiary The Private Trust Company, business consulting, succession planning for advisors looking to retire, and research on investments and market trends.

4. Investment Banking & Brokerage

Investment banks and brokerages facilitate capital raises, mergers and acquisitions, and securities trading. The sector benefits from corporate activity during economic expansion, increased retail trading participation, and advisory opportunities in emerging sectors. Headwinds include economic cycle vulnerability affecting deal flow, compressed trading commissions due to electronic platforms, and regulatory capital requirements constraining certain higher-risk activities.

LPL Financial competes with other independent broker-dealers like Raymond James Financial (NYSE:RJF), Ameriprise Financial (NYSE:AMP), and Cetera Financial Group (private), as well as with traditional wirehouses such as Morgan Stanley (NYSE:MS), Merrill Lynch (part of Bank of America, NYSE:BAC), and UBS (NYSE:UBS).

5. Revenue Growth

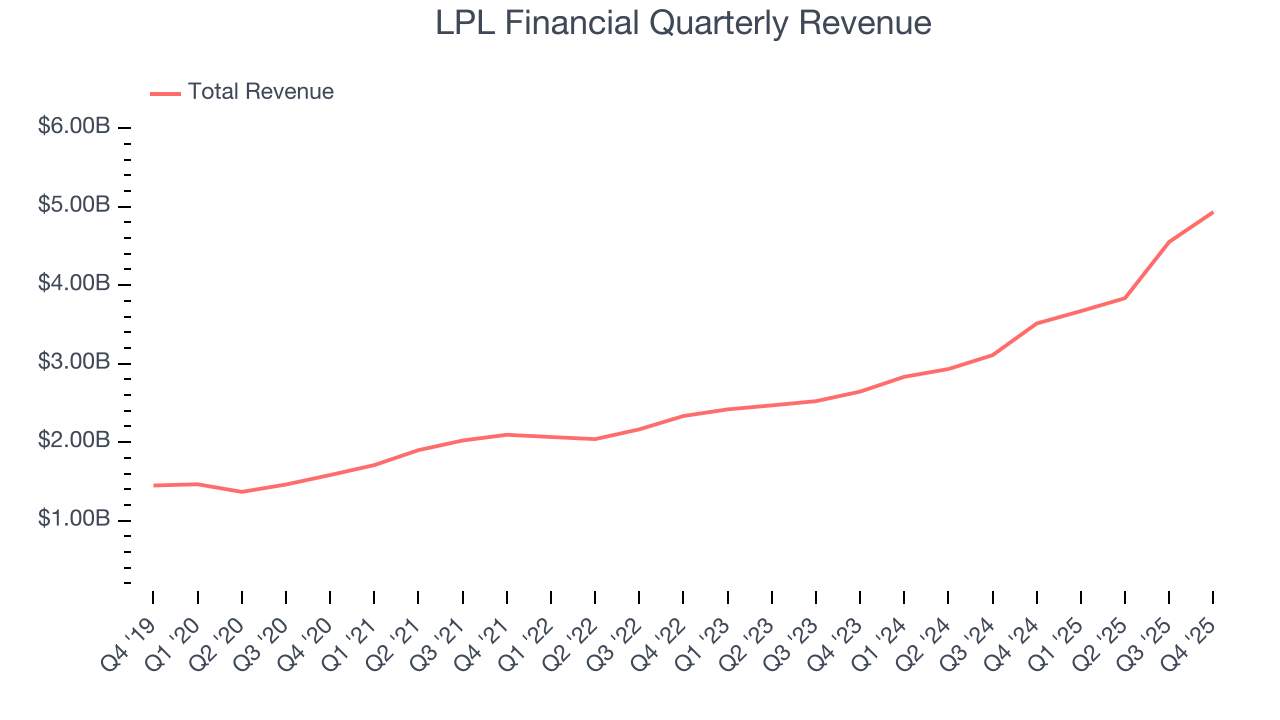

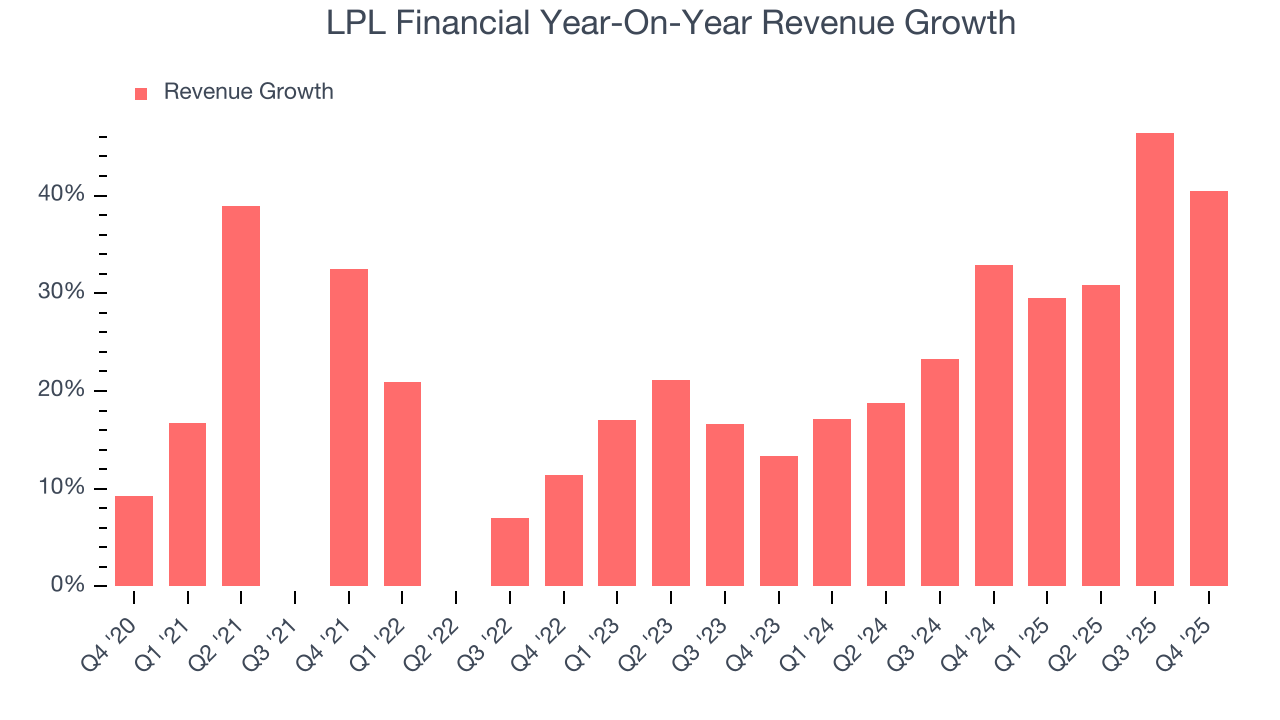

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, LPL Financial’s revenue grew at an exceptional 23.7% compounded annual growth rate over the last five years. Its growth surpassed the average financials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. LPL Financial’s annualized revenue growth of 30% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, LPL Financial reported magnificent year-on-year revenue growth of 40.4%, and its $4.93 billion of revenue beat Wall Street’s estimates by 1.1%.

6. Assets Under Management (AUM)

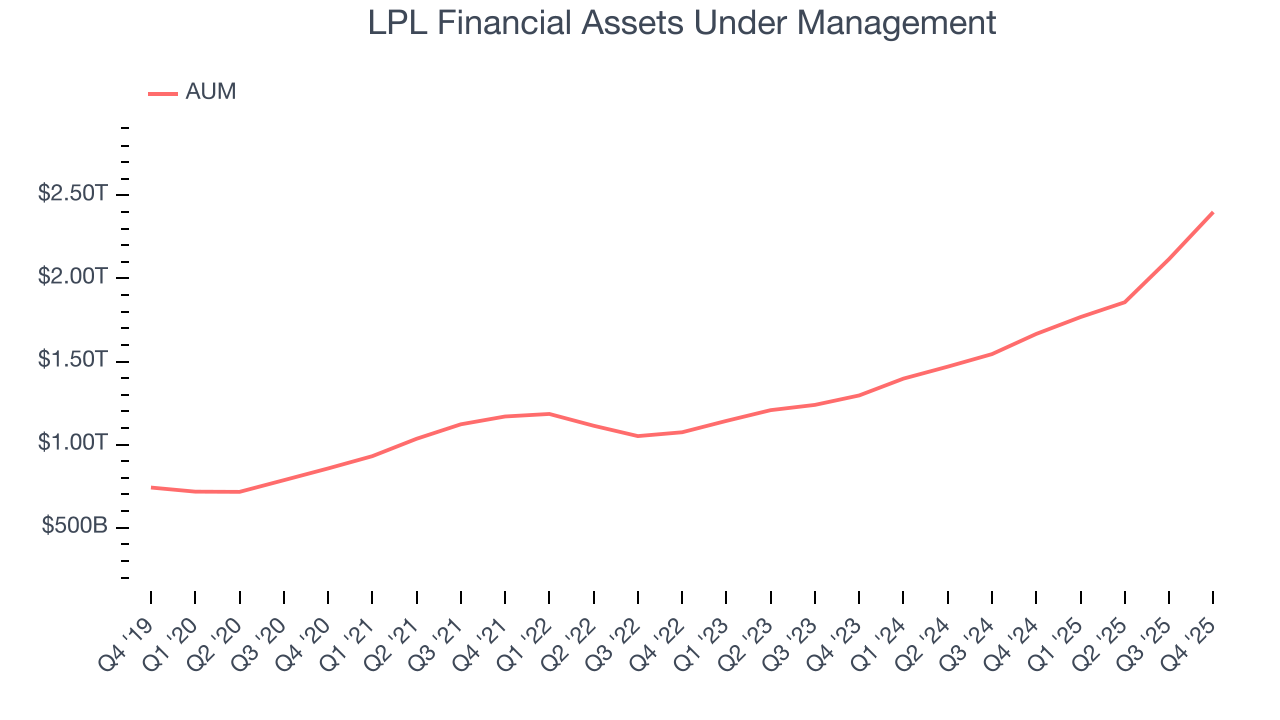

Assets Under Management (AUM) encompasses all client funds under a firm's investment management umbrella. The recurring fee structure on these assets provides consistent revenue generation, offering financial stability even during periods of poor investment returns, though sustained underperformance can impact future asset flows.

LPL Financial’s AUM has grown at an annual rate of 21.5% over the last five years, better than the broader financials industry but slower than its total revenue. When analyzing LPL Financial’s AUM over the last two years, we can see that growth accelerated to 29.1% annually. This performance aligned with its total revenue.

LPL Financial’s AUM punched in at $2.4 trillion this quarter, beating analysts’ expectations by 2.5%. This print was 44% higher than the same quarter last year.

7. Pre-Tax Profit Margin

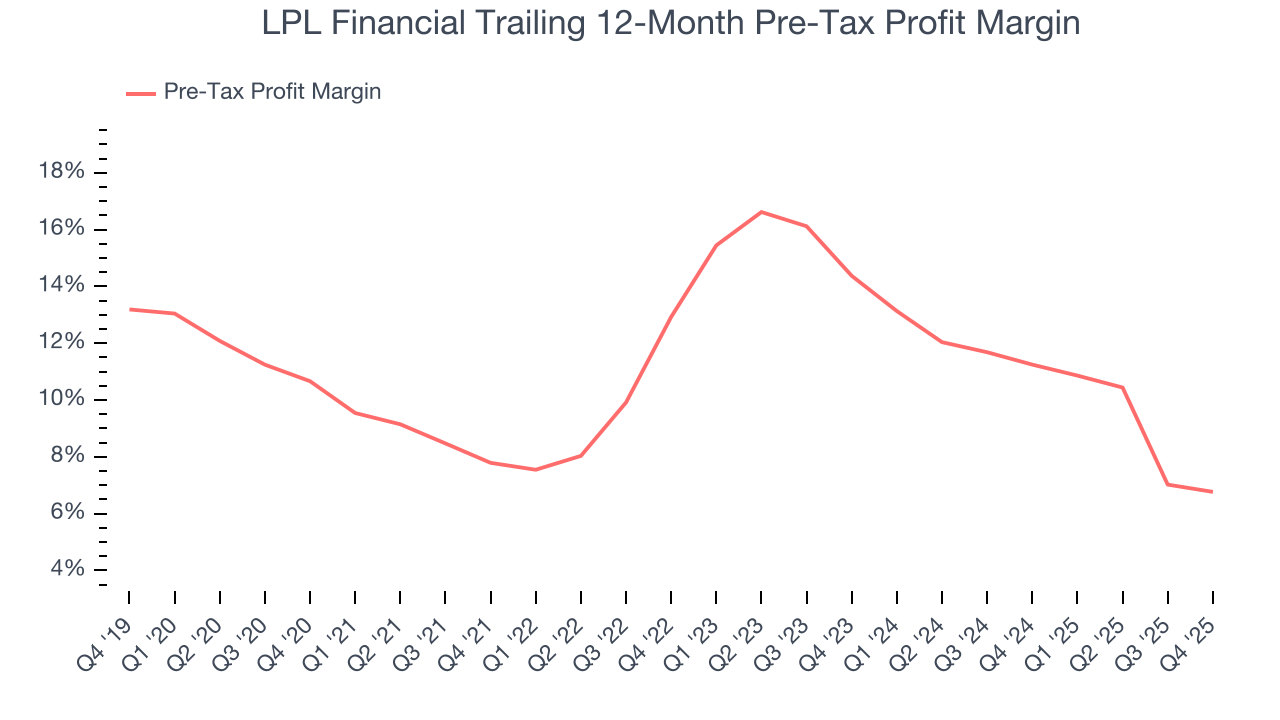

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Investment Banking & Brokerage companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

Interest income and expenses play a big role in financial institutions' profitability, so they should be factored into the definition of profit. Taxes, however, should not as they are largely out of a company's control. This is pre-tax profit by definition.

Over the last five years, LPL Financial’s pre-tax profit margin has risen by 3.9 percentage points, going from 7.8% to 6.8%. It has also declined by 7.6 percentage points on a two-year basis, showing its expenses have consistently increased at a faster rate than revenue. This usually raises questions unless the company is in high-growth mode and reinvesting its profits into attractive ventures.

In Q4, LPL Financial’s pre-tax profit margin was 8.1%. This result was 1.7 percentage points worse than the same quarter last year.

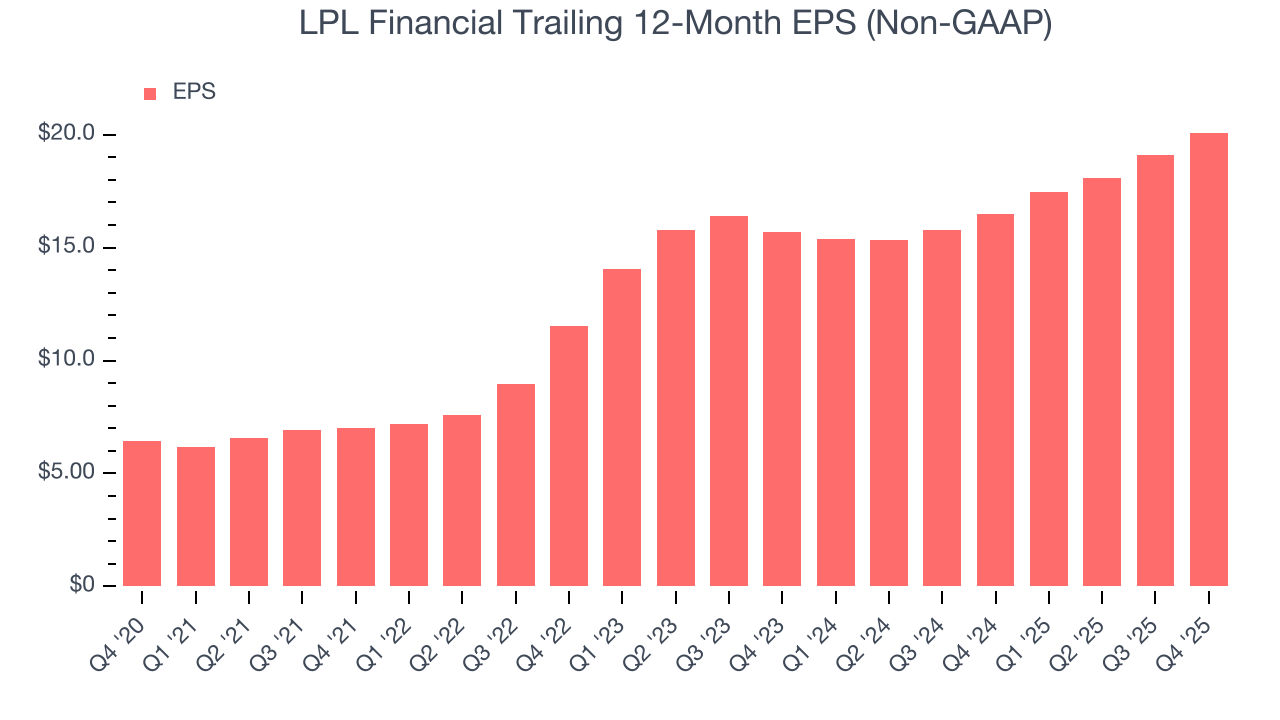

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

LPL Financial’s astounding 25.5% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

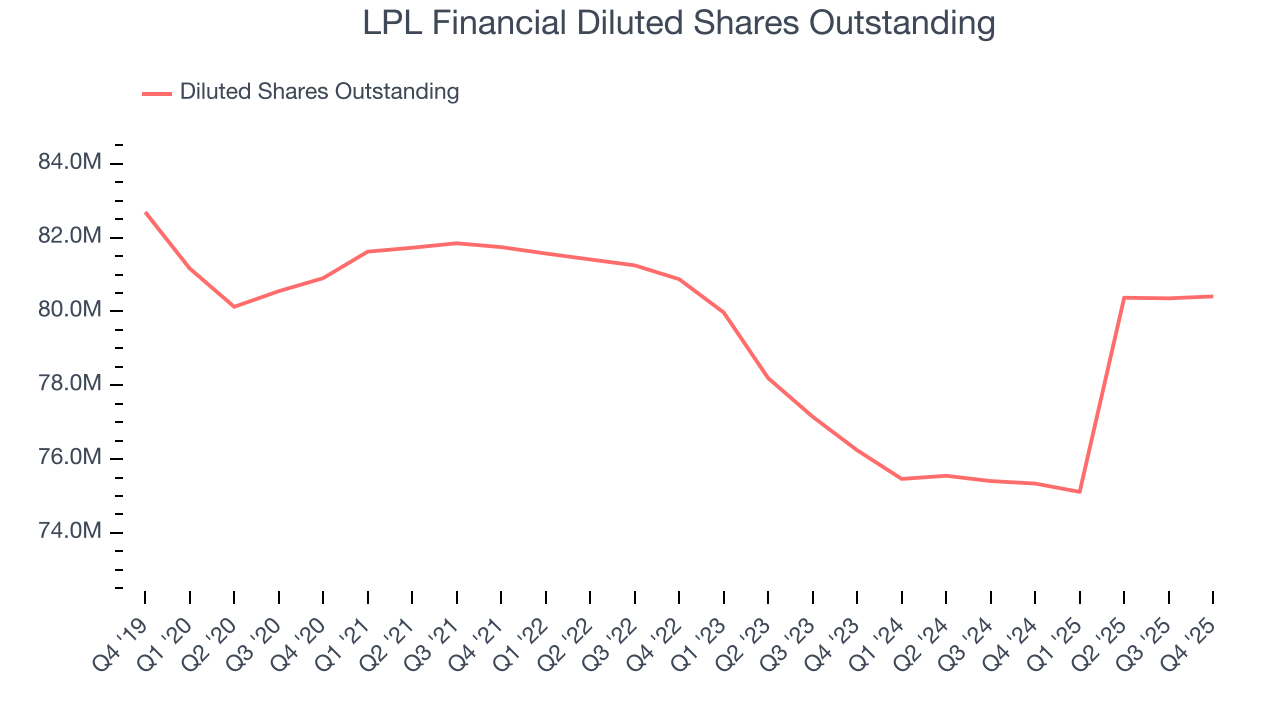

Although it performed well, LPL Financial’s two-year annual EPS growth of 13.2% lower than its 30% two-year revenue growth.

Diving into LPL Financial’s quality of earnings can give us a better understanding of its performance. LPL Financial’s pre-tax profit margin has declined over the last two yearswhile its share count has grown 5.5%. This means the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q4, LPL Financial reported adjusted EPS of $5.23, up from $4.25 in the same quarter last year. This print beat analysts’ estimates by 6.8%. Over the next 12 months, Wall Street expects LPL Financial’s full-year EPS of $20.09 to grow 17%.

9. Return on Equity

Return on equity (ROE) measures how effectively banks generate profit from each dollar of shareholder equity - a critical funding source. High-ROE institutions typically compound shareholder wealth faster over time through retained earnings, share repurchases, and dividend payments.

Over the last five years, LPL Financial has averaged an ROE of 38.7%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows LPL Financial has a strong competitive moat.

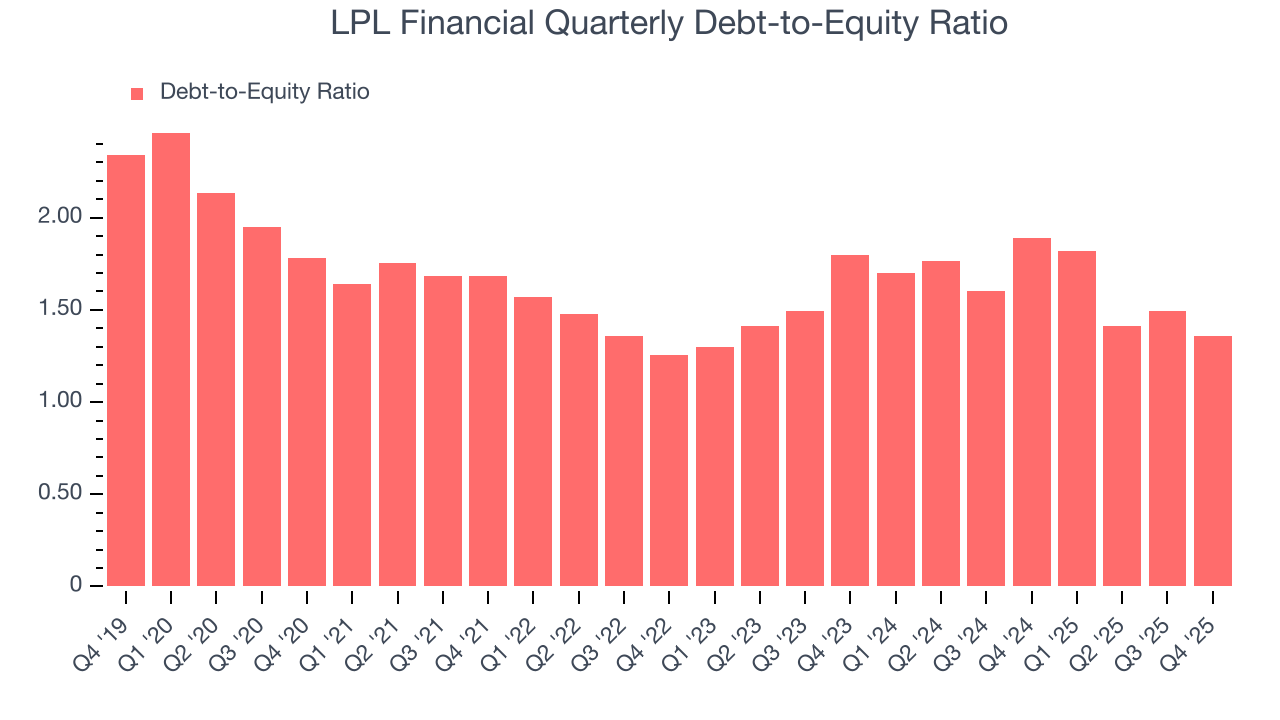

10. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

LPL Financial currently has $7.26 billion of debt and $5.34 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 1.5×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

11. Key Takeaways from LPL Financial’s Q4 Results

We enjoyed seeing LPL Financial beat analysts’ AUM expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, this print had some key positives. Investors were likely hoping for more, and shares traded down 2.2% to $354.93 immediately following the results.

12. Is Now The Time To Buy LPL Financial?

Updated: January 29, 2026 at 4:51 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own LPL Financial, you should also grasp the company’s longer-term business quality and valuation.

LPL Financial is an amazing business ranking highly on our list. First, the company’s revenue growth was exceptional over the last five years, and analysts believe it can continue growing at these levels. And while its declining pre-tax profit margin shows the business has become less efficient, its stellar ROE suggests it has been a well-run company historically. Additionally, LPL Financial’s astounding EPS growth over the last five years shows its profits are trickling down to shareholders.

LPL Financial’s P/E ratio based on the next 12 months is 15.4x. Looking at the financials space today, LPL Financial’s qualities as one of the best businesses really stand out, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $445.92 on the company (compared to the current share price of $354.93), implying they see 25.6% upside in buying LPL Financial in the short term.