Masimo (MASI)

Masimo doesn’t excite us. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Masimo Will Underperform

Founded in 1989 to solve the "unsolvable problem" of accurate pulse oximetry during patient movement, Masimo (NASDAQ:MASI) develops and manufactures noninvasive patient monitoring technologies, including its breakthrough pulse oximetry systems that accurately measure blood oxygen levels even during patient movement.

- Subscale operations are evident in its revenue base of $1.48 billion, meaning it has fewer distribution channels than its larger rivals

- Below-average returns on capital indicate management struggled to find compelling investment opportunities, and its falling returns suggest its earlier profit pools are drying up

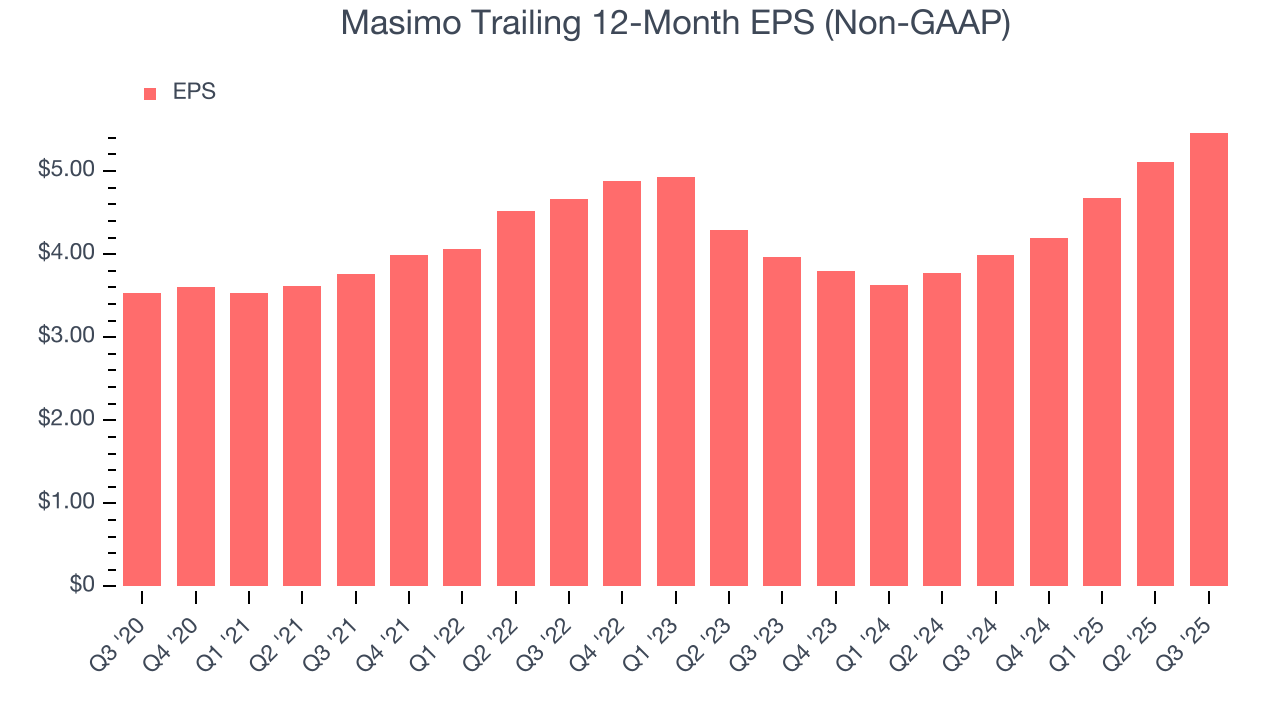

- A silver lining is that its earnings growth was above the peer group average over the last five years as its EPS compounded at 10.5% annually

Masimo doesn’t live up to our standards. There are better opportunities in the market.

Why There Are Better Opportunities Than Masimo

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Masimo

At $175.35 per share, Masimo trades at 30.5x forward P/E. This multiple is higher than that of healthcare peers; it’s also rich for the top-line growth of the company. Not a great combination.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. Masimo (MASI) Research Report: Q3 CY2025 Update

Medical tech company Masimo (NASDAQ:MASI) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 8.2% year on year to $371.5 million. The company expects the full year’s revenue to be around $1.52 billion, close to analysts’ estimates. Its non-GAAP profit of $1.32 per share was 9.9% above analysts’ consensus estimates.

Masimo (MASI) Q3 CY2025 Highlights:

- Revenue: $371.5 million vs analyst estimates of $366.5 million (8.2% year-on-year growth, 1.4% beat)

- Adjusted EPS: $1.32 vs analyst estimates of $1.20 (9.9% beat)

- Adjusted EBITDA: $101.1 million vs analyst estimates of $111.4 million (27.2% margin, 9.3% miss)

- The company reconfirmed its revenue guidance for the full year of $1.52 billion at the midpoint

- Management raised its full-year Adjusted EPS guidance to $5.71 at the midpoint, a 7.1% increase

- Operating Margin: 22.5%, up from 8.8% in the same quarter last year

- Free Cash Flow Margin: 13.7%, up from 5.7% in the same quarter last year

- Constant Currency Revenue rose 7.6% year on year (5.4% in the same quarter last year)

- Market Capitalization: $7.87 billion

Company Overview

Founded in 1989 to solve the "unsolvable problem" of accurate pulse oximetry during patient movement, Masimo (NASDAQ:MASI) develops and manufactures noninvasive patient monitoring technologies, including its breakthrough pulse oximetry systems that accurately measure blood oxygen levels even during patient movement.

Masimo's core technology, Signal Extraction Technology (SET) pulse oximetry, revolutionized the field by maintaining accuracy when conventional devices fail due to patient movement or low blood flow. This innovation has made Masimo the preferred pulse oximetry provider for nine of the top ten U.S. hospitals, with its technology monitoring over 200 million patients annually worldwide.

Beyond its flagship SET pulse oximetry, Masimo has expanded its rainbow Pulse CO-Oximetry platform to measure additional blood components noninvasively, including total hemoglobin (SpHb), carbon monoxide levels (SpCO), and methemoglobin (SpMet). These measurements previously required invasive blood draws but can now be monitored continuously and in real-time.

Masimo's product portfolio includes standalone monitors like the Radical-7 and Rad-97, the Root patient monitoring and connectivity hub, and various sensors and cables. The company also offers hospital automation solutions through its Patient SafetyNet platform, which enables remote monitoring of up to 200 patients simultaneously while providing clinician notification systems and integration with electronic medical records.

In recent years, Masimo has diversified beyond hospital settings into consumer health with products like the Masimo W1 health watch, Radius T wireless thermometer, and Masimo Opioid Halo, an FDA-cleared solution for detecting opioid-induced respiratory depression. The company has also expanded into home audio through its acquisition of consumer audio brands including Bowers & Wilkins, Denon, and Marantz.

Masimo sells its healthcare products directly to hospitals and through distributors globally, while also partnering with over 90 original equipment manufacturers (OEMs) who integrate Masimo technology into their own patient monitoring systems. The company's business model includes both hardware sales and recurring revenue from proprietary sensors, with many hospital contracts structured as sensor purchasing agreements.

4. Patient Monitoring

Patient monitoring companies within the healthcare equipment industry offer devices and technologies that track chronic conditions and support real-time health management, such as continuous glucose monitors (CGMs) and sleep apnea machines. These businesses benefit from recurring revenue from consumables and software subscriptions tied to device sales (razor, razor blade model). The rising prevalence of chronic diseases like diabetes and respiratory disorders due to an aging population as well as growing adoption of digitization are good for the industry. However, these companies face challenges from high R&D costs and reliance on regulatory approvals. Looking ahead, the sector is positioned for growth due to tailwinds like the rising burden of chronic diseases from an aging population, the shift toward value-based care, and increased adoption of digital health solutions. Innovations in AI and machine learning are expected to enhance device accuracy and functionality, improving patient outcomes and driving demand. However, there are headwinds such as pricing pressures as healthcare costs are a key focus, especially in the US. An evolving regulatory landscape and competition from more tech-forward new entrants could present additional challenges.

Masimo's primary competitor in the healthcare monitoring space is Medtronic plc. In its consumer health and audio segments, Masimo competes with technology giants like Apple, Google, Amazon, and Samsung, as well as audio specialists such as Sonos, Bose, and Bang & Olufsen.

5. Revenue Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $1.48 billion in revenue over the past 12 months, Masimo is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

6. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Masimo grew its sales at a mediocre 6.2% compounded annual growth rate. This was below our standard for the healthcare sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Masimo’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 16.3% annually.

We can better understand the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 3.3% year-on-year growth. Because this number is better than its normal revenue growth, we can see that foreign exchange rates have been a headwind for Masimo.

This quarter, Masimo reported year-on-year revenue growth of 8.2%, and its $371.5 million of revenue exceeded Wall Street’s estimates by 1.4%.

Looking ahead, sell-side analysts expect revenue to grow 8.6% over the next 12 months, an improvement versus the last two years. This projection is healthy and implies its newer products and services will spur better top-line performance.

7. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

Masimo was profitable over the last five years but held back by its large cost base. Its average operating margin of 8.4% was weak for a healthcare business.

Looking at the trend in its profitability, Masimo’s operating margin decreased by 30.8 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 16.8 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

In Q3, Masimo generated an operating margin profit margin of 22.5%, up 13.7 percentage points year on year. This increase was a welcome development and shows it was more efficient.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Masimo’s EPS grew at a remarkable 9.1% compounded annual growth rate over the last five years, higher than its 6.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into Masimo’s quality of earnings can give us a better understanding of its performance. A five-year view shows that Masimo has repurchased its stock, shrinking its share count by 6.7%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q3, Masimo reported adjusted EPS of $1.32, up from $0.96 in the same quarter last year. This print beat analysts’ estimates by 9.9%. Over the next 12 months, Wall Street expects Masimo’s full-year EPS of $5.46 to grow 3.3%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Masimo has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 8.1% over the last five years, slightly better than the broader healthcare sector.

Taking a step back, we can see that Masimo’s margin dropped by 2.5 percentage points during that time. Continued declines could signal it is in the middle of an investment cycle.

Masimo’s free cash flow clocked in at $50.9 million in Q3, equivalent to a 13.7% margin. This result was good as its margin was 8 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends are more important.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Masimo historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.6%, somewhat low compared to the best healthcare companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Masimo’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

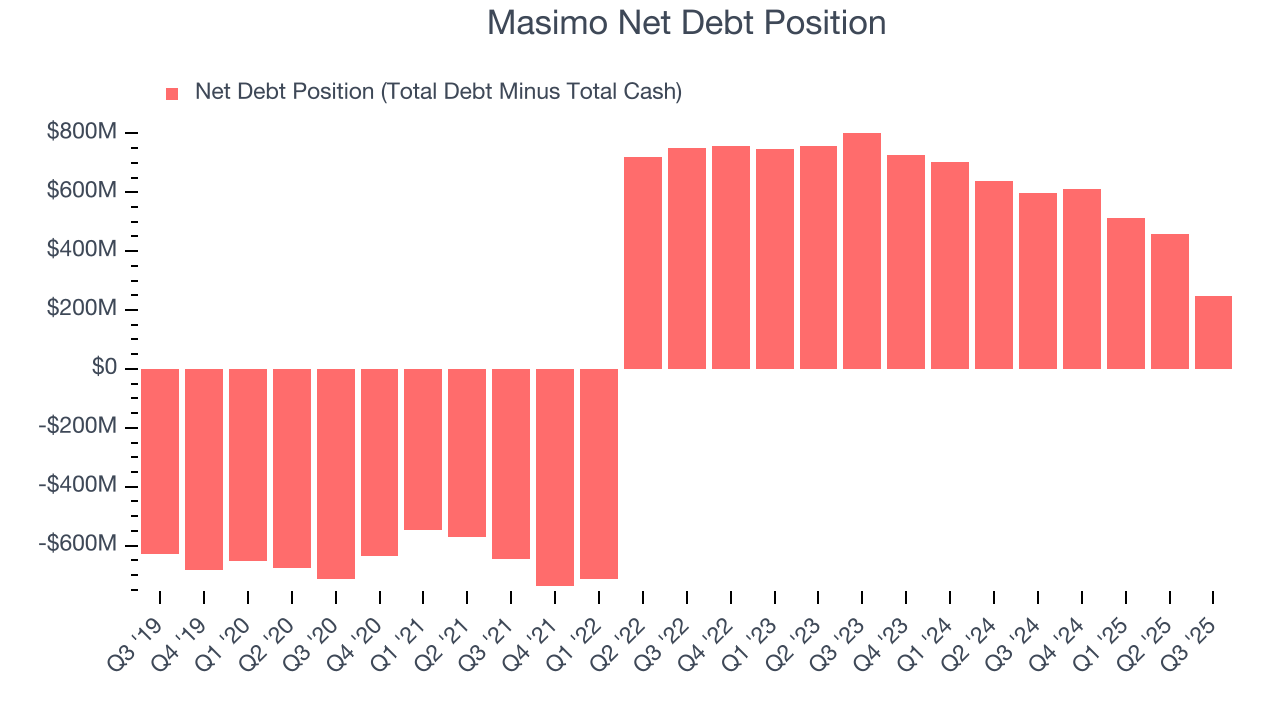

11. Balance Sheet Assessment

Masimo reported $312.3 million of cash and $559.1 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $384 million of EBITDA over the last 12 months, we view Masimo’s 0.6× net-debt-to-EBITDA ratio as safe. We also see its $23.9 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Masimo’s Q3 Results

We were impressed by how significantly Masimo blew past analysts’ full-year EPS guidance expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 1.2% to $150.70 immediately following the results.

13. Is Now The Time To Buy Masimo?

Updated: February 25, 2026 at 11:07 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Masimo.

Masimo isn’t a terrible business, but it isn’t one of our picks. To kick things off, its revenue growth was mediocre over the last five years. While its remarkable EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its subscale operations give it fewer distribution channels than its larger rivals.

Masimo’s P/E ratio based on the next 12 months is 30.5x. This multiple tells us a lot of good news is priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $178.60 on the company (compared to the current share price of $175.55).