Mattel (MAT)

Mattel is in for a bumpy ride. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Mattel Will Underperform

Known for the creation of iconic toys such as Barbie and Hotwheels, Mattel (NASDAQ:MAT) is a global children's entertainment company specializing in the design and production of consumer products.

- 3.3% annual revenue growth over the last five years was slower than its consumer discretionary peers

- Poor expense management has led to an operating margin that is below the industry average

- Poor free cash flow generation means it has few chances to reinvest for growth, repurchase shares, or distribute capital

Mattel doesn’t satisfy our quality benchmarks. You should search for better opportunities.

Why There Are Better Opportunities Than Mattel

Why There Are Better Opportunities Than Mattel

Mattel’s stock price of $21.55 implies a valuation ratio of 12.5x forward P/E. Mattel’s valuation may seem like a bargain, especially when stacked up against other consumer discretionary companies. We remind you that you often get what you pay for, though.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Mattel (MAT) Research Report: Q4 CY2025 Update

Toy manufacturing and entertainment company (NASDAQ:MAT) fell short of the market’s revenue expectations in Q4 CY2025, but sales rose 7.3% year on year to $1.77 billion. Its non-GAAP profit of $0.39 per share was 28.8% below analysts’ consensus estimates.

Mattel (MAT) Q4 CY2025 Highlights:

- Revenue: $1.77 billion vs analyst estimates of $1.83 billion (7.3% year-on-year growth, 3.7% miss)

- Adjusted EPS: $0.39 vs analyst expectations of $0.55 (28.8% miss)

- Adjusted EBITDA: $234.2 million vs analyst estimates of $316.7 million (13.3% margin, 26.1% miss)

- Adjusted EPS guidance for the upcoming financial year 2026 is $1.24 at the midpoint, missing analyst estimates by 29.6%

- Operating Margin: 8%, down from 9.4% in the same quarter last year

- Market Capitalization: $6.70 billion

Company Overview

Known for the creation of iconic toys such as Barbie and Hotwheels, Mattel (NASDAQ:MAT) is a global children's entertainment company specializing in the design and production of consumer products.

Mattel's story began in 1945 as a garage startup. Founded by Harold "Matt" Matson and Elliot Handler to craft picture frames, they later pivoted to dollhouse furniture. The founders' belief in the crucial role of play in a child's development spurred Mattel's shift toward toy manufacturing. This move led to the creation of Barbie, a toy that rapidly gained popularity.

Today, Mattel's portfolio encompasses a variety of toy lines and digital games that encourage imaginative play. Some of its products are also dedicated to educational purposes.

Mattel’s revenue is derived from sales of its toy and game portfolio, film and television content based on its brands (Barbie Movie), and licensing deals. It sells its products through direct-to-consumer sales channels and a retail presence. Mattel's potential lies in its ability to create characters and stories that resonate with children across various cultures.

4. Toys and Electronics

The toys and electronics industry presents both opportunities and challenges for investors. Established companies often enjoy strong brand recognition and customer loyalty while smaller players can carve out a niche if they develop a viral, hit new product. The downside, however, is that success can be short-lived because the industry is very competitive: the barriers to entry for developing a new toy are low, which can lead to pricing pressures and reduced profit margins, and the rapid pace of technological advancements necessitates continuous product updates, increasing research and development costs, and shortening product life cycles for electronics companies. Furthermore, these players must navigate various regulatory requirements, especially regarding product safety, which can pose operational challenges and potential legal risks.

Competitors in the toy and entertainment industry include Hasbro (NASDAQ:HAS), Funko (NASDAQ:FNKO), and Jakks Pacific (NASDAQ:JAKK).

5. Revenue Growth

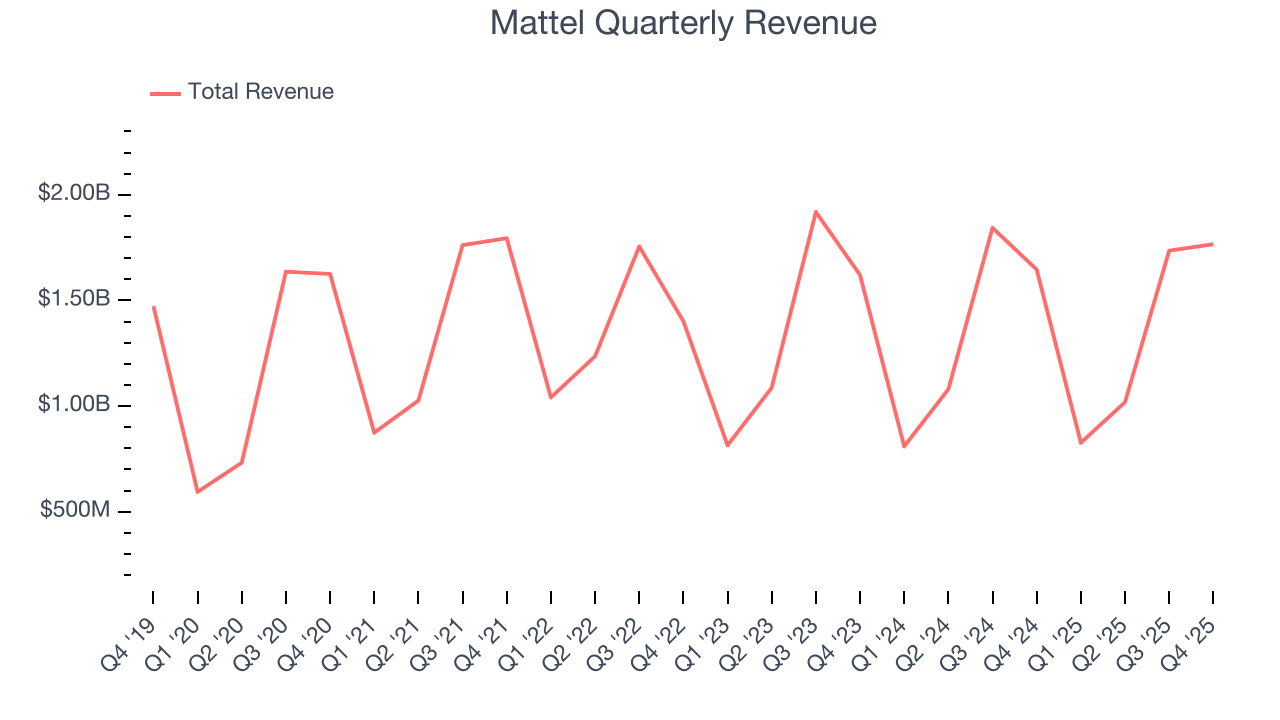

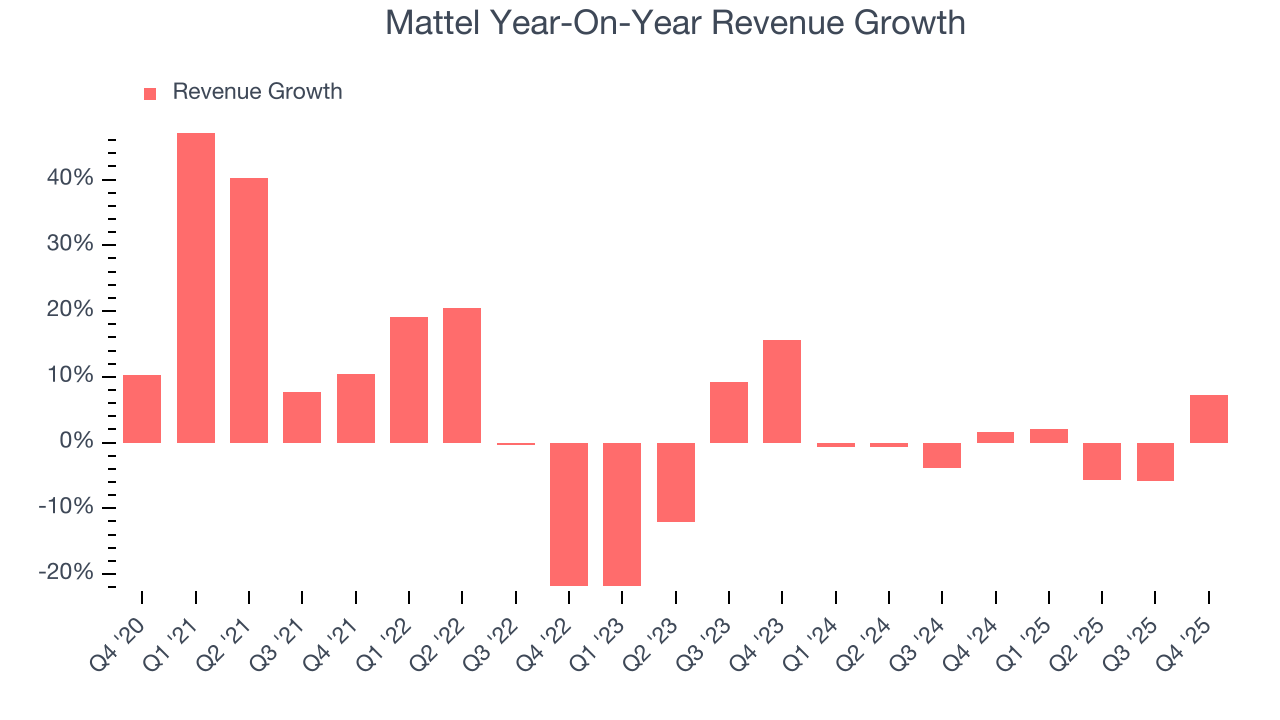

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Mattel grew its sales at a weak 3.1% compounded annual growth rate. This was below our standard for the consumer discretionary sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Mattel’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

This quarter, Mattel’s revenue grew by 7.3% year on year to $1.77 billion, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.7% over the next 12 months. While this projection indicates its newer products and services will catalyze better top-line performance, it is still below the sector average.

6. Operating Margin

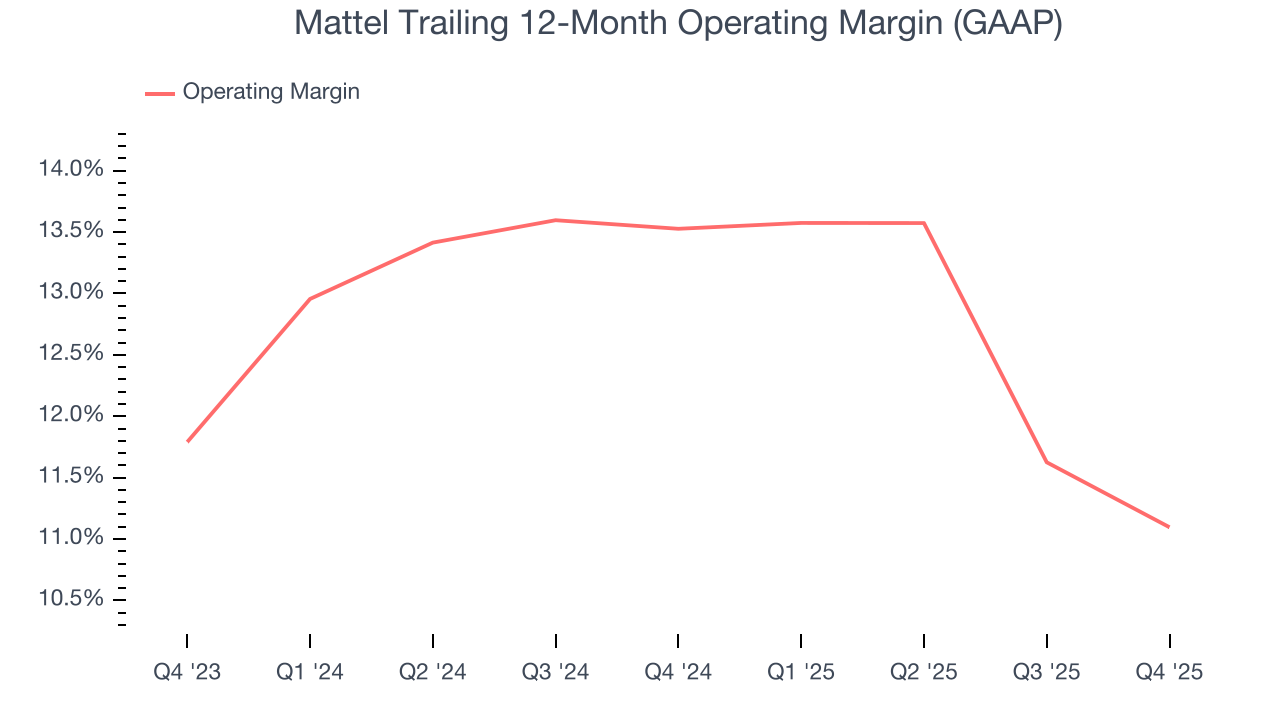

Mattel’s operating margin has shrunk over the last 12 months and averaged 12.3% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

In Q4, Mattel generated an operating margin profit margin of 8%, down 1.5 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

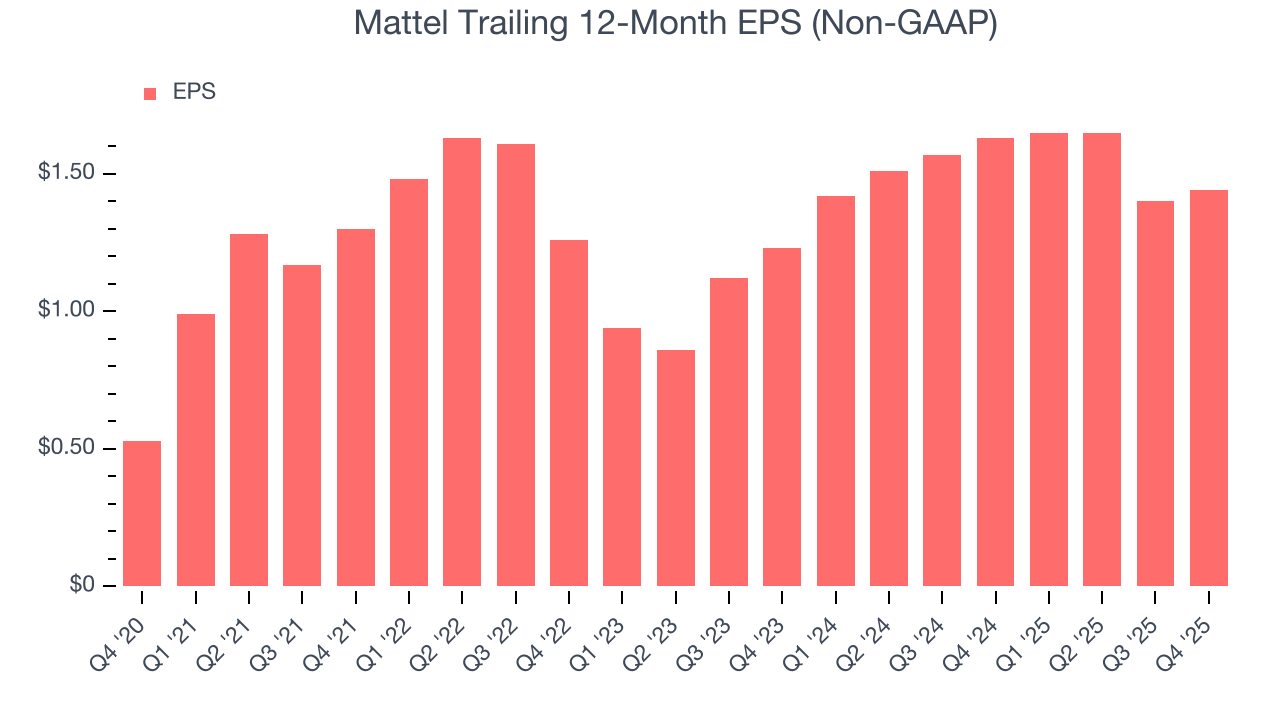

Mattel’s EPS grew at a weak 22.1% compounded annual growth rate over the last five years. This performance was better than its flat revenue but doesn’t tell us much about its business quality because its operating margin didn’t improve.

In Q4, Mattel reported adjusted EPS of $0.39, up from $0.35 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects Mattel’s full-year EPS of $1.44 to grow 23%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

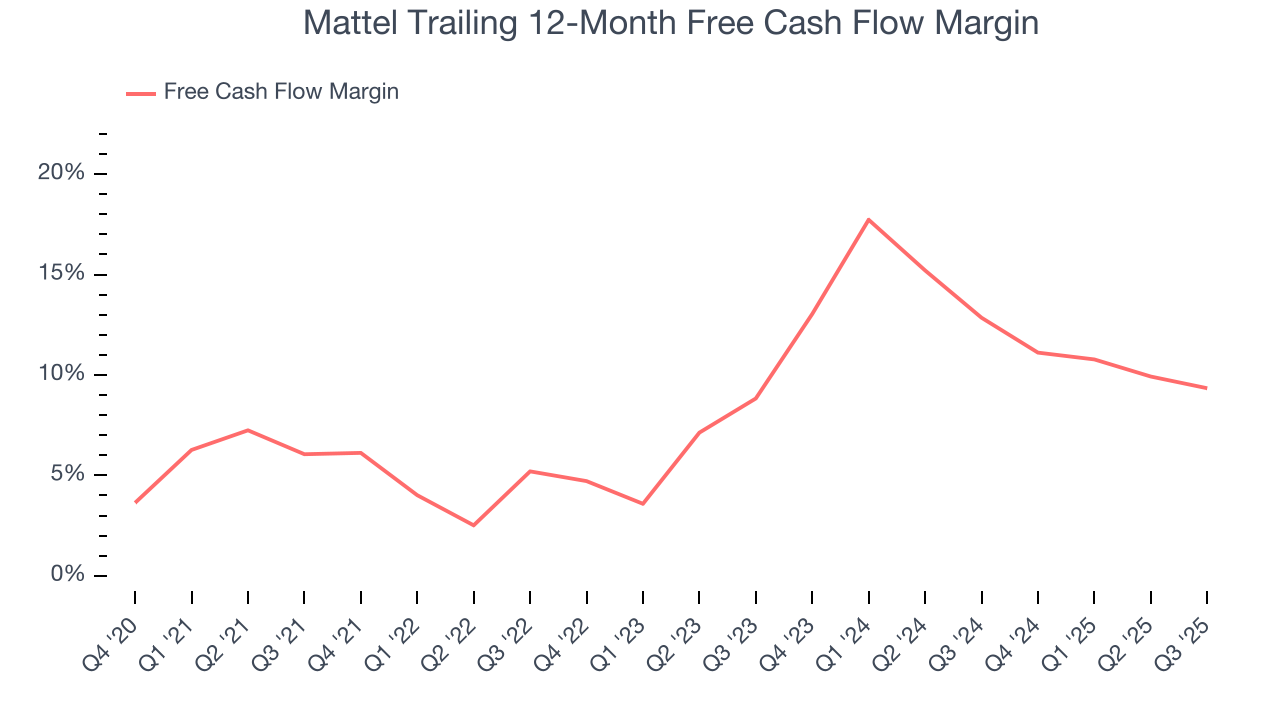

Mattel has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3%, lousy for a consumer discretionary business.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

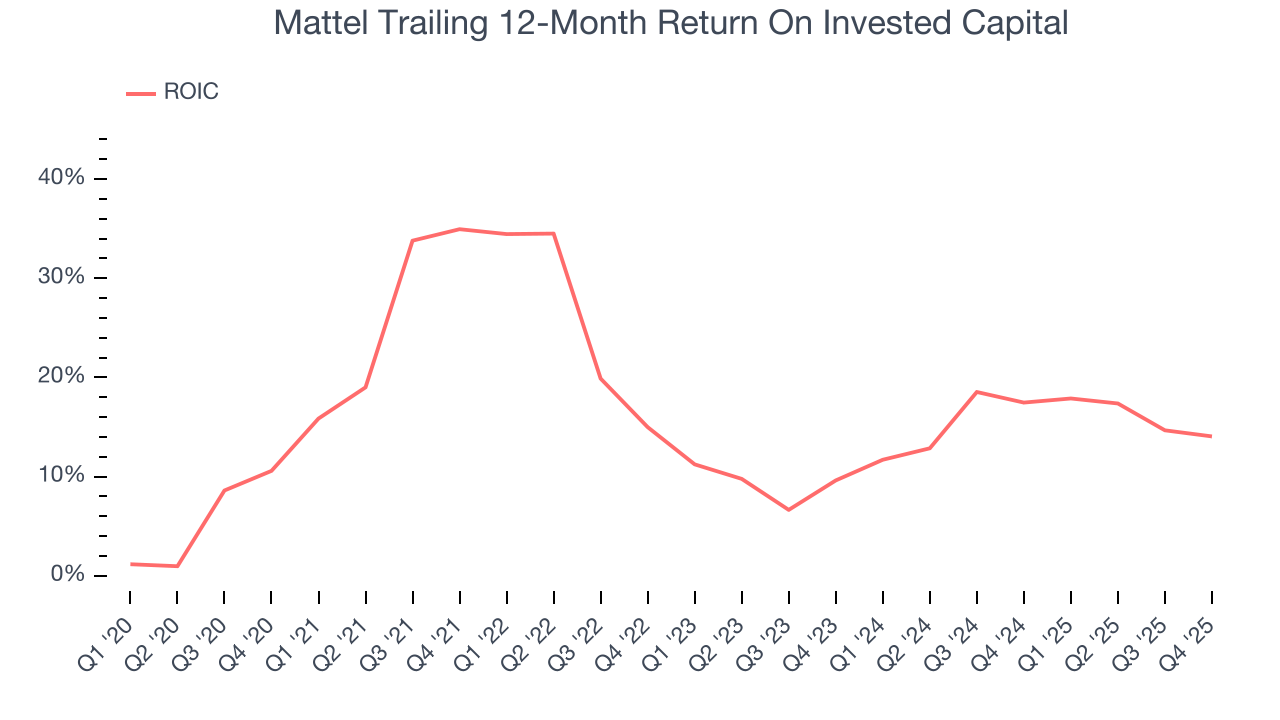

Mattel historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 18.2%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Mattel’s ROIC has unfortunately decreased. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Assessment

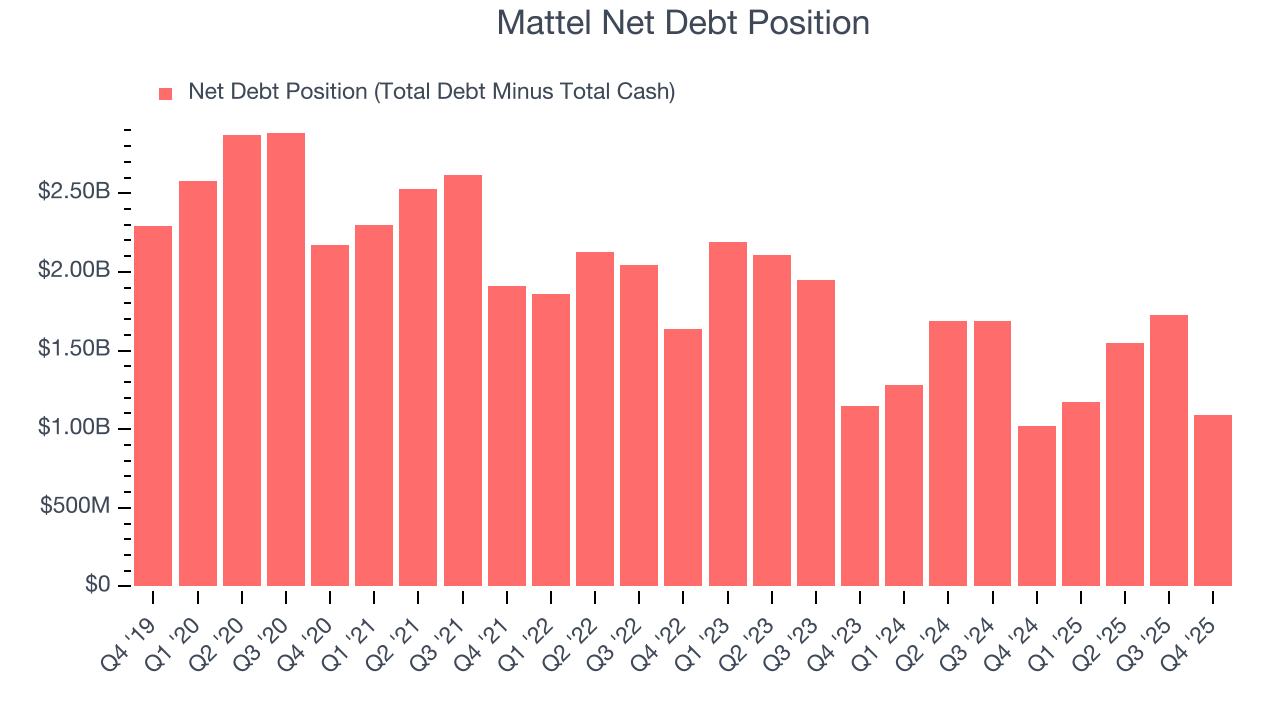

Mattel reported $1.24 billion of cash and $2.33 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $927.4 million of EBITDA over the last 12 months, we view Mattel’s 1.2× net-debt-to-EBITDA ratio as safe. We also see its $73.66 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Mattel’s Q4 Results

We struggled to find many positives in these results. Its full-year EPS guidance missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 8.8% to $19.21 immediately after reporting.

12. Is Now The Time To Buy Mattel?

Updated: February 10, 2026 at 10:08 PM EST

Before deciding whether to buy Mattel or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

We cheer for all companies serving everyday consumers, but in the case of Mattel, we’ll be cheering from the sidelines. To begin with, its revenue growth was weak over the last five years. On top of that, Mattel’s relatively low ROIC suggests management has struggled to find compelling investment opportunities, and its low free cash flow margins give it little breathing room.

Mattel’s P/E ratio based on the next 12 months is 12.2x. While this valuation is reasonable, we don’t see a big opportunity at the moment. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $24.50 on the company (compared to the current share price of $17.82).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.