MasterCraft (MCFT)

We wouldn’t buy MasterCraft. Its low returns on capital and plummeting sales suggest it struggles to generate demand and profits, a red flag.― StockStory Analyst Team

1. News

2. Summary

Why We Think MasterCraft Will Underperform

Started by a waterskiing instructor, MasterCraft (NASDAQ:MCFT) specializes in designing, manufacturing, and selling sport boats.

- Products and services aren't resonating with the market as its revenue declined by 4.7% annually over the last five years

- Falling earnings per share over the last five years has some investors worried as stock prices ultimately follow EPS over the long term

- Operating margin falls short of the industry average, and the smaller profit dollars make it harder to react to unexpected market developments

MasterCraft doesn’t fulfill our quality requirements. There are superior opportunities elsewhere.

Why There Are Better Opportunities Than MasterCraft

High Quality

Investable

Underperform

Why There Are Better Opportunities Than MasterCraft

At $21.55 per share, MasterCraft trades at 13.6x forward P/E. This multiple is cheaper than most consumer discretionary peers, but we think this is justified.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. MasterCraft (MCFT) Research Report: Q4 CY2025 Update

Sport boat manufacturer MasterCraft (NASDAQ:MCFT) fell short of the market’s revenue expectations in Q4 CY2025 as sales only rose 1.9% year on year to $64.57 million. Its non-GAAP profit of $0.10 per share was 39.1% below analysts’ consensus estimates.

MasterCraft (MCFT) Q4 CY2025 Highlights:

- Revenue: $64.57 million vs analyst estimates of $68.93 million (1.9% year-on-year growth, 6.3% miss)

- Adjusted EPS: $0.10 vs analyst expectations of $0.16 (39.1% miss)

- Adjusted EBITDA: $4.52 million vs analyst estimates of $5.45 million (7% margin, relatively in line)

- Operating Margin: 5.8%, up from 0.3% in the same quarter last year

- Market Capitalization: $376.6 million

Company Overview

Started by a waterskiing instructor, MasterCraft (NASDAQ:MCFT) specializes in designing, manufacturing, and selling sport boats.

MasterCraft was founded to manufacture high-performance sport boats. The company emerged to address the specific needs of waterskiing and wakeboarding enthusiasts, offering a range of boats that are designed to enhance the watersports experience.

Products from MasterCraft include sport boats that cater to various watersports activities, including waterskiing, wakeboarding, and luxury boating. Each model is designed to meet the performance demands of both recreational users and professional athletes, incorporating features aimed at improving functionality and onboard comfort.

MasterCraft generates revenue through its global dealership network and direct sales to consumers, enabling it to reach a broad market segment. This business model facilitates the company's engagement with its target audience, ensuring that its boats are accessible to a wide range of customers seeking specialized watersports equipment.

4. Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Competitors in the recreational watercraft industry include Brunswick (NYSE:BC), Malibu Boats (NASDAQ:MBUU), and Marine Products (NYSE:MPX).

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. MasterCraft’s demand was weak over the last five years as its sales fell at a 5.1% annual rate. This was below our standards and suggests it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. MasterCraft’s recent performance shows its demand remained suppressed as its revenue has declined by 25.3% annually over the last two years.

This quarter, MasterCraft’s revenue grew by 1.9% year on year to $64.57 million, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 9.6% over the next 12 months. Although this projection implies its newer products and services will catalyze better top-line performance, it is still below average for the sector.

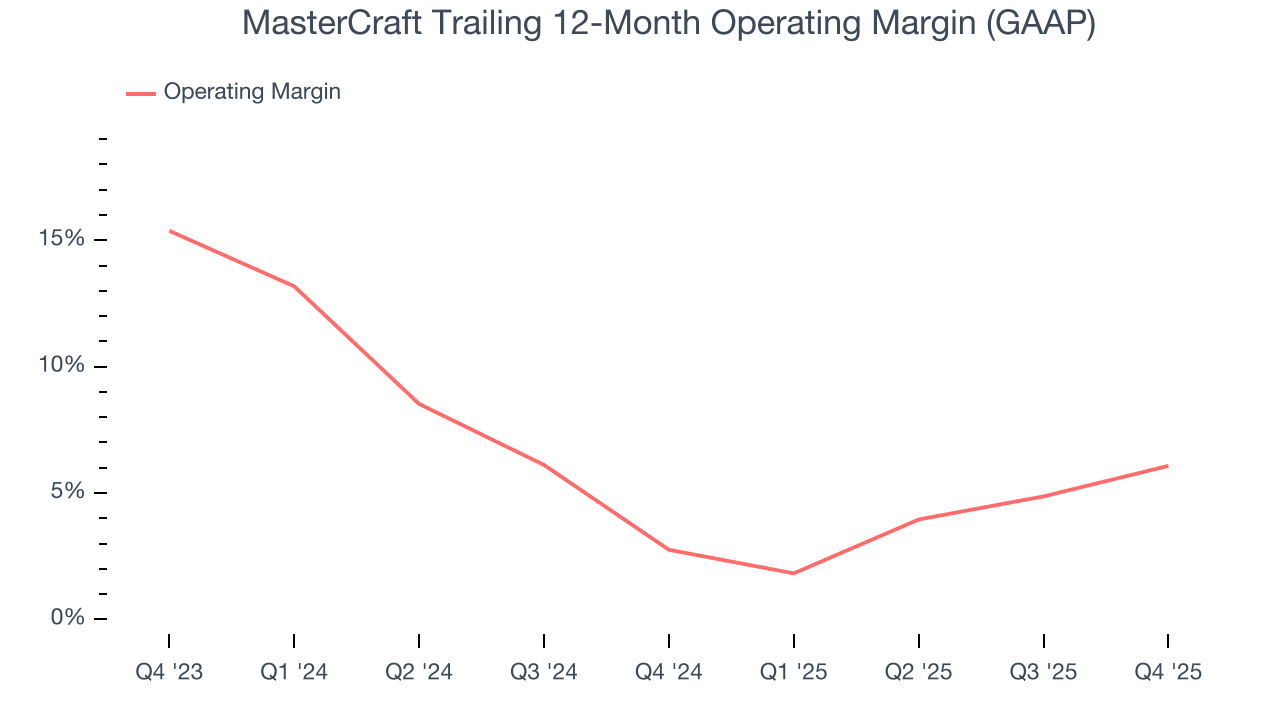

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

MasterCraft’s operating margin has been trending up over the last 12 months and averaged 4.5% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports inadequate profitability for a consumer discretionary business.

This quarter, MasterCraft generated an operating margin profit margin of 5.8%, up 5.5 percentage points year on year. This increase was a welcome development and shows it was more efficient.

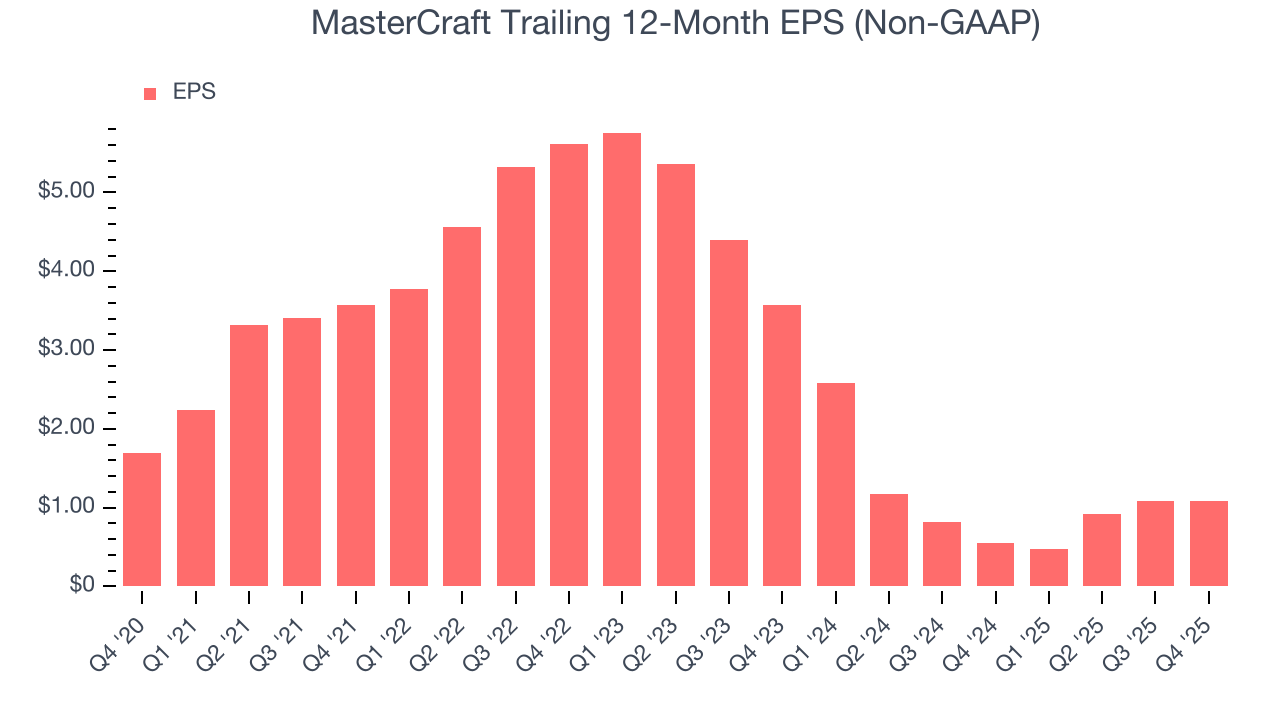

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for MasterCraft, its EPS declined by 8.6% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

In Q4, MasterCraft reported adjusted EPS of $0.10, in line with the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects MasterCraft’s full-year EPS of $1.08 to grow 21.3%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

MasterCraft has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 8.1%, lousy for a consumer discretionary business.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

MasterCraft historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 32.7%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, MasterCraft’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

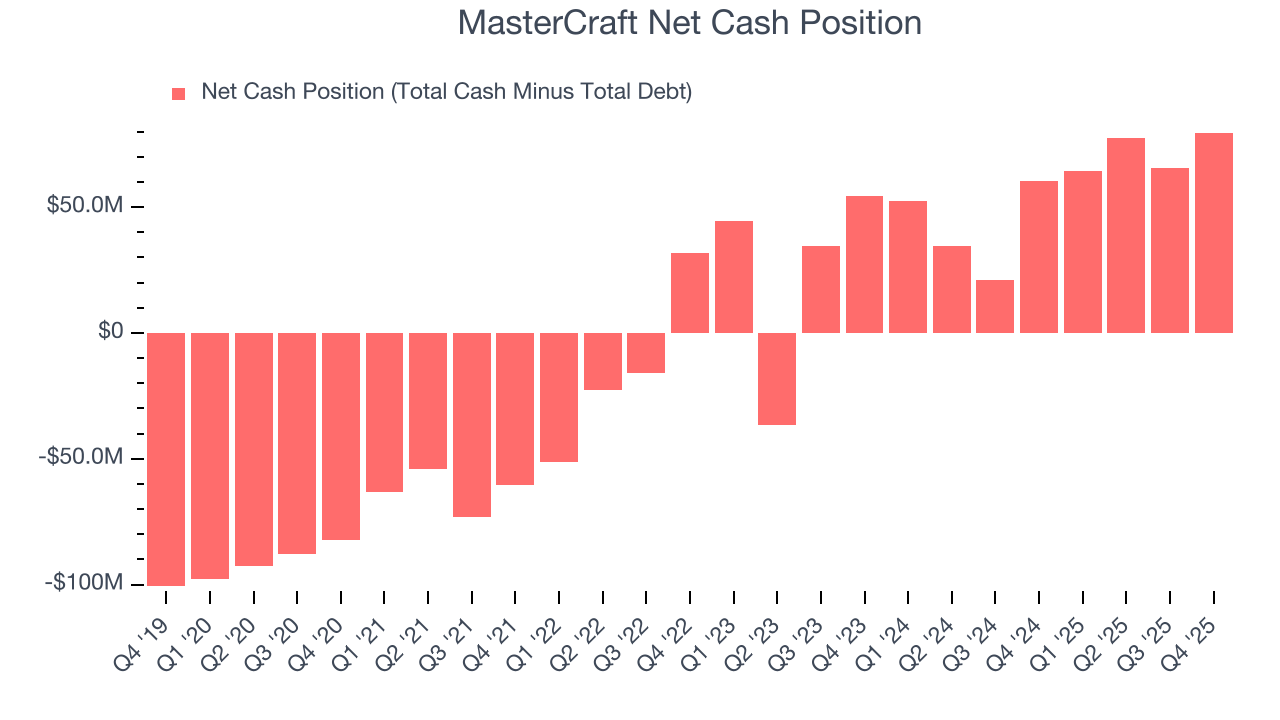

10. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

MasterCraft is a profitable, well-capitalized company with $81.38 million of cash and $1.74 million of debt on its balance sheet. This $79.64 million net cash position is 19.9% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from MasterCraft’s Q4 Results

We struggled to find many positives in these results. Its revenue missed and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. Still, the stock traded up 2.1% to $23.60 immediately after reporting.

12. Is Now The Time To Buy MasterCraft?

Updated: March 4, 2026 at 10:14 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own MasterCraft, you should also grasp the company’s longer-term business quality and valuation.

We see the value of companies helping consumers, but in the case of MasterCraft, we’re out. On top of that, MasterCraft’s number of boats sold has disappointed, and its Forecasted free cash flow margin suggests the company will ramp up its investments next year.

MasterCraft’s P/E ratio based on the next 12 months is 13.6x. This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $25 on the company (compared to the current share price of $21.55).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.