MercadoLibre (MELI)

MercadoLibre sets the gold standard. Its ability to balance growth and profitability while maintaining a bright outlook makes it a gem.― StockStory Analyst Team

1. News

2. Summary

Why We Like MercadoLibre

Originally started as an online auction platform, MercadoLibre (NASDAQ:MELI) is a one-stop e-commerce marketplace and fintech platform in Latin America.

- Market share has increased over the last three years as its 39.4% annual revenue growth was exceptional

- Market share will likely rise over the next 12 months as its expected revenue growth of 33.2% is robust

- Impressive free cash flow profitability enables the company to fund new investments or reward investors with share buybacks/dividends, and its rising cash conversion increases its margin of safety

MercadoLibre is a no-brainer. The valuation looks fair when considering its quality, and we think now is a prudent time to buy the stock.

Why Is Now The Time To Buy MercadoLibre?

High Quality

Investable

Underperform

Why Is Now The Time To Buy MercadoLibre?

At $2,154 per share, MercadoLibre trades at 21.1x forward EV/EBITDA. Looking at the consumer internet space, we think the valuation is fair - potentially even too low - for the business quality.

Entry price matters much less than business quality when investing for the long term, but hey, it certainly doesn’t hurt to get in at an attractive price.

3. MercadoLibre (MELI) Research Report: Q3 CY2025 Update

Latin American e-commerce and fintech company MercadoLibre (NASDAQ:MELI) announced better-than-expected revenue in Q3 CY2025, with sales up 39.5% year on year to $7.41 billion. Its GAAP profit of $8.32 per share was 10.5% below analysts’ consensus estimates.

MercadoLibre (MELI) Q3 CY2025 Highlights:

- Revenue: $7.41 billion vs analyst estimates of $7.20 billion (39.5% year-on-year growth, 2.9% beat)

- EPS (GAAP): $8.32 vs analyst expectations of $9.30 (10.5% miss)

- Adjusted EBITDA: $933 million vs analyst estimates of $964.1 million (12.6% margin, 3.2% miss)

- Operating Margin: 9.8%, in line with the same quarter last year

- Free Cash Flow Margin: 59.6%, up from 38.7% in the previous quarter

- Unique Active Buyers: 77 million, up 16.2 million year on year

- Market Capitalization: $116.4 billion

Company Overview

Originally started as an online auction platform, MercadoLibre (NASDAQ:MELI) is a one-stop e-commerce marketplace and fintech platform in Latin America.

The company connects buyers and sellers in the majority of countries across the continent. On its e-commerce platform, buyers can browse and purchase products ranging from furniture to groceries while sellers can list products and access tools to manage their online stores. It also offers payment and shipping solutions, as well as financial services such as loans through its subsidiary, MercadoPago.

MercadoLibre’s competitive advantage is its logistics network, which delivers 80%+ of orders within 48 hours. Shipping is particularly difficult in Latin America because of the region’s mountainous geography, so no other competitor is close to MercadoLibre’s capabilities.

MercadoLibre’s e-commerce business generates revenue primarily through commissions on third-party transactions. For example, when a seller makes a sale, MercadoLibre charges a fee ranging from mid-single-digits percentages to mid-teens percentages, depending on the category and sales volumes. Recently, it has started selling its own products to fill key inventory gaps. Advertising and sponsored listings are also additional sources of revenue.

In its fintech business, MercadoLibre leverages the seller data generated in its e-commerce business to provide loans to merchants. It also has a digital wallet offering that allows users to park their money and earn higher yields than in a traditional bank account—a high value proposition given the notorious inflation rates in Latin America.

4. Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

Competitors operating similar platforms include Amazon.com (NASDAQ:AMZN), Alibaba (NYSE:BABA), and eBay (NASDAQ:EBAY).

5. Revenue Growth

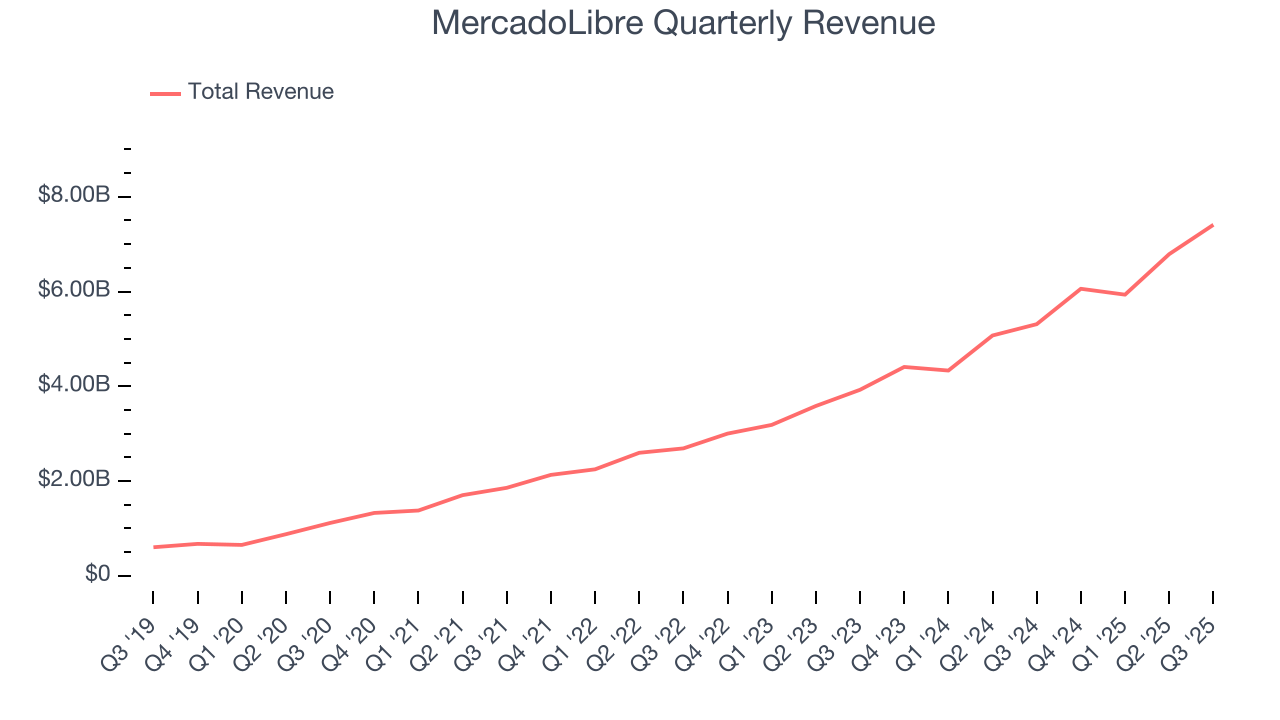

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, MercadoLibre’s sales grew at an incredible 39.4% compounded annual growth rate over the last three years. Its growth surpassed the average consumer internet company and shows its offerings resonate with customers, a great starting point for our analysis.

This quarter, MercadoLibre reported wonderful year-on-year revenue growth of 39.5%, and its $7.41 billion of revenue exceeded Wall Street’s estimates by 2.9%.

Looking ahead, sell-side analysts expect revenue to grow 28.3% over the next 12 months, a deceleration versus the last three years. Still, this projection is eye-popping given its scale and indicates the market sees success for its products and services.

6. Unique Active Buyers

User Growth

As an online marketplace, MercadoLibre generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

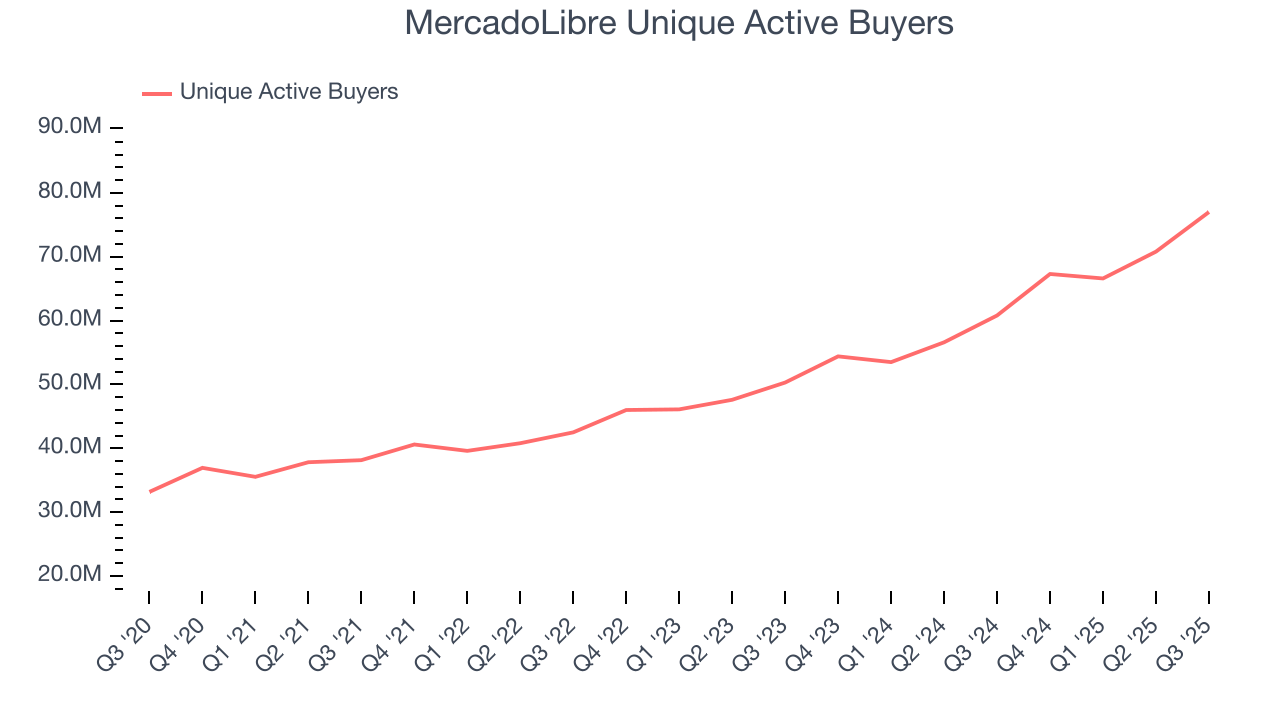

Over the last two years, MercadoLibre’s unique active buyers, a key performance metric for the company, increased by 21.8% annually to 77 million in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

In Q3, MercadoLibre added 16.2 million unique active buyers, leading to 26.6% year-on-year growth. The quarterly print was higher than its two-year result, suggesting its new initiatives are accelerating user growth.

Revenue Per User

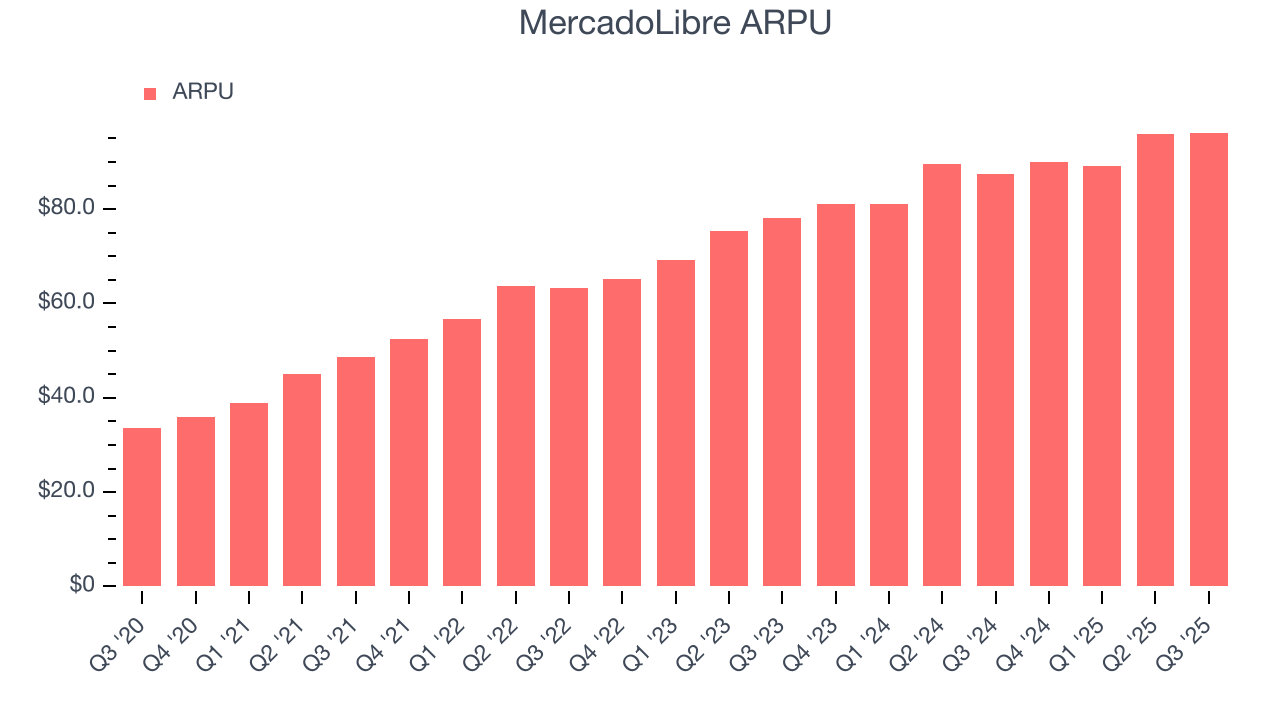

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns in transaction fees from each user. ARPU also gives us unique insights into a user’s average order size and MercadoLibre’s take rate, or "cut", on each order.

MercadoLibre’s ARPU growth has been exceptional over the last two years, averaging 13.8%. Its ability to increase monetization while growing its unique active buyers at an impressive rate reflects the strength of its platform, as its users are spending significantly more than last year.

This quarter, MercadoLibre’s ARPU clocked in at $96.22. It grew by 10.1% year on year, slower than its user growth.

7. Gross Margin & Pricing Power

For online marketplaces like MercadoLibre, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include payment processing, hosting, and bandwidth fees in addition to the costs necessary to onboard buyers and sellers, such as identity verification.

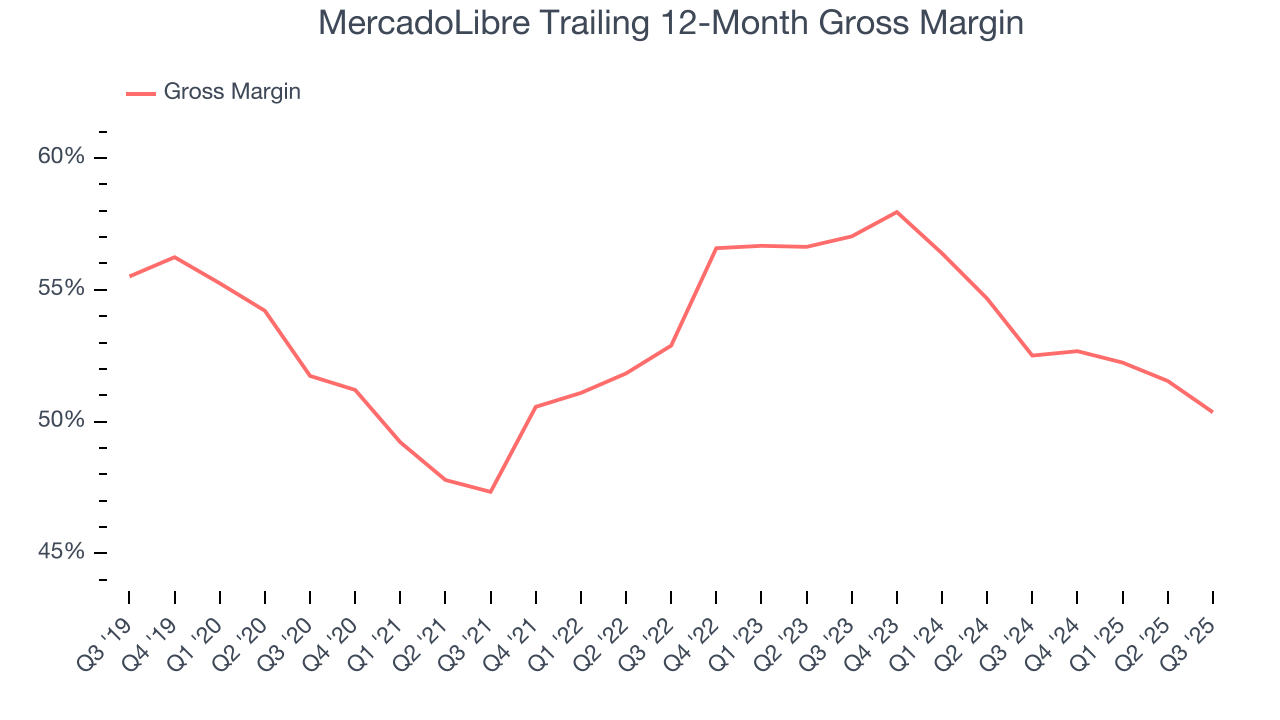

MercadoLibre’s gross margin is slightly below the average consumer internet company, giving it less room to invest in areas such as product and marketing to grow its presence. As you can see below, it averaged a 51.3% gross margin over the last two years. That means MercadoLibre paid its providers a lot of money ($48.74 for every $100 in revenue) to run its business.

In Q3, MercadoLibre produced a 43.3% gross profit margin, down 2.6 percentage points year on year. MercadoLibre’s full-year margin has also been trending down over the past 12 months, decreasing by 2.1 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs.

8. User Acquisition Efficiency

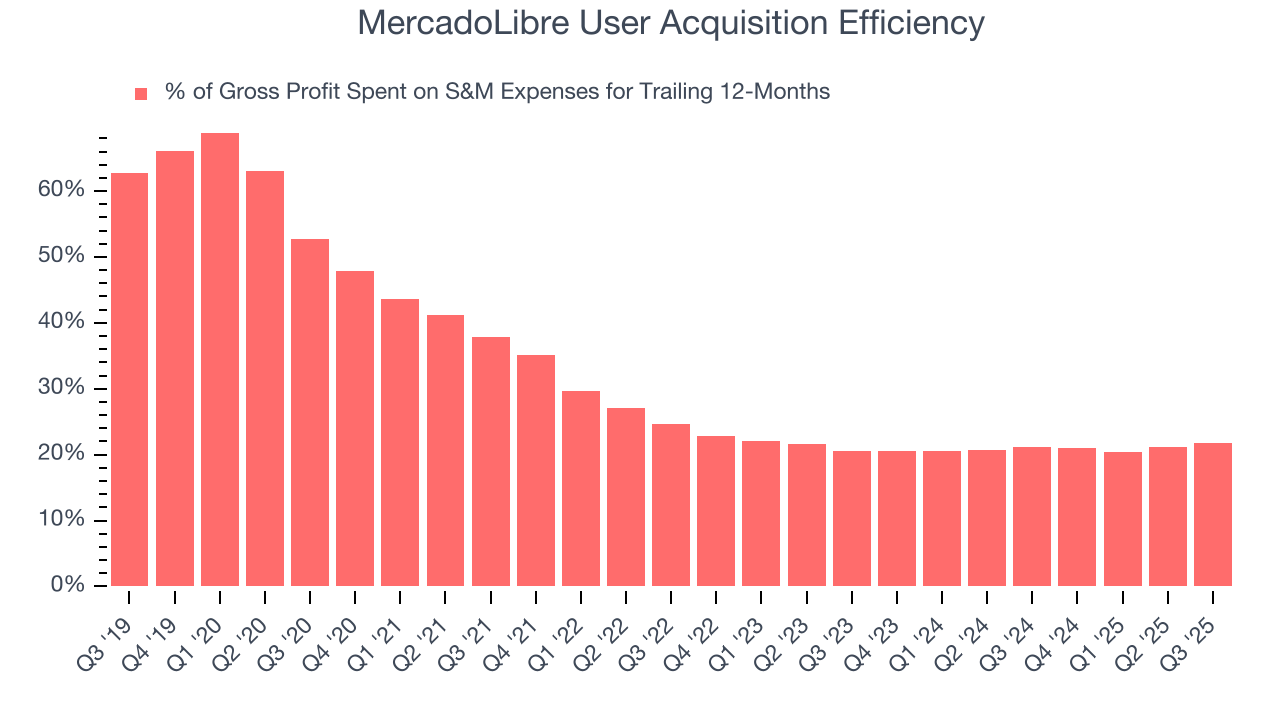

Consumer internet businesses like MercadoLibre grow from a combination of product virality, paid advertisement, and incentives (unlike enterprise software products, which are often sold by dedicated sales teams).

MercadoLibre is very efficient at acquiring new users, spending only 21.8% of its gross profit on sales and marketing expenses over the last year. This efficiency indicates that it has a highly differentiated product offering and strong brand reputation from scale, giving MercadoLibre the freedom to invest its resources into new growth initiatives while maintaining optionality.

9. EBITDA

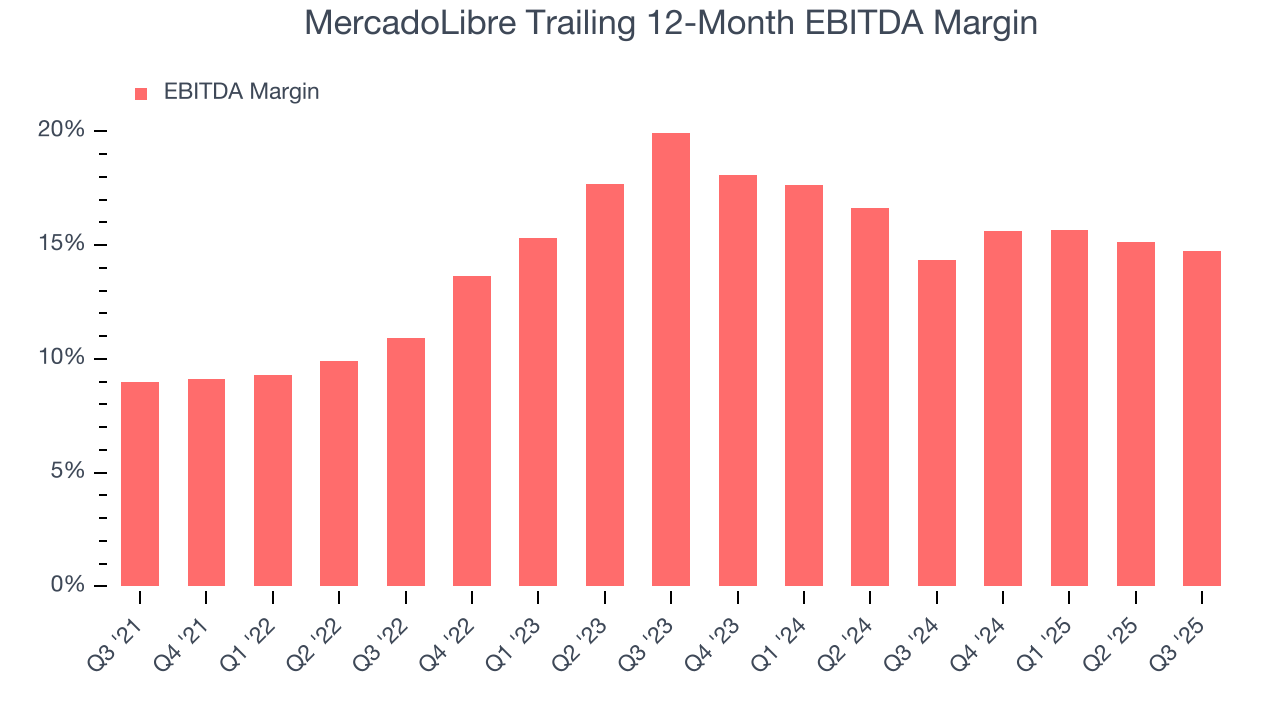

EBITDA is a good way of judging operating profitability for consumer internet companies because it excludes various one-time or non-cash expenses (depreciation), providing a more standardized view of the business’s profit potential.

MercadoLibre has been an efficient company over the last two years. It was one of the more profitable businesses in the consumer internet sector, boasting an average EBITDA margin of 14.6%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, MercadoLibre’s EBITDA margin rose by 3.8 percentage points over the last few years, as its sales growth gave it operating leverage.

In Q3, MercadoLibre generated an EBITDA margin profit margin of 12.6%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

10. Earnings Per Share

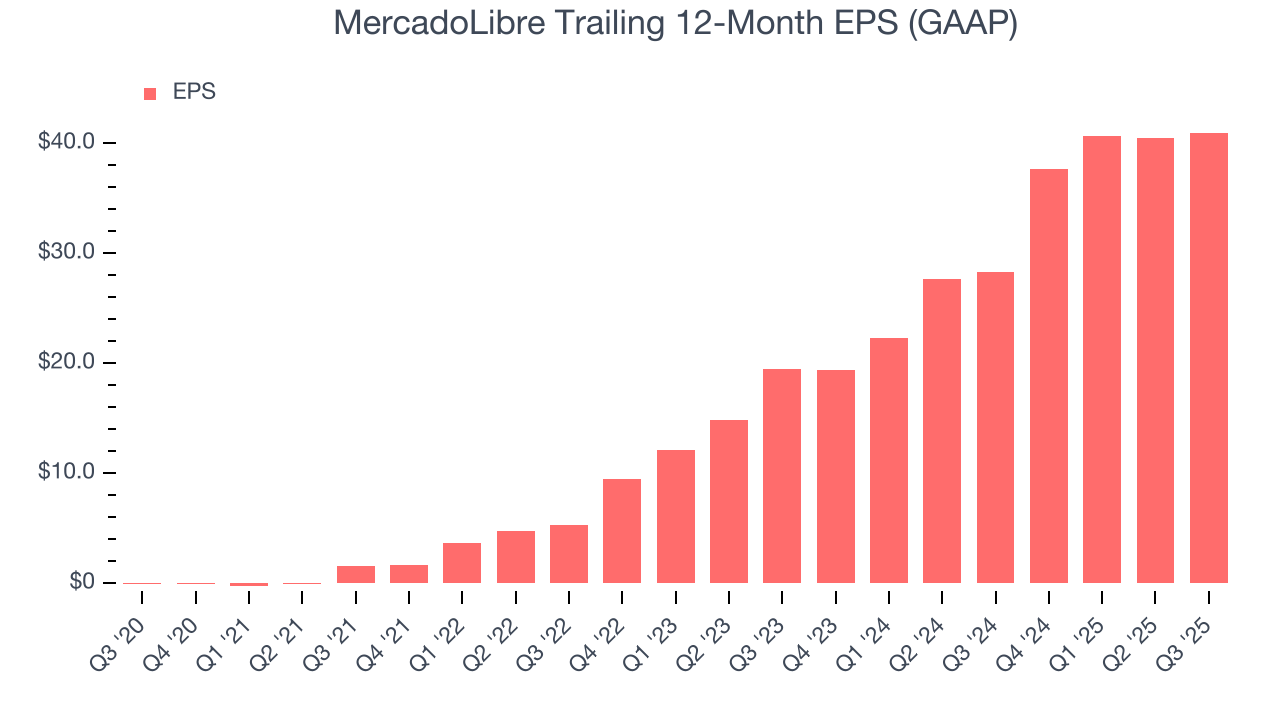

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

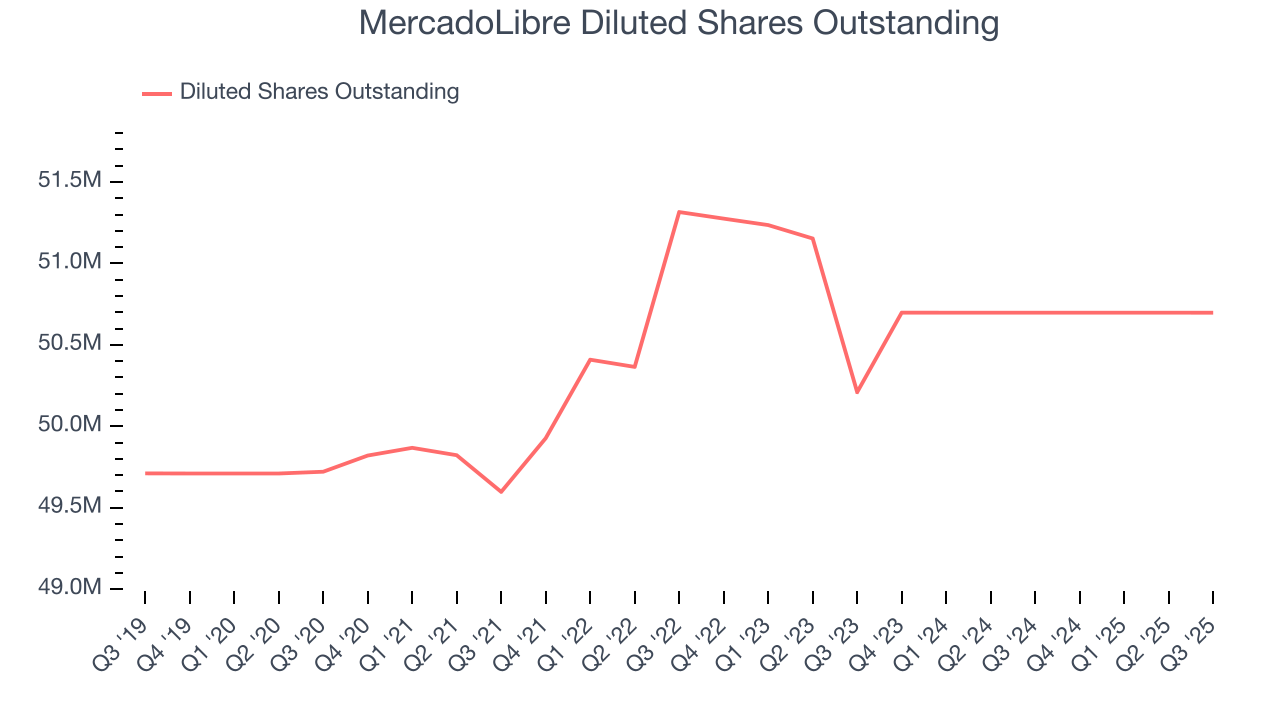

We can take a deeper look into MercadoLibre’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, MercadoLibre’s EBITDA margin was flat this quarter but expanded by 3.8 percentage points over the last three years. On top of that, its share count shrank by 1.2%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q3, MercadoLibre reported EPS of $8.32, up from $7.83 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects MercadoLibre’s full-year EPS of $40.98 to grow 38.3%.

11. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

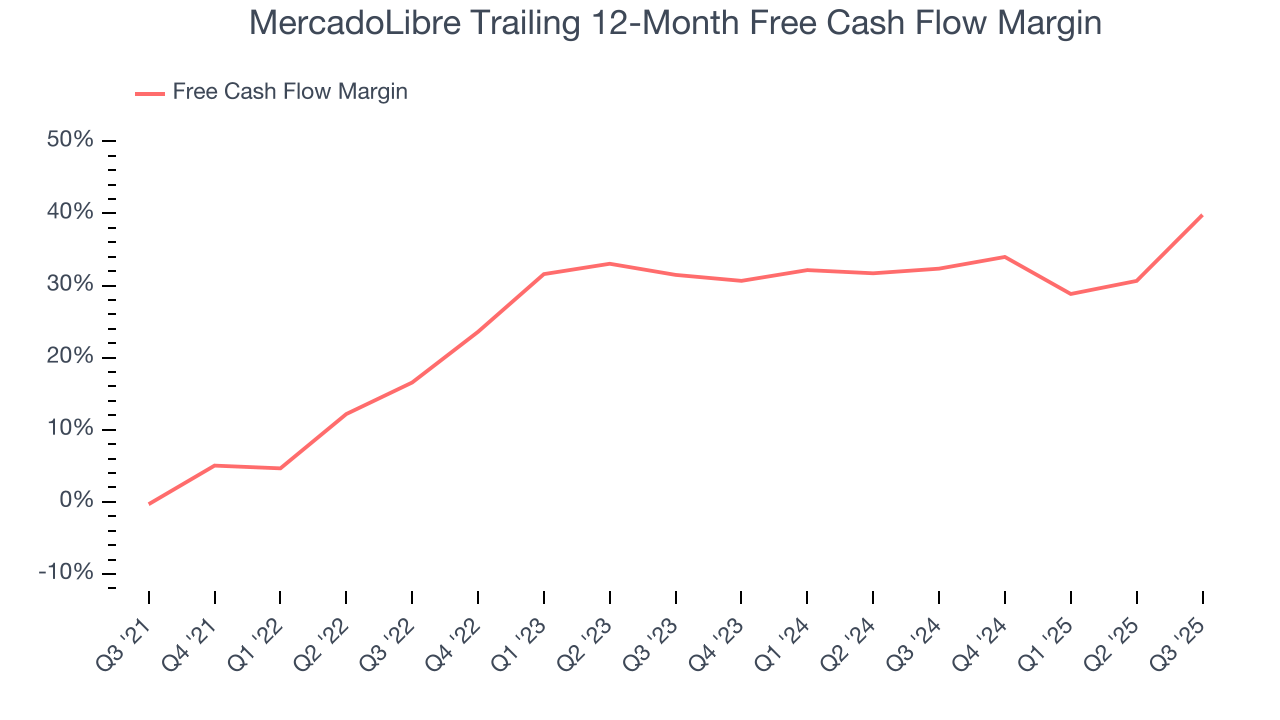

MercadoLibre has shown terrific cash profitability, driven by its cost-effective customer acquisition strategy that enables it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the consumer internet sector, averaging an eye-popping 36.7% over the last two years.

Taking a step back, we can see that MercadoLibre’s margin expanded by 23.3 percentage points over the last few years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

MercadoLibre’s free cash flow clocked in at $4.42 billion in Q3, equivalent to a 59.6% margin. This result was good as its margin was 33.7 percentage points higher than in the same quarter last year, building on its favorable historical trend.

12. Balance Sheet Assessment

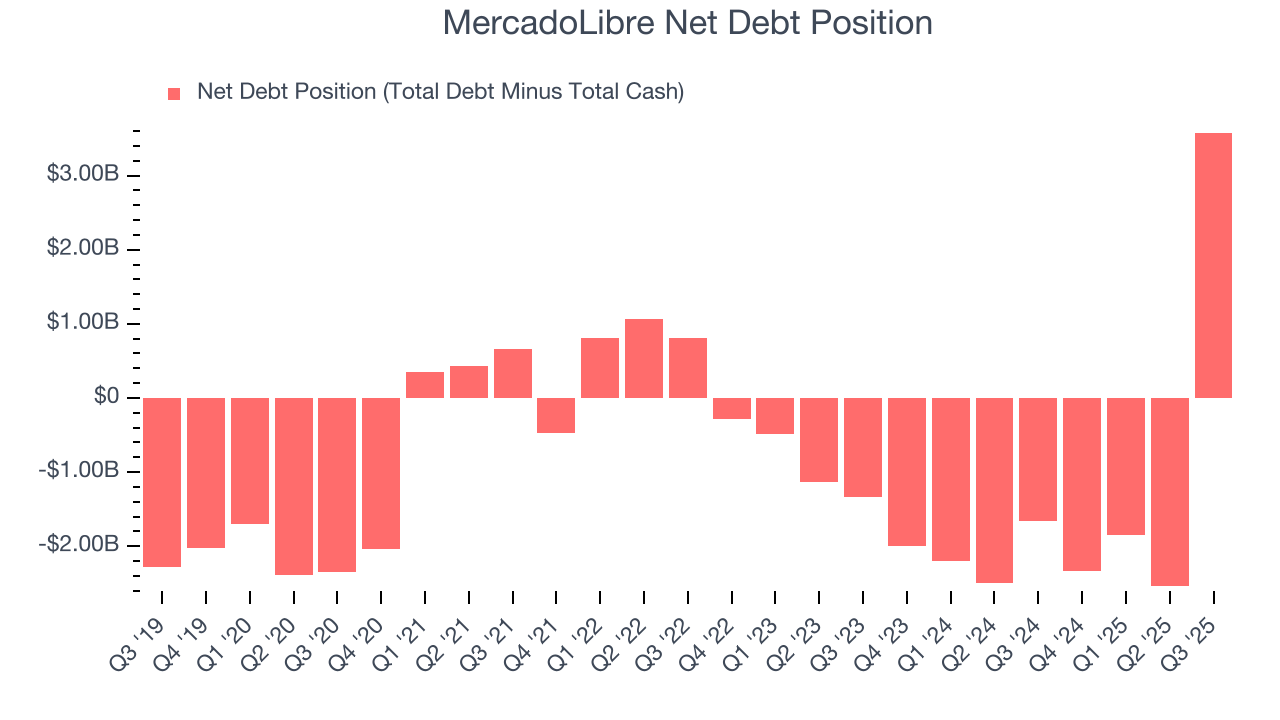

MercadoLibre reported $6.30 billion of cash and $9.88 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $3.86 billion of EBITDA over the last 12 months, we view MercadoLibre’s 0.9× net-debt-to-EBITDA ratio as safe. We also see its $84 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from MercadoLibre’s Q3 Results

We enjoyed seeing MercadoLibre increase its number of users this quarter. We were also happy its number of unique active buyers outperformed Wall Street’s estimates, leading to a consolidated revenue beat. On the other hand, its EPS missed due to "strategic investments that increased cost of revenue, sales & marketing and provisions for doubtful accounts as a percentage of revenue. These include lowering our free shipping threshold in Brazil, ramping-up 1P, investing in social commerce and expanding our credits business." Zooming out, we think this was a mixed quarter. Investors were likely hoping for more, and shares traded down 3.4% to $2,226 immediately following the results.

14. Is Now The Time To Buy MercadoLibre?

Updated: January 22, 2026 at 9:37 PM EST

When considering an investment in MercadoLibre, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

MercadoLibre is an amazing business ranking highly on our list. For starters, its revenue growth was exceptional over the last three years. On top of that, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits, and its rising cash profitability gives it more optionality.

MercadoLibre’s EV/EBITDA ratio based on the next 12 months is 21.1x. Scanning the consumer internet landscape today, MercadoLibre’s fundamentals clearly illustrate that it’s an elite business, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $2,817 on the company (compared to the current share price of $2,154), implying they see 30.8% upside in buying MercadoLibre in the short term.