Magnite (MGNI)

Magnite is an exciting business. Its rapid revenue growth gives it operating leverage, making it more profitable as it expands.― StockStory Analyst Team

1. News

2. Summary

Why We Like Magnite

Born from the 2020 merger of Rubicon Project and Telaria, Magnite (NASDAQ:MGNI) operates the world's largest independent sell-side advertising platform that automates the buying and selling of digital advertising inventory across all channels and formats.

- Annual revenue growth of 30.2% over the past five years was outstanding, reflecting market share gains this cycle

- Incremental sales significantly boosted profitability as its annual earnings per share growth of 65.2% over the last five years outstripped its revenue performance

- Powerful free cash flow generation enables it to reinvest its profits or return capital to investors consistently, and its rising cash conversion increases its margin of safety

Magnite is a top-tier company. The valuation looks reasonable based on its quality, so this could be a favorable time to invest in some shares.

Why Is Now The Time To Buy Magnite?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Magnite?

Magnite is trading at $15.25 per share, or 15.4x forward P/E. Most business services companies are more expensive, so we think Magnite is a good deal when considering its quality characteristics.

Our analysis and backtests show high-quality businesses routinely outperform the market over a multi-year period, especially when priced like this.

3. Magnite (MGNI) Research Report: Q3 CY2025 Update

Digital advertising platform Magnite (NASDAQ:MGNI) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 10.8% year on year to $179.5 million. Its non-GAAP profit of $0.20 per share was in line with analysts’ consensus estimates.

Magnite (MGNI) Q3 CY2025 Highlights:

- Revenue: $179.5 million vs analyst estimates of $178 million (10.8% year-on-year growth, 0.9% beat)

- Adjusted EPS: $0.20 vs analyst estimates of $0.20 (in line)

- Adjusted EBITDA: $57.17 million vs analyst estimates of $53.1 million (31.9% margin, 7.7% beat)

- Operating Margin: 14%, up from 9.3% in the same quarter last year

- Free Cash Flow Margin: 38.1%, down from 47.7% in the same quarter last year

- Market Capitalization: $2.38 billion

Company Overview

Born from the 2020 merger of Rubicon Project and Telaria, Magnite (NASDAQ:MGNI) operates the world's largest independent sell-side advertising platform that automates the buying and selling of digital advertising inventory across all channels and formats.

Magnite's technology serves as the crucial intermediary between publishers (sellers of advertising space) and advertisers (buyers of that space) in the complex digital advertising ecosystem. The company's platform processes trillions of ad requests monthly, providing publishers with tools to maximize the value of their advertising inventory while giving advertisers access to premium digital content across websites, mobile apps, and connected TV (CTV).

CTV has become a strategic focus for Magnite following its acquisitions of SpotX and SpringServe in 2021, which significantly expanded its capabilities in streaming television advertising. These acquisitions positioned Magnite as the largest independent CTV advertising marketplace, enabling streaming content providers and broadcasters to monetize their programming through programmatic advertising.

For publishers, Magnite offers sophisticated yield management tools that help optimize revenue from their digital properties. A streaming platform might use Magnite's technology to automatically fill commercial breaks with relevant ads while maintaining viewing experience quality through features like frequency capping (preventing the same ad from appearing too often) and competitive separation (ensuring competing brands don't appear in the same ad break).

Advertisers and media buyers use Magnite's platform to reach specific audiences across thousands of publishers in a brand-safe environment. For example, an automotive company looking to promote a new vehicle might use Magnite to programmatically purchase ad space across premium CTV content that reaches their target demographic of affluent professionals.

Magnite generates revenue primarily through taking a percentage of the advertising transactions facilitated through its platform. The company operates globally with established presence in North America, Europe, and Australia, and developing operations in Asia and South America.

4. Advertising & Marketing Services

The sector is on the precipice of both disruption and growth as AI, programmatic advertising, and data-driven marketing reshape how things are done. For example, the advent of the Internet broadly and programmatic advertising specifically means that brand building is not a relationship business anymore but instead one based on data and technology, which could hurt traditional ad agencies. On the other hand, the companies in the sector that beef up their tech chops by automating the buying of ad inventory or facilitating omnichannel marketing, for example, stand to benefit. With or without advances in digitization and AI, the sector is still highly levered to the macro, and economic uncertainty may lead to fluctuating ad spend, particularly in cyclical industries.

Magnite competes with large tech companies that have their own advertising inventory and technology, including Google (NASDAQ: GOOGL), Meta (NASDAQ: META), and Amazon (NASDAQ: AMZN). In the sell-side platform space, its competitors include PubMatic (NASDAQ: PUBM), The Trade Desk (NASDAQ: TTD), and privately-held companies like Index Exchange and OpenX.

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

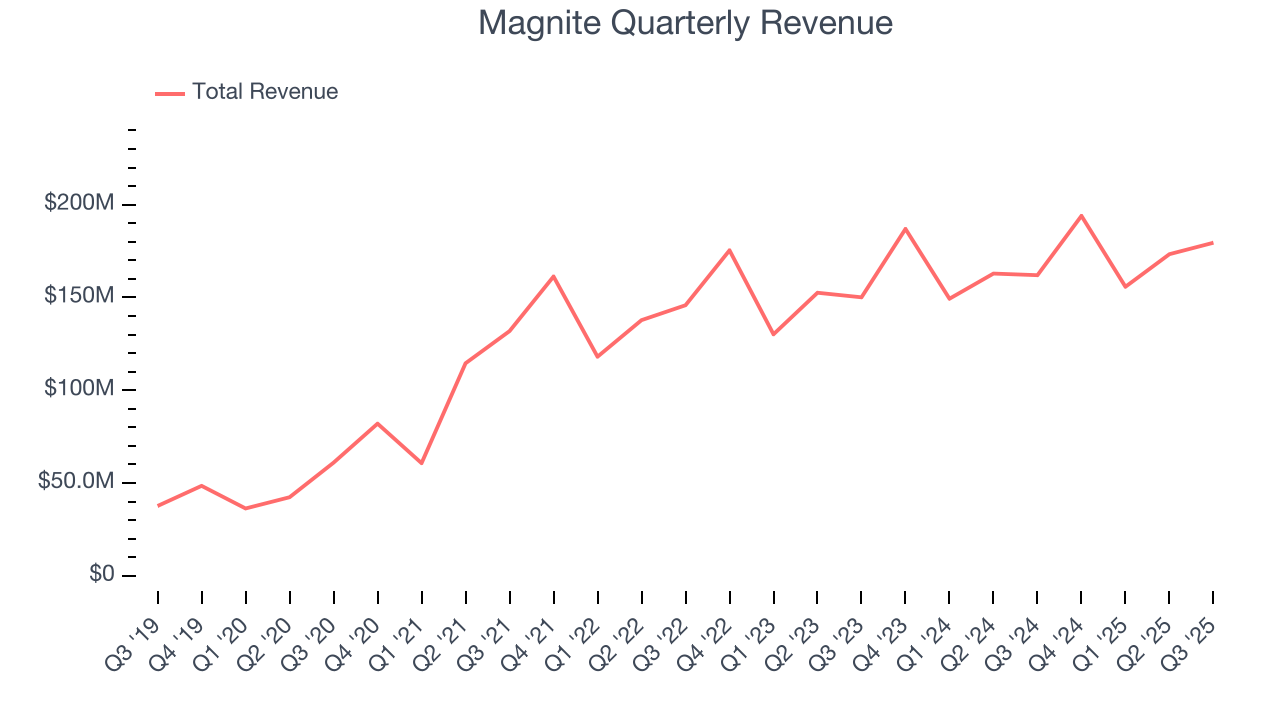

With $702.6 million in revenue over the past 12 months, Magnite is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

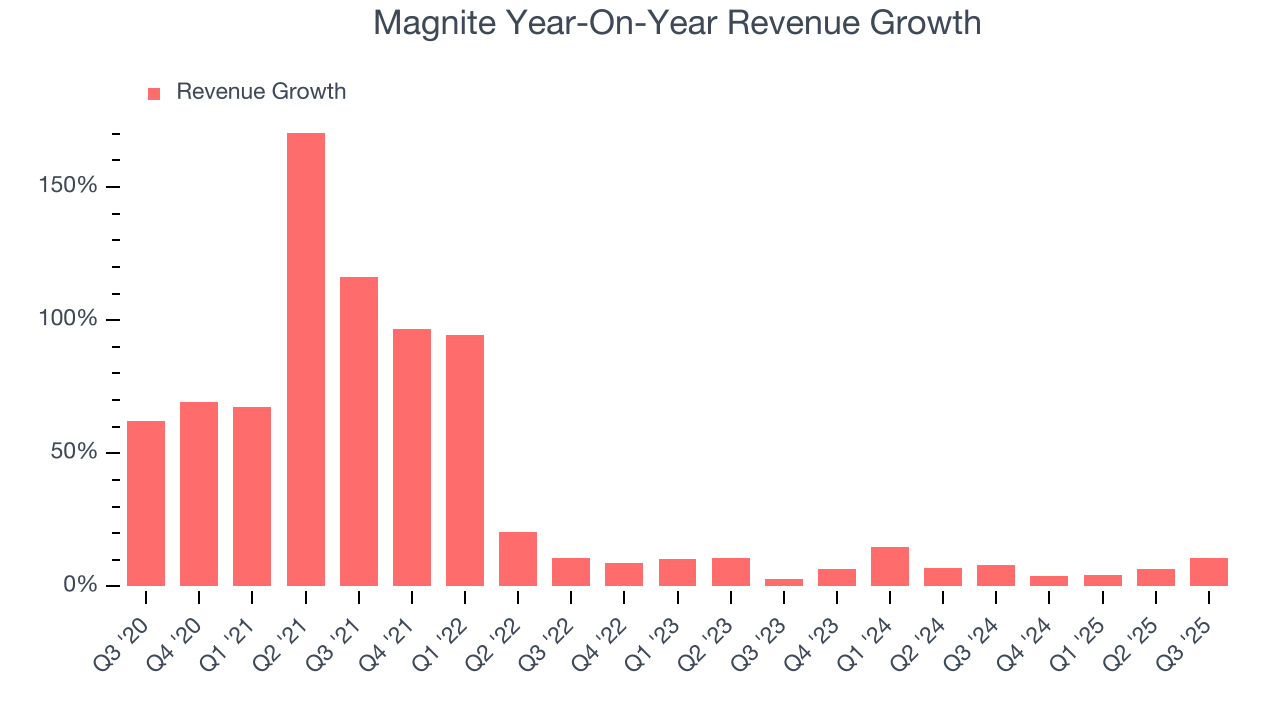

As you can see below, Magnite’s sales grew at an incredible 30.2% compounded annual growth rate over the last five years. This is a great starting point for our analysis because it shows Magnite’s demand was higher than many business services companies.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Magnite’s annualized revenue growth of 7.5% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Magnite reported year-on-year revenue growth of 10.8%, and its $179.5 million of revenue exceeded Wall Street’s estimates by 0.9%.

Looking ahead, sell-side analysts expect revenue to grow 13.5% over the next 12 months, an improvement versus the last two years. This projection is commendable and implies its newer products and services will spur better top-line performance.

6. Operating Margin

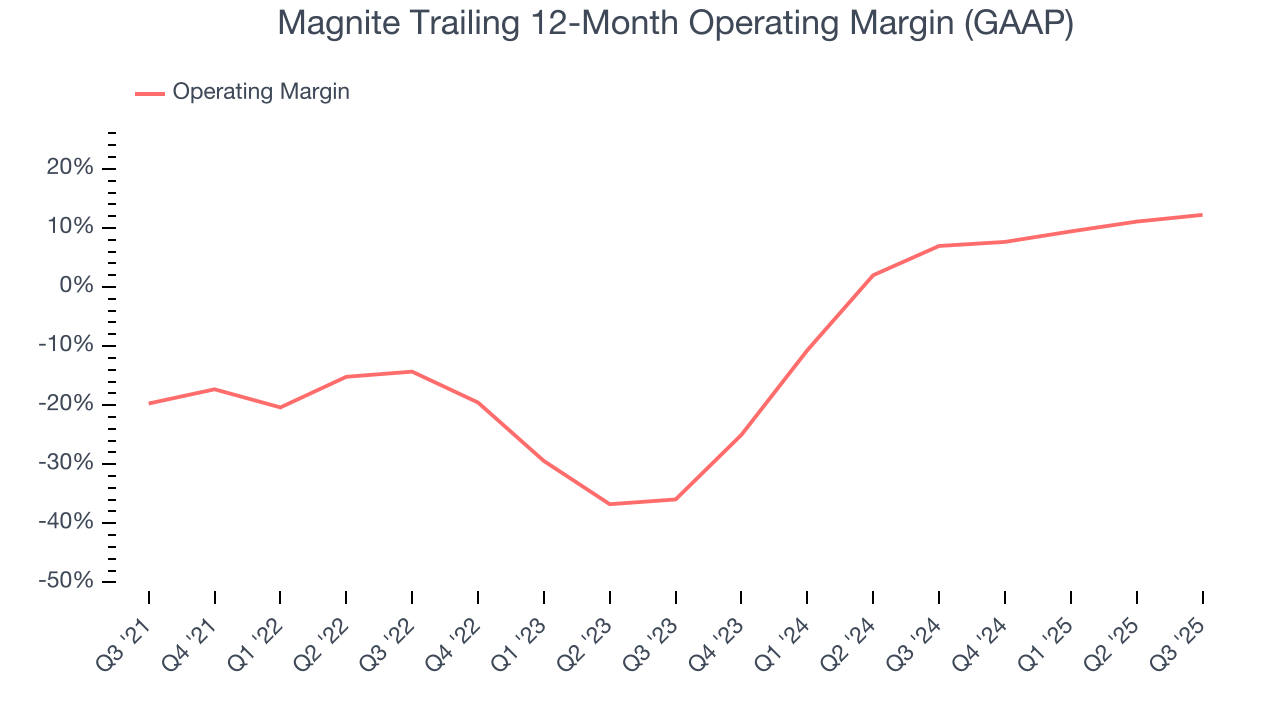

Although Magnite was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 8.3% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, Magnite’s operating margin rose by 31.9 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to show consistent profitability.

This quarter, Magnite generated an operating margin profit margin of 14%, up 4.6 percentage points year on year. This increase was a welcome development and shows it was more efficient.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

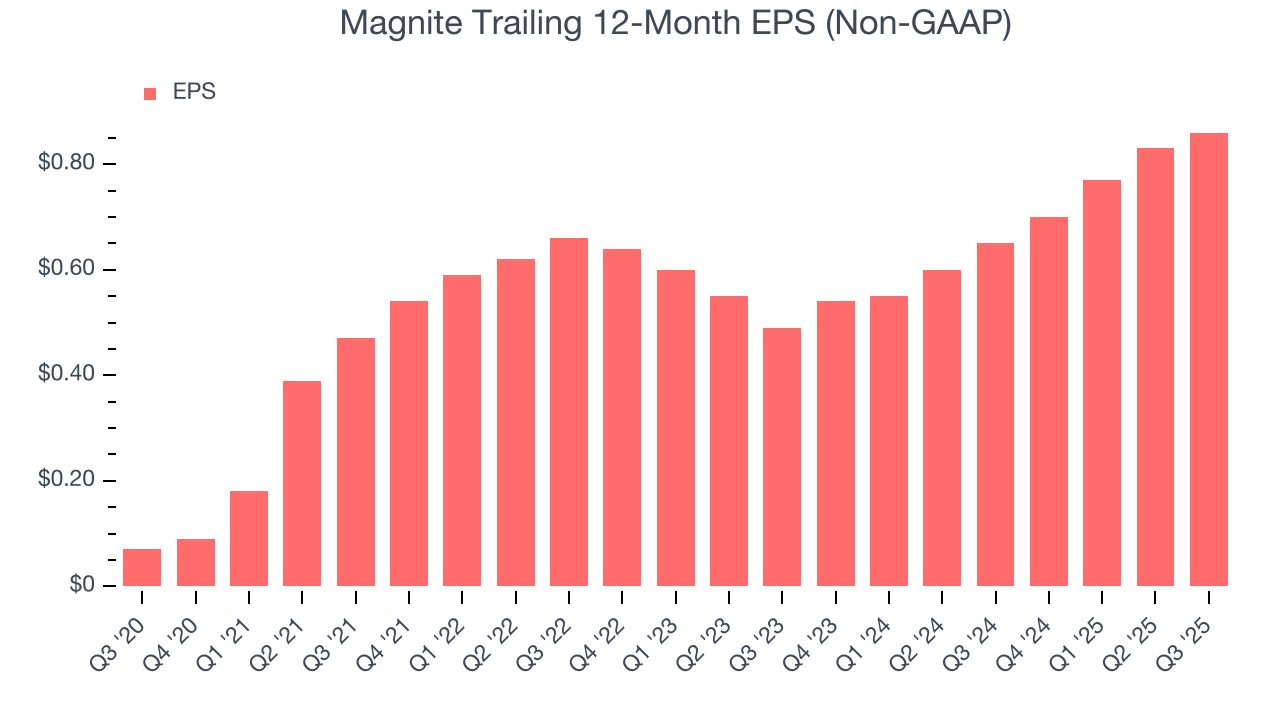

Magnite’s EPS grew at an astounding 65.2% compounded annual growth rate over the last five years, higher than its 30.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Magnite’s earnings can give us a better understanding of its performance. As we mentioned earlier, Magnite’s operating margin expanded by 31.9 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Magnite, its two-year annual EPS growth of 32.5% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q3, Magnite reported adjusted EPS of $0.20, up from $0.17 in the same quarter last year. This print beat analysts’ estimates by 2.6%. Over the next 12 months, Wall Street expects Magnite’s full-year EPS of $0.86 to grow 23.3%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

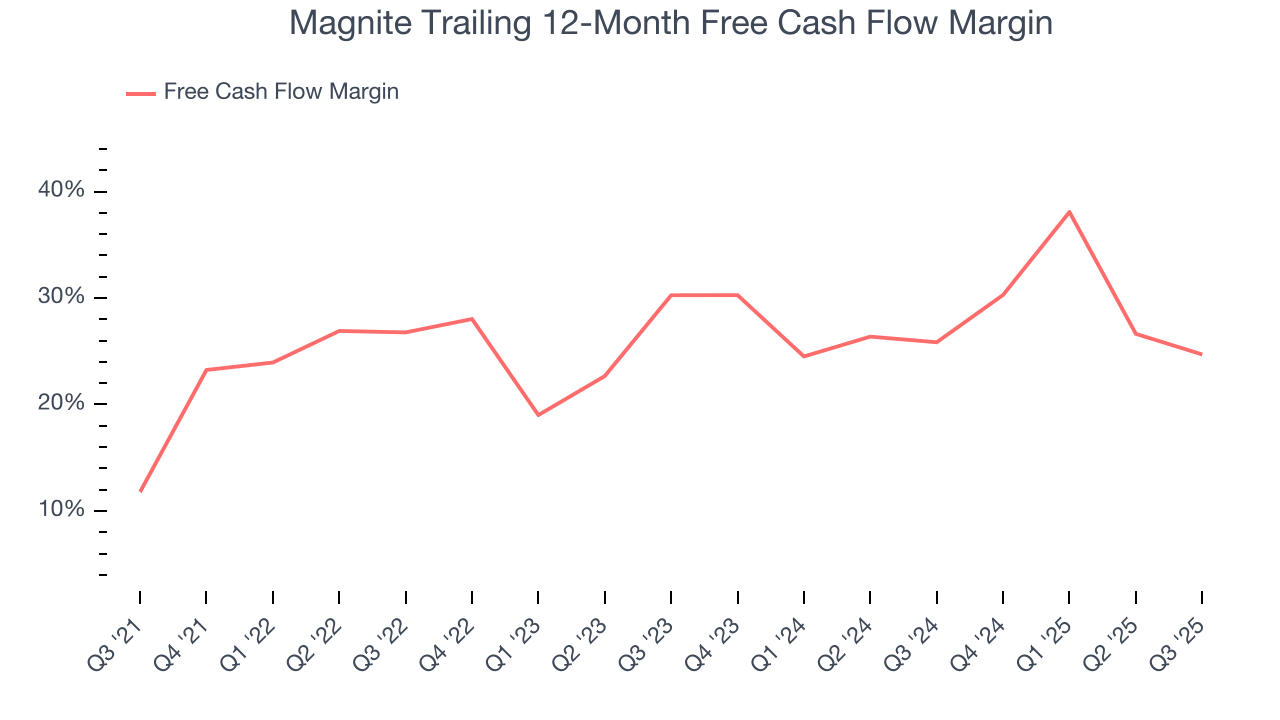

Magnite has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the business services sector, averaging 24.8% over the last five years. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that Magnite’s margin expanded by 12.9 percentage points during that time. This is encouraging because it gives the company more optionality.

Magnite’s free cash flow clocked in at $68.38 million in Q3, equivalent to a 38.1% margin. The company’s cash profitability regressed as it was 9.6 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends are more important.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

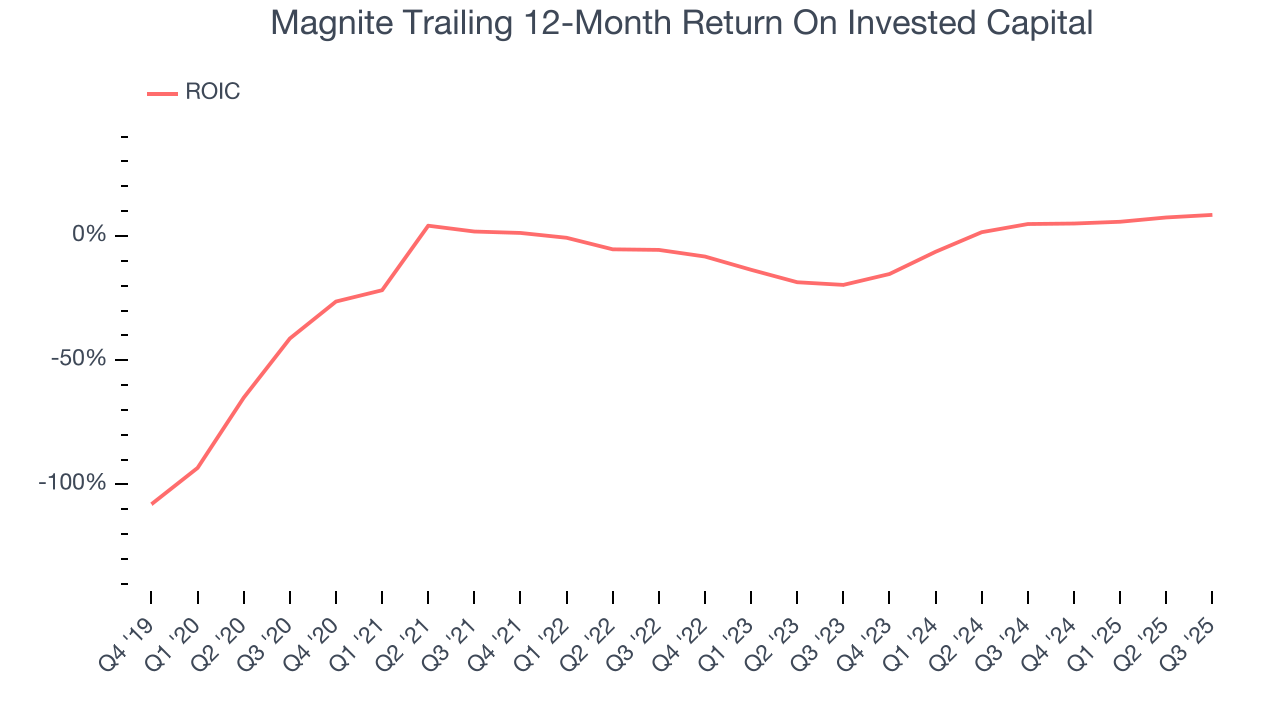

Although Magnite has shown solid business quality lately, it struggled to grow profitably in the past. Its five-year average ROIC was negative 2%, meaning management lost money while trying to expand the business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Magnite’s ROIC has increased. This is a good sign, but we recognize its lack of profitable growth during the COVID era was the primary reason for the change.

10. Balance Sheet Assessment

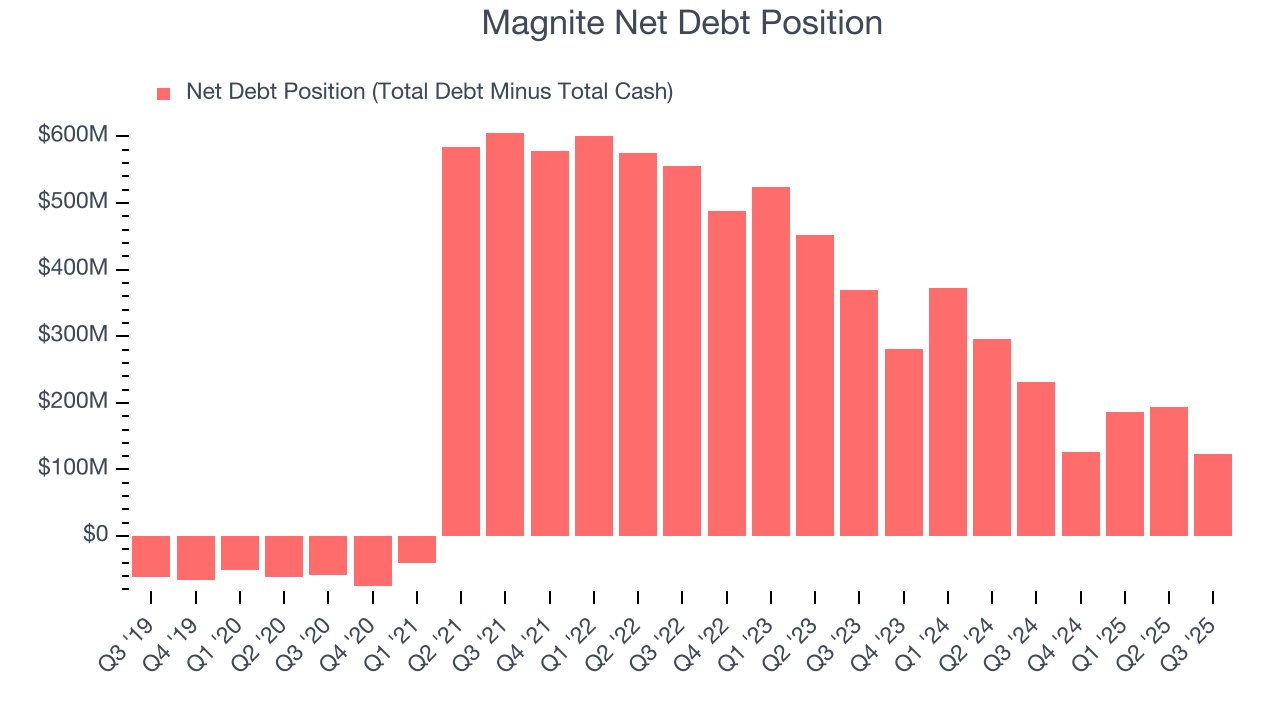

Magnite reported $482.1 million of cash and $605 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $224.9 million of EBITDA over the last 12 months, we view Magnite’s 0.5× net-debt-to-EBITDA ratio as safe. We also see its $11.01 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Magnite’s Q3 Results

It was good to see Magnite narrowly top analysts’ revenue expectations this quarter. We were also glad its EPS was in line with Wall Street’s estimates. Overall, this print had some key positives. The stock remained flat at $17.30 immediately following the results.

12. Is Now The Time To Buy Magnite?

Updated: January 23, 2026 at 11:10 PM EST

Before deciding whether to buy Magnite or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Magnite is a rock-solid business worth owning. For starters, its revenue growth was exceptional over the last five years. And while its relatively low ROIC suggests management has struggled to find compelling investment opportunities, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits. On top of that, Magnite’s rising cash profitability gives it more optionality.

Magnite’s P/E ratio based on the next 12 months is 15.4x. Looking at the business services landscape today, Magnite’s fundamentals really stand out, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $26.86 on the company (compared to the current share price of $15.25), implying they see 76.1% upside in buying Magnite in the short term.