Clear Channel Outdoor (CCO)

We’re skeptical of Clear Channel Outdoor. Its plummeting sales and historical cash burn make us question the business’s long-term viability.― StockStory Analyst Team

1. News

2. Summary

Why Clear Channel Outdoor Is Not Exciting

With thousands of digital and traditional displays lighting up America's highways, city streets, and airports, Clear Channel Outdoor (NYSE:CCO) operates billboards, street furniture, and airport displays, connecting advertisers with millions of consumers across the US.

- Customers postponed purchases of its products and services this cycle as its revenue declined by 2.9% annually over the last five years

- Cash burn makes us question whether it can achieve sustainable long-term growth

- High net-debt-to-EBITDA ratio of 12× increases the risk of forced asset sales or dilutive financing if operational performance weakens

Clear Channel Outdoor doesn’t check our boxes. There’s a wealth of better opportunities.

Why There Are Better Opportunities Than Clear Channel Outdoor

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Clear Channel Outdoor

At $2.39 per share, Clear Channel Outdoor trades at 14.1x forward EV-to-EBITDA. This multiple is high given its weaker fundamentals.

We’d rather pay up for companies with elite fundamentals than get a decent price on a poor one. High-quality businesses often have more durable earnings power, helping us sleep well at night.

3. Clear Channel Outdoor (CCO) Research Report: Q4 CY2025 Update

Outdoor advertising company Clear Channel Outdoor (NYSE:CCO) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 8.2% year on year to $461.5 million. Its GAAP profit of $0.02 per share was in line with analysts’ consensus estimates.

Clear Channel Outdoor (CCO) Q4 CY2025 Highlights:

- Revenue: $461.5 million vs analyst estimates of $448.9 million (8.2% year-on-year growth, 2.8% beat)

- EPS (GAAP): $0.02 vs analyst estimates of $0.01 (in line)

- Adjusted EBITDA: $164.5 million vs analyst estimates of $156.2 million (35.6% margin, 5.3% beat)

- Operating Margin: 23.3%, in line with the same quarter last year

- Market Capitalization: $1.2 billion

Company Overview

With thousands of digital and traditional displays lighting up America's highways, city streets, and airports, Clear Channel Outdoor (NYSE:CCO) operates billboards, street furniture, and airport displays, connecting advertisers with millions of consumers across the US.

The company's business is divided into two main segments: America and Airports. The America segment manages over 48,700 displays across major US markets, focusing on high-visibility locations along expressways, commuting routes, and key intersections. These displays range from traditional billboards to spectacular digital installations in landmark locations like Times Square and Las Vegas.

Clear Channel's Airports segment operates more than 13,100 displays across nearly 200 commercial and private airports in the US and Caribbean. These strategically placed advertisements target travelers throughout their journey, appearing as printed, digital, and experiential formats, including custom exhibits and interactive displays.

Digital transformation is at the heart of Clear Channel's strategy, with a growing focus on expanding its digital display inventory and enhancing its data-driven RADAR offering, which measures impressions using anonymous location data from smartphones. This technology allows advertisers to better understand who sees their messages and when, making outdoor advertising more measurable and targeted.

The company typically secures long-term leases for billboard locations and enters into contracts with municipal authorities and transit operators for street furniture and airport advertising rights. These arrangements often involve revenue sharing or minimum fee payments to the property owners or authorities.

4. Advertising & Marketing Services

The sector is on the precipice of both disruption and growth as AI, programmatic advertising, and data-driven marketing reshape how things are done. For example, the advent of the Internet broadly and programmatic advertising specifically means that brand building is not a relationship business anymore but instead one based on data and technology, which could hurt traditional ad agencies. On the other hand, the companies in the sector that beef up their tech chops by automating the buying of ad inventory or facilitating omnichannel marketing, for example, stand to benefit. With or without advances in digitization and AI, the sector is still highly levered to the macro, and economic uncertainty may lead to fluctuating ad spend, particularly in cyclical industries.

Clear Channel Outdoor competes with other out-of-home advertising companies such as Outfront Media (NYSE:OUT), Lamar Advertising Company (NASDAQ:LAMR), and JCDecaux (OTCMKTS:JCDXF), along with digital and traditional media companies vying for advertising dollars.

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $1.6 billion in revenue over the past 12 months, Clear Channel Outdoor is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

As you can see below, Clear Channel Outdoor’s revenue declined by 2.9% per year over the last five years, a rough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Clear Channel Outdoor’s annualized revenue growth of 5.8% over the last two years is above its five-year trend, suggesting some bright spots.

This quarter, Clear Channel Outdoor reported year-on-year revenue growth of 8.2%, and its $461.5 million of revenue exceeded Wall Street’s estimates by 2.8%.

Looking ahead, sell-side analysts expect revenue to grow 3.6% over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and implies its products and services will face some demand challenges.

6. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

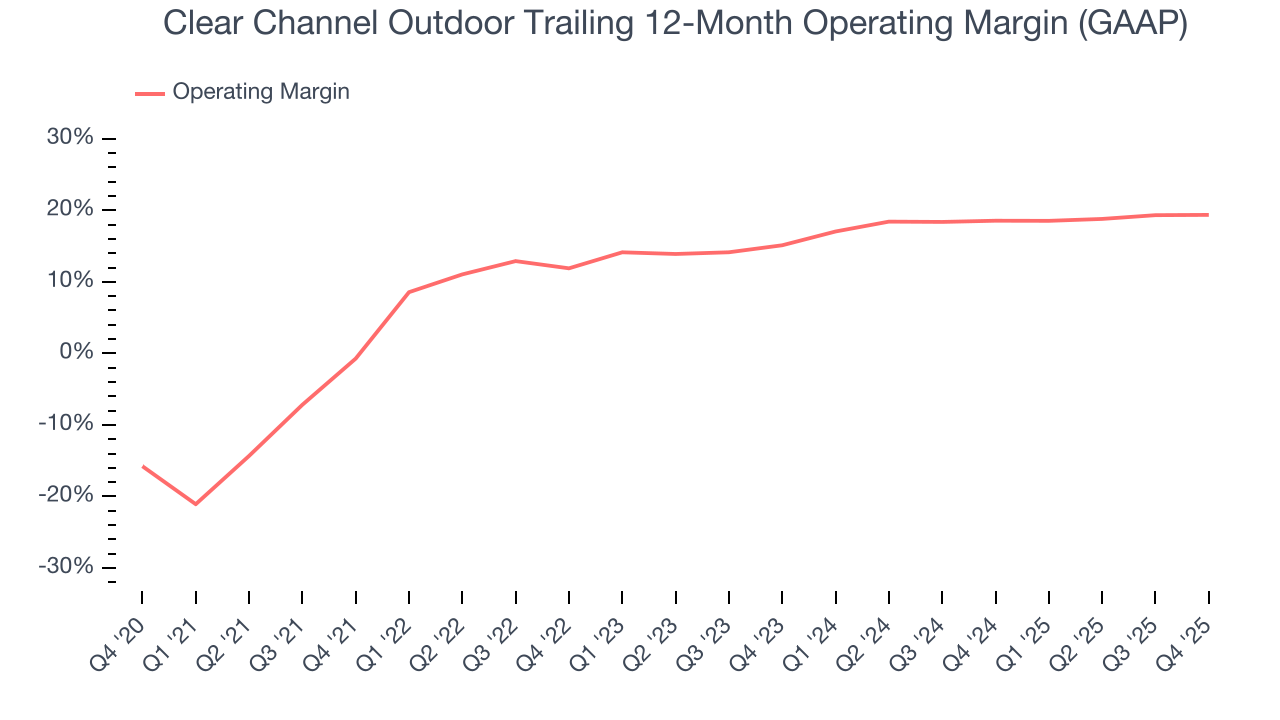

Clear Channel Outdoor has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 11.7%, higher than the broader business services sector.

Analyzing the trend in its profitability, Clear Channel Outdoor’s operating margin rose by 20.1 percentage points over the last five years, showing its efficiency has meaningfully improved.

This quarter, Clear Channel Outdoor generated an operating margin profit margin of 23.3%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Clear Channel Outdoor’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Clear Channel Outdoor, its two-year annual EPS growth of 43.9% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, Clear Channel Outdoor reported EPS of $0.02, up from negative $0.04 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Clear Channel Outdoor to perform poorly. Analysts forecast its full-year EPS of $0.05 will invert to negative negative $0.11.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Clear Channel Outdoor’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 6.2%, meaning it lit $6.20 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that Clear Channel Outdoor’s margin expanded by 15.9 percentage points during that time. We have no doubt shareholders would like to continue seeing its cash conversion rise.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Clear Channel Outdoor’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 12.4%, slightly better than typical business services business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Clear Channel Outdoor’s ROIC has increased over the last few years. This is a good sign, and if its returns keep rising, there’s a chance it could evolve into an investable business.

10. Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

Clear Channel Outdoor’s $5.1 billion of debt exceeds the $190 million of cash on its balance sheet. Furthermore, its 10× net-debt-to-EBITDA ratio (based on its EBITDA of $504.8 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Clear Channel Outdoor could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Clear Channel Outdoor can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

11. Key Takeaways from Clear Channel Outdoor’s Q4 Results

It was encouraging to see Clear Channel Outdoor meet analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $2.39 immediately following the results.

12. Is Now The Time To Buy Clear Channel Outdoor?

Updated: March 1, 2026 at 12:57 AM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Clear Channel Outdoor, you should also grasp the company’s longer-term business quality and valuation.

Clear Channel Outdoor’s business quality ultimately falls short of our standards. To begin with, its revenue has declined over the last five years. While its rising cash profitability gives it more optionality, the downside is its projected EPS for the next year is lacking. On top of that, its cash burn raises the question of whether it can sustainably maintain growth.

Clear Channel Outdoor’s EV-to-EBITDA ratio based on the next 12 months is 14.1x. Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $2.45 on the company (compared to the current share price of $2.39).