monday.com (MNDY)

monday.com is in a league of its own. Its high growth, robust unit economics, and optimistic prospects make it a spectacular asset.― StockStory Analyst Team

1. News

2. Summary

Why We Like monday.com

With its colorful interface of boards, columns, and automation that replaced the chaos of spreadsheets, monday.com (NASDAQ:MNDY) is a cloud-based work operating system that helps teams manage projects, track tasks, and streamline workflows through customizable interfaces.

- Annual revenue growth of 53.3% over the last five years was superb and indicates its market share is rising

- Ability to secure long-term commitments with customers is evident in its 28.8% ARR growth over the last year

- Software is difficult to replicate at scale and leads to a best-in-class gross margin of 89.2%

We’re fond of companies like monday.com. The valuation seems reasonable relative to its quality, and we think now is a prudent time to buy the stock.

Why Is Now The Time To Buy monday.com?

High Quality

Investable

Underperform

Why Is Now The Time To Buy monday.com?

monday.com’s stock price of $95.85 implies a valuation ratio of 3.7x forward price-to-sales. The stock’s multiple sure seems like a bargain relative to its business quality and fundamentals.

A powerful one-two punch is a company that can both grow earnings and earn a higher multiple over time. High-quality companies trading at big discounts to intrinsic value are good ways to set up this combination.

3. monday.com (MNDY) Research Report: Q4 CY2025 Update

Work management platform monday.com (NASDAQ:MNDY) announced better-than-expected revenue in Q4 CY2025, with sales up 24.6% year on year to $333.9 million. On the other hand, next quarter’s revenue guidance of $339 million was less impressive, coming in 1.1% below analysts’ estimates. Its non-GAAP profit of $1.04 per share was 13.2% above analysts’ consensus estimates.

monday.com (MNDY) Q4 CY2025 Highlights:

- Revenue: $333.9 million vs analyst estimates of $329.5 million (24.6% year-on-year growth, 1.3% beat)

- Adjusted EPS: $1.04 vs analyst estimates of $0.92 (13.2% beat)

- Adjusted Operating Income: $41.93 million vs analyst estimates of $37.43 million (12.6% margin, 12% beat)

- Revenue Guidance for Q1 CY2026 is $339 million at the midpoint, below analyst estimates of $342.6 million

- Operating Margin: 0.7%, down from 3.6% in the same quarter last year

- Free Cash Flow Margin: 15.6%, down from 29.1% in the previous quarter

- Customers: 4,281 customers paying more than $50,000 annually

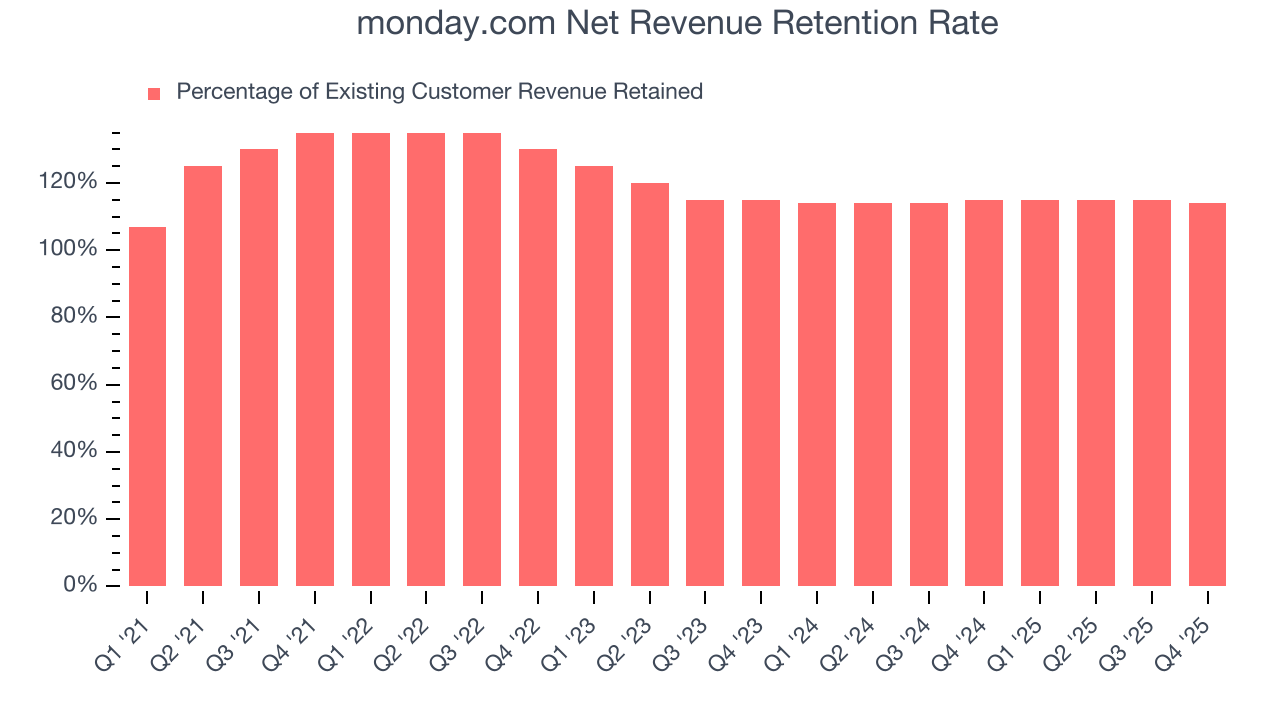

- Net Revenue Retention Rate: 114%, down from 115% in the previous quarter

- Market Capitalization: $5.05 billion

Company Overview

With its colorful interface of boards, columns, and automation that replaced the chaos of spreadsheets, monday.com (NASDAQ:MNDY) is a cloud-based work operating system that helps teams manage projects, track tasks, and streamline workflows through customizable interfaces.

The company's platform functions as a digital workspace where teams can plan, execute, and monitor work across departments. Users build tailored workflows by selecting from hundreds of templates or creating boards from scratch, then customize them with columns that represent different aspects of work—from simple status indicators to complex formulas and dependencies.

A marketing team might use monday.com to plan campaigns by visualizing deadlines on timelines, tracking content creation progress, and automating approval workflows. Meanwhile, an IT department could manage support tickets, prioritize issues, and track resolution times all in one place.

monday.com operates on a subscription-based revenue model, offering several pricing tiers from basic plans for small teams to enterprise solutions for large organizations. The platform integrates with over 200 popular tools including Slack, Microsoft Teams, Google Drive, and Zoom, allowing customers to connect their existing tech stack.

Beyond the core work management features, the company offers specialized products like monday sales CRM for managing sales pipelines, monday dev for software development teams, and monday projects for professional project managers. These targeted solutions help monday.com serve diverse industries from technology and marketing to construction and education.

4. Project Management Software

The future of work requires teams to collaborate across departments and remote offices. Project management software is both driving this change and benefiting from it. While the trend of collaborative work management has been strong for a while, the Covid pandemic has definitively accelerated the demand for tools that allow work to be done remotely.

monday.com competes with other work management platforms like Asana (NYSE:ASAN), Atlassian's Trello and Jira (NASDAQ:TEAM), Smartsheet (NYSE:SMAR), and privately-held companies like Notion, ClickUp, and Wrike (owned by Citrix).

5. Revenue Growth

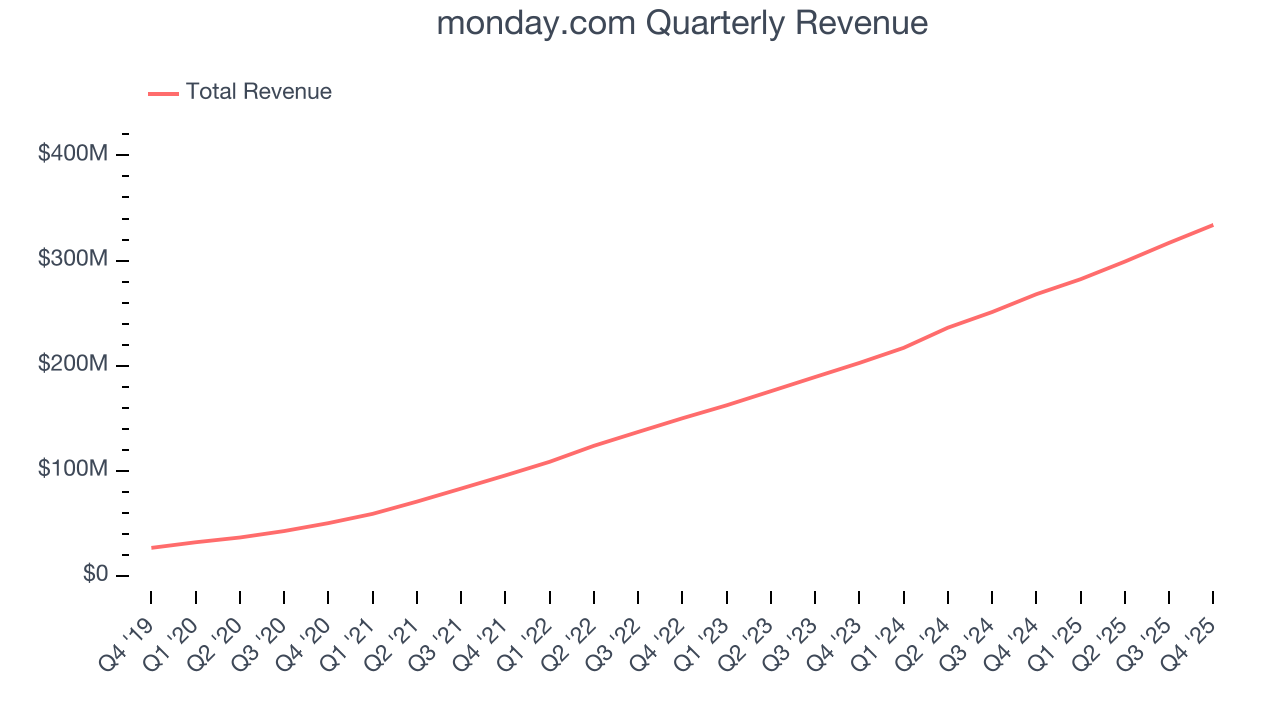

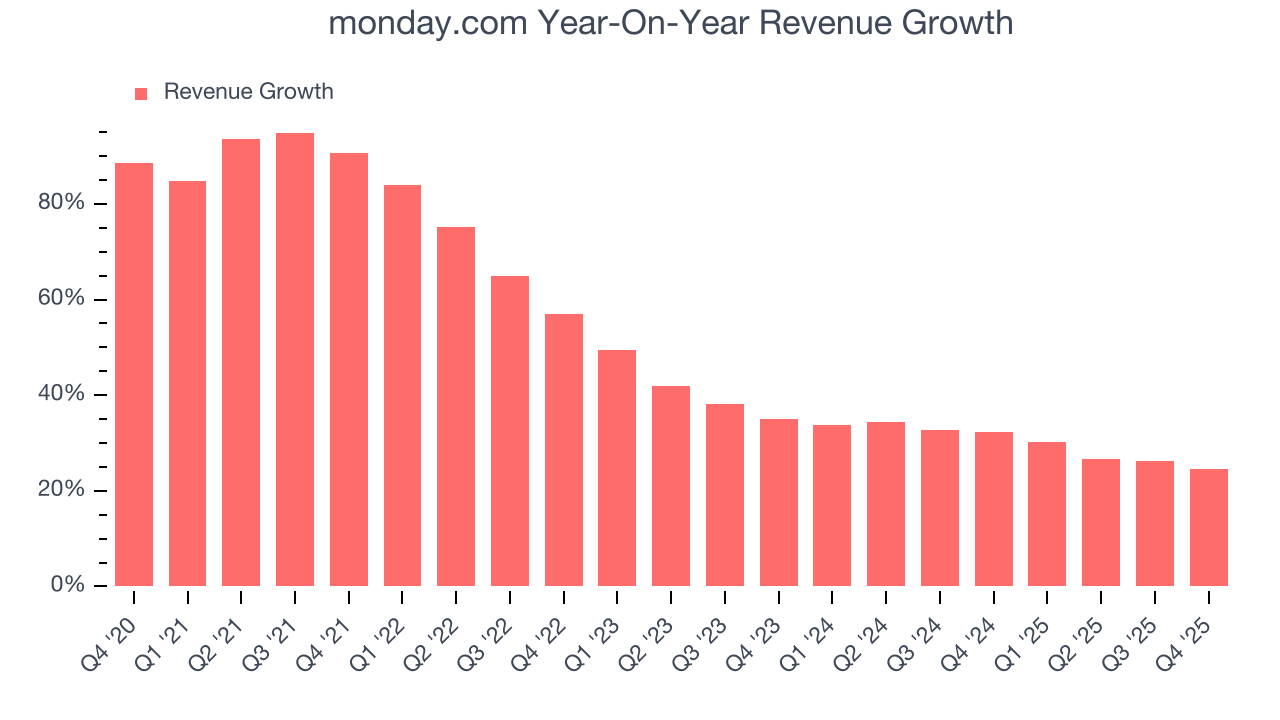

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, monday.com’s 50.2% annualized revenue growth over the last five years was incredible. Its growth surpassed the average software company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. monday.com’s annualized revenue growth of 29.9% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, monday.com reported robust year-on-year revenue growth of 24.6%, and its $333.9 million of revenue topped Wall Street estimates by 1.3%. Company management is currently guiding for a 20.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 19.7% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is healthy and implies the market is forecasting success for its products and services.

6. Enterprise Customer Base

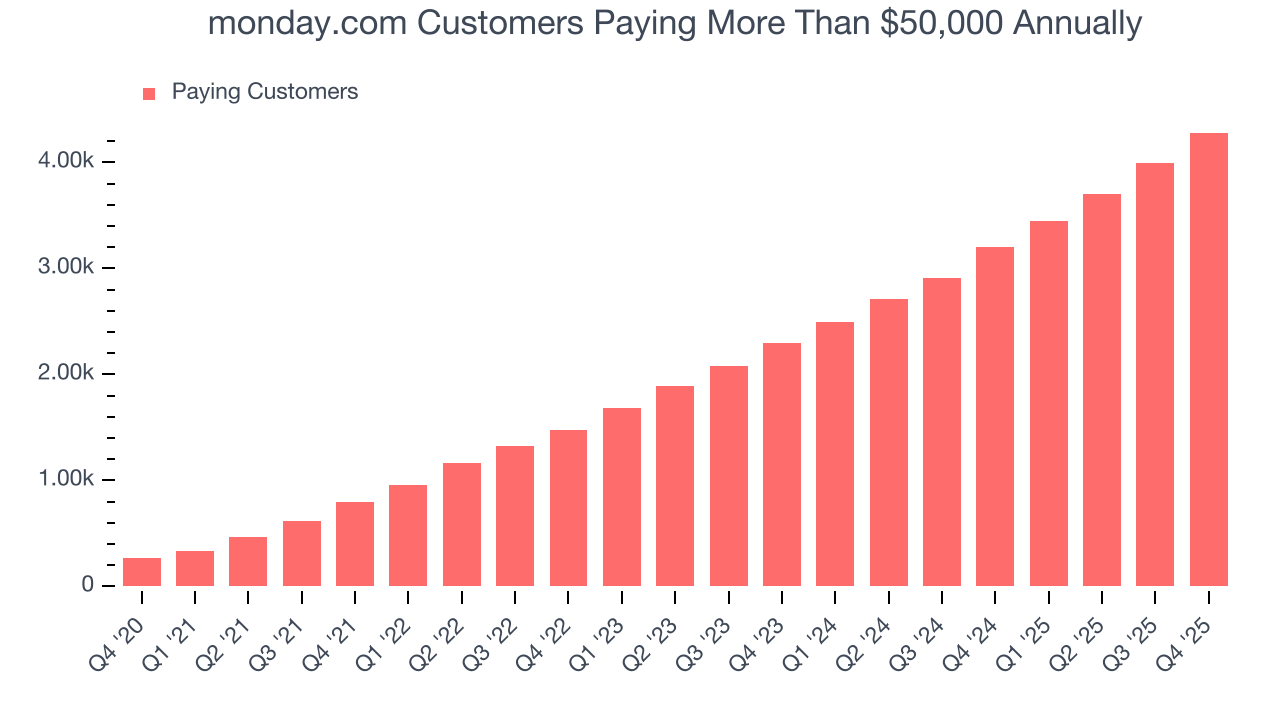

This quarter, monday.com reported 4,281 enterprise customers paying more than $50,000 annually, an increase of 288 from the previous quarter. That’s in line with the number of contract wins in the last quarter and quite a bit above what we’ve seen over the previous year, confirming that the company is maintaining its sales momentum.

7. Customer Acquisition Efficiency

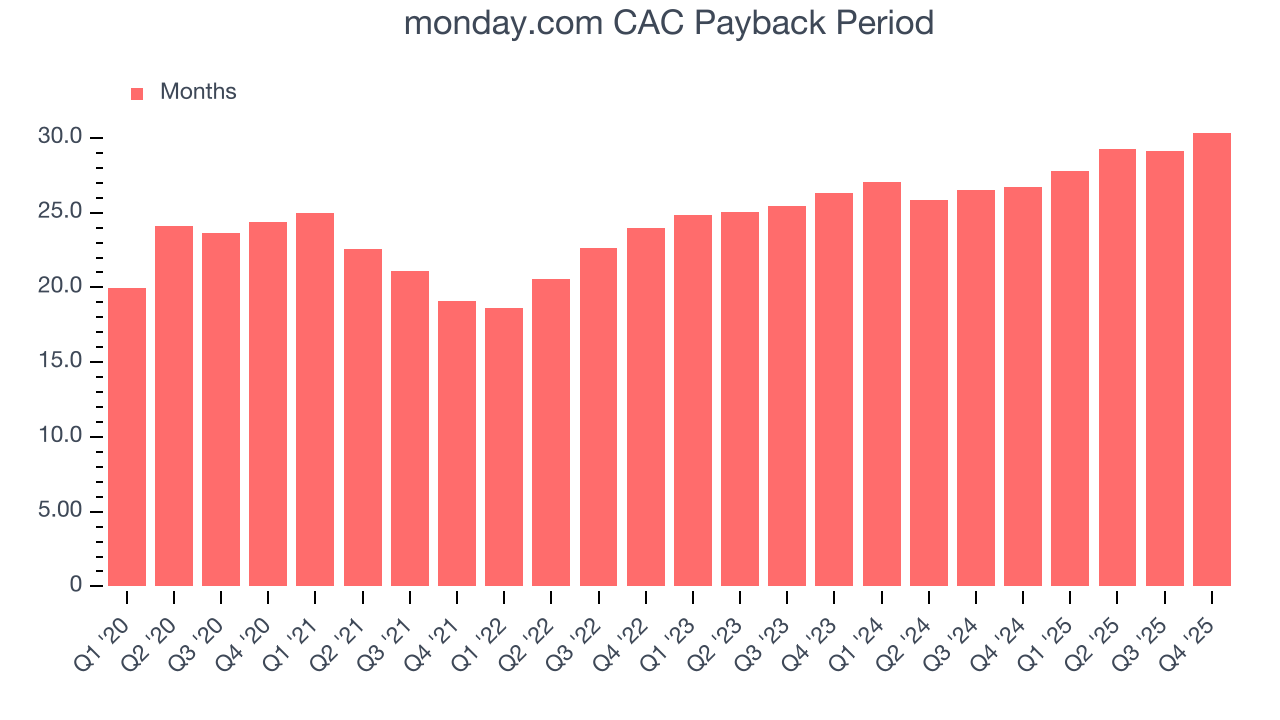

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

monday.com is quite efficient at acquiring new customers, and its CAC payback period checked in at 30.4 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a strong brand reputation, giving it more resources pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

8. Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

monday.com’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 115% in Q4. This means monday.com would’ve grown its revenue by 14.7% even if it didn’t win any new customers over the last 12 months.

monday.com has a good net retention rate, proving that customers are satisfied with its software and getting more value from it over time, which is always great to see.

9. Gross Margin & Pricing Power

Software is eating the world. It’s one of our favorite business models because once you develop the product, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

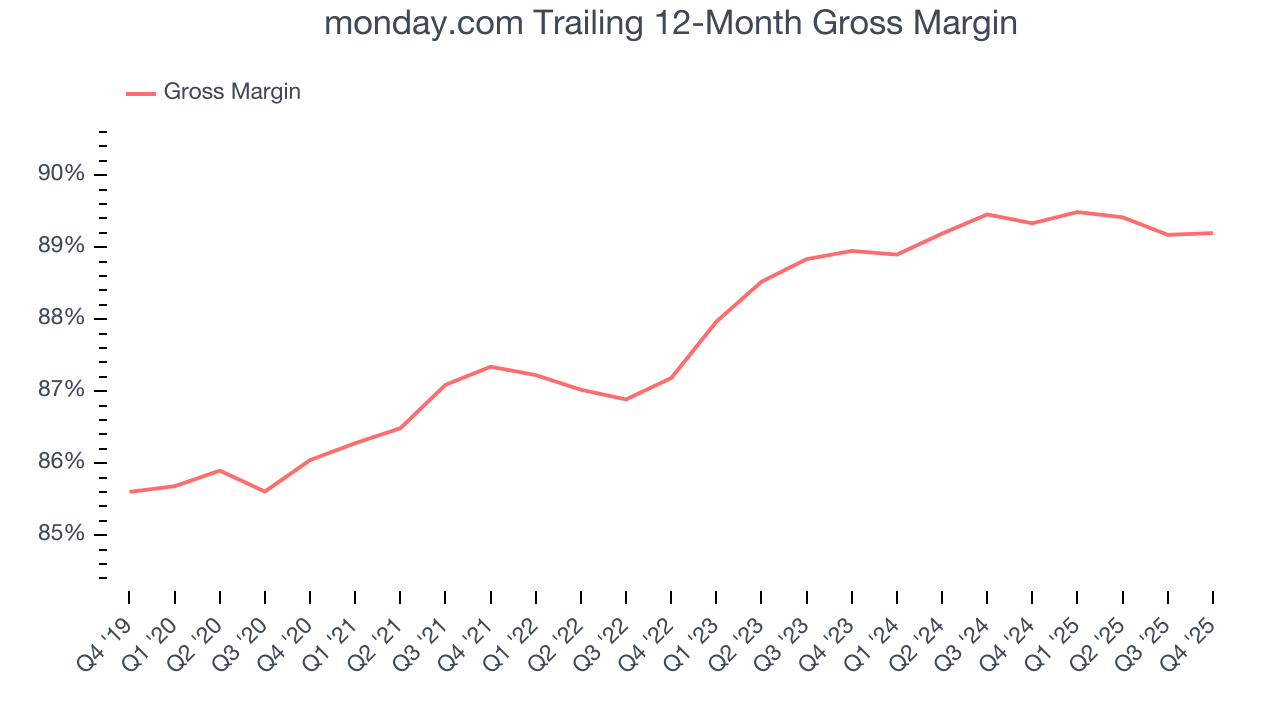

monday.com’s gross margin is one of the best in the software sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in new products and sales during periods of rapid growth to achieve outsized profits at scale. As you can see below, it averaged an elite 89.2% gross margin over the last year. That means monday.com only paid its providers $10.80 for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. monday.com has seen gross margins improve by 0.2 percentage points over the last 2 year, which is slightly better than average for software.

In Q4, monday.com produced a 88.8% gross profit margin, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

10. Operating Margin

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

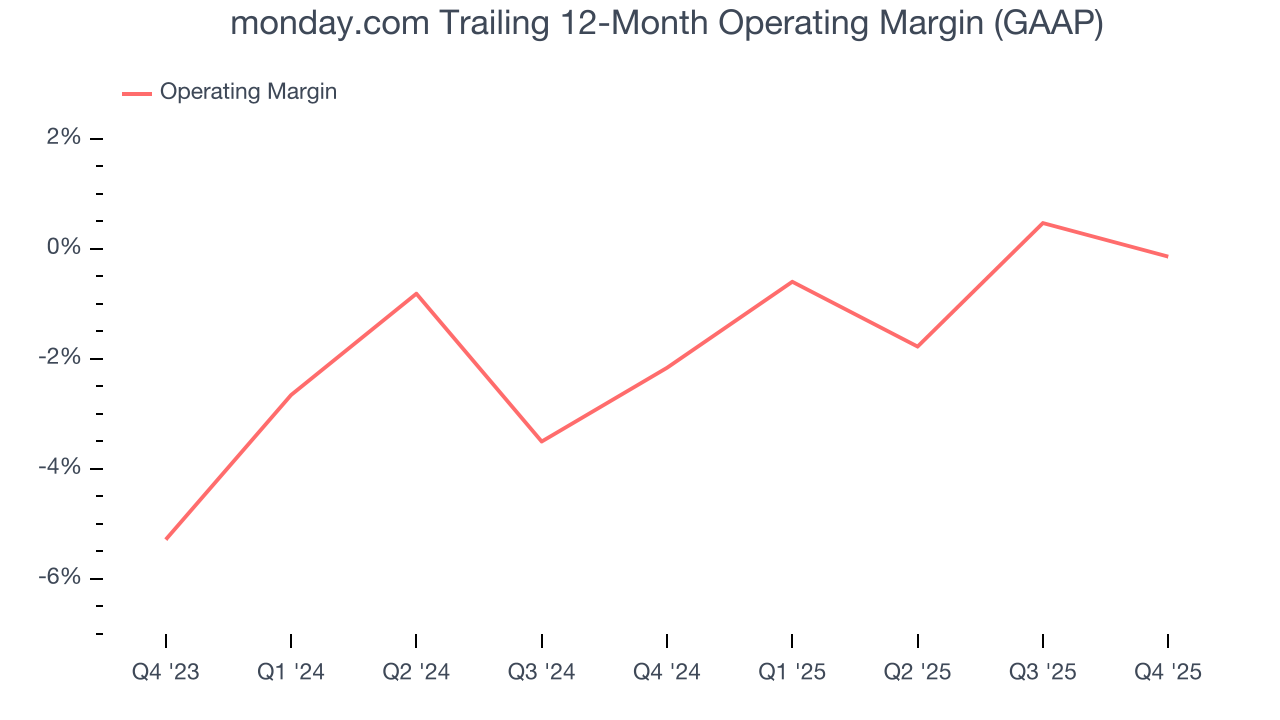

monday.com was roughly breakeven when averaging the last year of quarterly operating profits, mediocre for a software business. This result is surprising given its high gross margin as a starting point.

On the plus side, monday.com’s operating margin rose by 2 percentage points over the last two years, as its sales growth gave it operating leverage.

In Q4, monday.com’s breakeven margin was 0.7%, down 2.9 percentage points year on year. Since monday.com’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

11. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

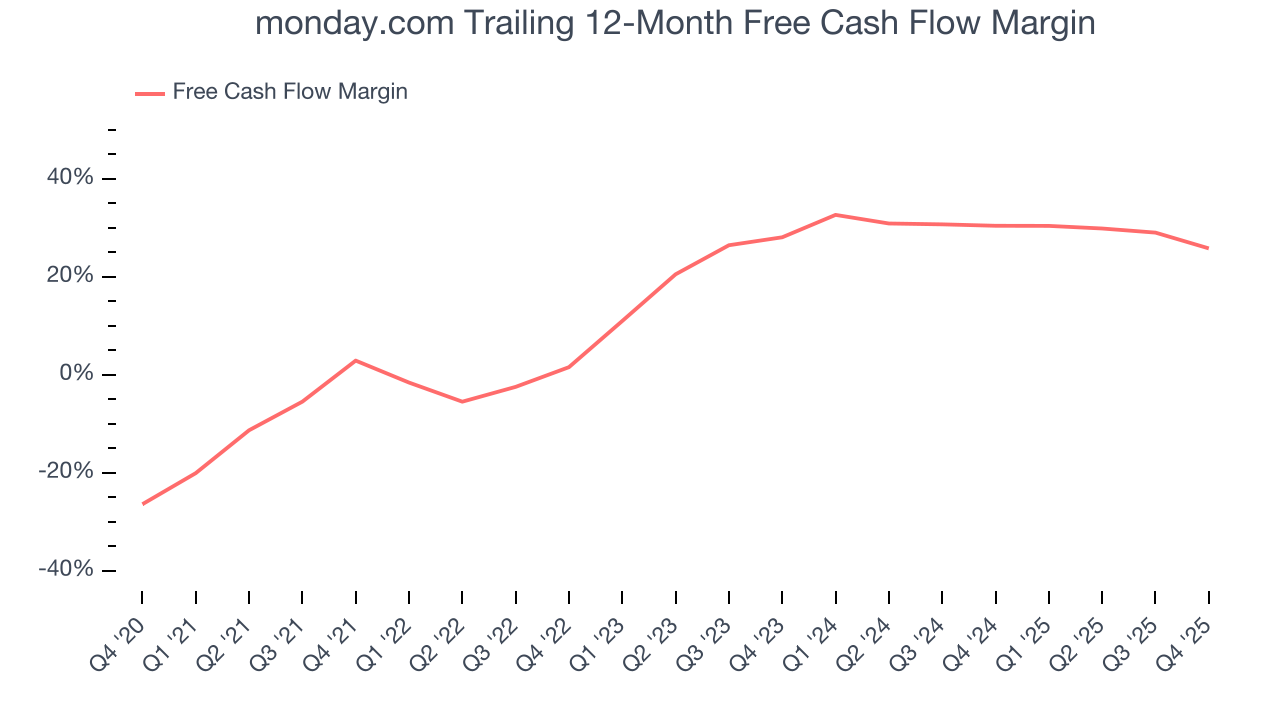

monday.com has shown robust cash profitability, driven by its attractive business model and cost-effective customer acquisition strategy that enable it to invest in new products and services rather than sales and marketing. The company’s free cash flow margin averaged 25.8% over the last year, quite impressive for a software business. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

monday.com’s free cash flow clocked in at $52.15 million in Q4, equivalent to a 15.6% margin. The company’s cash profitability regressed as it was 11.5 percentage points lower than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

Over the next year, analysts predict monday.com’s cash conversion will slightly improve. Their consensus estimates imply its free cash flow margin of 25.8% for the last 12 months will increase to 28%, it options for capital deployment (investments, share buybacks, etc.).

12. Key Takeaways from monday.com’s Q4 Results

It was good to see monday.com narrowly top analysts’ revenue expectations this quarter. On the other hand, its full-year revenue guidance slightly missed and its revenue guidance for next quarter fell slightly short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 13.3% to $84.98 immediately after reporting.

13. Is Now The Time To Buy monday.com?

Updated: February 9, 2026 at 7:18 AM EST

Before making an investment decision, investors should account for monday.com’s business fundamentals and valuation in addition to what happened in the latest quarter.

monday.com is an amazing business ranking highly on our list. First of all, the company’s revenue growth was exceptional over the last five years. And while its expanding operating margin shows it’s becoming more efficient at building and selling its software, its admirable gross margin indicates excellent unit economics. Additionally, monday.com’s surging ARR shows its fundamentals and revenue predictability are improving.

monday.com’s price-to-sales ratio based on the next 12 months is 3.5x. Looking at the software space today, monday.com’s qualities as one of the best businesses really stand out, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $203.40 on the company (compared to the current share price of $84.98), implying they see 139% upside in buying monday.com in the short term.