Myriad Genetics (MYGN)

Myriad Genetics faces an uphill battle. Its poor sales growth shows demand is soft and its negative returns on capital suggest it destroyed value.― StockStory Analyst Team

1. News

2. Summary

Why We Think Myriad Genetics Will Underperform

Founded in 1991 as one of the pioneers in translating genetic discoveries into clinical applications, Myriad Genetics (NASDAQ:MYGN) develops genetic tests that assess disease risk, guide treatment decisions, and provide insights across oncology, women's health, and mental health.

- Push for growth has led to negative returns on capital, signaling value destruction, and its shrinking returns suggest its past profit sources are losing steam

- Cash burn makes us question whether it can achieve sustainable long-term growth

- Modest revenue base of $824.5 million gives it less fixed cost leverage and fewer distribution channels than larger companies

Myriad Genetics’s quality is insufficient. Our attention is focused on better businesses.

Why There Are Better Opportunities Than Myriad Genetics

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Myriad Genetics

Myriad Genetics’s stock price of $5.16 implies a valuation ratio of 75.4x forward P/E. The current multiple is quite expensive, especially for the fundamentals of the business.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. Myriad Genetics (MYGN) Research Report: Q4 CY2025 Update

Genetic testing company Myriad Genetics (NASDAQ:MYGN) beat Wall Street’s revenue expectations in Q4 CY2025, but sales were flat year on year at $209.8 million. The company expects the full year’s revenue to be around $870 million, close to analysts’ estimates. Its non-GAAP profit of $0.04 per share was significantly above analysts’ consensus estimates.

Myriad Genetics (MYGN) Q4 CY2025 Highlights:

- Revenue: $209.8 million vs analyst estimates of $207.4 million (flat year on year, 1.2% beat)

- Adjusted EPS: $0.04 vs analyst estimates of -$0.02 (significant beat)

- Adjusted EBITDA: $14.3 million vs analyst estimates of $6.46 million (6.8% margin, significant beat)

- EBITDA guidance for the upcoming financial year 2026 is $43 million at the midpoint, above analyst estimates of $41.33 million

- Operating Margin: -2.7%, up from -18.5% in the same quarter last year

- Free Cash Flow Margin: 2.2%, similar to the same quarter last year

- Market Capitalization: $399.9 million

Company Overview

Founded in 1991 as one of the pioneers in translating genetic discoveries into clinical applications, Myriad Genetics (NASDAQ:MYGN) develops genetic tests that assess disease risk, guide treatment decisions, and provide insights across oncology, women's health, and mental health.

Myriad's testing portfolio spans three key areas where genetic insights can significantly improve patient care. In oncology, the company offers tests like MyRisk, which analyzes 48 genes to assess hereditary cancer risk, and companion diagnostic tests such as BRACAnalysis CDx and MyChoice CDx that help determine which patients might benefit from specific cancer therapies like PARP inhibitors. These tests guide treatment decisions for breast, ovarian, prostate, and other cancers.

In women's health, Myriad provides prenatal screening solutions including the Prequel Prenatal Screen, which uses maternal blood to detect chromosomal disorders in a fetus with a remarkably low failure rate of less than 1 in 1,000 patients. The company's Foresight Carrier Screen helps prospective parents understand their risk of passing on recessive genetic conditions to their children, while SneakPeek offers early gender determination as early as six weeks into pregnancy.

For mental health, Myriad's GeneSight test analyzes how a patient's genetic makeup might affect their response to medications for depression, anxiety, and ADHD. By analyzing DNA from a simple cheek swab, GeneSight provides information about which medications may require dose adjustments or might be more likely to cause side effects for a particular patient.

Myriad generates revenue primarily through its sales force of approximately 500 individuals across dedicated sales channels in the United States, Japan, Germany, and France, with additional global accounts served through indirect channels. The company has evolved its sales approach to include digital marketing, direct-to-patient outreach, and inside sales teams to improve efficiency.

The company's business experiences seasonal patterns, with typically lower volumes in the first quarter due to insurance deductible resets and during summer months, while the fourth quarter often sees increased volumes as patients reach their annual deductibles.

4. Therapeutics

Over the next few years, therapeutic companies, which develop a wide variety of treatments for diseases and disorders, face strong tailwinds from advancements in precision medicine (including the use of AI to improve hit rates) and growing demand for treatments targeting rare diseases. However, headwinds such as rising scrutiny over drug pricing, regulatory unknowns, and competition from larger, more resourced pharmaceutical companies could weigh on growth.

Myriad Genetics competes with several companies across its business segments, including Invitae Corporation, Natera, Inc., Ambry Genetics, Laboratory Corporation of America (LabCorp), and Quest Diagnostics in oncology and women's health testing. In pharmacogenomics, competitors include Genomind, Tempus, and other specialized genetic testing providers.

5. Revenue Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $824.5 million in revenue over the past 12 months, Myriad Genetics is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

6. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, Myriad Genetics’s sales grew at a decent 8.2% compounded annual growth rate over the last five years. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Myriad Genetics’s recent performance shows its demand has slowed as its annualized revenue growth of 4.6% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

This quarter, Myriad Genetics’s $209.8 million of revenue was flat year on year but beat Wall Street’s estimates by 1.2%.

Looking ahead, sell-side analysts expect revenue to grow 4.9% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and indicates its newer products and services will not accelerate its top-line performance yet.

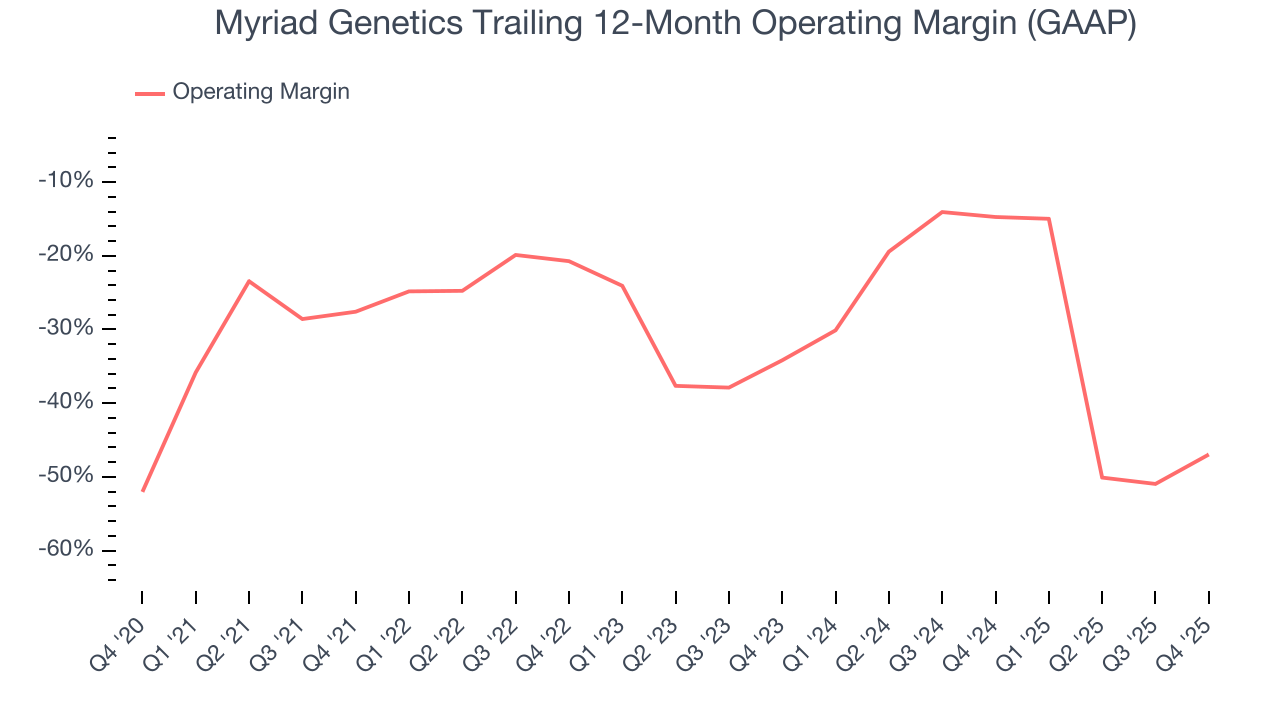

7. Operating Margin

Myriad Genetics’s high expenses have contributed to an average operating margin of negative 29% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, Myriad Genetics’s operating margin decreased by 19.4 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 12.8 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Myriad Genetics generated a negative 2.7% operating margin.

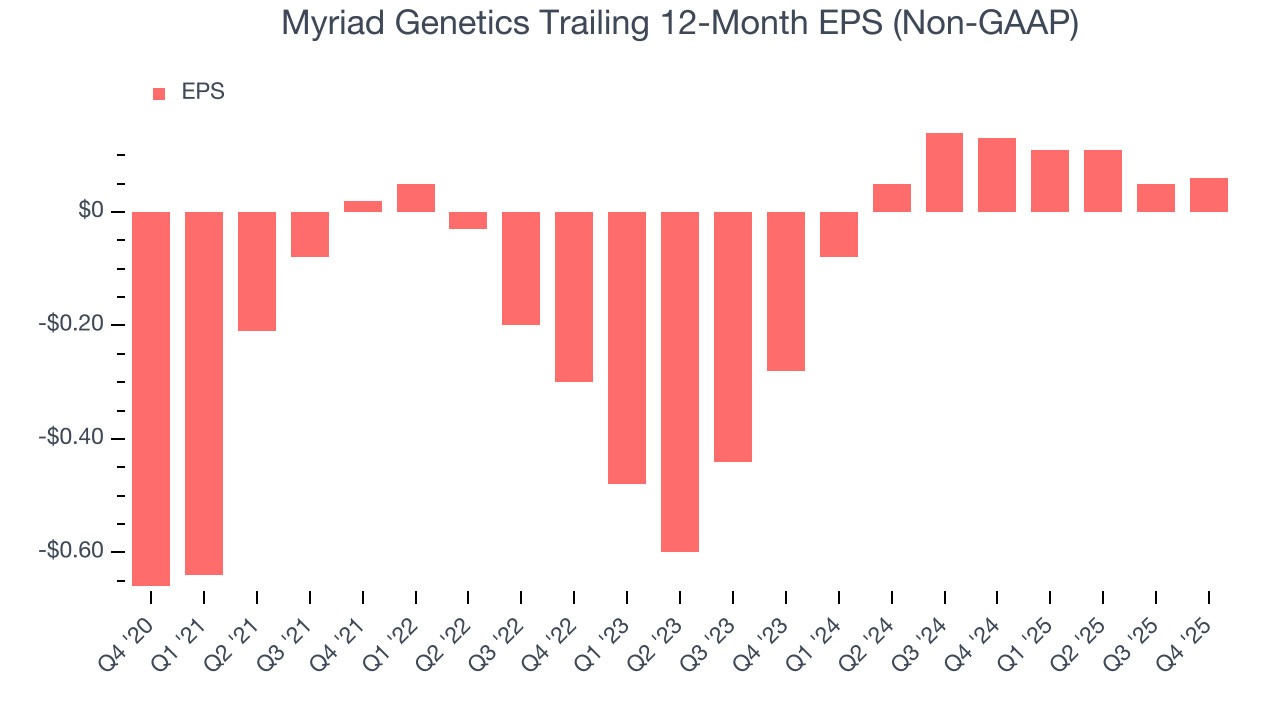

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Myriad Genetics’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q4, Myriad Genetics reported adjusted EPS of $0.04, up from $0.03 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Myriad Genetics’s full-year EPS of $0.06 to shrink by 19.3%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

While Myriad Genetics posted positive free cash flow this quarter, the broader story hasn’t been so clean. Myriad Genetics’s demanding reinvestments have consumed many resources over the last five years, contributing to an average free cash flow margin of negative 9.7%. This means it lit $9.73 of cash on fire for every $100 in revenue.

Taking a step back, we can see that Myriad Genetics’s margin dropped by 1.9 percentage points during that time. Almost any movement in the wrong direction is undesirable because it is already burning cash. If the trend continues, it could signal it’s in the middle of an investment cycle.

Myriad Genetics’s free cash flow clocked in at $4.6 million in Q4, equivalent to a 2.2% margin. This cash profitability was in line with the comparable period last year and above its five-year average.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Myriad Genetics’s five-year average ROIC was negative 34.3%, meaning management lost money while trying to expand the business. Its returns were among the worst in the healthcare sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Myriad Genetics’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

11. Balance Sheet Assessment

Myriad Genetics reported $149.6 million of cash and $209.8 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $39 million of EBITDA over the last 12 months, we view Myriad Genetics’s 1.5× net-debt-to-EBITDA ratio as safe. We also see its $1.5 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Myriad Genetics’s Q4 Results

It was good to see Myriad Genetics beat analysts’ EPS expectations this quarter. We were also glad its full-year EBITDA guidance exceeded Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 22% to $5.35 immediately following the results.

13. Is Now The Time To Buy Myriad Genetics?

Updated: March 7, 2026 at 11:20 PM EST

Are you wondering whether to buy Myriad Genetics or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Myriad Genetics doesn’t pass our quality test. Although its revenue growth was decent over the last five years, it’s expected to deteriorate over the next 12 months and its diminishing returns show management's prior bets haven't worked out. And while the company’s astounding EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Myriad Genetics’s P/E ratio based on the next 12 months is 75.4x. This valuation tells us a lot of optimism is priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $7.78 on the company (compared to the current share price of $5.16).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.