PlayStudios (MYPS)

We wouldn’t buy PlayStudios. Not only did its demand evaporate but also its negative returns on capital show it destroyed shareholder value.― StockStory Analyst Team

1. News

2. Summary

Why We Think PlayStudios Will Underperform

Founded by a team of former gaming industry executives, PlayStudios (NASDAQ:MYPS) offers free-to-play digital casino games.

- Annual sales declines of 1.2% for the past five years show its products and services struggled to connect with the market

- Historically negative EPS casts doubt for cautious investors and clouds its long-term earnings prospects

- Sales are projected to tank by 4.7% over the next 12 months as its demand continues evaporating

PlayStudios doesn’t check our boxes. We’re redirecting our focus to better businesses.

Why There Are Better Opportunities Than PlayStudios

Why There Are Better Opportunities Than PlayStudios

PlayStudios is trading at $0.50 per share, or 0.3x forward price-to-sales. The market typically values companies like PlayStudios based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy.

It’s better to pay up for high-quality businesses with strong long-term earnings potential rather than buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. PlayStudios (MYPS) Research Report: Q3 CY2025 Update

Digital casino game platform PlayStudios (NASDAQ:MYPS) missed Wall Street’s revenue expectations in Q3 CY2025, with sales falling 19.1% year on year to $57.65 million. Its GAAP loss of $0.07 per share was significantly below analysts’ consensus estimates.

PlayStudios (MYPS) Q3 CY2025 Highlights:

- Revenue: $57.65 million vs analyst estimates of $59.45 million (19.1% year-on-year decline, 3% miss)

- EPS (GAAP): -$0.07 vs analyst estimates of -$0.02 (significant miss)

- Adjusted EBITDA: $7.25 million vs analyst estimates of $10.06 million (12.6% margin, 28% miss)

- Operating Margin: -13.6%, down from -6.7% in the same quarter last year

- Daily Active Users: 2.21 million, down 750,000 year on year

- Market Capitalization: $116.6 million

Company Overview

Founded by a team of former gaming industry executives, PlayStudios (NASDAQ:MYPS) offers free-to-play digital casino games.

PlayStudios offers free-to-play casino games (slot machines, blackjack, and poker) that can be accessed through its mobile app myVEGAS. These are free-to-play games, which means that no real money is wagered, won, or lost.

However, players can earn rewards points that can be redeemed for prizes such as hotel stays, dining experiences, and tickets to events such as shows and concerts. Some argue there might be a potential for legal risk because the prizes that can be redeemed have real cash values. Additionally, some of the hotel stays and experiences won are at real casinos, which could feed a cycle of addictive gambling behaviors.

The company generates revenue primarily from the sale of in-game virtual currency, which players can purchase to enhance their playing experience (additional features, themes, game modes). PlayStudios also generates revenue through advertising and by partnering with real-world businesses to offer rewards to PlayStudios’s players. Businesses such as hotels, restaurants, and entertainment venues may pay PlayStudios for the right to be featured in games or to offer rewards.

4. Gaming Solutions

Gaming solution companies operate in a dynamic and evolving market, and the digital transformation of the gaming industry presents significant opportunities for innovation and growth, whether it be immersive slot machine terminals or mobile sports betting. However, the gaming solution industry is not without its challenges. Regulatory compliance is a crucial consideration as companies must navigate a complex and often fragmented regulatory landscape across different jurisdictions. Changes in regulations can impact product offerings, operational practices, and market access, requiring companies to maintain flexibility and adaptability in their business strategies. Additionally, the competitive nature of the industry necessitates continuous investment in research and development to stay ahead of competitors and meet evolving consumer demands.

Competitors offering casual digital games that may feature casino-like activities include Skillz (NYSE:SKLZ), SciPlay (NASDAQ:SCPL), and Huuuge (WSE:HUG).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. PlayStudios struggled to consistently generate demand over the last five years as its sales dropped at a 1.2% annual rate. This was below our standards and is a sign of poor business quality.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. PlayStudios’s recent performance shows its demand remained suppressed as its revenue has declined by 11.1% annually over the last two years.

This quarter, PlayStudios missed Wall Street’s estimates and reported a rather uninspiring 19.1% year-on-year revenue decline, generating $57.65 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 2.1% over the next 12 months. Although this projection indicates its newer products and services will fuel better top-line performance, it is still below average for the sector.

6. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

PlayStudios’s operating margin has been trending down over the last 12 months and averaged negative 9.1% over the last two years. Unprofitable consumer discretionary companies with falling margins deserve extra scrutiny because they’re spending loads of money to stay relevant, an unsustainable practice.

In Q3, PlayStudios generated a negative 13.6% operating margin. The company's consistent lack of profits raise a flag.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for PlayStudios, its EPS declined by 26.2% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

In Q3, PlayStudios reported EPS of negative $0.07, down from negative $0.02 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects PlayStudios to improve its earnings losses. Analysts forecast its full-year EPS of negative $0.29 will advance to negative $0.06.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

PlayStudios has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 14.8% over the last two years, better than the broader consumer discretionary sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

PlayStudios’s five-year average ROIC was negative 10.4%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

10. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

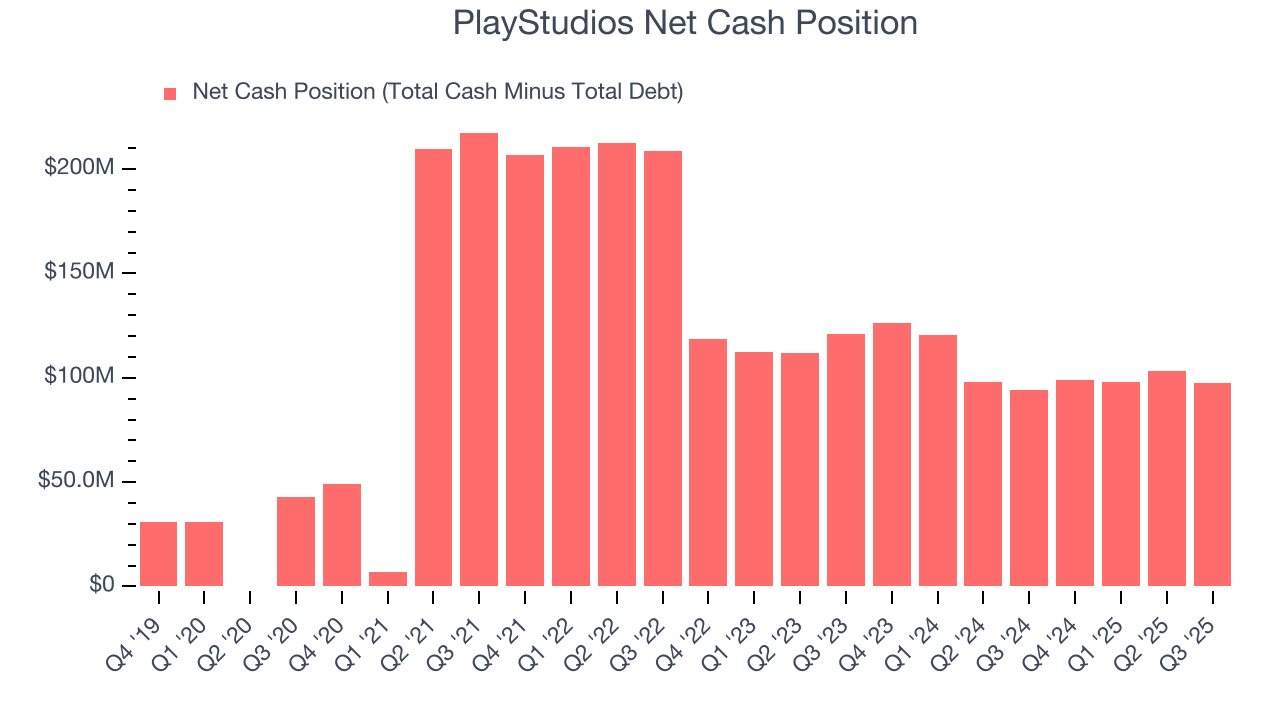

PlayStudios is a well-capitalized company with $106.3 million of cash and $8.65 million of debt on its balance sheet. This $97.67 million net cash position is 94.1% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from PlayStudios’s Q3 Results

We struggled to find many positives in these results. Its EBITDA missed and its EPS fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 14.6% to $0.77 immediately after reporting.

12. Is Now The Time To Buy PlayStudios?

Updated: March 6, 2026 at 9:40 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

We see the value of companies helping consumers, but in the case of PlayStudios, we’re out. On top of that, PlayStudios’s negative EPS four years ago gives us pause, and its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

PlayStudios’s forward price-to-sales ratio is 0.3x. The market typically values companies like PlayStudios based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy.

Wall Street analysts have a consensus one-year price target of $1.75 on the company (compared to the current share price of $0.50).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.