Navient (NAVI)

Navient keeps us up at night. Its sales and profitability have plummeted, suggesting it struggled to scale down its costs as demand faded.― StockStory Analyst Team

1. News

2. Summary

Why We Think Navient Will Underperform

Spun off from Sallie Mae in 2014 to handle the company's loan servicing and collection operations, Navient (NASDAQ:NAVI) provides education loan servicing and business processing solutions that help manage federal student loans, private education loans, and government services.

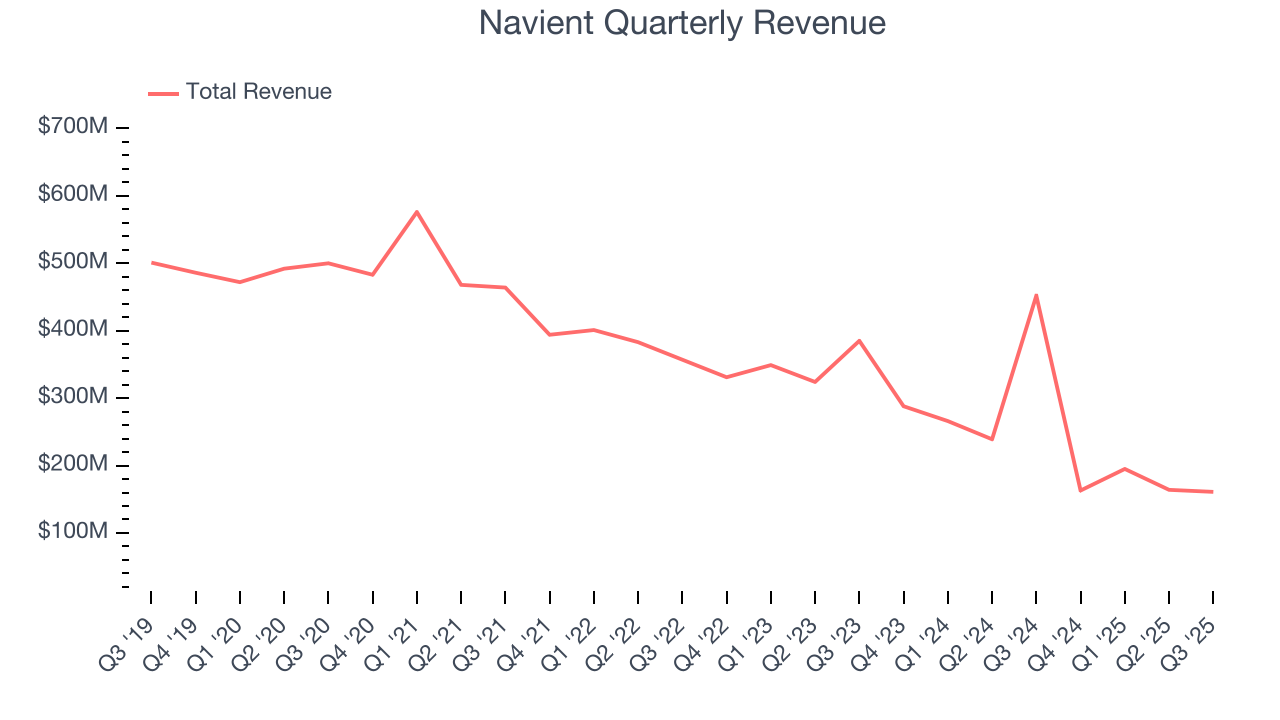

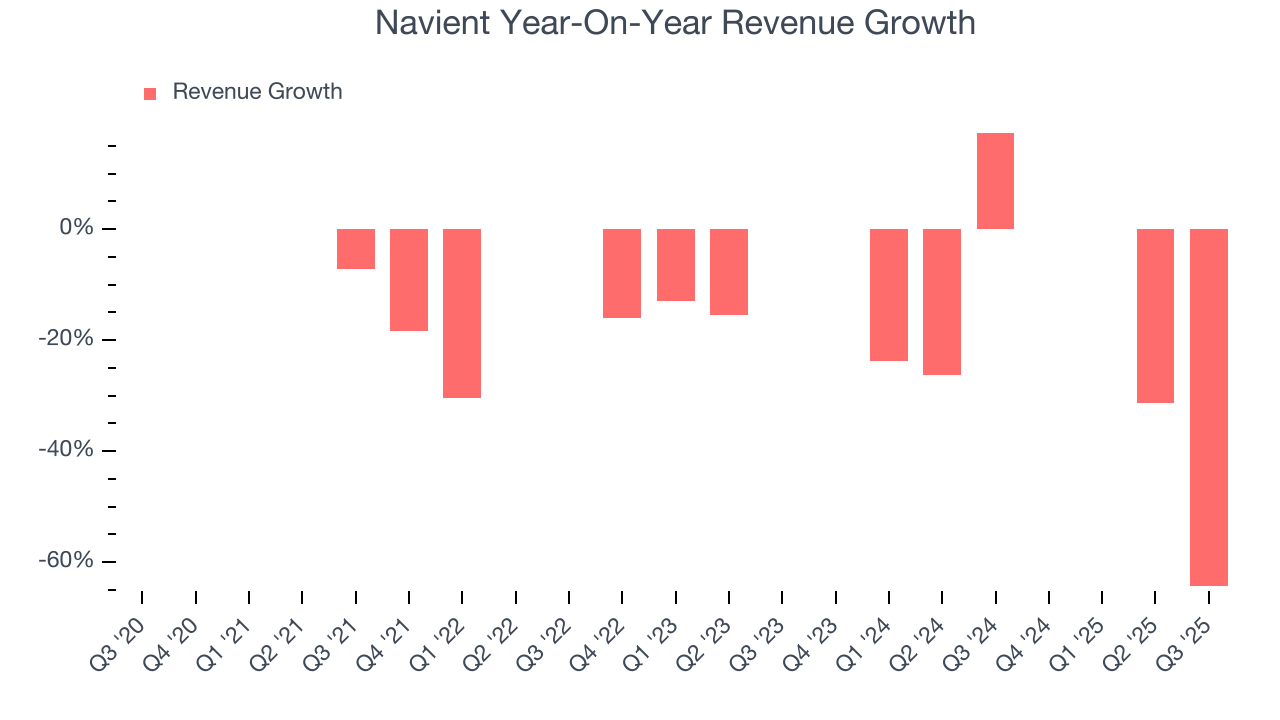

- Customers postponed purchases of its products and services this cycle as its revenue declined by 18.7% annually over the last five years

- Earnings per share have dipped by 17.1% annually over the past five years, which is concerning because stock prices follow EPS over the long term

Navient’s quality is not up to our standards. We’re hunting for superior stocks elsewhere.

Why There Are Better Opportunities Than Navient

Why There Are Better Opportunities Than Navient

Navient is trading at $12.51 per share, or 11.7x forward P/E. This multiple is cheaper than most financials peers, but we think this is justified.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Navient (NAVI) Research Report: Q3 CY2025 Update

Student loan servicer Navient (NASDAQ:NAVI) missed Wall Street’s revenue expectations in Q3 CY2025, with sales falling 64.4% year on year to $161 million. Its GAAP loss of $0.87 per share was significantly below analysts’ consensus estimates.

Navient (NAVI) Q3 CY2025 Highlights:

- Net Interest Income: $142 million vs analyst estimates of $143 million (0.7% miss)

- Revenue: $161 million vs analyst estimates of $162.8 million (64.4% year-on-year decline, 1.1% miss)

- Pre-tax Profit: -$117 million (-72.7% margin, 1,075% year-on-year decline)

- EPS (GAAP): -$0.87 vs analyst estimates of $0.17 (significant miss)

- Market Capitalization: $1.29 billion

Company Overview

Spun off from Sallie Mae in 2014 to handle the company's loan servicing and collection operations, Navient (NASDAQ:NAVI) provides education loan servicing and business processing solutions that help manage federal student loans, private education loans, and government services.

Navient operates through three main business segments. Its Federal Education Loans segment owns and services a portfolio of federally guaranteed loans under the Federal Family Education Loan Program (FFELP), generating revenue primarily through interest income on these loans. The Consumer Lending segment focuses on private education loans, including both refinancing existing student debt and originating new in-school loans through its Earnest and NaviRefi brands. These digital platforms help students find scholarships, compare financial aid offers, and secure lower interest rates on their education debt.

The company's third segment, Business Processing, leverages Navient's expertise in loan servicing to provide outsourced solutions to approximately 500 government and healthcare clients. These services include contact center operations, workflow processing, and revenue cycle management. Government clients range from federal agencies to state governments and tolling authorities, while healthcare clients include hospitals, medical centers, and physician groups.

Navient's technology infrastructure handles millions of complex transactions daily, using data-driven approaches to simplify customer experiences. For example, a recent college graduate struggling with federal loan payments might interact with Navient's systems to explore income-driven repayment options, while a hospital might use Navient's services to optimize patient billing processes and improve collection rates.

The company operates under significant regulatory oversight, including supervision by the Consumer Financial Protection Bureau (CFPB), the Department of Education, and various state agencies. This regulatory environment requires Navient to maintain comprehensive compliance systems covering everything from fair lending practices to consumer privacy protections.

4. Student Loan

Student loan providers finance higher education expenses. Growth opportunities exist in private loan offerings, refinancing existing debt, and international education funding. Challenges include political uncertainty around potential loan forgiveness programs, default risk correlation with employment markets, and increasing scrutiny of educational outcomes relative to debt burdens.

Navient's competitors include Nelnet (NYSE:NNI) in the student loan servicing space, Maximus (NYSE:MMS) in government services, and R1 RCM (NASDAQ:RCM) in healthcare revenue cycle management. The company also competes with SoFi (NASDAQ:SOFI) and Discover Financial Services (NYSE:DFS) in private student lending.

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Navient struggled to consistently generate demand over the last five years as its revenue dropped at a 18.9% annual rate. This was below our standards and is a sign of poor business quality.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Navient’s recent performance shows its demand remained suppressed as its revenue has declined by 29.9% annually over the last two years.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Navient missed Wall Street’s estimates and reported a rather uninspiring 64.4% year-on-year revenue decline, generating $161 million of revenue.

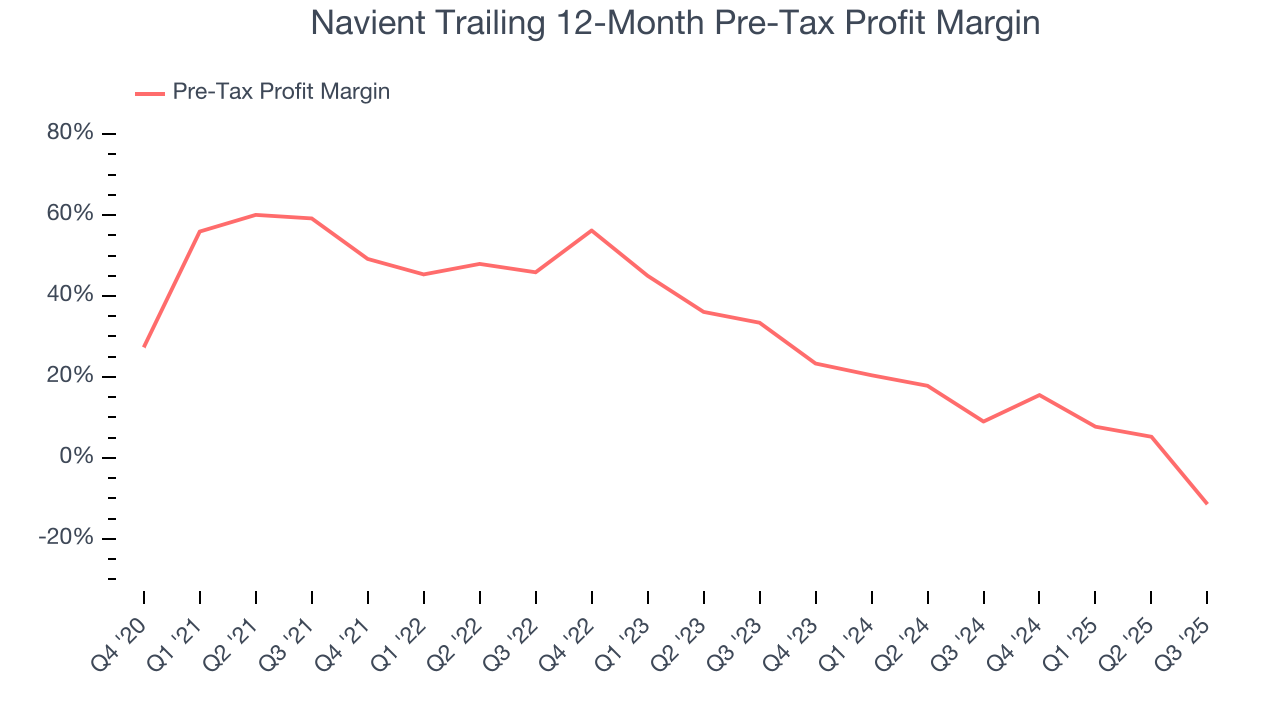

6. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Student Loan companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

Interest income and expenses play a big role in financial institutions' profitability, so they should be factored into the definition of profit. Taxes, however, should not as they are largely out of a company's control. This is pre-tax profit by definition.

Over the last four years, Navient’s pre-tax profit margin has risen by 70.6 percentage points, going from 59.2% to negative 11.4%. It has also declined by 44.8 percentage points on a two-year basis, showing its expenses have consistently increased at a faster rate than revenue. This usually raises questions unless the company is in high-growth mode and reinvesting its profits into attractive ventures.

In Q3, Navient’s pre-tax profit margin was negative 72.7%. This result was 75.3 percentage points worse than the same quarter last year.

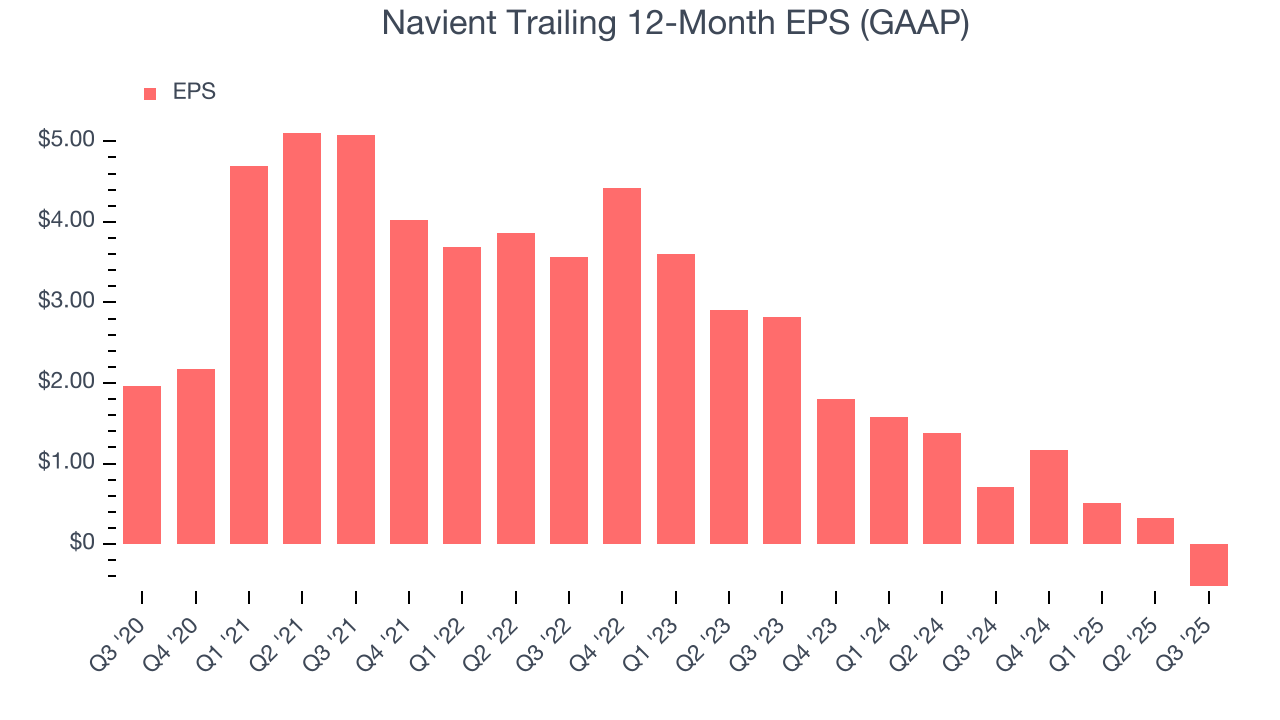

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Navient, its EPS and revenue declined by 17.8% and 18.9% annually over the last five years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Navient’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Navient’s two-year annual EPS declines of 47.9% were bad and lower than its two-year revenue losses.

We can take a deeper look into Navient’s earnings to better understand the drivers of its performance. Navient’s pre-tax profit margin has declined over the last two years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, Navient reported EPS of negative $0.87, down from negative $0.02 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Navient’s full-year EPS of negative $0.52 will flip to positive $1.29.

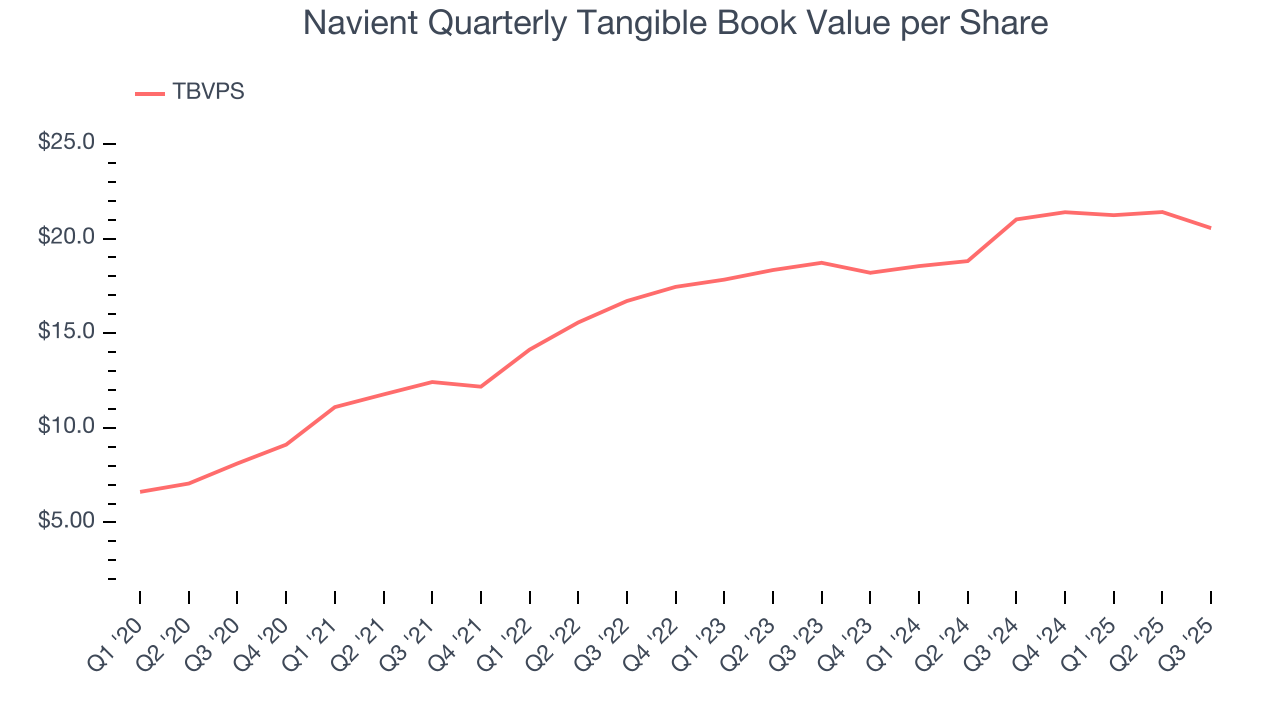

8. Tangible Book Value Per Share (TBVPS)

Financial firms profit by providing a wide range of services, making them fundamentally balance sheet-driven enterprises with multiple intermediation roles. Market participants emphasize balance sheet quality and sustained book value growth when evaluating these multifaceted institutions.

This is why we consider tangible book value per share (TBVPS) an important metric for the sector. TBVPS represents the real net worth per share across all business segments, providing a clear measure of shareholder equity regardless of the complexity of operations. On the other hand, EPS is often distorted by the diverse nature of operations, mergers, and various accounting treatments across different business units. Book value provides clearer performance insights.

Navient’s TBVPS grew at an incredible 20.4% annual clip over the last five years. However, TBVPS growth has recently decelerated to 4.8% annual growth over the last two years (from $18.72 to $20.55 per share).

9. Return on Equity

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, Navient has averaged an ROE of 14.8%, healthy for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This is a bright spot for Navient.

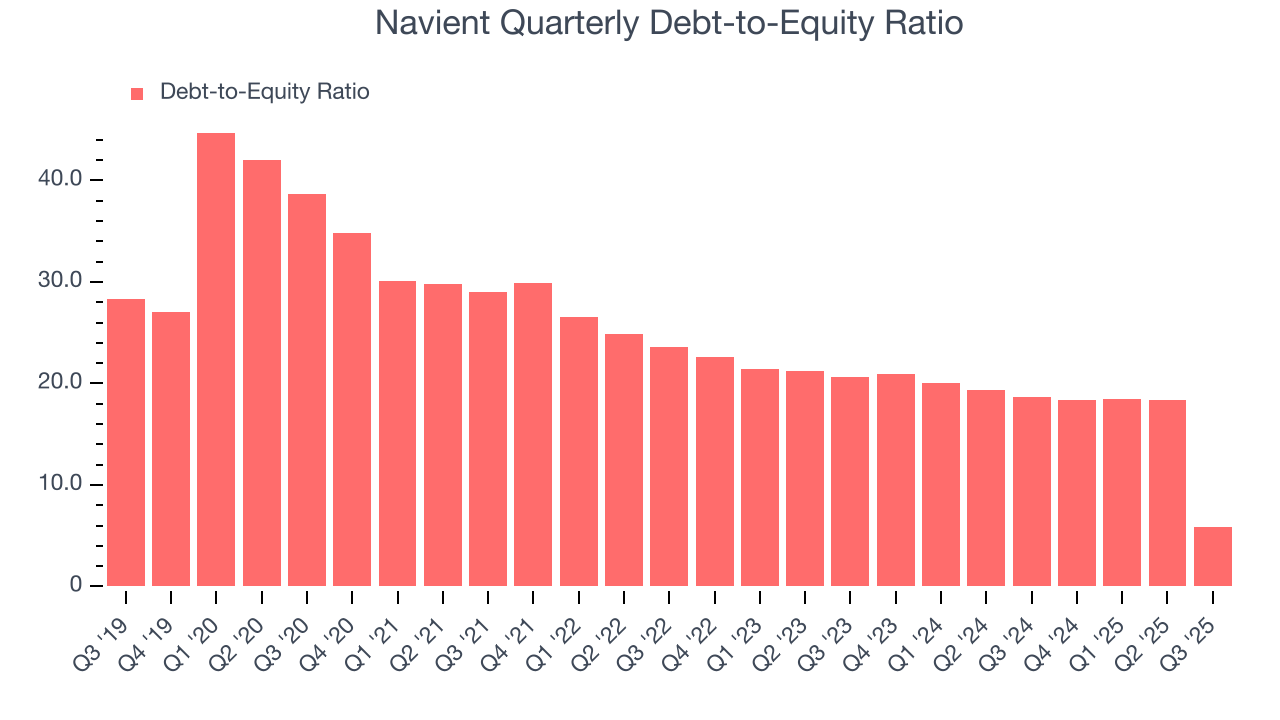

10. Balance Sheet Risk

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Navient currently has $46.33 billion of debt and $7.97 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 15.3×. We think this is dangerous - for a financials business, anything above 3.5× raises red flags.

11. Key Takeaways from Navient’s Q3 Results

We struggled to find many positives in these results. Its EPS missed and its net interest income fell slightly short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 4.6% to $12.35 immediately following the results.

12. Is Now The Time To Buy Navient?

Updated: December 4, 2025 at 11:45 PM EST

When considering an investment in Navient, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Navient falls short of our quality standards. First off, its revenue has declined over the last five years. And while its TBVPS growth was exceptional over the last five years, the downside is its declining pre-tax profit margin shows the business has become less efficient. On top of that, its declining EPS over the last five years makes it a less attractive asset to the public markets.

Navient’s P/E ratio based on the next 12 months is 11.7x. At this valuation, there’s a lot of good news priced in - we think there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $12.89 on the company (compared to the current share price of $12.51).