NeoGenomics (NEO)

NeoGenomics faces an uphill battle. Its poor investment decisions are evident in its negative returns on capital, a troubling sign for investors.― StockStory Analyst Team

1. News

2. Summary

Why We Think NeoGenomics Will Underperform

Operating a network of CAP-accredited and CLIA-certified laboratories across the United States and United Kingdom, NeoGenomics (NASDAQ:NEO) provides specialized cancer diagnostic testing services, including genetic analysis, molecular testing, and pathology consultation for oncologists and healthcare providers.

- Push for growth has led to negative returns on capital, signaling value destruction

- Historical adjusted operating margin losses point to an inefficient cost structure

- High net-debt-to-EBITDA ratio of 6× increases the risk of forced asset sales or dilutive financing if operational performance weakens

NeoGenomics falls below our quality standards. We’re hunting for superior stocks elsewhere.

Why There Are Better Opportunities Than NeoGenomics

High Quality

Investable

Underperform

Why There Are Better Opportunities Than NeoGenomics

At $11.38 per share, NeoGenomics trades at 75.9x forward P/E. We consider this valuation aggressive considering the business fundamentals.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. NeoGenomics (NEO) Research Report: Q4 CY2025 Update

Oncology (cancer) diagnostics company NeoGenomics (NASDAQ:NEO) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 10.6% year on year to $190.2 million. The company expects the full year’s revenue to be around $797 million, close to analysts’ estimates. Its non-GAAP profit of $0.06 per share was $0.02 above analysts’ consensus estimates.

NeoGenomics (NEO) Q4 CY2025 Highlights:

- Revenue: $190.2 million vs analyst estimates of $188.3 million (10.6% year-on-year growth, 1% beat)

- Adjusted EPS: $0.06 vs analyst estimates of $0.04 ($0.02 beat)

- Adjusted EBITDA: $13.38 million vs analyst estimates of $13.77 million (7% margin, 2.8% miss)

- Adjusted EPS guidance for the upcoming financial year 2026 is $0.19 at the midpoint, missing analyst estimates by 0.9%

- EBITDA guidance for the upcoming financial year 2026 is $56 million at the midpoint, below analyst estimates of $57.38 million

- Operating Margin: -7.1%, up from -10.7% in the same quarter last year

- Free Cash Flow was -$6.53 million compared to -$1.80 million in the same quarter last year

- Market Capitalization: $1.47 billion

Company Overview

Operating a network of CAP-accredited and CLIA-certified laboratories across the United States and United Kingdom, NeoGenomics (NASDAQ:NEO) provides specialized cancer diagnostic testing services, including genetic analysis, molecular testing, and pathology consultation for oncologists and healthcare providers.

NeoGenomics serves as a critical link in cancer care by offering comprehensive diagnostic testing that helps physicians determine the specific characteristics of a patient's cancer. The company's testing portfolio includes cytogenetics (analyzing chromosome structures), fluorescence in-situ hybridization (FISH), flow cytometry, immunohistochemistry, and advanced molecular and next-generation sequencing (NGS) tests that identify genetic mutations and other biomarkers in cancer cells.

These sophisticated tests enable oncologists to make more precise diagnoses and develop personalized treatment plans. For example, a lung cancer patient might have their tumor sample analyzed by NeoGenomics to identify specific genetic mutations that could make them eligible for targeted therapies rather than traditional chemotherapy.

The company operates through two main segments. The Clinical Services segment serves community pathology practices, hospital labs, academic centers, and oncology groups who need specialized cancer testing beyond their in-house capabilities. Many clients use NeoGenomics on a "tech-only" basis, where the company performs the technical component of testing while the client's pathologists interpret the results. The Advanced Diagnostics segment partners with pharmaceutical companies to support clinical trials, drug development, and companion diagnostic tests that determine which patients might respond to specific cancer therapies.

NeoGenomics has expanded its capabilities through strategic acquisitions, including Inivata in 2021, which added liquid biopsy technology that can detect cancer through blood samples rather than tissue biopsies. The company's InVisionFirst-Lung test analyzes blood samples from non-small cell lung cancer patients, while its RaDaR assay can detect minimal residual disease after treatment, helping to monitor for cancer recurrence.

The company generates revenue through reimbursement from Medicare, Medicaid, private insurance, and direct billing to healthcare providers. For pharmaceutical clients, NeoGenomics typically operates under service contracts for clinical trials and research projects.

4. Testing & Diagnostics Services

The testing and diagnostics services industry plays a crucial role in disease detection, monitoring, and prevention, serving hospitals, clinics, and individual consumers. This sector benefits from stable demand, driven by an aging population, increased prevalence of chronic diseases, and growing awareness of preventive healthcare. Recurring revenue streams come from routine screenings, lab tests, and diagnostic imaging, with reimbursement from Medicare, Medicaid, private insurance, and out-of-pocket payments. However, the industry faces challenges such as pricing pressures, regulatory compliance, and the need for continuous investment in new testing technologies. Looking ahead, industry tailwinds include the expansion of personalized medicine, increased adoption of at-home and rapid diagnostic tests, and advancements in AI-driven diagnostics that enhance accuracy and efficiency. However, headwinds such as reimbursement uncertainties, competition from decentralized testing solutions, and regulatory scrutiny over test validity and cost-effectiveness may impact profitability. Adapting to evolving healthcare models and integrating automation will be key for sustaining growth and maintaining operational efficiency.

NeoGenomics competes with large laboratory companies like Quest Diagnostics and Laboratory Corporation of America, as well as specialized cancer diagnostics firms including Guardant Health (NASDAQ:GH), Natera (NASDAQ:NTRA), Exact Sciences (NASDAQ:EXAS), Caris Life Sciences, Tempus Labs, and Myriad Genetics (NASDAQ:MYGN).

5. Revenue Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $727.3 million in revenue over the past 12 months, NeoGenomics is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

6. Revenue Growth

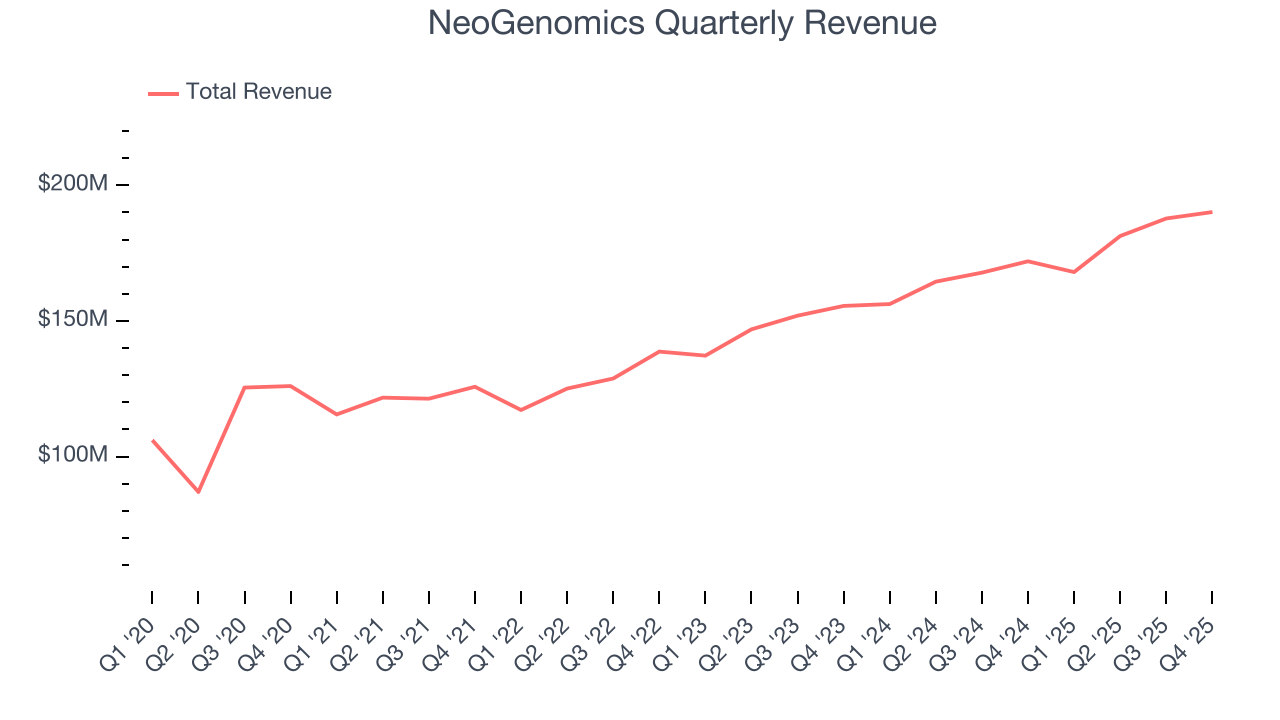

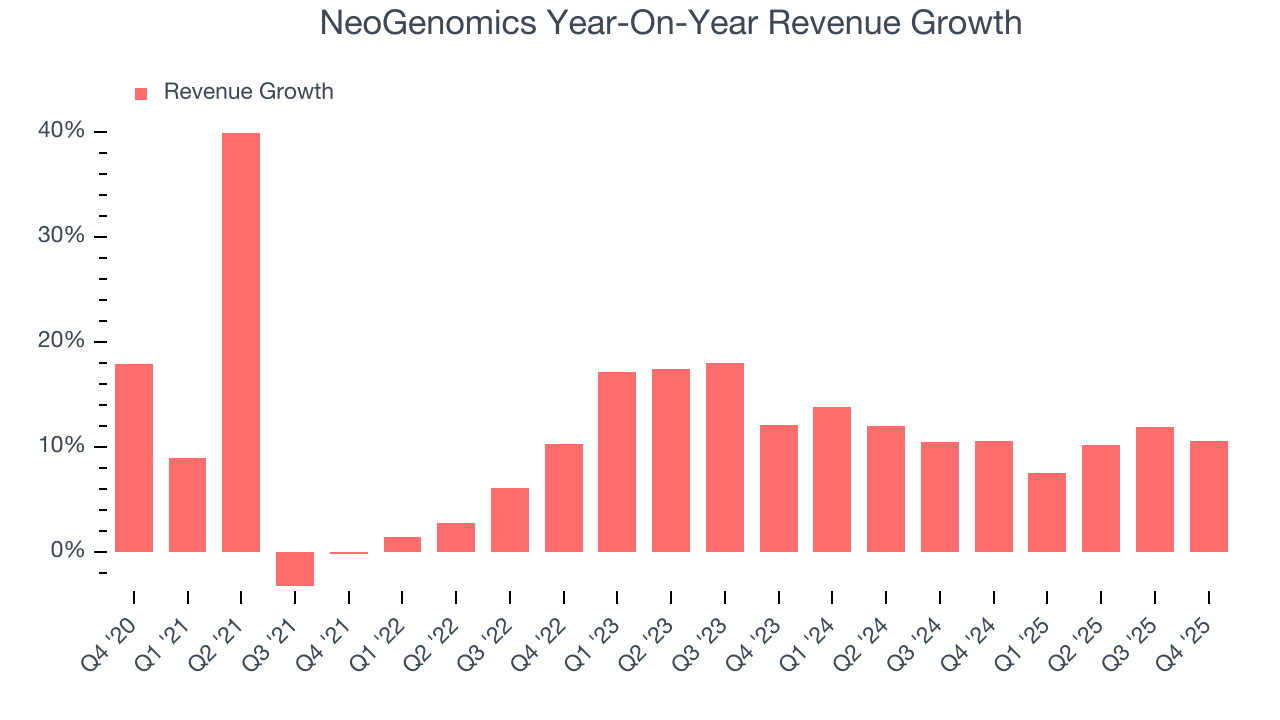

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, NeoGenomics grew its sales at a decent 10.4% compounded annual growth rate. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. NeoGenomics’s annualized revenue growth of 10.9% over the last two years aligns with its five-year trend, suggesting its demand was stable.

This quarter, NeoGenomics reported year-on-year revenue growth of 10.6%, and its $190.2 million of revenue exceeded Wall Street’s estimates by 1%.

Looking ahead, sell-side analysts expect revenue to grow 9.5% over the next 12 months, similar to its two-year rate. Still, this projection is commendable and indicates the market is forecasting success for its products and services.

7. Operating Margin

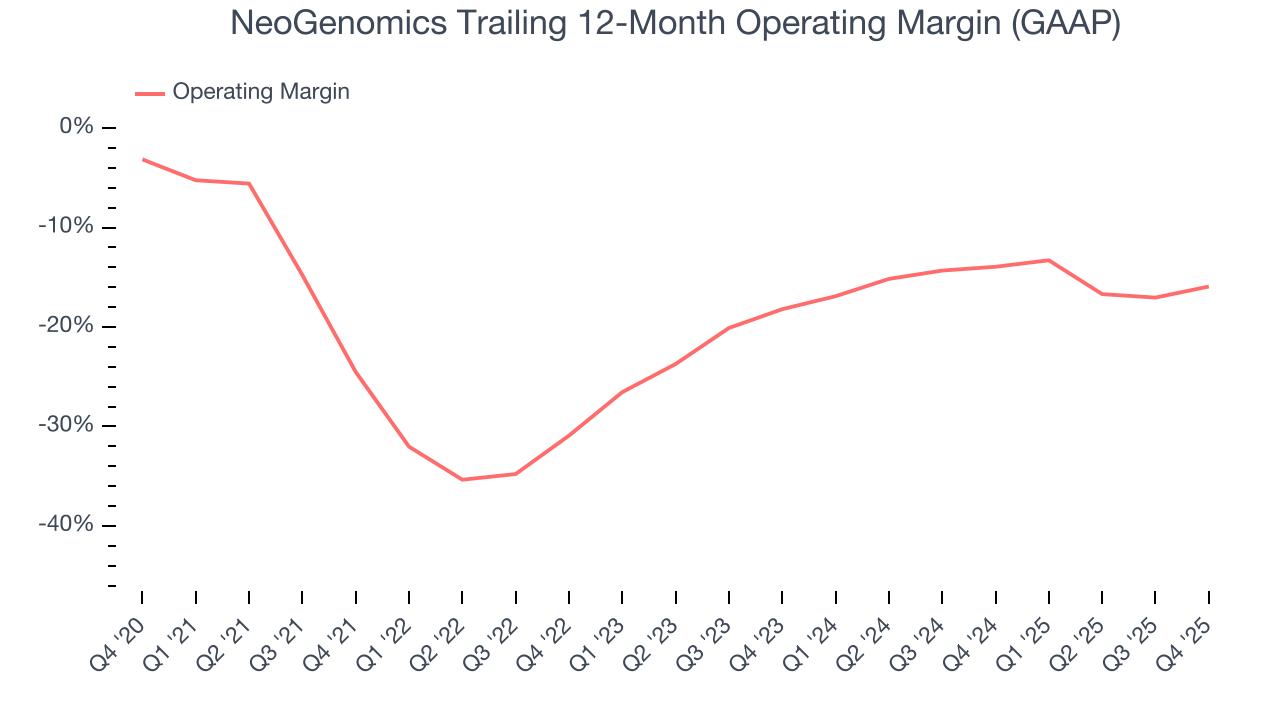

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

NeoGenomics’s high expenses have contributed to an average operating margin of negative 19.9% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, NeoGenomics’s operating margin rose by 8.6 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 2.3 percentage points on a two-year basis.

In Q4, NeoGenomics generated a negative 7.1% operating margin.

8. Earnings Per Share

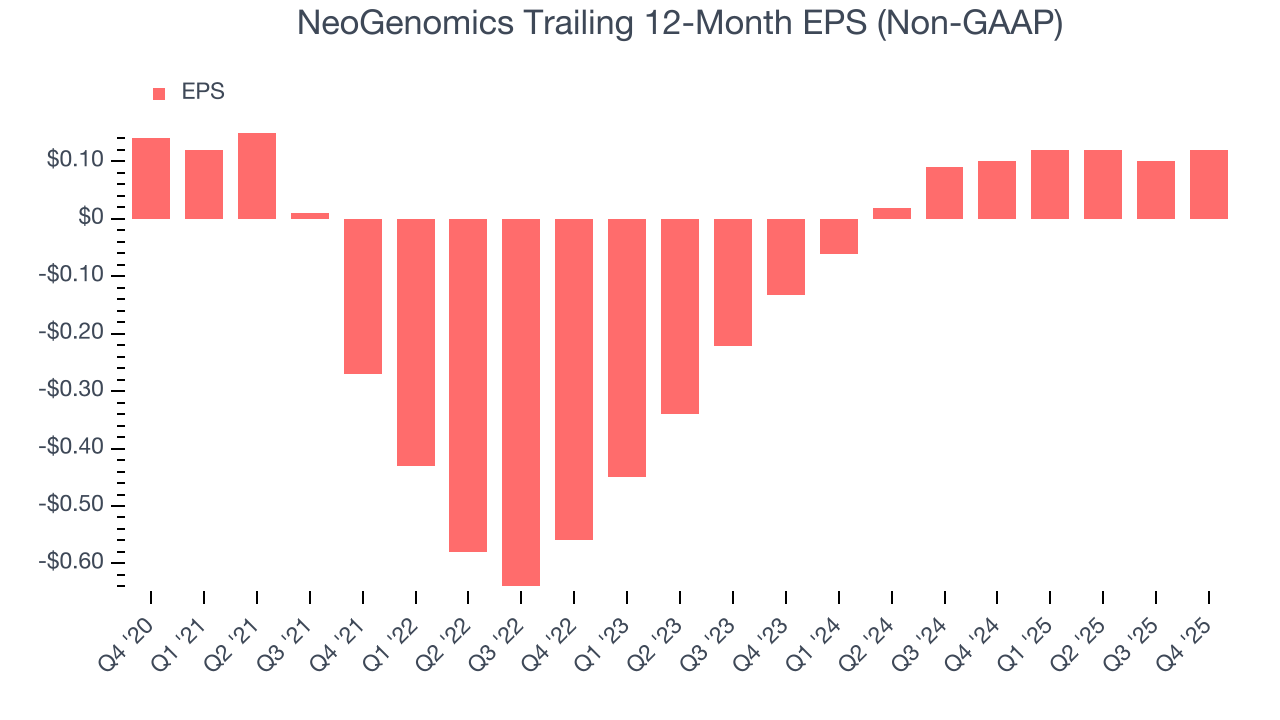

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

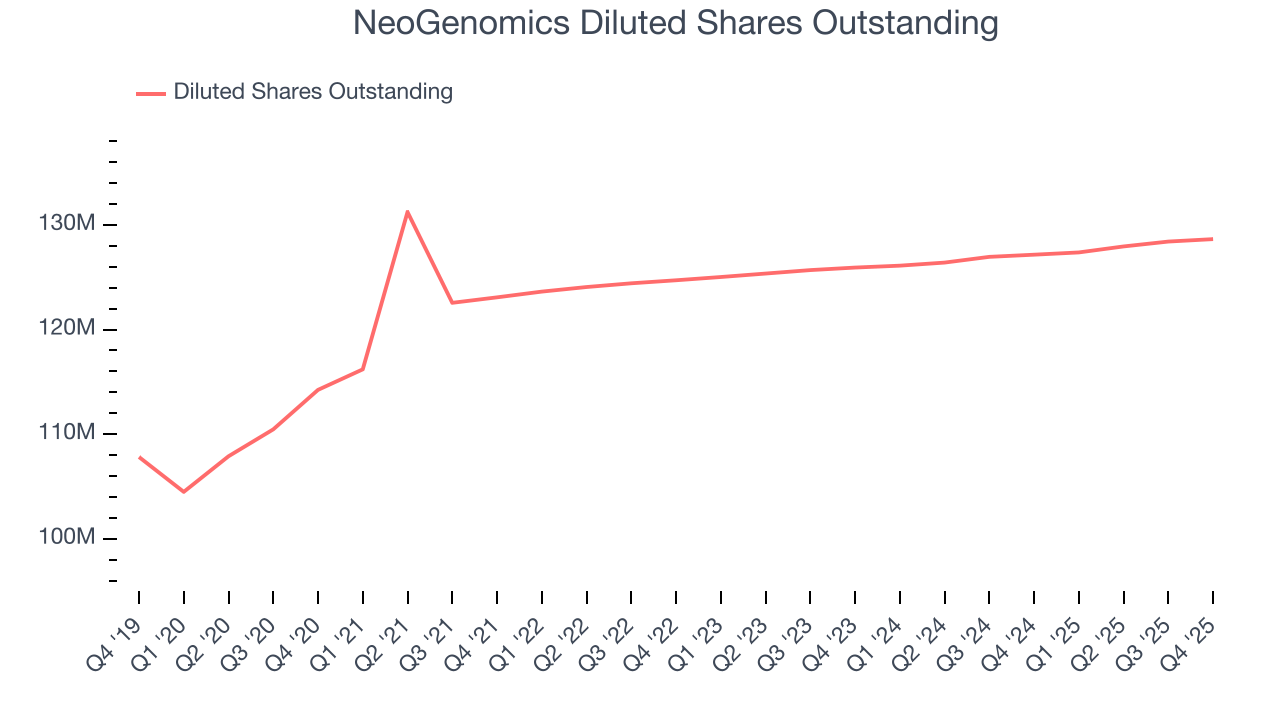

Sadly for NeoGenomics, its EPS declined by 3% annually over the last five years while its revenue grew by 10.4%. However, its operating margin actually improved during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

Diving into the nuances of NeoGenomics’s earnings can give us a better understanding of its performance. A five-year view shows NeoGenomics has diluted its shareholders, growing its share count by 12.6%. This dilution overshadowed its increased operational efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, NeoGenomics reported adjusted EPS of $0.06, up from $0.04 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects NeoGenomics’s full-year EPS of $0.12 to grow 50%.

9. Cash Is King

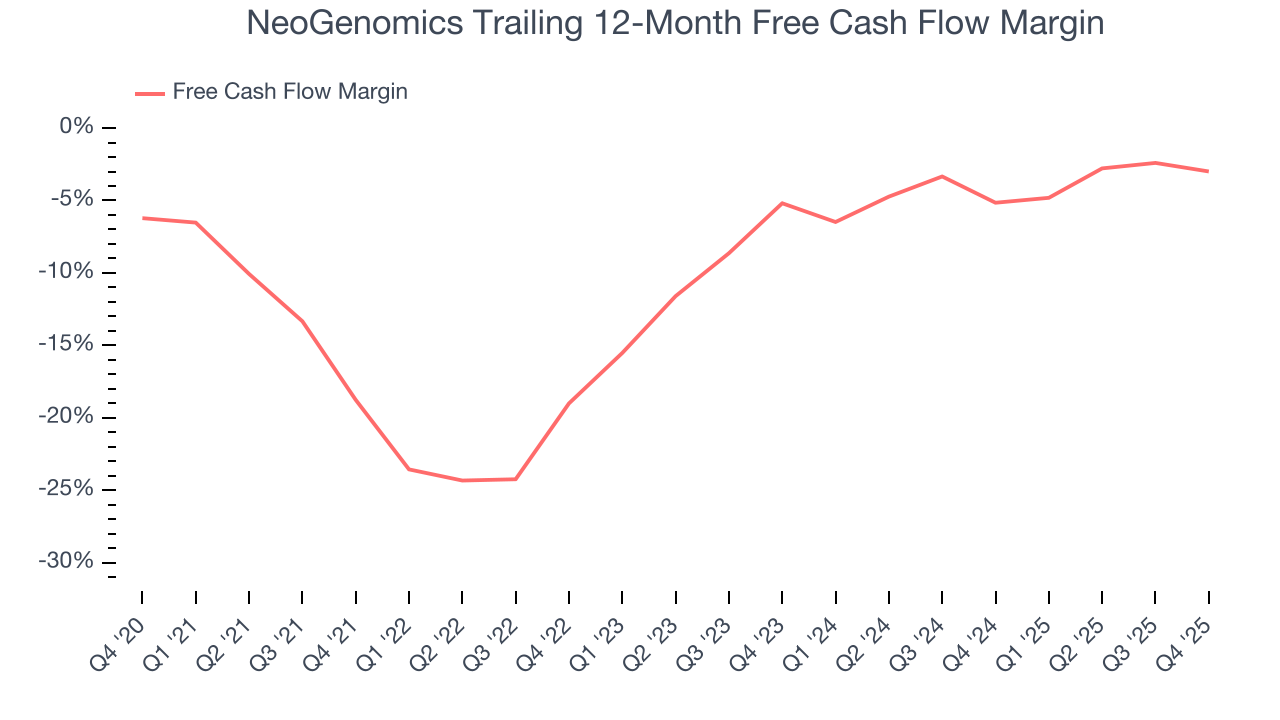

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

NeoGenomics’s demanding reinvestments have consumed many resources over the last five years, contributing to an average free cash flow margin of negative 9.2%. This means it lit $9.22 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that NeoGenomics’s margin expanded by 15.8 percentage points during that time. We have no doubt shareholders would like to continue seeing its cash conversion rise.

NeoGenomics burned through $6.53 million of cash in Q4, equivalent to a negative 3.4% margin. The company’s cash burn was similar to its $1.80 million of lost cash in the same quarter last year.

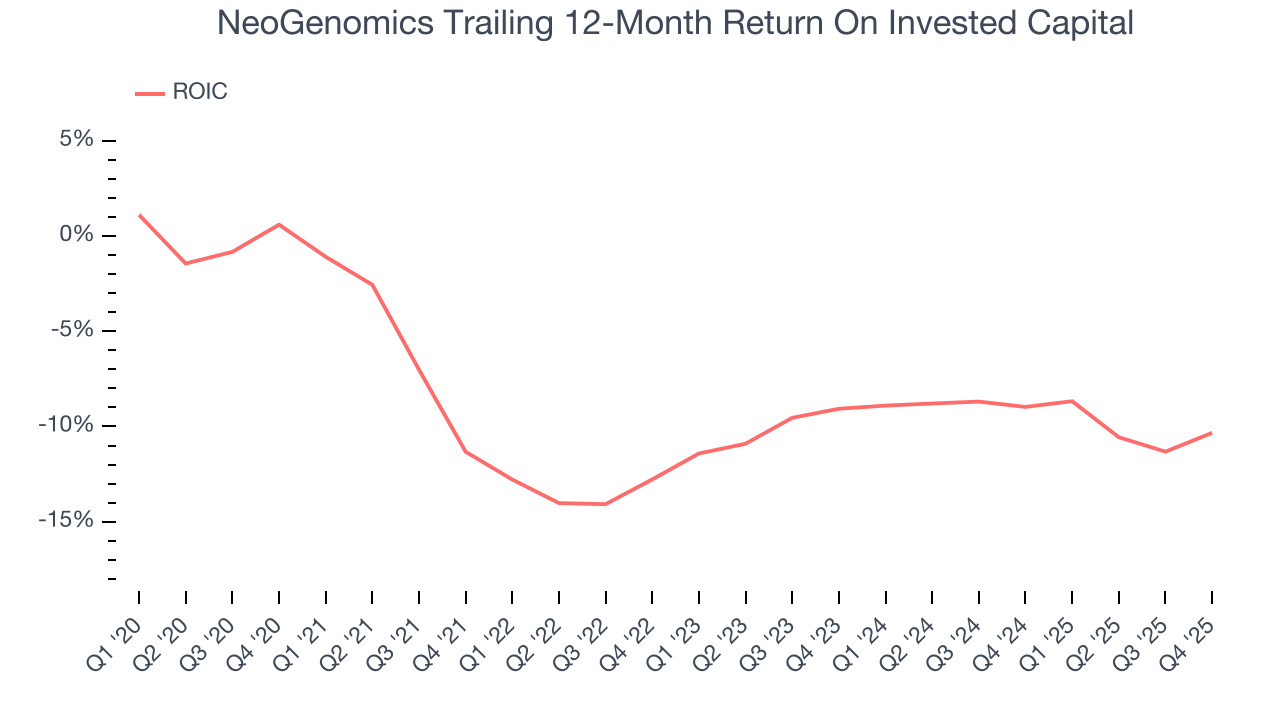

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

NeoGenomics’s five-year average ROIC was negative 10.5%, meaning management lost money while trying to expand the business. Its returns were among the worst in the healthcare sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, NeoGenomics’s ROIC averaged 2.4 percentage point increases each year. This is a good sign, and we hope the company can continue improving.

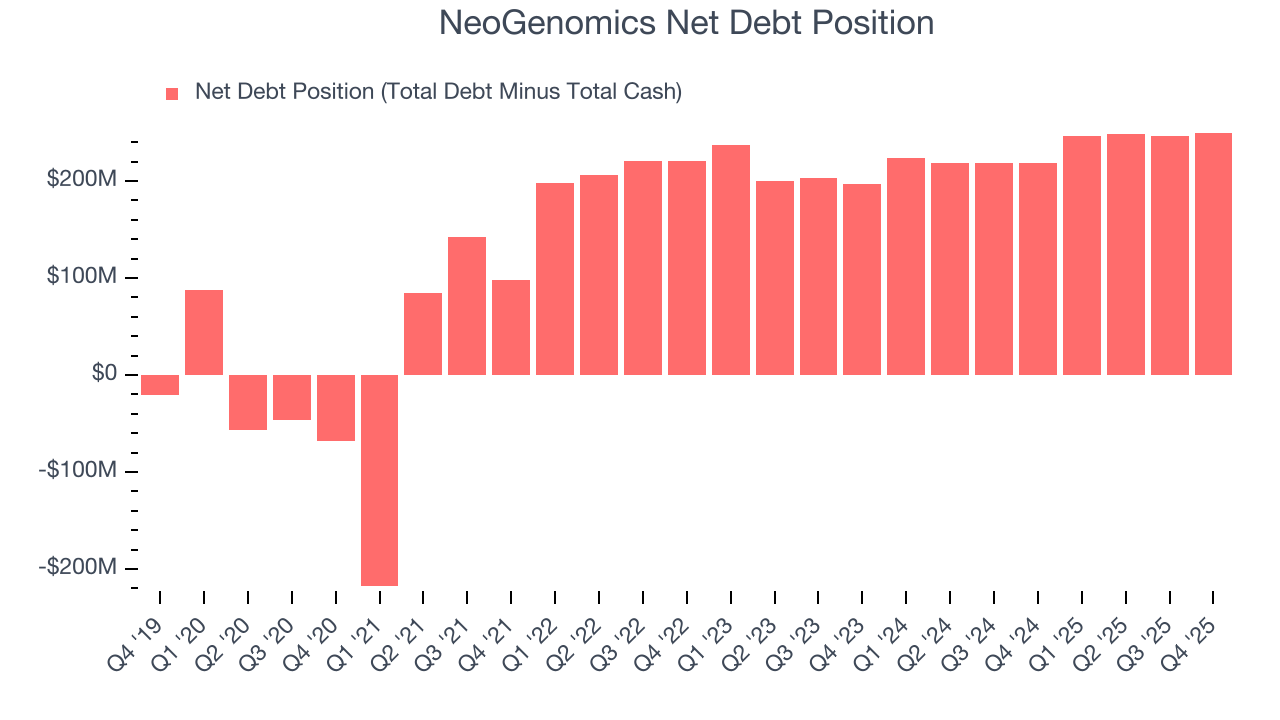

11. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

NeoGenomics’s $409.5 million of debt exceeds the $159.6 million of cash on its balance sheet. Furthermore, its 6× net-debt-to-EBITDA ratio (based on its EBITDA of $43.36 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. NeoGenomics could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope NeoGenomics can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

12. Key Takeaways from NeoGenomics’s Q4 Results

It was good to see NeoGenomics beat analysts’ EPS expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance slightly missed and its full-year EBITDA guidance fell short of Wall Street’s estimates. Zooming out, we think this was a mixed quarter. The market seemed to be hoping for more, and the stock traded down 2.9% to $11.05 immediately following the results.

13. Is Now The Time To Buy NeoGenomics?

Updated: February 17, 2026 at 7:35 AM EST

Are you wondering whether to buy NeoGenomics or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

NeoGenomics doesn’t pass our quality test. Although its revenue growth was good over the last five years and Wall Street believes it will continue to grow, its relatively low ROIC suggests management has struggled to find compelling investment opportunities. And while the company’s rising cash profitability gives it more optionality, the downside is its operating margins reveal poor profitability compared to other healthcare companies.

NeoGenomics’s EV-to-EBITDA ratio based on the next 12 months is 4.6x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $14.56 on the company (compared to the current share price of $11.05).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.