Neogen (NEOG)

Neogen faces an uphill battle. Its poor sales growth shows demand is soft and its negative returns on capital suggest it destroyed value.― StockStory Analyst Team

1. News

2. Summary

Why We Think Neogen Will Underperform

Founded in 1981 and operating at the intersection of food safety and animal health, Neogen (NASDAQ:NEOG) develops and manufactures diagnostic tests and related products to detect dangerous substances in food and pharmaceuticals for animal health.

- Incremental sales over the last five years were much less profitable as its earnings per share fell by 12.6% annually while its revenue grew

- Poor expense management has led to adjusted operating margin losses

- Negative earnings profile makes it challenging to secure favorable financing terms from lenders

Neogen’s quality is lacking. There are more appealing investments to be made.

Why There Are Better Opportunities Than Neogen

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Neogen

Neogen is trading at $9.20 per share, or 34x forward P/E. Not only does Neogen trade at a premium to companies in the healthcare space, but this multiple is also high for its fundamentals.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. Neogen (NEOG) Research Report: Q4 CY2025 Update

Life sciences company Neogen (NASDAQ:NEOG) beat Wall Street’s revenue expectations in Q4 CY2025, but sales fell by 2.8% year on year to $224.7 million. The company’s full-year revenue guidance of $850 million at the midpoint came in 3% above analysts’ estimates. Its non-GAAP profit of $0.10 per share was 50% above analysts’ consensus estimates.

Neogen (NEOG) Q4 CY2025 Highlights:

- Revenue: $224.7 million vs analyst estimates of $209.7 million (2.8% year-on-year decline, 7.2% beat)

- Adjusted EPS: $0.10 vs analyst estimates of $0.07 (50% beat)

- Adjusted EBITDA: $48.75 million vs analyst estimates of $39.17 million (21.7% margin, 24.5% beat)

- The company lifted its revenue guidance for the full year to $850 million at the midpoint from $830 million, a 2.4% increase

- EBITDA guidance for the full year is $175 million at the midpoint, above analyst estimates of $165.8 million

- Operating Margin: -2.4%, up from -198% in the same quarter last year

- Free Cash Flow Margin: 3.5%, down from 10% in the same quarter last year

- Market Capitalization: $1.60 billion

Company Overview

Founded in 1981 and operating at the intersection of food safety and animal health, Neogen (NASDAQ:NEOG) develops and manufactures diagnostic tests and related products to detect dangerous substances in food and pharmaceuticals for animal health.

Neogen's business is divided into two main segments. The Food Safety segment provides diagnostic test kits that detect contaminants like foodborne pathogens, mycotoxins, allergens, and spoilage organisms in human food and animal feed. These tests help food producers ensure their products are safe for consumption. For example, a cookie manufacturer might use Neogen's allergen tests to verify that a production line is free from peanut residue before making a peanut-free product.

The Animal Safety segment offers a diverse range of products including veterinary instruments, pharmaceuticals, vaccines, rodenticides, insecticides, cleaners, and disinfectants. This segment also provides genomic testing services that help livestock producers improve breeding decisions. A cattle rancher might use Neogen's genomic testing to identify animals with superior genetic traits for breeding purposes.

Neogen's products are primarily consumable in nature – single-use test kits, culture media, and reagents that customers need to purchase repeatedly. The company sells directly to end users through specialized sales teams and also works with distributors to reach customers in over 100 countries.

The company generates revenue through the sale of its diagnostic kits, instruments, pharmaceuticals, and services. Its customers include food processors of all sizes (from small local grain elevators to multinational food corporations), regulatory agencies, veterinarians, livestock producers, and commercial laboratories.

Neogen has expanded its global footprint through strategic acquisitions and now maintains operations in 24 countries outside the United States, with manufacturing facilities in the U.S., U.K., Ireland, and Brazil, and genomics laboratories across six countries.

4. Medical Devices & Supplies - Diversified

The medical devices industry operates a business model that balances steady demand with significant investments in innovation and regulatory compliance. The industry benefits from recurring revenue streams tied to consumables, maintenance services, and incremental upgrades to the latest technologies. However, the capital-intensive nature of product development, coupled with lengthy regulatory pathways and the need for clinical validation, can weigh on profitability and timelines. In addition, there are constant pricing pressures from healthcare systems and insurers maximizing cost efficiency. Over the next several years, one tailwind is demographic–aging populations means rising chronic disease rates that drive greater demand for medical interventions and monitoring solutions. Advances in digital health, such as remote patient monitoring and smart devices, are also expected to unlock new demand by shortening upgrade cycles. On the other hand, the industry faces headwinds from pricing and reimbursement pressures as healthcare providers increasingly adopt value-based care models. Additionally, the integration of cybersecurity for connected devices adds further risk and complexity for device manufacturers.

Neogen's competitors in the food safety testing market include bioMérieux (EPA:BIM), Thermo Fisher Scientific (NYSE:TMO), and PerkinElmer (NYSE:PKI). In the animal safety segment, the company competes with Zoetis (NYSE:ZTS), Elanco Animal Health (NYSE:ELAN), and Merck Animal Health, a division of Merck & Co. (NYSE:MRK).

5. Revenue Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $880.3 million in revenue over the past 12 months, Neogen is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

6. Revenue Growth

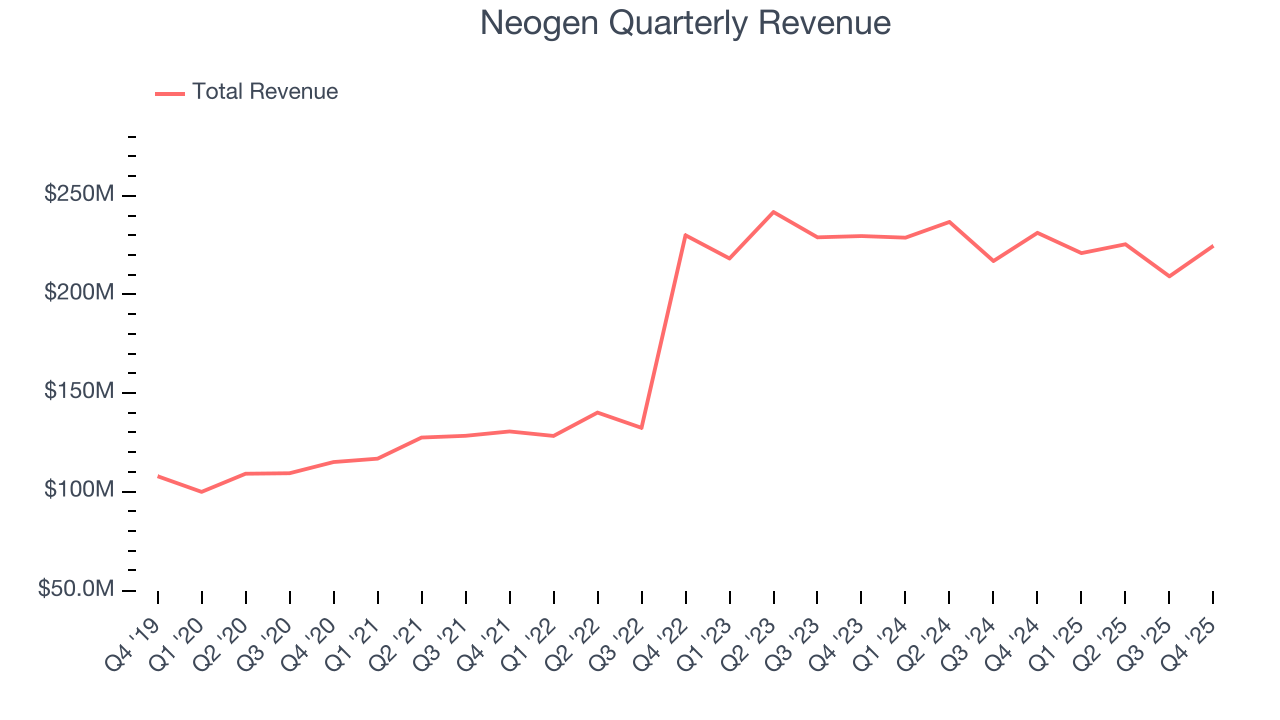

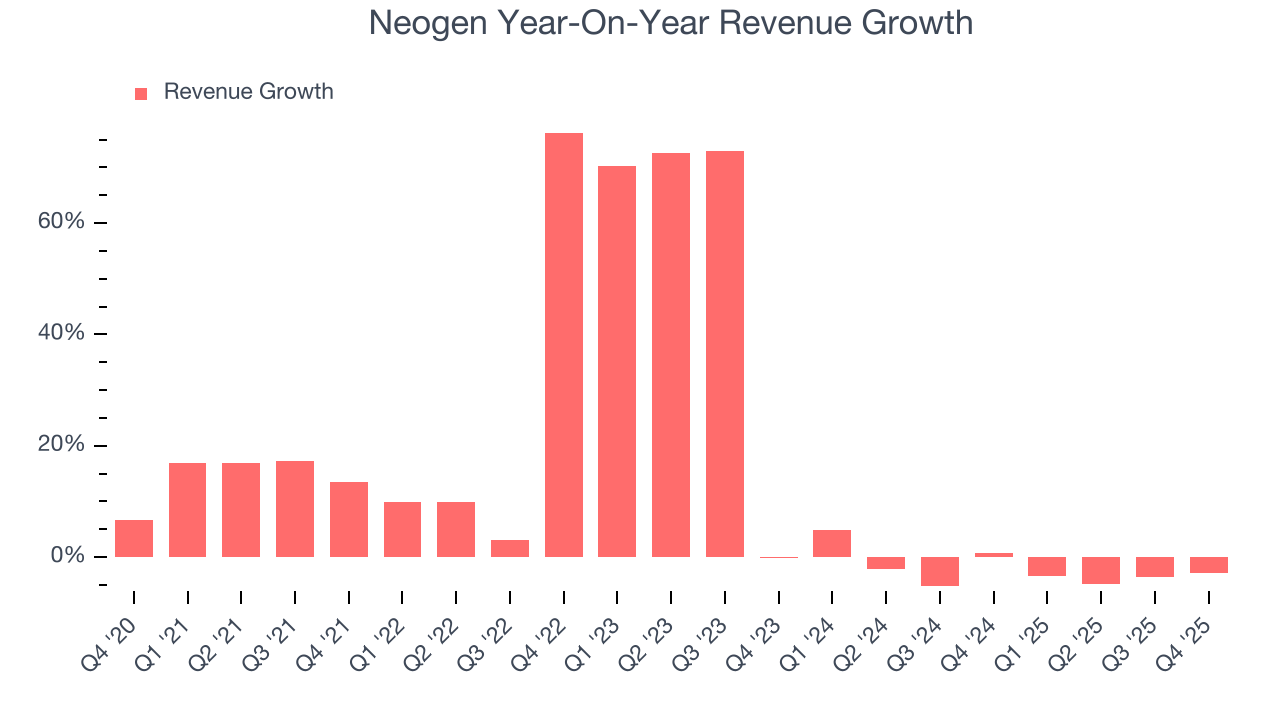

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, Neogen’s 15.2% annualized revenue growth over the last five years was solid. Its growth beat the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Neogen’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 2.1% over the last two years.

This quarter, Neogen’s revenue fell by 2.8% year on year to $224.7 million but beat Wall Street’s estimates by 7.2%.

Looking ahead, sell-side analysts expect revenue to decline by 5.3% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will see some demand headwinds.

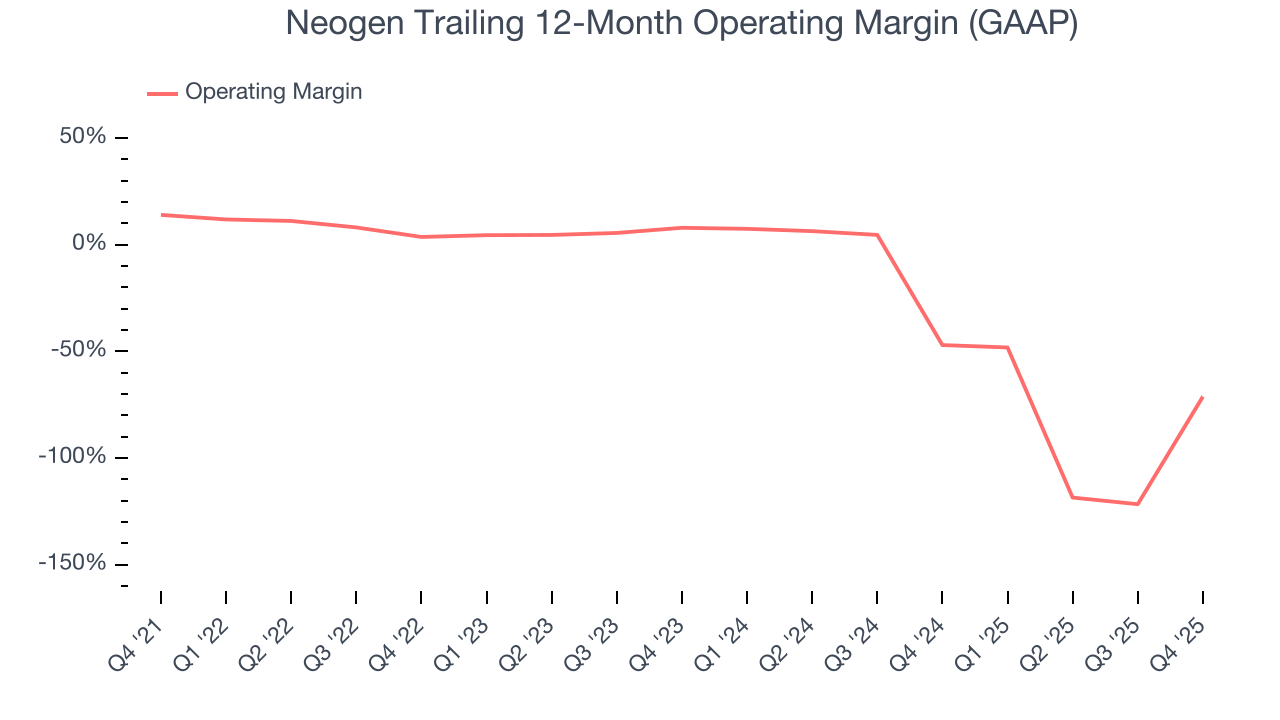

7. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

Neogen’s high expenses have contributed to an average operating margin of negative 23.2% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Analyzing the trend in its profitability, Neogen’s operating margin decreased by 85.2 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 79.2 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

Neogen’s operating margin was negative 2.4% this quarter.

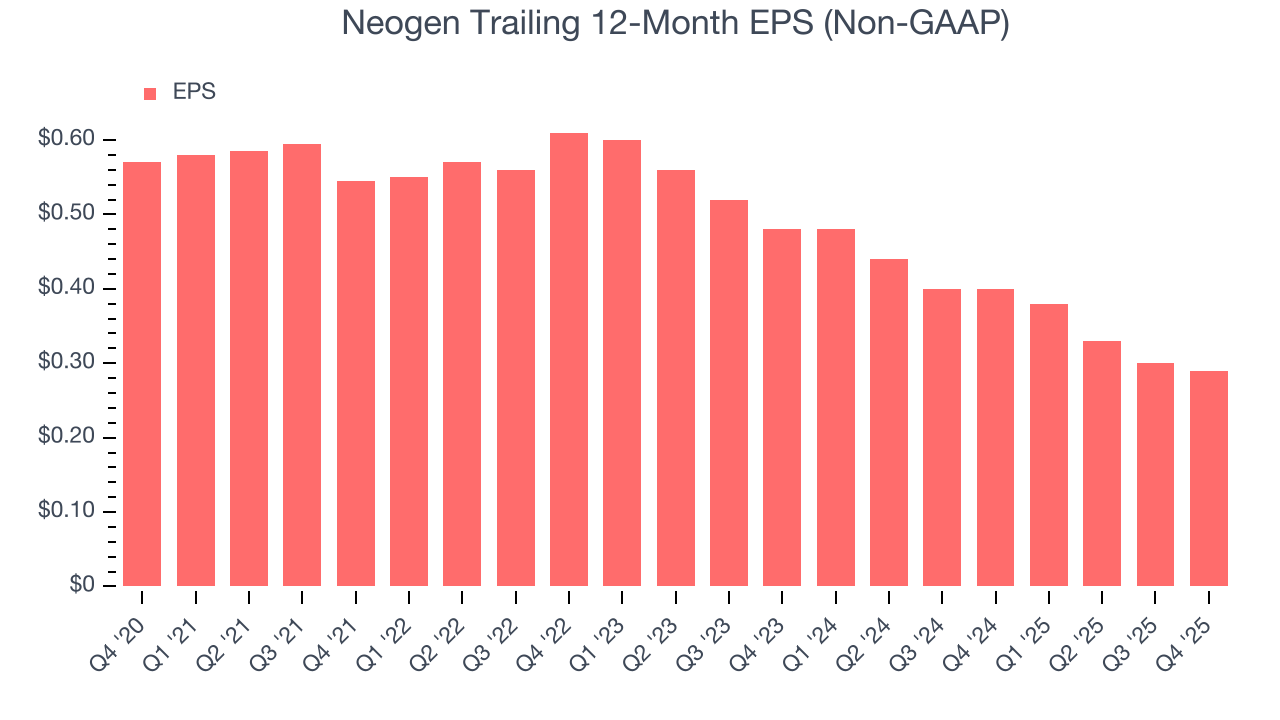

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

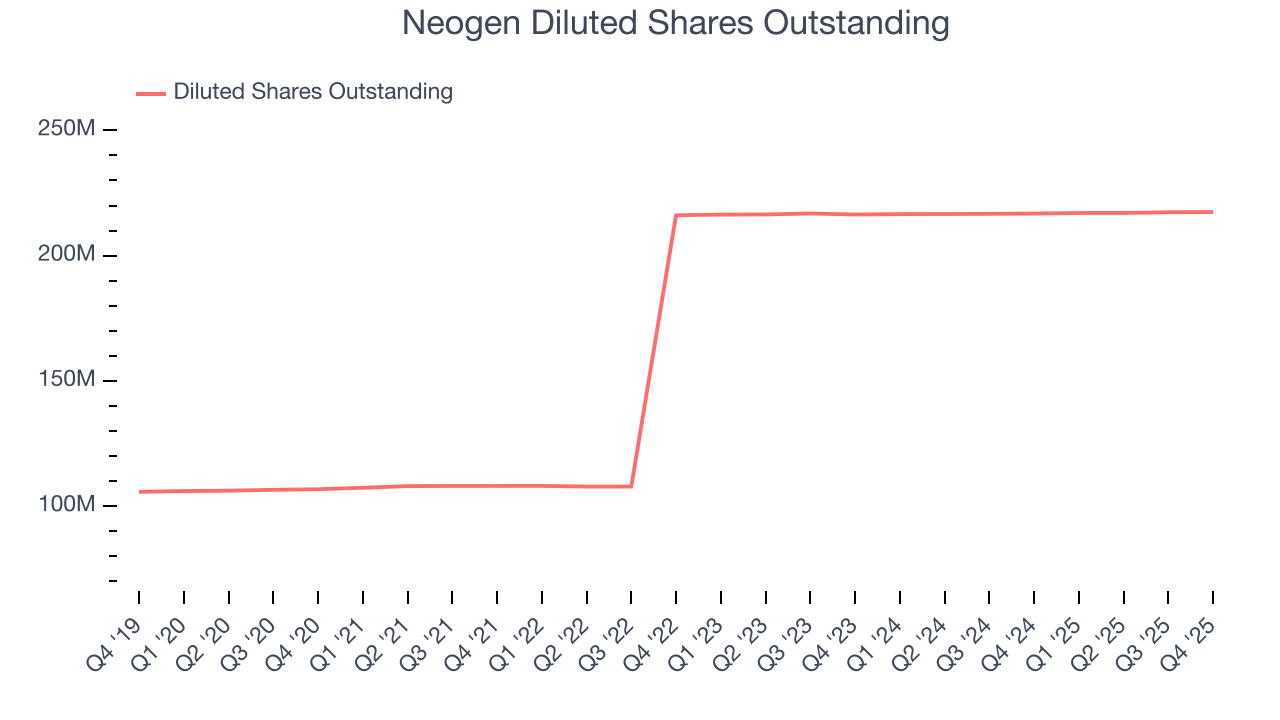

Sadly for Neogen, its EPS declined by 12.6% annually over the last five years while its revenue grew by 15.2%. This tells us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of Neogen’s earnings can give us a better understanding of its performance. As we mentioned earlier, Neogen’s operating margin expanded this quarter but declined by 85.2 percentage points over the last five years. Its share count also grew by 104%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q4, Neogen reported adjusted EPS of $0.10, down from $0.11 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Neogen’s full-year EPS of $0.29 to grow 34.5%.

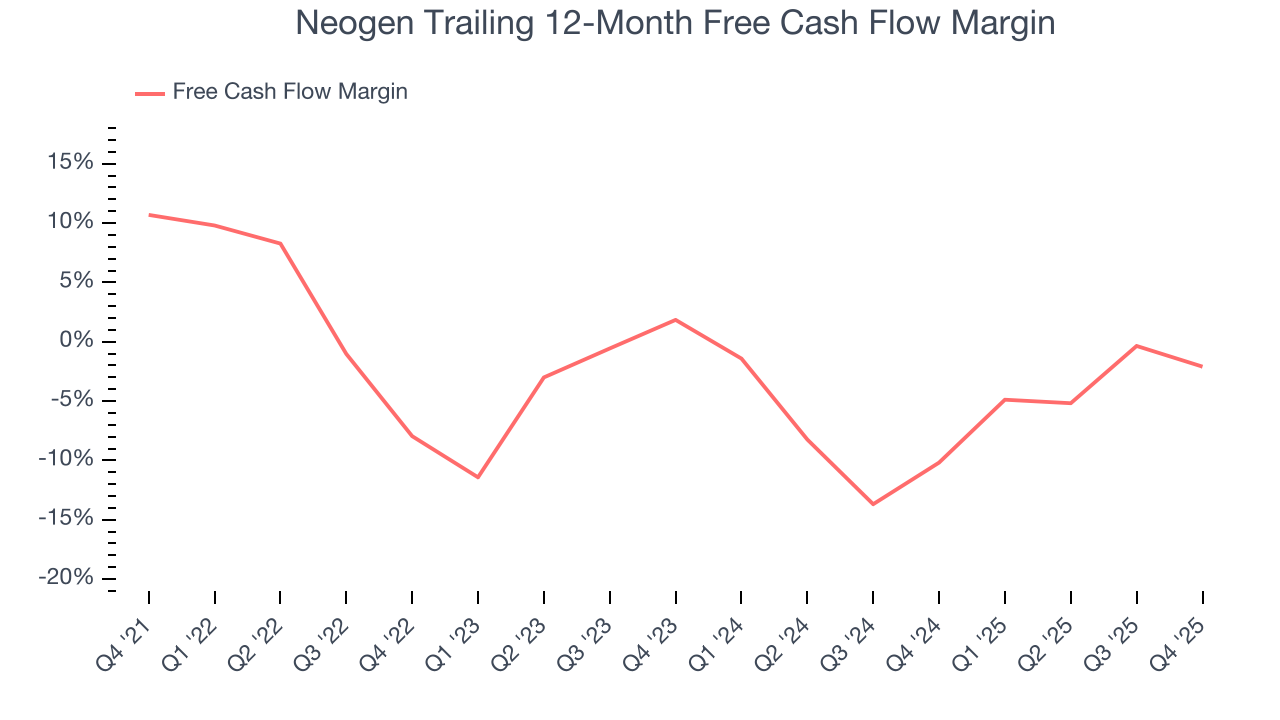

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

While Neogen posted positive free cash flow this quarter, the broader story hasn’t been so clean. Neogen’s demanding reinvestments have consumed many resources over the last five years, contributing to an average free cash flow margin of negative 2.4%. This means it lit $2.37 of cash on fire for every $100 in revenue.

Taking a step back, we can see that Neogen’s margin dropped by 12.8 percentage points during that time. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. Almost any movement in the wrong direction is undesirable because it’s already burning cash. If the longer-term trend returns, it could signal it’s in the middle of a big investment cycle.

Neogen’s free cash flow clocked in at $7.78 million in Q4, equivalent to a 3.5% margin. The company’s cash profitability regressed as it was 6.5 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends trump temporary fluctuations.

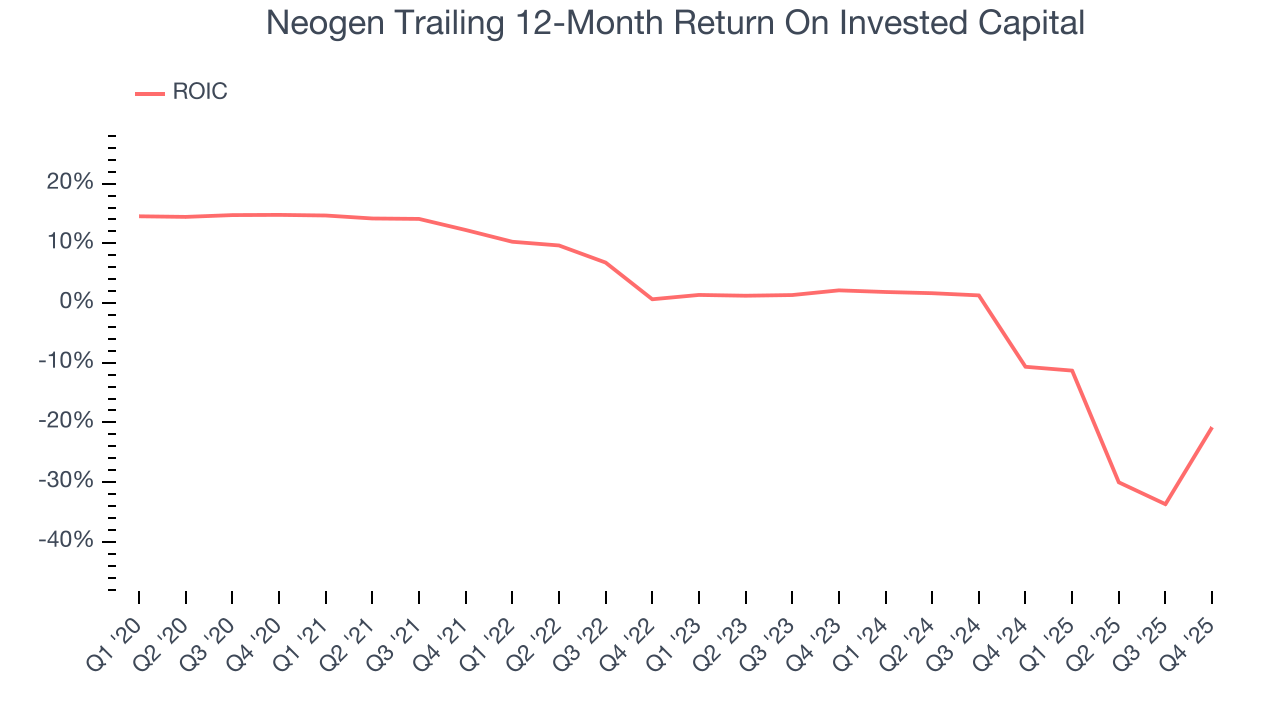

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Neogen’s five-year average ROIC was negative 3.3%, meaning management lost money while trying to expand the business. Its returns were among the worst in the healthcare sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Neogen’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

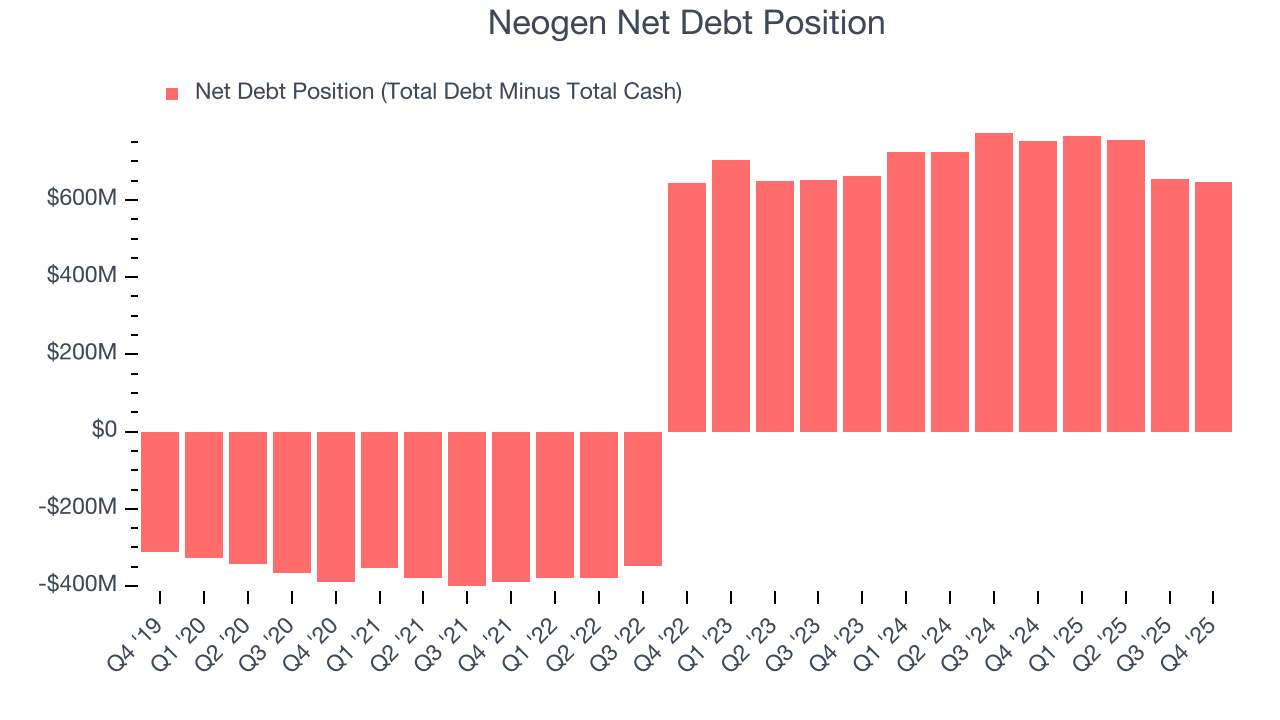

11. Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

Neogen posted negative $484.4 million of EBITDA over the last 12 months, and its $792.9 million of debt exceeds the $145.3 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

We implore our readers to tread carefully because credit agencies could downgrade Neogen if its unprofitable ways continue, making incremental borrowing more expensive and restricting growth prospects. The company could also be backed into a corner if the market turns unexpectedly. We hope Neogen can improve its profitability and remain cautious until then.

12. Key Takeaways from Neogen’s Q4 Results

This was a convincing 'beat and raise' quarter. It was good to see Neogen beat analysts’ revenue and EPS expectations handily this quarter. We were also excited its revenue guidance was raised and now exceed Wall Street’s estimates. Zooming out, we think this quarter featured many important positives and was very impressive. The stock traded up 19.8% to $8.84 immediately after reporting.

13. Is Now The Time To Buy Neogen?

Updated: January 16, 2026 at 10:38 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Neogen falls short of our quality standards. Although its revenue growth was solid over the last five years, it’s expected to deteriorate over the next 12 months and its diminishing returns show management's prior bets haven't worked out. On top of that, the company’s declining EPS over the last five years makes it a less attractive asset to the public markets.

Neogen’s P/E ratio based on the next 12 months is 34x. At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $11.67 on the company (compared to the current share price of $9.20).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.