Netflix (NFLX)

Netflix is intriguing. It’s not only a cash cow but also has increased its profitability, showing its fundamentals are improving.― StockStory Analyst Team

1. News

2. Summary

Why Netflix Is Interesting

Launched by Reed Hastings as a DVD mail rental company until its famous pivot to streaming in 2007, Netflix (NASDAQ: NFLX) is a pioneering streaming content platform.

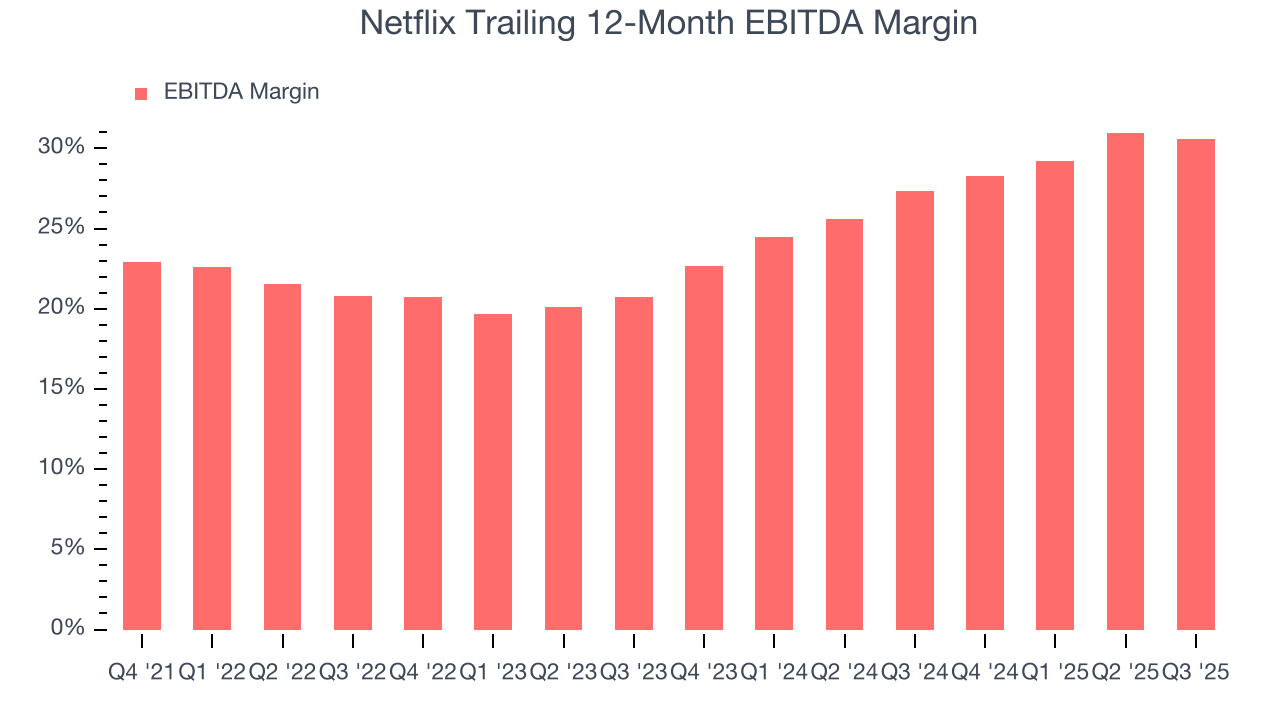

- Successful business model is illustrated by its impressive EBITDA margin, and its rise over the last few years was fueled by some leverage on its fixed costs

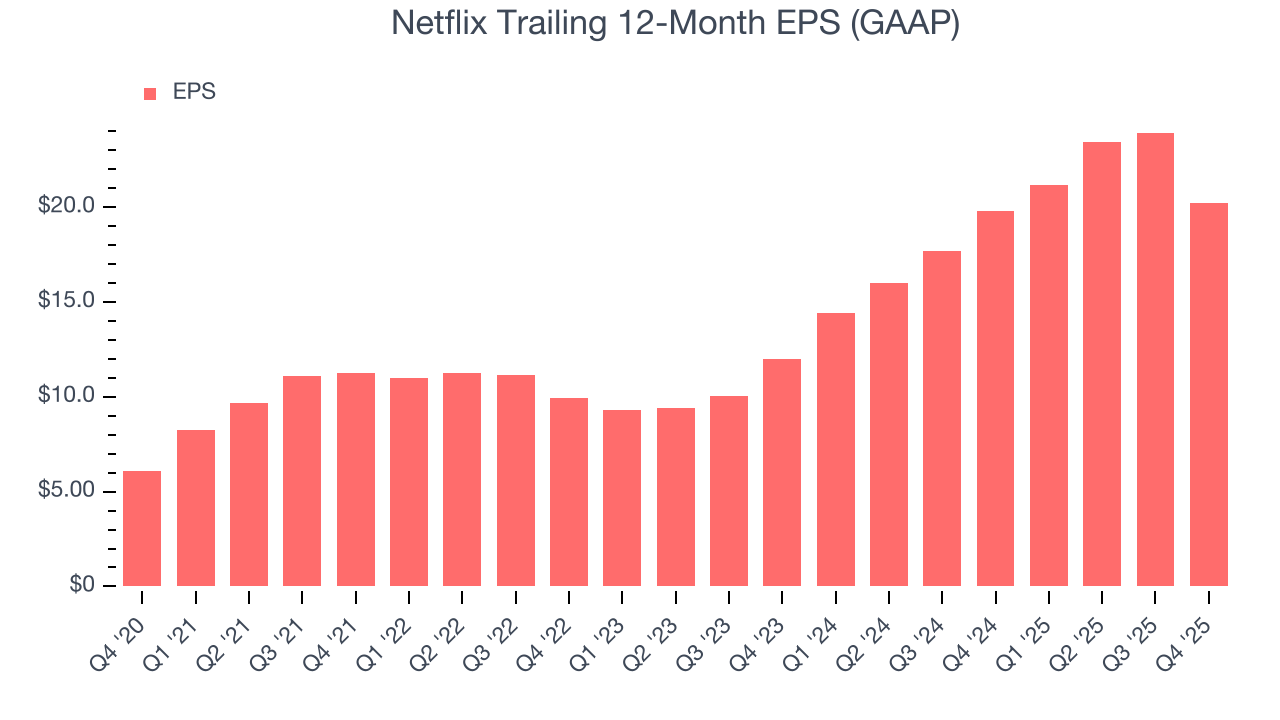

- Incremental sales significantly boosted profitability as its annual earnings per share growth of 29% over the last three years outstripped its revenue performance

- A drawback is its focus on expanding its platform has led to weaker growth in its average revenue per user

Netflix shows some potential. We’d wait until its quality rises or its price falls.

Why Should You Watch Netflix

High Quality

Investable

Underperform

Why Should You Watch Netflix

Netflix is trading at $88.44 per share, or 23.5x forward EV/EBITDA. This multiple is right around the sector average.

We’re not buyers right now, but we’ll keep tabs on this stock. We prefer to invest in higher-quality companies that trade at comparable valuation multiples.

3. Netflix (NFLX) Research Report: Q4 CY2025 Update

Streaming video giant Netflix (NASDAQ: NFLX) reported revenue ahead of Wall Streets expectations in Q4 CY2025, with sales up 17.6% year on year to $12.05 billion. The company expects next quarter’s revenue to be around $12.16 billion, close to analysts’ estimates. Its GAAP profit of $0.56 per share was in line with analysts’ consensus estimates.

Netflix (NFLX) Q4 CY2025 Highlights:

- Revenue: $12.05 billion vs analyst estimates of $11.97 billion (17.6% year-on-year growth, 0.7% beat)

- EPS (GAAP): $0.56 vs analyst estimates of $0.55 (in line)

- Revenue Guidance for Q1 CY2026 is $12.16 billion at the midpoint, roughly in line with what analysts were expecting

- EPS (GAAP) guidance for Q1 CY2026 is $0.76 at the midpoint, missing analyst estimates by 6.2%

- Operating Margin: 24.5%, up from 22.2% in the same quarter last year

- Free Cash Flow Margin: 15.5%, down from 23.1% in the previous quarter

- Market Capitalization: $402.1 billion

Company Overview

Launched by Reed Hastings as a DVD mail rental company until its famous pivot to streaming in 2007, Netflix (NASDAQ: NFLX) is a pioneering streaming content platform.

Netflix has a large and ever growing library of TV shows, movies, documentaries, and children’s programming. The company is known for its innovative approach to content delivery. For its first 10 years, that meant DVD rentals by mail with no return date. It launched streaming in 2007, which used customer data to surface programming that users might be interested in.

In 2013, the company began producing its own programming, weaning itself off of relying entirely on other company’s content. Hit shows such as "Stranger Things" and "The Crown" drew in audiences and kept them loyal to the platform. Today, Netflix generates revenue through its subscription-based model as well as an ad-supported one, with different plans at various price points.

For consumers, Netflix upended the traditional model of consuming content, flipping the paradigm from “appointment viewing” to a more customer centric “on demand viewing” Netflix’s granular viewing data also fundamentally altered what type of content was produced, stratifying what was once a handful of genres into dozens of niches that are able to find audiences in a sea of viewers. These innovations have been mimicked by many streaming services, and have become a quasi-standard of content consumption today.

4. Consumer Subscription

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

Netflix (NASDAQ:NFLX) competes with a range of streaming content rivals, from Amazon (NASDAQ: AMZN) and Disney (NYSE:DIS) to Paramount (NASDAQ:PARA) and Warner Bros Discovery (NASDAQ:WBD).

5. Revenue Growth

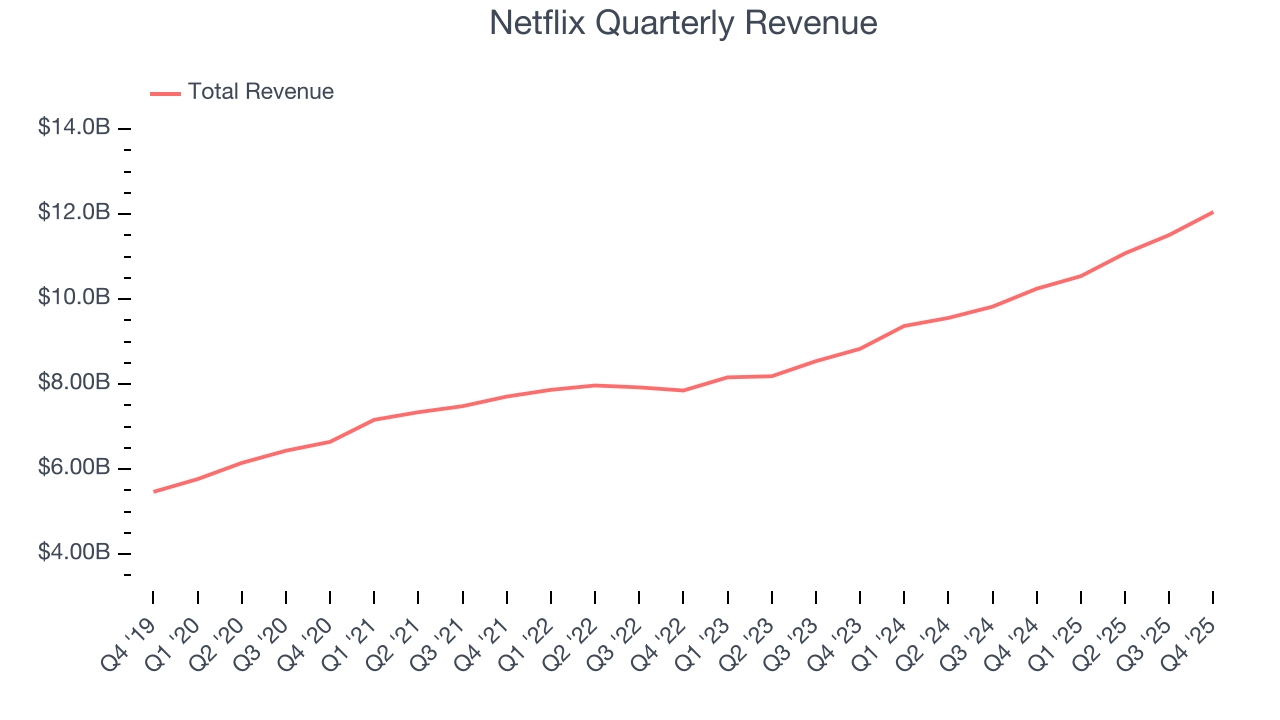

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Netflix’s sales grew at a decent 12.6% compounded annual growth rate over the last three years. Its growth was slightly above the average consumer internet company and shows its offerings resonate with customers.

This quarter, Netflix reported year-on-year revenue growth of 17.6%, and its $12.05 billion of revenue exceeded Wall Street’s estimates by 0.7%. Company management is currently guiding for a 15.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 13% over the next 12 months, similar to its three-year rate. This projection is particularly noteworthy for a company of its scale and indicates the market is forecasting success for its products and services.

6. Gross Margin & Pricing Power

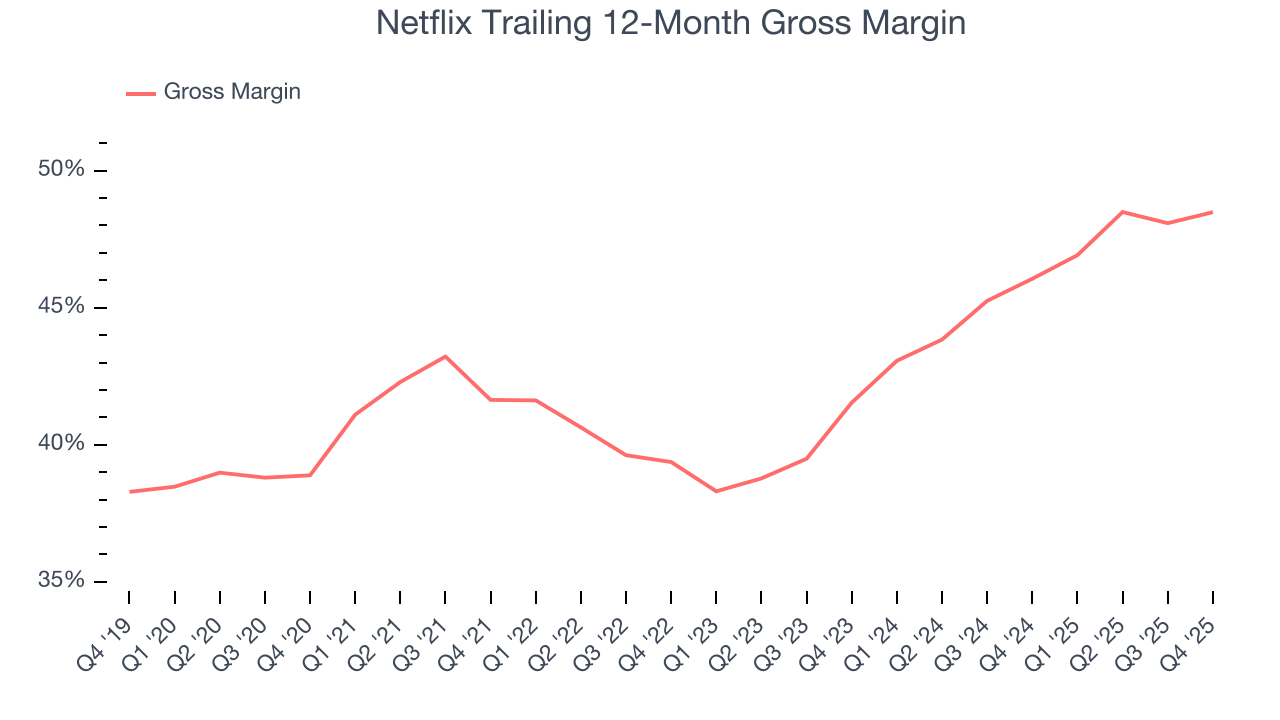

For internet subscription businesses like Netflix, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include customer service, data center and infrastructure expenses, royalties, and other content-related costs if the company’s offerings include features such as video or music.

Netflix’s gross margin is below the broader consumer internet industry, giving it less room to hire engineering talent that can develop new products and services. As you can see below, it averaged a 47.4% gross margin over the last two years. That means Netflix paid its providers a lot of money ($52.64 for every $100 in revenue) to run its business.

Netflix produced a 45.9% gross profit margin in Q4, up 2.2 percentage points year on year. Netflix’s full-year margin has also been trending up over the past 12 months, increasing by 2.4 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as servers).

7. User Acquisition Efficiency

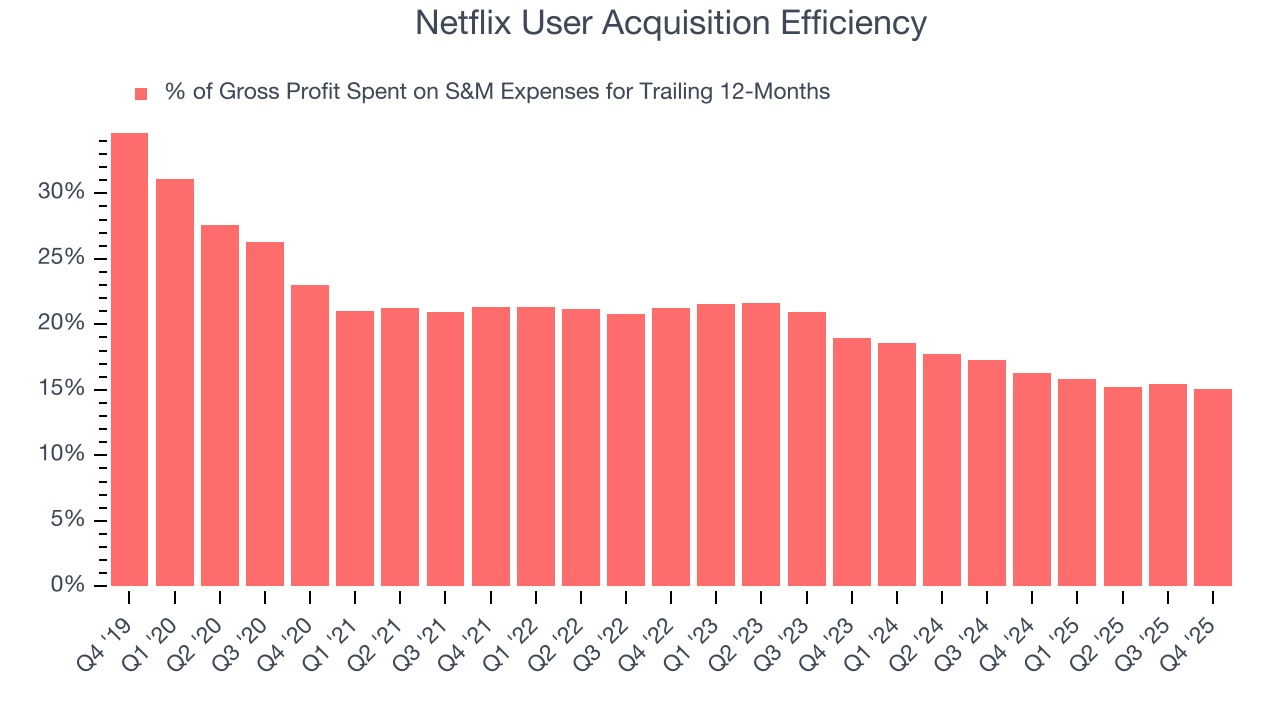

Consumer internet businesses like Netflix grow from a combination of product virality, paid advertisement, and incentives (unlike enterprise software products, which are often sold by dedicated sales teams).

Netflix is extremely efficient at acquiring new users, spending only 15.1% of its gross profit on sales and marketing expenses over the last year. This efficiency indicates that it has a highly differentiated product offering and strong brand reputation from scale, giving Netflix the freedom to invest its resources into new growth initiatives while maintaining optionality.

8. EBITDA

Netflix has been a well-oiled machine over the last two years. It demonstrated elite profitability for a consumer internet business, boasting an average EBITDA margin of 30.3%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Netflix’s EBITDA margin rose by 8.6 percentage points over the last few years, as its sales growth gave it operating leverage.

9. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Netflix’s EPS grew at an astounding 26.7% compounded annual growth rate over the last three years, higher than its 12.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

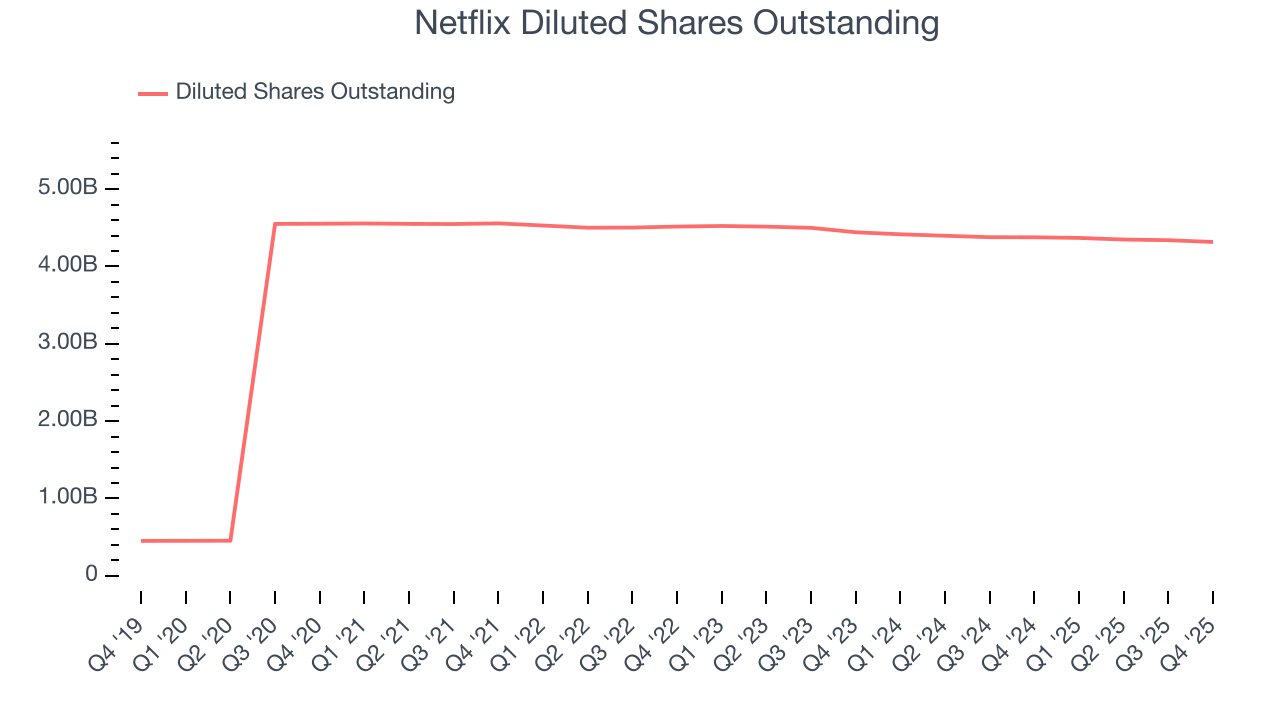

Diving into the nuances of Netflix’s earnings can give us a better understanding of its performance. As we mentioned earlier, Netflix’s EBITDA margin expanded by 8.6 percentage points over the last three years. On top of that, its share count shrank by 4.4%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q4, Netflix reported EPS of $0.56, down from $4.27 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 1.4%. Over the next 12 months, Wall Street expects Netflix’s full-year EPS of $20.23 to shrink by 84.1%.

10. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

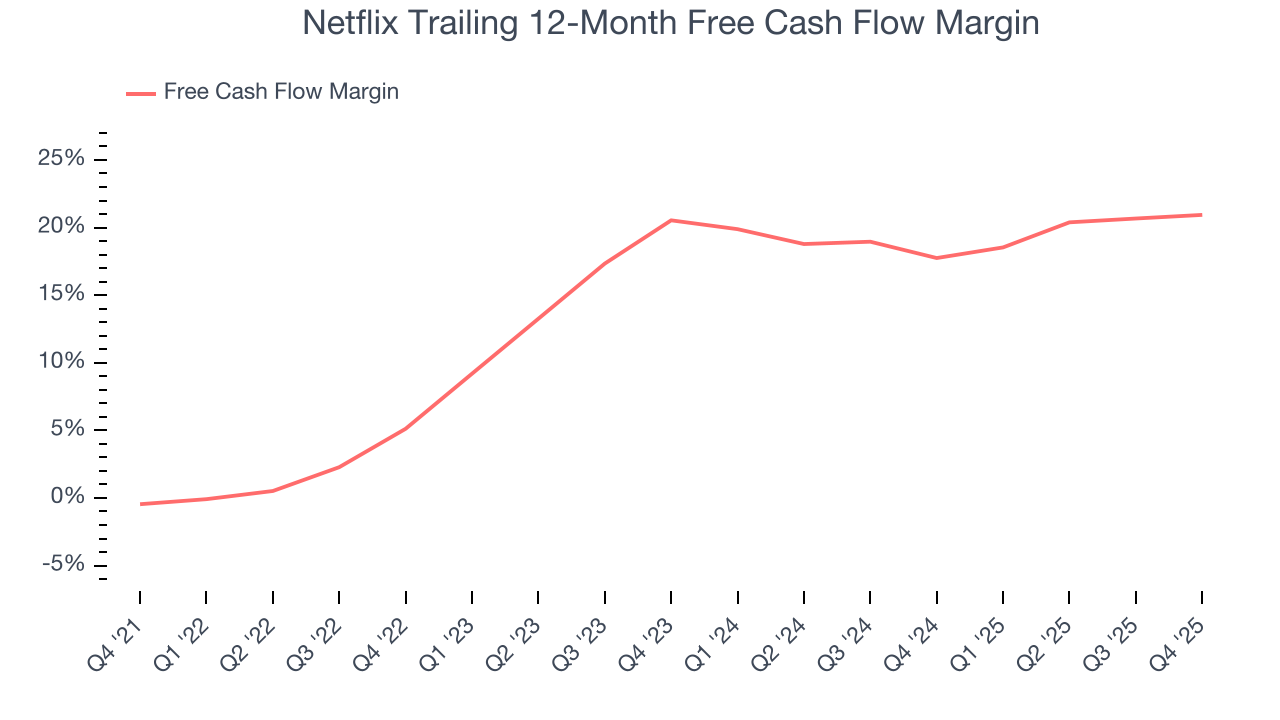

Netflix has shown robust cash profitability, driven by its cost-effective customer acquisition strategy that enables it to invest in new products and services rather than sales and marketing. The company’s free cash flow margin averaged 19.5% over the last two years, quite impressive for a consumer internet business.

Taking a step back, we can see that Netflix’s margin expanded by 15.8 percentage points over the last few years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Netflix’s free cash flow clocked in at $1.87 billion in Q4, equivalent to a 15.5% margin. This result was good as its margin was 2.1 percentage points higher than in the same quarter last year, building on its favorable historical trend.

11. Key Takeaways from Netflix’s Q4 Results

We struggled to find many positives in these results. Its EPS guidance for next quarter missed and its revenue guidance for next quarter was in line with Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 5.2% to $83.07 immediately following the results.

12. Is Now The Time To Buy Netflix?

Updated: January 20, 2026 at 4:27 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Netflix is a fine business. To begin with, the its revenue growth was good over the last three years, and analysts believe it can continue growing at these levels. And while its projected EPS for the next year is lacking, its impressive EBITDA margins show it has a highly efficient business model. On top of that, its rising cash profitability gives it more optionality.

Netflix’s EV/EBITDA ratio based on the next 12 months is 22.2x. At this valuation, there’s a lot of good news priced in. Add this one to your watchlist and come back to it later.

Wall Street analysts have a consensus one-year price target of $122.96 on the company (compared to the current share price of $83.07).