Paramount (PSKY)

We wouldn’t buy Paramount. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Paramount Will Underperform

Owner of Spongebob Squarepants and formerly known as ViacomCBS, Paramount Global (NASDAQ:PARA) is a major media conglomerate offering television, film production, and digital content across various global platforms.

- Annual sales growth of 2.7% over the last five years lagged behind its consumer discretionary peers as its large revenue base made it difficult to generate incremental demand

- Performance over the past five years shows its incremental sales were much less profitable, as its earnings per share fell by 34.8% annually

- Persistent operating margin losses suggest the business manages its expenses poorly

Paramount doesn’t meet our quality standards. We see more lucrative opportunities elsewhere.

Why There Are Better Opportunities Than Paramount

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Paramount

Paramount is trading at $14.24 per share, or 14.3x forward P/E. This multiple is lower than most consumer discretionary companies, but for good reason.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Paramount (PSKY) Research Report: Q4 CY2025 Update

Multinational media and entertainment corporation Paramount (NASDAQ:PSKY) met Wall Street’s revenue expectations in Q4 CY2025, but sales fell by 5.1% year on year to $8.15 billion. On the other hand, next quarter’s revenue guidance of $7.25 billion was less impressive, coming in 2.3% below analysts’ estimates. Its GAAP loss of $0.52 per share was significantly below analysts’ consensus estimates.

Paramount (PSKY) Q4 CY2025 Highlights:

- Revenue: $8.15 billion vs analyst estimates of $8.14 billion (5.1% year-on-year decline, in line)

- EPS (GAAP): -$0.52 vs analyst estimates of -$0.20 (significant miss)

- Adjusted EBITDA: $612 million vs analyst estimates of $564 million (7.5% margin, 8.5% beat)

- Revenue Guidance for Q1 CY2026 is $7.25 billion at the midpoint, below analyst estimates of $7.42 billion

- EBITDA guidance for the upcoming financial year 2026 is $3.8 billion at the midpoint, above analyst estimates of $3.51 billion

- Operating Margin: -4.2%, down from 1.5% in the same quarter last year

- Free Cash Flow Margin: 1.2%, similar to the same quarter last year

- Market Capitalization: $11.4 billion

Company Overview

Owner of Spongebob Squarepants and formerly known as ViacomCBS, Paramount Global (NASDAQ:PARA) is a major media conglomerate offering television, film production, and digital content across various global platforms.

Paramount was born through the 2019 merger of Viacom and CBS, which brought together two industry giants to create a diversified media conglomerate. This strategic move was aimed at enhancing their capabilities in cable networks, film studios, and broadcast television, positioning them to compete effectively in the evolving entertainment market.

Paramount delivers a broad spectrum of services, including television and film production, cable network operations, and digital streaming services. Its multi-platform approach ensures versatility and widespread reach in the media landscape.

The company generates revenue from advertising, subscription fees, content licensing, and theatrical releases. Paramount's extensive content portfolio, including popular networks such as CBS and film franchises like Star Trek, appeals to a broad audience, making it a relevant player in the media and entertainment industry.

4. Consumer Discretionary - Broadcasting

The Consumer Discretionary sector, by definition, is made up of companies selling non-essential goods and services. When economic conditions deteriorate or tastes shift, consumers can easily cut back or eliminate these purchases. For long-term investors with five-year holding periods, this creates a structural challenge: the sector is inherently hit-driven, with low switching costs and fickle customers. As a result, only a handful of companies can reliably grow demand and compound earnings over long periods, which is why our bar is high and High Quality ratings are rare.

Broadcasting companies produce and distribute television and radio content, generating revenue primarily through advertising and, in some cases, retransmission fees (payments cable and satellite operators make to carry local channels). Tailwinds include resilient demand for live sports and event programming, which commands premium ad rates, and political advertising during election cycles. Headwinds, however, are substantial: secular cord-cutting (consumers canceling traditional pay-TV subscriptions) is shrinking linear audiences, digital platforms are capturing an increasing share of advertising budgets, and content production costs continue to rise. Regulatory scrutiny over media consolidation and spectrum ownership further constrains strategic flexibility.

Competitors in the media and entertainment production industry include Disney (NYSE:DIS), Warner Bros. Discovery (NASDAQ:WBD), and Comcast (NASDAQ:CMCSA).

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Paramount’s sales grew at a weak 2.7% compounded annual growth rate over the last five years. This fell short of our benchmarks and is a tough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Paramount’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 1.3% annually.

We can dig further into the company’s revenue dynamics by analyzing its three most important segments: TV Media, Direct-to-Consumer, and Filmed Entertainment, which are 57.9%, 27.2%, and 15.4% of revenue. Over the last two years, Paramount’s TV Media revenue (broadcasting) averaged 7.1% year-on-year declines, but its Direct-to-Consumer (streaming) and Filmed Entertainment (movies) revenues averaged 10.3% and 22.1% growth.

This quarter, Paramount reported a rather uninspiring 5.1% year-on-year revenue decline to $8.15 billion of revenue, in line with Wall Street’s estimates. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.8% over the next 12 months. Although this projection suggests its newer products and services will fuel better top-line performance, it is still below average for the sector.

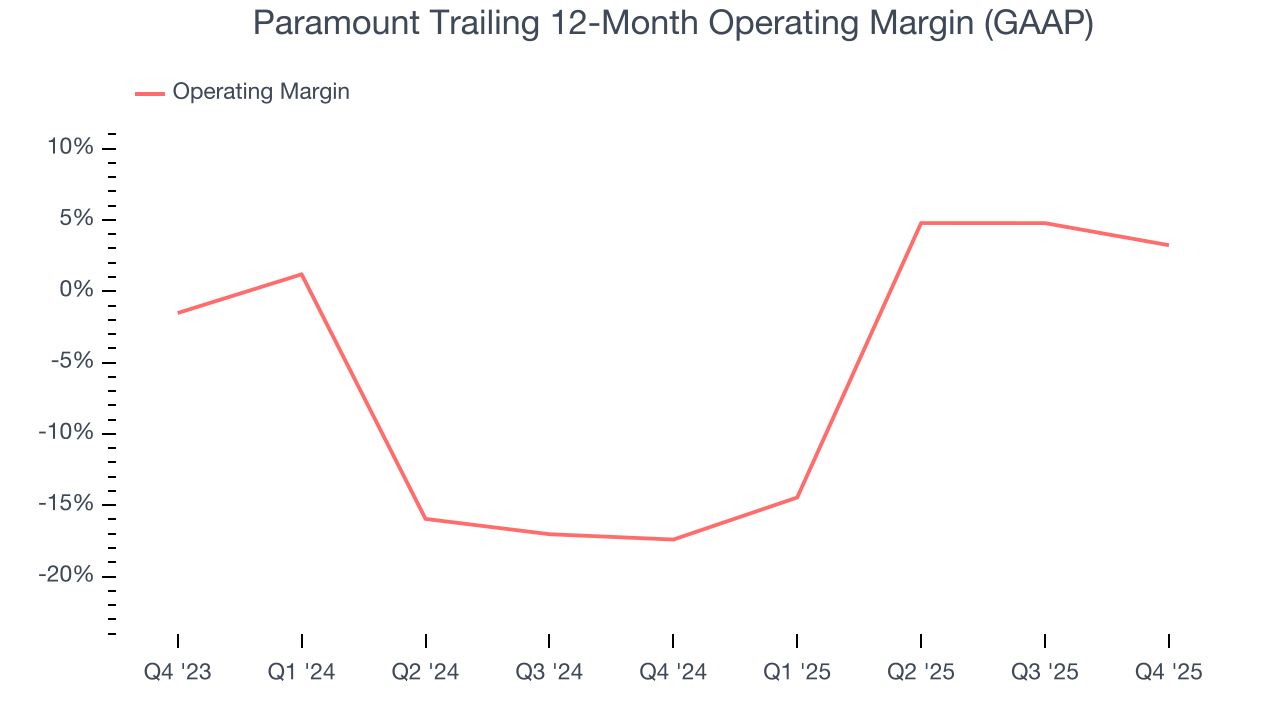

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Paramount’s operating margin has risen over the last 12 months, but it still averaged negative 7.3% over the last two years. This is due to its large expense base and inefficient cost structure.

In Q4, Paramount generated a negative 4.2% operating margin. The company's consistent lack of profits raise a flag.

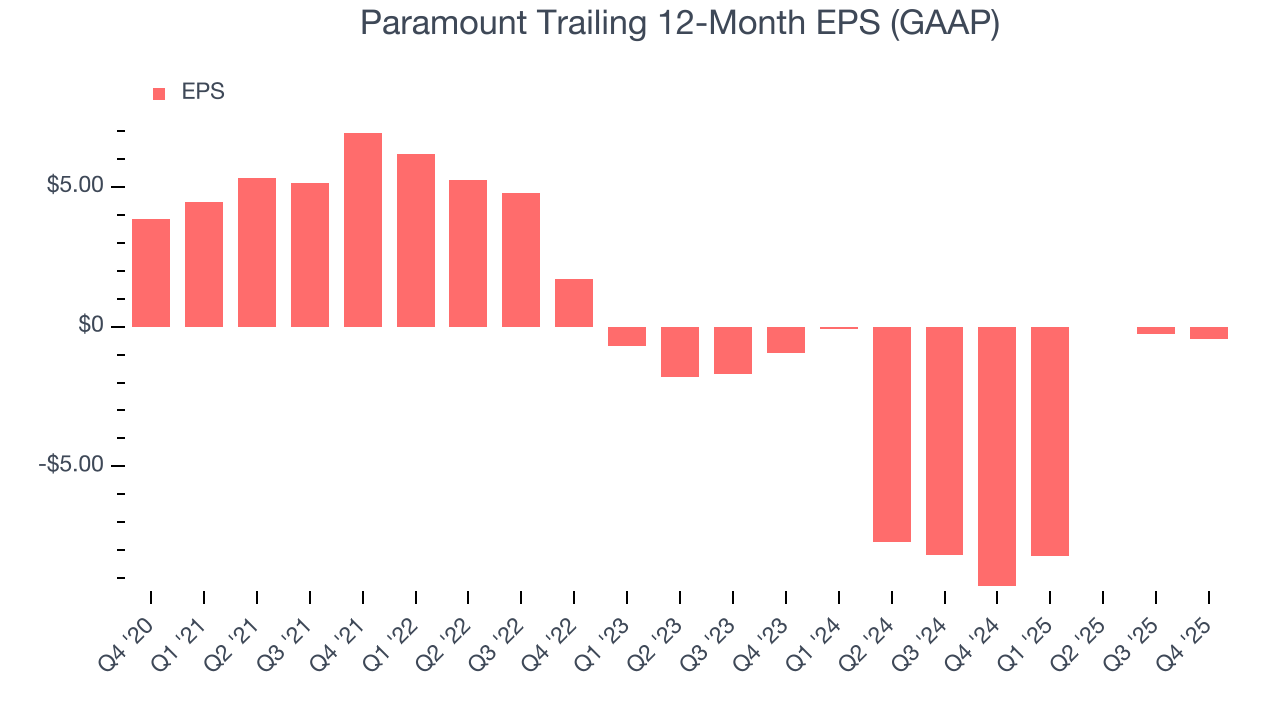

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Paramount, its EPS declined by 16.2% annually over the last five years while its revenue grew by 2.7%. This tells us the company became less profitable on a per-share basis as it expanded.

In Q4, Paramount reported EPS of negative $0.52, down from negative $0.33 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Paramount’s full-year EPS of negative $0.45 will flip to positive $0.60.

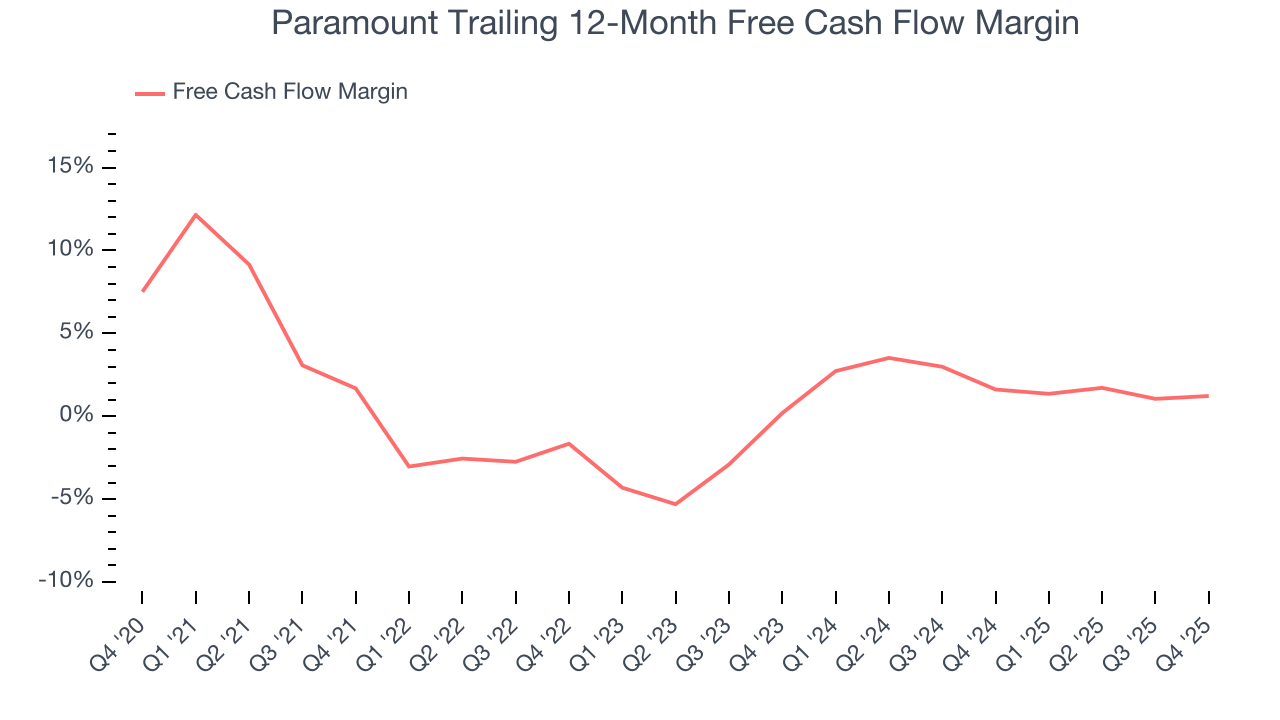

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Paramount has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.4%, lousy for a consumer discretionary business.

Paramount’s free cash flow clocked in at $101 million in Q4, equivalent to a 1.2% margin. This cash profitability was in line with the comparable period last year and its two-year average.

Over the next year, analysts predict Paramount will flip from cash-producing to cash-burning. Their consensus estimates imply its free cash flow margin of 1.2% for the last 12 months will decrease to negative 1%.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Paramount historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 0.9%, lower than the typical cost of capital (how much it costs to raise money) for consumer discretionary companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Paramount’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Assessment

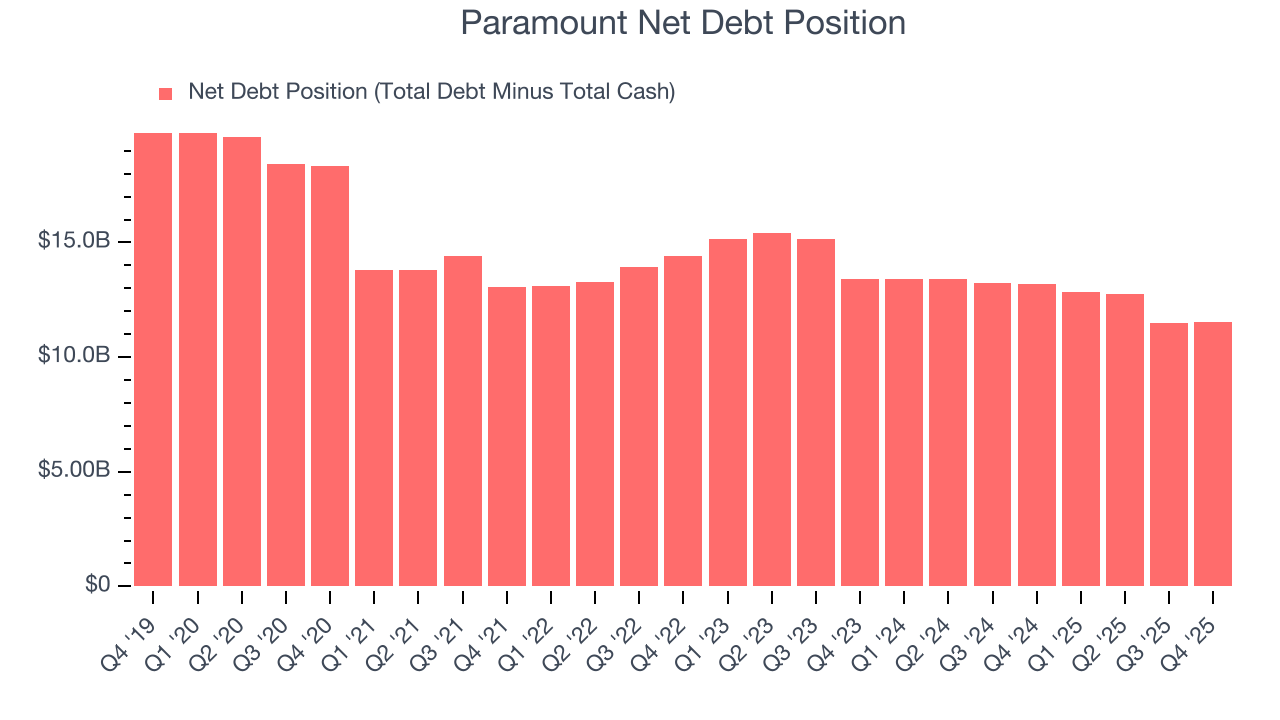

Paramount reported $3.27 billion of cash and $14.81 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $3.08 billion of EBITDA over the last 12 months, we view Paramount’s 3.7× net-debt-to-EBITDA ratio as safe. We also see its $359 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Paramount’s Q4 Results

It was great to see Paramount’s full-year EBITDA guidance top analysts’ expectations. We were also happy its EBITDA outperformed Wall Street’s estimates. On the other hand, its EPS missed and its revenue guidance for next quarter fell short of Wall Street’s estimates. Zooming out, we think this was a mixed quarter. The stock remained flat at $10.17 immediately after reporting.

12. Is Now The Time To Buy Paramount?

Updated: February 27, 2026 at 10:24 PM EST

Before investing in or passing on Paramount, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

We see the value of companies helping consumers, but in the case of Paramount, we’re out. While its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its Forecasted free cash flow margin suggests the company will ramp up its investments next year. On top of that, its declining EPS over the last five years makes it a less attractive asset to the public markets.

Paramount’s P/E ratio based on the next 12 months is 14.3x. While this valuation is fair, the upside isn’t great compared to the potential downside. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $13.46 on the company (compared to the current share price of $14.24).