NN (NNBR)

We wouldn’t recommend NN. Not only did its demand evaporate but also its negative returns on capital show it destroyed shareholder value.― StockStory Analyst Team

1. News

2. Summary

Why We Think NN Will Underperform

Formerly known as Nuturn, NN (NASDAQ:NNBR) provides metal components, bearings, and plastic and rubber components to the automotive, aerospace, medical, and industrial sectors.

- Products and services are facing end-market challenges during this cycle, as seen in its flat sales over the last five years

- Earnings per share have dipped by 16.5% annually over the past five years, which is concerning because stock prices follow EPS over the long term

- Historical operating margin losses point to an inefficient cost structure

NN doesn’t live up to our standards. We believe there are better opportunities elsewhere.

Why There Are Better Opportunities Than NN

High Quality

Investable

Underperform

Why There Are Better Opportunities Than NN

NN is trading at $1.45 per share, or 15.3x forward P/E. NN’s valuation may seem like a bargain, especially when stacked up against other industrials companies. We remind you that you often get what you pay for, though.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. NN (NNBR) Research Report: Q4 CY2025 Update

Industrial components supplier NN (NASDAQ:NNBR) missed Wall Street’s revenue expectations in Q4 CY2025, with sales falling 1.7% year on year to $104.7 million. On the other hand, the company’s full-year revenue guidance of $455 million at the midpoint came in 1.5% above analysts’ estimates. Its non-GAAP loss of $0 per share was in line with analysts’ consensus estimates.

NN (NNBR) Q4 CY2025 Highlights:

- Revenue: $104.7 million vs analyst estimates of $105.4 million (1.7% year-on-year decline, 0.6% miss)

- Adjusted EPS: $0 vs analyst estimates of $0.01 (in line)

- Adjusted EBITDA: $12.89 million vs analyst estimates of $15.64 million (12.3% margin, 17.6% miss)

- EBITDA guidance for the upcoming financial year 2026 is $55 million at the midpoint, below analyst estimates of $57.22 million

- Operating Margin: -9.9%, up from -11% in the same quarter last year

- Free Cash Flow was -$3.27 million, down from $3.72 million in the same quarter last year

- Market Capitalization: $74.79 million

Company Overview

Formerly known as Nuturn, NN (NASDAQ:NNBR) provides metal components, bearings, and plastic and rubber components to the automotive, aerospace, medical, and industrial sectors.

NN originally supplied components for the automotive industry but has grown to serve numerous markets by acquiring companies. A recent deal that bolstered its product portfolio was its roughly $250 million acquisition of Autocam in 2014, which added complex components for fuel systems, engines, transmissions, power steering, and electric motors to its lineup.

Today, NN provides precision metals, bearings, and plastic and rubber components. The company’s products play a part in a larger machine or piece of equipment, playing different roles such as reducing friction or providing structural support. For example, it manufactures metal components for automotive transmission systems and plastic parts for medical devices. The company caters to the automotive, aerospace, medical, and industrial sectors.

NN's customers include original equipment manufacturers (OEMs), distributors, and end-users. It engages in contracts with these customers that often involve long-term agreements and volume commitments. Additionally, the company offers value-added services such as engineering support and supply chain management to generate additional revenue.

4. Engineered Components and Systems

Engineered components and systems companies possess technical know-how in sometimes narrow areas such as metal forming or intelligent robotics. Lately, automation and connected equipment collecting analyzable data have been trending, creating new demand. On the other hand, like the broader industrials sector, engineered components and systems companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Competitors offering similar products include Barnes (NYSE:B), Timken (NYSE:TKR), and RBC Bearings (NYSE:RBC).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, NN struggled to consistently increase demand as its $422.2 million of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and suggests it’s a low quality business.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. NN’s recent performance shows its demand remained suppressed as its revenue has declined by 7.1% annually over the last two years.

This quarter, NN missed Wall Street’s estimates and reported a rather uninspiring 1.7% year-on-year revenue decline, generating $104.7 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 5.2% over the next 12 months. Although this projection implies its newer products and services will spur better top-line performance, it is still below the sector average.

6. Gross Margin & Pricing Power

Gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

NN has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 15.6% gross margin over the last five years. Said differently, NN had to pay a chunky $84.39 to its suppliers for every $100 in revenue.

In Q4, NN produced a 9.2% gross profit margin, down 5.4 percentage points year on year. NN’s full-year margin has also been trending down over the past 12 months, decreasing by 1.9 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

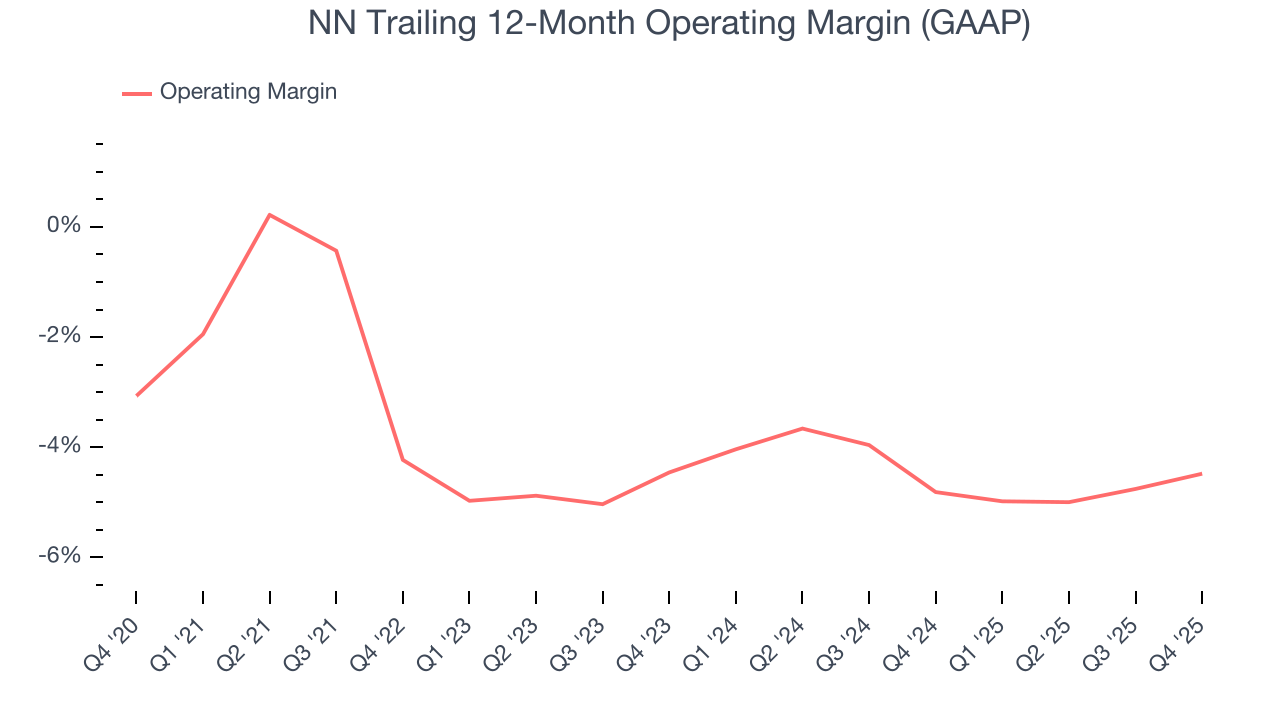

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

NN’s high expenses have contributed to an average operating margin of negative 4% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, NN’s operating margin decreased by 1.3 percentage points over the last five years. NN’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, NN generated a negative 9.9% operating margin. The company's consistent lack of profits raise a flag.

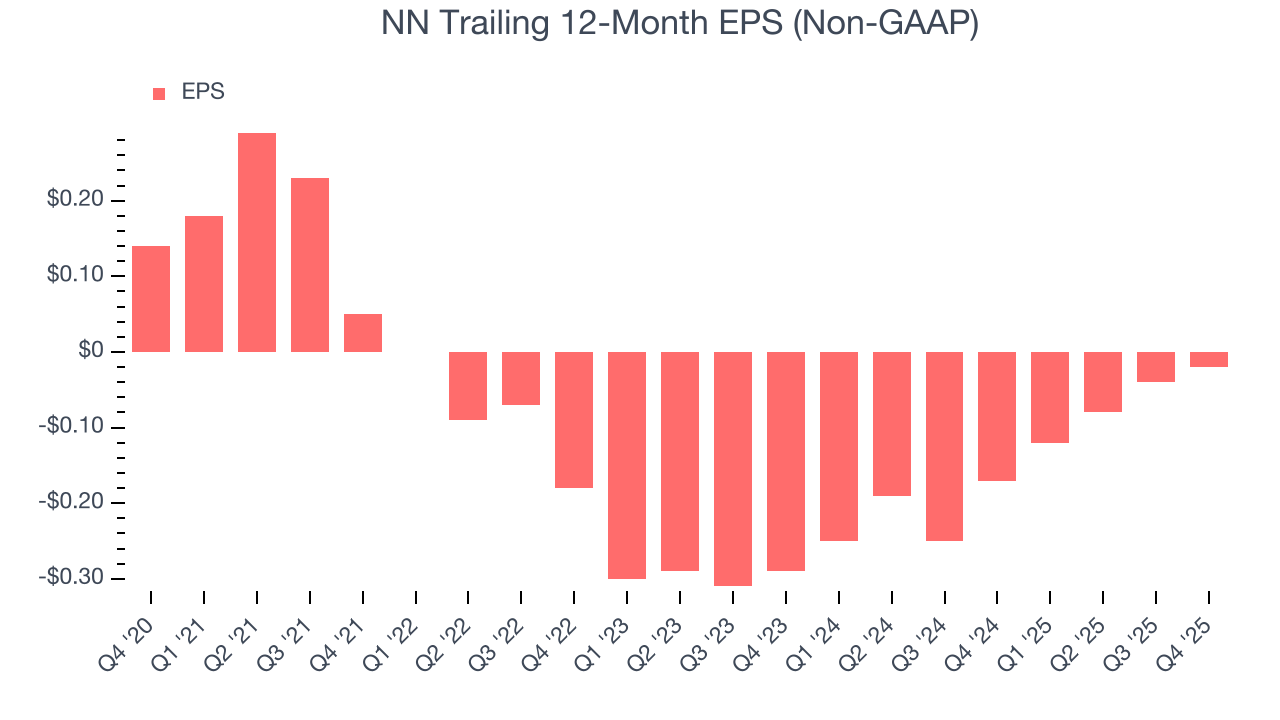

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for NN, its EPS declined by 16.5% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

We can take a deeper look into NN’s earnings to better understand the drivers of its performance. As we mentioned earlier, NN’s operating margin expanded this quarter but declined by 1.3 percentage points over the last five years. Its share count also grew by 17.4%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For NN, its two-year annual EPS growth of 73.7% was higher than its five-year trend. Its improving earnings is an encouraging data point, but a caveat is that its EPS is still in the red.

In Q4, NN reported adjusted EPS of $0, up from negative $0.02 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast NN’s full-year EPS of negative $0.02 will flip to positive $0.10.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

NN’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 1.1%, meaning it lit $1.10 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that NN’s margin expanded by 1.2 percentage points during that time. We have no doubt shareholders would like to continue seeing its cash conversion rise.

NN burned through $3.27 million of cash in Q4, equivalent to a negative 3.1% margin. The company’s cash flow turned negative after being positive in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

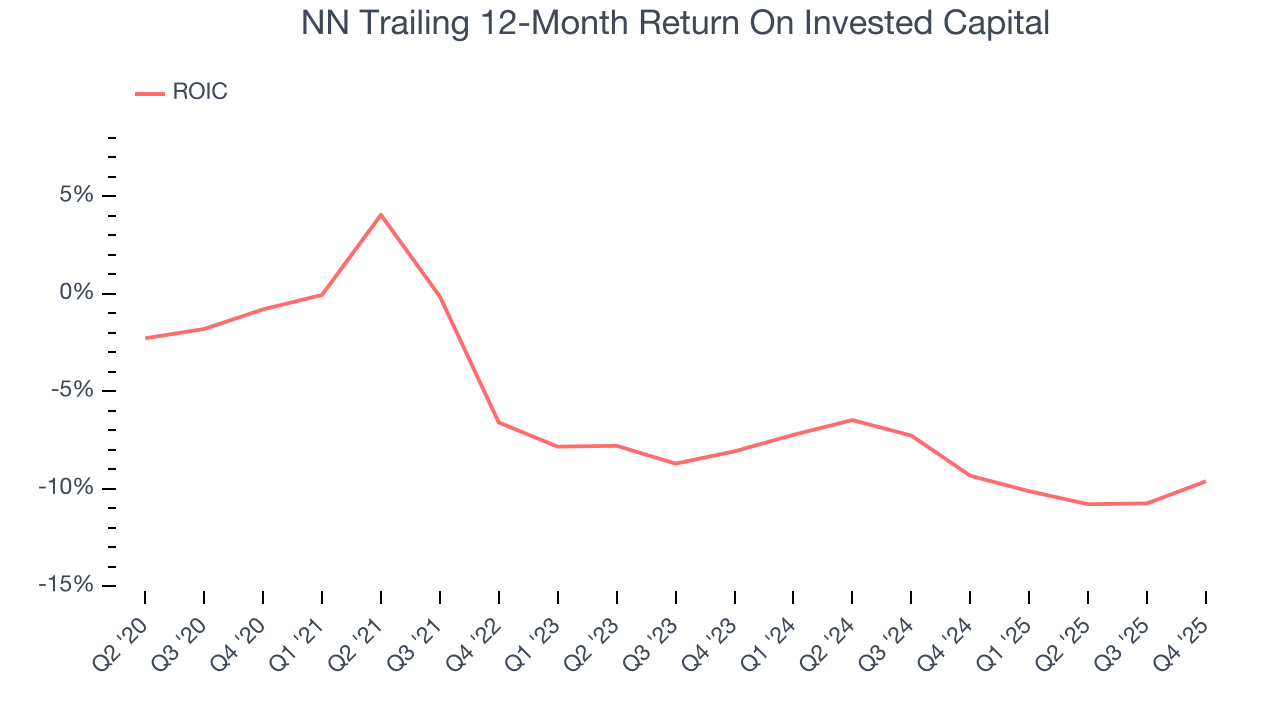

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

NN’s four-year average ROIC was negative 8.4%, meaning management lost money while trying to expand the business. Its returns were among the worst in the industrials sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, NN’s ROIC averaged 2.1 percentage point decreases each year over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

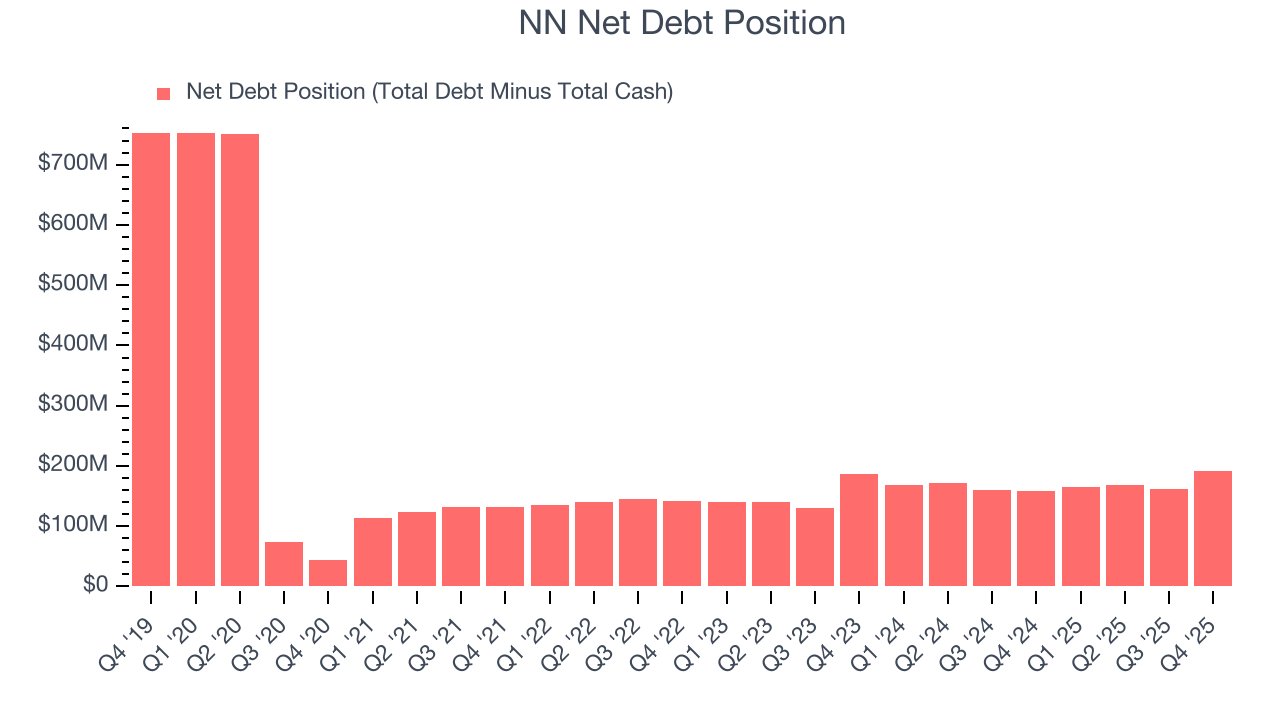

11. Balance Sheet Assessment

NN reported $11.38 million of cash and $203.1 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $49.01 million of EBITDA over the last 12 months, we view NN’s 3.9× net-debt-to-EBITDA ratio as safe. We also see its $10.67 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from NN’s Q4 Results

It was great to see NN’s full-year revenue guidance top analysts’ expectations. On the other hand, its full-year EBITDA guidance missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 5.4% to $1.44 immediately following the results.

13. Is Now The Time To Buy NN?

Updated: March 5, 2026 at 10:58 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

NN doesn’t pass our quality test. For starters, its revenue growth was weak over the last five years. While its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its relatively low ROIC suggests management has struggled to find compelling investment opportunities. On top of that, its declining EPS over the last five years makes it a less attractive asset to the public markets.

NN’s P/E ratio based on the next 12 months is 15.3x. While this valuation is reasonable, we don’t see a big opportunity at the moment. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $5.75 on the company (compared to the current share price of $1.45).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.