Novanta (NOVT)

Novanta doesn’t excite us. Its weak sales growth and declining returns on capital show its demand and profits are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think Novanta Will Underperform

Originally a pioneer in the laser scanning industry during the late 1960s, Novanta (NASDAQ:NOVT) offers medicine and manufacturing technology to the medical, life sciences, and manufacturing industries.

- On the bright side, its superior product capabilities and pricing power result in a premier gross margin of 44.2%

Novanta falls short of our quality standards. We believe there are better opportunities elsewhere.

Why There Are Better Opportunities Than Novanta

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Novanta

At $137.99 per share, Novanta trades at 39.2x forward P/E. This multiple is higher than that of industrials peers; it’s also rich for the business quality. Not a great combination.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. Novanta (NOVT) Research Report: Q3 CY2025 Update

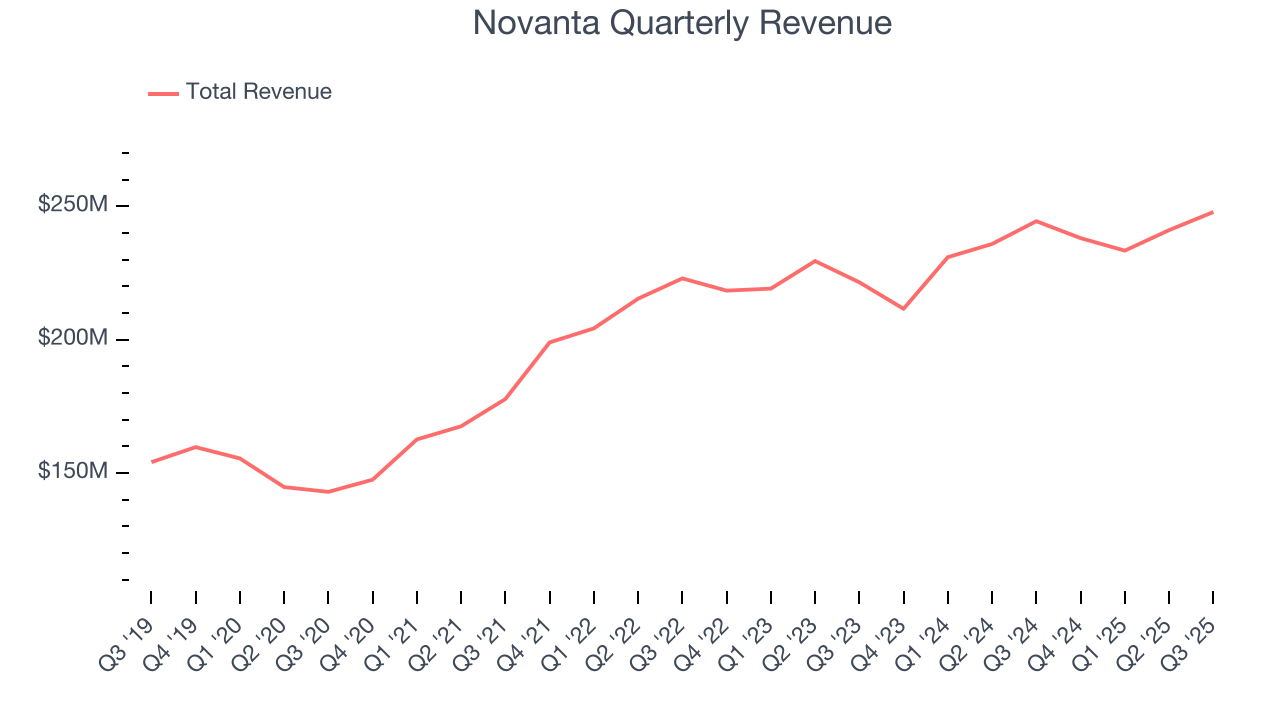

Medicine and manufacturing technology provider Novanta (NASDAQ:NOVT) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 1.4% year on year to $247.8 million. Its non-GAAP profit of $0.87 per share was 6.5% above analysts’ consensus estimates.

Novanta (NOVT) Q3 CY2025 Highlights:

- Revenue: $247.8 million vs analyst estimates of $245.9 million (1.4% year-on-year growth, 0.8% beat)

- Adjusted EPS: $0.87 vs analyst estimates of $0.82 (6.5% beat)

- Adjusted EBITDA: $39.76 million vs analyst estimates of $58.22 million (16% margin, 31.7% miss)

- Operating Margin: 11.5%, down from 14.3% in the same quarter last year

- Free Cash Flow Margin: 1.7%, down from 8% in the same quarter last year

- Market Capitalization: $4.63 billion

Company Overview

Originally a pioneer in the laser scanning industry during the late 1960s, Novanta (NASDAQ:NOVT) offers medicine and manufacturing technology to the medical, life sciences, and manufacturing industries.

Novanta was founded in 1968 as General Scanning and originally focused on laser beam steering and scanning. In 2005, the company merged with Lumonics (forming GSI Group) which rebranded as Novanta in 2016 to better reflect its portfolio of medicine and manufacturing technologies. Today, the company provides for the medical, life sciences, and manufacturing industries.

Novanta’s product offerings include laser systems (make cuts/marks on materials and are used in surgery and diagnostics), precision motion control (move and position parts in machines), and vision technologies (cameras and software that help machines see and analyze what it is working on). Whether products are used for medical procedures or the manufacturing process, Novanta’s products enable customers to improve accuracy (removing human error) and efficiency. Its customers range from healthcare providers and medical device manufacturers to industrial automation firms and tech companies.

Novanta sells its products directly to original equipment manufacturers (OEMs) and through a network of distributors, engaging in long-term contracts that often include service and support agreements. This ensures a stable revenue stream and strong customer relationships. In addition, the company offers OEMs a volume discount to incentivize more frequent and larger volume orders.

4. Electronic Components

Like many equipment and component manufacturers, electronic components companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include data centers and telecommunications, which can benefit companies whose optical and transceiver offerings fit those markets. But like the broader industrials sector, these companies are also at the whim of economic cycles. Consumer spending, for example, can greatly impact these companies’ volumes.

Competitors offering similar products include Danaher (NYSE:DHR), MKS Instruments (NASDAQ:MKSI), and Coherent (NASDAQ:COHR).

5. Revenue Growth

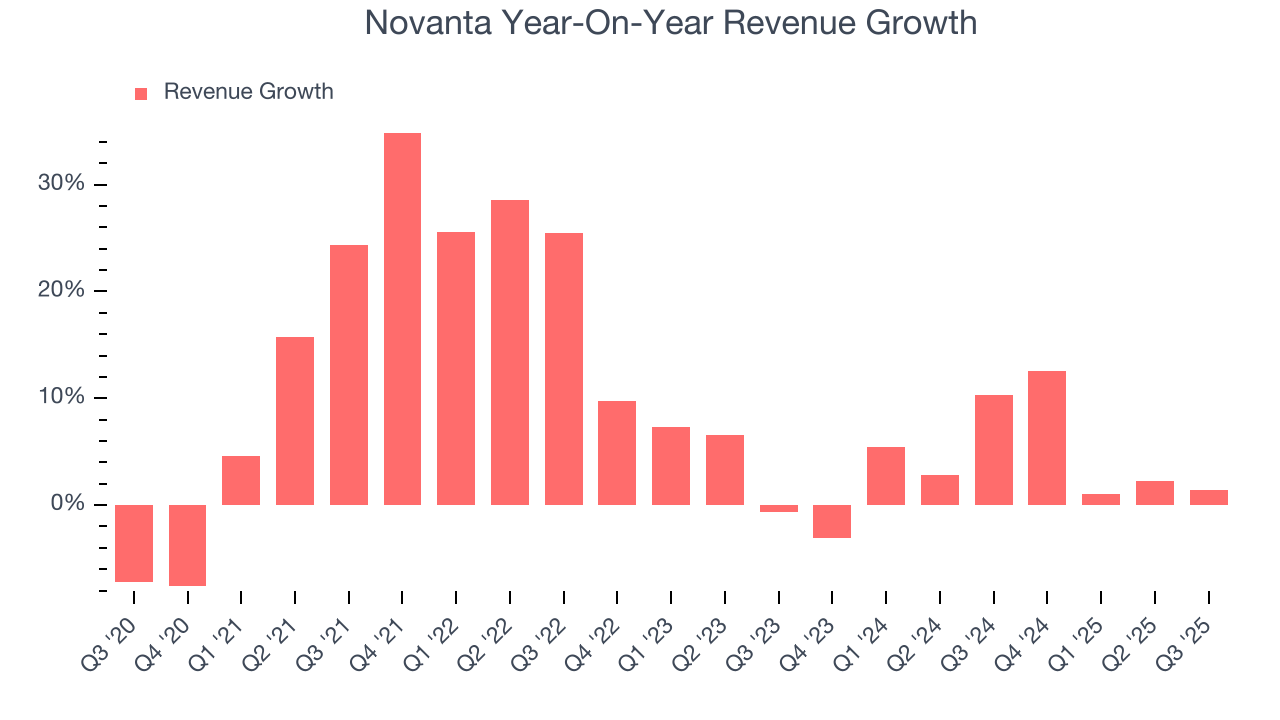

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Novanta’s sales grew at a solid 9.8% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Novanta’s recent performance shows its demand has slowed as its annualized revenue growth of 4% over the last two years was below its five-year trend.

This quarter, Novanta reported modest year-on-year revenue growth of 1.4% but beat Wall Street’s estimates by 0.8%.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

6. Gross Margin & Pricing Power

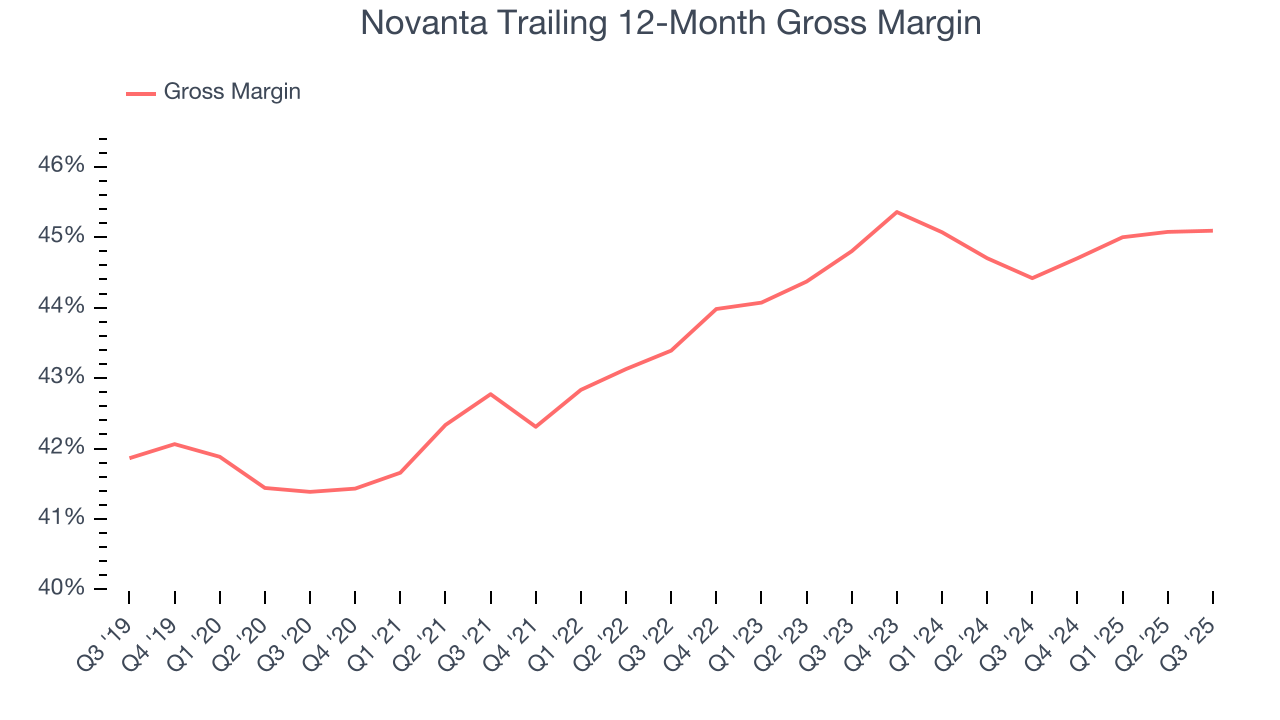

Novanta has best-in-class unit economics for an industrials company, enabling it to invest in areas such as research and development. Its margin also signals it sells differentiated products, not commodities. As you can see below, it averaged an elite 44.2% gross margin over the last five years. That means Novanta only paid its suppliers $55.81 for every $100 in revenue.

Novanta produced a 44.8% gross profit margin in Q3, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

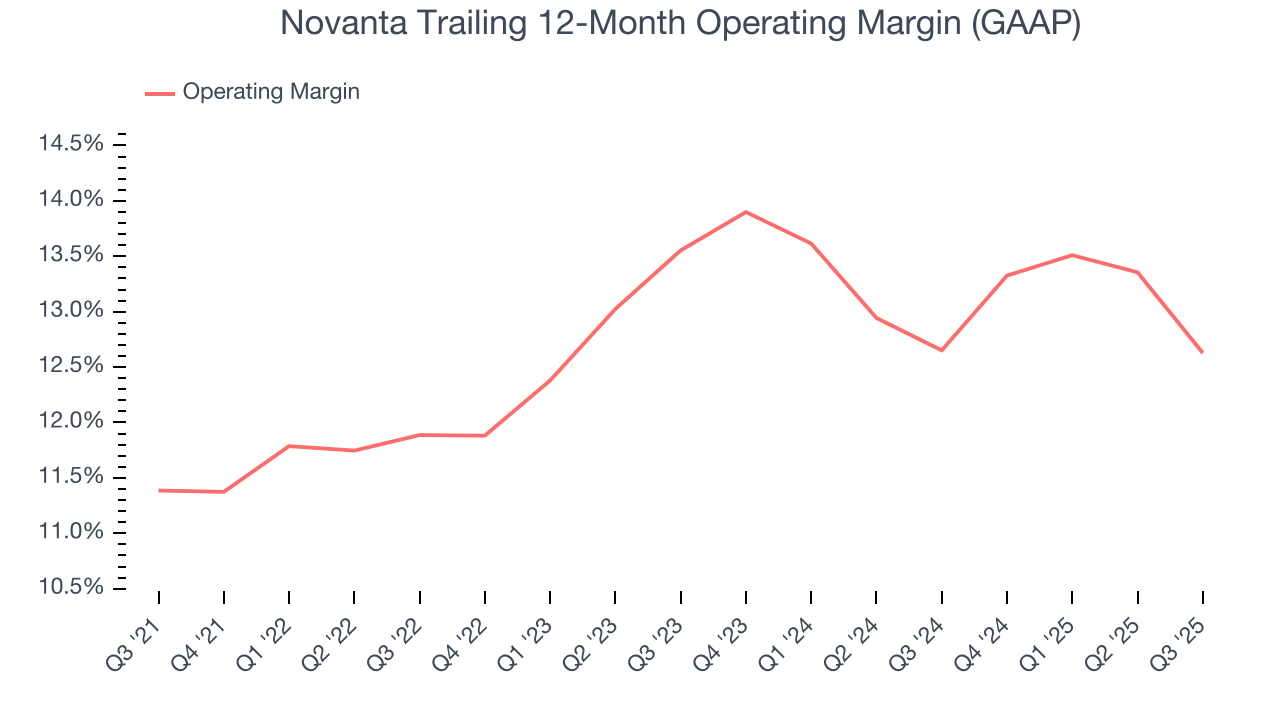

Novanta has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 12.5%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Novanta’s operating margin rose by 1.2 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Novanta generated an operating margin profit margin of 11.5%, down 2.8 percentage points year on year. Since Novanta’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

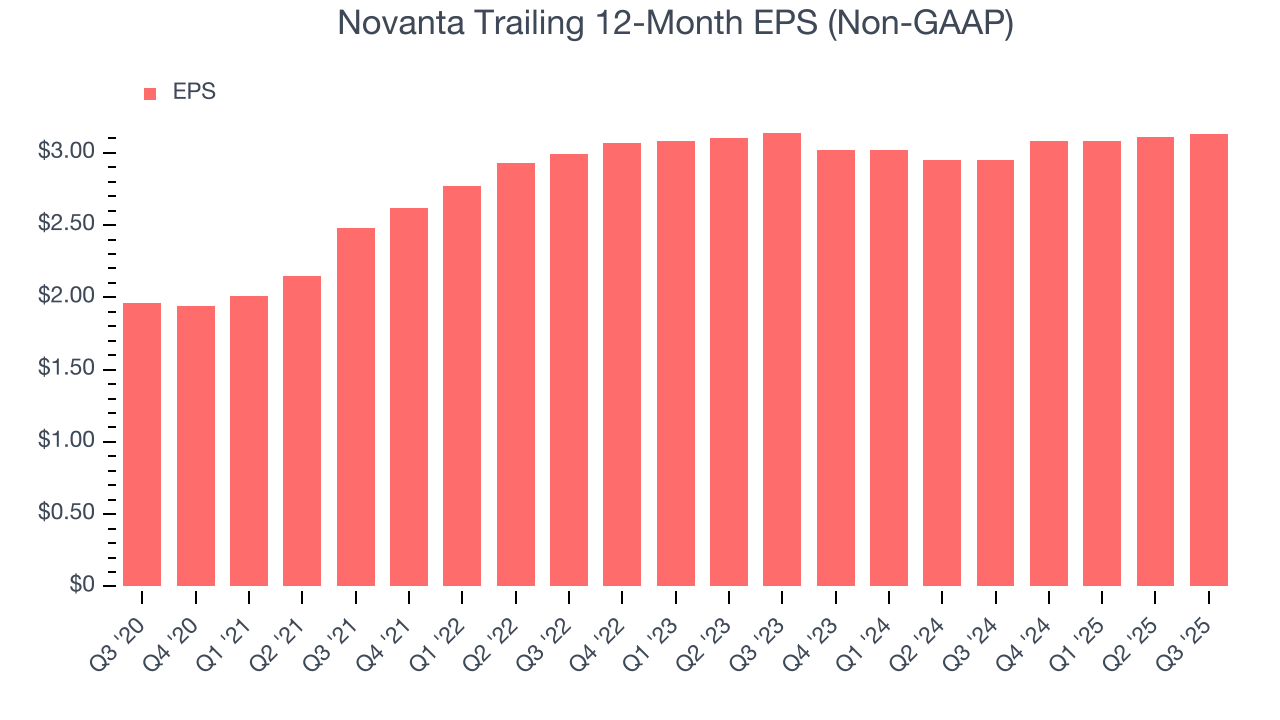

Novanta’s decent 9.8% annual EPS growth over the last five years aligns with its revenue performance. This tells us its incremental sales were profitable.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Novanta’s flat two-year EPS was bad and lower than its 4% two-year revenue growth.

We can take a deeper look into Novanta’s earnings to better understand the drivers of its performance. Novanta’s operating margin has declined over the last two years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, Novanta reported adjusted EPS of $0.87, up from $0.85 in the same quarter last year. This print beat analysts’ estimates by 6.5%. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

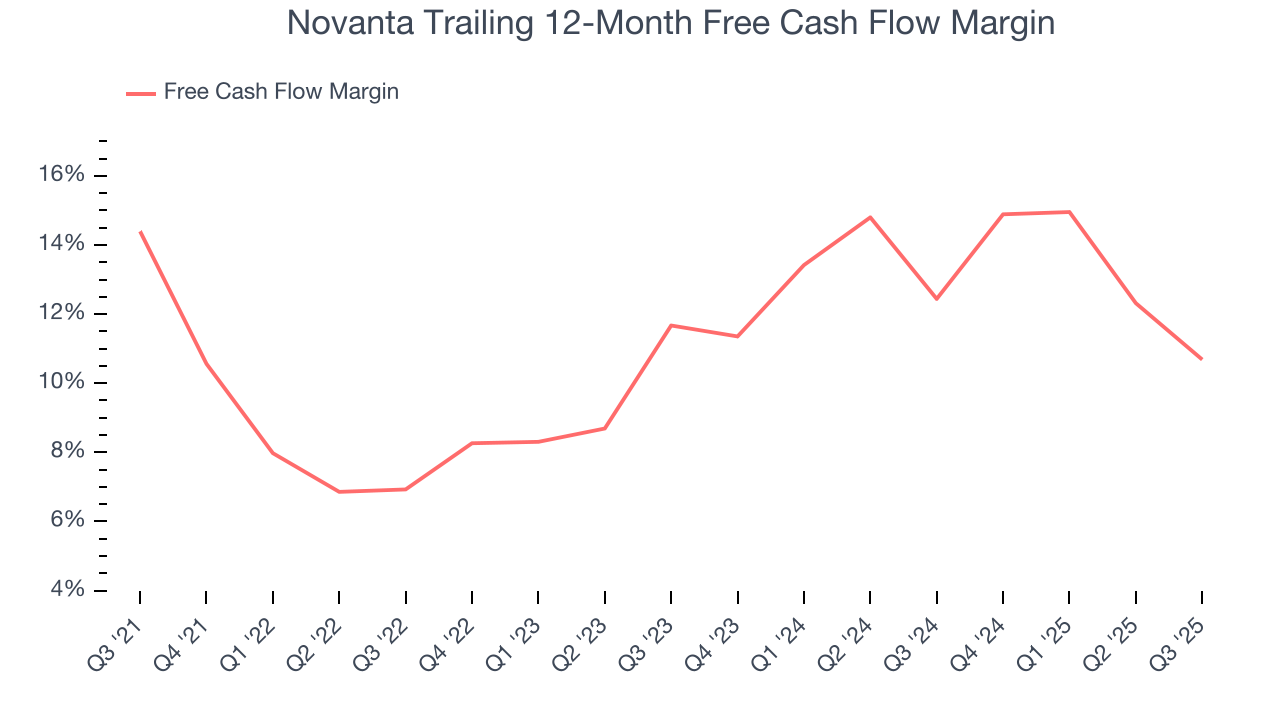

Novanta has shown robust cash profitability, enabling it to comfortably ride out cyclical downturns while investing in plenty of new offerings and returning capital to investors. The company’s free cash flow margin averaged 11.1% over the last five years, quite impressive for an industrials business.

Taking a step back, we can see that Novanta’s margin dropped by 3.7 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

Novanta’s free cash flow clocked in at $4.21 million in Q3, equivalent to a 1.7% margin. The company’s cash profitability regressed as it was 6.3 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

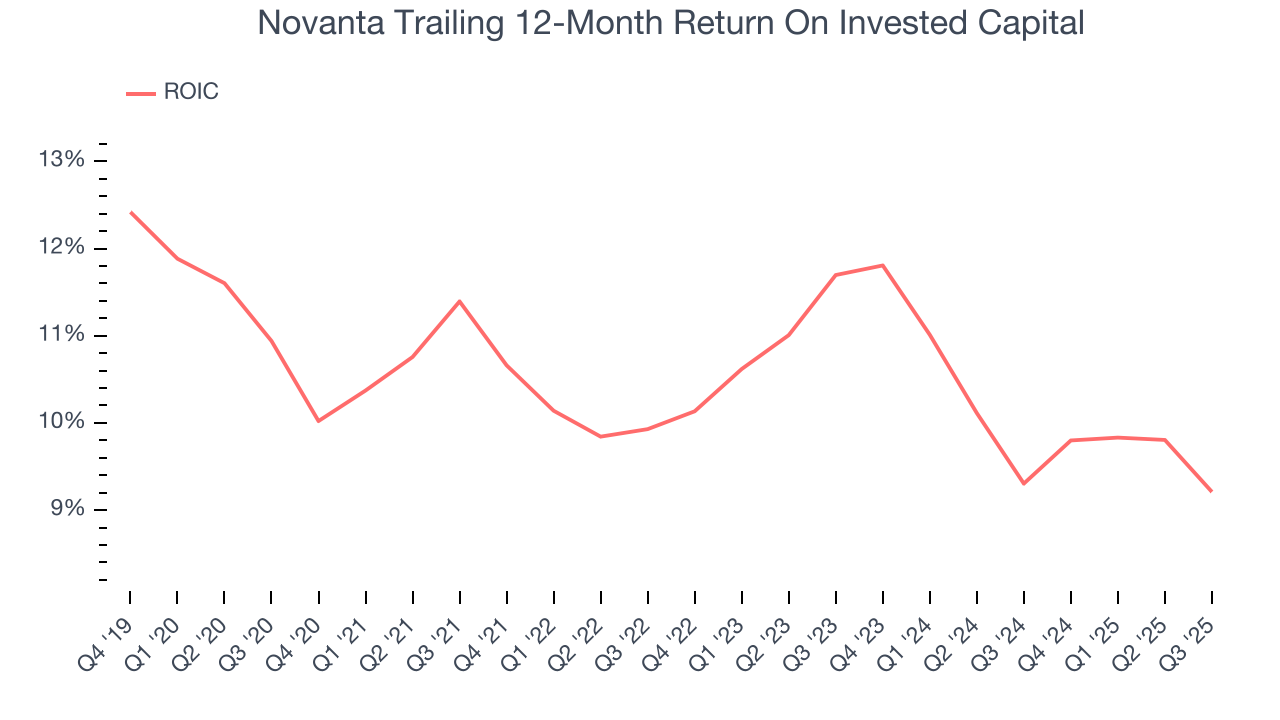

Novanta’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 10.3%, slightly better than typical industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Novanta’s ROIC decreased by 1.4 percentage points annually over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Balance Sheet Assessment

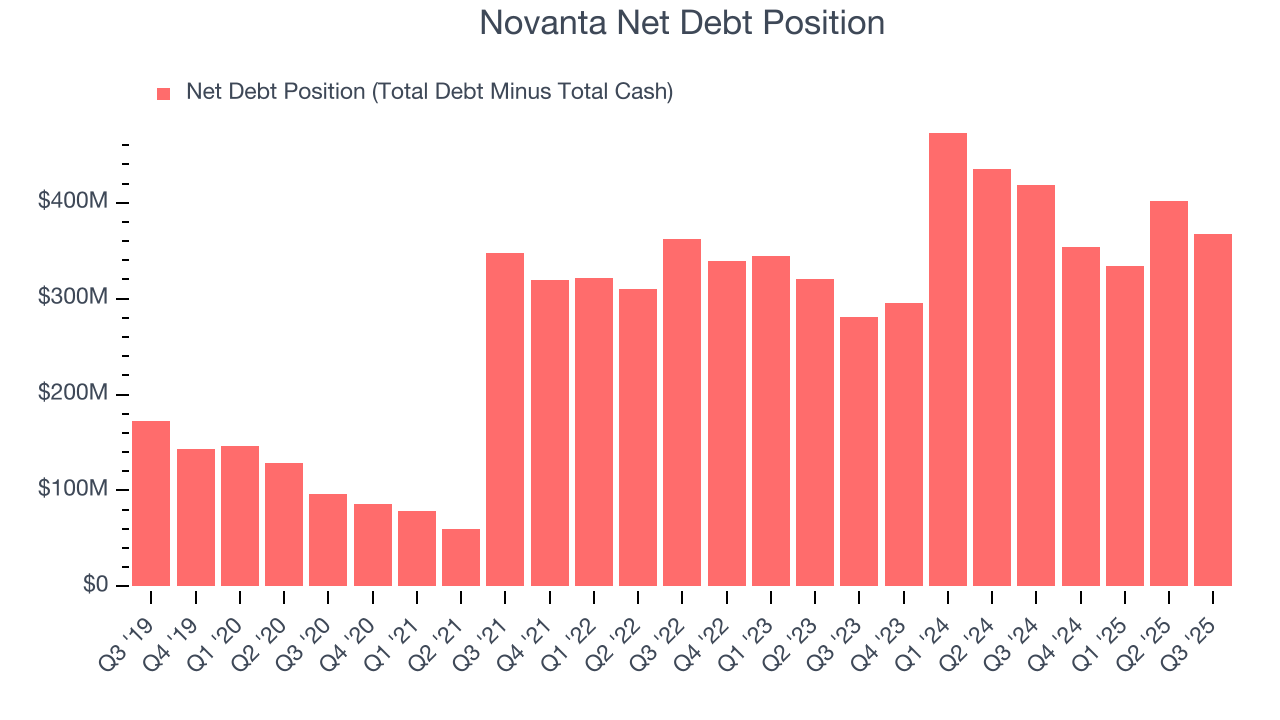

Novanta reported $89.22 million of cash and $456.6 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $194 million of EBITDA over the last 12 months, we view Novanta’s 1.9× net-debt-to-EBITDA ratio as safe. We also see its $24.36 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Novanta’s Q3 Results

It was good to see Novanta beat analysts’ EPS expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its EBITDA missed. Overall, this was a softer quarter. The stock remained flat at $130 immediately after reporting.

13. Is Now The Time To Buy Novanta?

Updated: January 24, 2026 at 9:06 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Novanta isn’t a terrible business, but it doesn’t pass our quality test. Although its revenue growth was solid over the last five years, it’s expected to deteriorate over the next 12 months and its cash profitability fell over the last five years. And while the company’s admirable gross margins indicate the mission-critical nature of its offerings, the downside is its diminishing returns show management's prior bets haven't worked out.

Novanta’s P/E ratio based on the next 12 months is 39.2x. At this valuation, there’s a lot of good news priced in - we think there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $154 on the company (compared to the current share price of $137.99).