Insight Enterprises (NSIT)

We wouldn’t recommend Insight Enterprises. Its inability to grow sales suggests demand is weak and its meager free cash flow margin puts it in a pinch.― StockStory Analyst Team

1. News

2. Summary

Why We Think Insight Enterprises Will Underperform

With over 35 years of IT expertise and partnerships with more than 8,000 technology providers, Insight Enterprises (NASDAQ:NSIT) provides end-to-end digital transformation solutions that help businesses modernize their IT infrastructure and maximize the value of technology.

- Sales were flat over the last five years, indicating it’s failed to expand this cycle

- Earnings growth over the last two years fell short of the peer group average as its EPS only increased by 1.9% annually

- Estimated sales growth of 1.1% for the next 12 months is soft and implies weaker demand

Insight Enterprises falls below our quality standards. We believe there are better businesses elsewhere.

Why There Are Better Opportunities Than Insight Enterprises

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Insight Enterprises

Insight Enterprises is trading at $81.74 per share, or 7.9x forward P/E. Insight Enterprises’s valuation may seem like a great deal, but we think there are valid reasons why it’s so cheap.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Insight Enterprises (NSIT) Research Report: Q4 CY2025 Update

IT solutions integrator Insight Enterprises (NASDAQ:NSIT) fell short of the market’s revenue expectations in Q4 CY2025, with sales falling 1.2% year on year to $2.05 billion. Its non-GAAP profit of $2.96 per share was 4.2% above analysts’ consensus estimates.

Insight Enterprises (NSIT) Q4 CY2025 Highlights:

- Revenue: $2.05 billion vs analyst estimates of $2.09 billion (1.2% year-on-year decline, 2% miss)

- Adjusted EPS: $2.96 vs analyst estimates of $2.84 (4.2% beat)

- Adjusted EBITDA: $156.2 million vs analyst estimates of $144.6 million (7.6% margin, 8% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $11.25 at the midpoint, beating analyst estimates by 7%

- Operating Margin: 4.6%, up from 3.1% in the same quarter last year

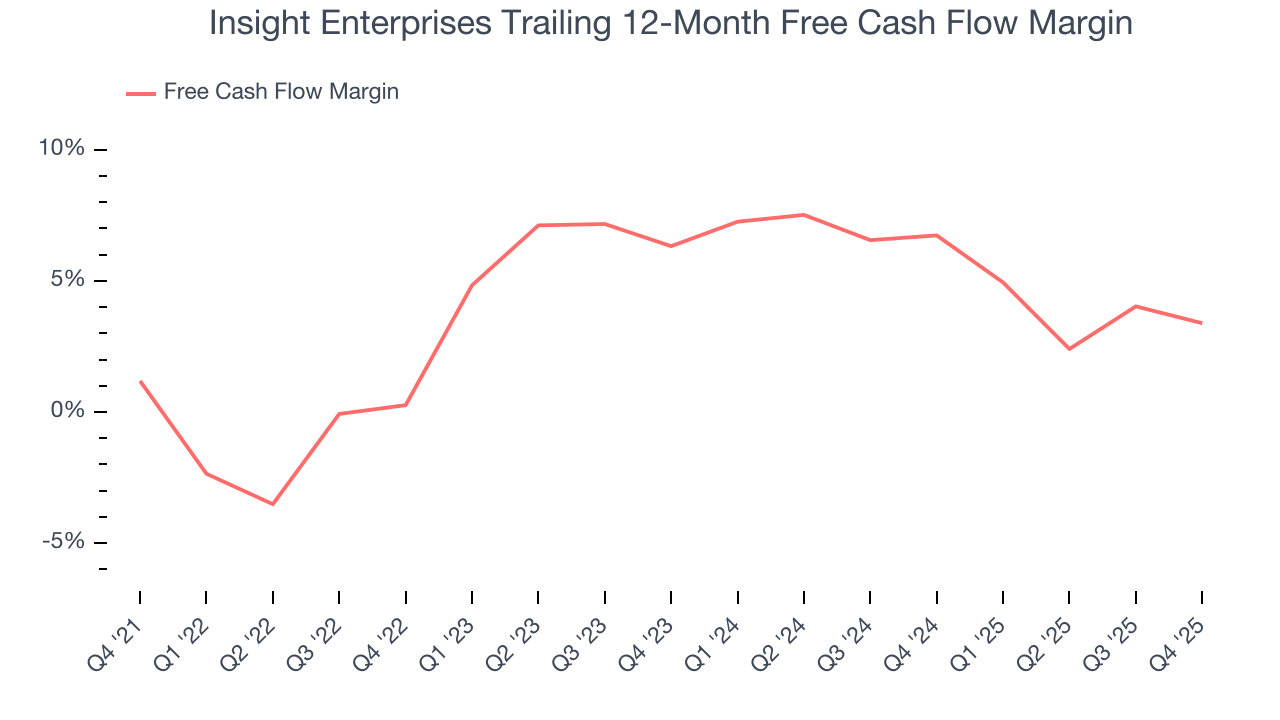

- Free Cash Flow Margin: 7.2%, down from 9.7% in the same quarter last year

- Market Capitalization: $2.53 billion

Company Overview

With over 35 years of IT expertise and partnerships with more than 8,000 technology providers, Insight Enterprises (NASDAQ:NSIT) provides end-to-end digital transformation solutions that help businesses modernize their IT infrastructure and maximize the value of technology.

Insight operates as a comprehensive solutions integrator across six key technology areas: modern platforms/infrastructure, cybersecurity, data & AI, modern workplace, modern applications, and intelligent edge. This portfolio allows the company to address the full spectrum of clients' digital transformation needs, from initial strategy through implementation and ongoing management.

For businesses looking to modernize their IT infrastructure, Insight architects multicloud and hybrid environments that balance flexibility with security. A healthcare provider might work with Insight to migrate patient records to a secure cloud platform while maintaining compliance with privacy regulations. In the cybersecurity realm, Insight helps organizations implement protective measures across their networks and systems, automating threat detection and response capabilities.

The company has positioned itself at the forefront of emerging technologies, particularly in data analytics and artificial intelligence. Insight helps clients leverage these technologies to transform operations and create new business opportunities. For example, a manufacturing client might engage Insight to implement AI-powered predictive maintenance systems that reduce equipment downtime.

Insight generates revenue through a mix of product sales (hardware and software) and services, with products representing about 83% of its business. The company maintains strategic partnerships with major technology vendors, including Microsoft, Cisco Systems, Dell, and thousands of others, allowing it to source and integrate best-of-breed solutions.

With operations spanning North America, Europe, the Middle East, Africa, and Asia-Pacific, Insight serves a global client base. The company has strengthened its capabilities through strategic acquisitions, including Amdaris (software development services) and SADA (Google Cloud expertise), expanding its ability to deliver comprehensive digital transformation solutions across diverse technology environments.

4. IT Distribution & Solutions

IT Distribution & Solutions will be buoyed by the increasing complexity of IT ecosystems, rising cloud adoption, and demand for cybersecurity solutions. Enterprises are less likely than ever to embark on these complicated journeys solo, and companies in the sector boast expertise and scale in these areas. However, cloud migration also means less need for hardware, which could dent demand for large portions of the product portfolio and hurt margins. Additionally, planning for potentially supply chain disruptions is ongoing, as the COVID-19 pandemic showed how damaging a pause in global trade could be in areas like semiconductor procurement.

Insight Enterprises competes with systems integrators and digital consultants such as ePlus, Presidio, World Wide Technology, and Accenture, as well as solution providers and value-added resellers including CDW (NASDAQ:CDW), Cognizant (NASDAQ:CTSH), SHI, and Computacenter (LON:CCC).

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $8.25 billion in revenue over the past 12 months, Insight Enterprises is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because it’s harder to find incremental growth when you’ve penetrated most of the market. For Insight Enterprises to boost its sales, it likely needs to adjust its prices, launch new offerings, or lean into foreign markets.

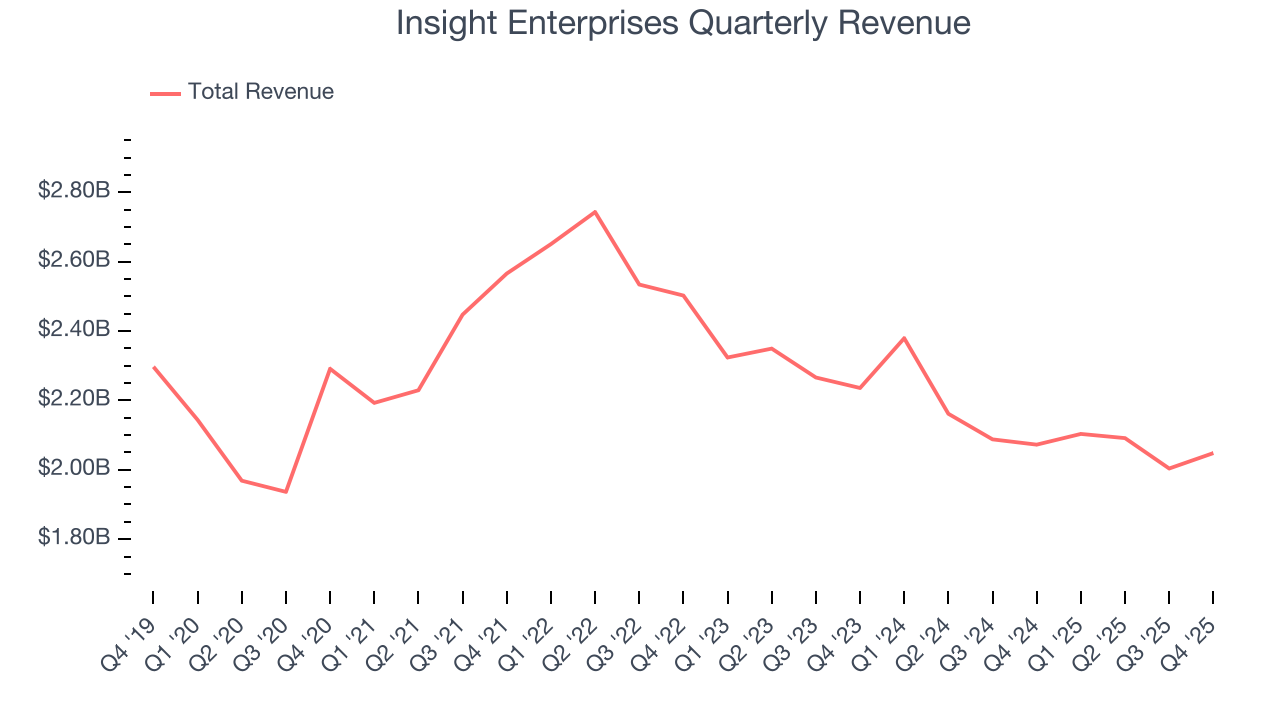

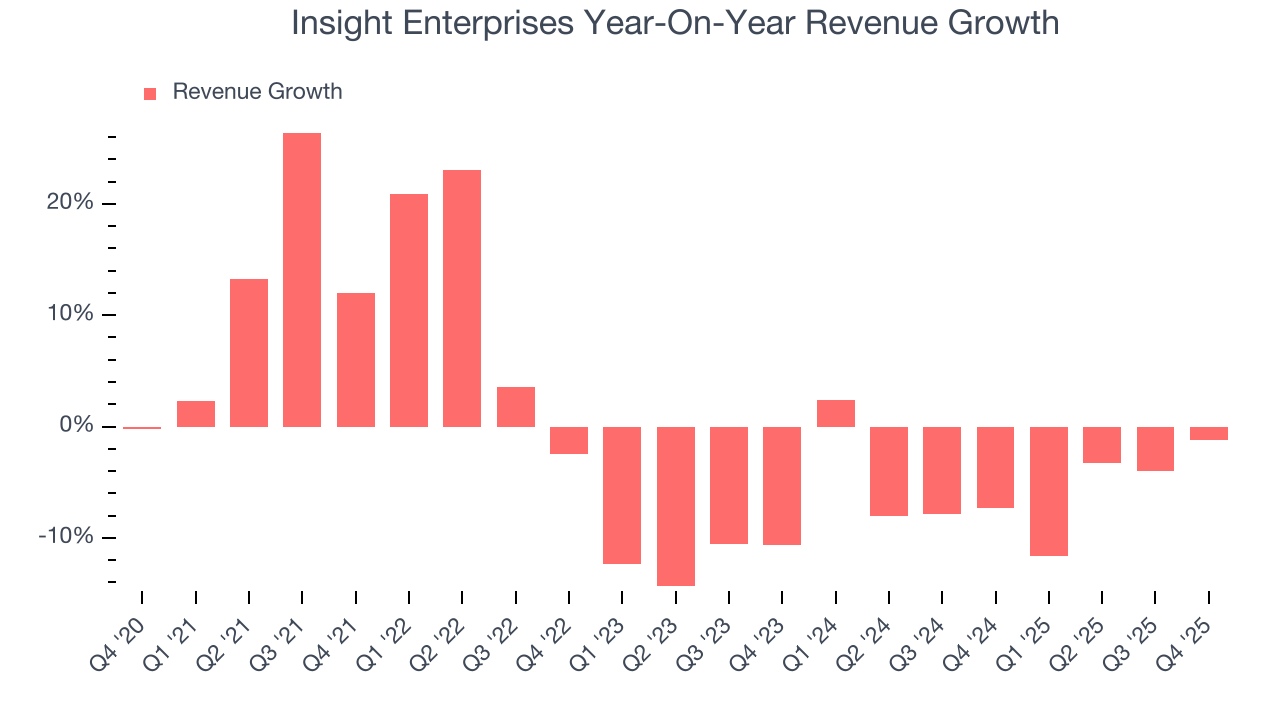

As you can see below, Insight Enterprises struggled to increase demand as its $8.25 billion of sales for the trailing 12 months was close to its revenue five years ago. This shows demand was soft, a rough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Insight Enterprises’s recent performance shows its demand remained suppressed as its revenue has declined by 5.2% annually over the last two years.

This quarter, Insight Enterprises missed Wall Street’s estimates and reported a rather uninspiring 1.2% year-on-year revenue decline, generating $2.05 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 1.8% over the next 12 months. While this projection suggests its newer products and services will catalyze better top-line performance, it is still below average for the sector.

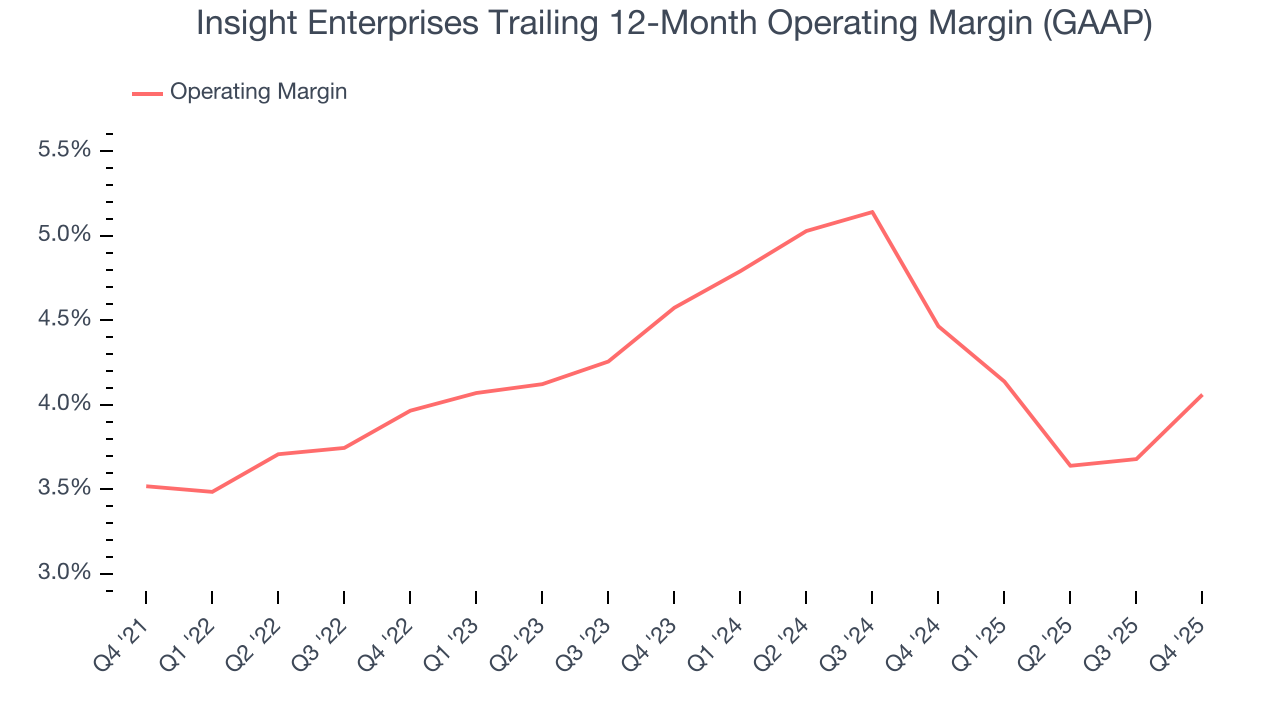

6. Operating Margin

Insight Enterprises’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 4.1% over the last five years. This profitability was lousy for a business services business and caused by its suboptimal cost structure.

Analyzing the trend in its profitability, Insight Enterprises’s operating margin might fluctuated slightly but has generally stayed the same over the last five years, meaning it will take a fundamental shift in the business model to change.

This quarter, Insight Enterprises generated an operating margin profit margin of 4.6%, up 1.5 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

7. Earnings Per Share

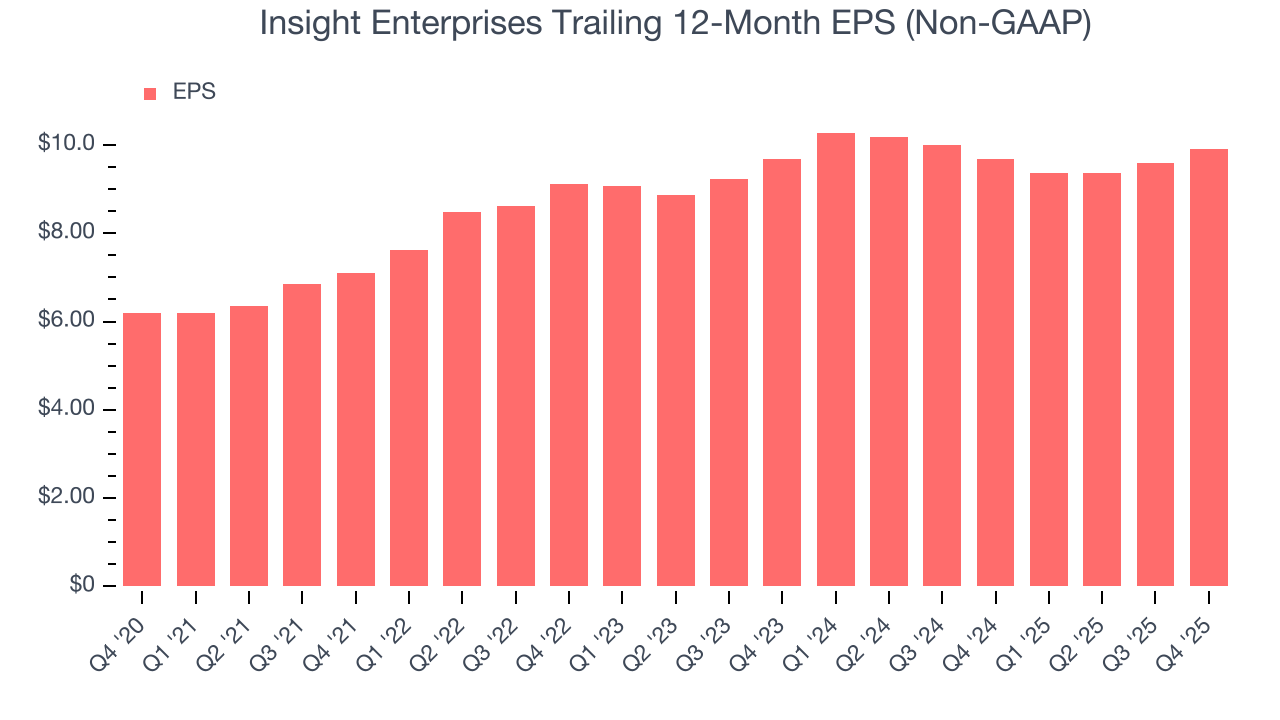

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Insight Enterprises’s EPS grew at a solid 9.8% compounded annual growth rate over the last five years, higher than its flat revenue. This tells us management responded to softer demand by adapting its cost structure.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Insight Enterprises, its two-year annual EPS growth of 1.1% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, Insight Enterprises reported adjusted EPS of $2.96, up from $2.66 in the same quarter last year. This print beat analysts’ estimates by 4.2%. Over the next 12 months, Wall Street expects Insight Enterprises’s full-year EPS of $9.90 to grow 4.1%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Insight Enterprises has shown weak cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.4%, subpar for a business services business.

Taking a step back, an encouraging sign is that Insight Enterprises’s margin expanded by 2.2 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

Insight Enterprises’s free cash flow clocked in at $146.8 million in Q4, equivalent to a 7.2% margin. The company’s cash profitability regressed as it was 2.5 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends are more important.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

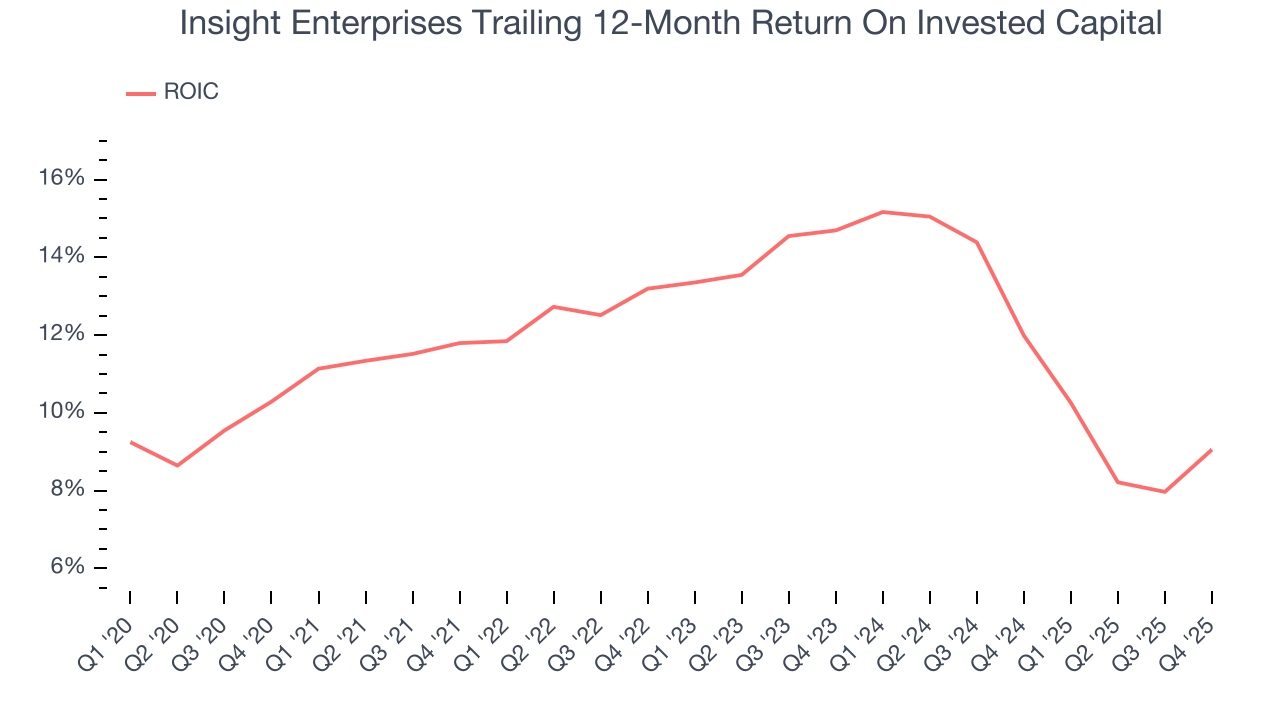

Insight Enterprises’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 12.1%, slightly better than typical business services business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Insight Enterprises’s ROIC decreased by 2 percentage points annually each year over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

10. Balance Sheet Assessment

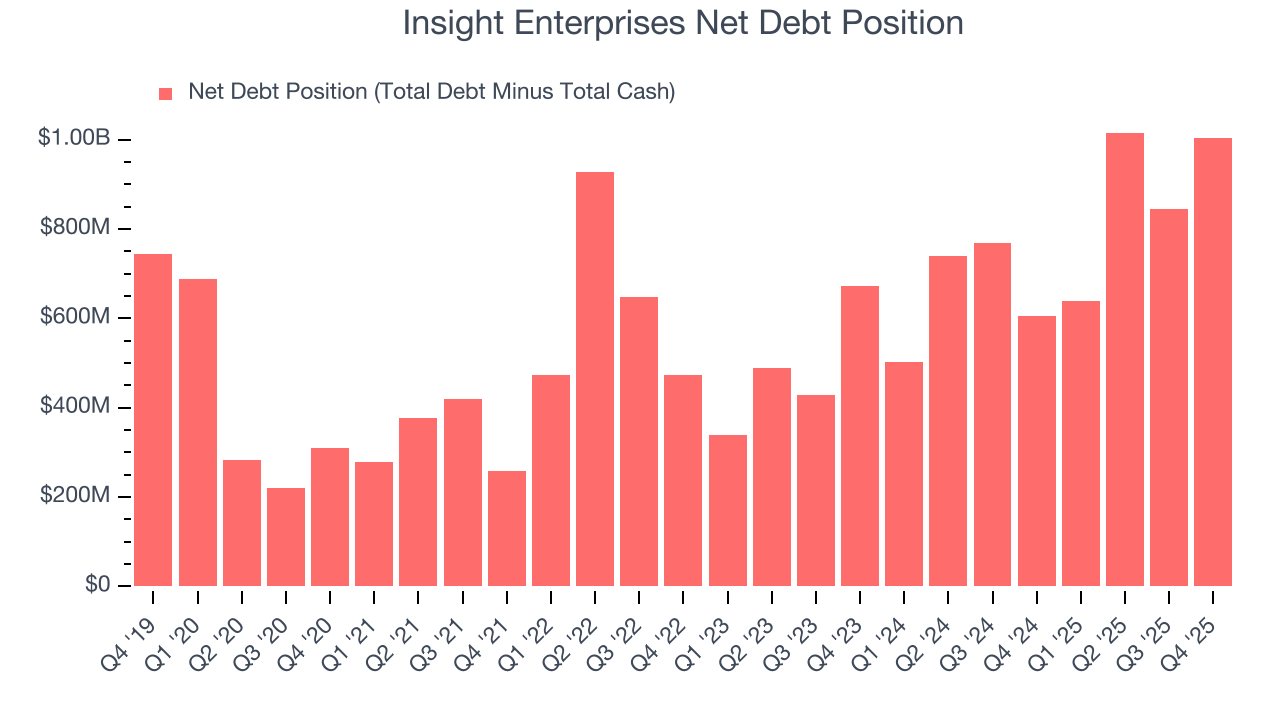

Insight Enterprises reported $358 million of cash and $1.36 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $540.4 million of EBITDA over the last 12 months, we view Insight Enterprises’s 1.9× net-debt-to-EBITDA ratio as safe. We also see its $37.7 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Insight Enterprises’s Q4 Results

We were impressed by how significantly Insight Enterprises blew past analysts’ full-year EPS guidance expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its revenue missed. Overall, this print had some key positives. The stock remained flat at $81.74 immediately following the results.

12. Is Now The Time To Buy Insight Enterprises?

Updated: February 5, 2026 at 8:32 AM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Insight Enterprises, you should also grasp the company’s longer-term business quality and valuation.

Insight Enterprises doesn’t pass our quality test. To begin with, its revenue growth was weak over the last five years. And while its scale and strong customer awareness give it negotiating power, the downside is its operating margins reveal poor profitability compared to other business services companies. On top of that, its low free cash flow margins give it little breathing room.

Insight Enterprises’s P/E ratio based on the next 12 months is 7.9x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $121.25 on the company (compared to the current share price of $81.74).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.