Napco (NSSC)

Napco is a compelling stock. Its fusion of growth, outstanding profitability, and encouraging prospects makes it a beloved asset.― StockStory Analyst Team

1. News

2. Summary

Why We Like Napco

Protecting everything from schools to government facilities since 1969, Napco Security Technologies (NASDAQ:NSSC) manufactures electronic security devices, access control systems, and communication services for intrusion and fire alarm systems.

- Incremental sales significantly boosted profitability as its annual earnings per share growth of 36.5% over the last five years outstripped its revenue performance

- Healthy operating margin shows it’s a well-run company with efficient processes

- Powerful free cash flow generation enables it to reinvest its profits or return capital to investors consistently, and its growing cash flow gives it even more resources to deploy

We’re optimistic about Napco. There’s a lot to like here.

Is Now The Time To Buy Napco?

High Quality

Investable

Underperform

Is Now The Time To Buy Napco?

Napco is trading at $45.86 per share, or 29.6x forward P/E. There are high expectations given this pricey multiple; we can’t deny that.

If you like the company and believe the bull case, we suggest making it a smaller position as our analysis shows high-quality companies outperform the market over a multi-year period regardless of valuation.

3. Napco (NSSC) Research Report: Q4 CY2025 Update

Security systems manufacturer Napco (NASDAQ:NSSC) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 12.2% year on year to $48.17 million. Its GAAP profit of $0.38 per share was 18.8% above analysts’ consensus estimates.

Napco (NSSC) Q4 CY2025 Highlights:

- Revenue: $48.17 million vs analyst estimates of $47.82 million (12.2% year-on-year growth, 0.7% beat)

- EPS (GAAP): $0.38 vs analyst estimates of $0.32 (18.8% beat)

- Adjusted EBITDA: $15.35 million vs analyst estimates of $13.86 million (31.9% margin, 10.8% beat)

- Operating Margin: 30.6%, up from 26% in the same quarter last year

- Free Cash Flow Margin: 30.1%, up from 28.8% in the same quarter last year

- Market Capitalization: $1.32 billion

Company Overview

Protecting everything from schools to government facilities since 1969, Napco Security Technologies (NASDAQ:NSSC) manufactures electronic security devices, access control systems, and communication services for intrusion and fire alarm systems.

Napco's product portfolio spans several security categories, including door locking devices, intrusion detectors, control panels, and video surveillance systems. The company's electronic door locks range from simple deadbolts to sophisticated microprocessor-based systems with card readers and biometric capabilities that can be networked and controlled remotely.

For intrusion and fire detection, Napco produces control panels that serve as the "brain" of alarm systems, along with various detectors and communication equipment. When an intrusion is detected, these systems can automatically alert a central monitoring station or designated contacts through cellular or digital communication channels.

A school administrator might use Napco's access control system to manage which staff members can enter specific areas of a building at certain times, while simultaneously monitoring these areas through the company's video surveillance equipment. Meanwhile, a hospital might install Napco's specialized anti-ligature locks in behavioral health units to prevent patient self-harm while meeting regulatory requirements.

The company has evolved beyond just selling hardware to offering recurring revenue services, particularly in cellular communications for alarm systems. As traditional copper landlines become obsolete, Napco provides cellular access for security devices on a subscription basis, creating a steady revenue stream alongside equipment sales.

Napco distributes its products through a network of approximately 1,800 independent distributors, dealers, and installers who serve commercial, residential, institutional, industrial, and governmental customers. The company maintains a sales and marketing team that trains these channel partners and introduces new products to the market.

4. Specialized Technology

Companies in this sector, especially if they invest wisely, could see demand tailwinds as the world moves towards more IoT (Internet of Things), automation, and analytics. Enterprises across most industries will balk at taking these journeys solo and will enlist companies with expertise and scale in these areas. However, headwinds could include rising competition from larger technology firms, as digitization lowers barriers to entry in the space. Additionally, companies in the space will likely face evolving regulatory scrutiny over data privacy, particularly for surveillance and security technologies. This could make companies have to continually pivot and invest.

Napco Security Technologies competes with larger security equipment manufacturers like Honeywell International (NASDAQ: HON), Johnson Controls (NYSE: JCI), and Allegion (NYSE: ALLE), as well as specialized security technology providers such as Alarm.com (NASDAQ: ALRM).

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $192 million in revenue over the past 12 months, Napco is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

As you can see below, Napco grew its sales at an exceptional 14% compounded annual growth rate over the last five years. This is a great starting point for our analysis because it shows Napco’s demand was higher than many business services companies.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Napco’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 4% over the last two years was well below its five-year trend.

This quarter, Napco reported year-on-year revenue growth of 12.2%, and its $48.17 million of revenue exceeded Wall Street’s estimates by 0.7%.

Looking ahead, sell-side analysts expect revenue to grow 9.6% over the next 12 months, an improvement versus the last two years. This projection is noteworthy and implies its newer products and services will spur better top-line performance.

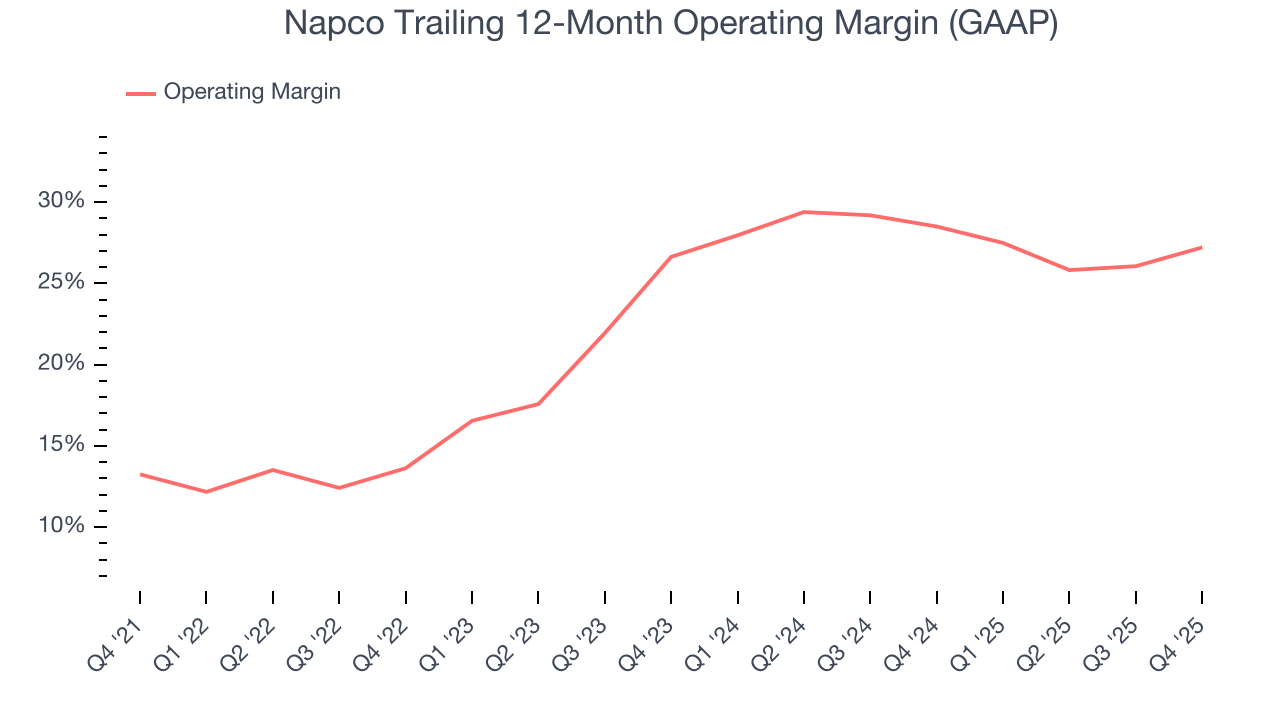

6. Operating Margin

Napco has been a well-oiled machine over the last five years. It demonstrated elite profitability for a business services business, boasting an average operating margin of 22.7%.

Looking at the trend in its profitability, Napco’s operating margin rose by 14 percentage points over the last five years, as its sales growth gave it immense operating leverage.

In Q4, Napco generated an operating margin profit margin of 30.6%, up 4.6 percentage points year on year. This increase was a welcome development and shows it was more efficient.

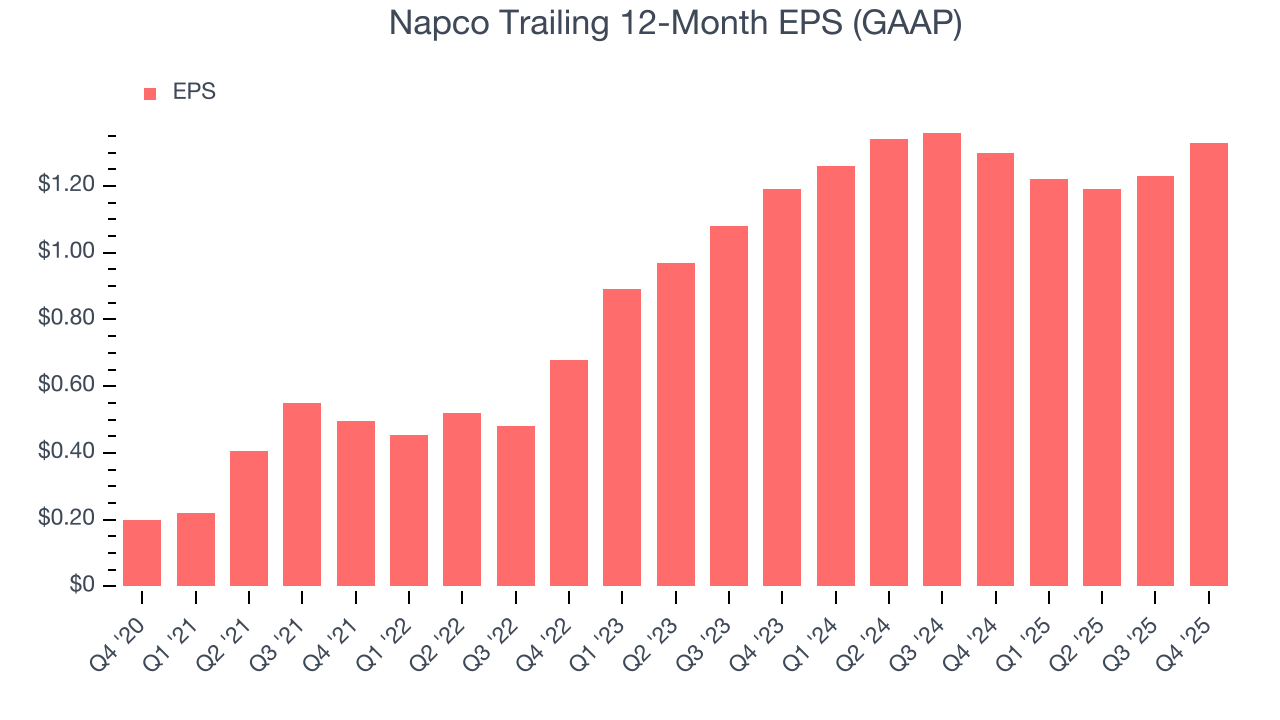

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Napco’s EPS grew at an astounding 46.1% compounded annual growth rate over the last five years, higher than its 14% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Napco’s earnings to better understand the drivers of its performance. As we mentioned earlier, Napco’s operating margin expanded by 14 percentage points over the last five years. On top of that, its share count shrank by 2.4%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Napco, its two-year annual EPS growth of 5.7% was lower than its five-year trend. This wasn’t great, but at least the company was successful in other measures of financial health.

In Q4, Napco reported EPS of $0.38, up from $0.28 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Napco’s full-year EPS of $1.33 to grow 9%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Napco has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the business services sector, averaging 19.3% over the last five years.

Taking a step back, we can see that Napco’s margin expanded by 12 percentage points during that time. This is encouraging because it gives the company more optionality.

Napco’s free cash flow clocked in at $14.51 million in Q4, equivalent to a 30.1% margin. This result was good as its margin was 1.3 percentage points higher than in the same quarter last year, building on its favorable historical trend.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Napco’s five-year average ROIC was 44.6%, placing it among the best business services companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Napco’s ROIC has increased significantly. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

10. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

Napco is a profitable, well-capitalized company with $115.4 million of cash and $5.26 million of debt on its balance sheet. This $110.1 million net cash position is 8.4% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Napco’s Q4 Results

It was good to see Napco beat analysts’ EPS expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The stock remained flat at $36.97 immediately following the results.

12. Is Now The Time To Buy Napco?

Updated: February 20, 2026 at 10:13 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Napco.

Napco is a rock-solid business worth owning. For starters, its revenue growth was exceptional over the last five years. And while its subscale operations give it fewer distribution channels than its larger rivals, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits. On top of that, Napco’s impressive operating margins show it has a highly efficient business model.

Napco’s P/E ratio based on the next 12 months is 29.6x. This multiple isn’t necessarily cheap, but we’ll happily own Napco as its fundamentals shine bright. It’s often wise to hold investments like this for at least three to five years, as the power of long-term compounding negates short-term price swings that can accompany relatively high valuations.

Wall Street analysts have a consensus one-year price target of $49.67 on the company (compared to the current share price of $45.86).