PAR Technology (PAR)

PAR Technology piques our interest, but the state of its balance sheet makes us slightly uncomfortable.― StockStory Analyst Team

1. News

2. Summary

Why PAR Technology Is Not Exciting

Originally founded in 1968 as a defense contractor for the U.S. government, PAR Technology (NYSE:PAR) provides cloud-based software, payment processing, and hardware solutions that help restaurants manage everything from point-of-sale to customer loyalty programs.

- Persistent adjusted operating margin losses suggest the business manages its expenses poorly

- Cash-burning history makes us doubt the long-term viability of its business model

- 13× net-debt-to-EBITDA ratio makes lenders less willing to extend additional capital, potentially necessitating dilutive equity offerings

PAR Technology has some noteworthy aspects, but we wouldn’t invest until its EBITDA can comfortably support its debt.

Why There Are Better Opportunities Than PAR Technology

High Quality

Investable

Underperform

Why There Are Better Opportunities Than PAR Technology

At $16.29 per share, PAR Technology trades at 40.3x forward P/E. We consider this valuation aggressive considering the business fundamentals.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. PAR Technology (PAR) Research Report: Q4 CY2025 Update

Restaurant technology provider PAR Technology (NYSE:PAR) announced better-than-expected revenue in Q4 CY2025, with sales up 14.4% year on year to $120.1 million. Its non-GAAP profit of $0.06 per share was $0.03 above analysts’ consensus estimates.

PAR Technology (PAR) Q4 CY2025 Highlights:

- Revenue: $120.1 million vs analyst estimates of $115.2 million (14.4% year-on-year growth, 4.3% beat)

- Adjusted EPS: $0.06 vs analyst estimates of $0.03 ($0.03 beat)

- Adjusted EBITDA: $7.05 million vs analyst estimates of $7.34 million (5.9% margin, 4% miss)

- Operating Margin: -15%, in line with the same quarter last year

- Annual Recurring Revenue: $315.4 million vs analyst estimates of $315.8 million (15.7% year-on-year growth, in line)

- Market Capitalization: $843.5 million

Company Overview

Originally founded in 1968 as a defense contractor for the U.S. government, PAR Technology (NYSE:PAR) provides cloud-based software, payment processing, and hardware solutions that help restaurants manage everything from point-of-sale to customer loyalty programs.

PAR Technology operates through two distinct business segments: Restaurant/Retail and Government. The Restaurant/Retail segment, which represents the company's primary focus, offers an integrated suite of technology solutions designed to streamline restaurant operations.

The company's software portfolio includes Brink POS (point-of-sale system), Punchh (customer loyalty and engagement platform), MENU (digital ordering platform), Data Central (back-office management), and PAR Payment Services (payment processing). These solutions work together to help restaurants handle everything from taking orders and processing payments to managing inventory and analyzing customer data.

For example, a fast-food chain might use PAR's Brink POS system to process orders at the counter, while simultaneously employing the Punchh platform to send personalized promotions to frequent customers via a mobile app. Meanwhile, managers could use Data Central to track food costs and employee scheduling across multiple locations.

On the hardware side, PAR offers durable point-of-sale terminals, tablets, wireless headsets for drive-thru operations, kitchen display systems, and other restaurant peripherals designed to withstand the demanding environment of food service establishments.

The company generates revenue through software subscriptions, hardware sales, payment processing fees, and professional services including installation, training, and technical support. PAR's solutions are used by more than 700 restaurant customers across 70,000+ locations, including major brands like McDonald's and Yum! Brands.

The Government segment provides technical expertise and systems solutions to the U.S. Department of Defense and intelligence agencies, including satellite communications support, intelligence surveillance systems, and mission-critical IT services.

4. Specialized Technology

Companies in this sector, especially if they invest wisely, could see demand tailwinds as the world moves towards more IoT (Internet of Things), automation, and analytics. Enterprises across most industries will balk at taking these journeys solo and will enlist companies with expertise and scale in these areas. However, headwinds could include rising competition from larger technology firms, as digitization lowers barriers to entry in the space. Additionally, companies in the space will likely face evolving regulatory scrutiny over data privacy, particularly for surveillance and security technologies. This could make companies have to continually pivot and invest.

PAR Technology competes with other restaurant technology providers such as Toast (NYSE:TOST), NCR Voyix (NYSE:VYX), Oracle (NYSE:ORCL), and Square (NYSE:SQ), as well as specialized loyalty and ordering platforms like Olo (NYSE:OLO).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $455.5 million in revenue over the past 12 months, PAR Technology is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

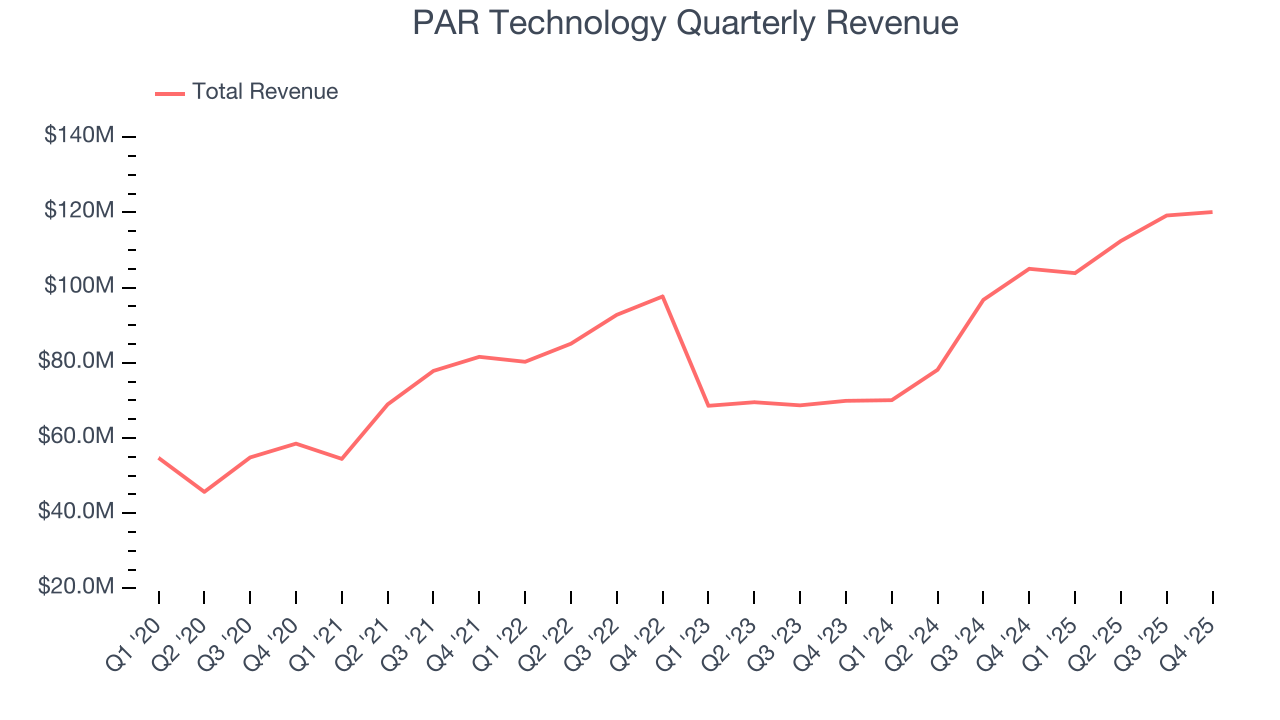

As you can see below, PAR Technology’s 16.3% annualized revenue growth over the last five years was incredible. This shows it had high demand, a useful starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. PAR Technology’s annualized revenue growth of 28.3% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

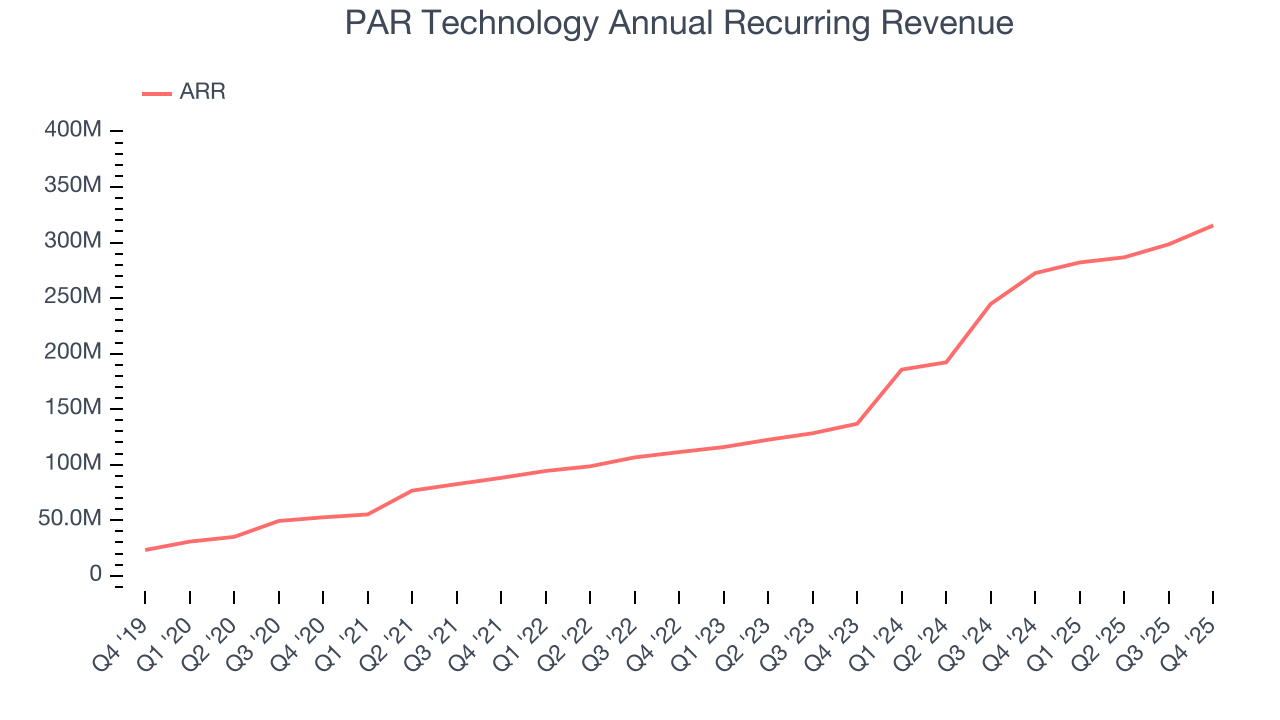

We can dig further into the company’s sales dynamics by analyzing its annual recurring revenue (ARR), or the predictable, normalized yearly income from subscriptions and contracts.PAR Technology’s ARR reached $315.4 million in the latest quarter and averaged 55.7% year-on-year growth over the last two years. Because this number is better than its normal revenue growth, we can see the company’s proportion of recurring revenue from long-term contracts and subscriptions has increased. This implies more stability in its business model and revenue streams.

This quarter, PAR Technology reported year-on-year revenue growth of 14.4%, and its $120.1 million of revenue exceeded Wall Street’s estimates by 4.3%.

Looking ahead, sell-side analysts expect revenue to grow 10.1% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is noteworthy and suggests the market is baking in success for its products and services.

6. Operating Margin

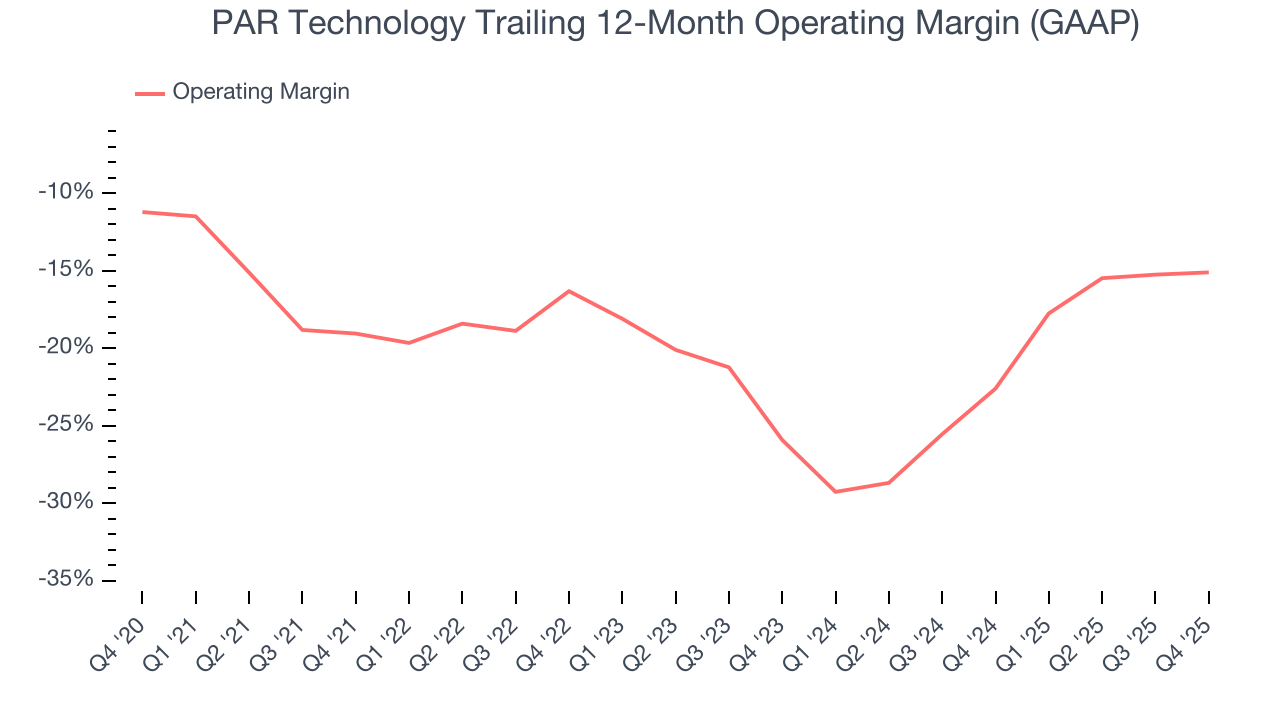

PAR Technology’s high expenses have contributed to an average operating margin of negative 19.3% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, PAR Technology’s operating margin rose by 4 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

In Q4, PAR Technology generated a negative 15% operating margin.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

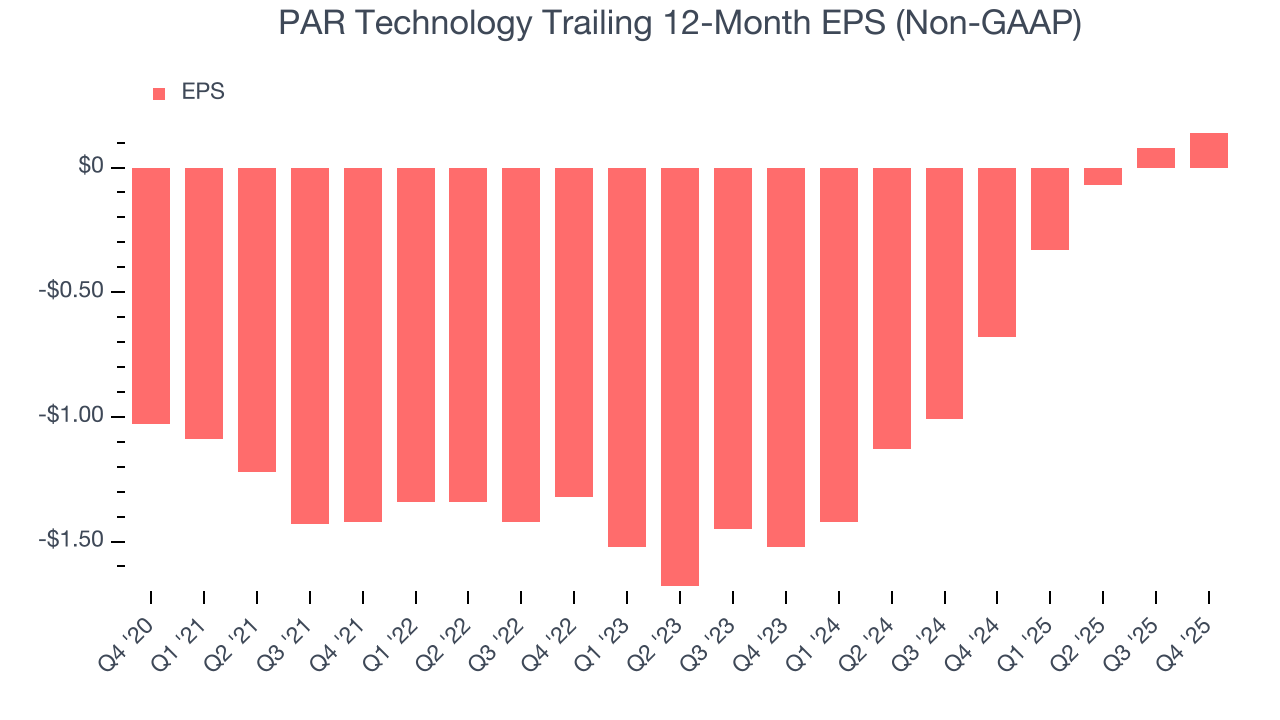

PAR Technology’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For PAR Technology, its two-year annual EPS growth of 44.6% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, PAR Technology reported adjusted EPS of $0.06, up from $0 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects PAR Technology’s full-year EPS of $0.14 to grow 331%.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

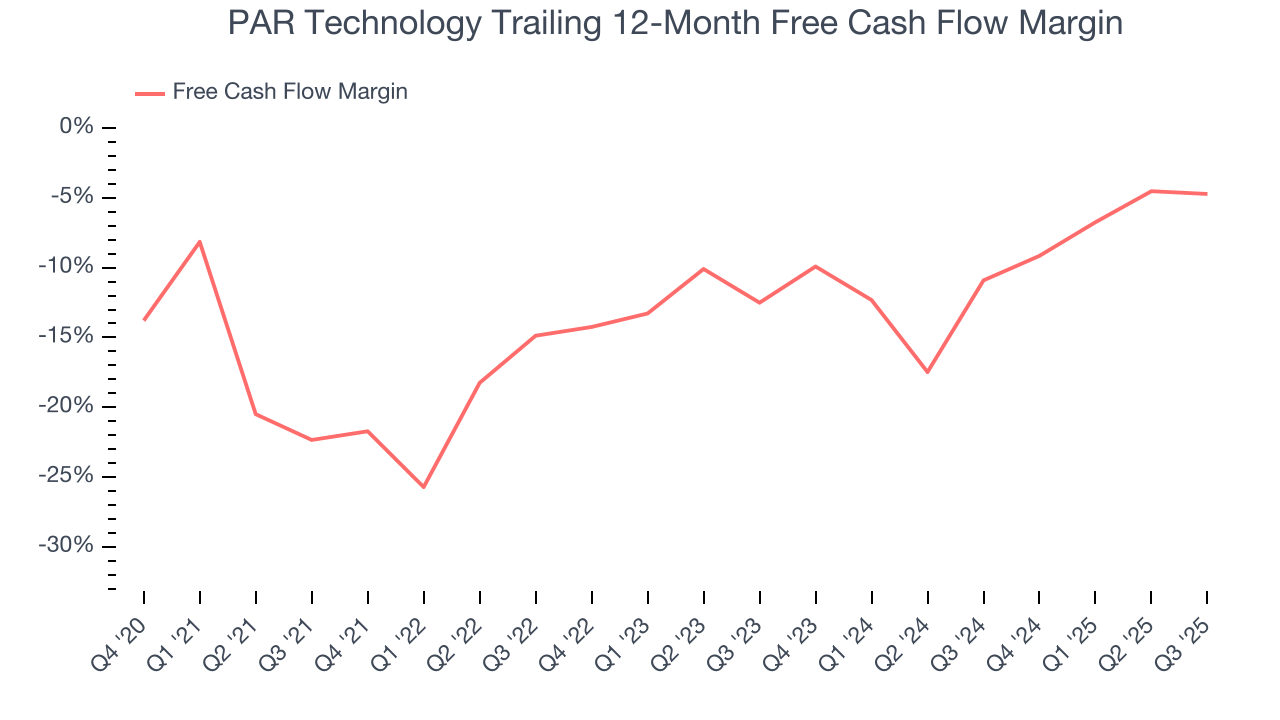

PAR Technology’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 12.1%, meaning it lit $12.10 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that PAR Technology’s margin expanded by 18.2 percentage points during that time. In light of its glaring cash burn, however, this improvement is a bucket of hot water in a cold ocean.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

PAR Technology’s five-year average ROIC was negative 8.7%, meaning management lost money while trying to expand the business. Its returns were among the worst in the business services sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, PAR Technology’s ROIC averaged 2.1 percentage point increases each year over the last few years. This is a good sign, and if its returns keep rising, there’s a chance it could evolve into an investable business.

10. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

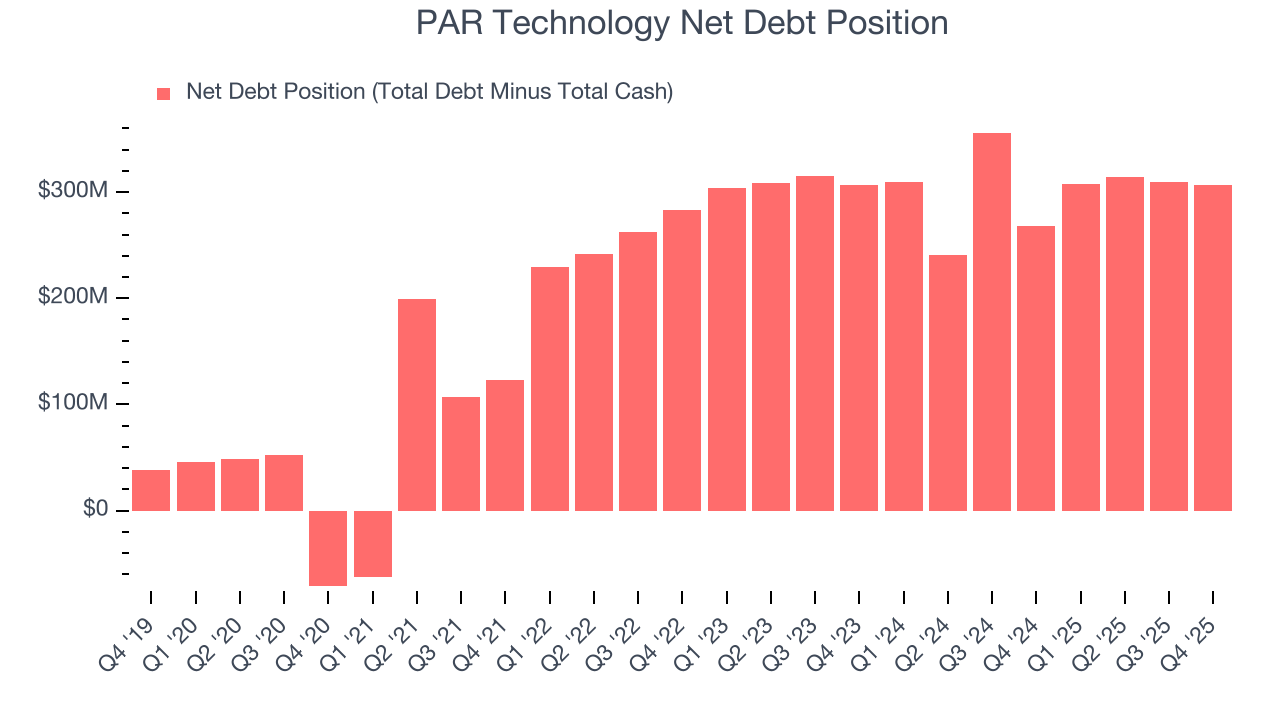

PAR Technology’s $400.5 million of debt exceeds the $93.69 million of cash on its balance sheet. Furthermore, its 13× net-debt-to-EBITDA ratio (based on its EBITDA of $22.97 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. PAR Technology could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope PAR Technology can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

11. Key Takeaways from PAR Technology’s Q4 Results

It was good to see PAR Technology beat analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The market seemed to be hoping for more, and the stock traded down 5.7% to $21.18 immediately after reporting.

12. Is Now The Time To Buy PAR Technology?

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own PAR Technology, you should also grasp the company’s longer-term business quality and valuation.

PAR Technology is a pretty good company if you ignore its balance sheet. For starters, its revenue growth was exceptional over the last five years. And while its relatively low ROIC suggests management has struggled to find compelling investment opportunities, its ARR growth has been marvelous. On top of that, PAR Technology’s rising cash profitability gives it more optionality.

PAR Technology’s P/E ratio based on the next 12 months is 37.2x. Despite its notable business characteristics, we’d hold off for now because its balance sheet concerns us. We think a potential buyer of the stock should wait until the company’s debt falls or its profits increase.

Wall Street analysts have a consensus one-year price target of $59.11 on the company (compared to the current share price of $21.18).