Northern Trust (NTRS)

We’re skeptical of Northern Trust. Its sluggish sales growth shows demand is soft, a worrisome sign for investors in high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why Northern Trust Is Not Exciting

Founded in 1889 during Chicago's post-Great Fire rebuilding boom, Northern Trust (NASDAQ:NTRS) provides wealth management, asset servicing, and banking solutions to corporations, institutions, families, and high-net-worth individuals globally.

- Earnings growth underperformed the sector average over the last five years as its EPS grew by just 6.6% annually

- Annual revenue growth of 5.2% over the last five years was below our standards for the financials sector

- The good news is that its adequate return on equity shows management makes decent investment decisions

Northern Trust fails to meet our quality criteria. There are more promising alternatives.

Why There Are Better Opportunities Than Northern Trust

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Northern Trust

Northern Trust is trading at $144.09 per share, or 15.2x forward P/E. This multiple is lower than most financials companies, but for good reason.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Northern Trust (NTRS) Research Report: Q4 CY2025 Update

Financial services company Northern Trust (NASDAQ:NTRS) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 8.4% year on year to $2.14 billion. Its GAAP profit of $2.42 per share was 2.8% above analysts’ consensus estimates.

Northern Trust (NTRS) Q4 CY2025 Highlights:

- Assets Under Management: $1.80 trillion vs analyst estimates of $1.80 trillion (12% year-on-year growth, in line)

- Revenue: $2.14 billion vs analyst estimates of $2.06 billion (8.4% year-on-year growth, 3.5% beat)

- Pre-tax Profit: $646.5 million (30.3% margin)

- EPS (GAAP): $2.42 vs analyst estimates of $2.35 (2.8% beat)

- Market Capitalization: $27.31 billion

Company Overview

Founded in 1889 during Chicago's post-Great Fire rebuilding boom, Northern Trust (NASDAQ:NTRS) provides wealth management, asset servicing, and banking solutions to corporations, institutions, families, and high-net-worth individuals globally.

Northern Trust operates through two primary business segments: Asset Servicing and Wealth Management. The Asset Servicing division caters to institutional clients like retirement funds, foundations, and sovereign wealth funds, offering custody services, fund administration, investment operations outsourcing, and treasury management. For example, a large corporate pension fund might use Northern Trust to safeguard its assets, handle transaction settlements, and provide performance reporting.

The Wealth Management segment focuses on affluent individuals, families, and privately-held businesses, delivering trust services, investment management, estate administration, and private banking. A typical client might be a business owner looking to transfer wealth to the next generation while minimizing tax implications.

Supporting both segments is the company's Asset Management business, which develops and manages investment products ranging from equity and fixed income strategies to alternative investments like private equity funds. Northern Trust generates revenue primarily through fees based on assets under management or custody, supplemented by interest income from its banking activities and foreign exchange services.

With offices across 22 countries spanning North America, Europe, the Middle East, and Asia-Pacific, Northern Trust maintains a global footprint while operating under various regulatory frameworks. The company's banking subsidiary, The Northern Trust Company, is an Illinois banking corporation that serves as the principal vehicle for delivering many of its services, including accepting deposits and making loans to clients.

4. Custody Bank

Custody banks safeguard financial assets and provide services like settlement, accounting, and regulatory compliance for institutional investors. Growth opportunities stem from increasing global assets under custody, demand for data analytics, and blockchain technology adoption for settlement efficiency. Challenges include fee pressure from large clients, substantial technology investment requirements, and competition from both traditional players and fintech firms entering the space.

Northern Trust competes with other major custody banks and wealth managers including State Street (NYSE:STT), Bank of New York Mellon (NYSE:BK), and JPMorgan Chase (NYSE:JPM) in institutional services, while facing competition from firms like Morgan Stanley (NYSE:MS) and Goldman Sachs (NYSE:GS) in wealth management.

5. Revenue Growth

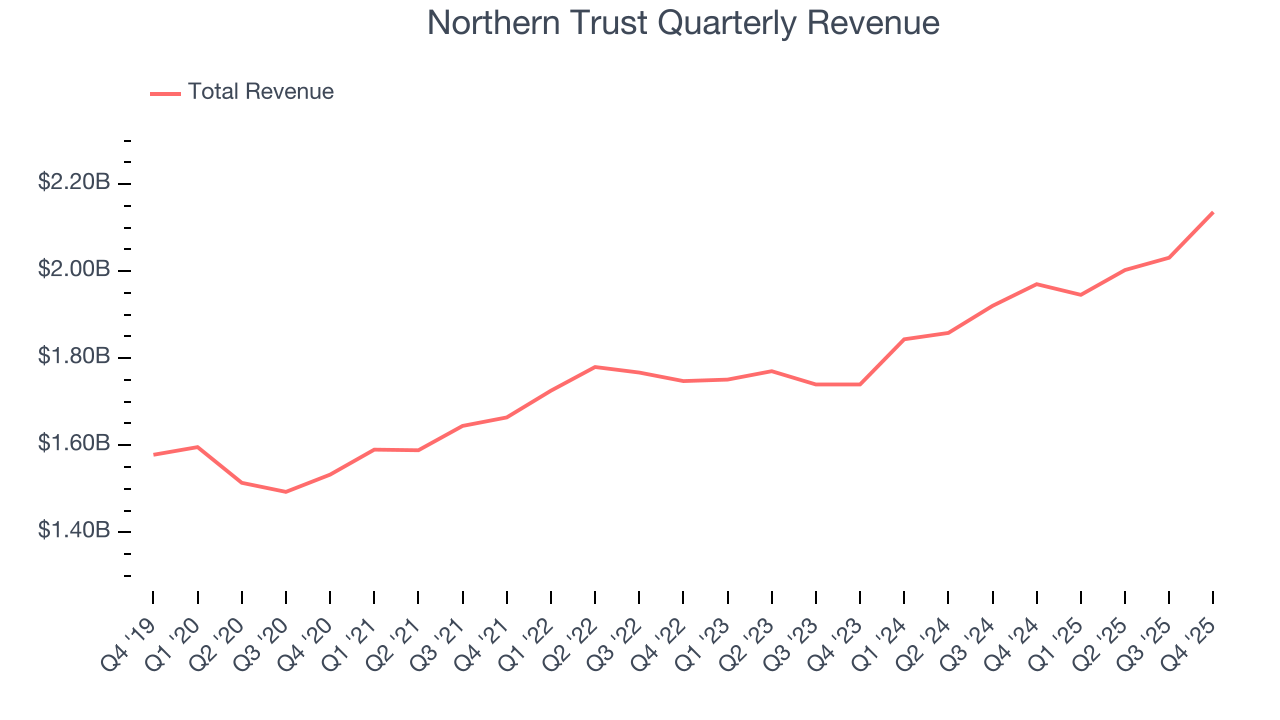

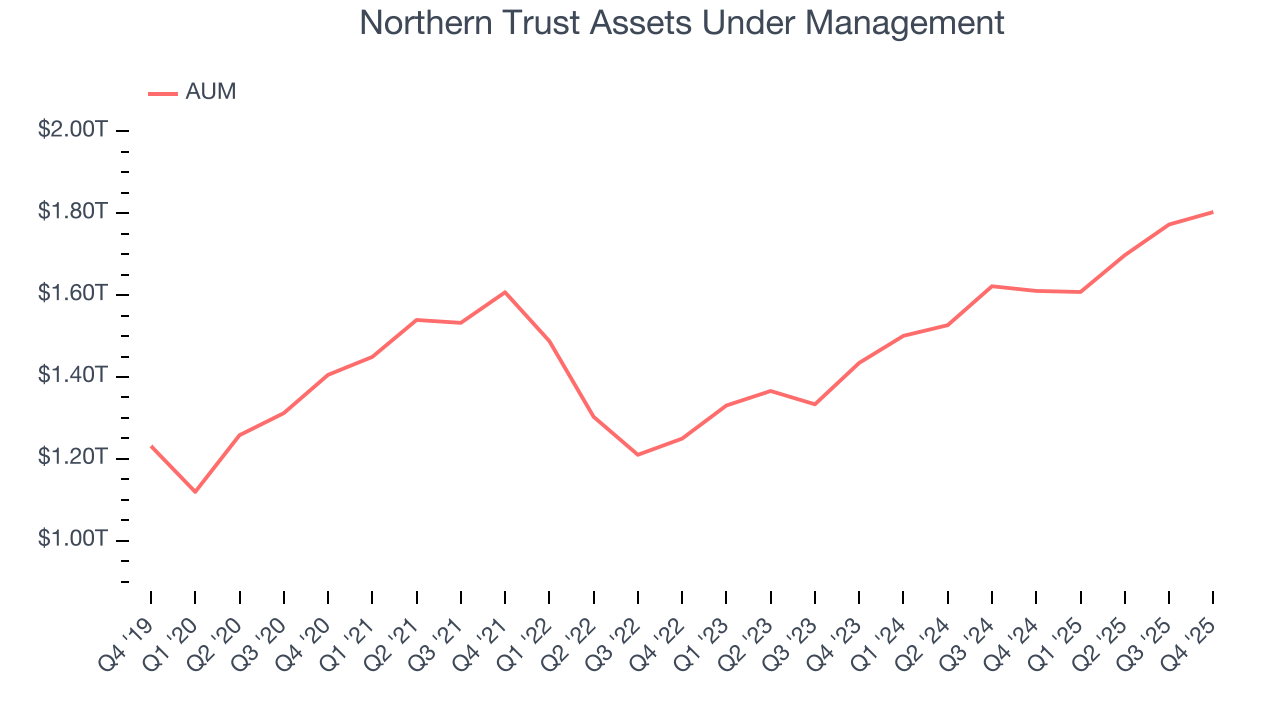

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Northern Trust’s 5.8% annualized revenue growth over the last five years was tepid. This was below our standard for the financials sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Northern Trust’s annualized revenue growth of 7.7% over the last two years is above its five-year trend, suggesting some bright spots.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Northern Trust reported year-on-year revenue growth of 8.4%, and its $2.14 billion of revenue exceeded Wall Street’s estimates by 3.5%.

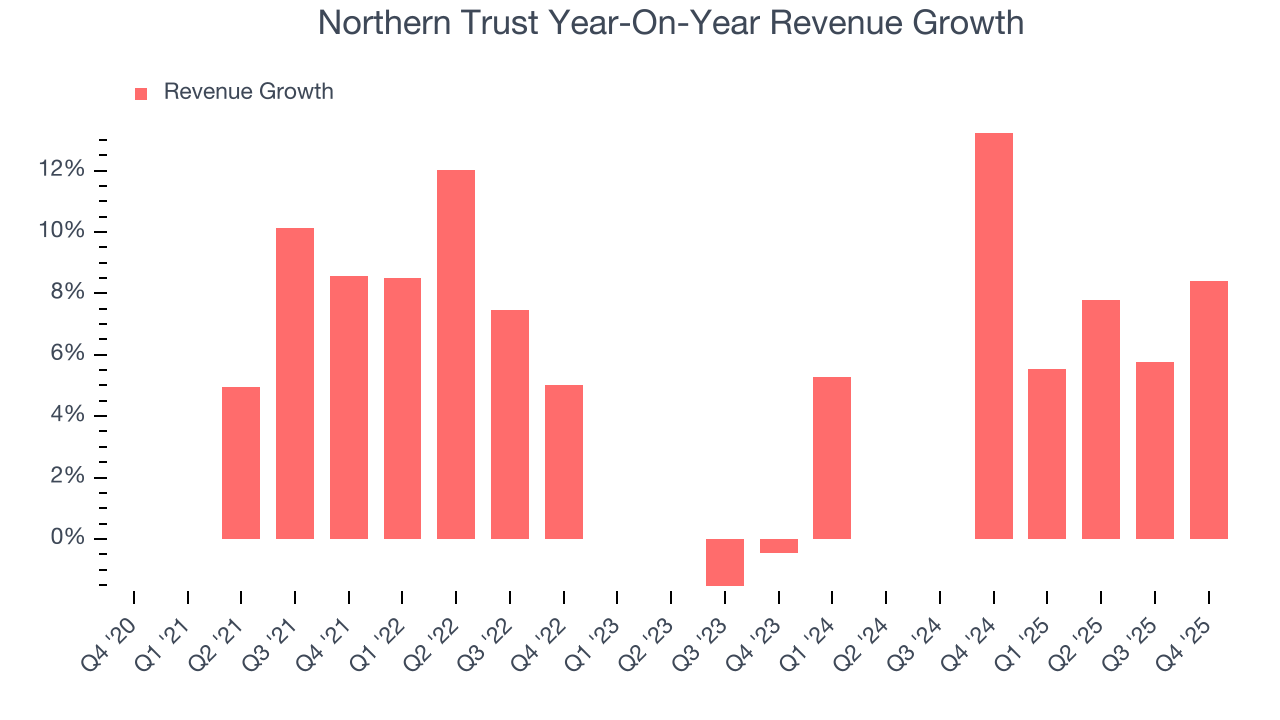

6. Assets Under Management (AUM)

Assets Under Management (AUM) is the cornerstone of a financial firm's investment division, representing all client capital under its stewardship. Management fees on this AUM create reliable, recurring revenue that maintains stability even when investment performance struggles, though prolonged poor returns can eventually affect asset retention and growth.

Northern Trust’s AUM has grown at an annual rate of 6.2% over the last five years, slightly worse than the broader financials industry and mirrored its total revenue. When analyzing Northern Trust’s AUM over the last two years, we can see that growth accelerated to 12.2% annually. Fundraising or short-term investment performance were net contributors for the company over this shorter period since assets grew faster than total revenue. But again, we put less weight on asset growth given how lumpy and cyclical it can be.

Northern Trust’s AUM punched in at $1.80 trillion this quarter, meeting analysts’ expectations. This print was 12% higher than the same quarter last year.

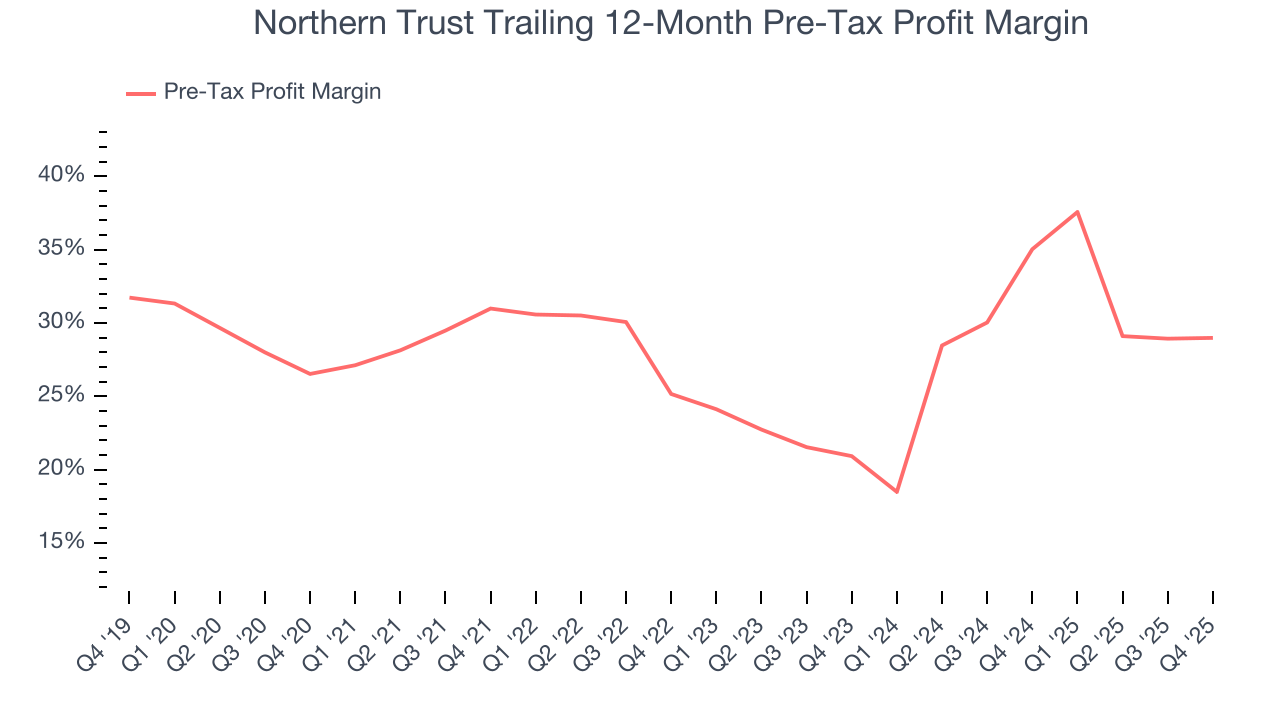

7. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Custody Bank companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

Interest income and expenses play a big role in financial institutions' profitability, so they should be factored into the definition of profit. Taxes, however, should not as they are largely out of a company's control. This is pre-tax profit by definition.

Over the last five years, Northern Trust’s pre-tax profit margin has fallen by 2.5 percentage points, going from 31% to 29%. It has also expanded by 8.1 percentage points on a two-year basis, showing its expenses have consistently grown at a slower rate than revenue. This typically signals prudent management.

In Q4, Northern Trust’s pre-tax profit margin was 30.3%. This result was in line with the same quarter last year.

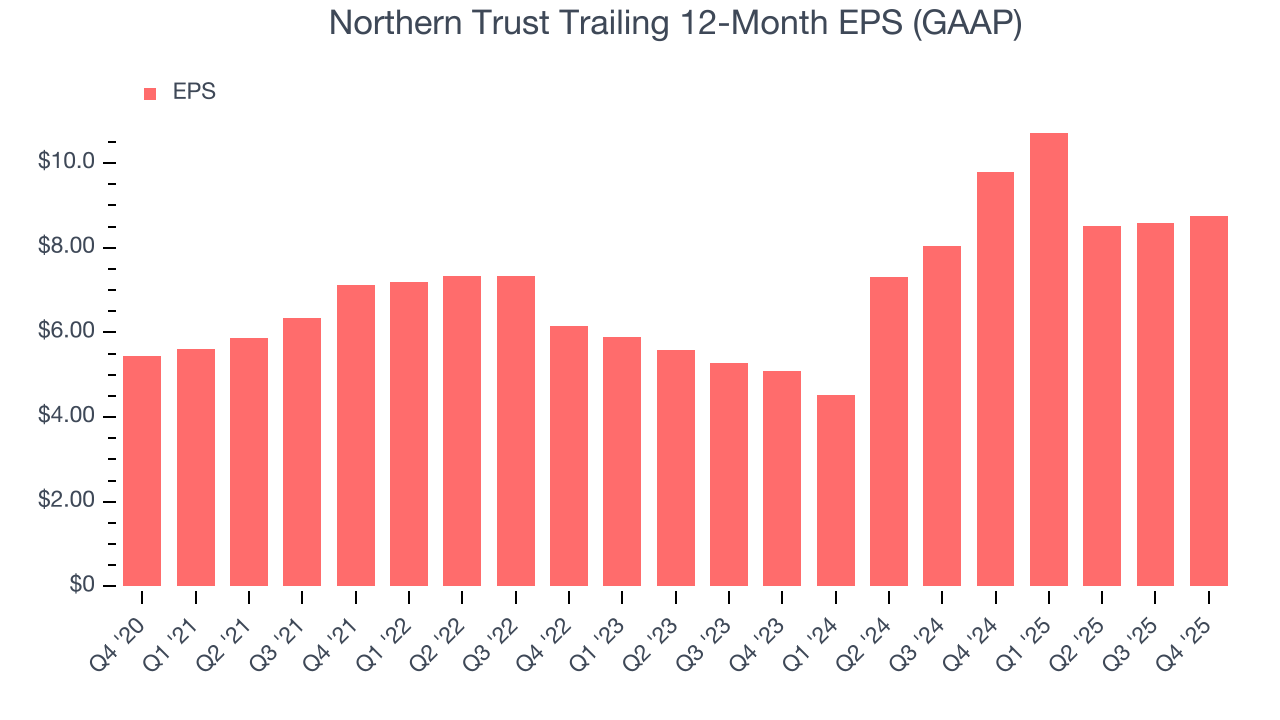

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Northern Trust’s EPS grew at an unimpressive 9.9% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 5.8% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Northern Trust, its two-year annual EPS growth of 31.2% was higher than its five-year trend. This acceleration made it one of the faster-growing financials companies in recent history.

In Q4, Northern Trust reported EPS of $2.42, up from $2.26 in the same quarter last year. This print beat analysts’ estimates by 2.8%. Over the next 12 months, Wall Street expects Northern Trust’s full-year EPS of $8.74 to grow 9.3%.

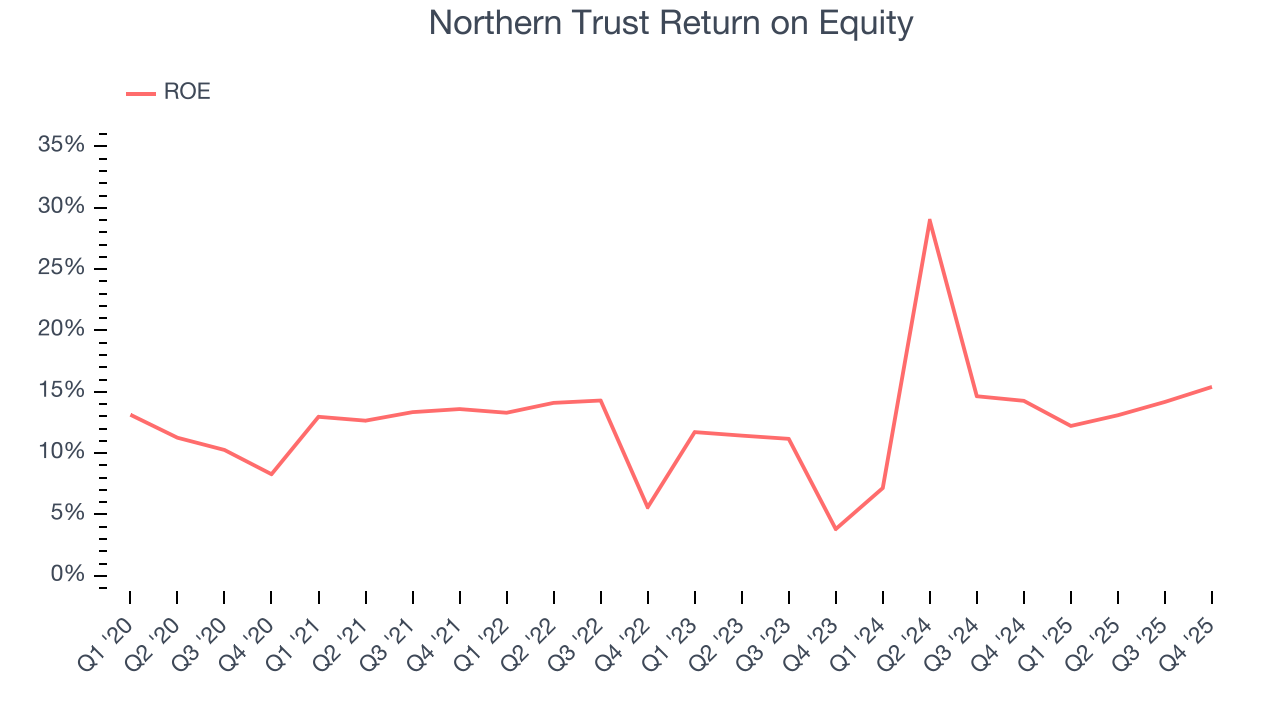

9. Return on Equity

Return on equity (ROE) measures how effectively banks generate profit from each dollar of shareholder equity - a critical funding source. High-ROE institutions typically compound shareholder wealth faster over time through retained earnings, share repurchases, and dividend payments.

Over the last five years, Northern Trust has averaged an ROE of 12.9%, respectable for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired.

10. Balance Sheet Assessment

Leverage is core to a financial firm’s business model (loans funded by deposits). To ensure economic stability and avoid a repeat of the 2008 GFC, regulators require certain levels of capital and liquidity, focusing on the Tier 1 capital ratio.

Tier 1 capital is the highest-quality capital that a firm holds, consisting primarily of common stock and retained earnings, but also physical gold. It serves as the primary cushion against losses and is the first line of defense in times of financial distress.

This capital is divided by risk-weighted assets to derive the Tier 1 capital ratio. Risk-weighted means that cash and US treasury securities are assigned little risk while unsecured consumer loans and equity investments get much higher risk weights, for example.

New regulation after the 2008 financial crisis requires that all firms must maintain a Tier 1 capital ratio greater than 4.5%. On top of this, there are additional buffers based on scale, risk profile, and other regulatory classifications, so that at the end of the day, firms generally must maintain a 7-10% ratio at minimum.

Over the last two years, Northern Trust has averaged a Tier 1 capital ratio of 14.5%, which is considered safe and well capitalized in the event that macro or market conditions suddenly deteriorate.

11. Key Takeaways from Northern Trust’s Q4 Results

It was encouraging to see Northern Trust beat analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock remained flat at $144.09 immediately after reporting.

12. Is Now The Time To Buy Northern Trust?

Updated: January 22, 2026 at 7:39 AM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Northern Trust.

Northern Trust has a few positive attributes, but it doesn’t top our wishlist. Although its revenue growth was uninspiring over the last five years and analysts expect growth to slow over the next 12 months, its expanding pre-tax profit margin shows the business has become more efficient. And while its AUM growth was mediocre over the last five years, its above-average ROE suggests its management team has made good investment decisions.

Northern Trust’s P/E ratio based on the next 12 months is 15.1x. This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $143.39 on the company (compared to the current share price of $144.09).