OSI Systems (OSIS)

Not many stocks excite us like OSI Systems. Its revenue and EPS are soaring, showing it can grow quickly and become more profitable as it scales.― StockStory Analyst Team

1. News

2. Summary

Why We Like OSI Systems

With security scanners deployed at airports and borders worldwide and patient monitors used in hospitals across the globe, OSI Systems (NASDAQ:OSIS) designs and manufactures specialized electronic systems for security screening, patient monitoring, and optoelectronic applications.

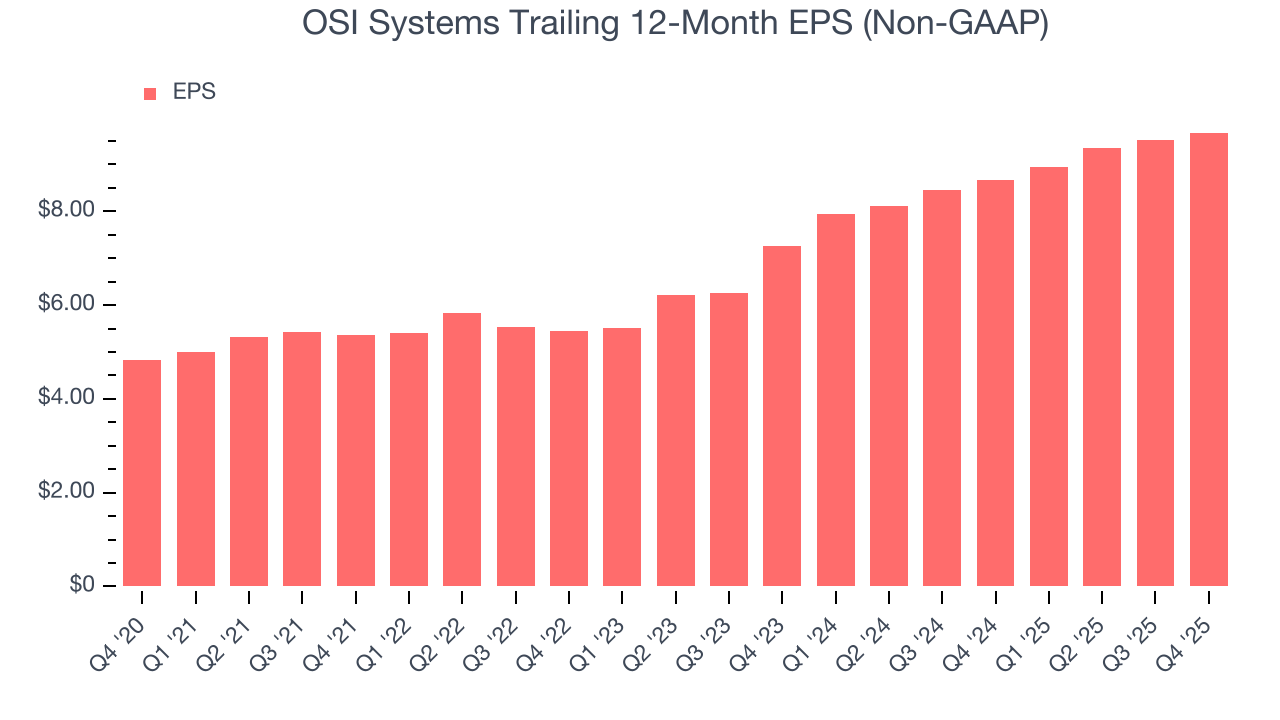

- Performance over the past five years shows its incremental sales were extremely profitable, as its annual earnings per share growth of 14.9% outpaced its revenue gains

- Market share has increased this cycle as its 14.7% annual revenue growth over the last two years was exceptional

- Adjusted operating margin of 13% shows it’s one of the more profitable companies in the business services space

OSI Systems is a remarkable business. The price looks fair relative to its quality, and we think now is the time to buy the stock.

Why Is Now The Time To Buy OSI Systems?

High Quality

Investable

Underperform

Why Is Now The Time To Buy OSI Systems?

OSI Systems’s stock price of $269.39 implies a valuation ratio of 25.1x forward P/E. Many business services names may carry a lower valuation multiple, but OSI Systems’s price is fair given its business quality.

Our analysis and backtests consistently tell us that buying high-quality companies and holding them for many years leads to market outperformance. Over the long term, entry price doesn’t matter nearly as much as business fundamentals.

3. OSI Systems (OSIS) Research Report: Q4 CY2025 Update

Security and healthcare technology company OSI Systems (NASDAQ:OSIS) missed Wall Street’s revenue expectations in Q4 CY2025, with sales flat year on year at $419.8 million. Its non-GAAP profit of $2.58 per share was 2.3% above analysts’ consensus estimates.

OSI Systems (OSIS) Q4 CY2025 Highlights:

- Revenue: $419.8 million vs analyst estimates of $453.1 million (flat year on year, 7.3% miss)

- Adjusted EPS: $2.58 vs analyst estimates of $2.52 (2.3% beat)

- Management slightly raised its full-year Adjusted EPS guidance to $10.43 at the midpoint

- Operating Margin: 13.8%, in line with the same quarter last year

- Market Capitalization: $4.61 billion

Company Overview

With security scanners deployed at airports and borders worldwide and patient monitors used in hospitals across the globe, OSI Systems (NASDAQ:OSIS) designs and manufactures specialized electronic systems for security screening, patient monitoring, and optoelectronic applications.

OSI Systems operates through three distinct divisions that serve critical infrastructure and healthcare needs. The Security division, marketed under the Rapiscan brand, produces X-ray machines, metal detectors, and explosive trace detection systems used to screen baggage, cargo, vehicles, and people. These systems help prevent terrorism, smuggling, and other criminal activities at airports, border crossings, seaports, and high-profile venues. The company also offers turnkey security screening services where it not only provides equipment but also staffs and operates security checkpoints.

The Healthcare division, operating under the Spacelabs Healthcare brand, manufactures patient monitoring systems used in hospital critical care, emergency, and perioperative settings. These systems track vital signs and alert medical staff to changes in patient condition. The division also produces cardiology equipment like Holter monitors for tracking heart activity and ambulatory blood pressure monitors. Their Sentinel system integrates data from various medical devices into a central database accessible throughout a healthcare facility.

The Optoelectronics and Manufacturing division serves as both an internal supplier to OSI's other divisions and an external provider to OEM customers. This division produces components that convert light into electrical signals, used in applications ranging from medical imaging to aerospace navigation systems. A hospital might use OSI's patient monitors containing optoelectronic sensors to measure oxygen saturation in a patient's blood, while a border security agency might deploy the company's X-ray scanning systems containing similar components to inspect shipping containers.

OSI Systems maintains manufacturing facilities across the United States as well as in Germany, Malaysia, Mexico, India, Indonesia, and the United Kingdom. This global footprint allows the company to serve customers worldwide while strategically locating labor-intensive manufacturing in regions with cost advantages.

4. Specialized Technology

Companies in this sector, especially if they invest wisely, could see demand tailwinds as the world moves towards more IoT (Internet of Things), automation, and analytics. Enterprises across most industries will balk at taking these journeys solo and will enlist companies with expertise and scale in these areas. However, headwinds could include rising competition from larger technology firms, as digitization lowers barriers to entry in the space. Additionally, companies in the space will likely face evolving regulatory scrutiny over data privacy, particularly for surveillance and security technologies. This could make companies have to continually pivot and invest.

OSI Systems' Security division competes with Smiths Group (LSE:SMIN), Leidos (NYSE:LDOS), and L3Harris Technologies (NYSE:LHX) in the security screening market. In healthcare monitoring, the company faces competition from Philips (NYSE:PHG), GE HealthCare (NASDAQ:GEHC), and Medtronic (NYSE:MDT). The Optoelectronics division competes with companies like TE Connectivity (NYSE:TEL) and Amphenol (NYSE:APH).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $1.75 billion in revenue over the past 12 months, OSI Systems is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

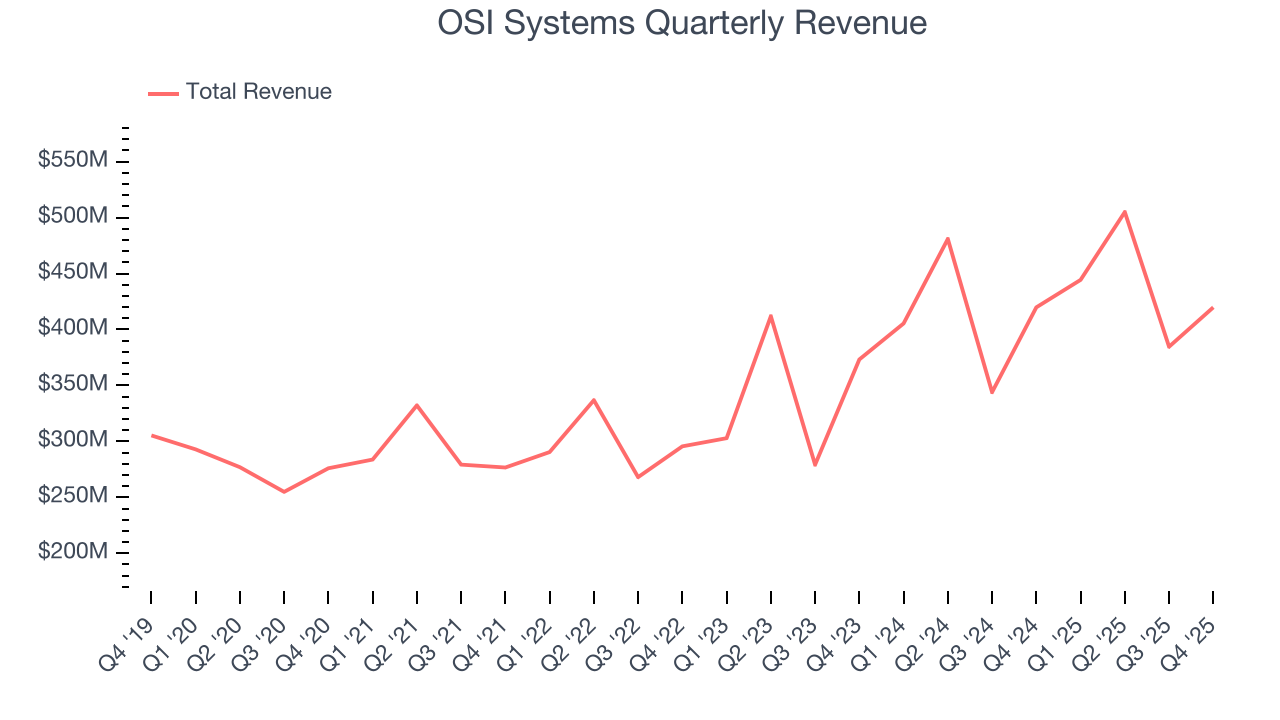

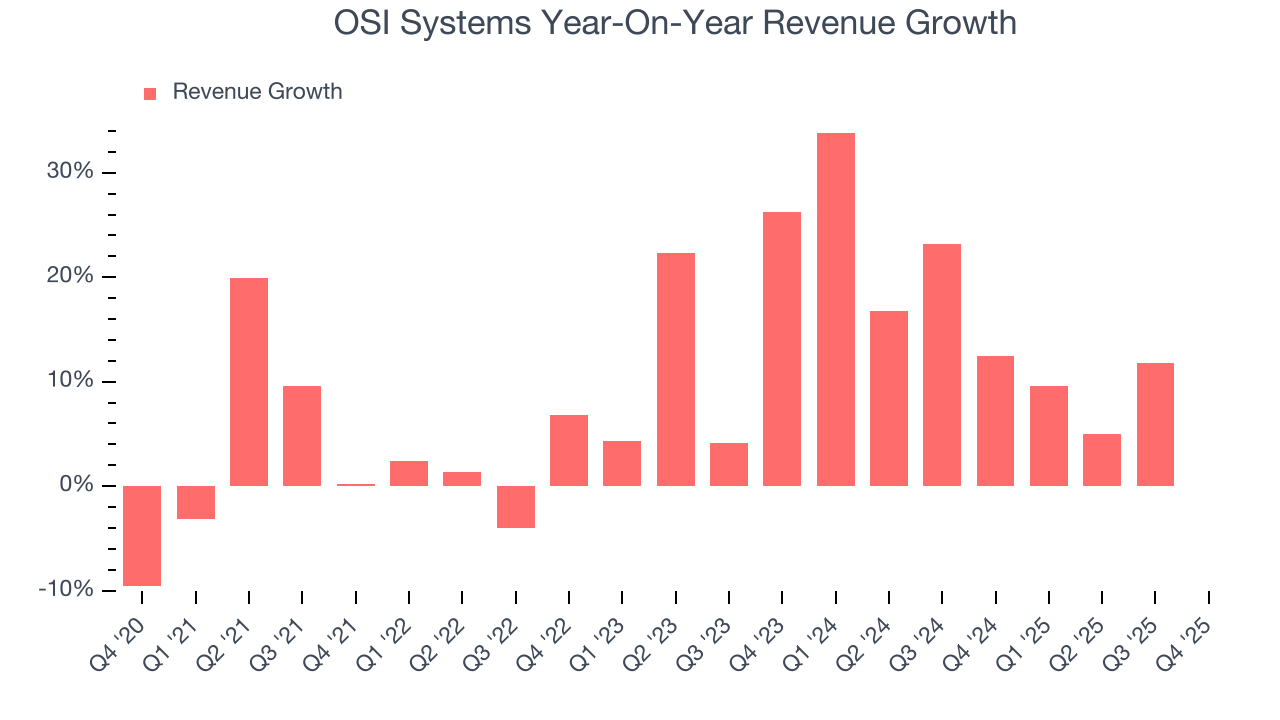

As you can see below, OSI Systems grew its sales at an impressive 9.8% compounded annual growth rate over the last five years. This is a great starting point for our analysis because it shows OSI Systems’s demand was higher than many business services companies.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. OSI Systems’s annualized revenue growth of 13.3% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

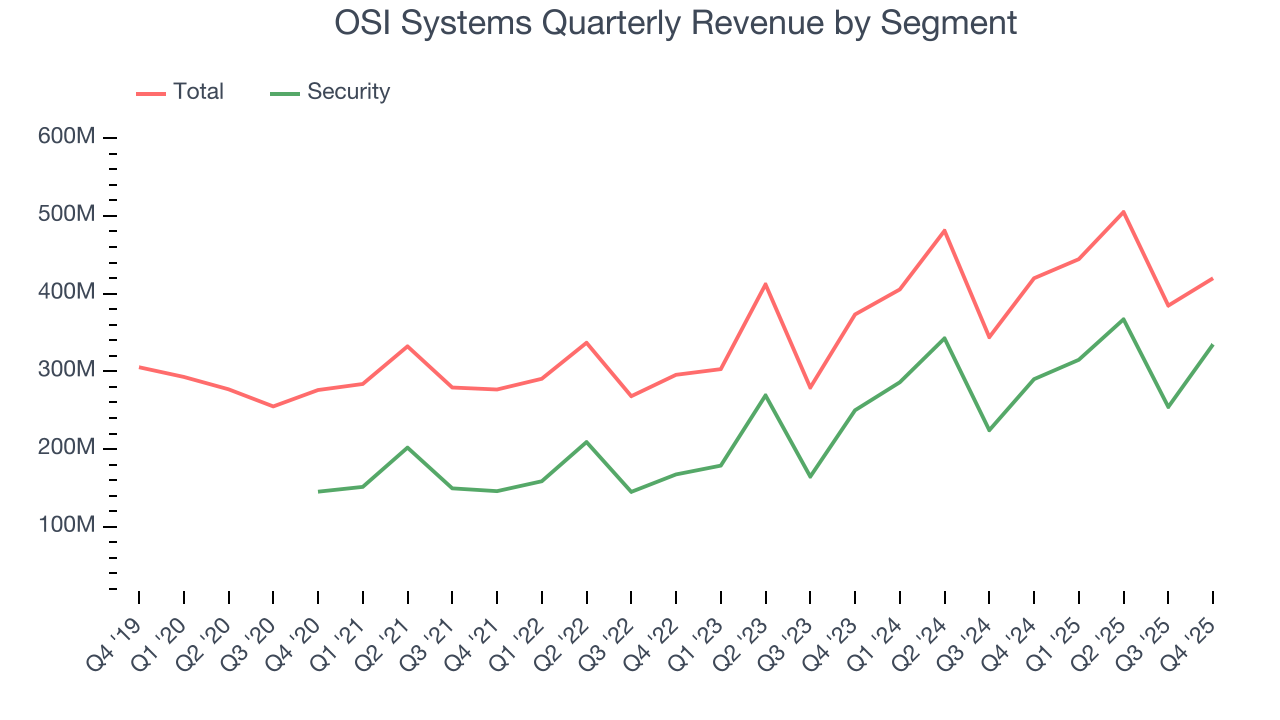

OSI Systems also breaks out the revenue for its most important segment, Security. Over the last two years, OSI Systems’s Security revenue (inspection systems) averaged 23.2% year-on-year growth. This segment has outperformed its total sales during the same period, lifting the company’s performance.

Looking ahead, sell-side analysts expect revenue to grow 7.6% over the next 12 months, a deceleration versus the last two years. Still, this projection is healthy and indicates the market is forecasting success for its products and services.

6. Operating Margin

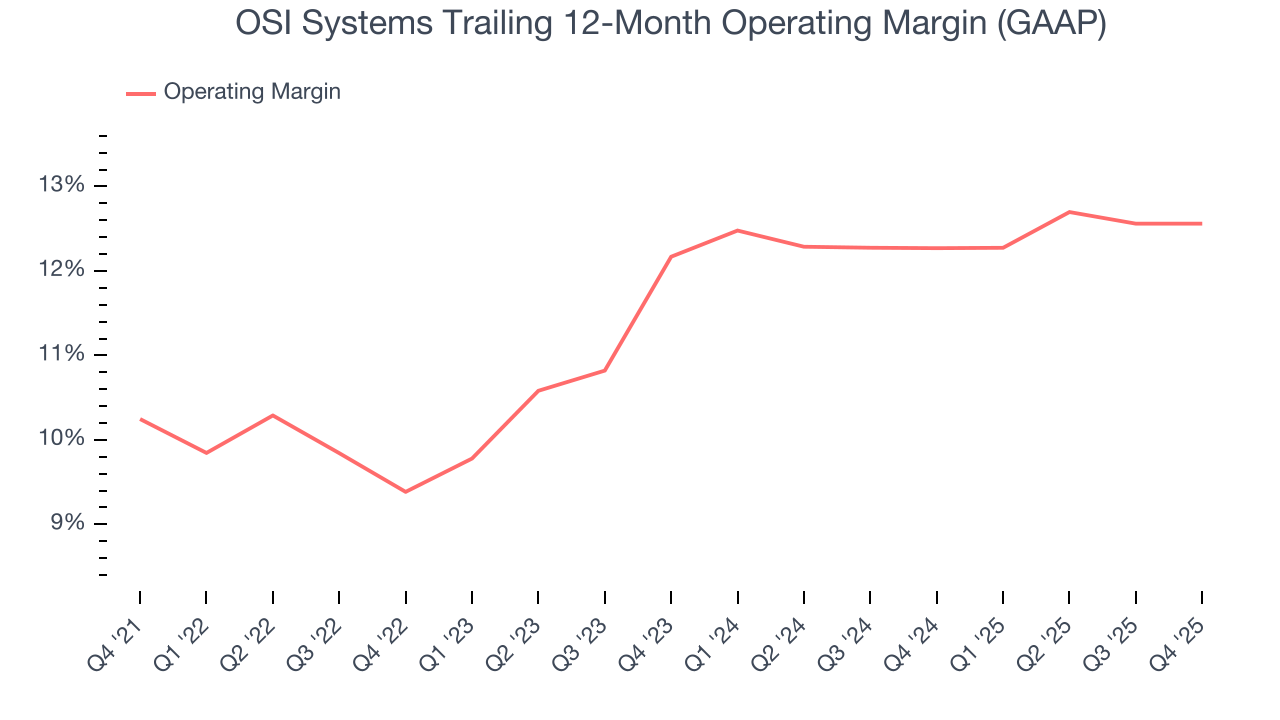

OSI Systems has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 11.5%, higher than the broader business services sector.

Analyzing the trend in its profitability, OSI Systems’s operating margin rose by 2.3 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, OSI Systems generated an operating margin profit margin of 13.8%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

OSI Systems’s EPS grew at a spectacular 14.9% compounded annual growth rate over the last five years, higher than its 9.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

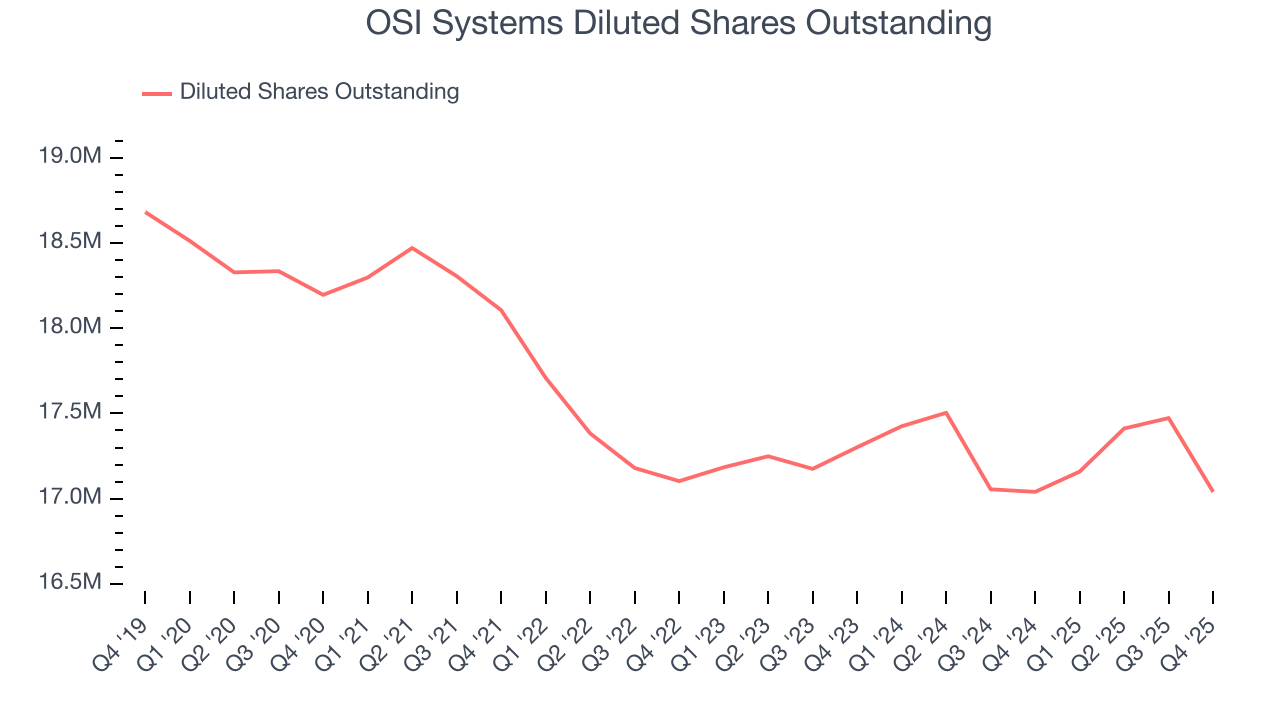

Diving into OSI Systems’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, OSI Systems’s operating margin was flat this quarter but expanded by 2.3 percentage points over the last five years. On top of that, its share count shrank by 6.4%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For OSI Systems, its two-year annual EPS growth of 15.4% is similar to its five-year trend, implying strong and stable earnings power.

In Q4, OSI Systems reported adjusted EPS of $2.58, up from $2.42 in the same quarter last year. This print beat analysts’ estimates by 2.3%. Over the next 12 months, Wall Street expects OSI Systems’s full-year EPS of $9.68 to grow 11.8%.

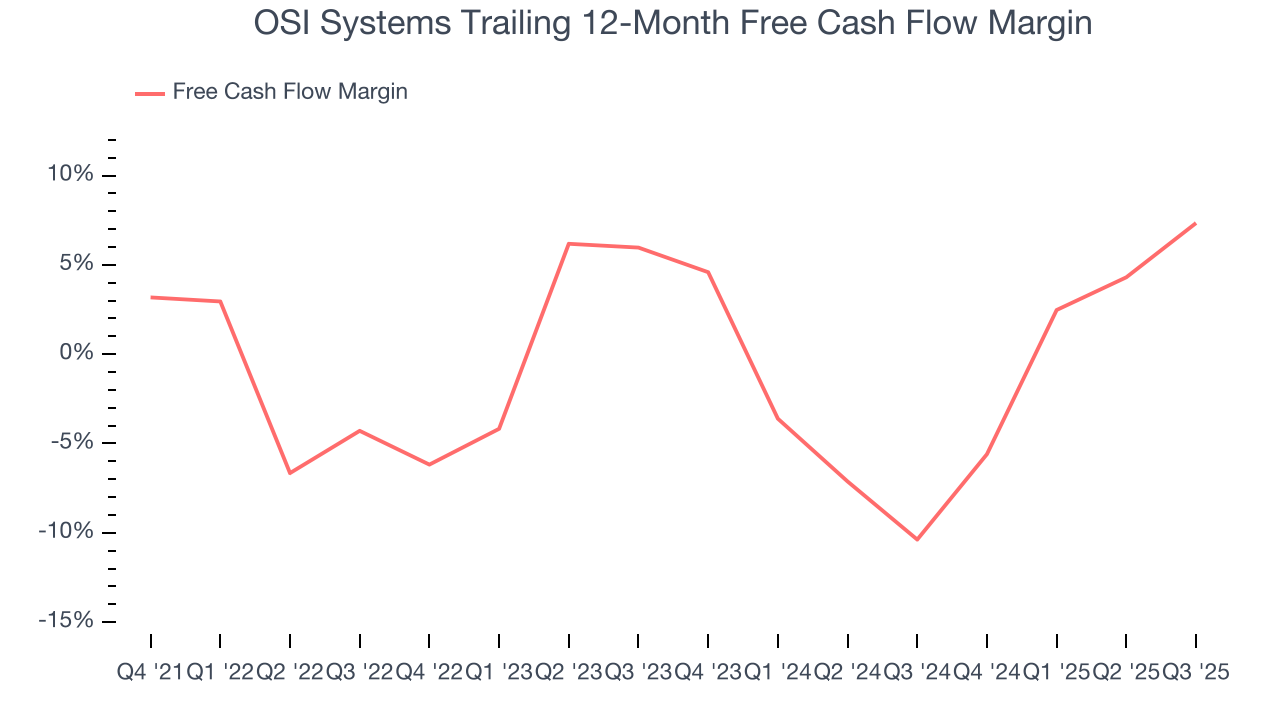

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

OSI Systems broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

Taking a step back, an encouraging sign is that OSI Systems’s margin expanded by 3.1 percentage points during that time. We have no doubt shareholders would like to continue seeing its cash conversion rise as it gives the company more optionality.

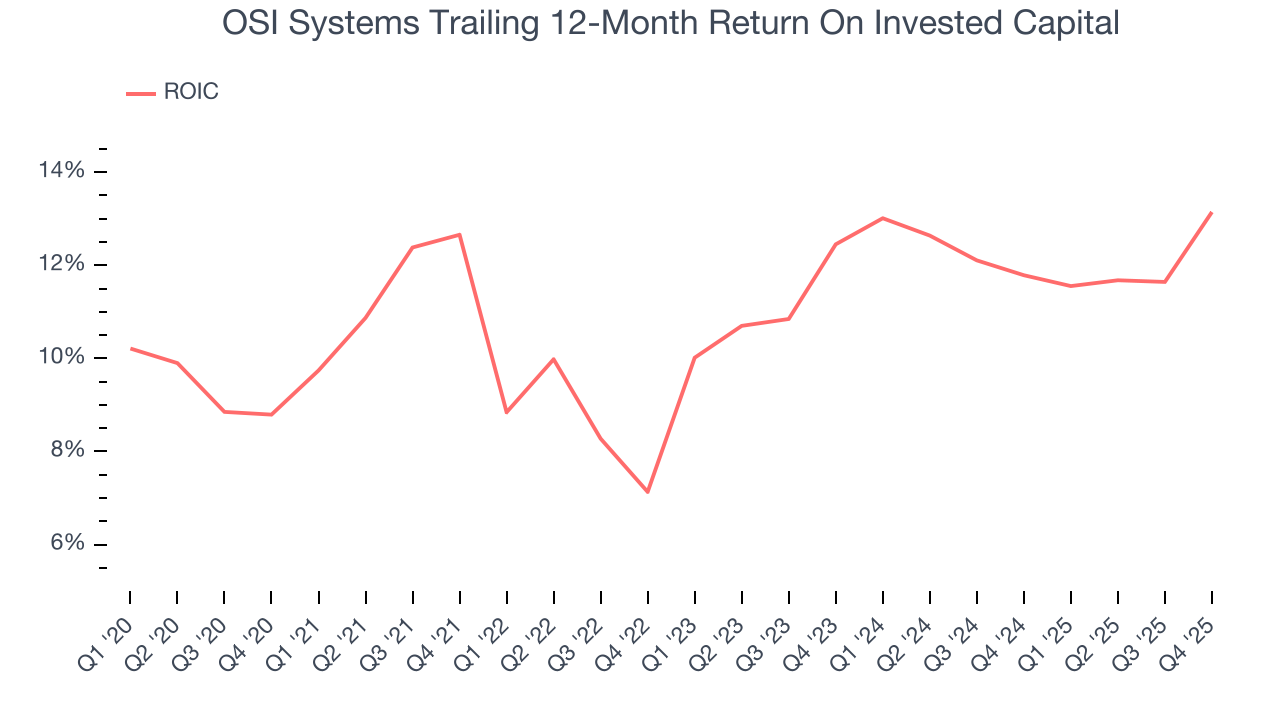

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

OSI Systems’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 11.4%, slightly better than typical business services business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, OSI Systems’s ROIC averaged 2.6 percentage point increases each year. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

10. Balance Sheet Assessment

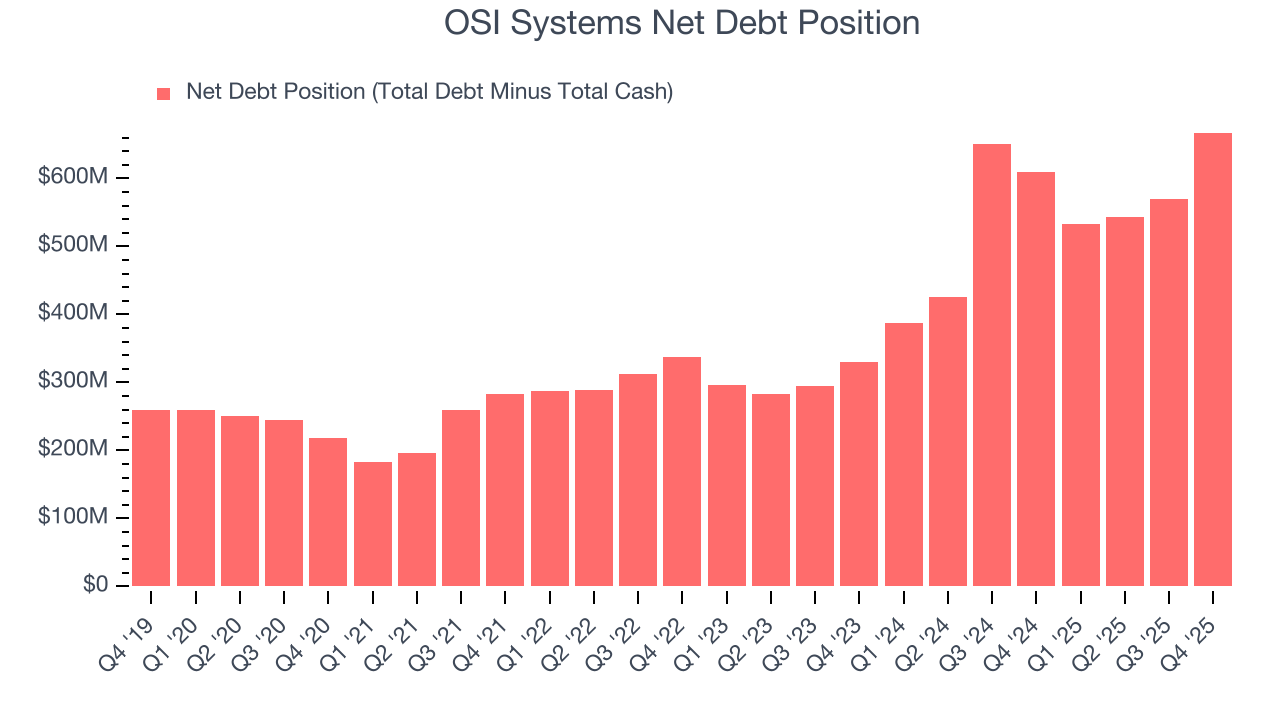

OSI Systems reported $336.7 million of cash and $1.00 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $292.8 million of EBITDA over the last 12 months, we view OSI Systems’s 2.3× net-debt-to-EBITDA ratio as safe. We also see its $31.47 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from OSI Systems’s Q4 Results

It was good to see OSI Systems beat analysts’ EPS expectations this quarter. On the other hand, its revenue missed by a wide margin. the company did, however, raise full-year EPS guidance. Overall, this was mixed. The stock remained flat at $269.39 immediately following the results.

12. Is Now The Time To Buy OSI Systems?

Updated: January 29, 2026 at 10:21 PM EST

Before deciding whether to buy OSI Systems or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

There is a lot to like about OSI Systems. For starters, its revenue growth was impressive over the last five years. And while its low free cash flow margins give it little breathing room, its spectacular EPS growth over the last five years shows its profits are trickling down to shareholders. Additionally, OSI Systems’s rising cash profitability gives it more optionality.

OSI Systems’s P/E ratio based on the next 12 months is 25.1x. Looking at the business services space today, OSI Systems’s qualities as one of the best businesses really stand out, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $295 on the company (compared to the current share price of $269.39), implying they see 9.5% upside in buying OSI Systems in the short term.