OSI Systems (OSIS)

OSI Systems is an amazing business. Its revenue is growing quickly while its profitability is rising, giving it multiple ways to win.― StockStory Analyst Team

1. News

2. Summary

Why We Like OSI Systems

With security scanners deployed at airports and borders worldwide and patient monitors used in hospitals across the globe, OSI Systems (NASDAQ:OSIS) designs and manufactures specialized electronic systems for security screening, patient monitoring, and optoelectronic applications.

- Incremental sales over the last five years have been highly profitable as its earnings per share increased by 14.9% annually, topping its revenue gains

- Annual revenue growth of 14.7% over the past two years was outstanding, reflecting market share gains this cycle

- Strict cost controls contribute to a sturdy adjusted operating margin that is better than most business services companies

OSI Systems is at the top of our list. The valuation looks reasonable based on its quality, and we think now is an opportune time to buy.

Why Is Now The Time To Buy OSI Systems?

High Quality

Investable

Underperform

Why Is Now The Time To Buy OSI Systems?

OSI Systems’s stock price of $285.22 implies a valuation ratio of 26.4x forward P/E. Most companies in the business services sector may feature a cheaper multiple, but we think OSI Systems is priced fairly given its fundamentals.

Entry price may seem important in the moment, but our work shows that time and again, long-term market outperformance is determined by business quality rather than getting an absolute bargain on a stock.

3. OSI Systems (OSIS) Research Report: Q4 CY2025 Update

Security and healthcare technology company OSI Systems (NASDAQ:OSIS) reported revenue ahead of Wall Streets expectations in Q4 CY2025, with sales up 10.5% year on year to $464.1 million. Its non-GAAP profit of $2.58 per share was 2.3% above analysts’ consensus estimates.

OSI Systems (OSIS) Q4 CY2025 Highlights:

- Revenue: $464.1 million vs analyst estimates of $453.1 million (10.5% year-on-year growth, 2.4% beat)

- Adjusted EPS: $2.58 vs analyst estimates of $2.52 (2.3% beat)

- Adjusted EBITDA: $78.75 million vs analyst estimates of $76.31 million (17% margin, 3.2% beat)

- Management slightly raised its full-year Adjusted EPS guidance to $10.43 at the midpoint

- Operating Margin: 12.7%, down from 13.8% in the same quarter last year

- Free Cash Flow Margin: 12%, similar to the same quarter last year

- Market Capitalization: $4.58 billion

Company Overview

With security scanners deployed at airports and borders worldwide and patient monitors used in hospitals across the globe, OSI Systems (NASDAQ:OSIS) designs and manufactures specialized electronic systems for security screening, patient monitoring, and optoelectronic applications.

OSI Systems operates through three distinct divisions that serve critical infrastructure and healthcare needs. The Security division, marketed under the Rapiscan brand, produces X-ray machines, metal detectors, and explosive trace detection systems used to screen baggage, cargo, vehicles, and people. These systems help prevent terrorism, smuggling, and other criminal activities at airports, border crossings, seaports, and high-profile venues. The company also offers turnkey security screening services where it not only provides equipment but also staffs and operates security checkpoints.

The Healthcare division, operating under the Spacelabs Healthcare brand, manufactures patient monitoring systems used in hospital critical care, emergency, and perioperative settings. These systems track vital signs and alert medical staff to changes in patient condition. The division also produces cardiology equipment like Holter monitors for tracking heart activity and ambulatory blood pressure monitors. Their Sentinel system integrates data from various medical devices into a central database accessible throughout a healthcare facility.

The Optoelectronics and Manufacturing division serves as both an internal supplier to OSI's other divisions and an external provider to OEM customers. This division produces components that convert light into electrical signals, used in applications ranging from medical imaging to aerospace navigation systems. A hospital might use OSI's patient monitors containing optoelectronic sensors to measure oxygen saturation in a patient's blood, while a border security agency might deploy the company's X-ray scanning systems containing similar components to inspect shipping containers.

OSI Systems maintains manufacturing facilities across the United States as well as in Germany, Malaysia, Mexico, India, Indonesia, and the United Kingdom. This global footprint allows the company to serve customers worldwide while strategically locating labor-intensive manufacturing in regions with cost advantages.

4. Specialized Technology

Companies in this sector, especially if they invest wisely, could see demand tailwinds as the world moves towards more IoT (Internet of Things), automation, and analytics. Enterprises across most industries will balk at taking these journeys solo and will enlist companies with expertise and scale in these areas. However, headwinds could include rising competition from larger technology firms, as digitization lowers barriers to entry in the space. Additionally, companies in the space will likely face evolving regulatory scrutiny over data privacy, particularly for surveillance and security technologies. This could make companies have to continually pivot and invest.

OSI Systems' Security division competes with Smiths Group (LSE:SMIN), Leidos (NYSE:LDOS), and L3Harris Technologies (NYSE:LHX) in the security screening market. In healthcare monitoring, the company faces competition from Philips (NYSE:PHG), GE HealthCare (NASDAQ:GEHC), and Medtronic (NYSE:MDT). The Optoelectronics division competes with companies like TE Connectivity (NYSE:TEL) and Amphenol (NYSE:APH).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $1.8 billion in revenue over the past 12 months, OSI Systems is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

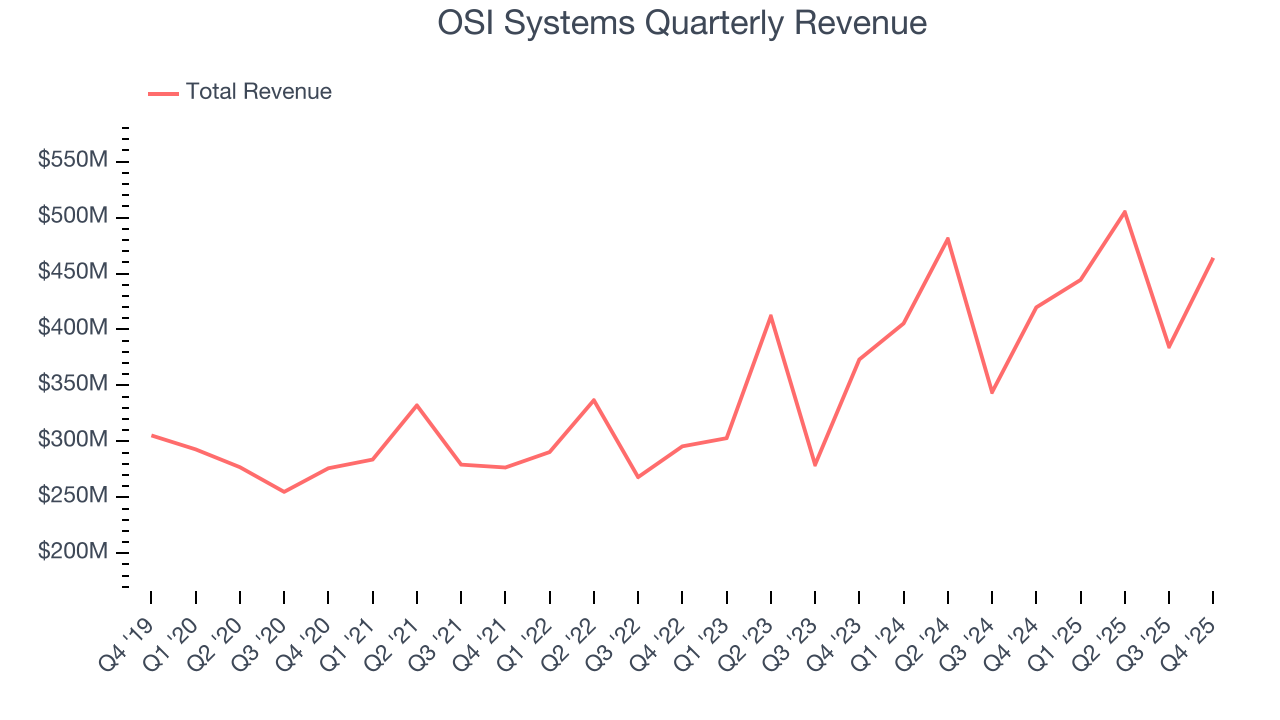

As you can see below, OSI Systems grew its sales at an impressive 10.3% compounded annual growth rate over the last five years. This is a great starting point for our analysis because it shows OSI Systems’s demand was higher than many business services companies.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. OSI Systems’s annualized revenue growth of 14.7% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

We can better understand the company’s revenue dynamics by analyzing its most important segment, Security. Over the last two years, OSI Systems’s Security revenue (inspection systems) averaged 23.2% year-on-year growth. This segment has outperformed its total sales during the same period, lifting the company’s performance.

This quarter, OSI Systems reported year-on-year revenue growth of 10.5%, and its $464.1 million of revenue exceeded Wall Street’s estimates by 2.4%.

Looking ahead, sell-side analysts expect revenue to grow 4.4% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and implies its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

6. Adjusted Operating Margin

Adjusted operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D. It also removes various one-time costs to paint a better picture of normalized profits.

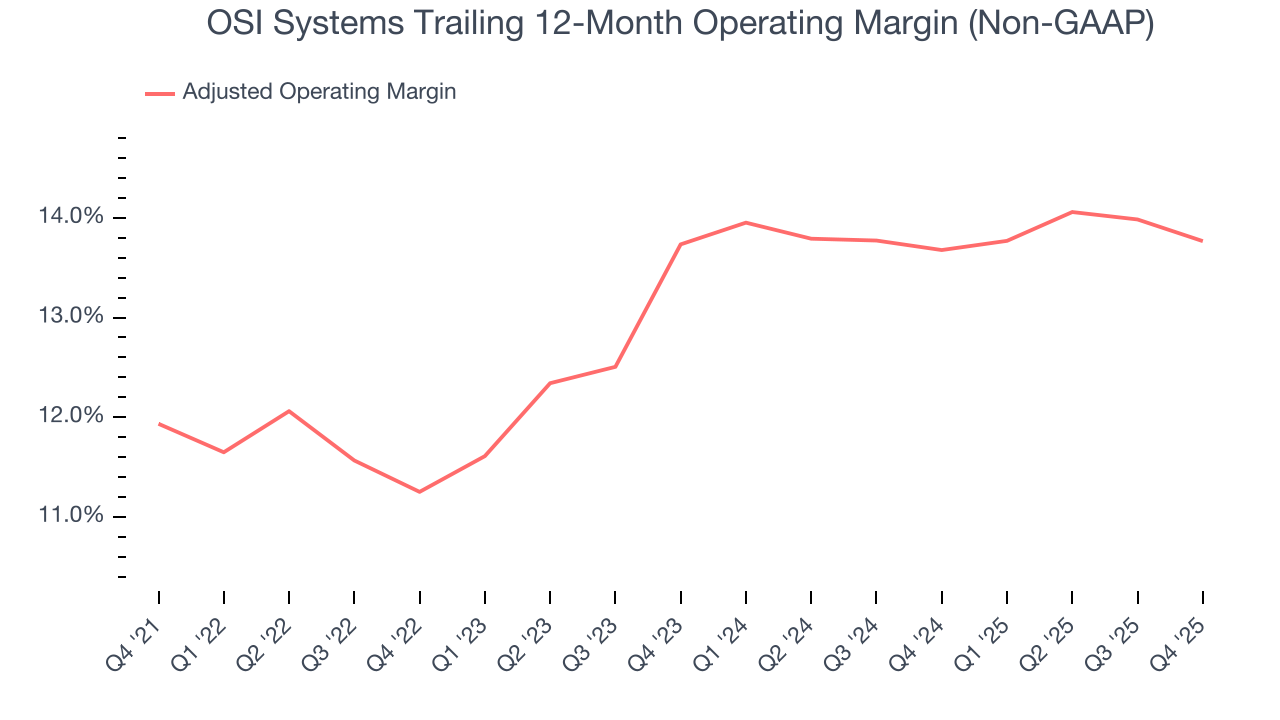

OSI Systems has managed its cost base well over the last five years. It demonstrated solid profitability for a business services business, producing an average adjusted operating margin of 13%.

Analyzing the trend in its profitability, OSI Systems’s adjusted operating margin rose by 1.8 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, OSI Systems generated an adjusted operating margin profit margin of 14%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

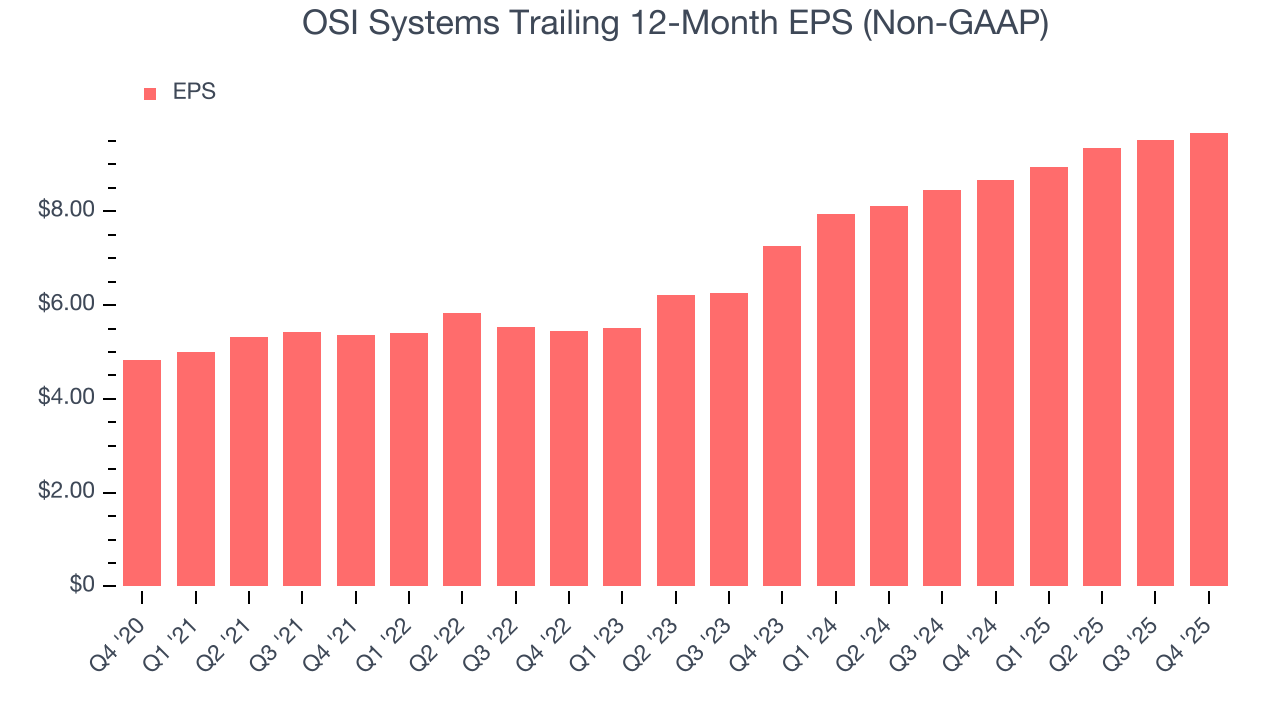

OSI Systems’s EPS grew at a spectacular 14.9% compounded annual growth rate over the last five years, higher than its 10.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

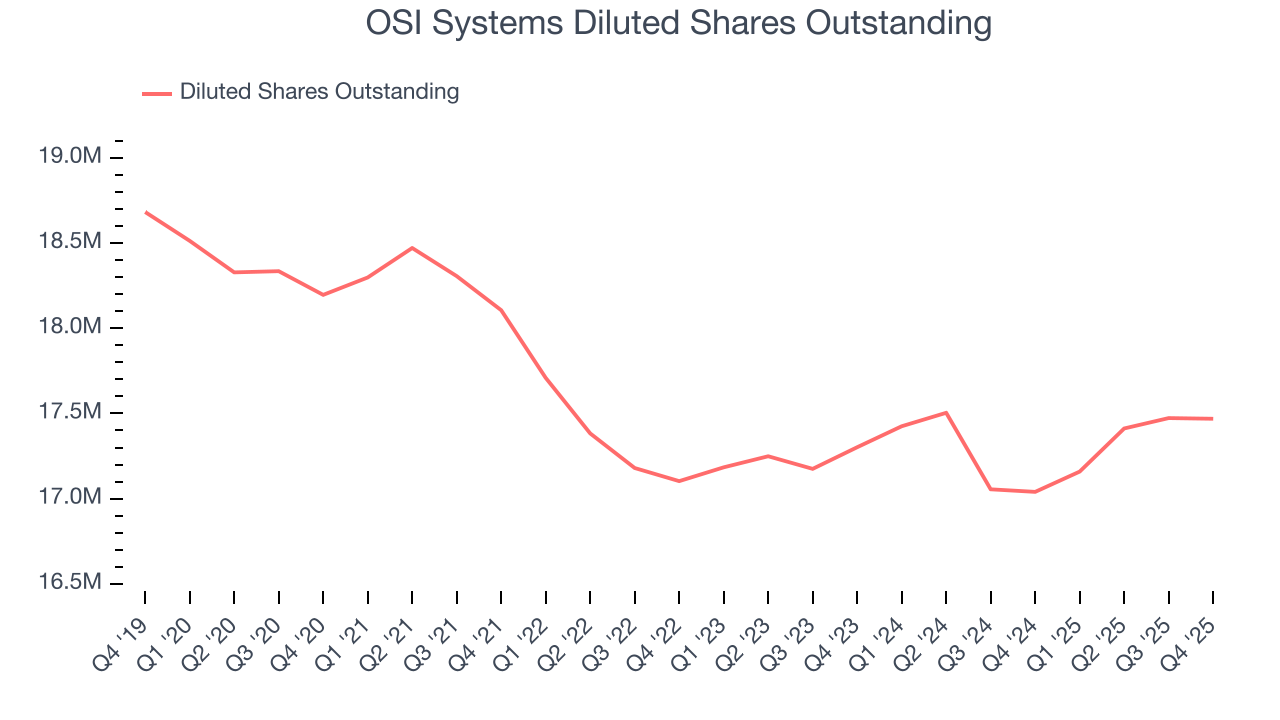

We can take a deeper look into OSI Systems’s earnings to better understand the drivers of its performance. As we mentioned earlier, OSI Systems’s adjusted operating margin was flat this quarter but expanded by 1.8 percentage points over the last five years. On top of that, its share count shrank by 4%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For OSI Systems, its two-year annual EPS growth of 15.4% is similar to its five-year trend, implying strong and stable earnings power.

In Q4, OSI Systems reported adjusted EPS of $2.58, up from $2.42 in the same quarter last year. This print beat analysts’ estimates by 2.3%. Over the next 12 months, Wall Street expects OSI Systems’s full-year EPS of $9.68 to grow 11.8%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

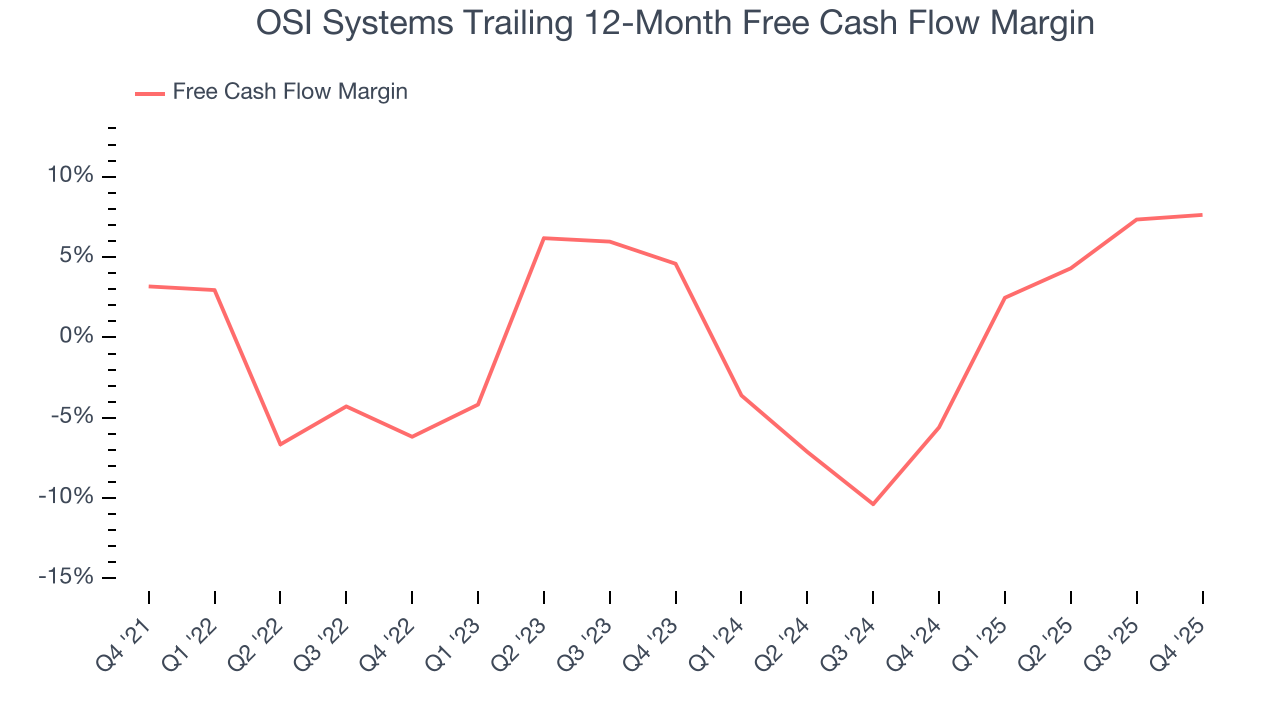

OSI Systems broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders. The divergence from its good adjusted operating margin stems from its capital-intensive business model, which requires OSI Systems to make large cash investments in working capital and capital expenditures.

Taking a step back, an encouraging sign is that OSI Systems’s margin expanded by 4.5 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

OSI Systems’s free cash flow clocked in at $55.52 million in Q4, equivalent to a 12% margin. This cash profitability was in line with the comparable period last year and above its five-year average.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

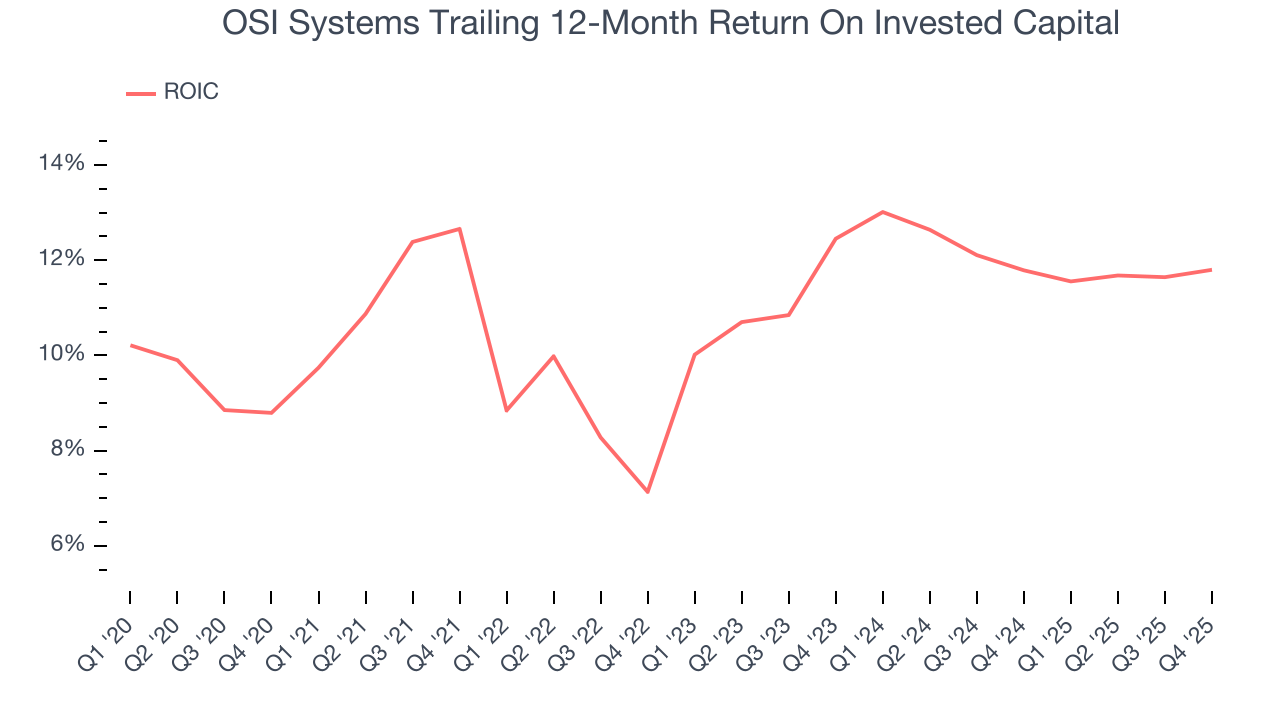

OSI Systems’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 11.2%, slightly better than typical business services business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, OSI Systems’s ROIC increased by 1.9 percentage points annually over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

10. Balance Sheet Assessment

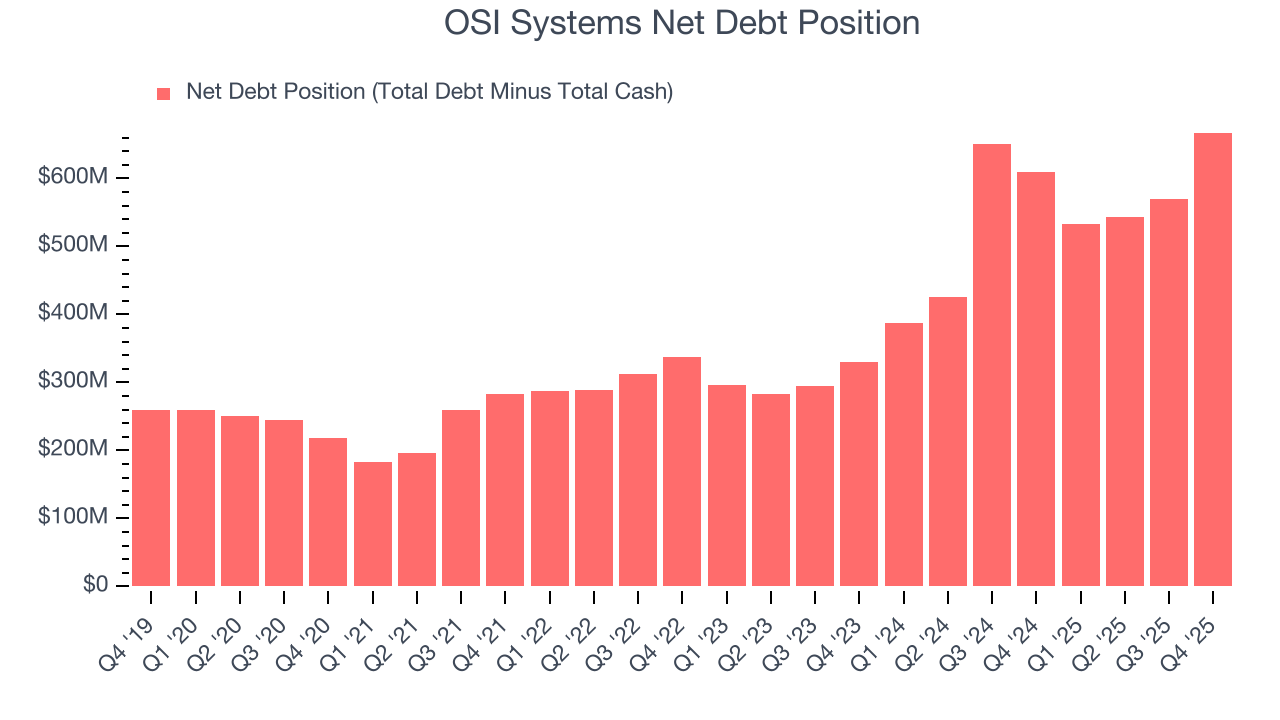

OSI Systems reported $336.7 million of cash and $1 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $302.7 million of EBITDA over the last 12 months, we view OSI Systems’s 2.2× net-debt-to-EBITDA ratio as safe. We also see its $33.56 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from OSI Systems’s Q4 Results

It was encouraging to see OSI Systems beat analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 1.3% to $273.20 immediately following the results.

12. Is Now The Time To Buy OSI Systems?

Updated: February 28, 2026 at 10:57 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

OSI Systems is a cream-of-the-crop business services company. For starters, its revenue growth was impressive over the last five years. And while its low free cash flow margins give it little breathing room, its spectacular EPS growth over the last five years shows its profits are trickling down to shareholders. Additionally, OSI Systems’s rising cash profitability gives it more optionality.

OSI Systems’s P/E ratio based on the next 12 months is 26.4x. Looking at the business services space today, OSI Systems’s qualities as one of the best businesses really stand out, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $300 on the company (compared to the current share price of $285.22), implying they see 5.2% upside in buying OSI Systems in the short term.