Pegasystems (PEGA)

We’re cautious of Pegasystems. Its sluggish sales growth shows demand is soft, a worrisome sign for investors in high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why We Think Pegasystems Will Underperform

With a "Center-out Business Architecture" approach that transcends organizational silos, Pegasystems (NASDAQ:PEGA) develops software that helps organizations automate workflows and use artificial intelligence to improve customer experiences and business processes.

- Competitive market means the company must spend more on sales and marketing to stand out even if the return on investment is low

- Revenue increased by 11.4% annually over the last five years, acceptable on an absolute basis but tepid for a software company enjoying secular tailwinds

- One positive is that its disciplined cost controls and effective management have materialized in a strong operating margin, and its operating leverage amplified its profits over the last year

Pegasystems’s quality doesn’t meet our hurdle. There are better opportunities in the market.

Why There Are Better Opportunities Than Pegasystems

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Pegasystems

Pegasystems is trading at $45.25 per share, or 4.1x forward price-to-sales. Pegasystems’s valuation may seem like a bargain, but we think there are valid reasons why it’s so cheap.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Pegasystems (PEGA) Research Report: Q4 CY2025 Update

Low-code automation software company Pegasystems (NASDAQ:PEGA) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 2.7% year on year to $504.3 million. The company’s full-year revenue guidance of $2 billion at the midpoint came in 7.9% above analysts’ estimates. Its non-GAAP profit of $0.76 per share was 3.5% above analysts’ consensus estimates.

Pegasystems (PEGA) Q4 CY2025 Highlights:

- Revenue: $504.3 million vs analyst estimates of $491.5 million (2.7% year-on-year growth, 2.6% beat)

- Adjusted EPS: $0.76 vs analyst estimates of $0.73 (3.5% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $2.75 at the midpoint, beating analyst estimates by 23.6%

- Operating Margin: 20.7%, down from 29.1% in the same quarter last year

- Free Cash Flow Margin: 30.2%, up from 13.6% in the previous quarter

- Market Capitalization: $7.10 billion

Company Overview

With a "Center-out Business Architecture" approach that transcends organizational silos, Pegasystems (NASDAQ:PEGA) develops software that helps organizations automate workflows and use artificial intelligence to improve customer experiences and business processes.

The company's Pega Infinity software portfolio enables businesses to build agility into their operations through low-code development and AI-powered decisioning. Its solutions span several intersecting software markets, including customer relationship management, digital process automation, and robotic process automation.

Pega's platform provides three main capabilities: Customer Engagement for hyper-personalized interactions, Customer Service for streamlining service experiences, and Intelligent Automation for automating mission-critical workflows. At the heart of these capabilities is the Pega Customer Decision Hub, an AI-powered decision engine that can predict customer behavior and recommend next best actions in real-time across channels.

The company serves Global 2000 organizations and government agencies across various industries. A financial services institution might use Pega to automate customer onboarding while detecting fraud; a healthcare provider could deploy it to coordinate care management and claims processing; and a telecom company might implement it to streamline order management and improve customer service.

Pega offers its solutions through both Pega Cloud, a secure internet-based infrastructure, and client-managed deployment options, giving customers flexibility in their implementation approach. The company supports its clients with consulting services, technical support, and training programs through its Global Client Success team and Pega Academy.

4. Automation Software

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

Pegasystems competes with major enterprise software providers including Salesforce.com, Microsoft Corporation, Oracle Corporation, ServiceNow, SAP SE, and IBM in various segments of the customer engagement, workflow automation, and low-code application development markets.

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Pegasystems grew its sales at a 11.4% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Pegasystems’s recent performance shows its demand has slowed as its annualized revenue growth of 10.4% over the last two years was below its five-year trend.

This quarter, Pegasystems reported modest year-on-year revenue growth of 2.7% but beat Wall Street’s estimates by 2.6%.

Looking ahead, sell-side analysts expect revenue to grow 5.9% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and implies its products and services will see some demand headwinds.

6. Annual Contract Value

While reported revenue for a SaaS business can include a range of one-time items like implementation fees, annual contract value (ACV) only considers contracted revenue, usually from recurring software subscriptions. This is the high-margin, predictable revenue stream that makes SaaS businesses so valuable.

Pegasystems’s ACV punched in at $1.61 billion in Q4, and over the last four quarters, its growth was solid as it averaged 17.2% year-on-year increases. This performance aligned with its total sales growth, reflecting the company’s ability to upsell its customers and maintain strong long-term relationships. Its growth also contributes positively to Pegasystems’s predictability and valuation, as investors typically prefer businesses with recurring revenue.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Pegasystems’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a competitive market and must continue investing to grow.

8. Gross Margin & Pricing Power

For software companies like Pegasystems, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Pegasystems’s gross margin is good for a software business and points to its solid unit economics, competitive products and services, and lack of meaningful pricing pressure. As you can see below, it averaged an impressive 75.9% gross margin over the last year. That means for every $100 in revenue, roughly $75.86 was left to spend on selling, marketing, and R&D.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Pegasystems has seen gross margins improve by 2.3 percentage points over the last 2 year, which is solid in the software space.

This quarter, Pegasystems’s gross profit margin was 79.5%, in line with the same quarter last year. Zooming out, Pegasystems’s full-year margin has been trending up over the past 12 months, increasing by 2 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as servers).

9. Operating Margin

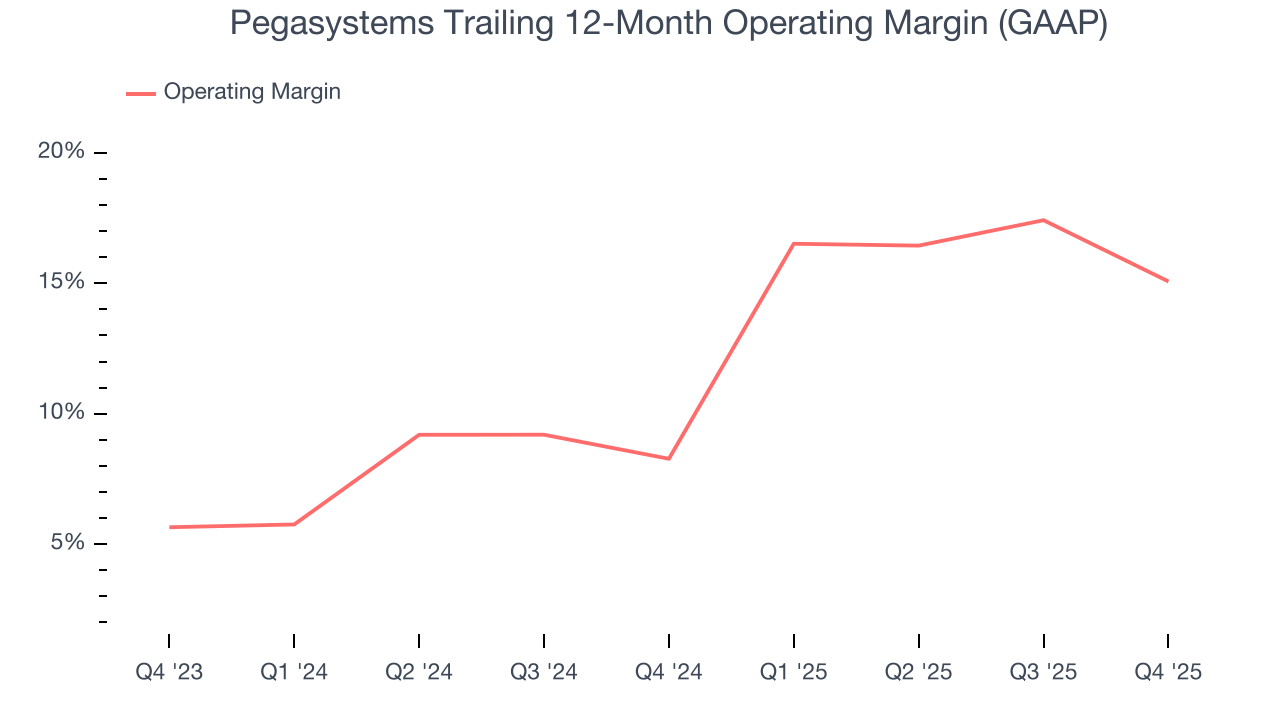

Pegasystems has been an efficient company over the last year. It was one of the more profitable businesses in the software sector, boasting an average operating margin of 15.1%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Pegasystems’s operating margin rose by 6.8 percentage points over the last two years, as its sales growth gave it operating leverage.

In Q4, Pegasystems generated an operating margin profit margin of 20.7%, down 8.4 percentage points year on year. Since Pegasystems’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

10. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Pegasystems has shown robust cash profitability, driven by its attractive business model that enables it to reinvest or return capital to investors while maintaining a cash cushion. The company’s free cash flow margin averaged 28.1% over the last year, quite impressive for a software business.

Pegasystems’s free cash flow clocked in at $152.4 million in Q4, equivalent to a 30.2% margin. This result was good as its margin was 11.4 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends carry greater meaning.

Over the next year, analysts predict Pegasystems’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 28.1% for the last 12 months will increase to 31.9%, it options for capital deployment (investments, share buybacks, etc.).

11. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

Pegasystems is a profitable, well-capitalized company with $425.8 million of cash and $60.83 million of debt on its balance sheet. This $365 million net cash position is 5% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Pegasystems’s Q4 Results

We were impressed by Pegasystems’s optimistic full-year EPS guidance, which blew past analysts’ expectations. We were also glad its full-year revenue guidance trumped Wall Street’s estimates. Zooming out, we think this was a solid print. The market seemed to be hoping for more, and the stock traded down 5.9% to $40.51 immediately following the results.

13. Is Now The Time To Buy Pegasystems?

Updated: February 20, 2026 at 9:35 PM EST

Before making an investment decision, investors should account for Pegasystems’s business fundamentals and valuation in addition to what happened in the latest quarter.

Pegasystems isn’t a terrible business, but it doesn’t pass our quality test. To begin with, its revenue growth was uninspiring over the last five years. While its impressive operating margins show it has a highly efficient business model, the downside is its customer acquisition is less efficient than many comparable companies. On top of that, its expanding operating margin shows it’s becoming more efficient at building and selling its software.

Pegasystems’s price-to-sales ratio based on the next 12 months is 4.1x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $59.64 on the company (compared to the current share price of $45.25).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.