Powell (POWL)

Powell is an amazing business. Its combination of extraordinary growth and robust profitability makes it a beloved asset.― StockStory Analyst Team

1. News

2. Summary

Why We Like Powell

Originally a metal-working shop supporting local petrochemical facilities, Powell (NYSE:POWL) has grown from a small Houston manufacturer to a global provider of electrical systems.

- Annual revenue growth of 17.8% over the past five years was outstanding, reflecting market share gains this cycle

- Additional sales over the last five years increased its profitability as the 67.7% annual growth in its earnings per share outpaced its revenue

- Backlog has averaged 15.4% growth over the past two years, showing it has a pipeline of unfulfilled orders that will support revenue in the future

Powell is a market leader. The valuation looks reasonable in light of its quality, and we think now is a favorable time to invest in the stock.

Why Is Now The Time To Buy Powell?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Powell?

Powell is trading at $440.86 per share, or 28.4x forward P/E. Valuation is above that of many industrials companies, but we think the price is justified given its business fundamentals.

Our analysis and backtests consistently tell us that buying high-quality companies and holding them for many years leads to market outperformance. Over the long term, entry price doesn’t matter nearly as much as business fundamentals.

3. Powell (POWL) Research Report: Q4 CY2025 Update

Electrical energy control systems manufacturer Powell (NYSE:POWL) fell short of the markets revenue expectations in Q4 CY2025 as sales rose 4% year on year to $251.2 million. Its GAAP profit of $3.40 per share was 16.6% above analysts’ consensus estimates.

Powell (POWL) Q4 CY2025 Highlights:

- Revenue: $251.2 million vs analyst estimates of $256.5 million (4% year-on-year growth, 2.1% miss)

- EPS (GAAP): $3.40 vs analyst estimates of $2.92 (16.6% beat)

- Adjusted EBITDA: $44.92 million vs analyst estimates of $42.86 million (17.9% margin, 4.8% beat)

- Operating Margin: 17%, up from 14.7% in the same quarter last year

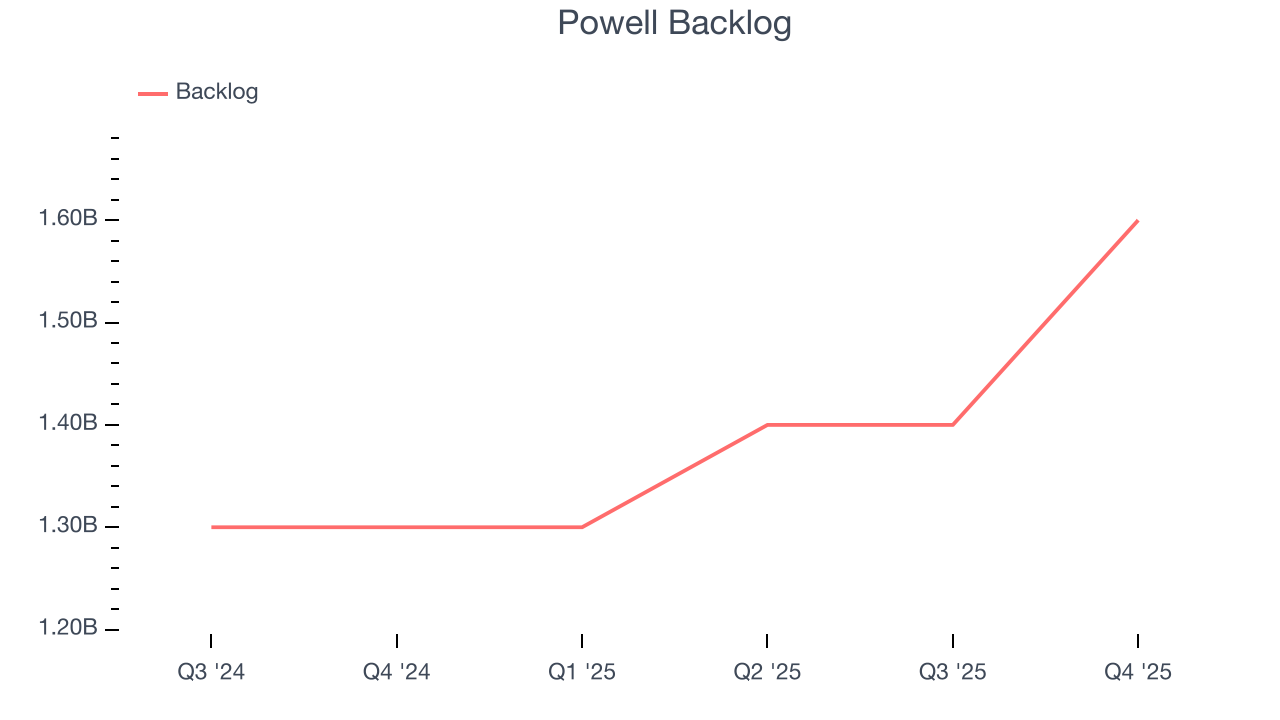

- Backlog: $1.6 billion at quarter end, up 23.1% year on year

- Market Capitalization: $5.35 billion

Company Overview

Originally a metal-working shop supporting local petrochemical facilities, Powell (NYSE:POWL) has grown from a small Houston manufacturer to a global provider of electrical systems.

The company has evolved through mergers and acquisitions, such as in 2009, when it acquired PowerComm and its subsidiaries, significantly boosting its presence in Canada's oil and gas sector.

Today, Powell serves a diverse range of industries including transportation, environmental, energy, industrial, and utility sectors. The company operates through two main business segments: Electrical Power Products and Process Control Systems.

The Electrical Power Products segment, which generates the majority of the company's revenue, focuses on designing and manufacturing custom electrical power distribution and control systems. These systems are engineered to distribute, monitor, and control electrical energy flow while providing protection to various electrically powered equipment. Powell's product lineup includes power control room substation packages, distribution switchgear, medium-voltage circuit breakers, monitoring and control communications systems, and bus duct systems. These products are designed for application voltages ranging from 480 volts to over 38,000 volts and are utilized in various heavy industrial markets.

Powell's Process Control Systems segment specializes in custom engineered-to-order technology solutions for managing critical transportation, environmental, and energy management processes and facilities. The segment's proprietary DYNAC® software suite serves as an integrated operations management solution for these vital operations, handling everything from traffic flow in transportation management to water quality in environmental treatment and electrical power status in substation automation.

Powell's customers are primarily large industrial users of electrical energy, including oil and gas producers, refineries, and utilities. The company markets directly to end-users and through engineering, procurement, and construction (EPC) firms.

4. Electrical Systems

Like many equipment and component manufacturers, electrical systems companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include Internet of Things (IoT) connectivity and the 5G telecom upgrade cycle, which can benefit companies whose cables and conduits fit those needs. But like the broader industrials sector, these companies are also at the whim of economic cycles. Interest rates, for example, can greatly impact projects that drive demand for these products.

Competitors of Powell (NYSE:POWL) include Eaton Corporation (NYSE:ETN), Schneider Electric SE (OTC:SBGSY), and ABB Ltd (NYSE:ABB).

5. Revenue Growth

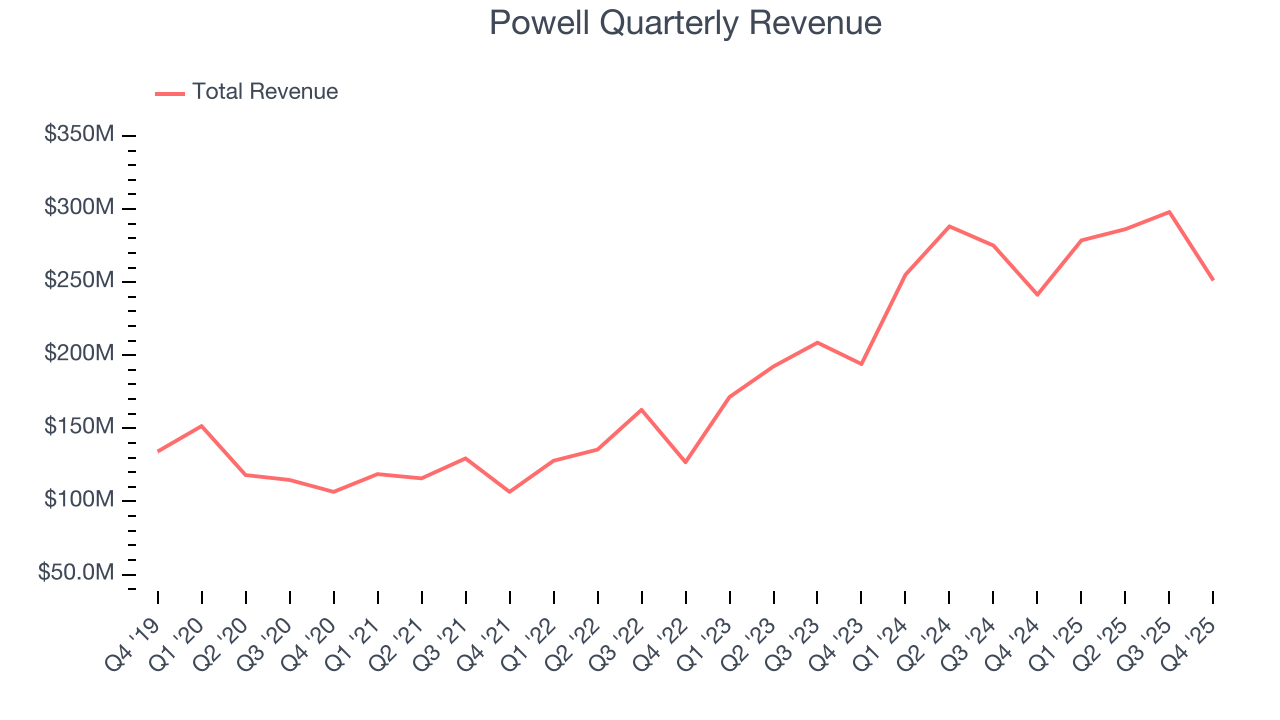

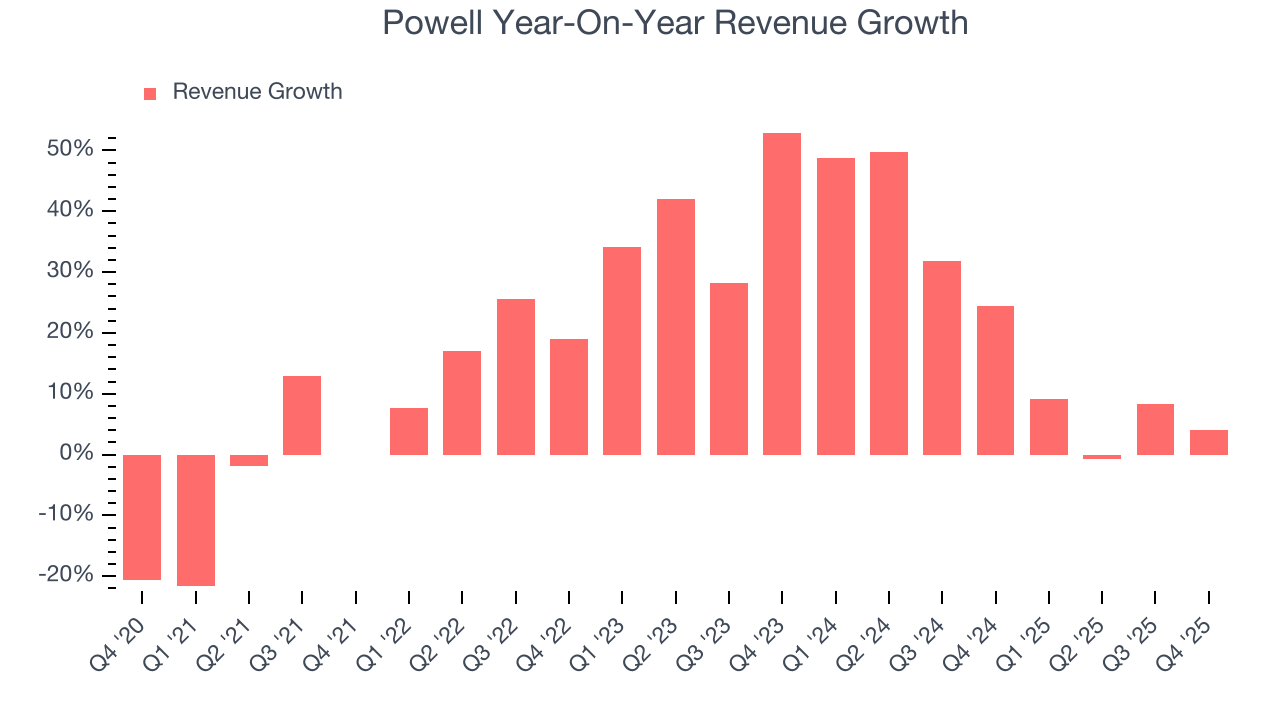

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Powell’s sales grew at an incredible 17.8% compounded annual growth rate over the last five years. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Powell’s annualized revenue growth of 20.6% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

We can better understand the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Powell’s backlog reached $1.6 billion in the latest quarter and averaged 15.4% year-on-year growth over the last two years. Because this number is lower than its revenue growth, we can see the company fulfilled orders at a faster rate than it added new orders to the backlog. This implies Powell was operating efficiently but raises questions about the health of its sales pipeline.

This quarter, Powell’s revenue grew by 4% year on year to $251.2 million, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 7.8% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is above average for the sector and indicates the market sees some success for its newer products and services.

6. Gross Margin & Pricing Power

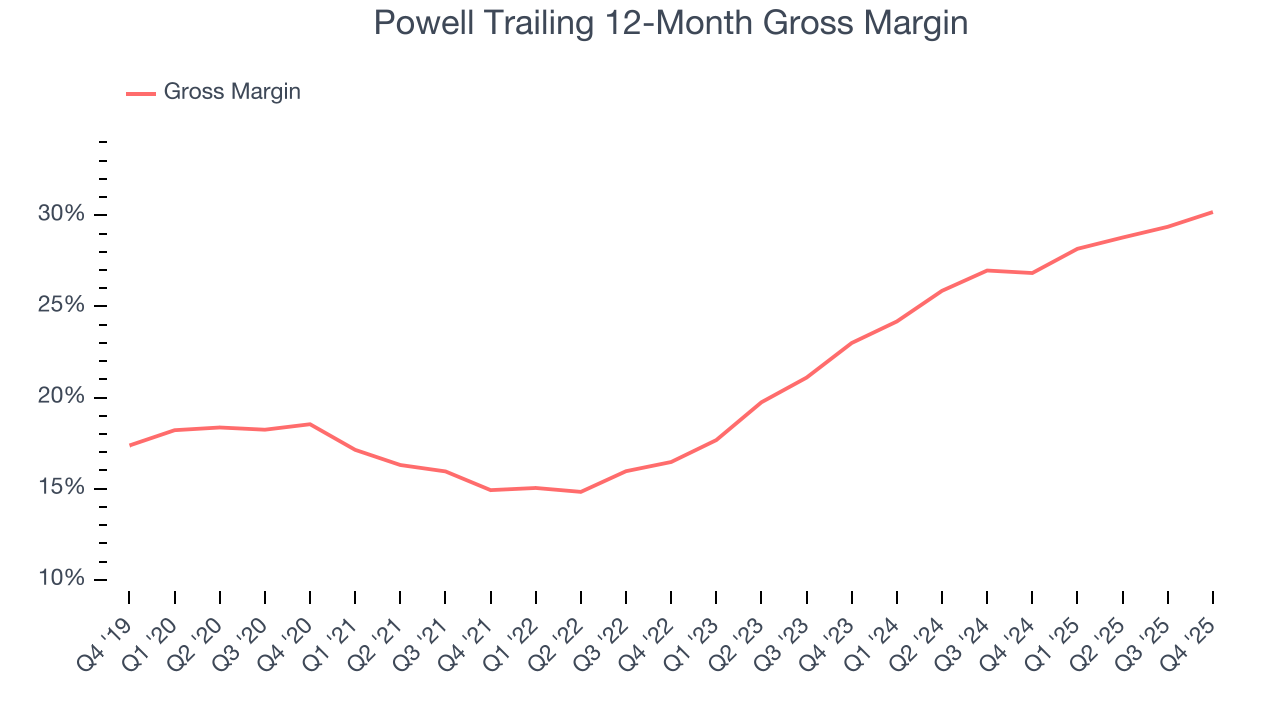

Powell has bad unit economics for an industrials company, giving it less room to reinvest and develop new offerings. As you can see below, it averaged a 24.2% gross margin over the last five years. Said differently, Powell had to pay a chunky $75.82 to its suppliers for every $100 in revenue.

Powell’s gross profit margin came in at 28.4% this quarter, up 3.8 percentage points year on year. Powell’s full-year margin has also been trending up over the past 12 months, increasing by 3.3 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

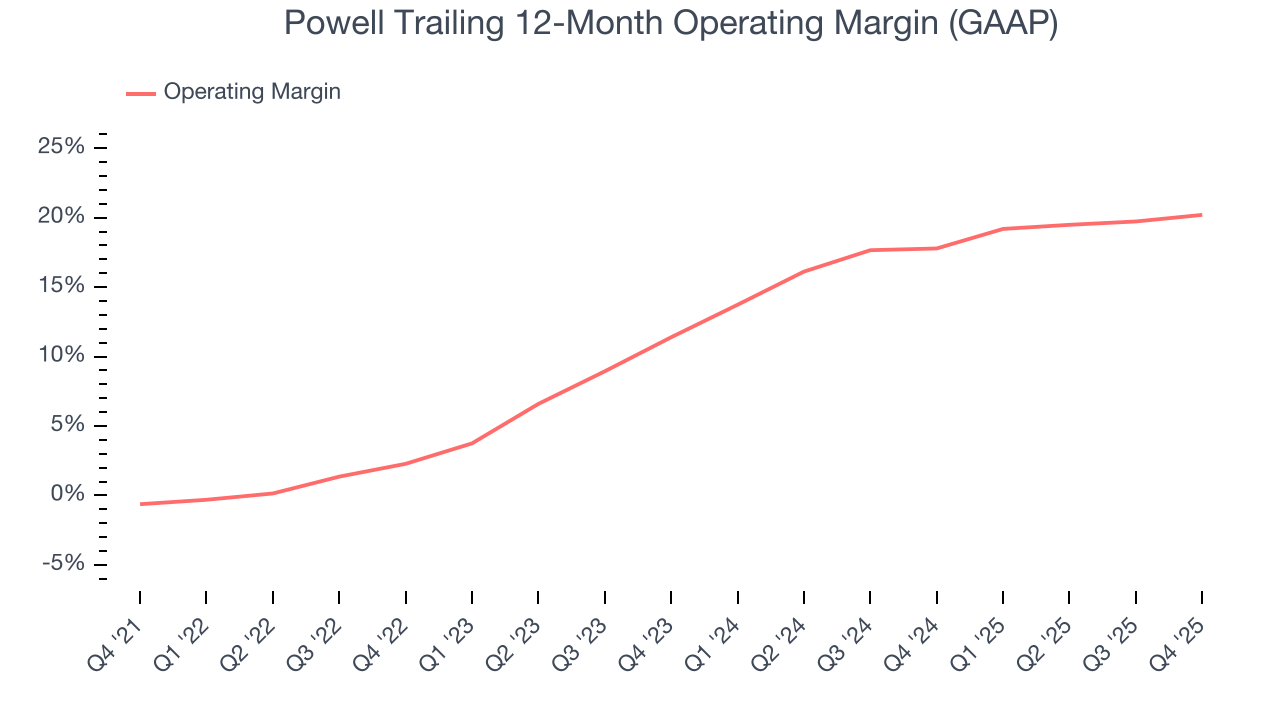

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Powell has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 12.9%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Powell’s operating margin rose by 20.8 percentage points over the last five years, as its sales growth gave it immense operating leverage.

In Q4, Powell generated an operating margin profit margin of 17%, up 2.3 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

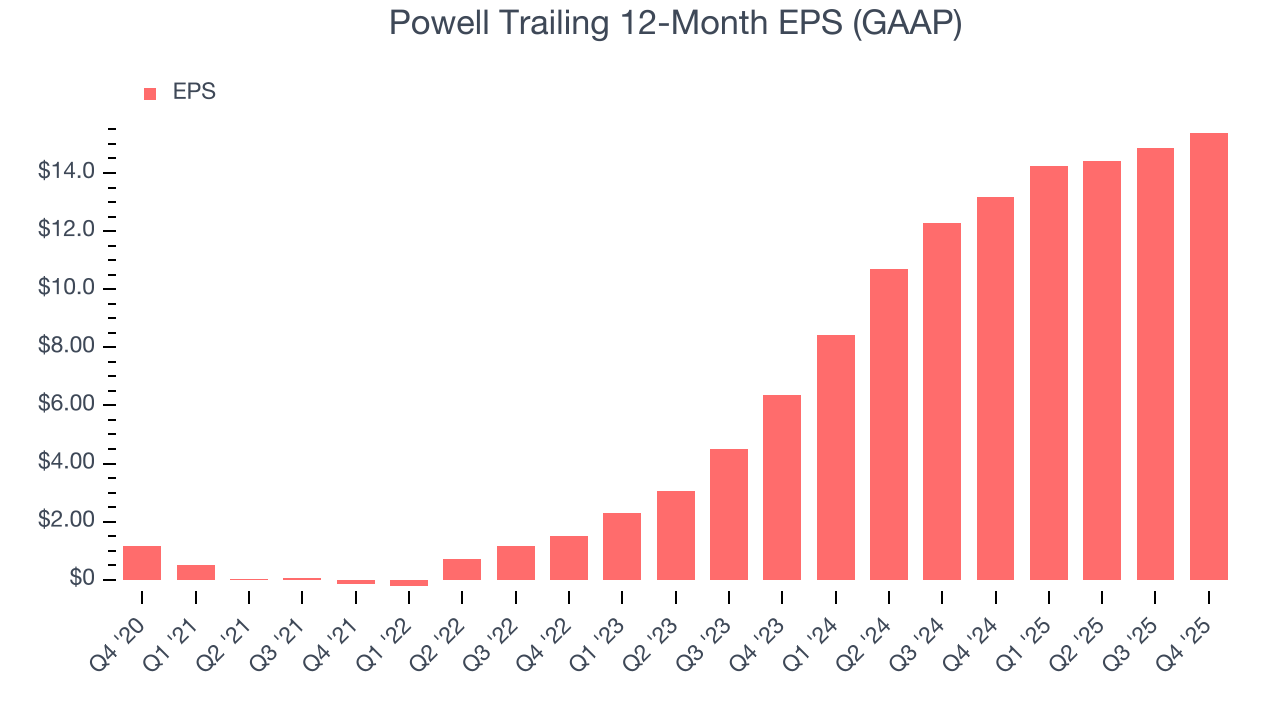

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Powell’s EPS grew at an astounding 67.7% compounded annual growth rate over the last five years, higher than its 17.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Powell’s earnings to better understand the drivers of its performance. As we mentioned earlier, Powell’s operating margin expanded by 20.8 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Powell, its two-year annual EPS growth of 55.4% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q4, Powell reported EPS of $3.40, up from $2.86 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Powell’s full-year EPS of $15.39 to grow 3.8%.

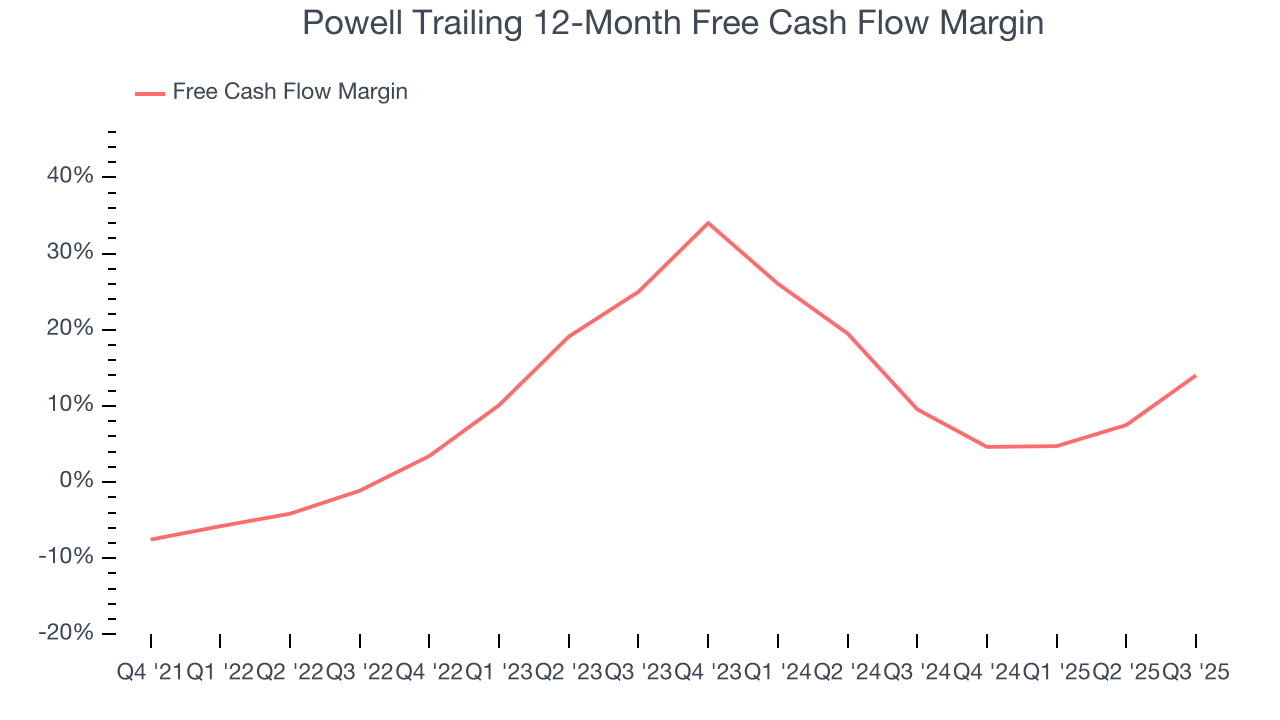

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Powell has shown robust cash profitability, enabling it to comfortably ride out cyclical downturns while investing in plenty of new offerings and returning capital to investors. The company’s free cash flow margin averaged 11.1% over the last five years, quite impressive for an industrials business.

Taking a step back, we can see that Powell’s margin expanded by 15.9 percentage points during that time. This is encouraging because it gives the company more optionality.

10. Key Takeaways from Powell’s Q4 Results

It was good to see Powell beat analysts’ EPS expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. On the other hand, its revenue missed. Overall, this print had some key positives. The stock remained flat at $453.50 immediately following the results.

11. Is Now The Time To Buy Powell?

Updated: February 3, 2026 at 9:13 PM EST

Before investing in or passing on Powell, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Powell is truly a cream-of-the-crop industrials company. First of all, the company’s revenue growth was exceptional over the last five years. And while its projected EPS for the next year is lacking, its backlog growth has been marvelous. Additionally, Powell’s rising cash profitability gives it more optionality.

Powell’s P/E ratio based on the next 12 months is 27.4x. Looking across the spectrum of industrials businesses, Powell’s fundamentals clearly illustrate it’s a special business. We like the stock at this price.

Wall Street analysts have a consensus one-year price target of $416.33 on the company (compared to the current share price of $454.25).