Perdoceo Education (PRDO)

Perdoceo Education keeps us up at night. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think Perdoceo Education Will Underperform

Formerly known as Career Education Corporation, Perdoceo Education (NASDAQ:PRDO) is an educational services company that specializes in postsecondary education.

- Sales trends were unexciting over the last five years as its 3.7% annual growth was below the typical consumer discretionary company

- Earnings growth over the last five years fell short of the peer group average as its EPS only increased by 10.8% annually

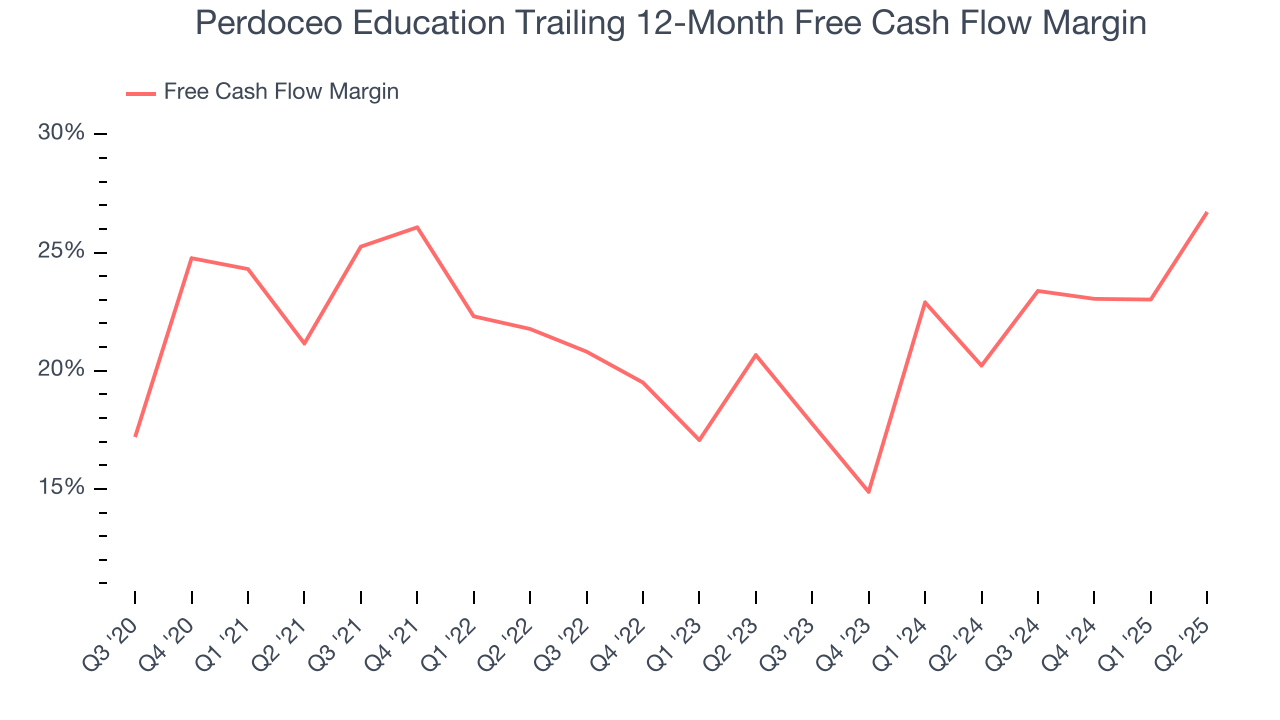

- Ability to fund investments or reward shareholders with increased buybacks or dividends is restricted by its weak free cash flow margin of 23.7% for the last two years

Perdoceo Education doesn’t satisfy our quality benchmarks. There are more profitable opportunities elsewhere.

Why There Are Better Opportunities Than Perdoceo Education

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Perdoceo Education

At $28.38 per share, Perdoceo Education trades at 38.6x forward EV-to-EBITDA. This multiple is quite expensive for the quality you get.

We’d rather invest in companies with elite fundamentals than questionable ones with open questions and big downside risks. The durable earnings power of high-quality businesses helps us sleep well at night.

3. Perdoceo Education (PRDO) Research Report: Q3 CY2025 Update

Higher education company Perdoceo Education (NASDAQ:PRDO) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 24.8% year on year to $211.9 million. Its non-GAAP profit of $0.65 per share was 6.6% above analysts’ consensus estimates.

Perdoceo Education (PRDO) Q3 CY2025 Highlights:

- Revenue: $211.9 million vs analyst estimates of $207 million (24.8% year-on-year growth, 2.4% beat)

- Adjusted EPS: $0.65 vs analyst estimates of $0.61 (6.6% beat)

- Adjusted EBITDA: $152.7 million vs analyst estimates of $57.9 million (72.1% margin, significant beat)

- Management raised its full-year Adjusted EPS guidance to $2.55 at the midpoint, a 1.4% increase

- Operating Margin: 24.1%, down from 26.4% in the same quarter last year

- Market Capitalization: $2.01 billion

Company Overview

Formerly known as Career Education Corporation, Perdoceo Education (NASDAQ:PRDO) is an educational services company that specializes in postsecondary education.

Perdoceo Education primarily operates through online platforms and campuses across the United States, focusing on career-oriented education. The company caters to a diverse student population, including working adults, through its university and college brands such as Colorado Technical University (CTU) and American InterContinental University (AIU). These institutions offer associate, bachelor's, master's, and doctoral degrees covering business administration, information technology, criminal justice, and healthcare management.

Perdoceo Education's curriculum aims to be industry-relevant, teaching skills and knowledge aligned with current professional standards and market demands. This focus on career readiness is further supported by comprehensive career services offered to students and alumni, including career planning, resume building, and job placement assistance.

4. Education Services

A whole industry has emerged to address the problem of rising education costs, offering consumers alternatives to traditional education paths such as four-year colleges. These alternative paths, which may include online courses or flexible schedules, make education more accessible to those with work or child-rearing obligations. However, some have run into issues around the value of the degrees and certifications they provide and whether customers are getting a good deal. Those who don’t prove their value could struggle to retain students, or even worse, invite the heavy hand of regulation.

Perdoceo Education's primary competitors include Strayer Education (NASDAQ:STRA), Grand Canyon Education (NASDAQ:LOPE), Adtalem Global Education (NYSE:ATGE), and American Public Education (NASDAQ:APEI).

5. Revenue Growth

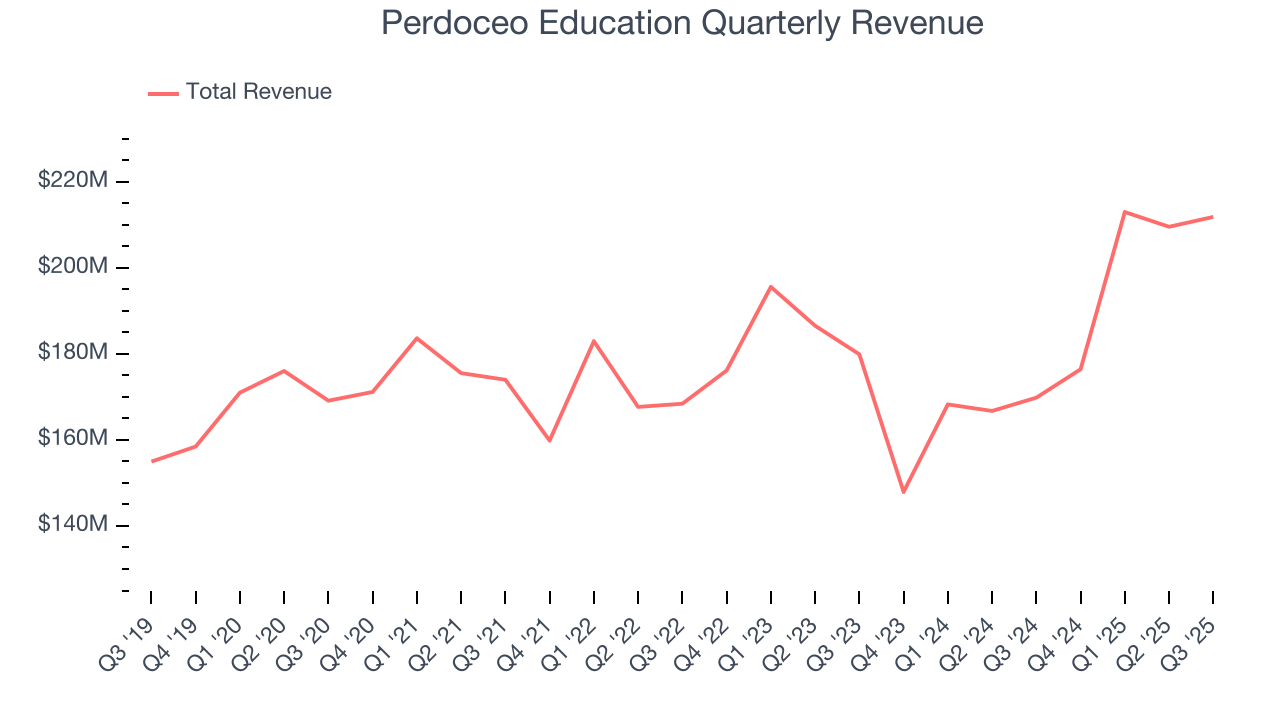

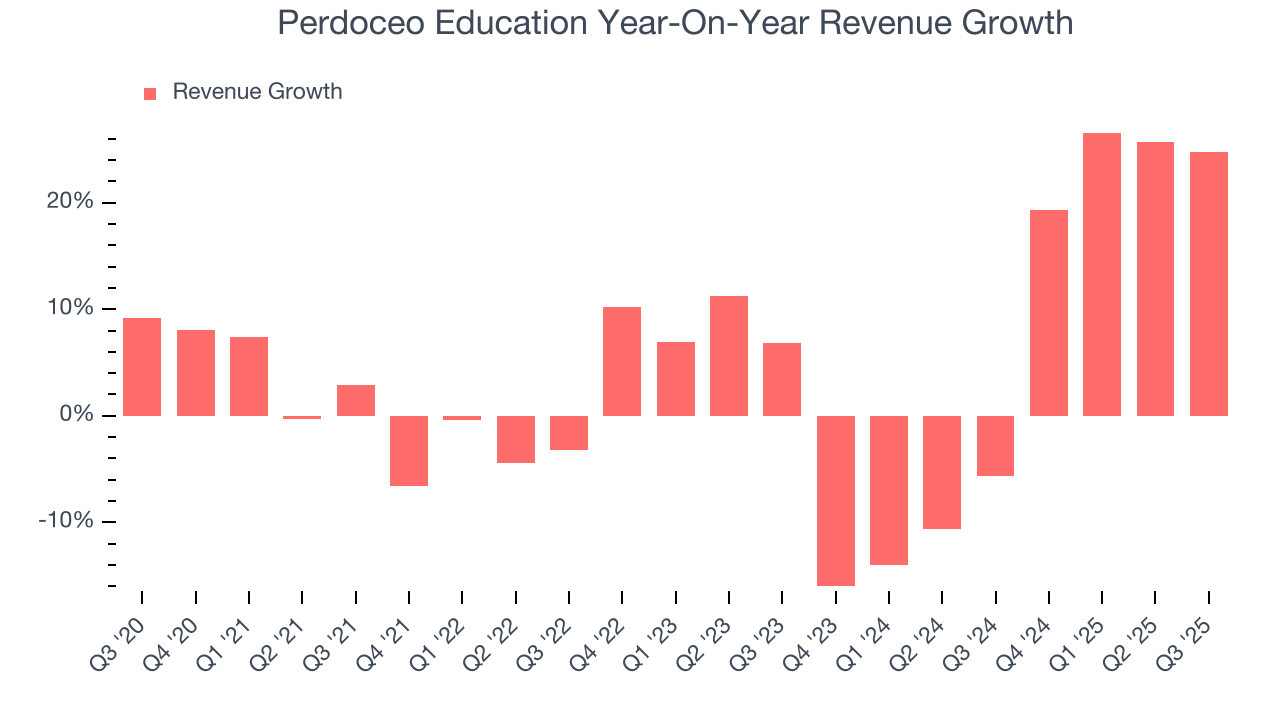

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Perdoceo Education’s 3.7% annualized revenue growth over the last five years was sluggish. This wasn’t a great result compared to the rest of the consumer discretionary sector, but there are still things to like about Perdoceo Education.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Perdoceo Education’s annualized revenue growth of 4.8% over the last two years is above its five-year trend, but we were still disappointed by the results.

This quarter, Perdoceo Education reported robust year-on-year revenue growth of 24.8%, and its $211.9 million of revenue topped Wall Street estimates by 2.4%.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates. This signals Perdoceo Education could be a hidden gem because it doesn’t get attention from professional brokers.

6. Operating Margin

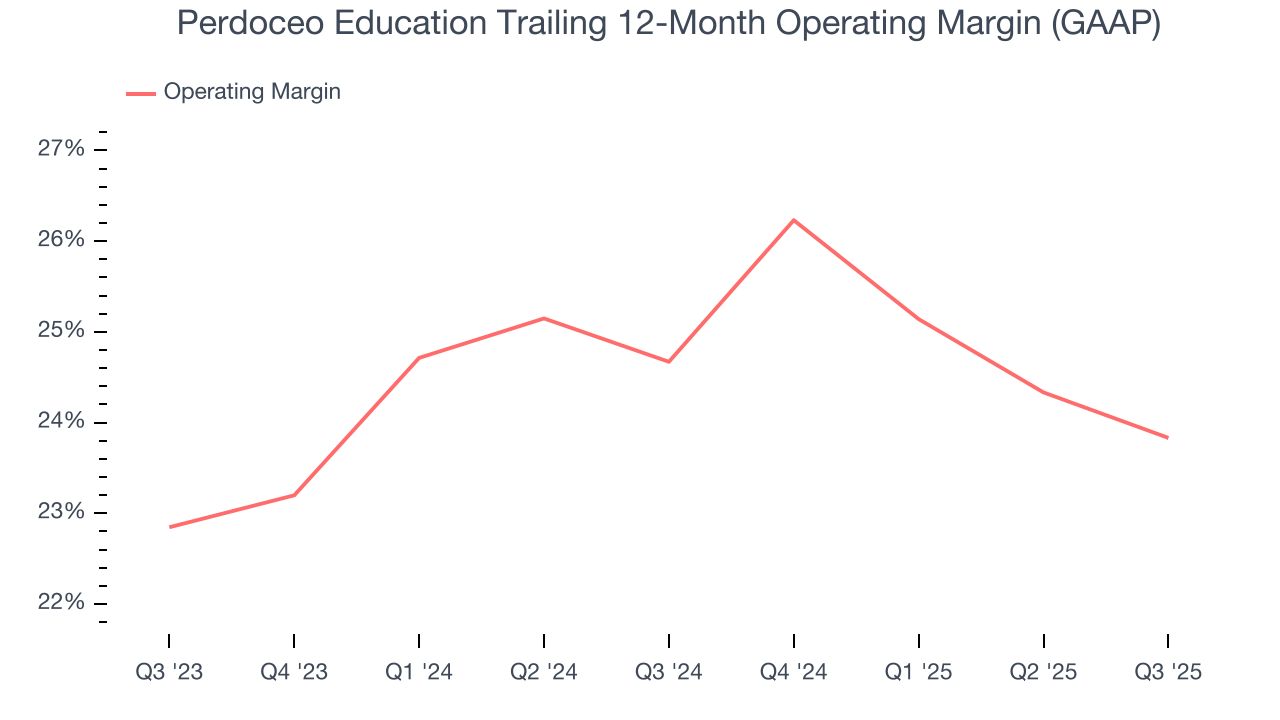

Perdoceo Education’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 24.2% over the last two years. This profitability was elite for a consumer discretionary business thanks to its efficient cost structure and economies of scale.

In Q3, Perdoceo Education generated an operating margin profit margin of 24.1%, down 2.3 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

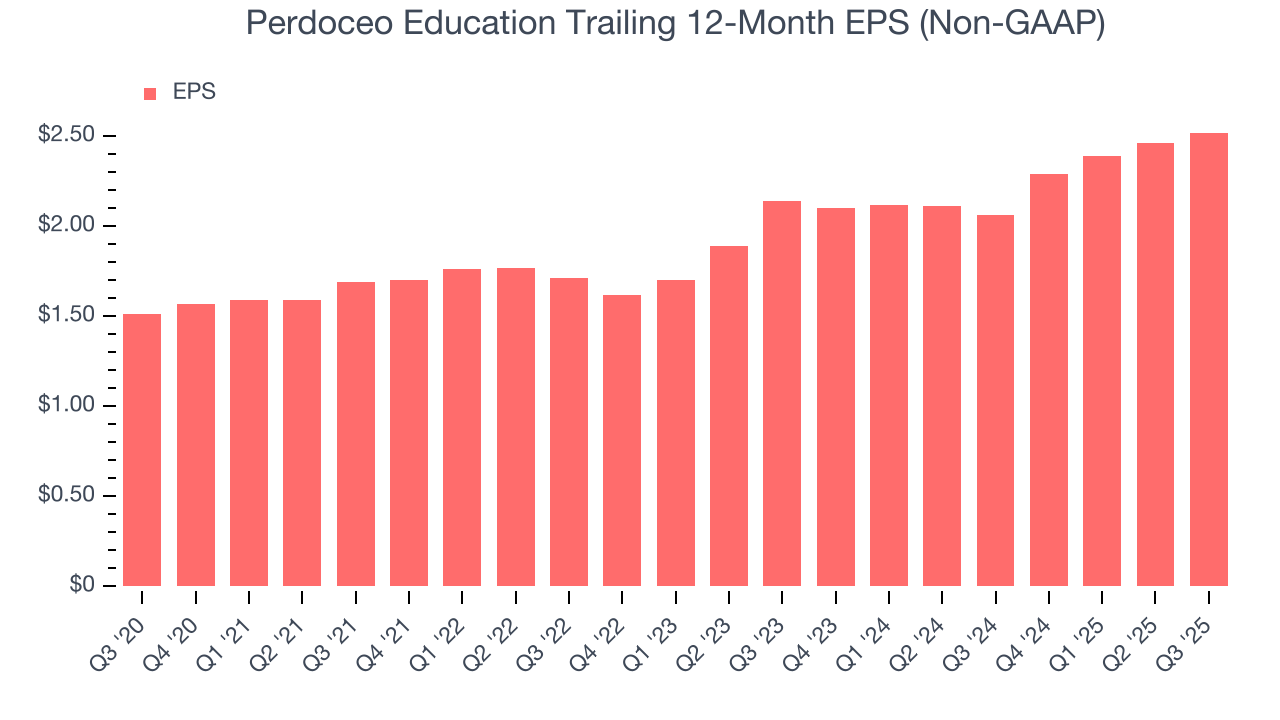

Perdoceo Education’s EPS grew at a decent 10.8% compounded annual growth rate over the last five years, higher than its 3.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q3, Perdoceo Education reported adjusted EPS of $0.65, up from $0.59 in the same quarter last year. This print beat analysts’ estimates by 6.6%. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data. This signals Perdoceo Education could be a hidden gem because it doesn’t have much coverage among professional brokers.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Perdoceo Education has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the consumer discretionary sector, averaging 24.6% over the last two years.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Perdoceo Education’s five-year average ROIC was 48.6%, placing it among the best consumer discretionary companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Perdoceo Education’s ROIC has decreased significantly over the last few years. Only time will tell if its new bets can bear fruit and potentially reverse the trend.

10. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

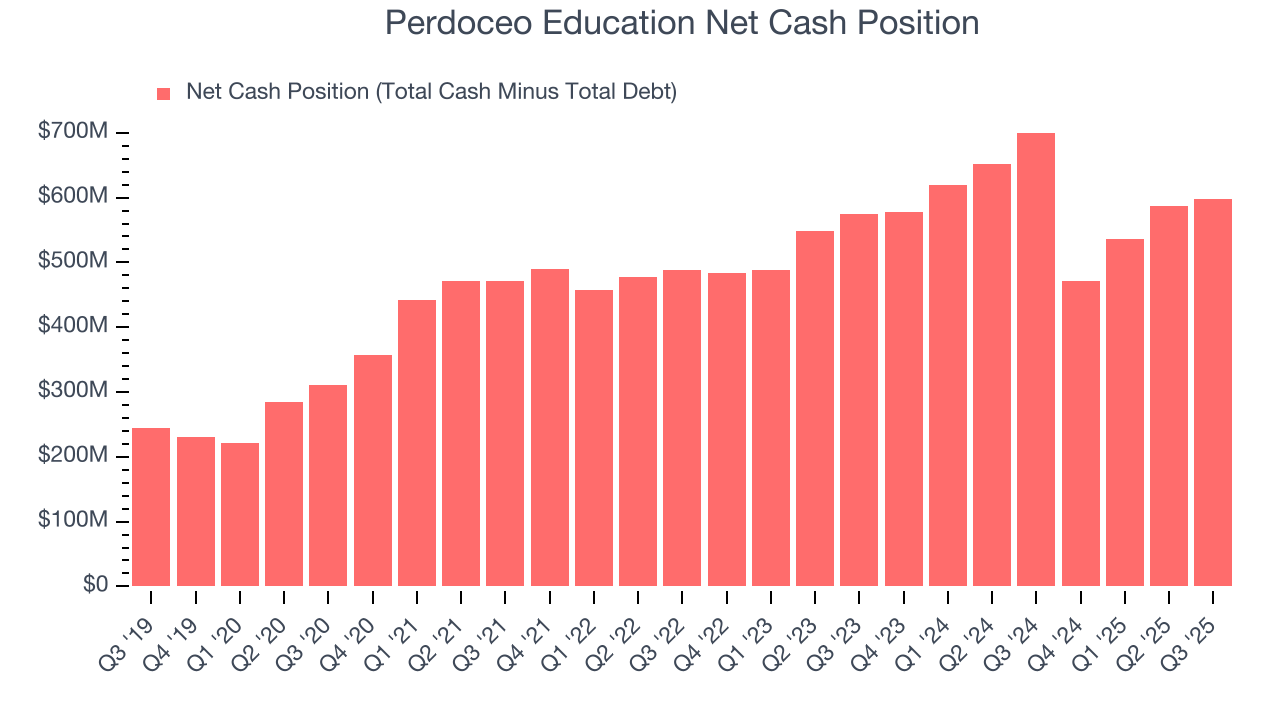

Perdoceo Education is a profitable, well-capitalized company with $668.6 million of cash and $70.37 million of debt on its balance sheet. This $598.3 million net cash position is 30.6% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Perdoceo Education’s Q3 Results

We were impressed by how significantly Perdoceo Education blew past analysts’ EBITDA expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock remained flat at $31.01 immediately following the results.

12. Is Now The Time To Buy Perdoceo Education?

Updated: December 3, 2025 at 9:11 PM EST

Are you wondering whether to buy Perdoceo Education or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Perdoceo Education falls short of our quality standards. For starters, its revenue growth was weak over the last five years. And while its solid ROIC suggests it has grown profitably in the past, the downside is its weak EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders. On top of that, its low free cash flow margins give it little breathing room.

Perdoceo Education’s EV-to-EBITDA ratio based on the next 12 months is 38.6x. At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $42 on the company (compared to the current share price of $28.38).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.