Regeneron (REGN)

We’re wary of Regeneron. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why Regeneron Is Not Exciting

Founded by scientists who wanted to build a company where science could thrive, Regeneron Pharmaceuticals (NASDAQ:REGN) develops and commercializes medicines for serious diseases, with key products treating eye conditions, allergic diseases, cancer, and other disorders.

- On the plus side, its excellent adjusted operating margin highlights the strength of its business model

Regeneron falls below our quality standards. There are more appealing investments to be made.

Why There Are Better Opportunities Than Regeneron

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Regeneron

Regeneron is trading at $756.01 per share, or 17.3x forward P/E. This multiple is lower than most healthcare companies, but for good reason.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Regeneron (REGN) Research Report: Q4 CY2025 Update

Biotech company Regeneron (NASDAQ:REGN) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 2.5% year on year to $3.88 billion. Its non-GAAP profit of $11.44 per share was 6.9% above analysts’ consensus estimates.

Regeneron (REGN) Q4 CY2025 Highlights:

- Revenue: $3.88 billion vs analyst estimates of $3.78 billion (2.5% year-on-year growth, 2.8% beat)

- Adjusted EPS: $11.44 vs analyst estimates of $10.70 (6.9% beat)

- Operating Margin: 22.7%, down from 26.1% in the same quarter last year

- Free Cash Flow Margin: 23.7%, down from 28.1% in the same quarter last year

- Market Capitalization: $76.89 billion

Company Overview

Founded by scientists who wanted to build a company where science could thrive, Regeneron Pharmaceuticals (NASDAQ:REGN) develops and commercializes medicines for serious diseases, with key products treating eye conditions, allergic diseases, cancer, and other disorders.

Regeneron's business model centers on using proprietary technologies to discover and develop innovative treatments. Its flagship VelociSuite platform includes technologies for producing fully human antibodies and accelerating drug discovery. The company's Regeneron Genetics Center has sequenced nearly 3 million samples to identify genetic targets for potential therapies.

The company's product portfolio includes EYLEA and EYLEA HD for retinal diseases; Dupixent for allergic and inflammatory conditions; Libtayo for various cancers; and several other medicines for conditions ranging from high cholesterol to rare diseases. These treatments are used by patients with conditions like macular degeneration, asthma, atopic dermatitis, and certain cancers who need targeted biological therapies to manage their diseases.

For example, a patient with severe asthma might receive Dupixent injections every two weeks to reduce inflammation in their airways and prevent asthma attacks, while someone with wet age-related macular degeneration might receive regular EYLEA injections to preserve their vision.

Regeneron generates revenue through direct sales of its products in the United States and through collaborations internationally. The company has significant partnerships with Sanofi for Dupixent and Kevzara, and with Bayer for EYLEA outside the U.S. These collaborations typically involve shared development costs and profit-splitting arrangements.

Beyond commercialized products, Regeneron maintains a robust pipeline of candidates in various stages of development. The company is exploring treatments across multiple therapeutic areas, including hematology, immunology, oncology, infectious diseases, and rare genetic disorders. Regeneron also collaborates with companies like Alnylam and Intellia to develop RNA interference and CRISPR gene-editing therapies.

4. Immuno-Oncology

Over the next few years, immuno-oncology companies, which harness the immune system to fight illnesses such as cancer, faces strong tailwinds from advancements in precision medicine (including the use of AI to improve hit rates) and growing demand for treatments targeting rare diseases. However, headwinds such as rising scrutiny over drug pricing, regulatory unknowns, and competition from larger, more resourced pharmaceutical companies could weigh on growth.

Regeneron's competitors vary by therapeutic area. In ophthalmology, EYLEA competes with products from Roche/Genentech, Novartis, and biosimilars from companies like Samsung Bioepis. For Dupixent, competitors include AbbVie, Eli Lilly, Pfizer, and AstraZeneca/Amgen. In oncology, Libtayo faces competition from Merck, Bristol-Myers Squibb, Roche, and AstraZeneca.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $14.34 billion in revenue over the past 12 months, Regeneron has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

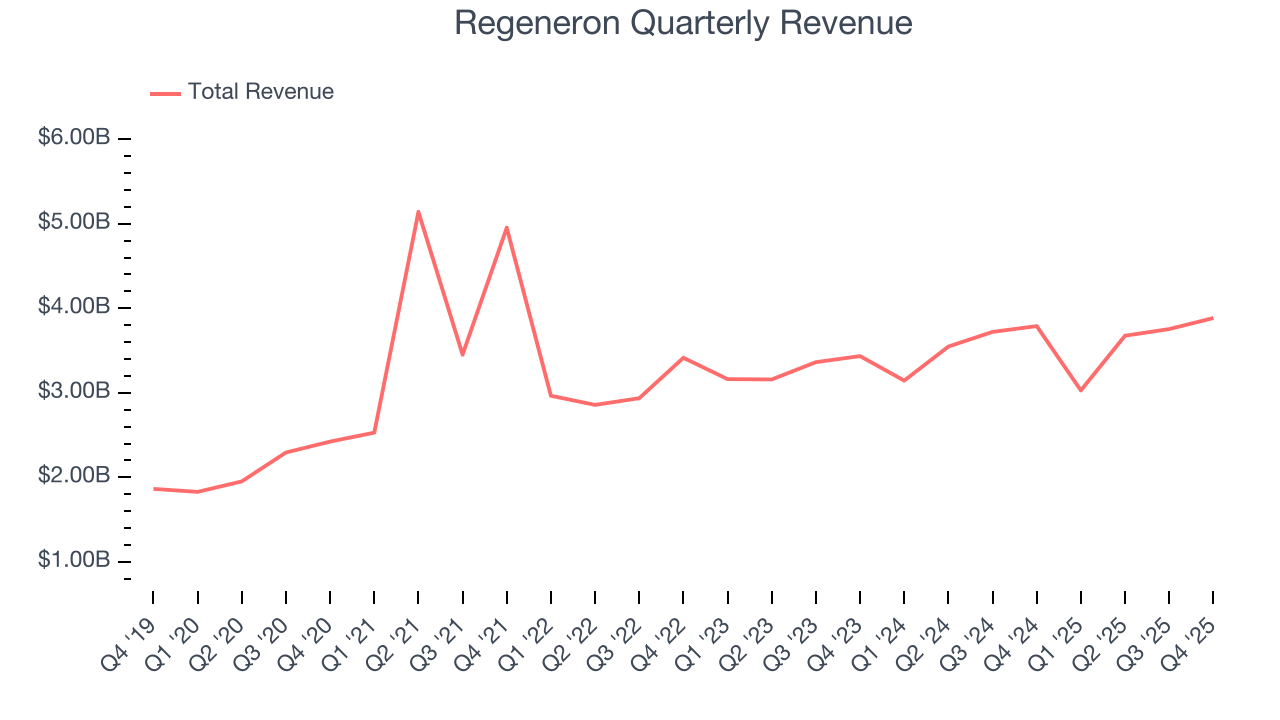

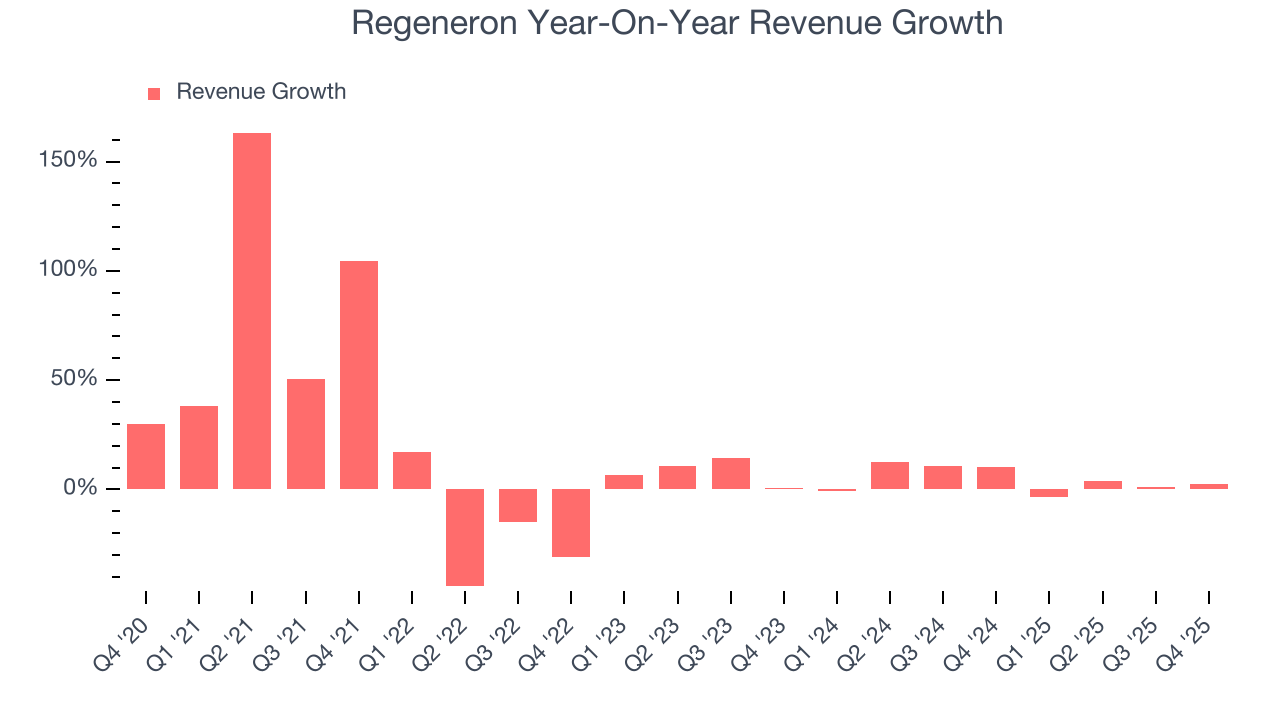

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Regeneron’s 11% annualized revenue growth over the last five years was decent. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Regeneron’s recent performance shows its demand has slowed as its annualized revenue growth of 4.6% over the last two years was below its five-year trend.

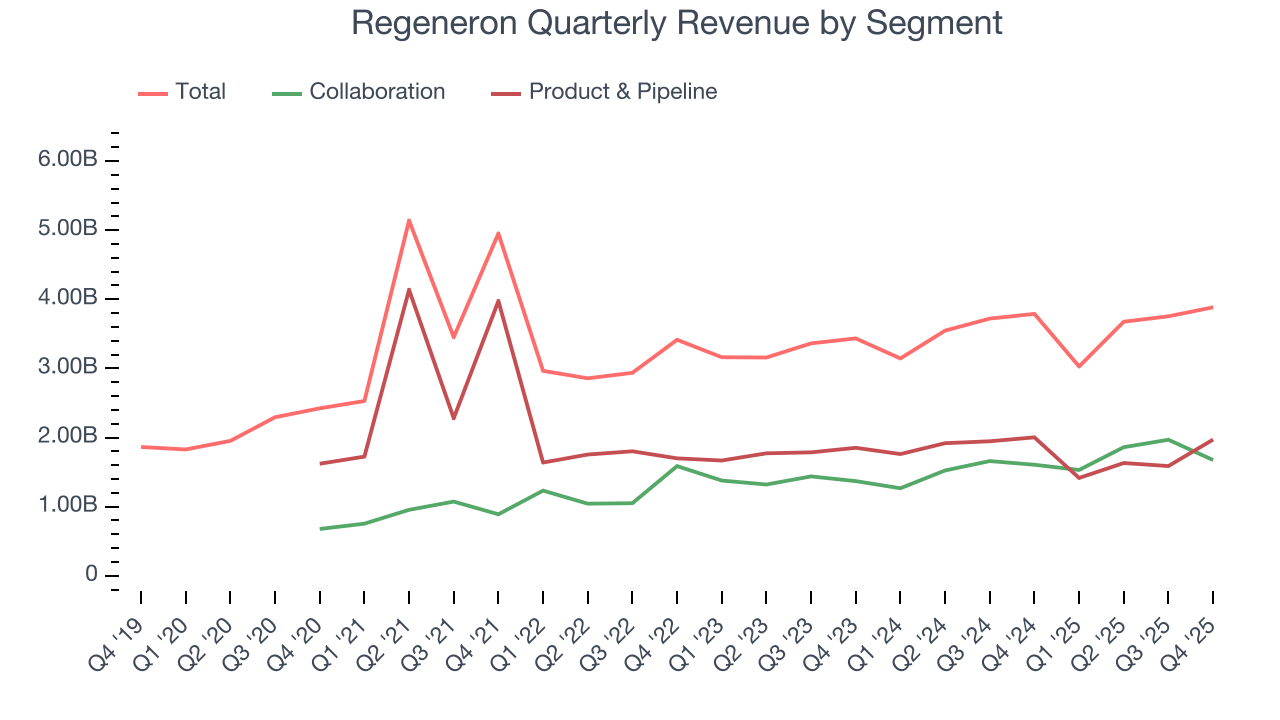

We can dig further into the company’s revenue dynamics by analyzing its most important segments, Collaboration and Product & Pipeline, which are 43.1% and 50.7% of revenue. Over the last two years, Regeneron’s Collaboration revenue averaged 13.2% year-on-year growth. On the other hand, its Product & Pipeline revenue averaged 3% declines.

This quarter, Regeneron reported modest year-on-year revenue growth of 2.5% but beat Wall Street’s estimates by 2.8%.

Looking ahead, sell-side analysts expect revenue to grow 7.7% over the next 12 months, an improvement versus the last two years. This projection is above average for the sector and suggests its newer products and services will spur better top-line performance.

7. Operating Margin

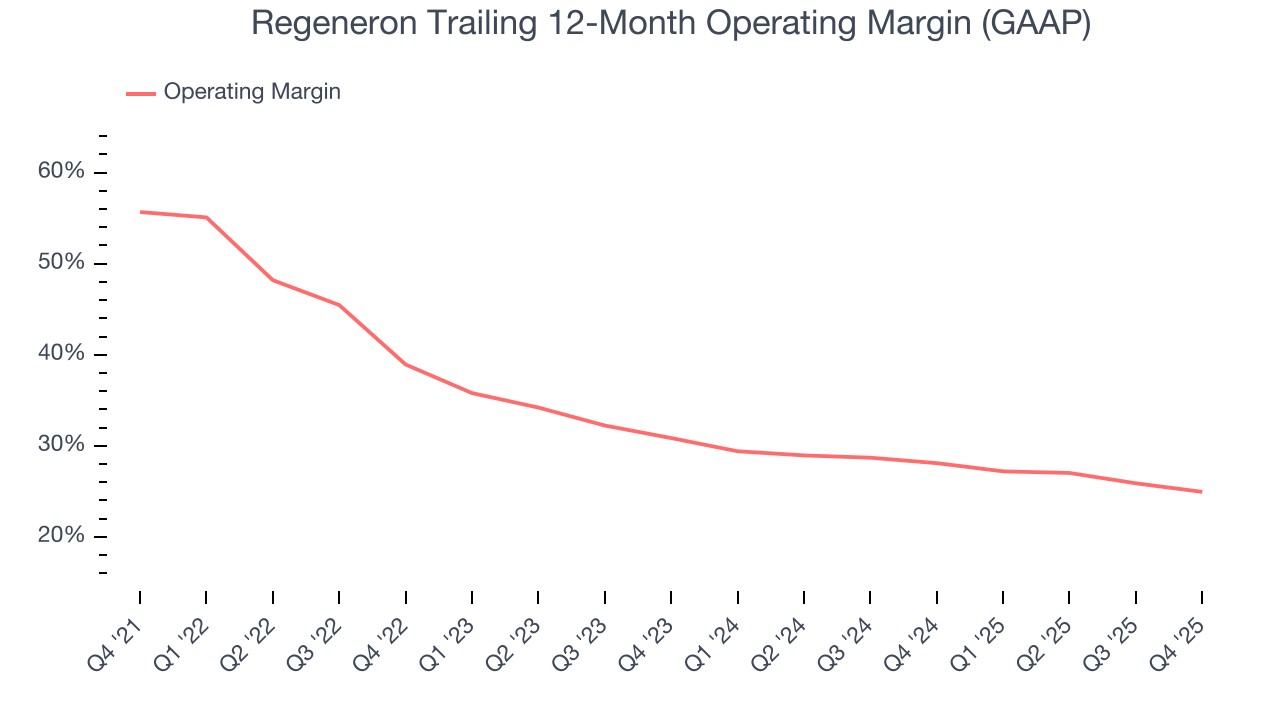

Regeneron has been a well-oiled machine over the last five years. It demonstrated elite profitability for a healthcare business, boasting an average operating margin of 36.2%.

Looking at the trend in its profitability, Regeneron’s operating margin decreased by 30.7 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 5.9 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Regeneron generated an operating margin profit margin of 22.7%, down 3.5 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

8. Earnings Per Share

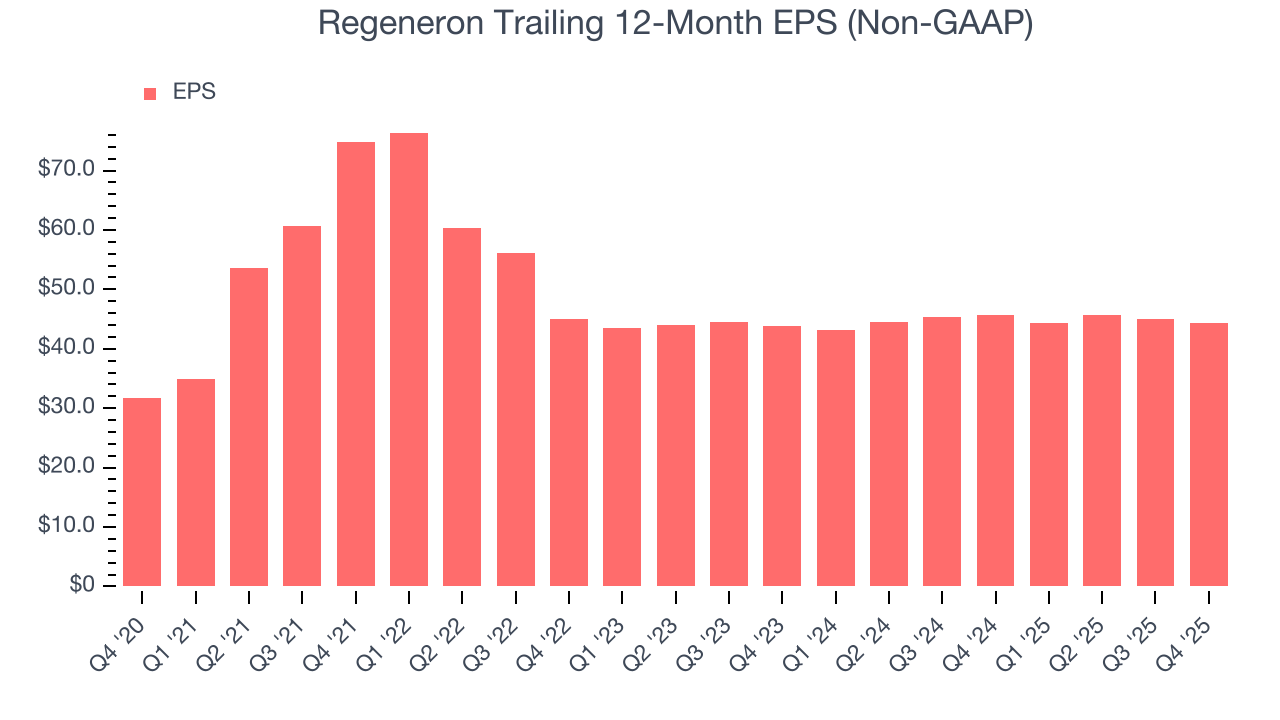

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Regeneron’s EPS grew at a decent 7% compounded annual growth rate over the last five years. However, this performance was lower than its 11% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

Diving into Regeneron’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Regeneron’s operating margin declined by 30.7 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Regeneron reported adjusted EPS of $11.44, down from $12.07 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 6.5%. Over the next 12 months, Wall Street expects Regeneron’s full-year EPS of $44.38 to stay about the same.

9. Cash Is King

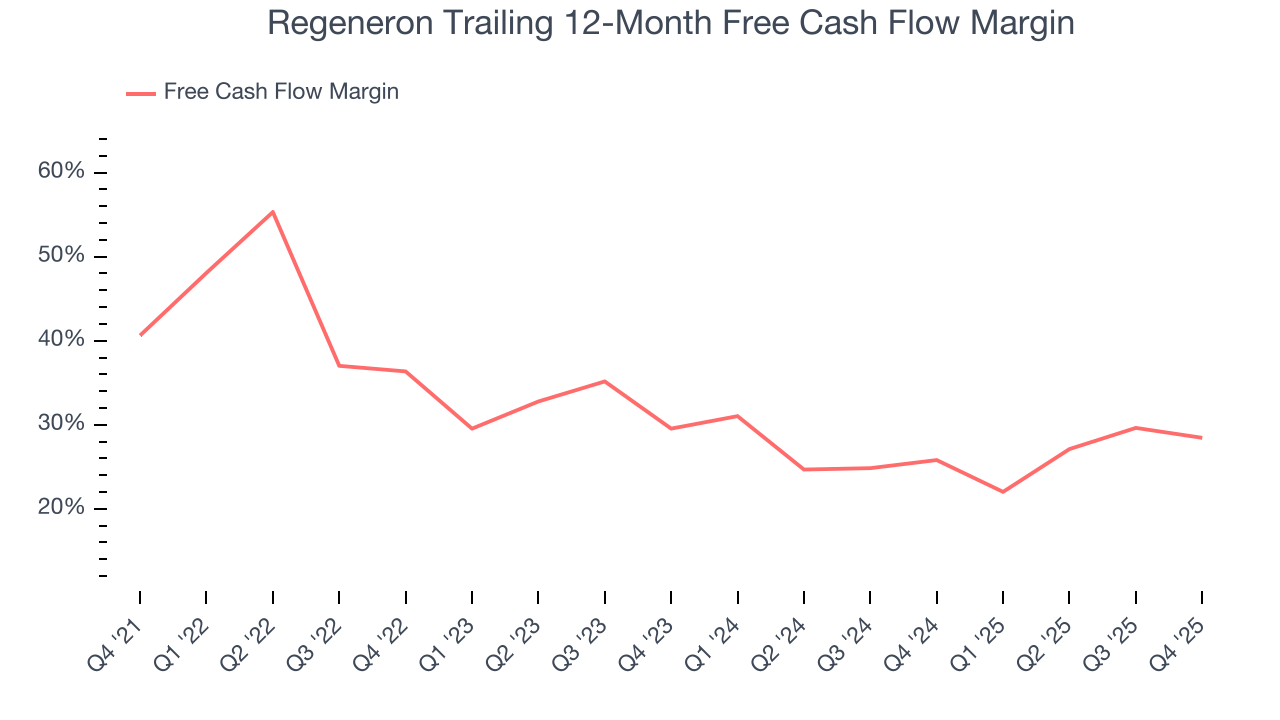

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Regeneron has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the healthcare sector, averaging an eye-popping 32.3% over the last five years.

Taking a step back, we can see that Regeneron’s margin dropped by 12.2 percentage points during that time. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal it is in the middle of an investment cycle.

Regeneron’s free cash flow clocked in at $922 million in Q4, equivalent to a 23.7% margin. The company’s cash profitability regressed as it was 4.3 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

10. Return on Invested Capital (ROIC)

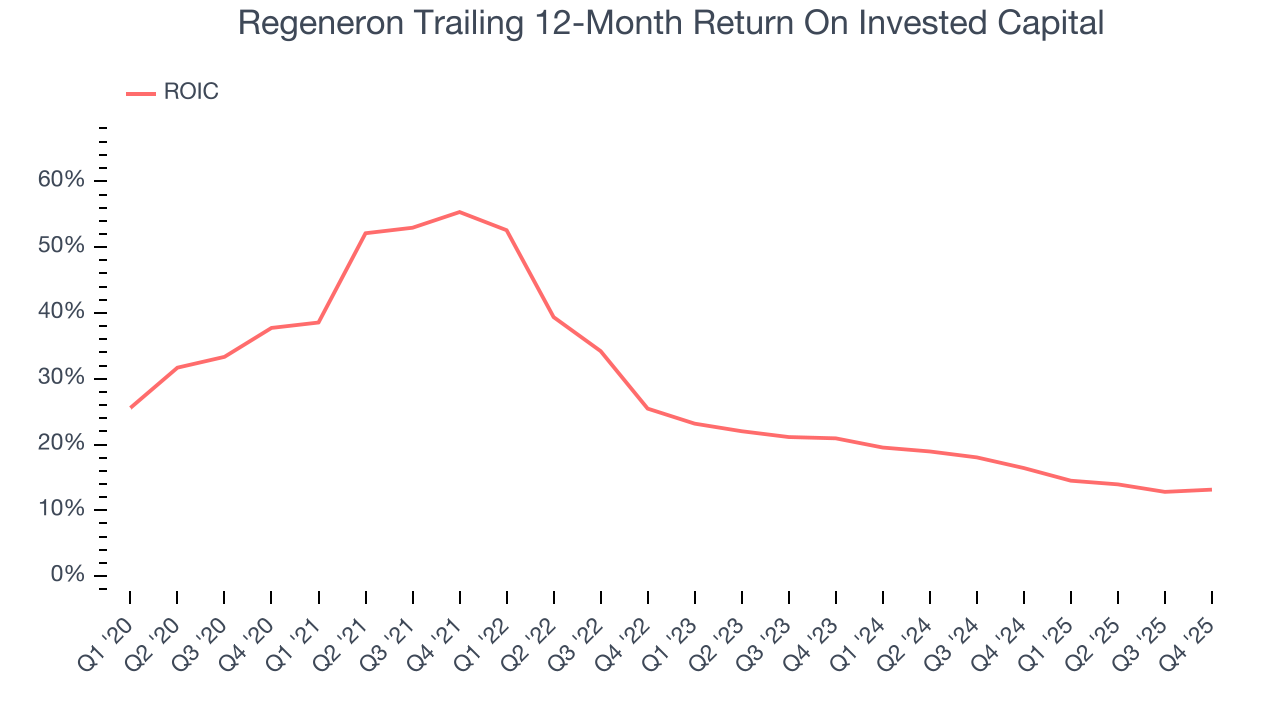

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Regeneron hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 26.3%, splendid for a healthcare business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Regeneron’s ROIC has decreased significantly over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Key Takeaways from Regeneron’s Q4 Results

We enjoyed seeing Regeneron beat analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The market seemed to be hoping for more, and the stock traded down 2.7% to $729.26 immediately following the results.

12. Is Now The Time To Buy Regeneron?

Updated: January 30, 2026 at 6:40 AM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Regeneron.

Regeneron isn’t a terrible business, but it isn’t one of our picks. Although its revenue growth was good over the last five years, it’s expected to deteriorate over the next 12 months and its diminishing returns show management's prior bets haven't worked out. And while the company’s powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits, the downside is its declining operating margin shows the business has become less efficient.

Regeneron’s P/E ratio based on the next 12 months is 16.8x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $832.15 on the company (compared to the current share price of $729.26).