Rivian (RIVN)

We see potential in Rivian, but its negative EBITDA and debt balance put it in a tough position.― StockStory Analyst Team

1. News

2. Summary

Why Rivian Is Not Exciting

The manufacturer of Amazon’s delivery trucks, Rivian (NASDAQ:RIVN) designs, manufactures, and sells electric vehicles and commercial delivery vans.

- Negative 40.4% gross margin means it loses money on every sale and must pivot or scale quickly to survive

- Suboptimal cost structure is highlighted by its history of operating margin losses

- Negative EBITDA restricts its access to capital and increases the probability of shareholder dilution if things turn unexpectedly

Rivian shows some potential. However, we’d refrain from buying the stock until its EBITDA can comfortably service its debt.

Why There Are Better Opportunities Than Rivian

Why There Are Better Opportunities Than Rivian

At $15.36 per share, Rivian trades at 2.6x forward price-to-sales. The market typically values companies like Rivian based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy.

It’s better to pay up for high-quality businesses with strong long-term earnings potential rather than buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Rivian (RIVN) Research Report: Q4 CY2025 Update

Electric vehicle manufacturer Rivian (NASDAQ:RIVN) beat Wall Street’s revenue expectations in Q4 CY2025, but sales fell by 25.8% year on year to $1.29 billion. Its GAAP loss of $0.66 per share was 16.7% above analysts’ consensus estimates.

Rivian (RIVN) Q4 CY2025 Highlights:

- Revenue: $1.29 billion vs analyst estimates of $1.28 billion (25.8% year-on-year decline, 0.7% beat)

- EPS (GAAP): -$0.66 vs analyst estimates of -$0.79 (16.7% beat)

- Adjusted EBITDA: -$465 million (-36.2% margin, 67.9% year-on-year decline)

- EBITDA guidance for the upcoming financial year 2026 is -$1.95 billion at the midpoint, below analyst estimates of -$1.81 billion

- Adjusted EBITDA Margin: -36.2%, down from -16% in the same quarter last year

- Free Cash Flow was -$1.14 billion, down from $856 million in the same quarter last year

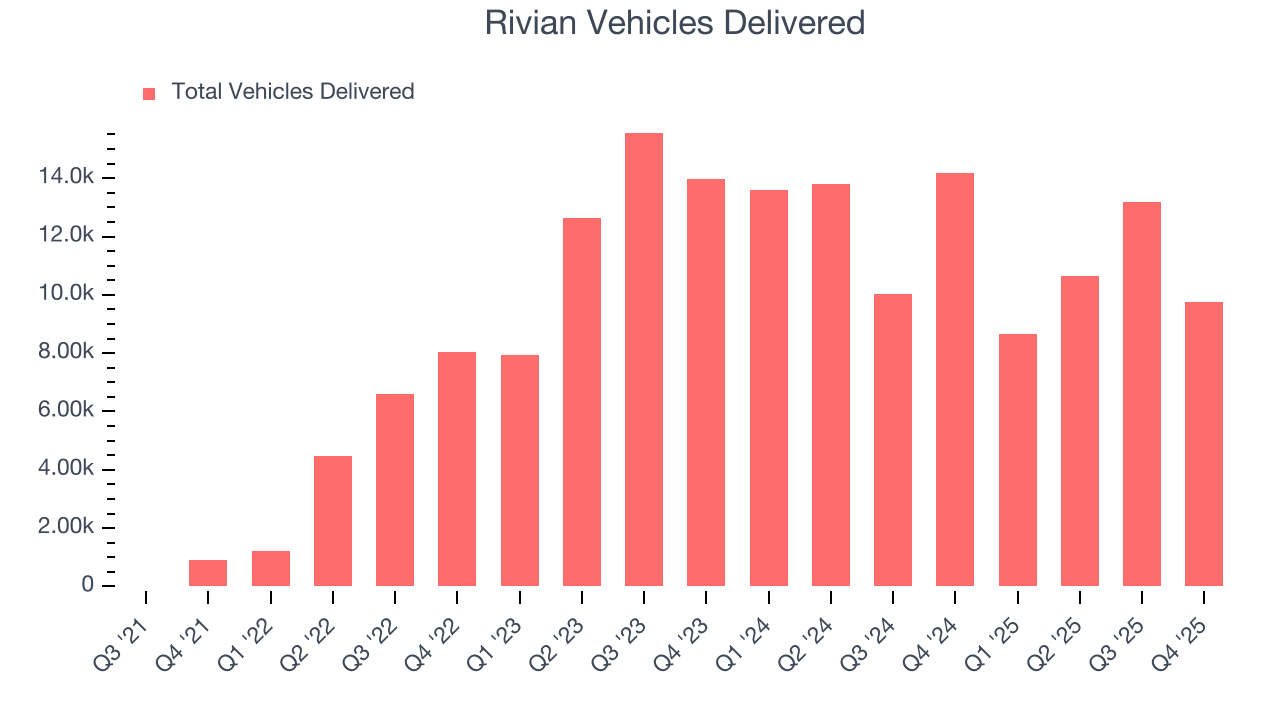

- Sales Volumes fell 31.3% year on year (1.5% in the same quarter last year)

- Market Capitalization: $18.09 billion

Company Overview

The manufacturer of Amazon’s delivery trucks, Rivian (NASDAQ:RIVN) designs, manufactures, and sells electric vehicles and commercial delivery vans.

Rivian sells to both the consumer and commercial markets. Its consumer lineup includes the R1T electric pickup truck and R1S electric SUV while its commercial products consist of electric delivery vans (RCV platform). Each of its vehicles is equipped with cloud-based software for fleet management, and Rivian also provides ancillary services such as charging solutions and financing.

Rivian emphasizes vertical integration in its operations, from product development to manufacturing. The company's Normal, Illinois factory has an annual production capacity of over 150,000 vehicles, which is distributed between its R1 (consumer vehicles) and RCV platforms. Rivian has plans for expansion, including the construction of a second manufacturing facility near Atlanta, Georgia, with an anticipated capacity to produce up to 400,000 vehicles annually.

The company primarily generates revenue through direct sales of its electric vehicles to consumers and commercial customers, bypassing traditional dealerships. By selling directly, Rivian maintains control over inventory and pricing while capturing full retail value rather than just wholesale revenue. On the flip side, this makes Rivian a more capital-intensive business.

In addition to outright vehicle sales, the company offers leasing options. A significant portion of revenue also comes from its commercial vehicle contract with Amazon.

4. Automobile Manufacturing

Much capital investment and technical know-how are needed to manufacture functional, safe, and aesthetically pleasing automobiles for the mass market. Barriers to entry are therefore high, and auto manufacturers with economies of scale can boast strong economic moats. However, this doesn’t insulate them from new entrants, as electric vehicles (EVs) have entered the market and are upending it. This has forced established manufacturers to not only contend with emerging EV-first competitors but also decide how much they want to invest in these disruptive technologies, which will likely cannibalize their legacy offerings.

Competitors in the electric vehicle industry include Tesla (NASDAQ:TSLA), Ford (NYSE:F), General Motors (NYSE:GM), and Lucid Motors (NASDAQ:LCID).

5. Revenue Growth

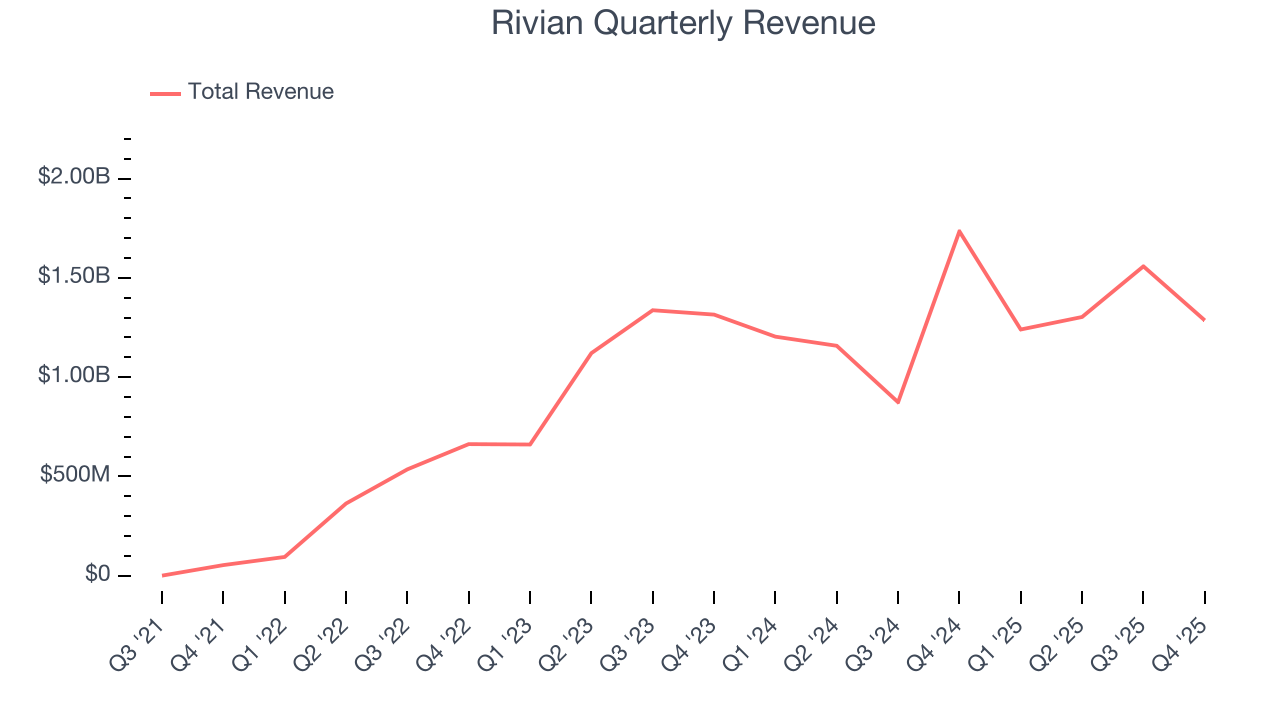

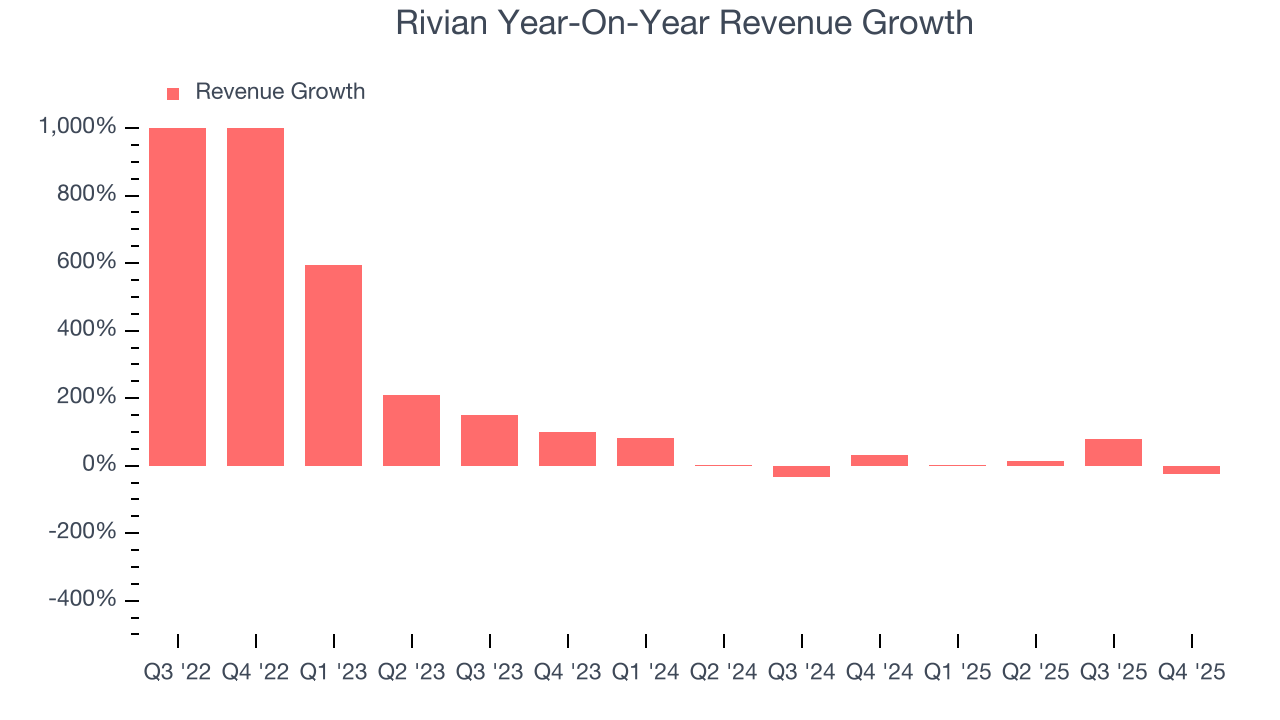

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Rivian’s 168% annualized revenue growth over the last four years was incredible. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. Rivian’s annualized revenue growth of 10.2% over the last two years is below its four-year trend, but we still think the results suggest healthy demand. Rivian’s recent performance shows it’s one of the better Automobile Manufacturing businesses as many of its peers faced declining sales because of cyclical headwinds.

We can better understand the company’s revenue dynamics by analyzing its number of vehicles delivered, which reached 9,745 in the latest quarter. Over the last two years, Rivian’s vehicles delivered declined by 8.2% annually. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, Rivian’s revenue fell by 25.8% year on year to $1.29 billion but beat Wall Street’s estimates by 0.7%.

Looking ahead, sell-side analysts expect revenue to grow 25.8% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and suggests its newer products and services will fuel better top-line performance.

6. Gross Margin & Pricing Power

Gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

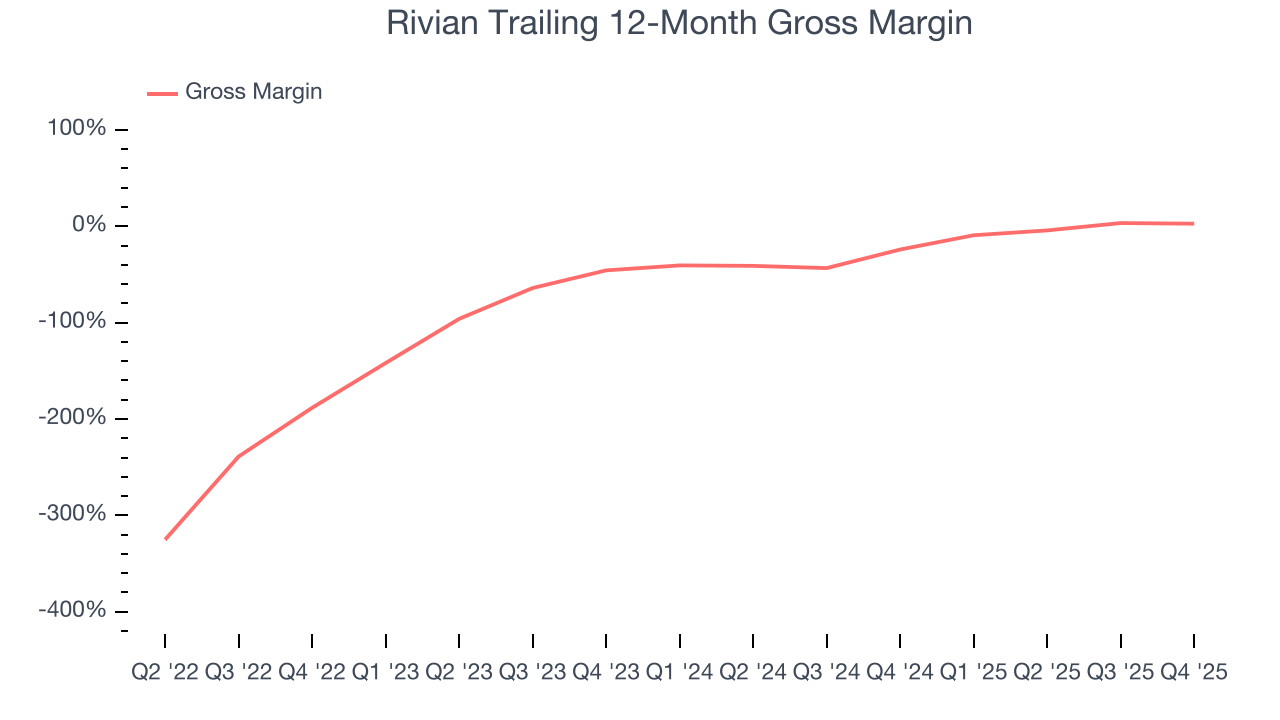

Rivian has bad unit economics for an industrials business, signaling it operates in a competitive market. This is also because it’s an automobile manufacturer.

Automobile manufacturers have structurally lower profitability as they often break even on the initial sale of vehicles and instead make money on parts and servicing, which come many years later - this explains why new entrants whose fleets are too young to generate substantial aftermarket revenues have negative gross margins. As you can see below, these dynamics culminated in an average negative 40.4% gross margin for Rivian over the last five years.

In Q4, Rivian produced a 9.3% gross profit margin, in line with the same quarter last year. On a wider time horizon, Rivian’s full-year margin has been trending up over the past 12 months, increasing by 26.8 percentage points. If this move continues, it could suggest an environment where the company has better pricing power and stable or shrinking input costs (such as raw materials).

7. Operating Margin

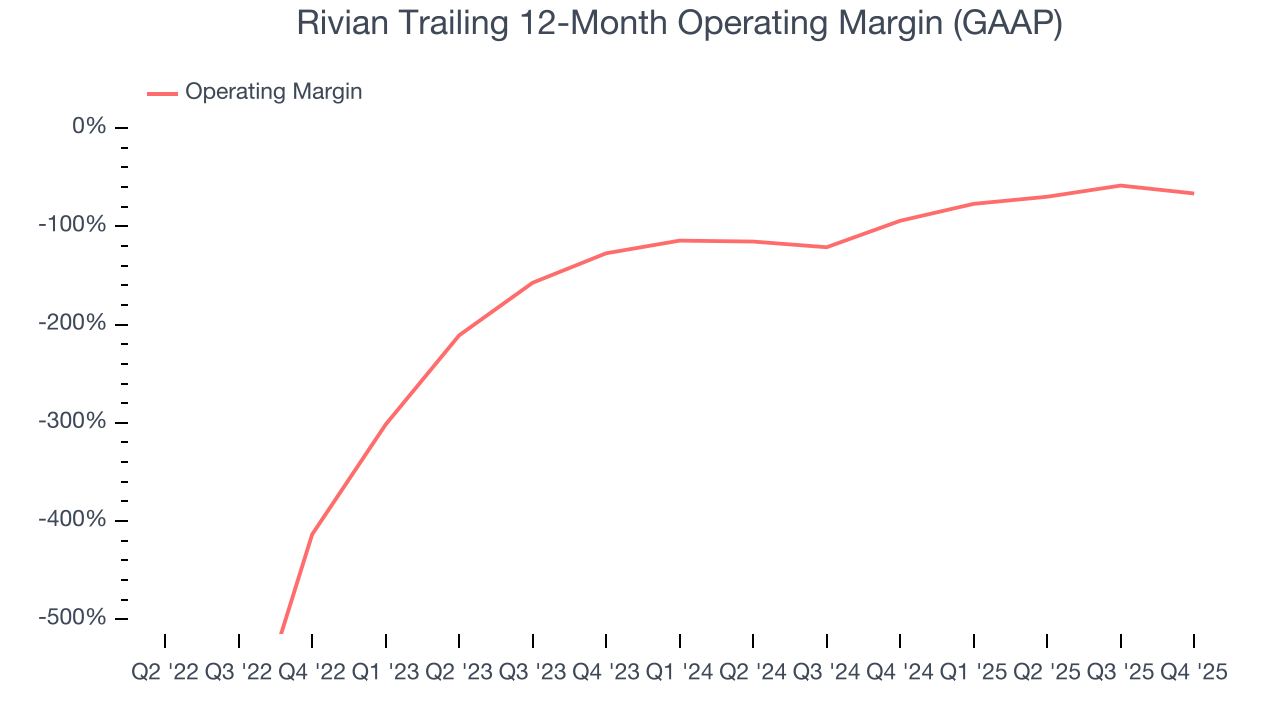

Rivian’s high expenses have contributed to an average operating margin of negative 141% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, Rivian’s operating margin rose over the last five years, as its sales growth gave it operating leverage. We’ll take Rivian’s improvement as many Automobile Manufacturing companies saw their margins fall (along with revenue, as mentioned above) because the cycle turned in the wrong direction.

Rivian’s operating margin was negative 64.8% this quarter.

8. Earnings Per Share

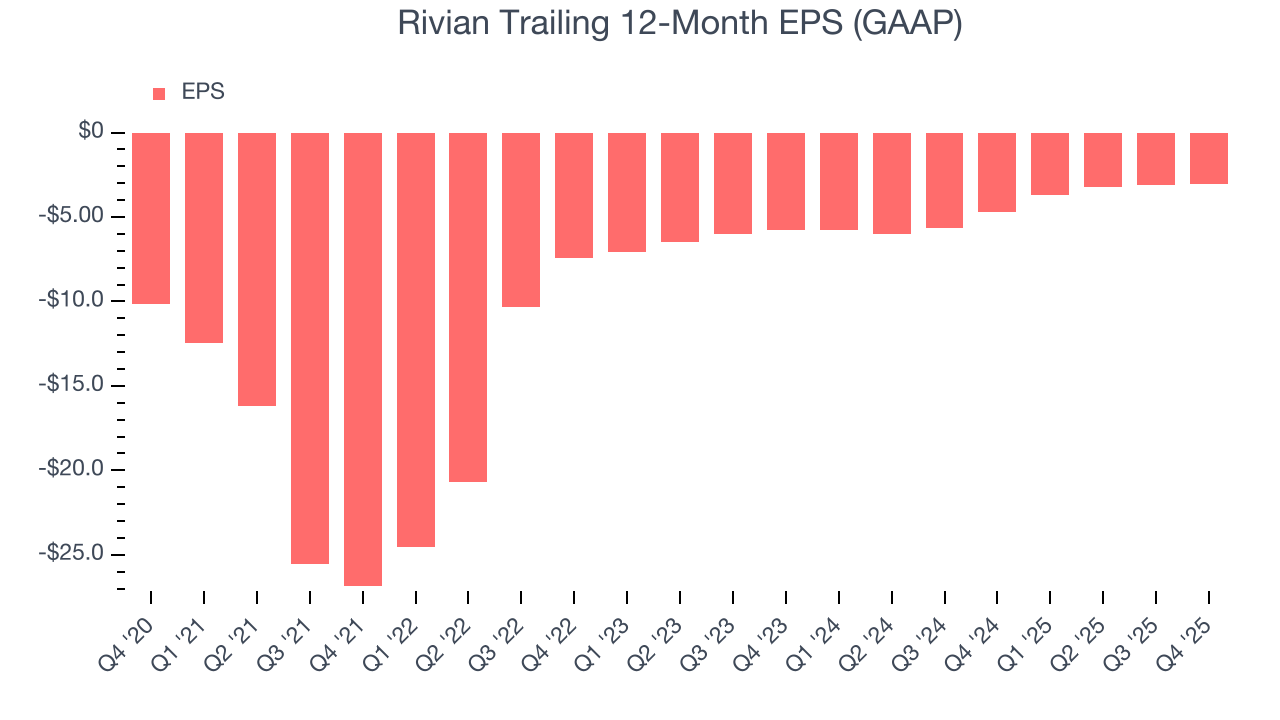

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Although Rivian’s full-year earnings are still negative, it reduced its losses and improved its EPS by 21.3% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon, especially since it recently diluted shareholders by forming a $5.8 billion joint venture with Volkswagen in November 2024.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Rivian, its two-year annual EPS growth of 27% was higher than its five-year trend. We love it when earnings improve, but a caveat is that its EPS is still in the red.

In Q4, Rivian reported EPS of negative $0.66, up from negative $0.70 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Rivian to improve its earnings losses. Analysts forecast its full-year EPS of negative $3.07 will advance to negative $2.91.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

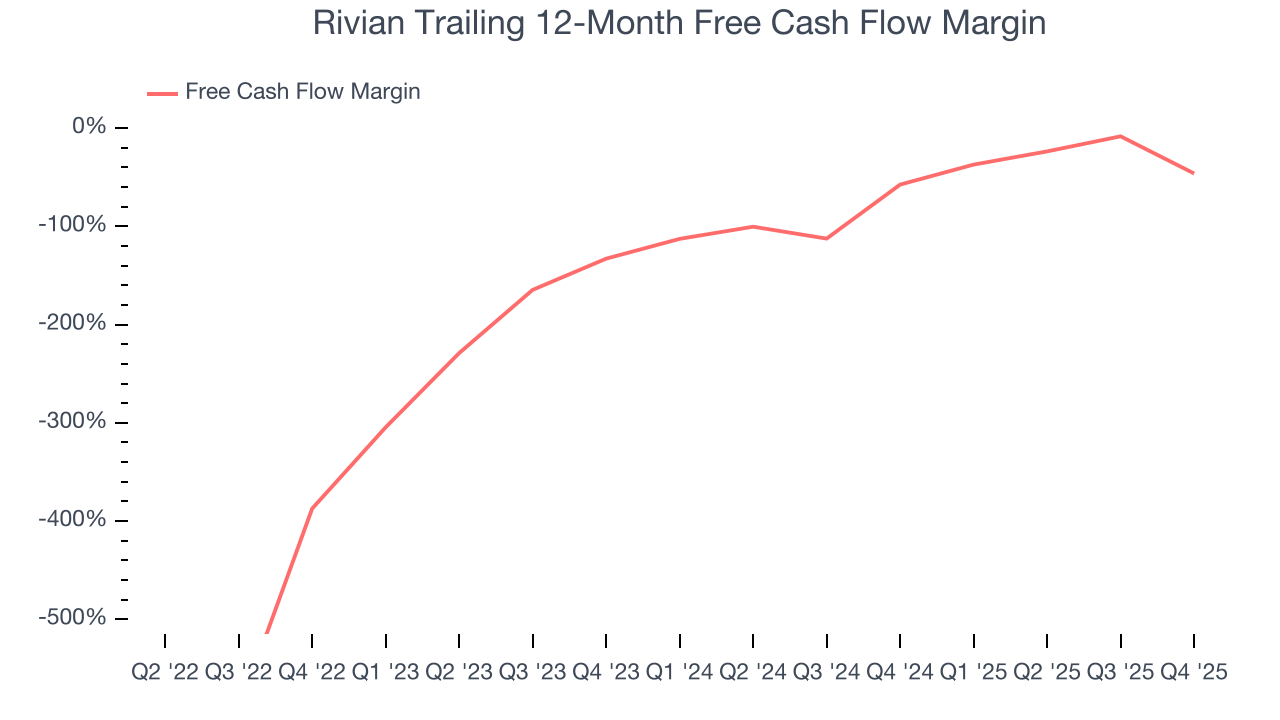

Rivian’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 123%, meaning it lit $123.32 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that Rivian’s margin expanded during that time. In light of its glaring cash burn, however, this improvement is a bucket of hot water in a cold ocean.

Rivian burned through $1.14 billion of cash in Q4, equivalent to a negative 89% margin. The company’s cash flow turned negative after being positive in the same quarter last year, but it’s still above its five-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends carry greater meaning.

10. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

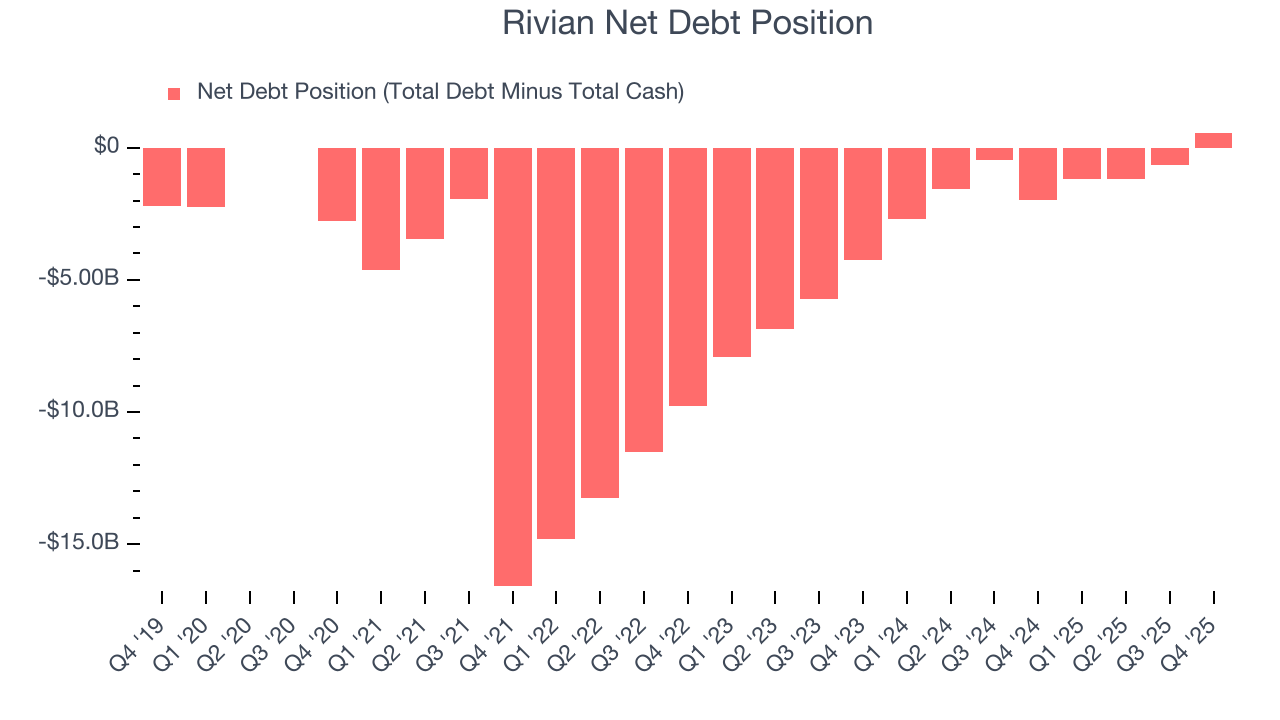

Rivian posted negative $2.06 billion of EBITDA over the last 12 months, and its $6.65 billion of debt exceeds the $6.08 billion of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

We implore our readers to tread carefully because credit agencies could downgrade Rivian if its unprofitable ways continue, making incremental borrowing more expensive and restricting growth prospects. The company could also be backed into a corner if the market turns unexpectedly. We hope Rivian can improve its profitability and remain cautious until then.

11. Key Takeaways from Rivian’s Q4 Results

We were impressed by how significantly Rivian blew past analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its full-year EBITDA guidance missed. Overall, this print had some key positives. The stock traded up 7.6% to $15.09 immediately after reporting.

12. Is Now The Time To Buy Rivian?

Updated: February 12, 2026 at 10:45 PM EST

Before deciding whether to buy Rivian or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Aside from its balance sheet, Rivian is a pretty decent company. First off, its revenue growth was exceptional over the last four years. And while its projected EPS for the next year is lacking, its rising cash profitability gives it more optionality. On top of that, its expanding operating margin shows the business has become more efficient.

Rivian’s forward price-to-sales ratio is 2.7x. Despite its notable business characteristics, we’d hold off for now because its balance sheet concerns us. Interested in this company and its prospects? We recommend you wait until it generates sufficient cash flows or raises money.

Wall Street analysts have a consensus one-year price target of $16.96 on the company (compared to the current share price of $15.36), implying they see 10.5% upside in buying Rivian in the short term.