EchoStar (SATS)

We wouldn’t buy EchoStar. Its poor sales growth shows demand is soft and its negative returns on capital suggest it destroyed value.― StockStory Analyst Team

1. News

2. Summary

Why We Think EchoStar Will Underperform

Following its 2023 acquisition of DISH Network, EchoStar (NASDAQ:SATS) provides satellite communications, pay-TV services, wireless networks, and broadband solutions across consumer and enterprise markets.

- Sales tumbled by 6.6% annually over the last two years, showing market trends are working against its favor during this cycle

- Performance over the past five years shows its incremental sales were much less profitable, as its earnings per share fell by 26.4% annually

- EBITDA losses may force it to accept punitive lending terms or high-cost debt

EchoStar’s quality is lacking. There are superior opportunities elsewhere.

Why There Are Better Opportunities Than EchoStar

High Quality

Investable

Underperform

Why There Are Better Opportunities Than EchoStar

EchoStar is trading at $126.03 per share, or 34.4x forward EV-to-EBITDA. The current multiple is quite expensive, especially for the fundamentals of the business.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. EchoStar (SATS) Research Report: Q3 CY2025 Update

Satellite communications company EchoStar (NASDAQGS:SATS) fell short of the markets revenue expectations in Q3 CY2025, with sales falling 7.1% year on year to $3.61 billion. Its GAAP loss of $44.37 per share was significantly below analysts’ consensus estimates.

EchoStar (SATS) Q3 CY2025 Highlights:

- Revenue: $3.61 billion vs analyst estimates of $3.73 billion (7.1% year-on-year decline, 3.1% miss)

- EPS (GAAP): -$44.37 vs analyst estimates of -$1.13 (significant miss)

- Adjusted EBITDA: $230.9 million vs analyst estimates of $291 million (6.4% margin, 20.7% miss)

- Operating Margin: -460%, down from -4.1% in the same quarter last year

- Free Cash Flow was -$144.4 million compared to -$57.52 million in the same quarter last year

- Market Capitalization: $20.81 billion

Company Overview

Following its 2023 acquisition of DISH Network, EchoStar (NASDAQ:SATS) provides satellite communications, pay-TV services, wireless networks, and broadband solutions across consumer and enterprise markets.

EchoStar operates through four primary business segments that span both consumer and enterprise markets. The Pay-TV segment offers television services under the DISH and SLING brands, with DISH TV providing traditional satellite television and SLING TV delivering streaming content over the internet. These services reach millions of subscribers with various programming packages including national networks, local broadcasts, and specialty content.

The Retail Wireless segment provides prepaid and postpaid mobile services primarily under the Boost Mobile and Gen Mobile brands. Currently operating mostly as a mobile virtual network operator (MVNO) using T-Mobile and AT&T's networks, EchoStar is gradually transitioning to become a mobile network operator (MNO) as it builds out its own 5G infrastructure.

The 5G Network Deployment segment represents EchoStar's ambitious effort to build America's first cloud-native, Open Radio Access Network (O-RAN) based 5G network. The company has invested heavily in wireless spectrum licenses and has met significant FCC-mandated population coverage requirements, reaching over 73% of the U.S. population with its 5G service.

The Broadband and Satellite Services segment leverages EchoStar's satellite fleet to provide internet connectivity to consumers and businesses across the Americas. The company also offers enterprise solutions including network services, satellite ground systems, and telecommunications infrastructure to government agencies and corporate clients. Its recently launched EchoStar XXIV satellite has expanded broadband capacity across North and South America.

EchoStar generates revenue through subscription fees for its consumer services, equipment sales, and enterprise service contracts. The company maintains distribution networks that include direct sales channels, third-party retailers, and online platforms. For its satellite and enterprise services, EchoStar designs and manufactures much of its equipment, sometimes outsourcing production to third-party manufacturers.

4. Traditional Media & Publishing

The sector faces structural headwinds from declining linear TV viewership, shifts in advertising spend toward digital platforms, and ongoing challenges in monetizing print and broadcast content. However, for companies that invest wisely, tailwinds can include AI, the power of which can result in more personalized content creation and more detailed audience analysis. These can create a flywheel of success where one feeds into the other. Still there are outstanding questions around AI-generated content oversight, and the regulatory framework around this could evolve in unseen ways over the next few years.

EchoStar's competitors vary by business segment. In Pay-TV, it competes with cable providers like Comcast and Charter, as well as streaming services such as Netflix and Disney+. In wireless, it faces major carriers including Verizon, AT&T, and T-Mobile. For satellite broadband, key competitors include ViaSat, SpaceX's Starlink, and OneWeb.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

With $15.18 billion in revenue over the past 12 months, EchoStar is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices.

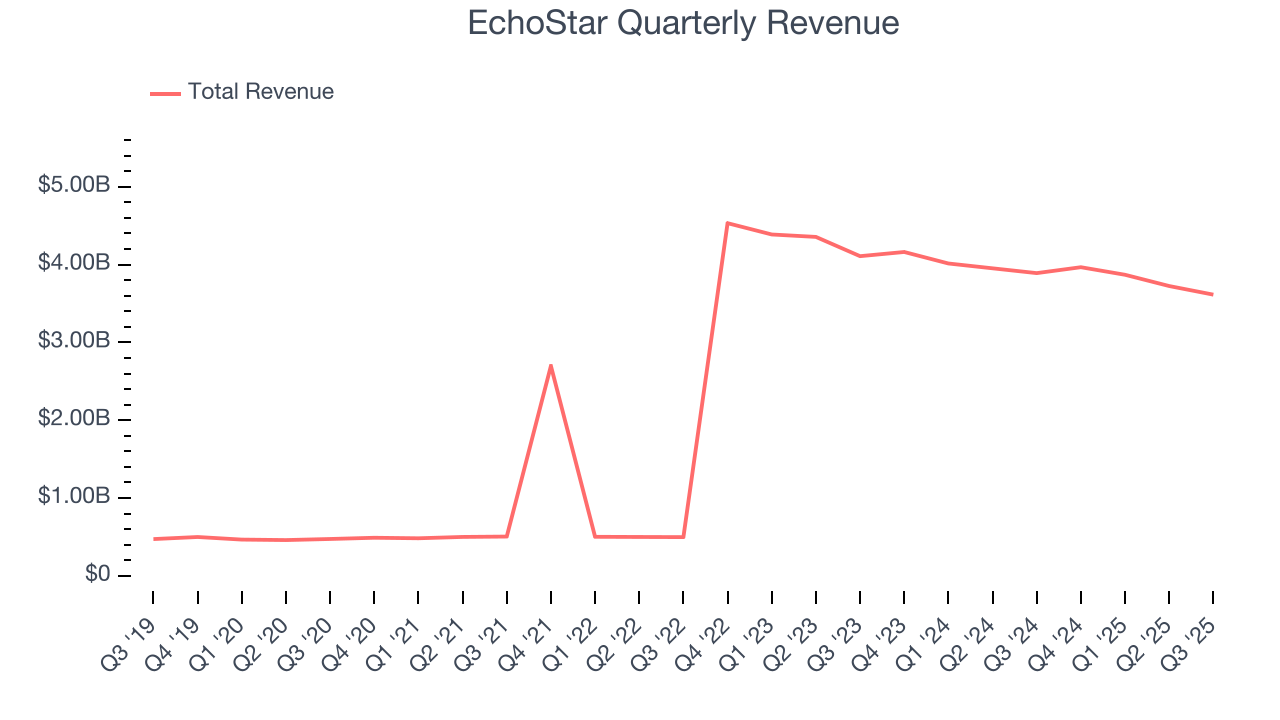

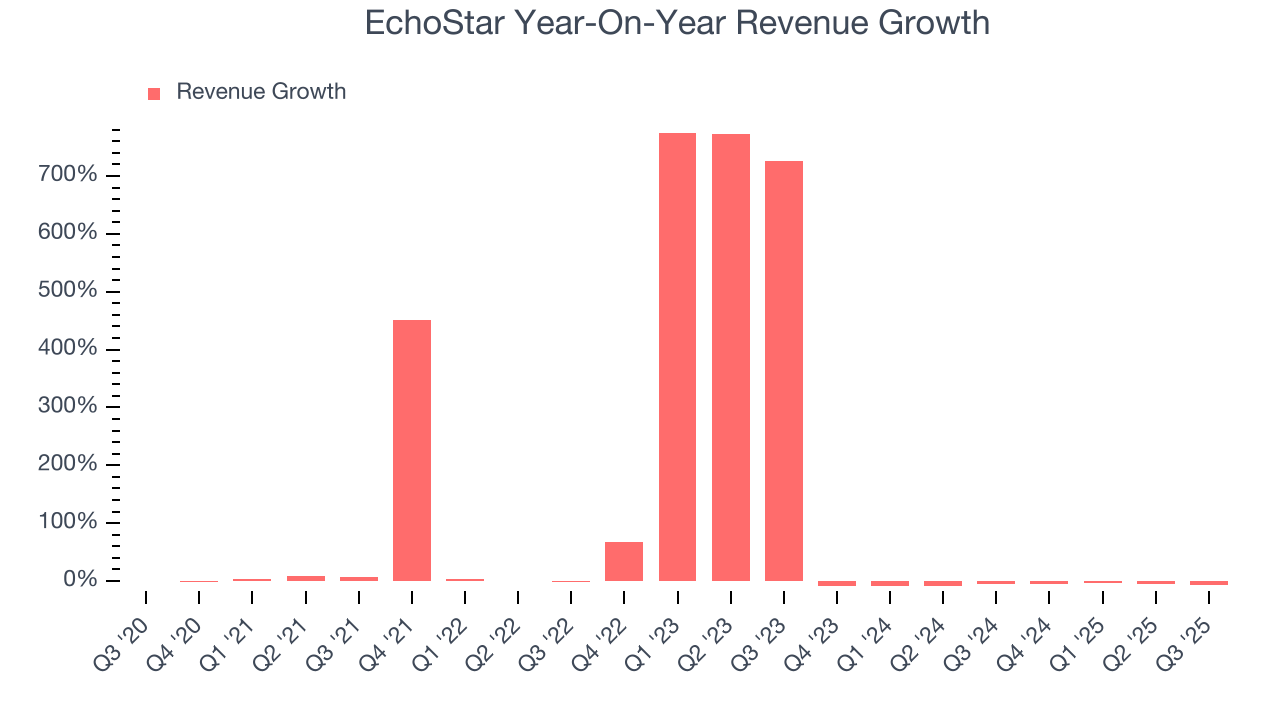

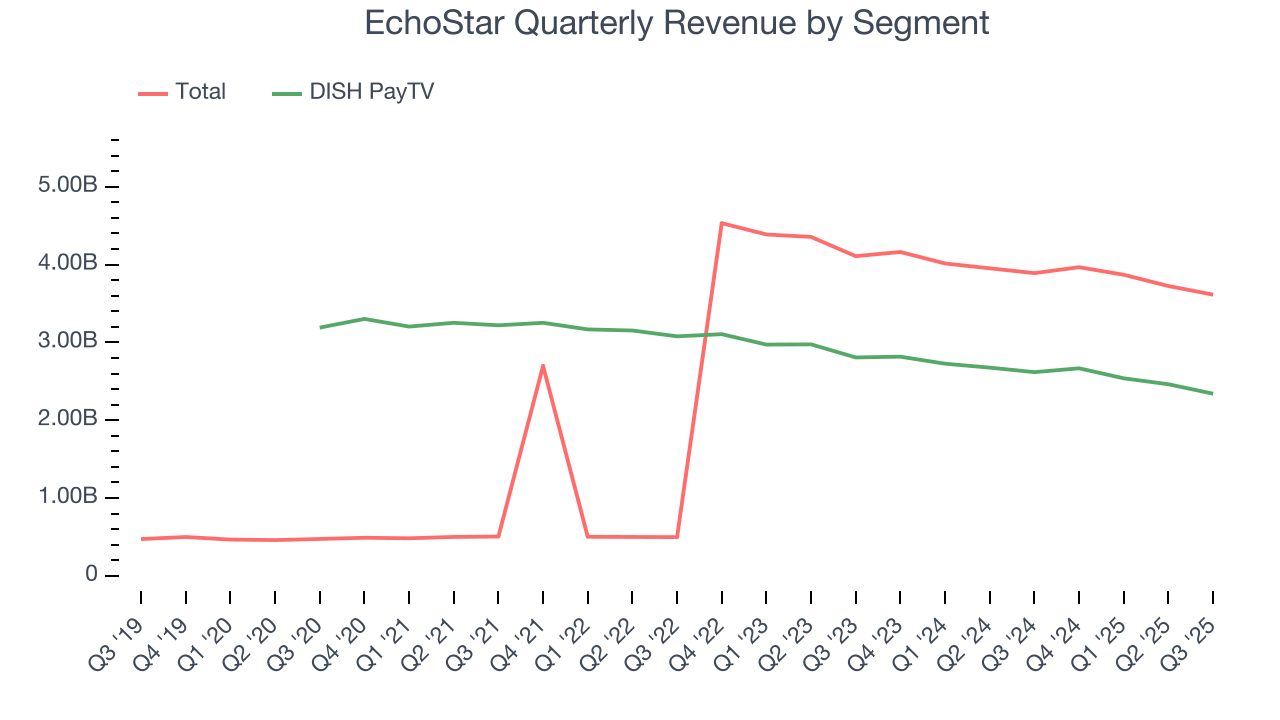

As you can see below, EchoStar’s sales grew at an incredible 51.6% compounded annual growth rate over the last five years. This shows it had high demand, a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. EchoStar’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 6.6% over the last two years.

We can dig further into the company’s revenue dynamics by analyzing its most important segment, DISH PayTV. Over the last two years, EchoStar’s DISH PayTV revenue averaged 8.1% year-on-year declines. This segment has lagged the company’s overall sales.

This quarter, EchoStar missed Wall Street’s estimates and reported a rather uninspiring 7.1% year-on-year revenue decline, generating $3.61 billion of revenue.

Looking ahead, sell-side analysts expect revenue to decline by 3.3% over the next 12 months. While this projection is better than its two-year trend, it’s hard to get excited about a company that is struggling with demand.

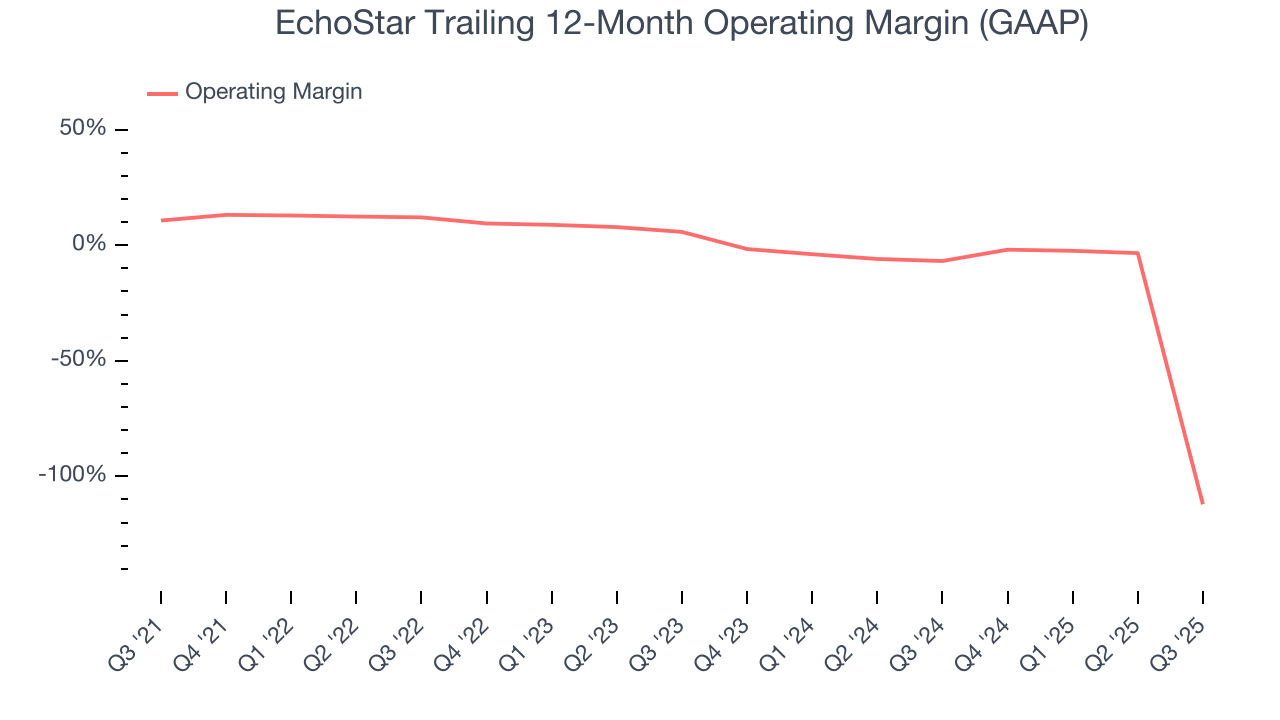

6. Operating Margin

EchoStar’s high expenses have contributed to an average operating margin of negative 29.9% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, EchoStar’s operating margin decreased significantly over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. EchoStar’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

EchoStar’s operating margin was negative 460% this quarter.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

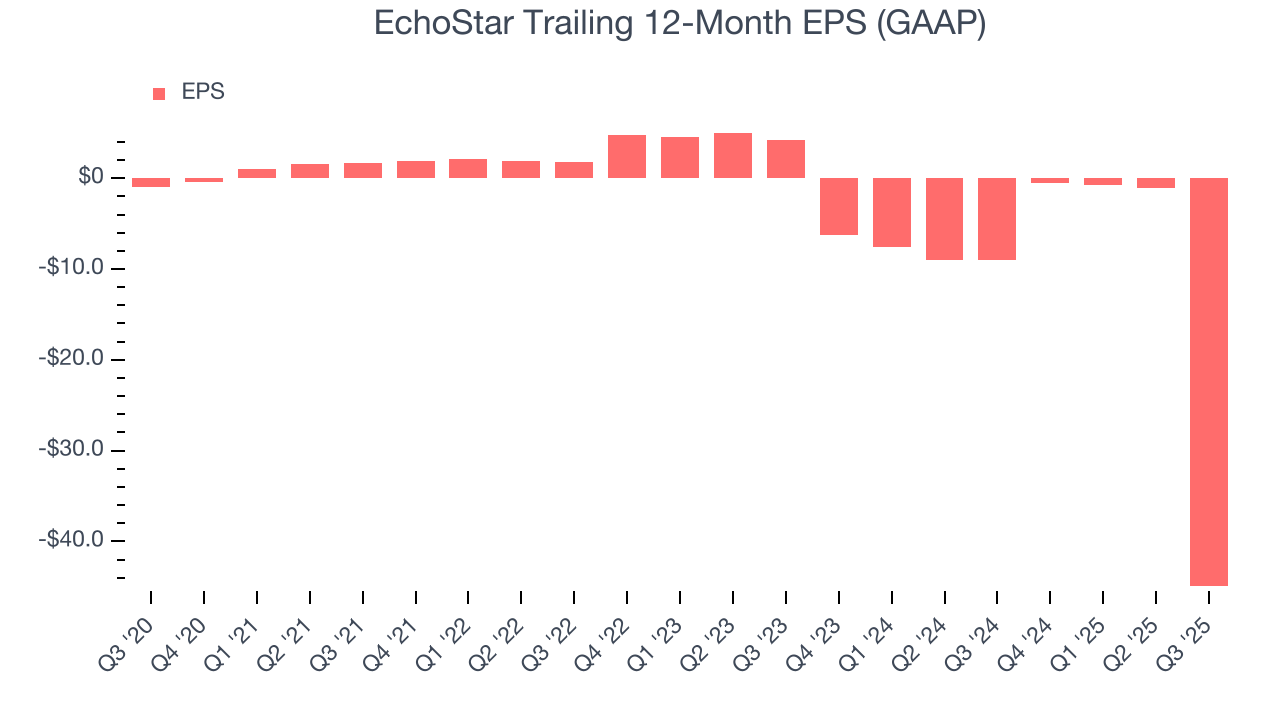

EchoStar’s earnings losses deepened over the last five years as its EPS dropped 116% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, EchoStar’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for EchoStar, its EPS declined by more than its revenue over the last two years, dropping 255%. This tells us the company struggled to adjust to shrinking demand.

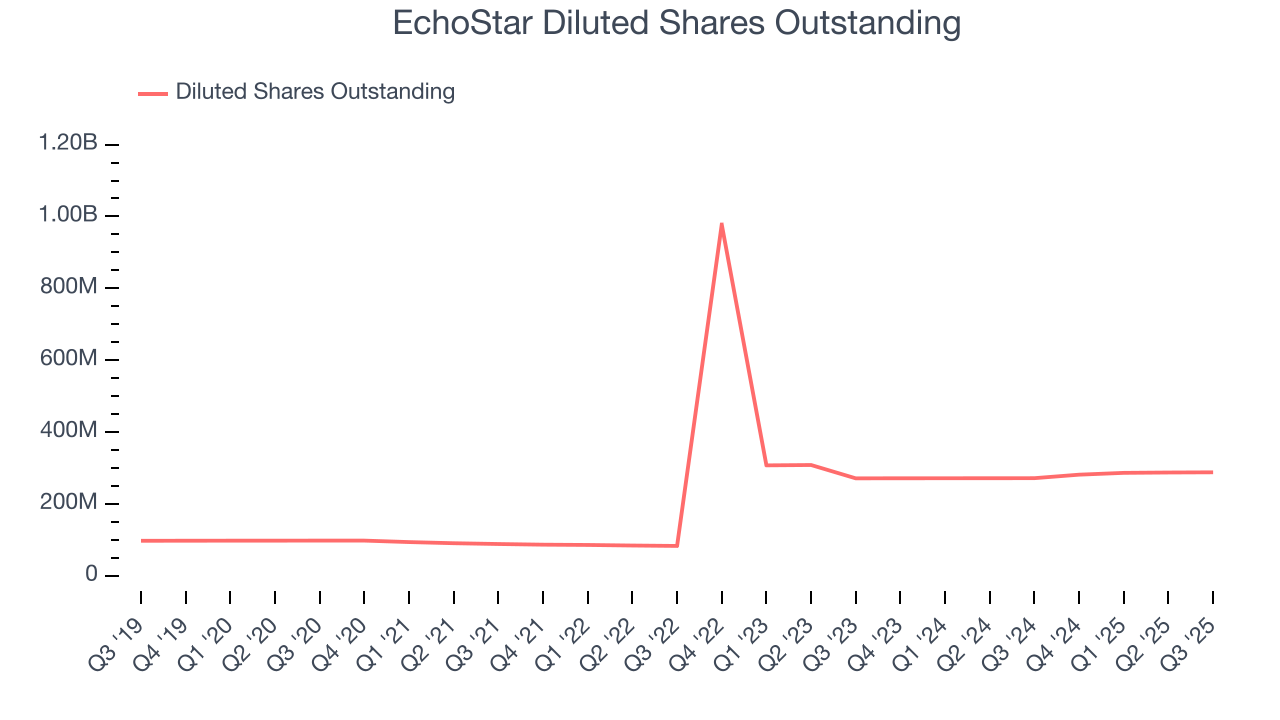

We can take a deeper look into EchoStar’s earnings to better understand the drivers of its performance. EchoStar’s operating margin has declined over the last two yearswhile its share count has grown 6.2%. This means the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q3, EchoStar reported EPS of negative $44.37, down from negative $0.52 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects EchoStar to improve its earnings losses. Analysts forecast its full-year EPS of negative $44.95 will advance to negative $4.49.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

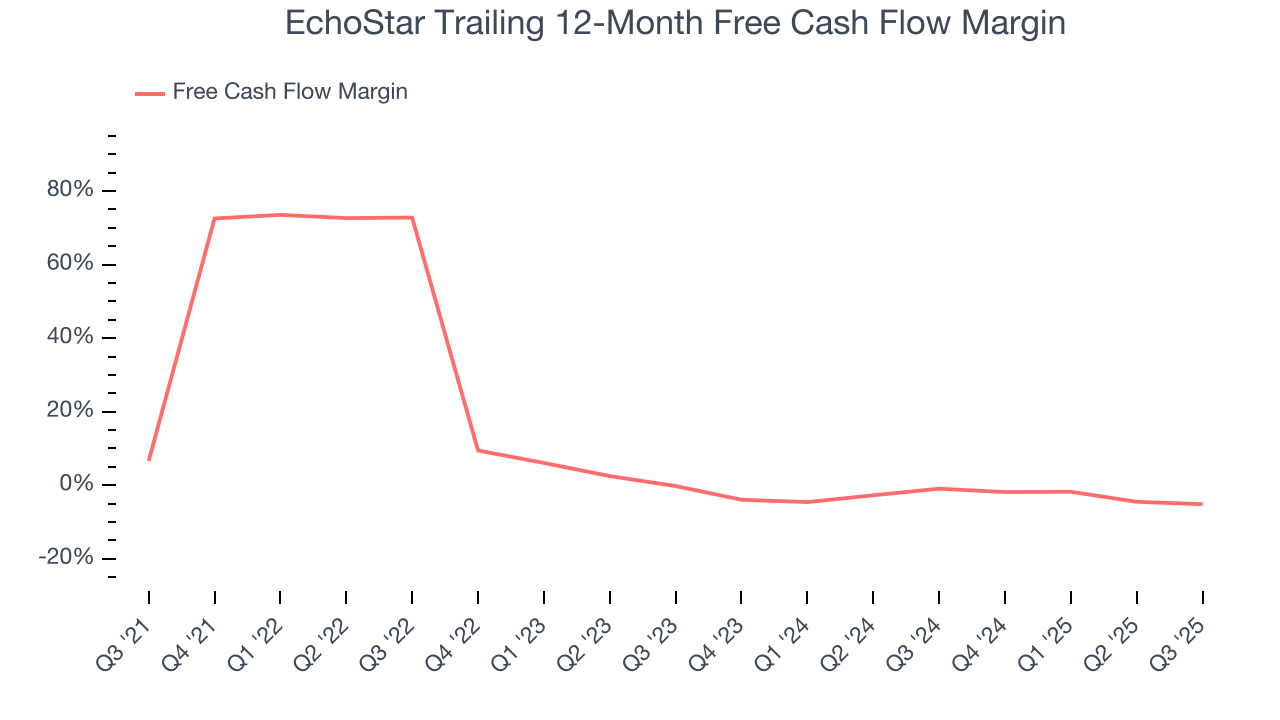

EchoStar has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.1%, subpar for a business services business.

Taking a step back, we can see that EchoStar’s margin dropped by 11.8 percentage points during that time. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s in the middle of a big investment cycle.

EchoStar burned through $144.4 million of cash in Q3, equivalent to a negative 4% margin. The company’s cash burn increased from $57.52 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, indicating it is a seasonal business that must build up inventory during certain quarters.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

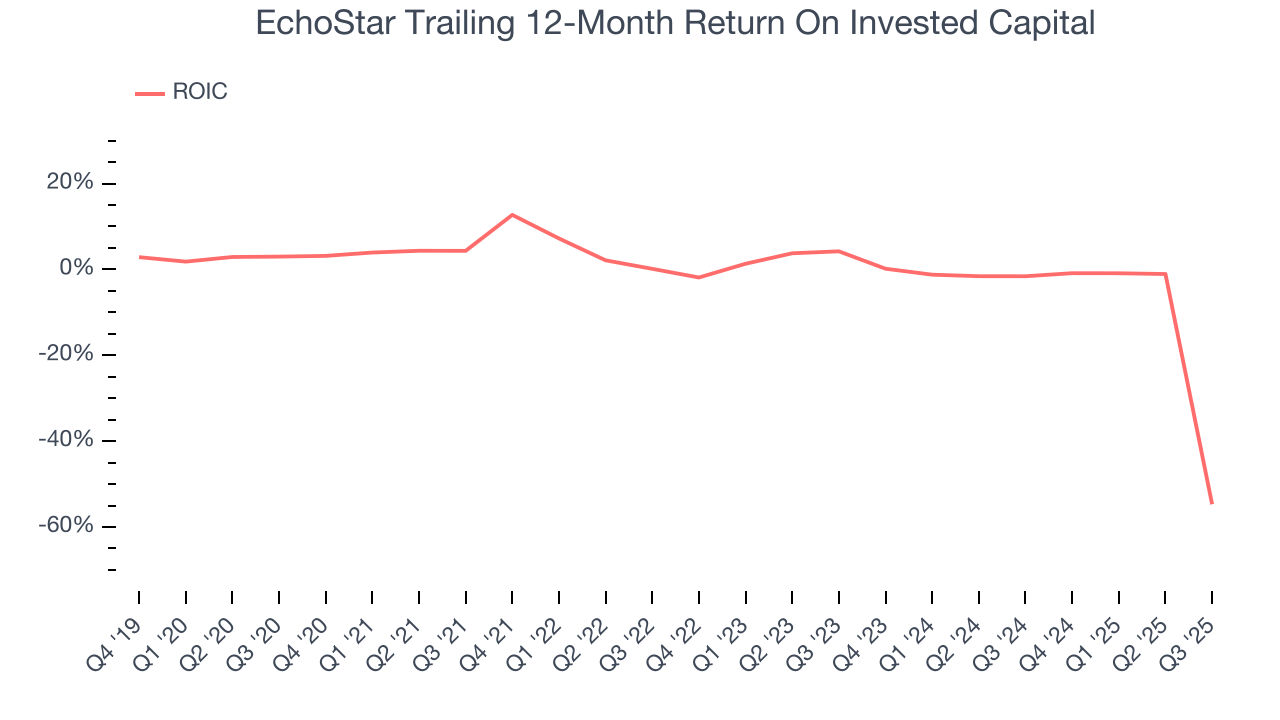

EchoStar’s five-year average ROIC was negative 9.5%, meaning management lost money while trying to expand the business. Its returns were among the worst in the business services sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, EchoStar’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

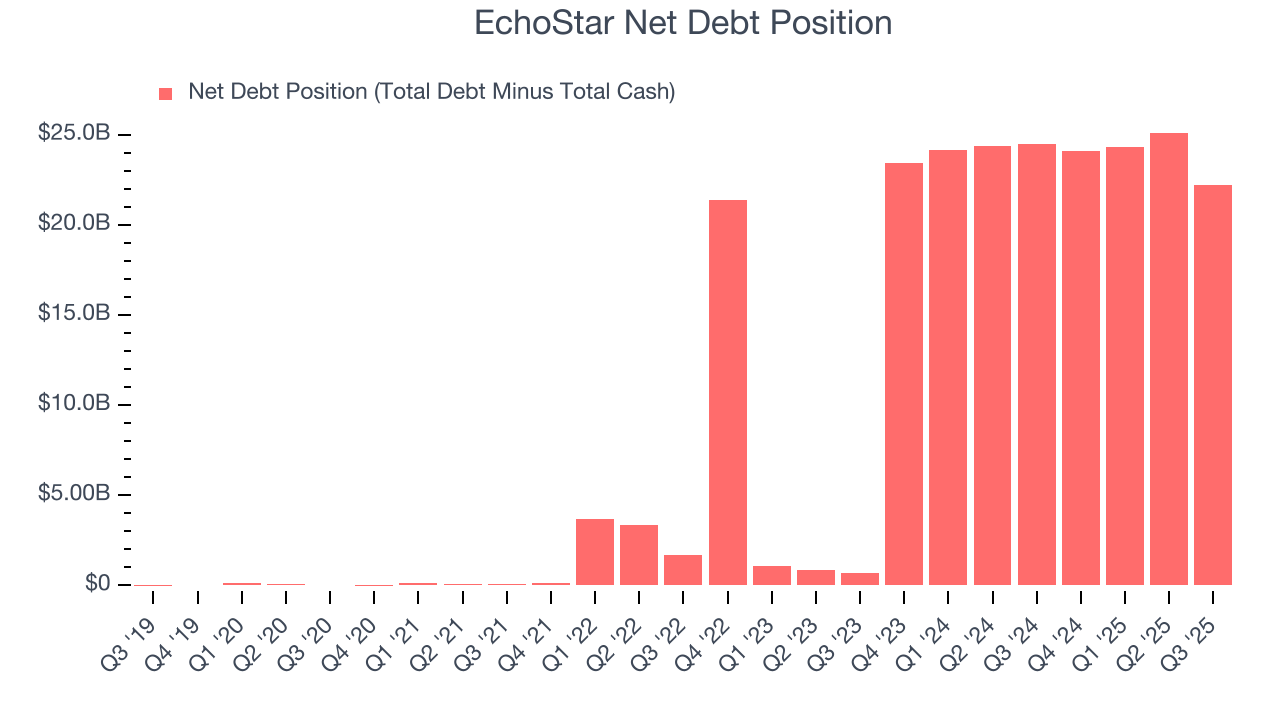

10. Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

EchoStar’s $26.31 billion of debt exceeds the $4.08 billion of cash on its balance sheet. Furthermore, its 17× net-debt-to-EBITDA ratio (based on its EBITDA of $1.31 billion over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. EchoStar could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope EchoStar can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

11. Key Takeaways from EchoStar’s Q3 Results

We struggled to find many positives in these results. Its revenue missed and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 2.9% to $70.25 immediately following the results.

12. Is Now The Time To Buy EchoStar?

Updated: January 23, 2026 at 11:27 PM EST

Before investing in or passing on EchoStar, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

We see the value of companies helping their customers, but in the case of EchoStar, we’re out. Although its revenue growth was exceptional over the last five years, it’s expected to deteriorate over the next 12 months and its diminishing returns show management's prior bets haven't worked out. And while the company’s scale makes it a trusted partner with negotiating leverage, the downside is its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

EchoStar’s EV-to-EBITDA ratio based on the next 12 months is 34.4x. This valuation tells us a lot of optimism is priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $122.86 on the company (compared to the current share price of $126.03), implying they don’t see much short-term potential in EchoStar.