ScanSource (SCSC)

ScanSource doesn’t excite us. Not only are its sales cratering but also its low returns on capital suggest it struggles to generate profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think ScanSource Will Underperform

Operating as a crucial link in the technology supply chain since 1992, ScanSource (NASDAQ:SCSC) is a hybrid distributor that connects hardware, software, and cloud services from technology suppliers to resellers and business customers.

- Flat sales over the last five years suggest it must find different ways to grow during this cycle

- Responsiveness to unforeseen market trends is restricted due to its substandard operating margin profitability

- The good news is that its earnings per share grew by 18.1% annually over the last five years and beat its peers

ScanSource doesn’t pass our quality test. There are superior stocks for sale in the market.

Why There Are Better Opportunities Than ScanSource

High Quality

Investable

Underperform

Why There Are Better Opportunities Than ScanSource

At $36.18 per share, ScanSource trades at 8.7x forward P/E. This certainly seems like a cheap stock, but we think there are valid reasons why it trades this way.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. ScanSource (SCSC) Research Report: Q4 CY2025 Update

Technology distribution company ScanSource (NASDAQ:SCSC) fell short of the market’s revenue expectations in Q4 CY2025 as sales rose 2.5% year on year to $766.5 million. The company’s full-year revenue guidance of $3.05 billion at the midpoint came in 3% below analysts’ estimates. Its non-GAAP profit of $0.80 per share was 20.8% below analysts’ consensus estimates.

ScanSource (SCSC) Q4 CY2025 Highlights:

- Revenue: $766.5 million vs analyst estimates of $782.5 million (2.5% year-on-year growth, 2% miss)

- Adjusted EPS: $0.80 vs analyst expectations of $1.01 (20.8% miss)

- Adjusted EBITDA: $31.19 million vs analyst estimates of $36.47 million (4.1% margin, 14.5% miss)

- EBITDA guidance for the upcoming financial year 2026 is $145 million at the midpoint, below analyst estimates of $151.3 million

- Operating Margin: 2.3%, in line with the same quarter last year

- Free Cash Flow was $28.86 million, up from -$8.16 million in the same quarter last year

- Market Capitalization: $972.7 million

Company Overview

Operating as a crucial link in the technology supply chain since 1992, ScanSource (NASDAQ:SCSC) is a hybrid distributor that connects hardware, software, and cloud services from technology suppliers to resellers and business customers.

ScanSource serves as a middleman in the technology ecosystem, sourcing products and services from approximately 500 technology suppliers and making them available to around 25,000 customers through multiple sales channels. These channels include value-added resellers (VARs), agents, independent sales organizations (ISOs), and independent software vendors (ISVs).

The company operates through two main business segments. The Specialty Technology Solutions segment focuses on enterprise mobile computing, barcode technology, point-of-sale systems, payment processing, physical security, and networking products. The Modern Communications & Cloud segment offers communications technologies, unified communications, video conferencing, and cloud services.

For example, a retail business might work with a ScanSource VAR to implement a complete point-of-sale system that includes hardware terminals, payment processing capabilities, and inventory management software—all sourced through ScanSource's distribution network.

ScanSource generates revenue by purchasing products from suppliers at volume discounts and selling them to its channel partners. The company has evolved beyond traditional distribution to include recurring revenue streams from hardware rentals, Software as a Service (SaaS), and cloud services. This hybrid model allows ScanSource to offer both one-time product sales and subscription-based technology services.

The company maintains facilities in the United States, Canada, and Brazil, with distribution centers in Mississippi, California, Kentucky, and various locations in Brazil. ScanSource adds value through services like product configuration, technical support, logistics assistance, and channel financial services, helping its partners deliver complete technology solutions to end users across industries including retail, healthcare, education, and government.

4. IT Distribution & Solutions

IT Distribution & Solutions will be buoyed by the increasing complexity of IT ecosystems, rising cloud adoption, and demand for cybersecurity solutions. Enterprises are less likely than ever to embark on these complicated journeys solo, and companies in the sector boast expertise and scale in these areas. However, cloud migration also means less need for hardware, which could dent demand for large portions of the product portfolio and hurt margins. Additionally, planning for potentially supply chain disruptions is ongoing, as the COVID-19 pandemic showed how damaging a pause in global trade could be in areas like semiconductor procurement.

ScanSource competes with broad-line technology distributors such as Ingram Micro and TD Synnex across most of its markets. In specialized segments, it faces competition from security distributors like ADI and Wesco, AIDC and POS distributors like BlueStar, and technology services distributors such as Avant and Telarus.

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $3.02 billion in revenue over the past 12 months, ScanSource is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

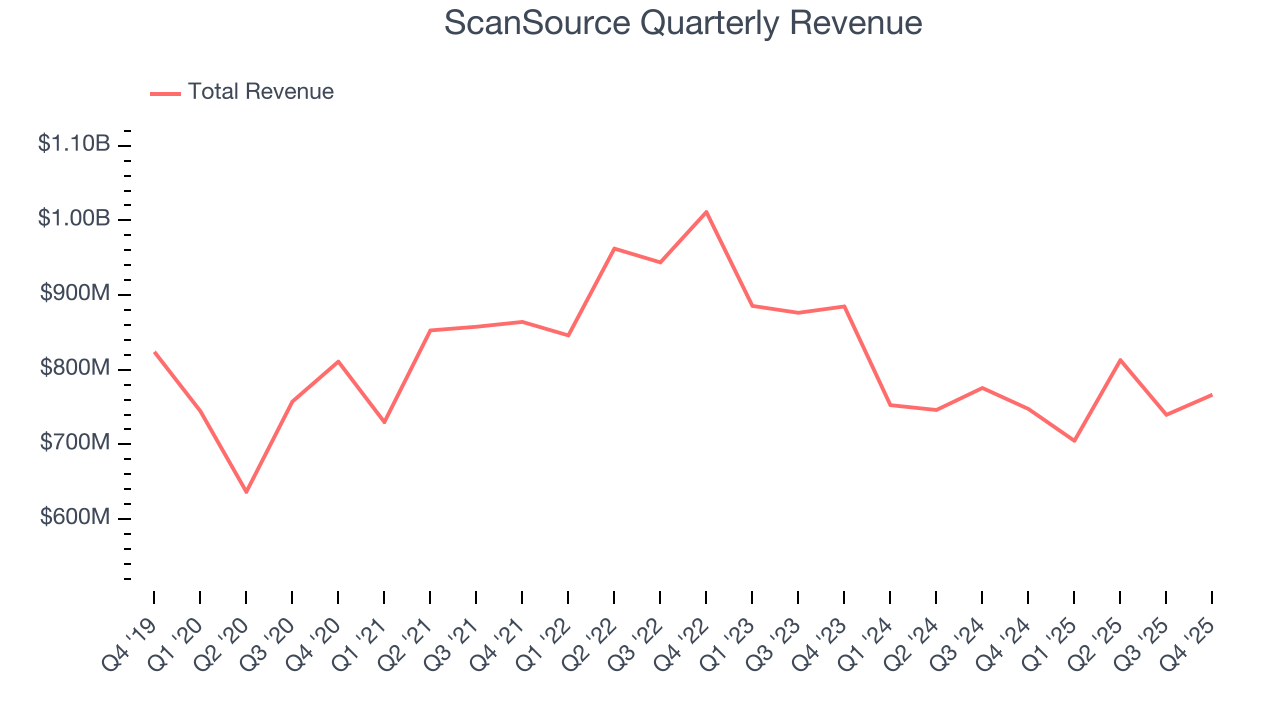

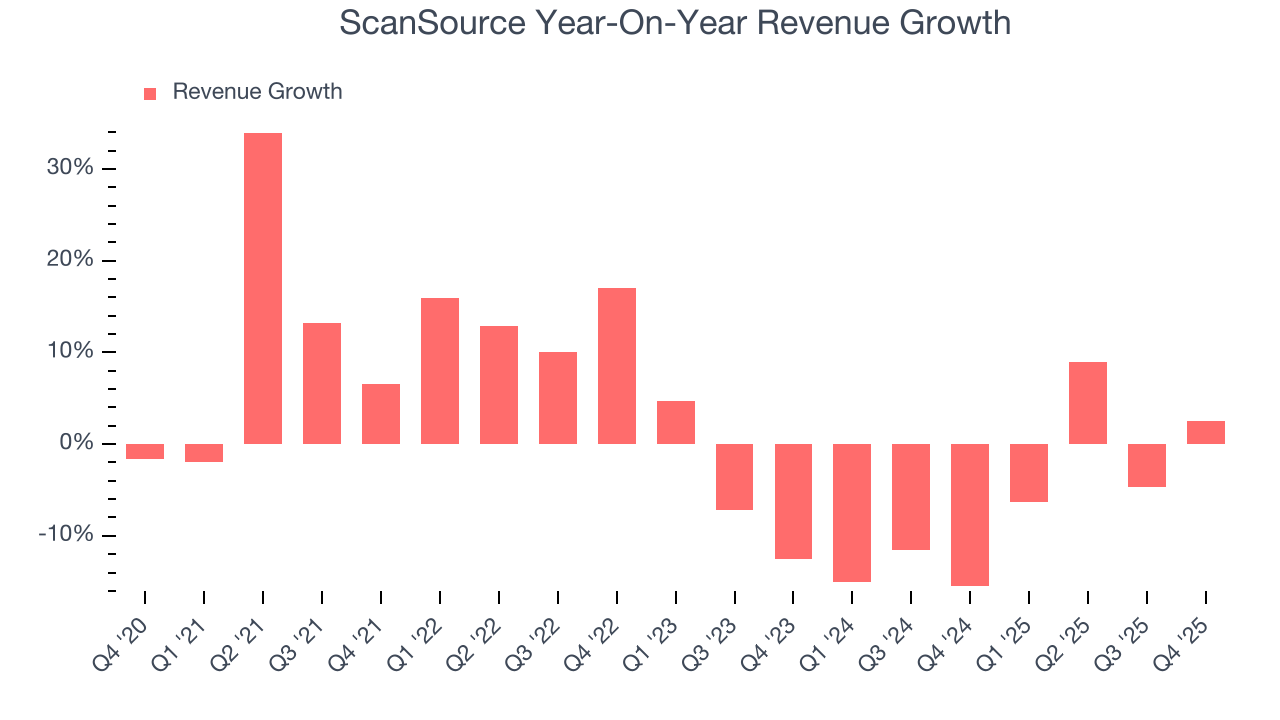

As you can see below, ScanSource struggled to increase demand as its $3.02 billion of sales for the trailing 12 months was close to its revenue five years ago. This shows demand was soft, a tough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. ScanSource’s recent performance shows its demand remained suppressed as its revenue has declined by 8.6% annually over the last two years.

This quarter, ScanSource’s revenue grew by 2.5% year on year to $766.5 million, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6.5% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and indicates its newer products and services will spur better top-line performance.

6. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

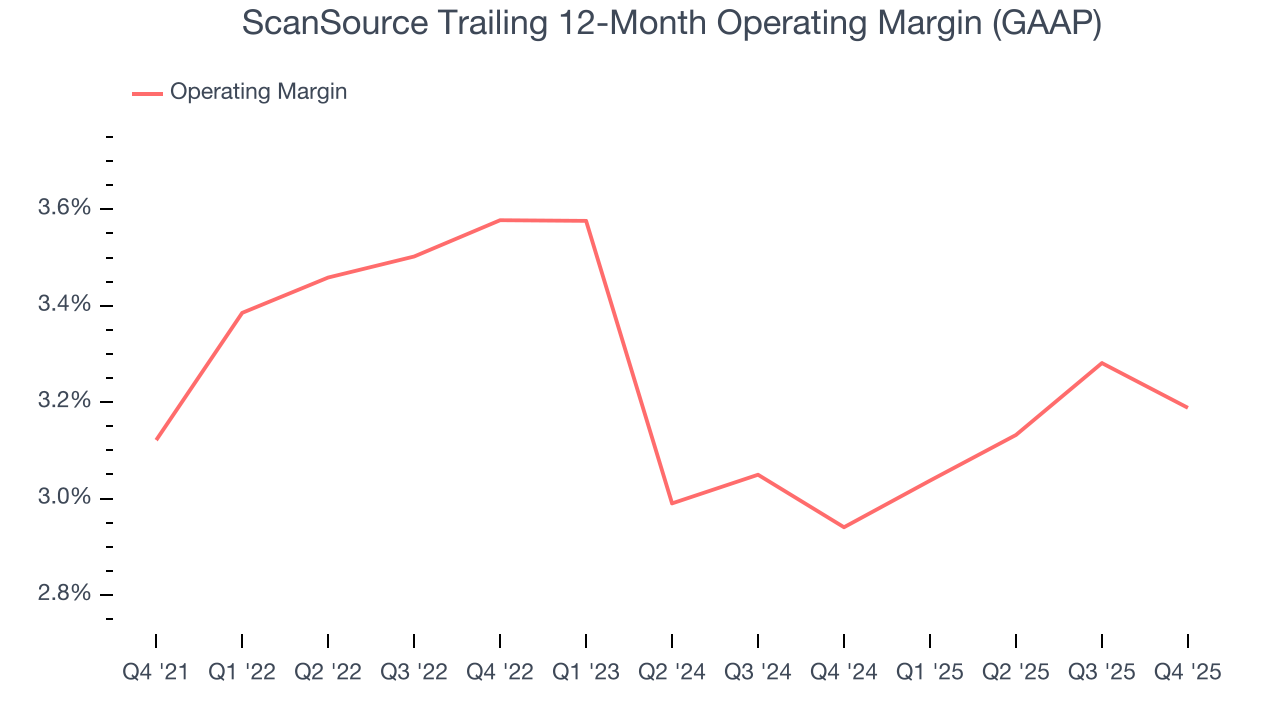

ScanSource’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 3.2% over the last five years. This profitability was lousy for a business services business and caused by its suboptimal cost structure.

Analyzing the trend in its profitability, ScanSource’s operating margin might fluctuated slightly but has generally stayed the same over the last five years, meaning it will take a fundamental shift in the business model to change.

This quarter, ScanSource generated an operating margin profit margin of 2.3%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

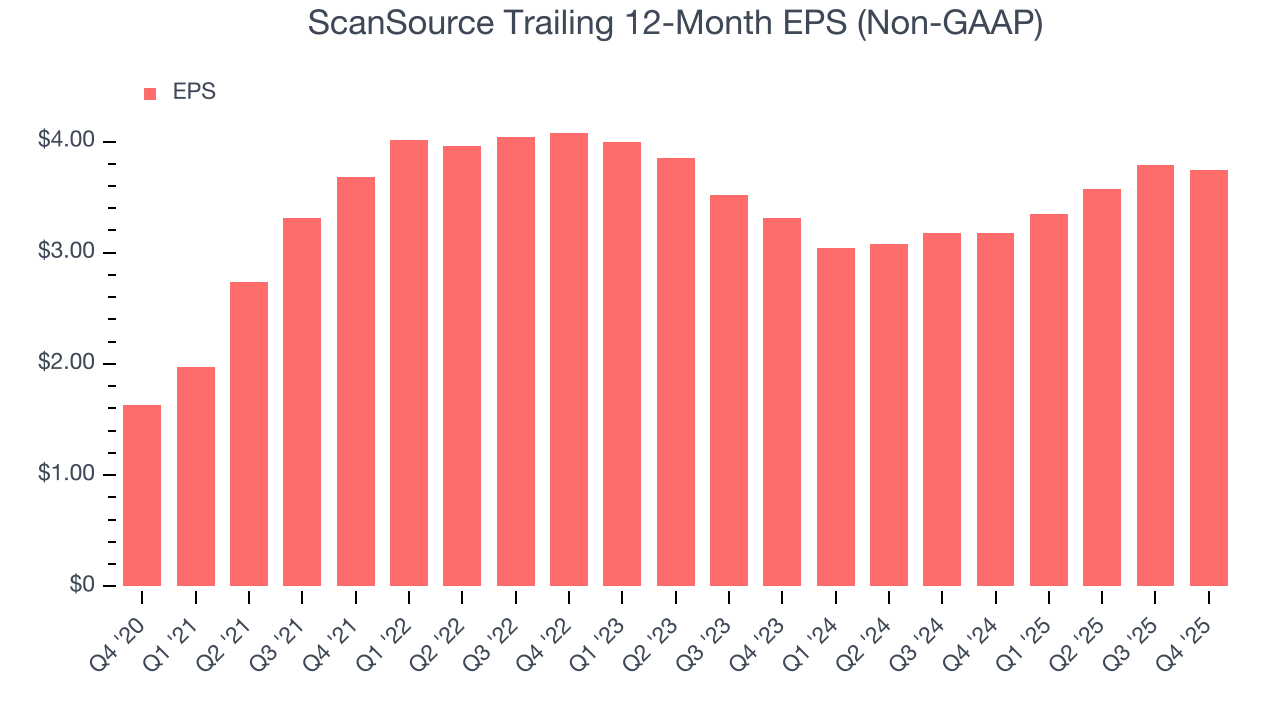

ScanSource’s EPS grew at an astounding 18.1% compounded annual growth rate over the last five years, higher than its flat revenue. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For ScanSource, its two-year annual EPS growth of 6.3% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, ScanSource reported adjusted EPS of $0.80, down from $0.85 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects ScanSource’s full-year EPS of $3.74 to grow 18.9%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

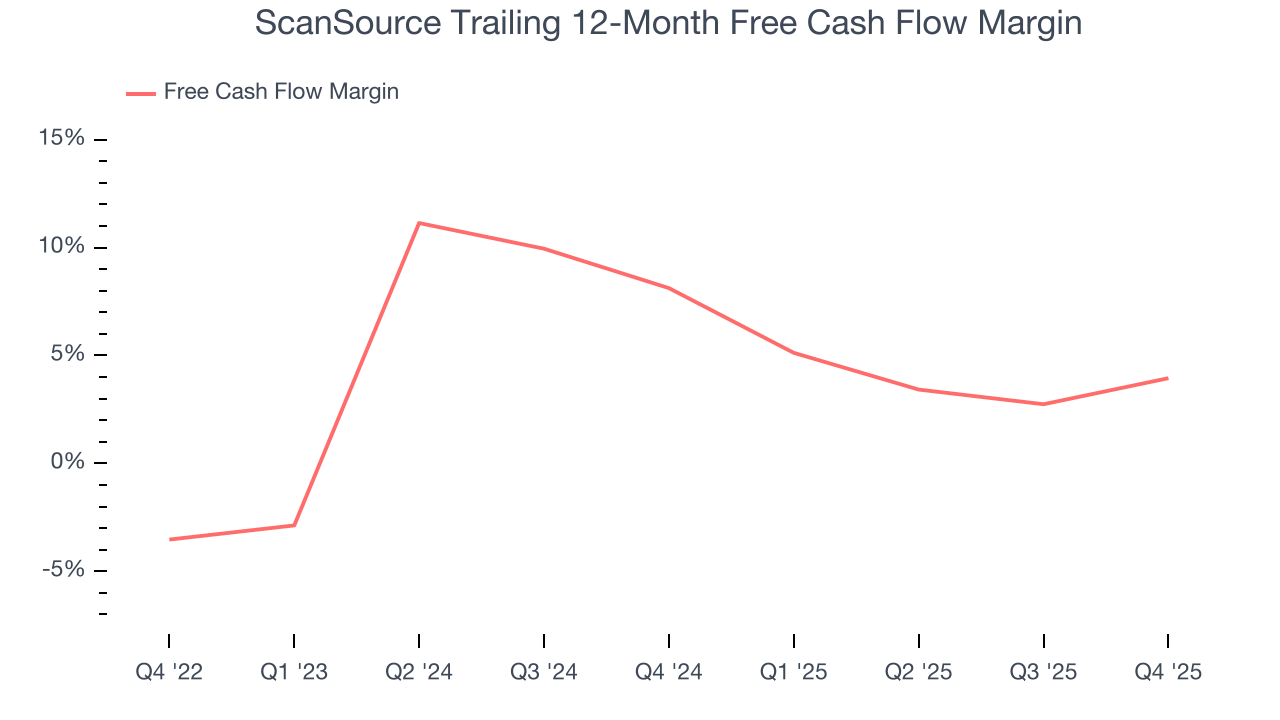

ScanSource has shown weak cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.6%, subpar for a business services business.

Taking a step back, an encouraging sign is that ScanSource’s margin expanded by 6.3 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

ScanSource’s free cash flow clocked in at $28.86 million in Q4, equivalent to a 3.8% margin. Its cash flow turned positive after being negative in the same quarter last year, building on its favorable historical trend.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

ScanSource historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 8.5%, somewhat low compared to the best business services companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, ScanSource’s ROIC averaged 1.7 percentage point decreases each year over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Assessment

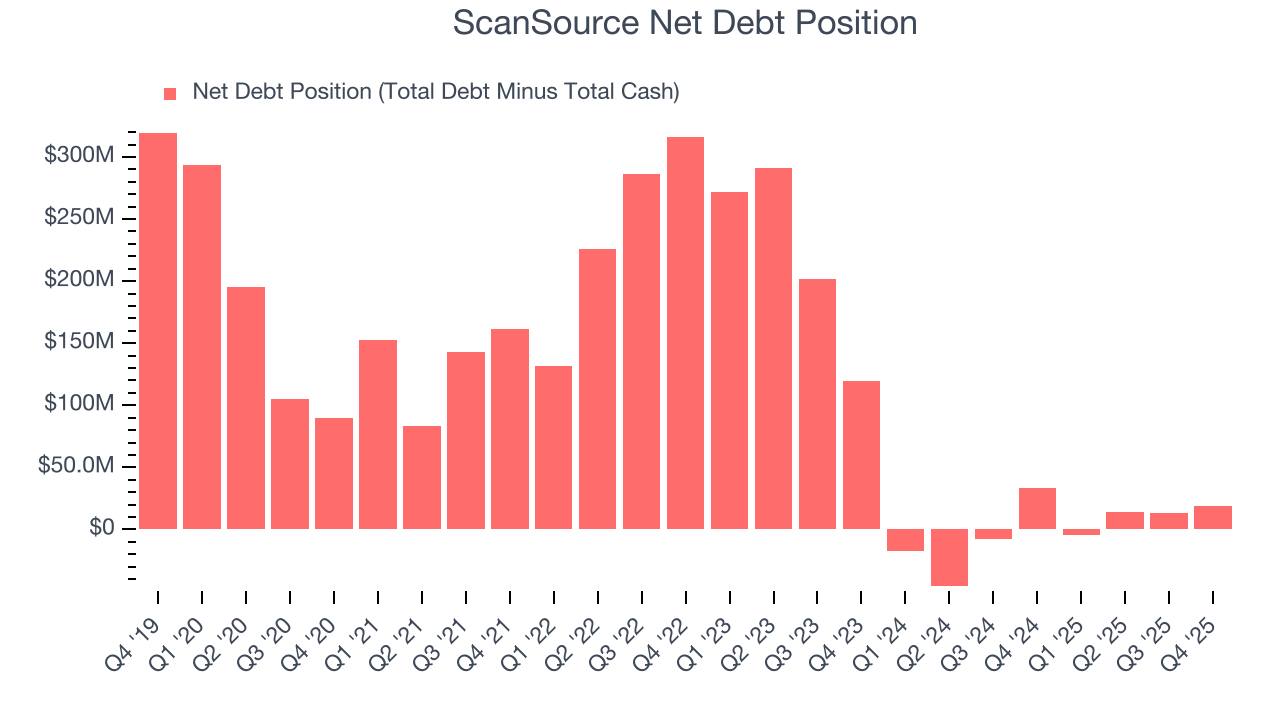

ScanSource reported $83.47 million of cash and $102.7 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $142 million of EBITDA over the last 12 months, we view ScanSource’s 0.1× net-debt-to-EBITDA ratio as safe. We also see its $1.81 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from ScanSource’s Q4 Results

We struggled to find many positives in these results. Its full-year revenue guidance missed and its revenue fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 3.1% to $42.96 immediately after reporting.

12. Is Now The Time To Buy ScanSource?

Updated: March 6, 2026 at 11:42 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

ScanSource isn’t a terrible business, but it doesn’t pass our quality test. To begin with, its revenue growth was weak over the last five years. While its rising cash profitability gives it more optionality, the downside is its operating margins reveal poor profitability compared to other business services companies. On top of that, its low free cash flow margins give it little breathing room.

ScanSource’s P/E ratio based on the next 12 months is 8.7x. While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $51.67 on the company (compared to the current share price of $36.18).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.