Shoe Carnival (SCVL)

We wouldn’t buy Shoe Carnival. Not only are its sales cratering but also its low returns on capital suggest it struggles to generate profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Shoe Carnival Will Underperform

Known for its playful atmosphere that features carnival elements, Shoe Carnival (NASDAQ:SCVL) is a retailer that sells footwear from mainstream brands for the entire family.

- Weak same-store sales trends over the past two years suggest there may be few opportunities in its core markets to open new locations

- Smaller revenue base of $1.14 billion means it hasn’t achieved the economies of scale that some industry juggernauts enjoy

- Forecasted revenue decline of 1.8% for the upcoming 12 months implies demand will fall even further

Shoe Carnival’s quality isn’t great. There are better opportunities in the market.

Why There Are Better Opportunities Than Shoe Carnival

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Shoe Carnival

Shoe Carnival is trading at $19 per share, or 12.1x forward P/E. The current valuation may be appropriate, but we’re still not buyers of the stock.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. Shoe Carnival (SCVL) Research Report: Q3 CY2025 Update

Footwear retailer Shoe Carnival (NASDAQ:SCVL) announced better-than-expected revenue in Q3 CY2025, but sales fell by 3.2% year on year to $297.2 million. The company expects the full year’s revenue to be around $1.14 billion, close to analysts’ estimates. Its GAAP profit of $0.53 per share was in line with analysts’ consensus estimates.

Shoe Carnival (SCVL) Q3 CY2025 Highlights:

- Revenue: $297.2 million vs analyst estimates of $295.2 million (3.2% year-on-year decline, 0.7% beat)

- EPS (GAAP): $0.53 vs analyst estimates of $0.53 (in line)

- The company reconfirmed its revenue guidance for the full year of $1.14 billion at the midpoint

- EPS (GAAP) guidance for the full year is $1.95 at the midpoint, beating analyst estimates by 5.1%

- Operating Margin: 6.3%, down from 8.1% in the same quarter last year

- Free Cash Flow Margin: 6.6%, up from 2.7% in the same quarter last year

- Same-Store Sales fell 2.7% year on year (-4.1% in the same quarter last year)

- Market Capitalization: $457.1 million

Company Overview

Known for its playful atmosphere that features carnival elements, Shoe Carnival (NASDAQ:SCVL) is a retailer that sells footwear from mainstream brands for the entire family.

A shopper can find shoes from Nike, Adidas, Skechers, Converse, Vans, and Crocs for sale at a typical store. Because Shoe Carnival focuses on keeping prices low and attracting a value customer, the selection from these brands will likely not be the newest, hottest releases but the staples. The company’s purchasing approach is also a major reason prices are competitive–Shoe Carnival acquires some inventory through excess inventory and closeouts. The company also maintains direct relationships with many suppliers, cutting out the expenses of middlemen.

On average, Shoe Carnival stores are mid-sized in the world of retail at approximately 10,000 square feet. Stores are typically located in both urban and suburban areas shopping centers and malls alongside other apparel and footwear retailers. The floors are easy to navigate, with sections for men, women, and children and those sections with further subsections for athletic, casual, and dress shoes. Shoe Carnival does have an e-commerce presence, established in 2008, but it is a concept and category that tends to draw shoppers in person.

4. Footwear Retailer

Footwear sales–like their apparel counterparts–are driven by seasons, trends, and innovation more so than absolute need and similarly face the bigger-picture secular trend of e-commerce penetration. Footwear plays a part in societal belonging, personal expression, and occasion, and retailers selling shoes recognize this. Therefore, they aim to balance selection, competitive prices, and the latest trends to attract consumers. Unlike their apparel counterparts, footwear retailers most sell popular third-party brands (as opposed to their own exclusive brands), which could mean less exclusivity of product but more nimbleness to pivot to what’s hot.

Footwear retailer competitors include Designer Brands’s (NYSE:DBI) DSW banner, Foot Locker (NYSE:FL), and TJX (NYSE:TJX).

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $1.14 billion in revenue over the past 12 months, Shoe Carnival is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers.

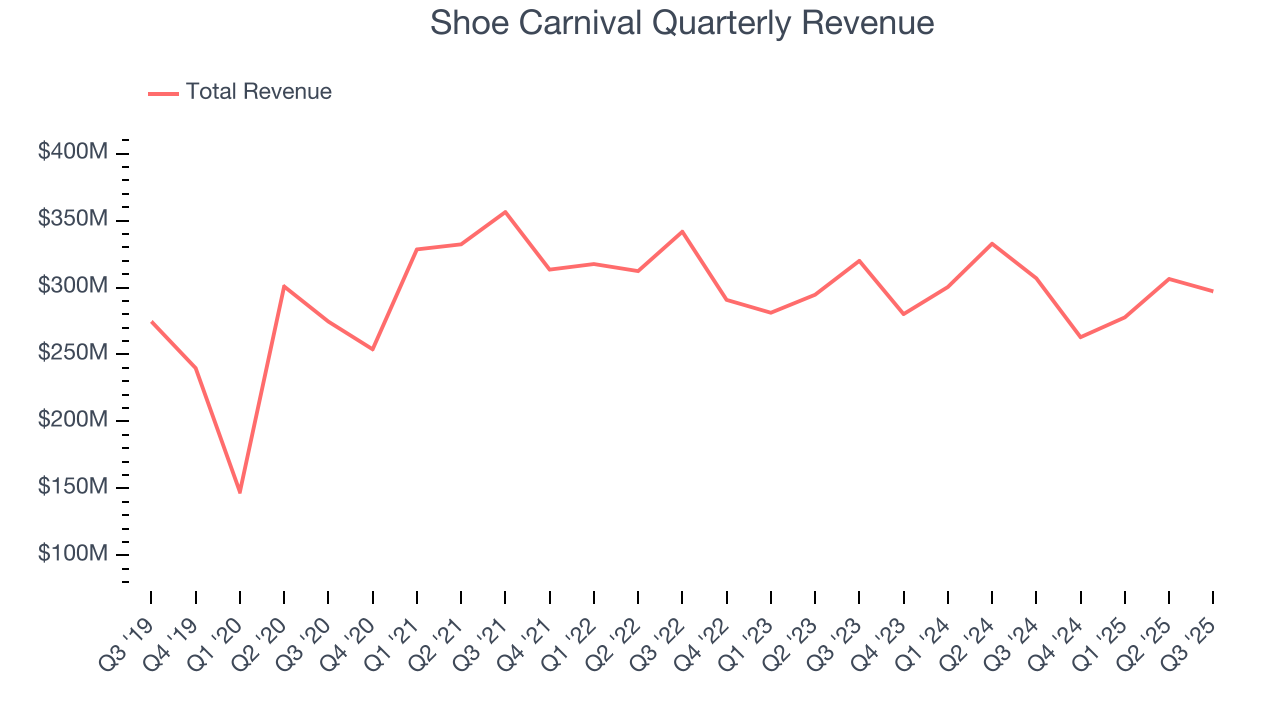

As you can see below, Shoe Carnival’s sales grew at a sluggish 1.7% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts).

This quarter, Shoe Carnival’s revenue fell by 3.2% year on year to $297.2 million but beat Wall Street’s estimates by 0.7%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a slight deceleration versus the last six years. This projection is underwhelming and suggests its products will face some demand challenges.

6. Store Performance

Number of Stores

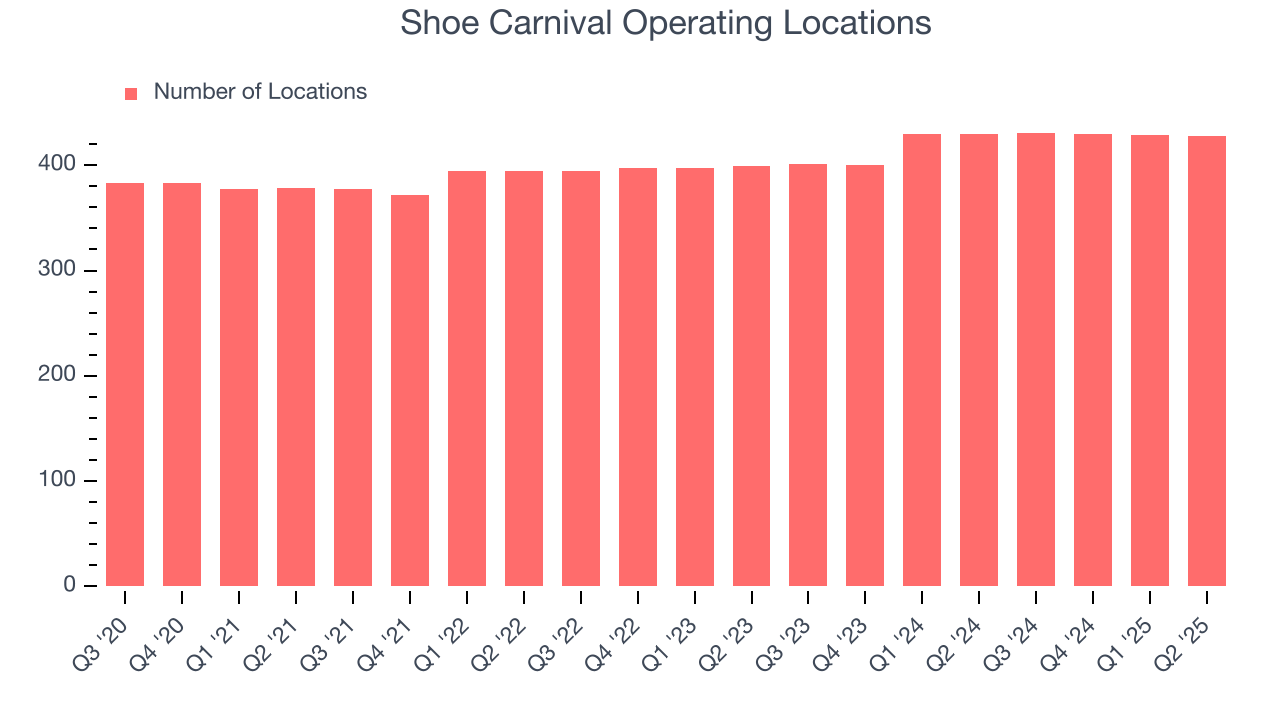

Shoe Carnival opened new stores at a rapid clip over the last two years, averaging 4.4% annual growth, much faster than the broader consumer retail sector. This gives it a chance to scale into a mid-sized business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Note that Shoe Carnival reports its store count intermittently, so some data points are missing in the chart below.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

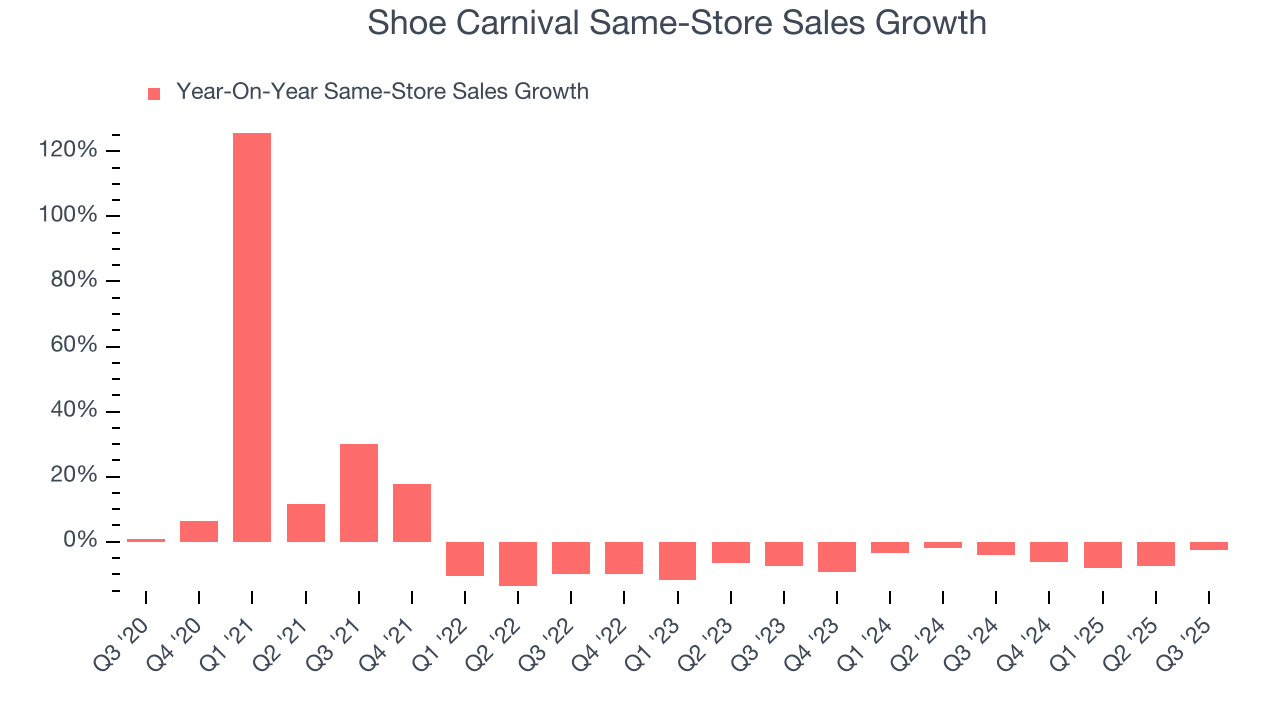

Shoe Carnival’s demand has been shrinking over the last two years as its same-store sales have averaged 5.4% annual declines. This performance is concerning - it shows Shoe Carnival artificially boosts its revenue by building new stores. We’d like to see a company’s same-store sales rise before it takes on the costly, capital-intensive endeavor of expanding its store base.

In the latest quarter, Shoe Carnival’s same-store sales fell by 2.7% year on year. This decrease was an improvement from its historical levels. It’s always great to see a business’s demand trends improve.

7. Gross Margin & Pricing Power

At StockStory, we prefer high gross margin businesses because they indicate pricing power or differentiated products, giving the company a chance to generate higher operating profits.

Shoe Carnival’s unit economics are higher than the typical retailer, giving it the flexibility to invest in areas such as marketing and talent to reach more consumers. As you can see below, it averaged a decent 36.2% gross margin over the last two years. That means for every $100 in revenue, $63.83 went towards paying for inventory, transportation, and distribution.

Shoe Carnival’s gross profit margin came in at 37.6% this quarter, marking a 1.6 percentage point increase from 36% in the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting it strives to keep prices low for customers and has stable input costs (such as labor and freight expenses to transport goods).

8. Operating Margin

Shoe Carnival was profitable over the last two years but held back by its large cost base. Its average operating margin of 7.1% was weak for a consumer retail business.

Analyzing the trend in its profitability, Shoe Carnival’s operating margin decreased by 2 percentage points over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Shoe Carnival’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q3, Shoe Carnival generated an operating margin profit margin of 6.3%, down 1.8 percentage points year on year. Conversely, its gross margin actually rose, so we can assume its recent inefficiencies were driven by increased operating expenses like marketing, and administrative overhead.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Shoe Carnival has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 4.6% over the last two years, better than the broader consumer retail sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that Shoe Carnival’s margin dropped by 3 percentage points over the last year. This decrease came from the higher costs associated with opening more stores.

Shoe Carnival’s free cash flow clocked in at $19.71 million in Q3, equivalent to a 6.6% margin. This result was good as its margin was 3.9 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Shoe Carnival historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 14.4%, somewhat low compared to the best consumer retail companies that consistently pump out 25%+.

11. Balance Sheet Assessment

Shoe Carnival reported $107.7 million of cash and $362.8 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $109.4 million of EBITDA over the last 12 months, we view Shoe Carnival’s 2.3× net-debt-to-EBITDA ratio as safe. We also see its $4.83 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Shoe Carnival’s Q3 Results

We liked that Shoe Carnival exceeded analysts’ revenue expectations this quarter despite a decline in same-store sales. We were also glad its full-year EPS guidance trumped Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock remained flat at $16.69 immediately after reporting.

13. Is Now The Time To Buy Shoe Carnival?

Updated: January 24, 2026 at 9:38 PM EST

Before investing in or passing on Shoe Carnival, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Shoe Carnival falls short of our quality standards. First off, its revenue has declined over the last three years. And while its expanding store base shows it’s playing offense to grow its brand, the downside is its shrinking same-store sales tell us it will need to change its strategy to succeed. On top of that, its brand caters to a niche market.

Shoe Carnival’s P/E ratio based on the next 12 months is 12.1x. While this valuation is reasonable, we don’t see a big opportunity at the moment. There are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $19 on the company (compared to the current share price of $19).