Sezzle (SEZL)

Sezzle is a sound business. Its revenue growth shows it’s winning market share, underscoring the popularity of its offerings.― StockStory Analyst Team

1. News

2. Summary

Why Sezzle Is Interesting

Founded in 2016 as an alternative to traditional credit cards for younger shoppers, Sezzle (NASDAQ:SEZL) provides a payment platform that allows consumers to split purchases into four interest-free installments over six weeks at participating retailers.

- Annual revenue growth of 58% over the past five years was outstanding, reflecting market share gains this cycle

- One risk is its negative return on equity shows management lost money while trying to expand the business

Sezzle is close to becoming a high-quality business. If you’ve been itching to buy the stock, the valuation seems fair.

Why Is Now The Time To Buy Sezzle?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Sezzle?

Sezzle is trading at $67.57 per share, or 16.2x forward P/E. Scanning the financials landscape, we think the price is reasonable for the revenue growth you get.

If you think the market is undervaluing the company, now could be a good time to build a position.

3. Sezzle (SEZL) Research Report: Q3 CY2025 Update

Buy-now-pay-later service Sezzle (NASDAQCM:SEZL) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 67% year on year to $116.8 million. Its GAAP profit of $0.75 per share was 15.4% above analysts’ consensus estimates.

Sezzle (SEZL) Q3 CY2025 Highlights:

Company Overview

Founded in 2016 as an alternative to traditional credit cards for younger shoppers, Sezzle (NASDAQ:SEZL) provides a payment platform that allows consumers to split purchases into four interest-free installments over six weeks at participating retailers.

Sezzle's buy-now-pay-later (BNPL) solution integrates with merchants' checkout systems, both online and in physical stores. When shoppers select Sezzle at checkout, they pay 25% upfront and the remaining balance in three equal bi-weekly payments, with no interest charges if payments are made on time. This payment structure appeals particularly to millennial and Gen Z consumers who may be wary of traditional credit products but still want purchasing flexibility.

For merchants, Sezzle serves as more than just a payment processor—it's a tool for increasing sales. Retailers typically see higher conversion rates and larger average order values when offering Sezzle as a payment option, as it removes the barrier of upfront cost for consumers. The company assumes the credit risk, paying merchants in full at the time of purchase while collecting the installments from consumers.

Sezzle's revenue comes primarily from merchant fees, typically a percentage of the transaction value plus a fixed fee per transaction. The company also generates income from late payment fees when consumers miss scheduled payments, though its business model emphasizes responsible lending through soft credit checks and spending limits tailored to each user's payment history.

The company differentiates itself in the competitive BNPL market through its user-friendly mobile app, which allows consumers to track payments, discover partner retailers, and access exclusive deals. Sezzle also maintains B Corporation certification, reflecting its commitment to social responsibility and ethical business practices in the financial technology sector.

4. Personal Loan

Personal loan providers offer unsecured credit for various consumer needs. The sector benefits from digital application processes, increasing consumer comfort with online financial services, and opportunities in underserved credit segments. Headwinds include credit risk management in unsecured lending, regulatory oversight of lending practices, and intense competition affecting margins from both traditional and fintech lenders.

Sezzle competes in the increasingly crowded buy-now-pay-later space against larger players like Affirm (NASDAQ:AFRM), Block's Afterpay (NYSE:SQ), Klarna, and PayPal's Pay in 4 (NASDAQ:PYPL), as well as traditional credit card companies expanding into installment payment options.

5. Revenue Growth

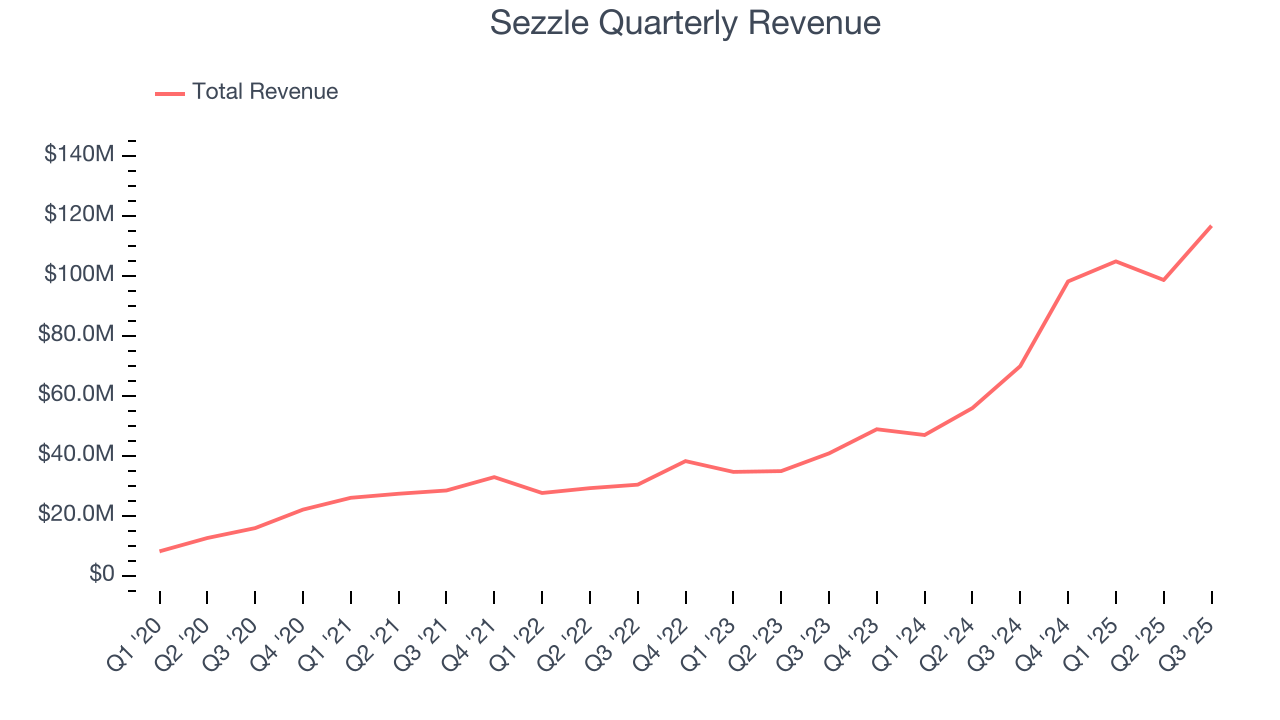

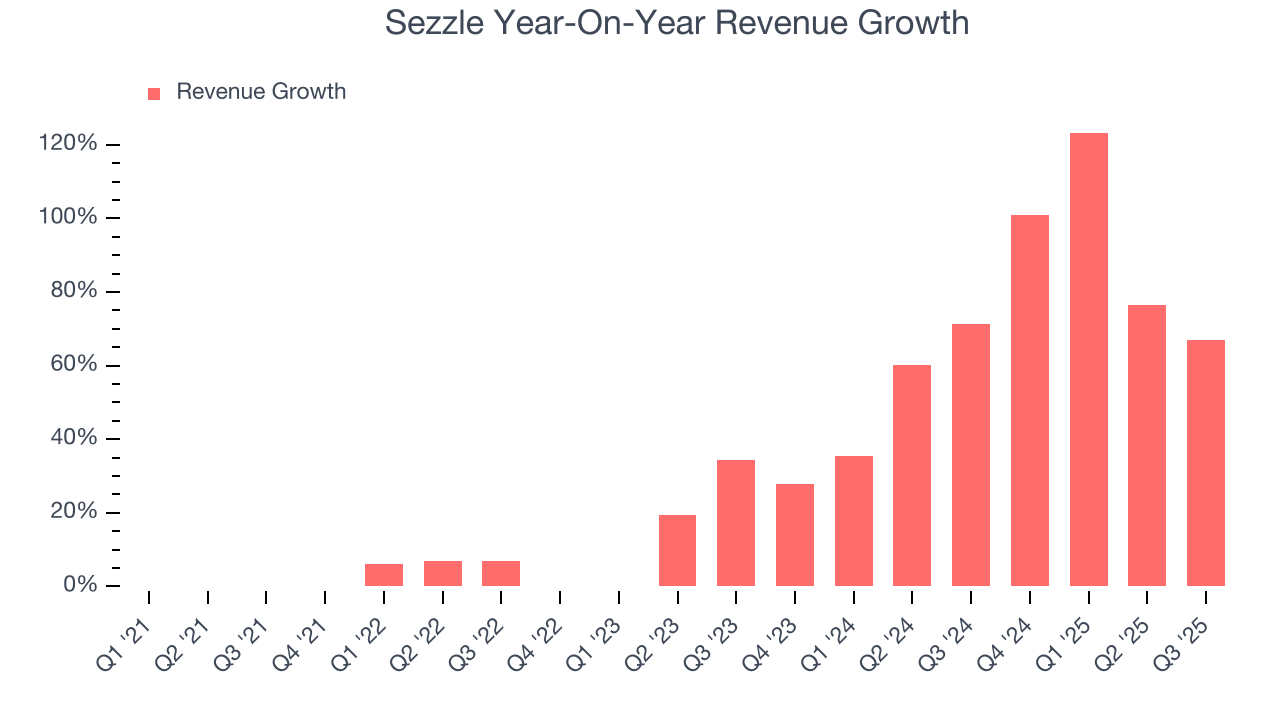

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Sezzle’s revenue grew at an incredible 54.2% compounded annual growth rate over the last five years. Its growth beat the average financials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Sezzle’s annualized revenue growth of 67.8% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Sezzle reported magnificent year-on-year revenue growth of 67%, and its $116.8 million of revenue beat Wall Street’s estimates by 11.5%.

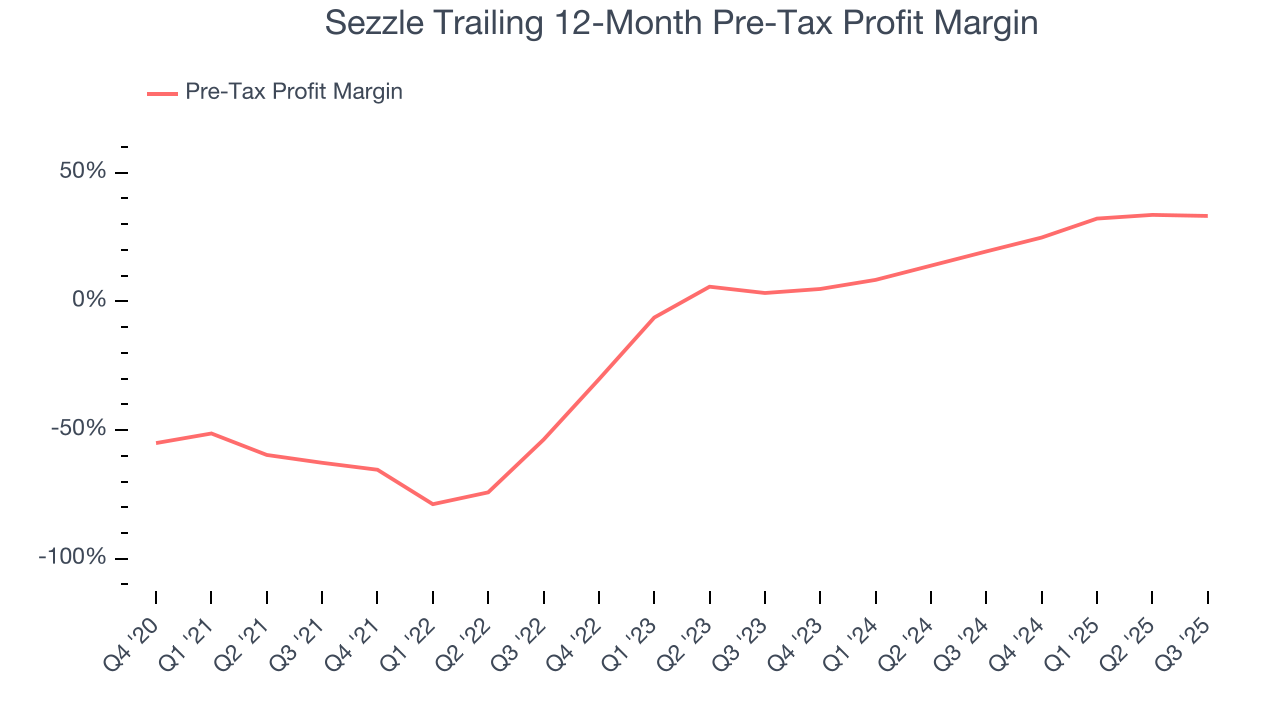

6. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Personal Loan companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

This is because for financials businesses, interest income and expense should be factored into the definition of profit but taxes - which are largely out of a company's control - should not.

Over the last four years, Sezzle’s pre-tax profit margin has fallen by 95.9 percentage points, going from negative 62.7% to 33.2%. It has also expanded by 29.9 percentage points on a two-year basis, showing its expenses have consistently grown at a slower rate than revenue. This typically signals prudent management.

Sezzle’s pre-tax profit margin came in at 27.1% this quarter. This result was 1.9 percentage points better than the same quarter last year.

7. Return on Equity

Return on equity, or ROE, tells us how much profit a company generates for each dollar of shareholder equity, a key funding source for banks. Over a long period, banks with high ROE tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, Sezzle has averaged an ROE of negative 15.6%, a bad result not only in absolute terms but also relative to the majority of firms putting up 25%+. It also shows that Sezzle has little to no competitive moat.

8. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Sezzle currently has $118 million of debt and $155.3 million of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 0.9×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

9. Key Takeaways from Sezzle’s Q3 Results

We were impressed by how significantly Sezzle blew past analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 15.4% to $76.46 immediately after reporting.

10. Is Now The Time To Buy Sezzle?

Updated: January 24, 2026 at 11:47 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Sezzle, you should also grasp the company’s longer-term business quality and valuation.

In our opinion, Sezzle is a good company. First off, its revenue growth was exceptional over the last five years. And while its relatively low ROE suggests management has struggled to find compelling investment opportunities, its astounding EPS growth over the last two years shows its profits are trickling down to shareholders. On top of that, its expanding pre-tax profit margin shows the business has become more efficient.

Sezzle’s P/E ratio based on the next 12 months is 16.2x. Looking at the financials space right now, Sezzle trades at a compelling valuation. If you’re a fan of the business and management team, now is a good time to scoop up some shares.

Wall Street analysts have a consensus one-year price target of $103.25 on the company (compared to the current share price of $67.57), implying they see 52.8% upside in buying Sezzle in the short term.