Surgery Partners (SGRY)

Surgery Partners doesn’t excite us. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why Surgery Partners Is Not Exciting

With more than 180 locations across 33 states serving as alternatives to traditional hospital settings, Surgery Partners (NASDAQ:SGRY) operates a national network of outpatient surgical facilities including ambulatory surgery centers and short-stay surgical hospitals.

- Estimated sales growth of 2.9% for the next 12 months implies demand will slow from its two-year trend

- High net-debt-to-EBITDA ratio of 7× increases the risk of forced asset sales or dilutive financing if operational performance weakens

Surgery Partners’s quality isn’t up to par. We’re on the lookout for more interesting opportunities.

Why There Are Better Opportunities Than Surgery Partners

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Surgery Partners

Surgery Partners is trading at $13.35 per share, or 57.1x forward P/E. We consider this valuation aggressive considering the business fundamentals.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. Surgery Partners (SGRY) Research Report: Q4 CY2025 Update

Healthcare company Surgery Partners (NASDAQ:SGRY) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 2.4% year on year to $885 million. On the other hand, the company’s full-year revenue guidance of $3.4 billion at the midpoint came in 4.5% below analysts’ estimates. Its non-GAAP profit of $0.12 per share was 59.7% below analysts’ consensus estimates.

Surgery Partners (SGRY) Q4 CY2025 Highlights:

- Revenue: $885 million vs analyst estimates of $868.1 million (2.4% year-on-year growth, 1.9% beat)

- Adjusted EPS: $0.12 vs analyst expectations of $0.30 (59.7% miss)

- Adjusted EBITDA: $156.9 million vs analyst estimates of $167.6 million (17.7% margin, 6.4% miss)

- EBITDA guidance for the upcoming financial year 2026 is $530 million at the midpoint, below analyst estimates of $591.3 million

- Operating Margin: 12.5%, down from 14.7% in the same quarter last year

- Free Cash Flow Margin: 10.2%, similar to the same quarter last year

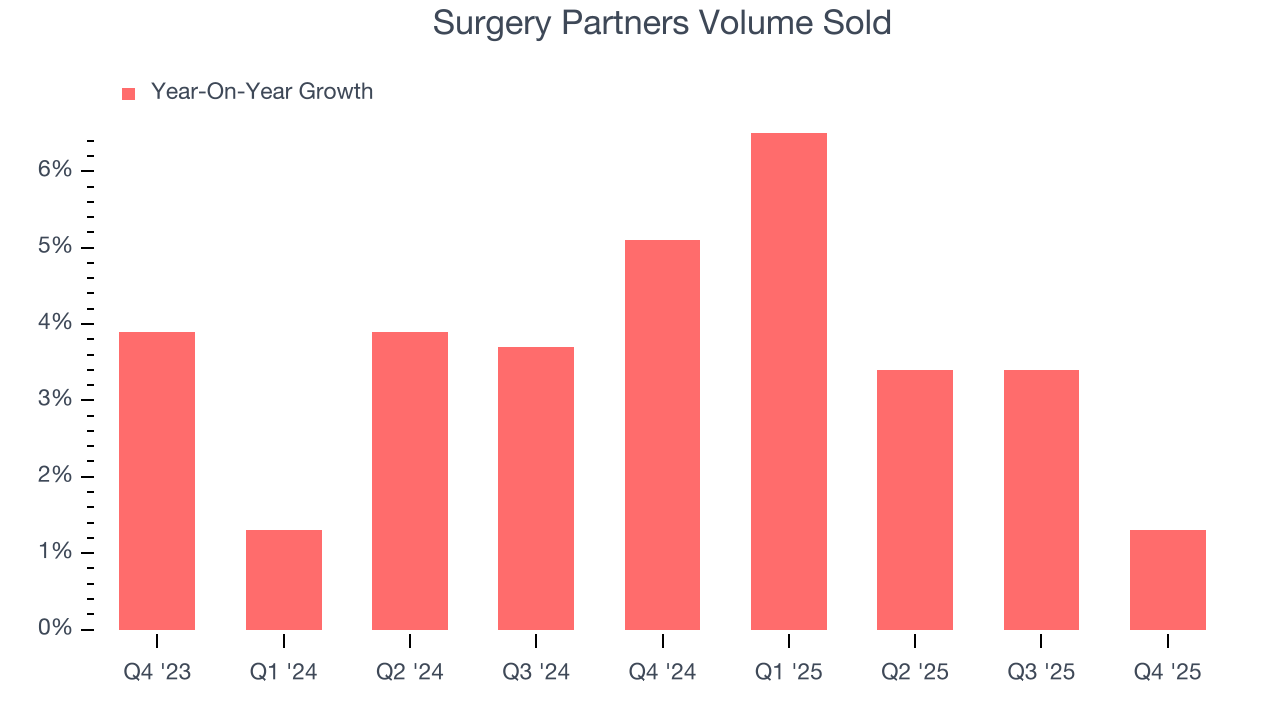

- Sales Volumes rose 1.3% year on year (5.1% in the same quarter last year)

- Market Capitalization: $1.99 billion

Company Overview

With more than 180 locations across 33 states serving as alternatives to traditional hospital settings, Surgery Partners (NASDAQ:SGRY) operates a national network of outpatient surgical facilities including ambulatory surgery centers and short-stay surgical hospitals.

Surgery Partners focuses on providing surgical procedures that don't require overnight hospital stays, such as orthopedic surgeries, ophthalmology procedures, gastroenterology treatments, and pain management interventions. These outpatient facilities are designed to be more efficient and cost-effective than traditional hospitals for planned, non-emergency procedures.

The company typically owns and operates its facilities through partnerships with physicians, physician groups, and healthcare systems. As of the end of 2023, Surgery Partners held majority ownership in 90 of its 162 surgical facilities. This partnership model allows physicians to maintain partial ownership while Surgery Partners provides management expertise, operational support, and capital resources.

Patients benefit from Surgery Partners' facilities by receiving specialized surgical care in convenient, focused environments that often offer shorter wait times and lower infection risks than larger hospitals. For example, a patient needing cataract surgery might visit a Surgery Partners ophthalmology-focused center, have the procedure performed in under an hour, and return home the same day.

The company generates revenue primarily through facility fees for services performed at its surgical centers. These fees come from a mix of government programs (like Medicare and Medicaid) and private insurance. Surgery Partners also earns management fees from the facilities it operates but doesn't fully own.

Beyond surgical facilities, the company offers complementary ancillary services including multi-specialty physician practices and anesthesia services. In states like Florida, Surgery Partners directly employs physicians, while in other states it operates physician practices through management service agreements with physician-owned professional corporations due to varying state regulations.

4. Outpatient & Specialty Care

The outpatient and specialty care industry delivers targeted medical services in non-hospital settings that are often cost-effective compared to inpatient alternatives. This means that they are more desired as rising healthcare costs and ways to combat them become more and more top-of-mind. Outpatient and specialty care providers boast revenue streams that are stable due to the recurring nature of treatment for chronic conditions and long-term patient relationships. However, their reliance on government reimbursement programs like Medicare means stroke-of-the-pen risk. Additionally, scaling a network of facilities can be capital-intensive with uneven return profiles amid competition from integrated healthcare systems. Looking ahead, the industry is positioned to grow as demand for outpatient services expands, driven by aging populations, a rising prevalence of chronic diseases, and a shift toward value-based care models. Tailwinds include advancements in medical technology that support more complex procedures in outpatient settings and the increasing focus on preventive care, which can be aided by data and AI. However, headwinds such as reimbursement rate cuts, labor shortages, and the financial strain of digitization may temper growth.

Surgery Partners' main competitors include other ambulatory surgery center operators such as United Surgical Partners International (owned by Tenet Healthcare, NYSE:THC), AmSurg (part of Envision Healthcare), HCA Healthcare (NYSE:HCA), and SCA Health (owned by Optum, a UnitedHealth Group company, NYSE:UNH).

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $3.31 billion in revenue over the past 12 months, Surgery Partners has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Surgery Partners grew its sales at a solid 12.2% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Surgery Partners’s annualized revenue growth of 9.8% over the last two years is below its five-year trend, but we still think the results were respectable.

Surgery Partners also reports its number of units sold. Over the last two years, Surgery Partners’s units sold averaged 3.6% year-on-year growth. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, Surgery Partners reported modest year-on-year revenue growth of 2.4% but beat Wall Street’s estimates by 1.9%.

Looking ahead, sell-side analysts expect revenue to grow 8.1% over the next 12 months, a slight deceleration versus the last two years. Still, this projection is commendable and indicates the market is baking in success for its products and services.

7. Operating Margin

Surgery Partners has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 12.3%, higher than the broader healthcare sector.

Looking at the trend in its profitability, Surgery Partners’s operating margin decreased by 1.8 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Surgery Partners generated an operating margin profit margin of 12.5%, down 2.3 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

8. Earnings Per Share

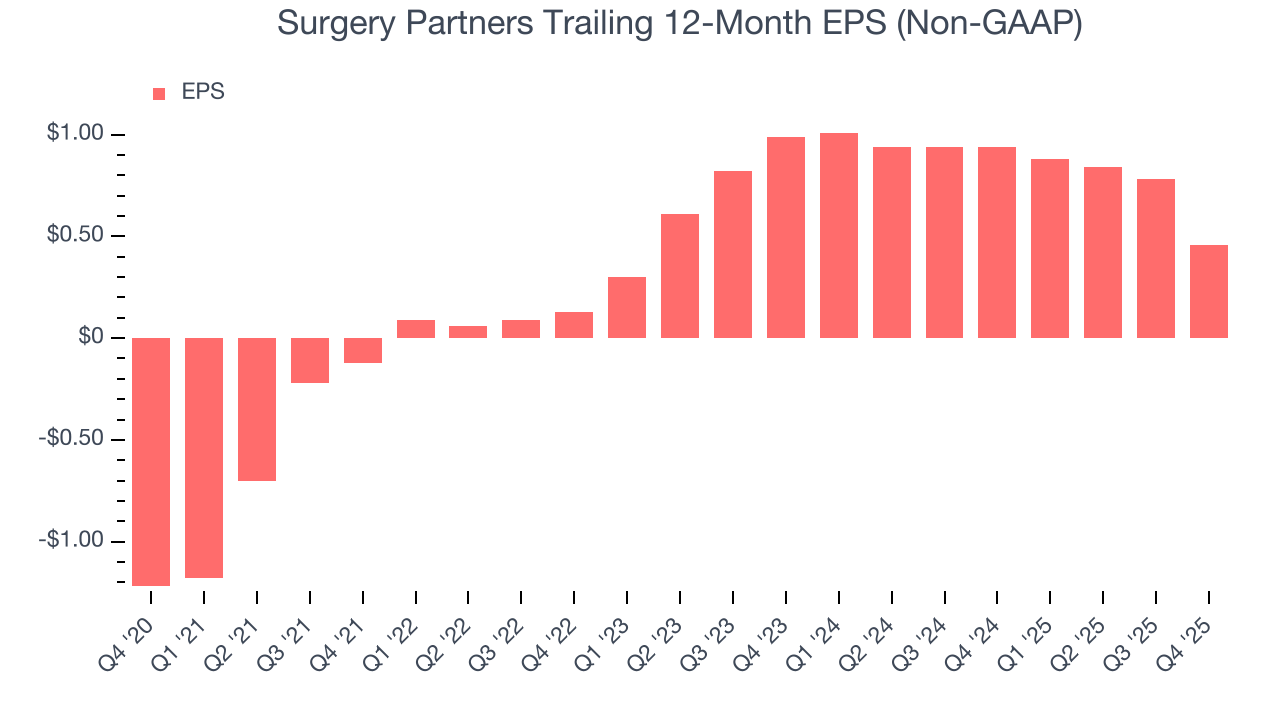

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Surgery Partners’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q4, Surgery Partners reported adjusted EPS of $0.12, down from $0.44 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Surgery Partners’s full-year EPS of $0.46 to grow 57.5%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Surgery Partners has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 5.2% over the last five years, slightly better than the broader healthcare sector.

Taking a step back, we can see that Surgery Partners’s margin expanded by 4.6 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

Surgery Partners’s free cash flow clocked in at $90.6 million in Q4, equivalent to a 10.2% margin. This cash profitability was in line with the comparable period last year and above its five-year average.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Surgery Partners’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 7.9%, slightly better than typical healthcare business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Surgery Partners’s ROIC decreased by 1.2 percentage points annually each year over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Surgery Partners’s $3.70 billion of debt exceeds the $239.9 million of cash on its balance sheet. Furthermore, its 7× net-debt-to-EBITDA ratio (based on its EBITDA of $526.2 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Surgery Partners could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Surgery Partners can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

12. Key Takeaways from Surgery Partners’s Q4 Results

It was encouraging to see Surgery Partners beat analysts’ revenue expectations this quarter. On the other hand, its full-year revenue guidance missed and its full-year EBITDA guidance fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 18% to $13.03 immediately after reporting.

13. Is Now The Time To Buy Surgery Partners?

Updated: March 7, 2026 at 11:26 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Surgery Partners, you should also grasp the company’s longer-term business quality and valuation.

Aside from its balance sheet, Surgery Partners is a pretty decent company. To kick things off, its revenue growth was solid over the last five years. On top of that, Surgery Partners’s astounding EPS growth over the last five years shows its profits are trickling down to shareholders, and its rising cash profitability gives it more optionality.

Surgery Partners’s P/E ratio based on the next 12 months is 57.1x. All that said, we aren’t investing at the moment because its balance sheet makes us balk. If you’re interested in buying the stock, wait until it generates sufficient cash flows or raises some money.

Wall Street analysts have a consensus one-year price target of $19.34 on the company (compared to the current share price of $13.35).