Shoals (SHLS)

We aren’t fans of Shoals. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Shoals Will Underperform

Started in Huntsville, Alabama, Shoals (NASDAQ:SHLS) designs and manufactures products that make solar energy systems work more efficiently.

- Earnings growth over the last four years fell short of the peer group average as its EPS only increased by 4.3% annually

- Underwhelming 8.6% return on capital reflects management’s difficulties in finding profitable growth opportunities, and its shrinking returns suggest its past profit sources are losing steam

- On the bright side, its annual revenue growth of 20% over the past five years was outstanding, reflecting market share gains this cycle

Shoals doesn’t meet our quality standards. There are more appealing investments to be made.

Why There Are Better Opportunities Than Shoals

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Shoals

Shoals’s stock price of $9.23 implies a valuation ratio of 18.6x forward P/E. Shoals’s valuation may seem like a bargain, especially when stacked up against other industrials companies. We remind you that you often get what you pay for, though.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Shoals (SHLS) Research Report: Q3 CY2025 Update

Solar energy systems company Shoals (NASDAQ:SHLS) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 32.9% year on year to $135.8 million. On top of that, next quarter’s revenue guidance ($145 million at the midpoint) was surprisingly good and 3.4% above what analysts were expecting. Its non-GAAP profit of $0.12 per share was in line with analysts’ consensus estimates.

Shoals (SHLS) Q3 CY2025 Highlights:

- Revenue: $135.8 million vs analyst estimates of $131.1 million (32.9% year-on-year growth, 3.6% beat)

- Adjusted EPS: $0.12 vs analyst estimates of $0.13 (in line)

- Revenue Guidance for Q4 CY2025 is $145 million at the midpoint, above analyst estimates of $140.3 million

- EBITDA guidance for the full year is $107.5 million at the midpoint, below analyst estimates of $108.1 million

- Operating Margin: 13.7%, up from 4.4% in the same quarter last year

- Free Cash Flow Margin: 6.6%, down from 13% in the same quarter last year

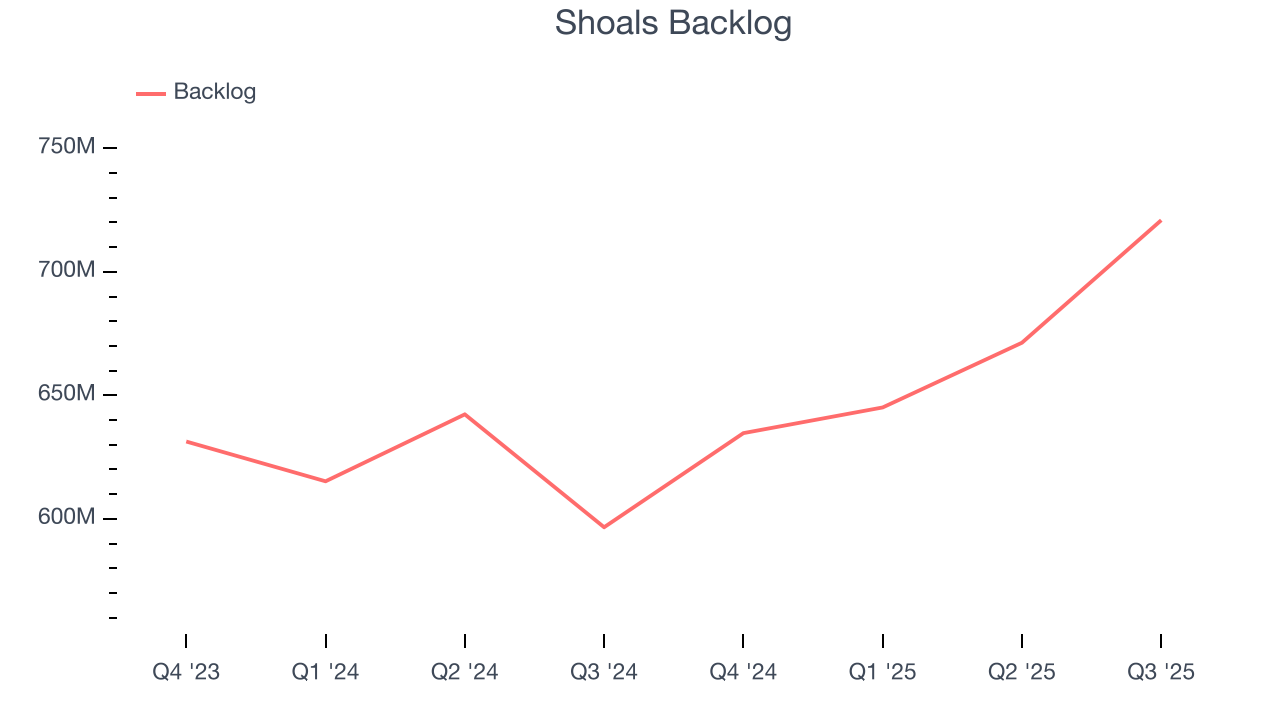

- Backlog: $720.9 million at quarter end, up 20.8% year on year

- Market Capitalization: $1.73 billion

Company Overview

Started in Huntsville, Alabama, Shoals (NASDAQ:SHLS) designs and manufactures products that make solar energy systems work more efficiently.

These products are called electrical balance of systems (BOS), which optimize the performance and reliability of companies or individuals using solar power. Shoals sells these BOS solutions to solar energy developers, installers, and operators, with companies like Tesla in its target market.

Specifically, Shoals's products include direct current disconnectors, combiner boxes, junction boxes, and other components that together make up a BOS. Along with its hardware, the company provides software to monitor and control its products, as well as installation and support services and engineering and design services for customized projects.

The company generates revenue through the sale of its hardware and software products, which are sold via direct sales to companies. Its accompanying services typically come in the form of service contracts or maintenance agreements.

4. Renewable Energy

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

Competitors of Shoals Technologies include ABB (NYSE:ABB), Amphenol (NYSE:APH), and private company TMEIC.

5. Revenue Growth

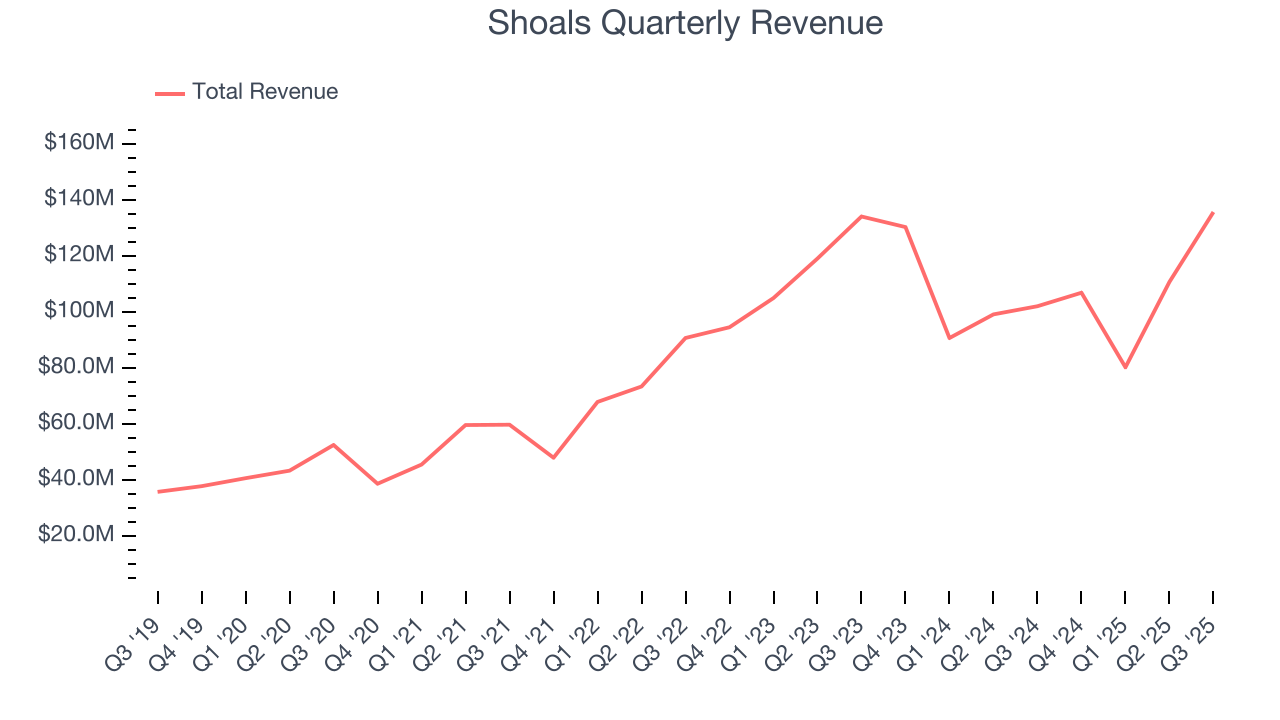

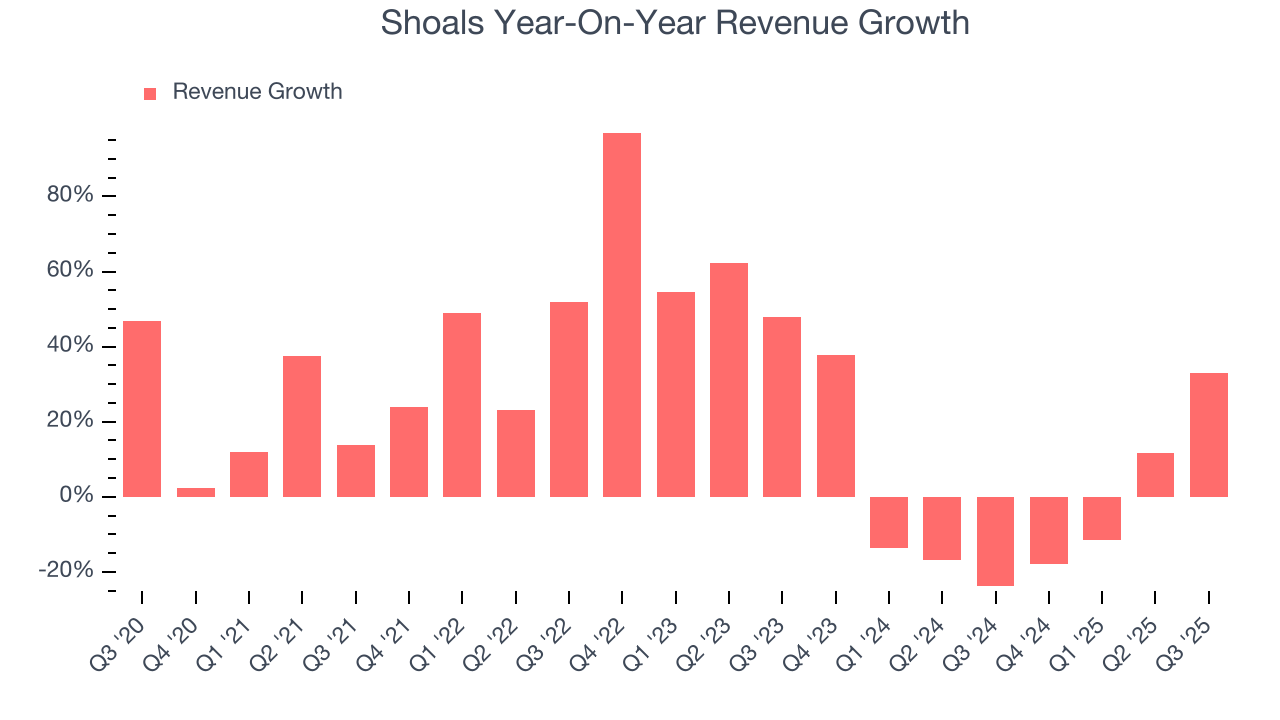

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Shoals’s sales grew at an incredible 20% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Shoals’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 2.1% over the last two years. Shoals isn’t alone in its struggles as the Renewable Energy industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

We can dig further into the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Shoals’s backlog reached $720.9 million in the latest quarter and averaged 7.7% year-on-year growth over the last two years. Because this number is better than its revenue growth, we can see the company accumulated more orders than it could fulfill and deferred revenue to the future. This could imply elevated demand for Shoals’s products and services but raises concerns about capacity constraints.

This quarter, Shoals reported wonderful year-on-year revenue growth of 32.9%, and its $135.8 million of revenue exceeded Wall Street’s estimates by 3.6%. Company management is currently guiding for a 35.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 20.9% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and suggests its newer products and services will spur better top-line performance.

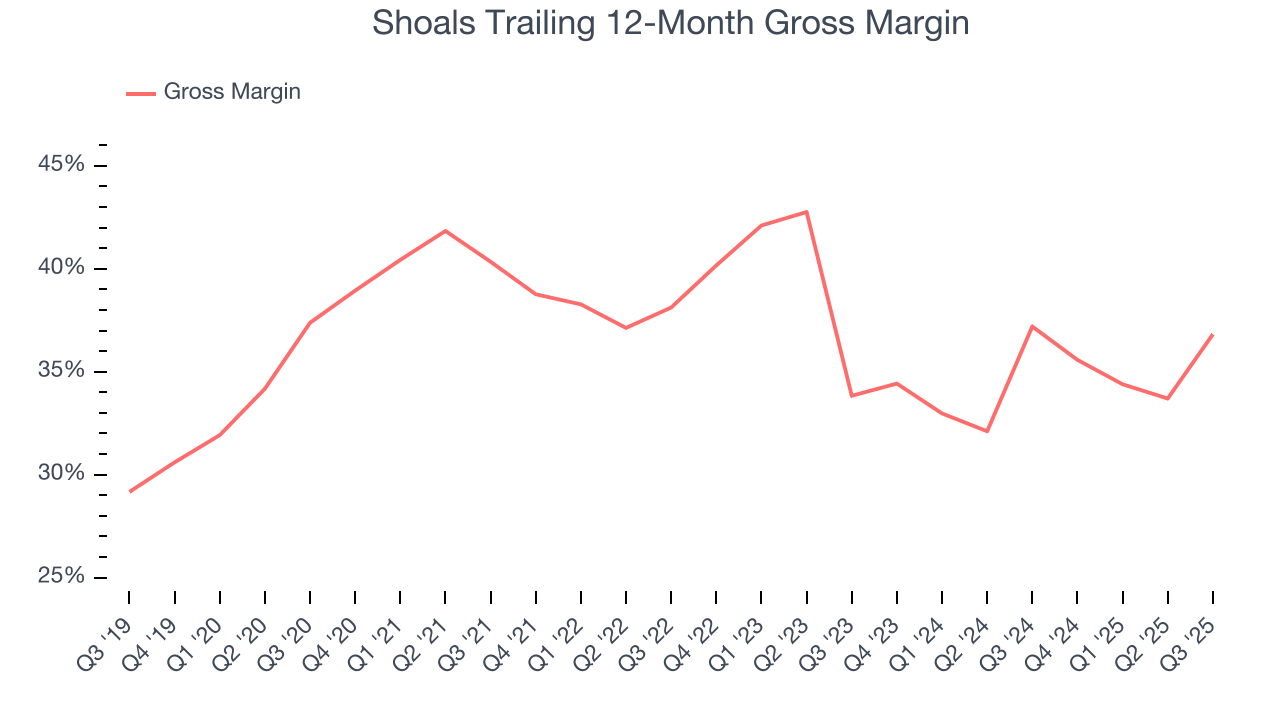

6. Gross Margin & Pricing Power

All else equal, we prefer higher gross margins because they make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

Shoals’s unit economics are great compared to the broader industrials sector and signal that it enjoys product differentiation through quality or brand. As you can see below, it averaged an excellent 36.8% gross margin over the last five years. Said differently, roughly $36.76 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

Shoals’s gross profit margin came in at 37% this quarter, up 12.2 percentage points year on year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

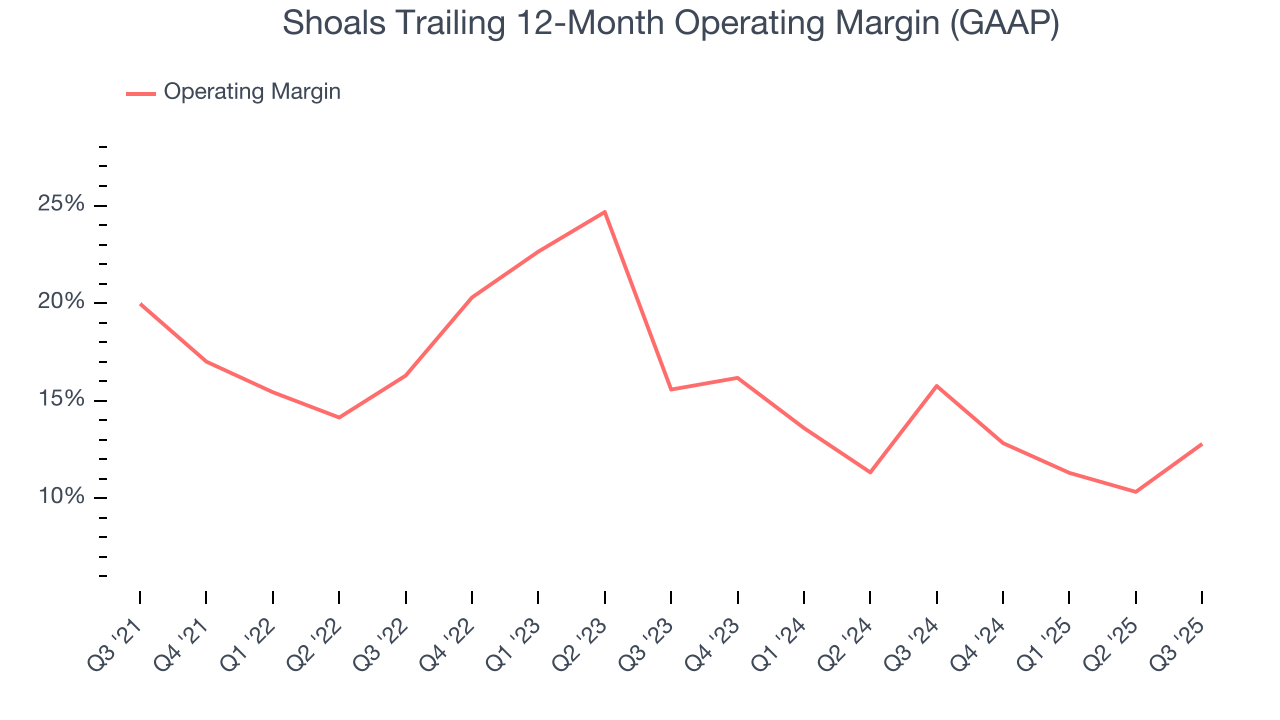

7. Operating Margin

Shoals has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 15.5%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Shoals’s operating margin decreased by 7.2 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Shoals generated an operating margin profit margin of 13.7%, up 9.3 percentage points year on year. The increase was driven by stronger leverage on its cost of sales (not higher efficiency with its operating expenses), as indicated by its larger rise in gross margin.

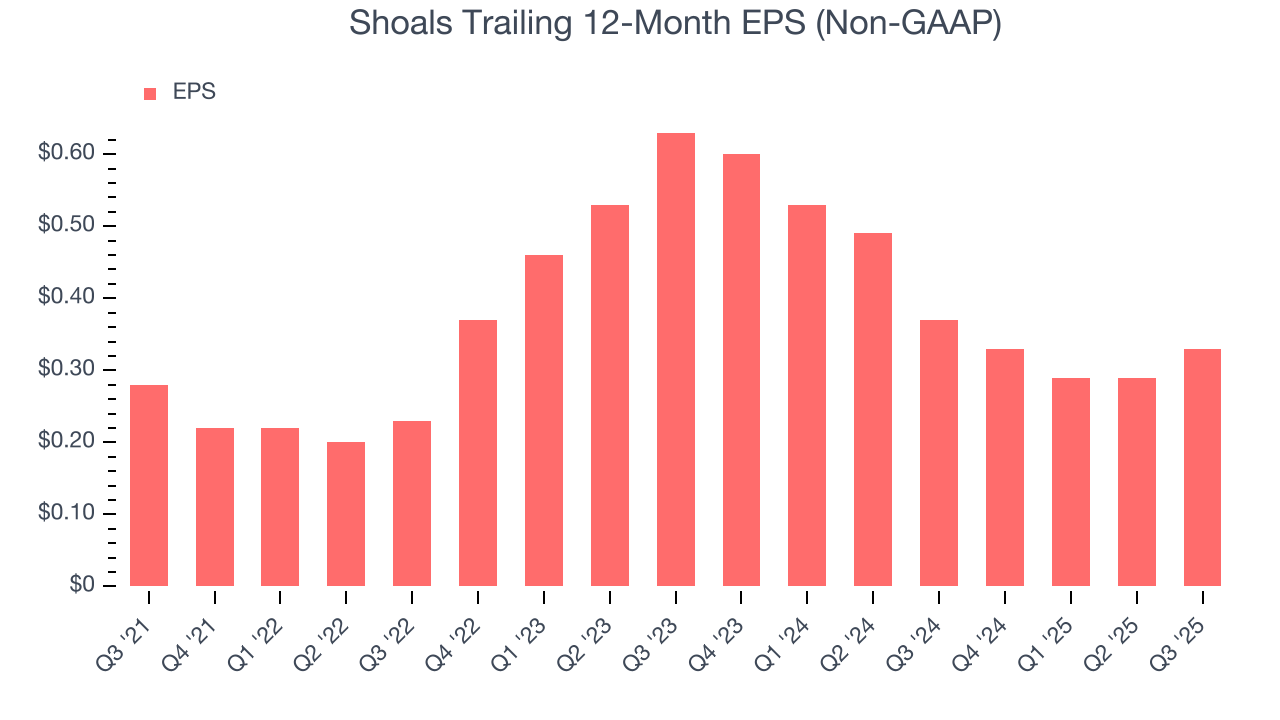

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Shoals’s full-year EPS grew at an unimpressive 4.3% compounded annual growth rate over the last four years, worse than the broader industrials sector.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for Shoals, its EPS declined by more than its revenue over the last two years, dropping 27.6%. This tells us the company struggled to adjust to shrinking demand.

In Q3, Shoals reported adjusted EPS of $0.12, up from $0.08 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects Shoals’s full-year EPS of $0.33 to grow 46.9%.

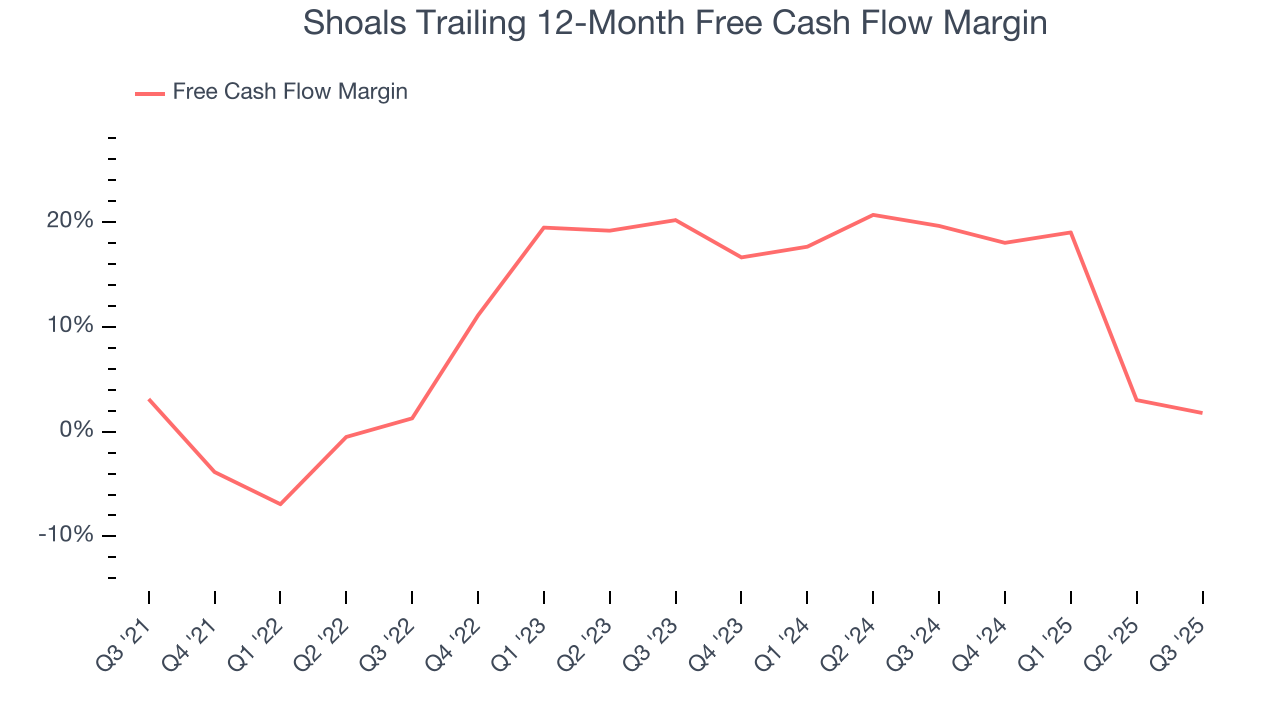

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Shoals has shown robust cash profitability, enabling it to comfortably ride out cyclical downturns while investing in plenty of new offerings and returning capital to investors. The company’s free cash flow margin averaged 10.7% over the last five years, quite impressive for an industrials business.

Taking a step back, we can see that Shoals’s margin dropped by 1.3 percentage points during that time. Continued declines could signal it is in the middle of an investment cycle.

Shoals’s free cash flow clocked in at $8.97 million in Q3, equivalent to a 6.6% margin. The company’s cash profitability regressed as it was 6.4 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

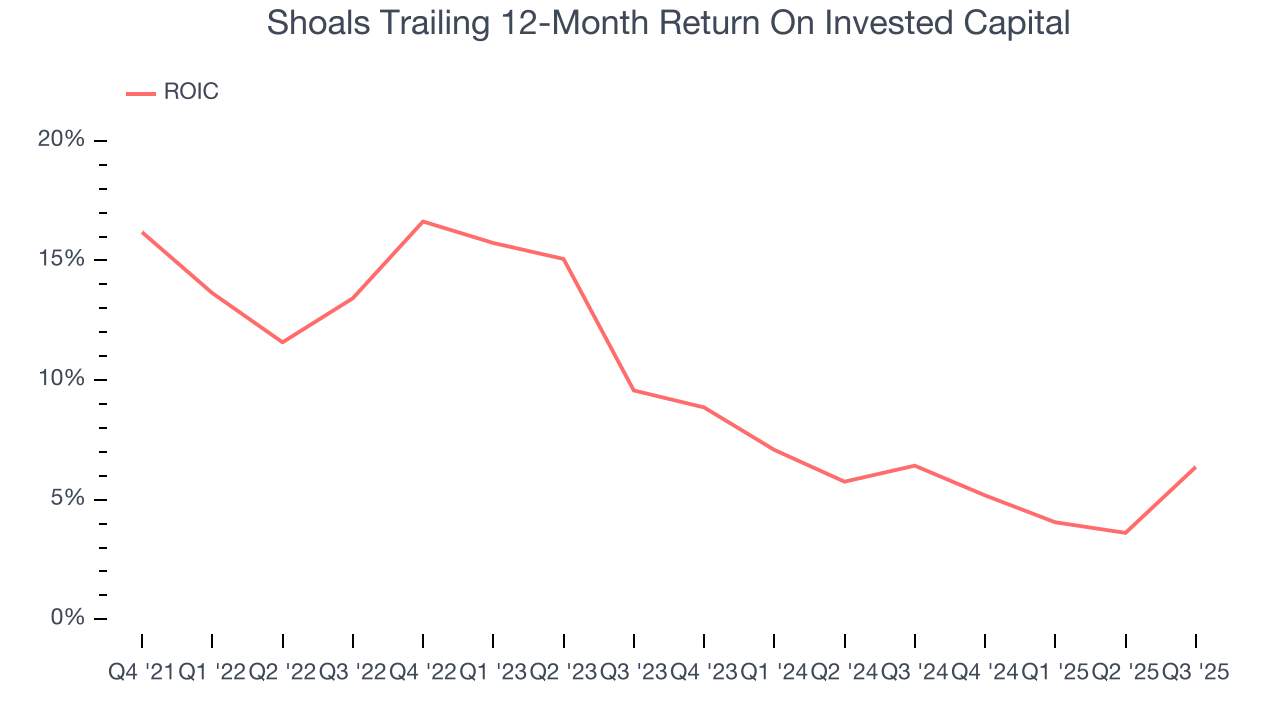

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Shoals historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 8.9%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Shoals’s ROIC has unfortunately decreased. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

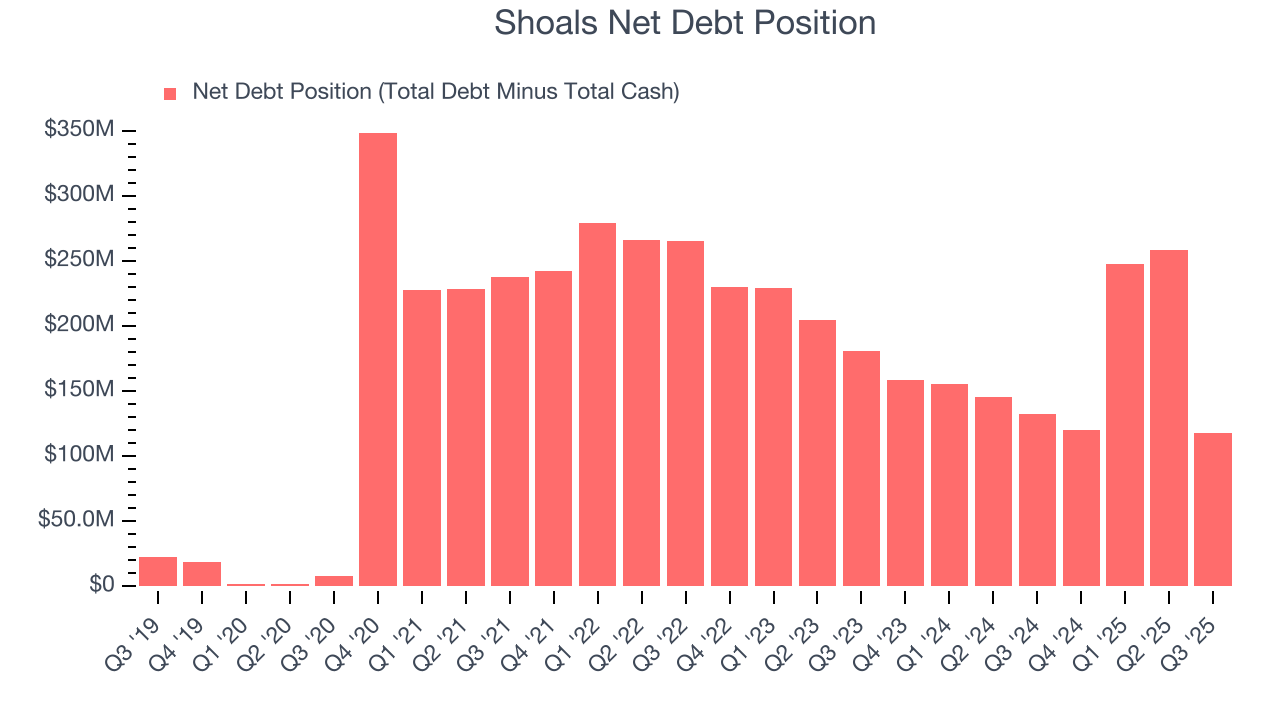

11. Balance Sheet Assessment

Shoals reported $8.59 million of cash and $126.8 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $95.64 million of EBITDA over the last 12 months, we view Shoals’s 1.2× net-debt-to-EBITDA ratio as safe. We also see its $4.46 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Shoals’s Q3 Results

We liked that revenue beat expectations this quarter. We were also glad its full-year revenue guidance exceeded Wall Street’s estimates. On the other hand, its EPS was just in line and its EBITDA guidance fell short of Wall Street’s estimates. Overall, this print could have been better. Shares traded down 16.8% to $8.58 immediately after reporting.

13. Is Now The Time To Buy Shoals?

Updated: January 20, 2026 at 10:27 PM EST

When considering an investment in Shoals, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Shoals isn’t a terrible business, but it doesn’t pass our quality test. Although its revenue growth was exceptional over the last five years and is expected to accelerate over the next 12 months, its diminishing returns show management's prior bets haven't worked out. And while the company’s projected EPS for the next year implies the company’s fundamentals will improve, the downside is its declining operating margin shows the business has become less efficient.

Shoals’s P/E ratio based on the next 12 months is 18.6x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $10.20 on the company (compared to the current share price of $9.23).