BeautyHealth (SKIN)

BeautyHealth faces an uphill battle. Its falling revenue and negative returns on capital suggest it’s destroying value as demand fizzles out.― StockStory Analyst Team

1. News

2. Summary

Why We Think BeautyHealth Will Underperform

Operating in the emerging beauty health category, the appropriately named BeautyHealth (NASDAQ:SKIN) is a skincare company best known for its Hydrafacial product that cleanses and hydrates skin.

- Products aren't resonating with the market as its revenue declined by 4.4% annually over the last three years

- Suboptimal cost structure is highlighted by its history of operating margin losses

- Negative returns on capital show that some of its growth strategies have backfired

BeautyHealth is skating on thin ice. We believe there are better businesses elsewhere.

Why There Are Better Opportunities Than BeautyHealth

High Quality

Investable

Underperform

Why There Are Better Opportunities Than BeautyHealth

BeautyHealth is trading at $1.53 per share, or 10.1x forward EV-to-EBITDA. This multiple rich for the business quality. Not a great combination.

It’s better to pay up for high-quality businesses with strong long-term earnings potential rather than to buy lower-quality companies with open questions and big downside risks.

3. BeautyHealth (SKIN) Research Report: Q3 CY2025 Update

Skincare company BeautyHealth (NASDAQ:SKIN) reported Q3 CY2025 results topping the market’s revenue expectations, but sales fell by 10.3% year on year to $70.7 million. The company’s full-year revenue guidance of $296.5 million at the midpoint came in 0.8% above analysts’ estimates. Its GAAP loss of $0.09 per share was in line with analysts’ consensus estimates.

BeautyHealth (SKIN) Q3 CY2025 Highlights:

- Revenue: $70.7 million vs analyst estimates of $68.91 million (10.3% year-on-year decline, 2.6% beat)

- EPS (GAAP): -$0.09 vs analyst estimates of -$0.08 (in line)

- Adjusted EBITDA: $8.9 million vs analyst estimates of $2.58 million (12.6% margin, significant beat)

- The company lifted its revenue guidance for the full year to $296.5 million at the midpoint from $292.5 million, a 1.4% increase

- EBITDA guidance for the full year is $38 million at the midpoint, above analyst estimates of $30.5 million

- Operating Margin: -8.8%, up from -27.3% in the same quarter last year

- Free Cash Flow Margin: 13.7%, up from 10.4% in the same quarter last year

- Market Capitalization: $186.4 million

Company Overview

Operating in the emerging beauty health category, the appropriately named BeautyHealth (NASDAQ:SKIN) is a skincare company best known for its Hydrafacial product that cleanses and hydrates skin.

Traditionally, getting a facial is a very labor-intensive process, involving lots of rubbing, squeezing, and tweezing. There are serums and lotions. There might even be some steam for heat and cucumbers for cooling.

Hydrafacial adds technology and takes much of the manual labor out of this process. It involves a ‘Delivery System’--which is essentially a non-invasive medical device–as well as attachments for the device and serums delivered by the device. A Hydrafacial treatment involves the use of a specialized device that applies gentle suction while simultaneously delivering customized serums to the skin.

The company’s aim is to employ the razor/razorblade selling model. The Delivery Systems, which are sold to a network of aestheticians, physicians, day spas, resorts, and other partners, are the razors that can last for years. The single-use attachments and serums used with the devices are the razorblades, creating more recurring revenue.

As mentioned, the company operates in the emerging beauty health category. The category occupies a position at the intersection of medical aesthetics and over-the-counter personal care products. Historically, these categories were viewed separately, but they are increasingly converging as consumers combine the ever-present desire to look their best with advancements in medical technology.

4. Personal Care

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Competitors in the beauty health category that employ medical technology and personal care products include AbbVie (NYSE:ABBV) and Venus Concept (NASDAQ:VERO) as well as private companies Cartessa Aesthetics and DermaSweep.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $302 million in revenue over the past 12 months, BeautyHealth is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

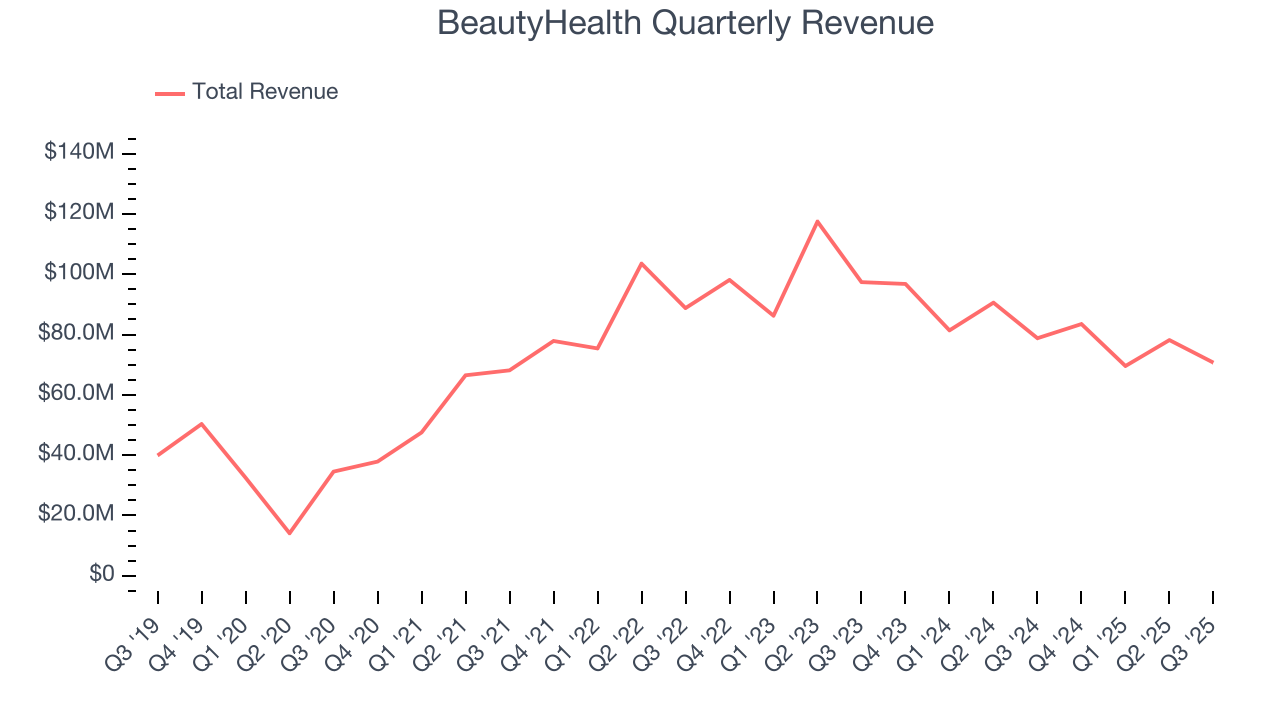

As you can see below, BeautyHealth’s revenue declined by 4.4% per year over the last three years, a tough starting point for our analysis.

This quarter, BeautyHealth’s revenue fell by 10.3% year on year to $70.7 million but beat Wall Street’s estimates by 2.6%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection implies its newer products will spur better top-line performance, it is still below average for the sector.

6. Gross Margin & Pricing Power

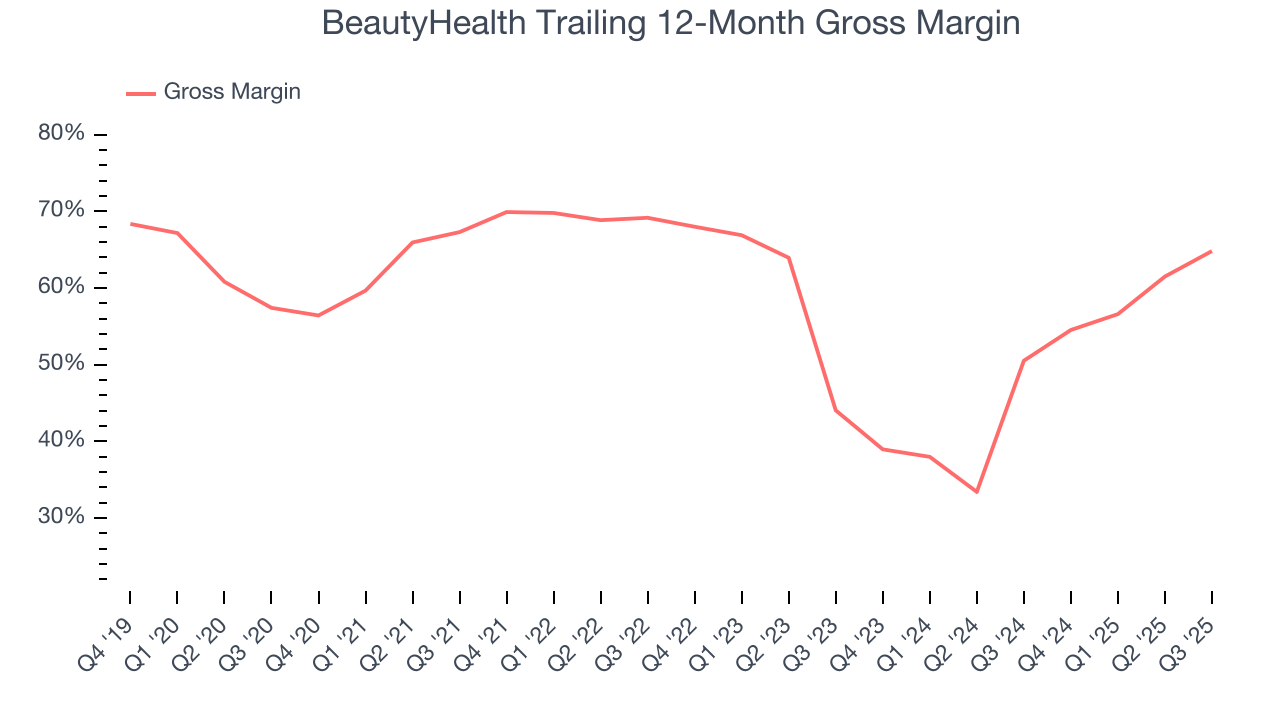

BeautyHealth has best-in-class unit economics for a consumer staples company, enabling it to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged an elite 57.2% gross margin over the last two years. That means for every $100 in revenue, only $42.83 went towards paying for raw materials, production of goods, transportation, and distribution.

BeautyHealth’s gross profit margin came in at 64.6% this quarter, up 13.1 percentage points year on year. BeautyHealth’s full-year margin has also been trending up over the past 12 months, increasing by 14.3 percentage points. If this move continues, it could suggest an environment where the company has better pricing power and stable or shrinking input costs (such as raw materials).

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

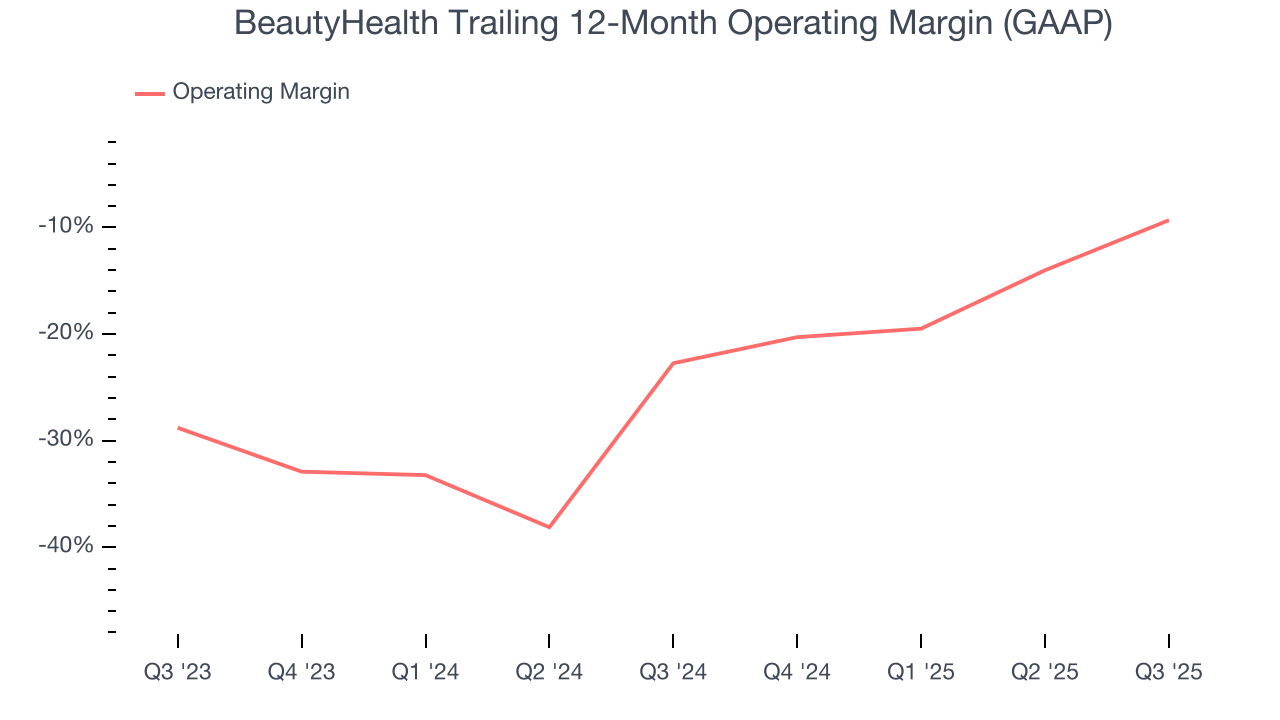

Unprofitable public companies are rare in the defensive consumer staples industry. Unfortunately, BeautyHealth was one of them over the last two years as its high expenses contributed to an average operating margin of negative 16.5%.

On the plus side, BeautyHealth’s operating margin rose by 13.4 percentage points over the last year. Still, it will take much more for the company to reach long-term profitability.

In Q3, BeautyHealth generated a negative 8.8% operating margin. The company's consistent lack of profits raise a flag.

8. Earnings Per Share

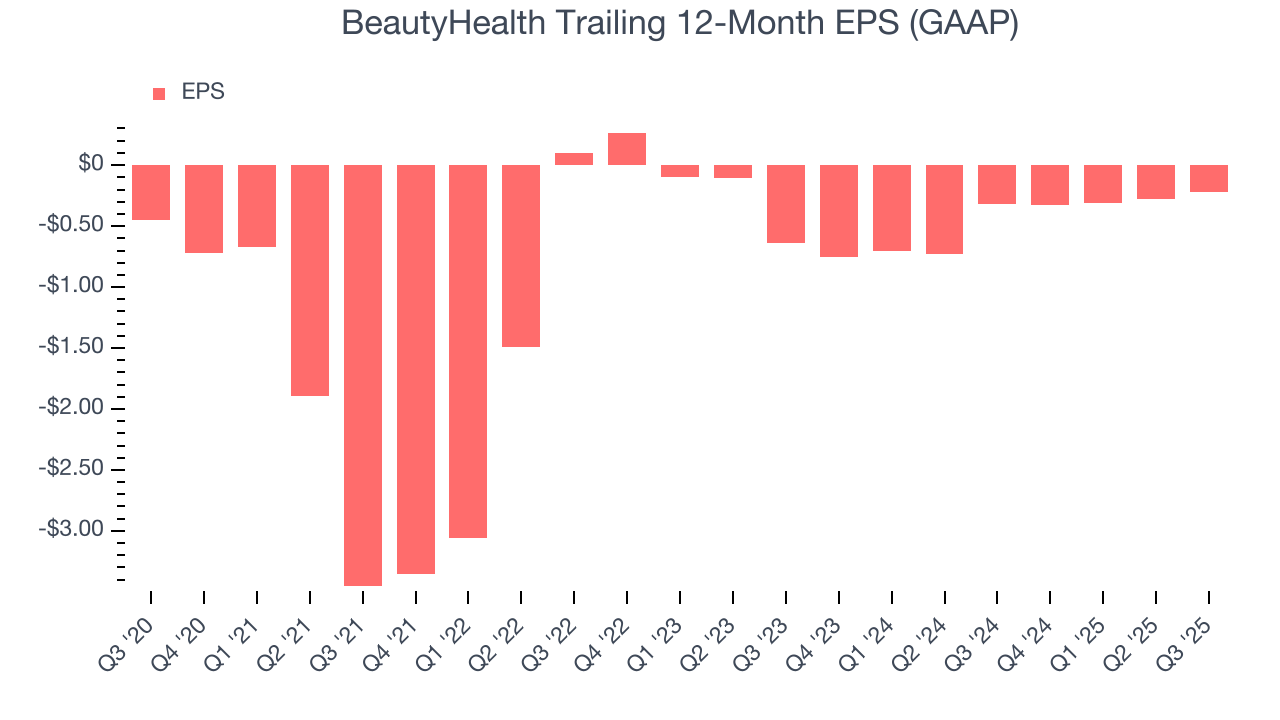

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

In Q3, BeautyHealth reported EPS of negative $0.09, up from negative $0.15 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects BeautyHealth to improve its earnings losses. Analysts forecast its full-year EPS of negative $0.22 will advance to negative $0.15.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

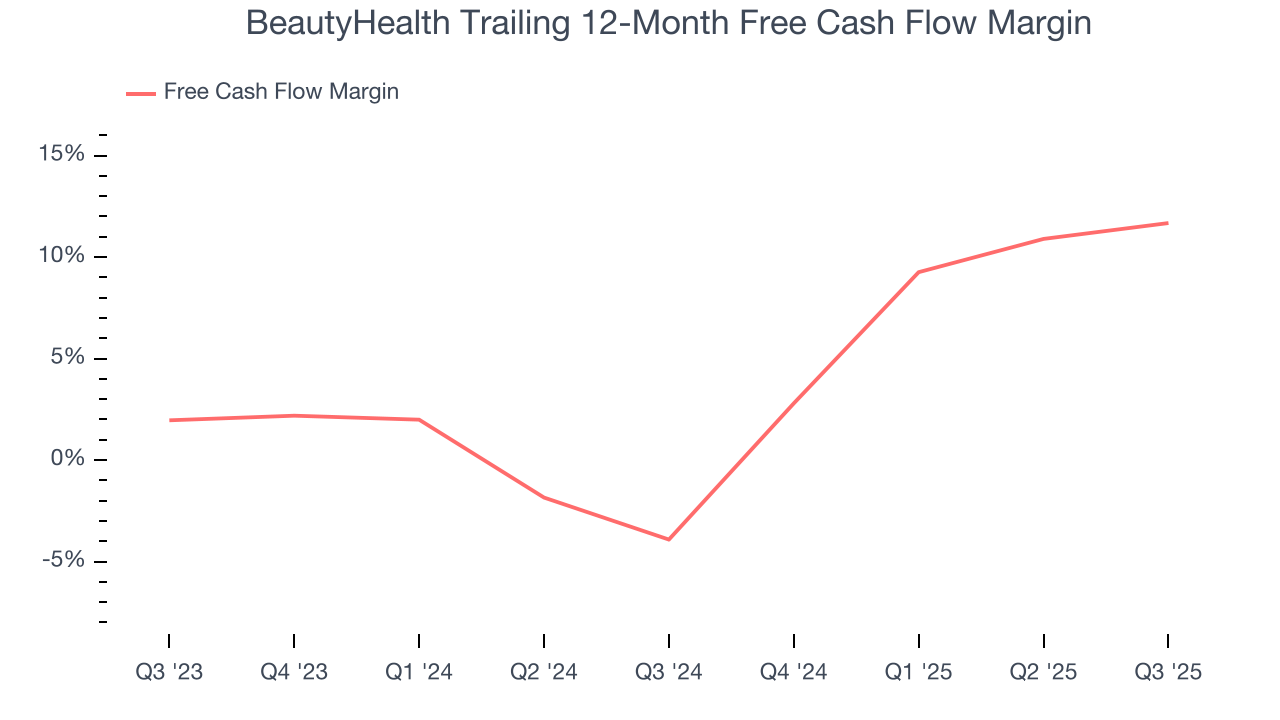

BeautyHealth has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.3%, subpar for a consumer staples business.

Taking a step back, an encouraging sign is that BeautyHealth’s margin expanded by 15.6 percentage points over the last year. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

BeautyHealth’s free cash flow clocked in at $9.7 million in Q3, equivalent to a 13.7% margin. This result was good as its margin was 3.3 percentage points higher than in the same quarter last year, building on its favorable historical trend.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

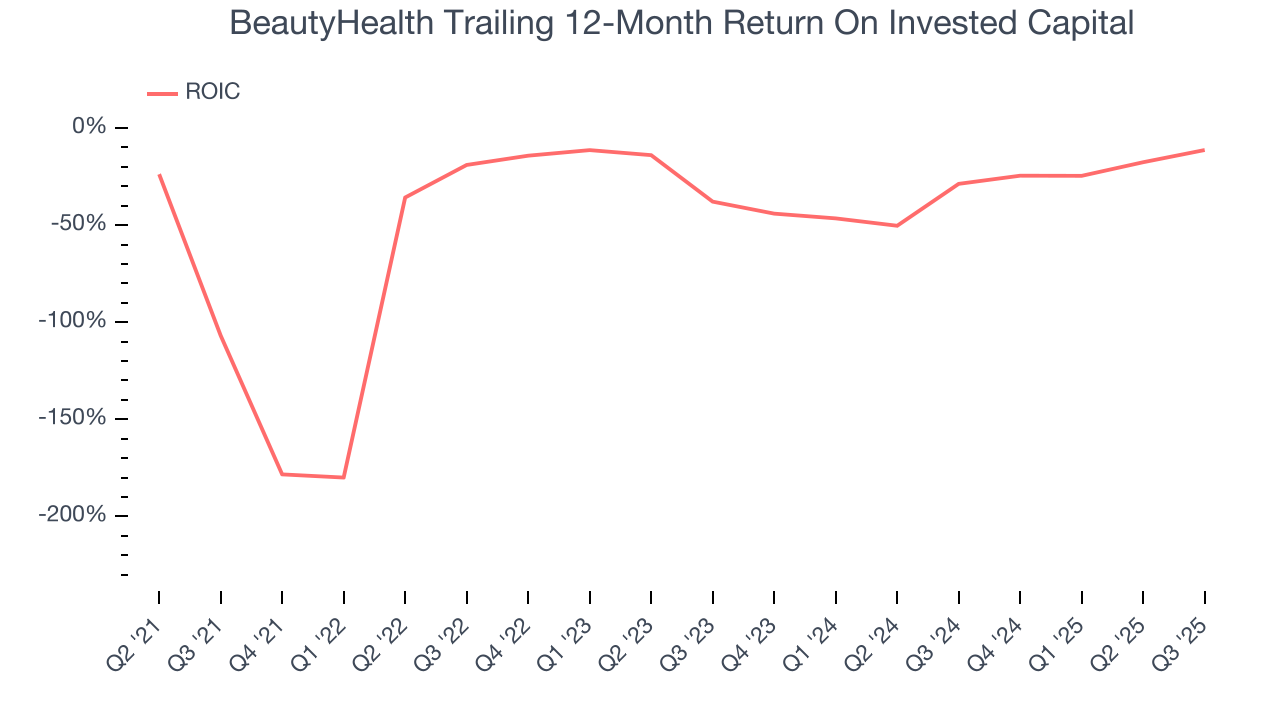

BeautyHealth’s five-year average ROIC was negative 24.2%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer staples sector.

11. Balance Sheet Assessment

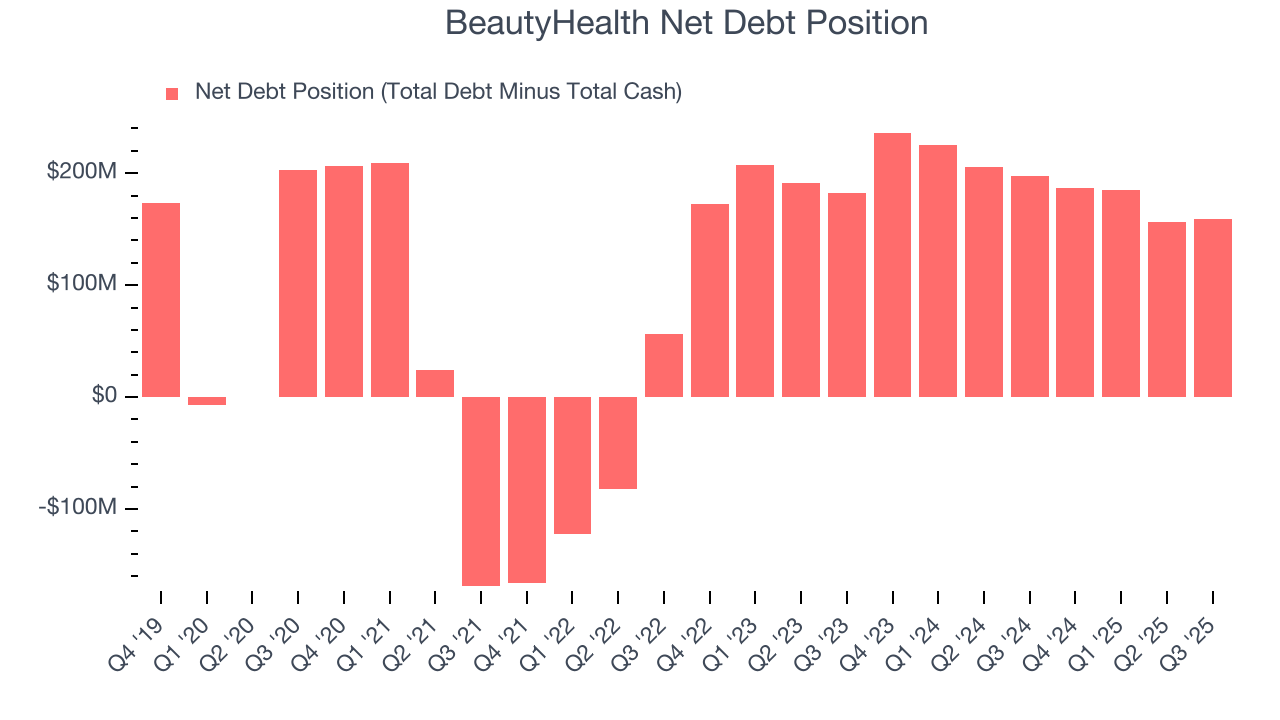

BeautyHealth reported $219.4 million of cash and $379 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $39.1 million of EBITDA over the last 12 months, we view BeautyHealth’s 4.1× net-debt-to-EBITDA ratio as safe. We also see its $4.30 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from BeautyHealth’s Q3 Results

We were impressed by how significantly BeautyHealth blew past analysts’ EBITDA expectations this quarter. We were also glad its full-year EBITDA guidance trumped Wall Street’s estimates. On the other hand, its EPS was in line and its gross margin fell short of Wall Street’s estimates. Overall, we think this was still a decent quarter with some key metrics above expectations. The stock traded up 16.7% to $1.50 immediately after reporting.

13. Is Now The Time To Buy BeautyHealth?

Updated: January 24, 2026 at 9:52 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

We cheer for all companies serving everyday consumers, but in the case of BeautyHealth, we’ll be cheering from the sidelines. To begin with, its revenue has declined over the last three years. And while its expanding operating margin shows the business has become more efficient, the downside is its brand caters to a niche market. On top of that, its projected EPS for the next year is lacking.

BeautyHealth’s EV-to-EBITDA ratio based on the next 12 months is 10.1x. At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $1.96 on the company (compared to the current share price of $1.53).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.