SoundHound AI (SOUN)

We’re not sold on SoundHound AI. Its low gross margin indicates poor unit economics, partly explaining why it has historically burned cash.― StockStory Analyst Team

1. News

2. Summary

Why SoundHound AI Is Not Exciting

Born from the idea that machines should understand human speech as naturally as people do, SoundHound AI (NASDAQ:SOUN) develops voice recognition and conversational intelligence technology that enables businesses to integrate voice assistants into their products and services.

- Sky-high servicing costs result in an inferior gross margin of 42.4% that must be offset through increased usage

- Cash-burning history makes us doubt the long-term viability of its business model

- One positive is that its market share has increased as its 68% annual revenue growth over the last four years was exceptional

SoundHound AI’s quality is insufficient. You should search for better opportunities.

Why There Are Better Opportunities Than SoundHound AI

High Quality

Investable

Underperform

Why There Are Better Opportunities Than SoundHound AI

SoundHound AI’s stock price of $8.10 implies a valuation ratio of 15x forward price-to-sales. This valuation multiple seems a bit much considering the quality you get.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. SoundHound AI (SOUN) Research Report: Q4 CY2025 Update

Voice AI technology company SoundHound AI (NASDAQ:SOUN) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 59.4% year on year to $55.06 million. Its GAAP loss of $0.03 per share was 69.1% above analysts’ consensus estimates.

SoundHound AI (SOUN) Q4 CY2025 Highlights:

- Revenue: $55.06 million vs analyst estimates of $53.84 million (59.4% year-on-year growth, 2.3% beat)

- EPS (GAAP): -$0.03 vs analyst estimates of -$0.10 (69.1% beat)

- Adjusted EBITDA: $72.28 million (131% margin, 530% year-on-year growth)

- Operating Margin: 77.3%, up from -744% in the same quarter last year

- Free Cash Flow was -$24.43 million compared to -$32.83 million in the previous quarter

- Market Capitalization: $3.58 billion

Company Overview

Born from the idea that machines should understand human speech as naturally as people do, SoundHound AI (NASDAQ:SOUN) develops voice recognition and conversational intelligence technology that enables businesses to integrate voice assistants into their products and services.

SoundHound's core technology revolves around its proprietary Speech-to-Meaning and Deep Meaning Understanding capabilities, which process spoken language in real-time without the traditional two-step process of first transcribing speech to text. This approach allows for faster, more accurate responses to voice commands, even for complex queries with multiple criteria.

The company offers several key products including the Houndify platform, which provides developers with tools to build voice interfaces; Smart Ordering for restaurants to handle phone orders; Smart Answering for businesses to manage customer calls; and SoundHound Chat AI, which combines domain knowledge with generative AI capabilities. These solutions serve industries ranging from automotive and restaurants to customer service centers and IoT device manufacturers.

A restaurant chain might use SoundHound's Smart Ordering system to automate phone orders, with the AI understanding complex requests like "I'd like a large pepperoni pizza with extra cheese, but no garlic on half, and add a side of wings with ranch dressing." The technology translates this directly into an order in the restaurant's point-of-sale system.

SoundHound monetizes its technology through subscription and licensing models, with customers including major automakers, restaurant chains, and electronics manufacturers. The company's intellectual property is protected by over 155 granted patents and 115 pending patents covering speech recognition, natural language understanding, and machine learning.

4. Automation Software

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

SoundHound AI competes with major tech companies that offer voice assistant technology such as Google (NASDAQ: GOOGL) with its Google Assistant, Amazon (NASDAQ: AMZN) with Alexa, Apple (NASDAQ: AAPL) with Siri, and Microsoft (NASDAQ: MSFT) with Cortana, as well as specialized conversational AI providers like Nuance Communications (acquired by Microsoft) and Cerence (NASDAQ: CRNC).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last four years, SoundHound AI grew its sales at an incredible 68% compounded annual growth rate. Its growth beat the average software company and shows its offerings resonate with customers.

Long-term growth is the most important, but within software, a stretched historical view may miss new innovations or demand cycles. SoundHound AI’s annualized revenue growth of 91.9% over the last two years is above its four-year trend, suggesting its demand was strong and recently accelerated.

This quarter, SoundHound AI reported magnificent year-on-year revenue growth of 59.4%, and its $55.06 million of revenue beat Wall Street’s estimates by 2.3%.

Looking ahead, sell-side analysts expect revenue to grow 34.8% over the next 12 months, a deceleration versus the last two years. Still, this projection is healthy and implies the market sees success for its products and services.

6. Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

SoundHound AI’s billings punched in at $58.85 million in Q4, and over the last four quarters, its growth was fantastic as it averaged 119% year-on-year increases. This alternate topline metric grew faster than total sales, meaning the company collects cash upfront and then recognizes the revenue over the length of its contracts - a boost for its liquidity and future revenue prospects.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

SoundHound AI’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a competitive market and must continue investing to grow.

8. Gross Margin & Pricing Power

For software companies like SoundHound AI, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

SoundHound AI’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 42.4% gross margin over the last year. Said differently, SoundHound AI had to pay a chunky $57.64 to its service providers for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. SoundHound AI has seen gross margins decline by 33 percentage points over the last 2 year, which is among the worst in the software space.

SoundHound AI produced a 47.9% gross profit margin in Q4 , marking a 8 percentage point increase from 39.9% in the same quarter last year. Zooming out, however, SoundHound AI’s full-year margin has been trending down over the past 12 months, decreasing by 6.5 percentage points. If this move continues, it could suggest deteriorating pricing power and higher input costs.

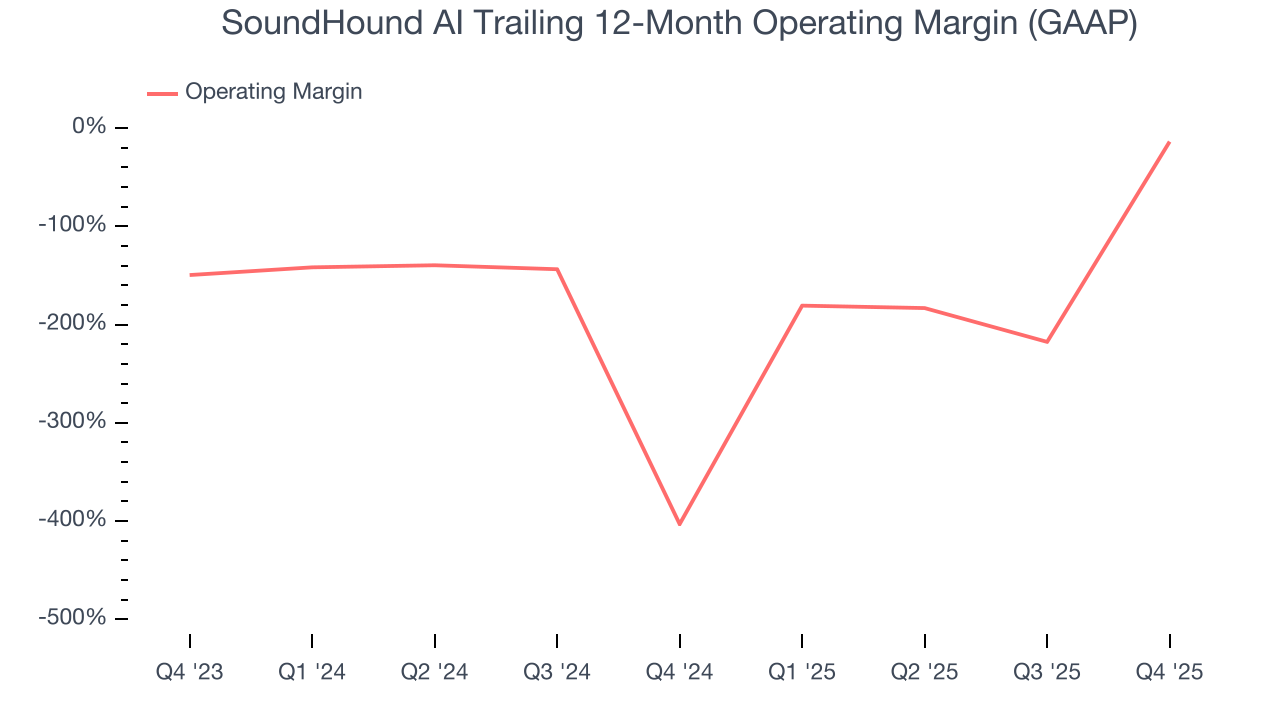

9. Operating Margin

Although SoundHound AI was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 13.8% over the last year. Unprofitable, high-growth software companies require extra attention because they spend heaps of money to capture market share. As seen in its fast historical revenue growth, this strategy seems to have worked so far, but it’s unclear what would happen if SoundHound AI reeled back its investments. Wall Street seems to be optimistic about its growth, but we have some doubts.

Over the last two years, SoundHound AI’s expanding sales gave it operating leverage as its margin rose. Still, it will take much more for the company to show consistent profitability.

In Q4, SoundHound AI generated an operating margin profit margin of 77.3%, up 821.5 percentage points year on year. The increase was solid, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

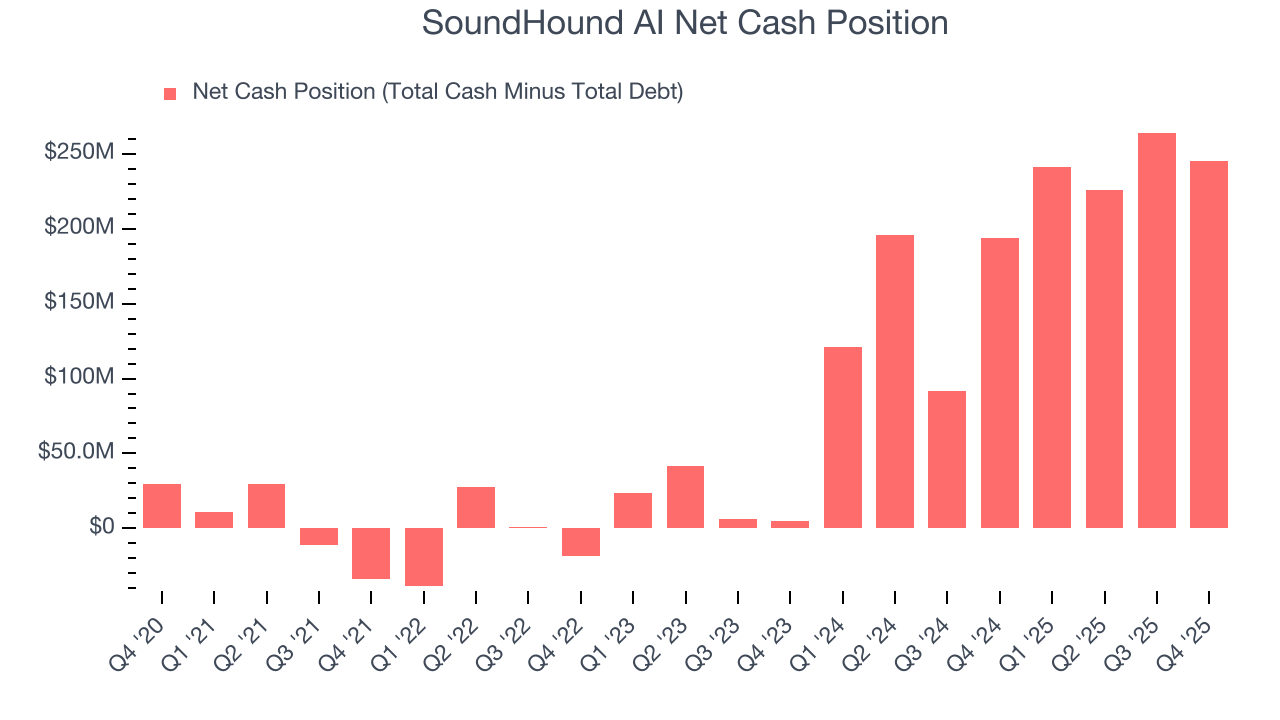

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

SoundHound AI’s demanding reinvestments have drained its resources over the last year, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 60%, meaning it lit $59.96 of cash on fire for every $100 in revenue.

SoundHound AI burned through $24.43 million of cash in Q4, equivalent to a negative 44.4% margin. The company’s cash burn was similar to its $33.2 million of lost cash in the same quarter last year.

Over the next year, analysts predict SoundHound AI will continue burning cash, albeit to a lesser extent. Their consensus estimates imply its free cash flow margin of negative 60% for the last 12 months will increase to negative 17.5%.

11. Balance Sheet Assessment

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

SoundHound AI burned through $101.3 million of cash over the last year. Although the company has $4.21 million of debt on its balance sheet, we think its $249.2 million of cash gives it enough runway (we typically look for at least two years) to prioritize growth over profitability.

12. Key Takeaways from SoundHound AI’s Q4 Results

We were impressed by how significantly SoundHound AI blew past analysts’ EBITDA expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $9.02 immediately following the results.

13. Is Now The Time To Buy SoundHound AI?

Updated: March 9, 2026 at 12:02 AM EDT

Before deciding whether to buy SoundHound AI or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

SoundHound AI doesn’t top our investment wishlist, but we understand that it’s not a bad business. To kick things off, its revenue growth was exceptional over the last four years. And while SoundHound AI’s customer acquisition is less efficient than many comparable companies, its expanding operating margin shows it’s becoming more efficient at building and selling its software.

SoundHound AI’s price-to-sales ratio based on the next 12 months is 15x. Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $14.63 on the company (compared to the current share price of $8.10).