STAAR Surgical (STAA)

STAAR Surgical is in for a bumpy ride. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think STAAR Surgical Will Underperform

With over 2.5 million implants performed worldwide, STAAR Surgical (NASDAQ:STAA) designs and manufactures implantable lenses that correct vision problems without removing the eye's natural lens.

- Products and services are facing significant end-market challenges during this cycle as sales have declined by 13.8% annually over the last two years

- Performance over the past five years shows its incremental sales were much less profitable, as its earnings per share fell by 30.7% annually

- Revenue base of $239.4 million puts it at a disadvantage compared to larger competitors exhibiting economies of scale

STAAR Surgical doesn’t meet our quality criteria. There are better opportunities in the market.

Why There Are Better Opportunities Than STAAR Surgical

High Quality

Investable

Underperform

Why There Are Better Opportunities Than STAAR Surgical

STAAR Surgical is trading at $18.45 per share, or 29.1x forward P/E. Not only does STAAR Surgical trade at a premium to companies in the healthcare space, but this multiple is also high for its fundamentals.

There are stocks out there featuring similar valuation multiples with better fundamentals. We prefer to invest in those.

3. STAAR Surgical (STAA) Research Report: Q4 CY2025 Update

Medical lens company STAAR Surgical (NASDAQ:STAA) fell short of the market’s revenue expectations in Q4 CY2025, but sales rose 18.1% year on year to $57.8 million. Its GAAP loss of $0.37 per share was significantly below analysts’ consensus estimates.

STAAR Surgical (STAA) Q4 CY2025 Highlights:

- Revenue: $57.8 million vs analyst estimates of $75.81 million (18.1% year-on-year growth, 23.8% miss)

- EPS (GAAP): -$0.37 vs analyst estimates of $0.04 (significant miss)

- Adjusted EBITDA: $0 vs analyst estimates of $12.91 million (0% margin, significant miss)

- Operating Margin: -39.5%, up from -57% in the same quarter last year

- Free Cash Flow was -$5.59 million compared to -$5.08 million in the same quarter last year

- Market Capitalization: $947.6 million

Company Overview

With over 2.5 million implants performed worldwide, STAAR Surgical (NASDAQ:STAA) designs and manufactures implantable lenses that correct vision problems without removing the eye's natural lens.

STAAR's flagship products are its Implantable Collamer Lenses (ICLs), marketed under the EVO brand family. These lenses are made from Collamer, a proprietary collagen copolymer material that makes them soft, flexible, and biocompatible with the eye. Unlike laser-based procedures such as LASIK that remove corneal tissue, ICLs are inserted through a small incision and placed behind the iris but in front of the natural lens, preserving the eye's natural structures.

The company's EVO ICL product line treats myopia (nearsightedness), while other variants address hyperopia (farsightedness), astigmatism, and presbyopia (age-related loss of near vision). The EVO Viva, one of STAAR's newer offerings, features an extended depth of focus design specifically for patients with presbyopia.

A typical ICL procedure is performed on an outpatient basis using topical anesthesia. Patients usually experience immediate vision improvement within a day. The procedure is generally elective and paid for directly by patients rather than through insurance.

STAAR has a global footprint with 95% of its revenue coming from outside the United States. The company sells its products in more than 75 countries, with direct distribution in Japan, the U.S., Germany, Spain, Singapore, Canada, and the UK. In China, which represents a significant market, STAAR works through Shanghai Lansheng, its distributor.

The company maintains manufacturing facilities in Monrovia and Aliso Viejo, California, with additional operations in Switzerland and Japan. STAAR is expanding its manufacturing capabilities in Nidau, Switzerland to meet growing demand.

To drive awareness and adoption of its ICL technology, STAAR invests in surgeon training, marketing campaigns, and partnerships with celebrities like Joe Jonas and Peyton List. The company's marketing positions ICLs as a premium alternative to glasses, contact lenses, and laser-based corrective procedures.

4. Medical Devices & Supplies - Specialty

The medical devices industry operates a business model that balances steady demand with significant investments in innovation and regulatory compliance. The industry benefits from recurring revenue streams tied to consumables, maintenance services, and incremental upgrades to the latest technologies, although specialty devices are more niche. The capital-intensive nature of product development, coupled with lengthy regulatory pathways and the need for clinical validation, can weigh on profitability and timelines. In addition, there are constant pricing pressures from healthcare systems and insurers maximizing cost efficiency. Over the next several years, one tailwind is demographic–aging populations means rising chronic disease rates that drive greater demand for medical interventions and monitoring solutions. Advances in digital health, such as remote patient monitoring and smart devices, are also expected to unlock new demand by shortening upgrade cycles. On the other hand, the industry faces headwinds from pricing and reimbursement pressures as healthcare providers increasingly adopt value-based care models. Additionally, the integration of cybersecurity for connected devices adds further risk and complexity for device manufacturers.

STAAR Surgical's main competitors in the ophthalmic medical device market include Alcon (NYSE:ALC), Johnson & Johnson Vision (NYSE:JNJ), Bausch Health Companies (NYSE:BHC), and Carl Zeiss Meditec AG (ETR:AFX).

5. Revenue Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $239.4 million in revenue over the past 12 months, STAAR Surgical is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

6. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, STAAR Surgical’s sales grew at a decent 7.9% compounded annual growth rate over the last five years. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. STAAR Surgical’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 13.8% over the last two years.

This quarter, STAAR Surgical’s revenue grew by 18.1% year on year to $57.8 million but fell short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 31.5% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and implies its newer products and services will fuel better top-line performance.

7. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

STAAR Surgical was roughly breakeven when averaging the last five years of quarterly operating profits, lousy for a healthcare business.

Analyzing the trend in its profitability, STAAR Surgical’s operating margin decreased by 52.8 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 47 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, STAAR Surgical generated an operating margin profit margin of negative 39.5%, up 17.5 percentage points year on year. This increase was a welcome development and shows it was more efficient.

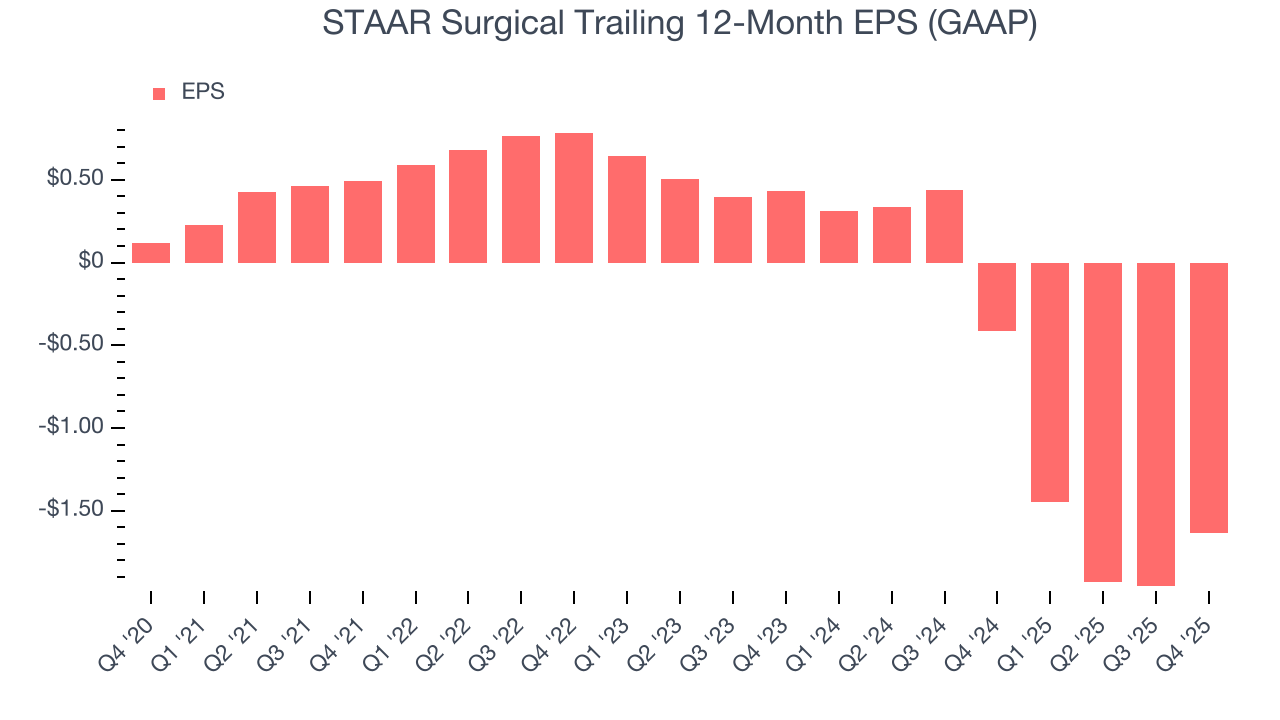

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for STAAR Surgical, its EPS declined by 73.2% annually over the last five years while its revenue grew by 7.9%. This tells us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of STAAR Surgical’s earnings can give us a better understanding of its performance. As we mentioned earlier, STAAR Surgical’s operating margin expanded this quarter but declined by 52.8 percentage points over the last five years. Its share count also grew by 1.9%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q4, STAAR Surgical reported EPS of negative $0.37, up from negative $0.69 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast STAAR Surgical’s full-year EPS of negative $1.63 will flip to positive $0.09.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

STAAR Surgical broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

Taking a step back, we can see that STAAR Surgical’s margin dropped by 29.9 percentage points during that time. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s in the middle of a big investment cycle.

STAAR Surgical burned through $5.59 million of cash in Q4, equivalent to a negative 9.7% margin. The company’s cash burn was similar to its $5.08 million of lost cash in the same quarter last year.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

STAAR Surgical historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5%, somewhat low compared to the best healthcare companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, STAAR Surgical’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

11. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

STAAR Surgical is a well-capitalized company with $187.5 million of cash and $38.35 million of debt on its balance sheet. This $149.2 million net cash position is 15.7% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from STAAR Surgical’s Q4 Results

We struggled to find many positives in these results. Its revenue missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 10.9% to $16.87 immediately following the results.

13. Is Now The Time To Buy STAAR Surgical?

Updated: March 9, 2026 at 12:34 AM EDT

When considering an investment in STAAR Surgical, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

We see the value of companies making people healthier, but in the case of STAAR Surgical, we’re out. Although its revenue growth was decent over the last five years and is expected to accelerate over the next 12 months, its diminishing returns show management's prior bets haven't worked out. On top of that, the company’s declining EPS over the last five years makes it a less attractive asset to the public markets.

STAAR Surgical’s P/E ratio based on the next 12 months is 29.1x. This valuation tells us a lot of optimism is priced in - we think there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $19.17 on the company (compared to the current share price of $18.45).