Smith & Wesson (SWBI)

Smith & Wesson is in for a bumpy ride. Not only are its sales cratering but also its low returns on capital suggest it struggles to generate profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Smith & Wesson Will Underperform

With a history dating back to 1852, Smith & Wesson (NASDAQ:SWBI) is a firearms manufacturer known for its handguns and rifles.

- Products and services have few die-hard fans as sales have declined by 10.2% annually over the last five years

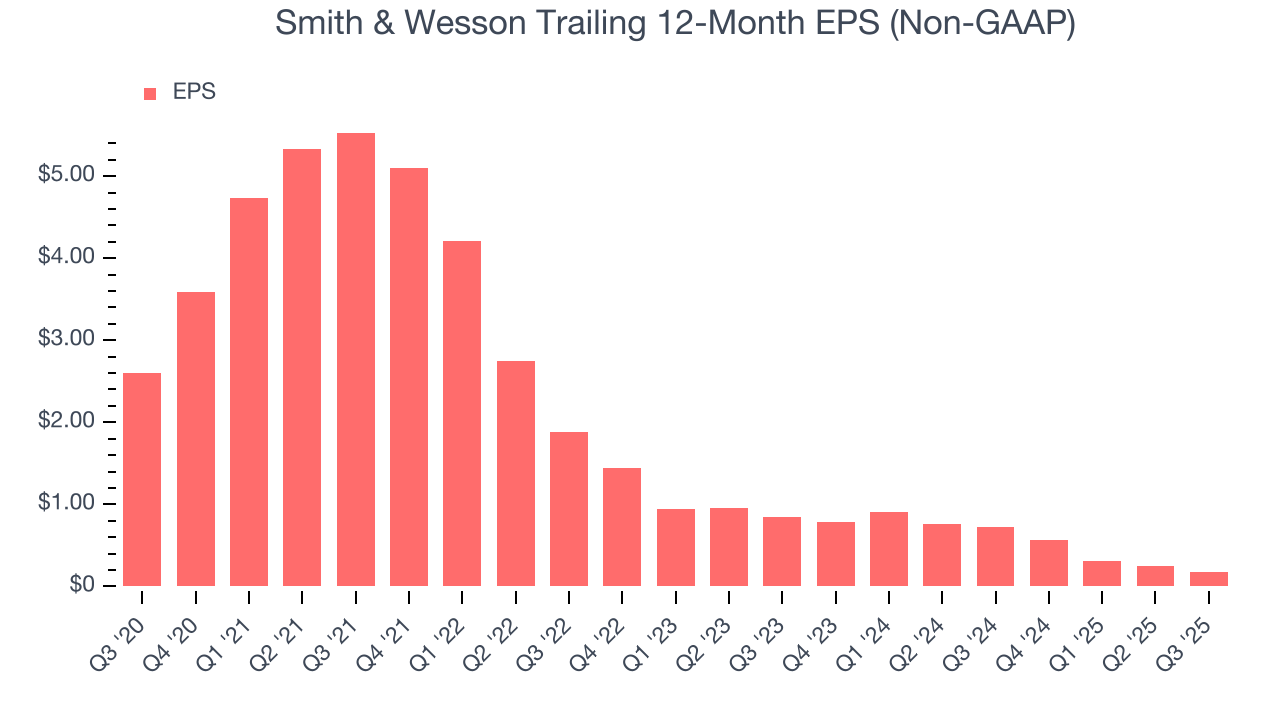

- Earnings per share decreased by more than its revenue over the last five years, showing each sale was less profitable

- Subpar operating margin constrains its ability to invest in process improvements or effectively respond to new competitive threats

Smith & Wesson fails to meet our quality criteria. There are more promising alternatives.

Why There Are Better Opportunities Than Smith & Wesson

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Smith & Wesson

Smith & Wesson is trading at $12.15 per share, or 42.9x forward P/E. The current multiple is quite expensive, especially for the tepid revenue growth.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. Smith & Wesson (SWBI) Research Report: Q3 CY2025 Update

American firearms manufacturer Smith & Wesson (NASDAQ:SWBI) announced better-than-expected revenue in Q3 CY2025, but sales fell by 3.9% year on year to $124.7 million. Its non-GAAP profit of $0.04 per share was $0.02 above analysts’ consensus estimates.

Smith & Wesson (SWBI) Q3 CY2025 Highlights:

- Revenue: $124.7 million vs analyst estimates of $123.7 million (3.9% year-on-year decline, 0.8% beat)

- Adjusted EPS: $0.04 vs analyst estimates of $0.02 ($0.02 beat)

- Adjusted EBITDA: $15.14 million vs analyst estimates of $12.02 million (12.1% margin, 26% beat)

- Operating Margin: 3.3%, down from 5.8% in the same quarter last year

- Free Cash Flow was $16.28 million, up from -$10.7 million in the same quarter last year

- Market Capitalization: $393.8 million

Company Overview

With a history dating back to 1852, Smith & Wesson (NASDAQ:SWBI) is a firearms manufacturer known for its handguns and rifles.

Smith & Wesson was established as a small partnership in Springfield, Massachusetts, with the vision of creating innovative firearm safety mechanisms, which led to the development of the Volcanic rifle. The company's founding was driven by the goal of enhancing the security and reliability of firearms.

Smith & Wesson offers an extensive catalog of firearms, including revolvers, semi-automatic pistols, and rifles. Its products address the need for dependable and precise firearms in situations where performance can mean the difference between life and death.

The company's revenue stems from sales of firearms, ammunition, and other accessories to the commercial, law enforcement, and military sectors.

4. Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Competitors in the firearms market include Sturm, Ruger & Company (NYSE:RGR), Vista Outdoor (NYSE:VSTO), and American Outdoor Brands (NASDAQ:AOUT).

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Smith & Wesson struggled to consistently generate demand over the last five years as its sales dropped at a 10.2% annual rate. This wasn’t a great result and is a sign of poor business quality.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Smith & Wesson’s annualized revenue declines of 4.7% over the last two years suggest its demand continued shrinking.

This quarter, Smith & Wesson’s revenue fell by 3.9% year on year to $124.7 million but beat Wall Street’s estimates by 0.8%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection indicates its newer products and services will catalyze better top-line performance, it is still below the sector average.

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Smith & Wesson’s operating margin has shrunk over the last 12 months and averaged 6.5% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

This quarter, Smith & Wesson generated an operating margin profit margin of 3.3%, down 2.5 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Smith & Wesson, its EPS declined by 41.4% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

In Q3, Smith & Wesson reported adjusted EPS of $0.04, down from $0.11 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Smith & Wesson’s full-year EPS of $0.18 to grow 25%.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Smith & Wesson has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.1%, lousy for a consumer discretionary business.

Smith & Wesson’s free cash flow clocked in at $16.28 million in Q3, equivalent to a 13.1% margin. Its cash flow turned positive after being negative in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Smith & Wesson historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 13.8%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Smith & Wesson’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

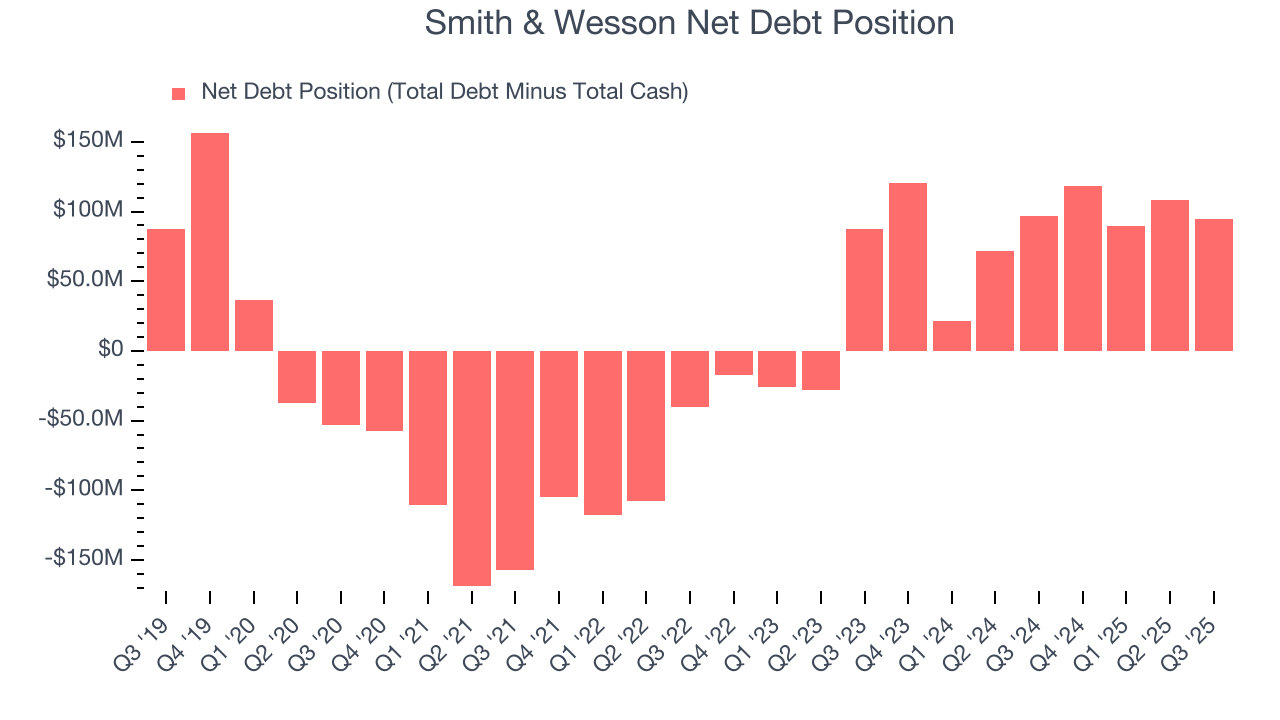

10. Balance Sheet Assessment

Smith & Wesson reported $27.32 million of cash and $121.8 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $60.61 million of EBITDA over the last 12 months, we view Smith & Wesson’s 1.6× net-debt-to-EBITDA ratio as safe. We also see its $5.06 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Smith & Wesson’s Q3 Results

It was good to see Smith & Wesson beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. The stock traded up 1.6% to $9.05 immediately following the results.

12. Is Now The Time To Buy Smith & Wesson?

Updated: February 22, 2026 at 10:19 PM EST

Before deciding whether to buy Smith & Wesson or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Smith & Wesson falls short of our quality standards. While its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its declining EPS over the last five years makes it a less attractive asset to the public markets. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Smith & Wesson’s P/E ratio based on the next 12 months is 42.9x. This multiple tells us a lot of good news is priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $13.50 on the company (compared to the current share price of $12.15).