Trimble (TRMB)

Trimble is up against the odds. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Trimble Will Underperform

Playing a role in the construction of the Paris Grand, Trimble (NASDAQ:TRMB) offers geospatial devices and technology to the agriculture, construction, transportation, and logistics industries.

- Sales tumbled by 2.8% annually over the last two years, showing market trends are working against its favor during this cycle

- Low returns on capital reflect management’s struggle to allocate funds effectively, and its shrinking returns suggest its past profit sources are losing steam

- Earnings per share lagged its peers over the last five years as they only grew by 7.1% annually

Trimble doesn’t meet our quality criteria. More profitable opportunities exist elsewhere.

Why There Are Better Opportunities Than Trimble

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Trimble

Trimble’s stock price of $65.60 implies a valuation ratio of 19.1x forward P/E. This multiple is cheaper than most industrials peers, but we think this is justified.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Trimble (TRMB) Research Report: Q4 CY2025 Update

Geospatial technology provider Trimble (NASDAQ:TRMB) beat Wall Street’s revenue expectations in Q4 CY2025, but sales fell by 1.4% year on year to $969.8 million. Guidance for next quarter’s revenue was better than expected at $905.5 million at the midpoint, 1% above analysts’ estimates. Its non-GAAP profit of $1 per share was 4.1% above analysts’ consensus estimates.

Trimble (TRMB) Q4 CY2025 Highlights:

- Revenue: $969.8 million vs analyst estimates of $947.8 million (1.4% year-on-year decline, 2.3% beat)

- Adjusted EPS: $1 vs analyst estimates of $0.96 (4.1% beat)

- Revenue Guidance for Q1 CY2026 is $905.5 million at the midpoint, above analyst estimates of $896.4 million

- Adjusted EPS guidance for the upcoming financial year 2026 is $3.52 at the midpoint, beating analyst estimates by 1.8%

- Operating Margin: 22.3%, up from 17.6% in the same quarter last year

- Free Cash Flow Margin: 16%, up from 11.1% in the same quarter last year

- Organic Revenue rose 4% year on year (beat)

- Market Capitalization: $15.92 billion

Company Overview

Playing a role in the construction of the Paris Grand, Trimble (NASDAQ:TRMB) offers geospatial devices and technology to the agriculture, construction, transportation, and logistics industries.

The company was founded in 1978 by two partners from Hewlett-Packard as a land surveying business. Since then, it has expanded its data analytics capabilities and become a major player in the Internet of Things (IoT) market.

Today, Trimble offers products for GPS, construction and agriculture machinery guidance, vehicle fleet management, and software for studying maps and analyzing geographic data. For example, it makes tools that farmers use to plant crops in straight lines and construction workers use to build roads accurately. In essence, Trimble's technology ensures that everything knows precisely where it is in the world and how to move efficiently from one place to another.

Trimble primarily sells its products through direct sales, distribution channels, and partnerships with resellers and dealers. The company engages in direct sales agreements with large enterprise customers, distribution agreements with authorized dealers, and partnerships with technology providers. These contracts may range from one-time purchases of hardware and software to long-term service agreements. Additionally, Trimble offers subscription-based services and software-as-a-service (SaaS) solutions, allowing customers to continuously access its products.

4. Internet of Things

Industrial Internet of Things (IoT) companies are buoyed by the secular trend of a more connected world. They often specialize in nascent areas such as hardware and services for factory automation, fleet tracking, or smart home technologies. Those who play their cards right can generate recurring subscription revenues by providing cloud-based software services, boosting their margins. On the other hand, if the technologies these companies have invested in don’t pan out, they may have to make costly pivots.

Competitors offering similar products include Topcon (NASDAQ:TOPCF), Autodesk (NASDAQ:ADSK), Samsara (NYSE:IOT), and Garmin (NASDAQ:GRMN).

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Trimble grew its sales at a sluggish 2.6% compounded annual growth rate. This was below our standards and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Trimble’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 2.8% annually.

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Trimble’s organic revenue averaged 5.6% year-on-year growth. Because this number is better than its two-year revenue growth, we can see that some mixture of divestitures and foreign exchange rates dampened its headline results.

This quarter, Trimble’s revenue fell by 1.4% year on year to $969.8 million but beat Wall Street’s estimates by 2.3%. Company management is currently guiding for a 7.7% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 7.1% over the next 12 months. While this projection implies its newer products and services will catalyze better top-line performance, it is still below average for the sector.

6. Gross Margin & Pricing Power

Trimble has best-in-class unit economics for an industrials company, enabling it to invest in areas such as research and development. Its margin also signals it sells differentiated products, not commodities. As you can see below, it averaged an elite 64% gross margin over the last five years. Said differently, roughly $64.00 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

Trimble’s gross profit margin came in at 72% this quarter, in line with the same quarter last year. On a wider time horizon, Trimble’s full-year margin has been trending up over the past 12 months, increasing by 2.8 percentage points. If this move continues, it could suggest better unit economics due to some combination of stable to improving pricing power and input costs (such as raw materials).

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

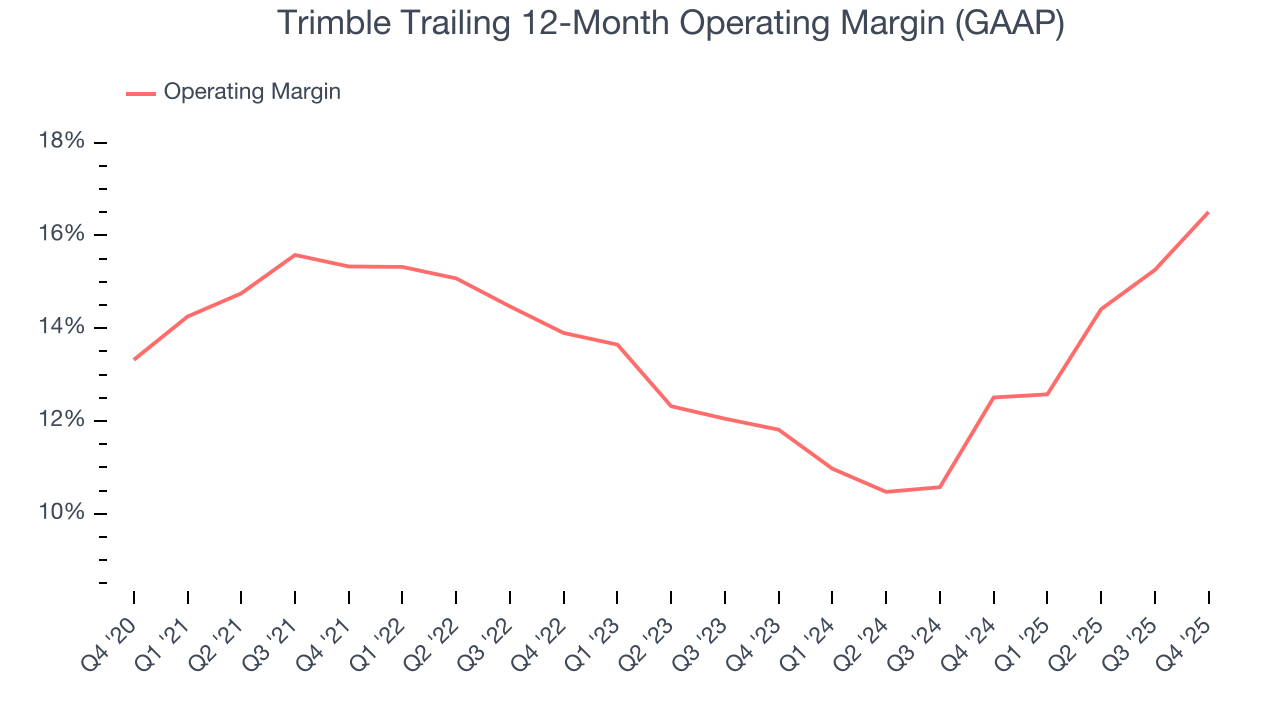

Trimble has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 14%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Trimble’s operating margin rose by 1.2 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Trimble generated an operating margin profit margin of 22.3%, up 4.7 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

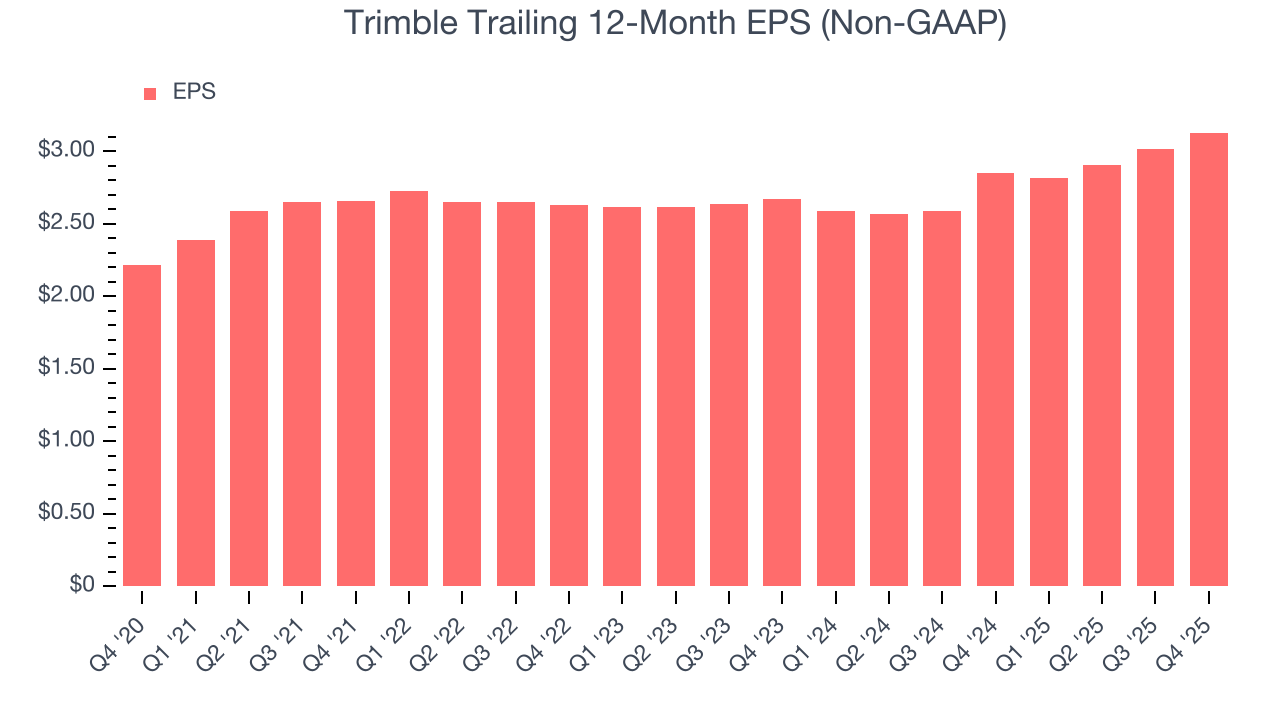

Trimble’s EPS grew at an unimpressive 7.1% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 2.6% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Trimble’s earnings can give us a better understanding of its performance. As we mentioned earlier, Trimble’s operating margin expanded by 1.2 percentage points over the last five years. On top of that, its share count shrank by 5.4%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Trimble, its two-year annual EPS growth of 8.3% was higher than its five-year trend. Accelerating earnings growth is almost always an encouraging data point.

In Q4, Trimble reported adjusted EPS of $1, up from $0.89 in the same quarter last year. This print beat analysts’ estimates by 4.1%. Over the next 12 months, Wall Street expects Trimble’s full-year EPS of $3.13 to grow 9.8%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Trimble has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 13.4% over the last five years.

Taking a step back, we can see that Trimble’s margin dropped by 9.2 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

Trimble’s free cash flow clocked in at $154.7 million in Q4, equivalent to a 16% margin. This result was good as its margin was 4.9 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends trump fluctuations.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Trimble historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.4%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Trimble’s ROIC decreased by 2.5 percentage points annually each year over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

11. Balance Sheet Assessment

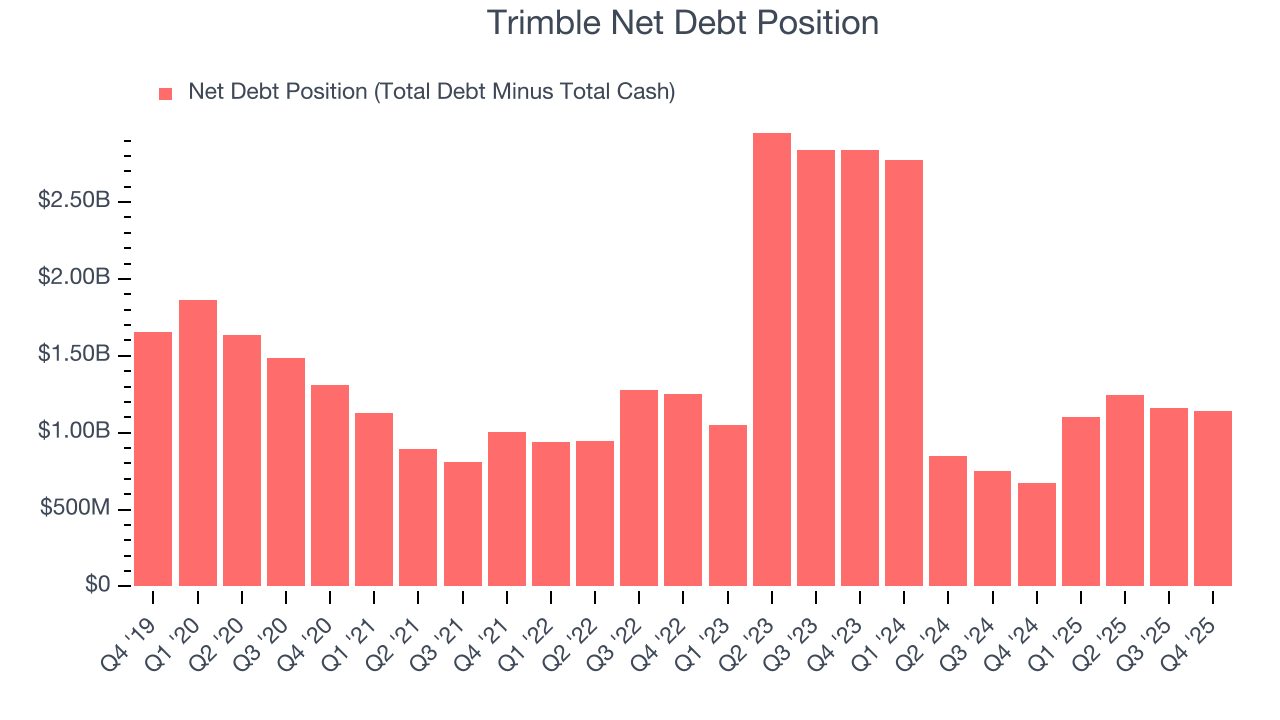

Trimble reported $253.4 million of cash and $1.39 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1 billion of EBITDA over the last 12 months, we view Trimble’s 1.1× net-debt-to-EBITDA ratio as safe. We also see its $74.4 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Trimble’s Q4 Results

We enjoyed seeing Trimble beat analysts’ revenue expectations this quarter. We were also glad its full-year EPS guidance exceeded Wall Street’s estimates. Overall, this print had some key positives. The stock remained flat at $66.93 immediately following the results.

13. Is Now The Time To Buy Trimble?

Updated: February 23, 2026 at 10:55 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Trimble.

Trimble falls short of our quality standards. To kick things off, its revenue growth was weak over the last five years. While its admirable gross margins indicate the mission-critical nature of its offerings, the downside is its cash profitability fell over the last five years. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Trimble’s P/E ratio based on the next 12 months is 19.1x. This valuation multiple is fair, but we don’t have much confidence in the company. There are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $93.33 on the company (compared to the current share price of $65.60).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.