Urban Outfitters (URBN)

Urban Outfitters catches our eye. Its demand is through the roof, as seen by its rapid growth in same-store sales and physical locations.― StockStory Analyst Team

1. News

2. Summary

Why Urban Outfitters Is Interesting

Founded as a purveyor of vintage items, Urban Outfitters (NASDAQ:URBN) now largely sells new apparel and accessories to teens and young adults seeking on-trend fashion.

- Comparable store sales rose by 4.6% on average over the past two years, demonstrating its ability to drive increased spending at existing locations

- Sales outlook for the upcoming 12 months implies the business will have more momentum than most peers

- One risk is its gross margin of 35.1% is below its competitors, leaving less money for marketing and promotions

Urban Outfitters has some respectable qualities. If you like the stock, the valuation seems fair.

Why Is Now The Time To Buy Urban Outfitters?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Urban Outfitters?

Urban Outfitters is trading at $67.10 per share, or 12.4x forward P/E. Compared to other consumer retail companies, we think this multiple is fair for the quality you get.

This could be a good time to invest if you think there are underappreciated aspects of the business.

3. Urban Outfitters (URBN) Research Report: Q3 CY2025 Update

Clothing and accessories retailer Urban Outfitters (NASDAQ:URBN) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 12.3% year on year to $1.53 billion. Its GAAP profit of $1.28 per share was 8.5% above analysts’ consensus estimates.

Urban Outfitters (URBN) Q3 CY2025 Highlights:

- Revenue: $1.53 billion vs analyst estimates of $1.49 billion (12.3% year-on-year growth, 2.6% beat)

- EPS (GAAP): $1.28 vs analyst estimates of $1.18 (8.5% beat)

- Adjusted EBITDA: $185 million vs analyst estimates of $168.8 million (12.1% margin, 9.6% beat)

- Operating Margin: 9.4%, in line with the same quarter last year

- Free Cash Flow was -$22.76 million compared to -$26.65 million in the same quarter last year

- Same-Store Sales rose 8% year on year (1.5% in the same quarter last year)

- Market Capitalization: $5.58 billion

Company Overview

Founded as a purveyor of vintage items, Urban Outfitters (NASDAQ:URBN) now largely sells new apparel and accessories to teens and young adults seeking on-trend fashion.

In addition to being trendy, the aesthetic tends to also be edgy and creative. Skaters and art students can be thought of as embodying the Urban Outfitters style. In addition to clothing and accessories such as beanies, socks, and bags, the company also sells unique items such as home decor and vinyl records to augment its aesthetic.

A typical Urban Outfitters store is roughly 10,000 square feet and located in both urban and suburban shopping centers as well as close to places with a high density of young consumers such as college campuses. The stores don’t usually follow typical retail layouts and are designed to be more edgy and nonconformist. There can be some initial difficulty navigating a store but the upside is more exploration and wandering.

In addition to the core Urban Outfitters brand, the company also operates Anthropologie and Free People. Anthropologie sells women’s clothing, accessories, and home decor featuring a bohemian aesthetic. Free People is a similar brand to Anthropologie but strictly focuses on apparel and accessories. All Urban Outfitters brands have an ecommerce presence that gives customers multiple ways to shop, return, and exchange merchandise.

4. Apparel Retailer

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

Retailers offering casual yet trendy apparel for men, women, and children include H&M (OM:HMB), Inditex (BME:ITX) which owns Zara, Abercrombie & Fitch (NYSE:ANF), and American Eagle Outfitters (NYSE:AEO).

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $6 billion in revenue over the past 12 months, Urban Outfitters is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

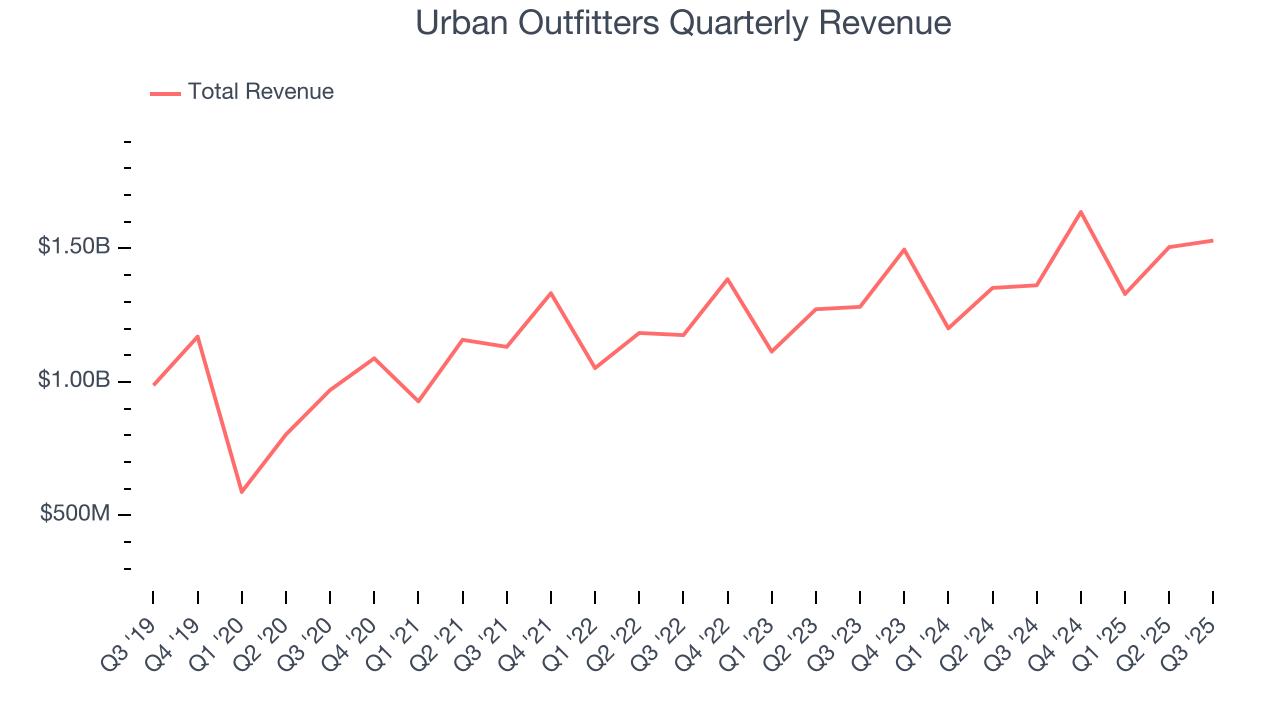

As you can see below, Urban Outfitters’s 8.2% annualized revenue growth over the last three years (we compare to 2019 to normalize for COVID-19 impacts) was mediocre, but to its credit, it opened new stores and increased sales at existing, established locations.

This quarter, Urban Outfitters reported year-on-year revenue growth of 12.3%, and its $1.53 billion of revenue exceeded Wall Street’s estimates by 2.6%.

Looking ahead, sell-side analysts expect revenue to grow 7% over the next 12 months, similar to its three-year rate. Despite the slowdown, this projection is admirable and implies the market is baking in success for its products.

6. Store Performance

Number of Stores

A retailer’s store count influences how much it can sell and how quickly revenue can grow.

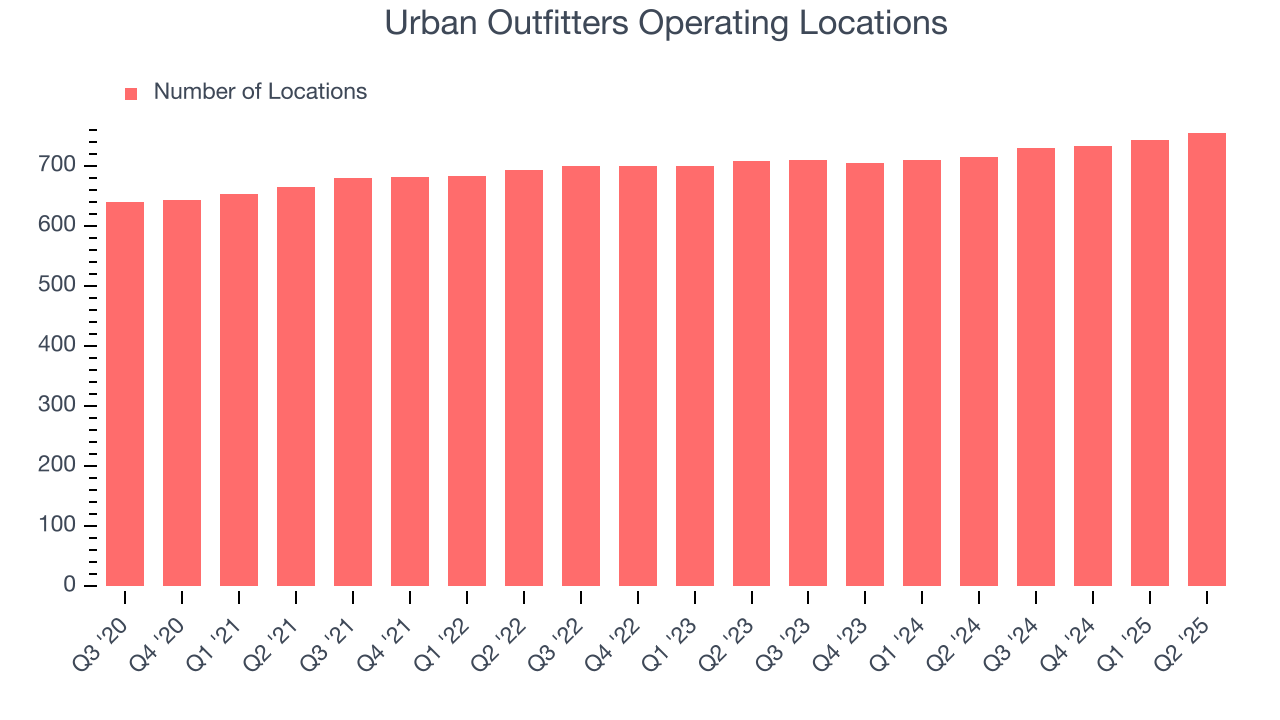

Over the last two years, Urban Outfitters opened new stores quickly, averaging 2.9% annual growth. This was faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Note that Urban Outfitters reports its store count intermittently, so some data points are missing in the chart below.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales provides a deeper understanding of this issue because it measures organic growth at brick-and-mortar shops for at least a year.

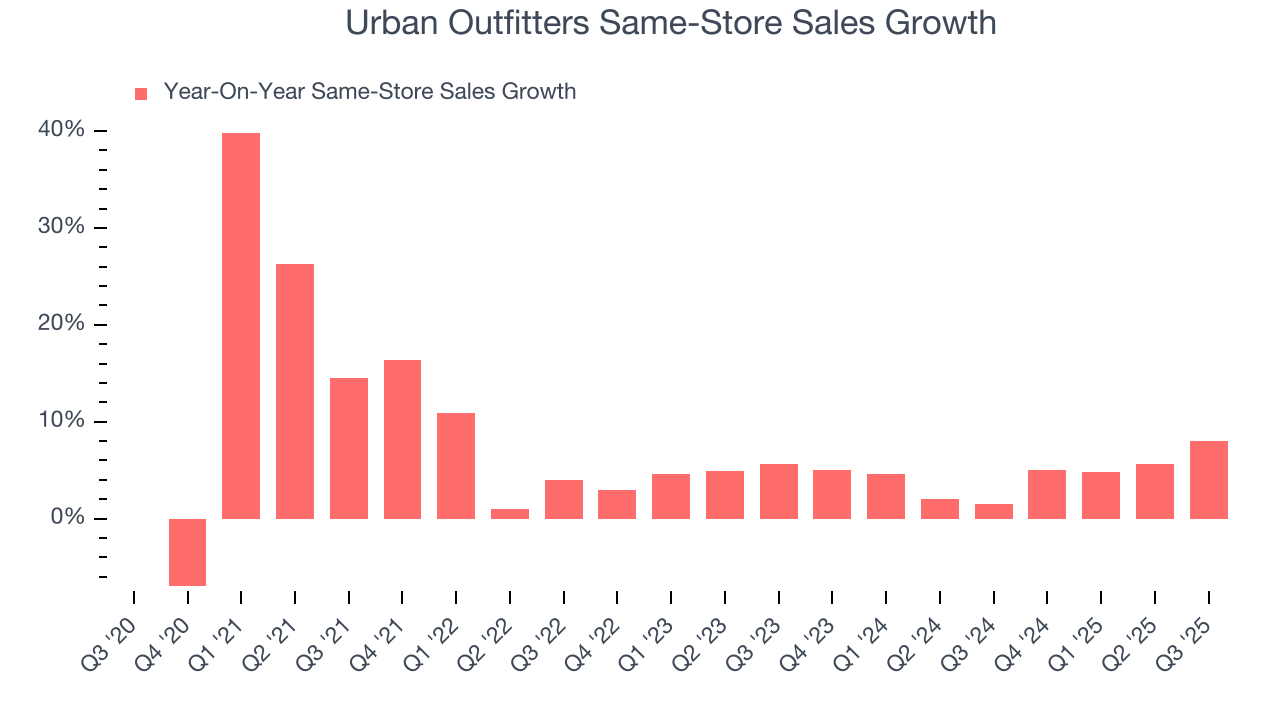

Urban Outfitters has been one of the most successful retailers over the last two years thanks to skyrocketing demand within its existing locations. On average, the company has posted exceptional year-on-year same-store sales growth of 4.6%. This performance suggests its rollout of new stores is beneficial for shareholders. We like this backdrop because it gives Urban Outfitters multiple ways to win: revenue growth can come from new stores, e-commerce, or increased foot traffic and higher sales per customer at existing locations.

In the latest quarter, Urban Outfitters’s same-store sales rose 8% year on year. This growth was an acceleration from its historical levels, which is always an encouraging sign.

7. Gross Margin & Pricing Power

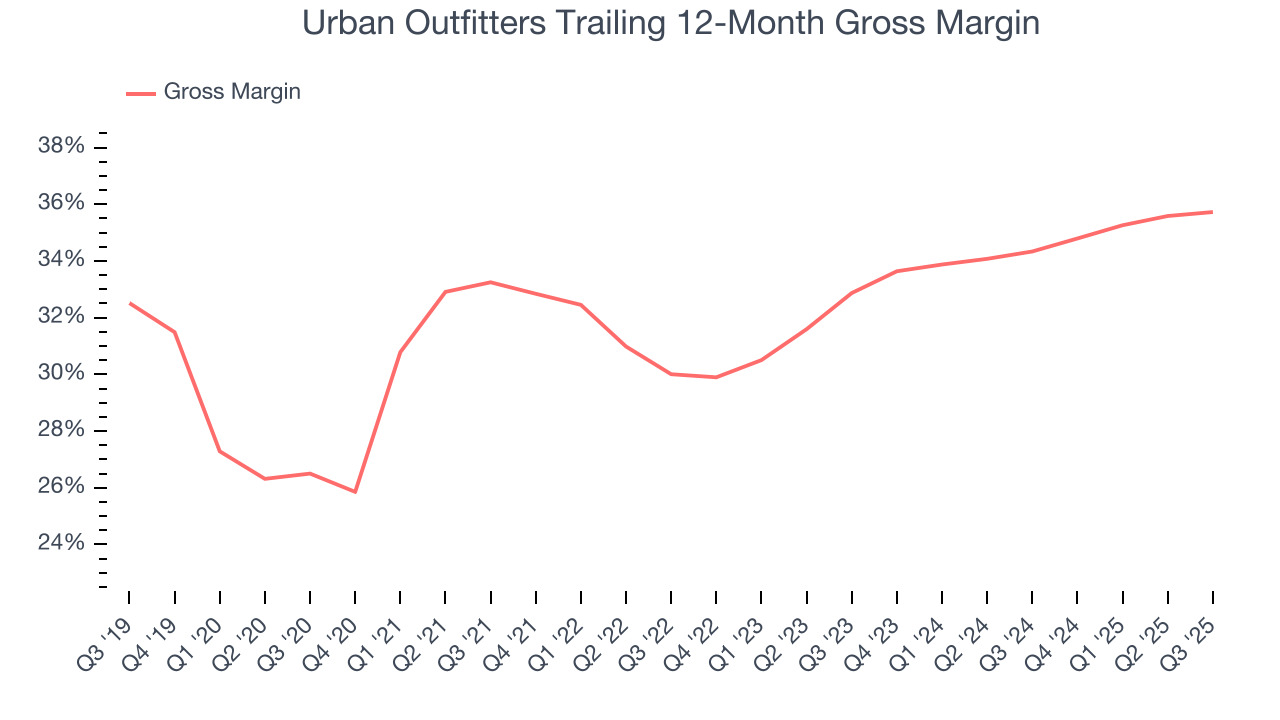

Urban Outfitters has bad unit economics for a retailer, giving it less room to reinvest and grow its presence. As you can see below, it averaged a 35.1% gross margin over the last two years. That means Urban Outfitters paid its suppliers a lot of money ($64.93 for every $100 in revenue) to run its business.

Urban Outfitters produced a 37% gross profit margin in Q3, in line with the same quarter last year. On a wider time horizon, Urban Outfitters’s full-year margin has been trending up over the past 12 months, increasing by 1.4 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold.

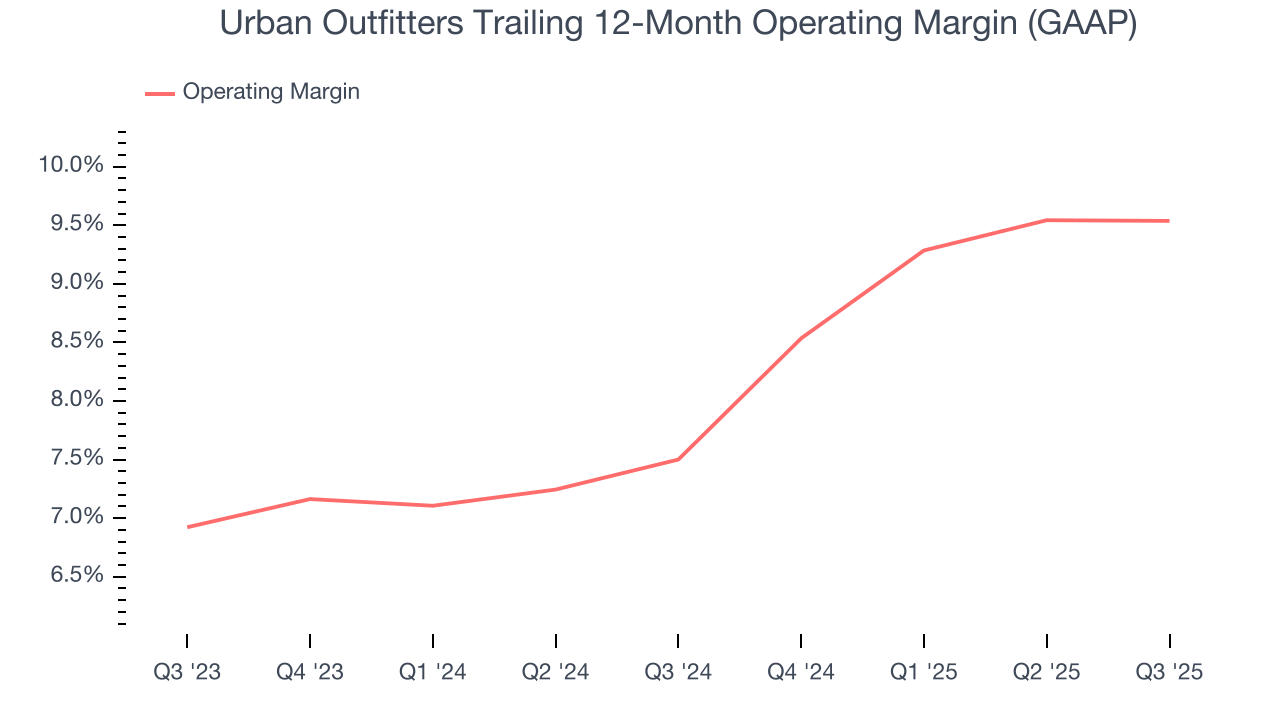

8. Operating Margin

Operating margin is an important measure of profitability for retailers as it accounts for all expenses necessary to run a store, including wages, inventory, rent, advertising, and other administrative costs.

Urban Outfitters has done a decent job managing its cost base over the last two years. The company has produced an average operating margin of 8.6%, higher than the broader consumer retail sector.

Looking at the trend in its profitability, Urban Outfitters’s operating margin rose by 2 percentage points over the last year, as its sales growth gave it operating leverage.

In Q3, Urban Outfitters generated an operating margin profit margin of 9.4%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

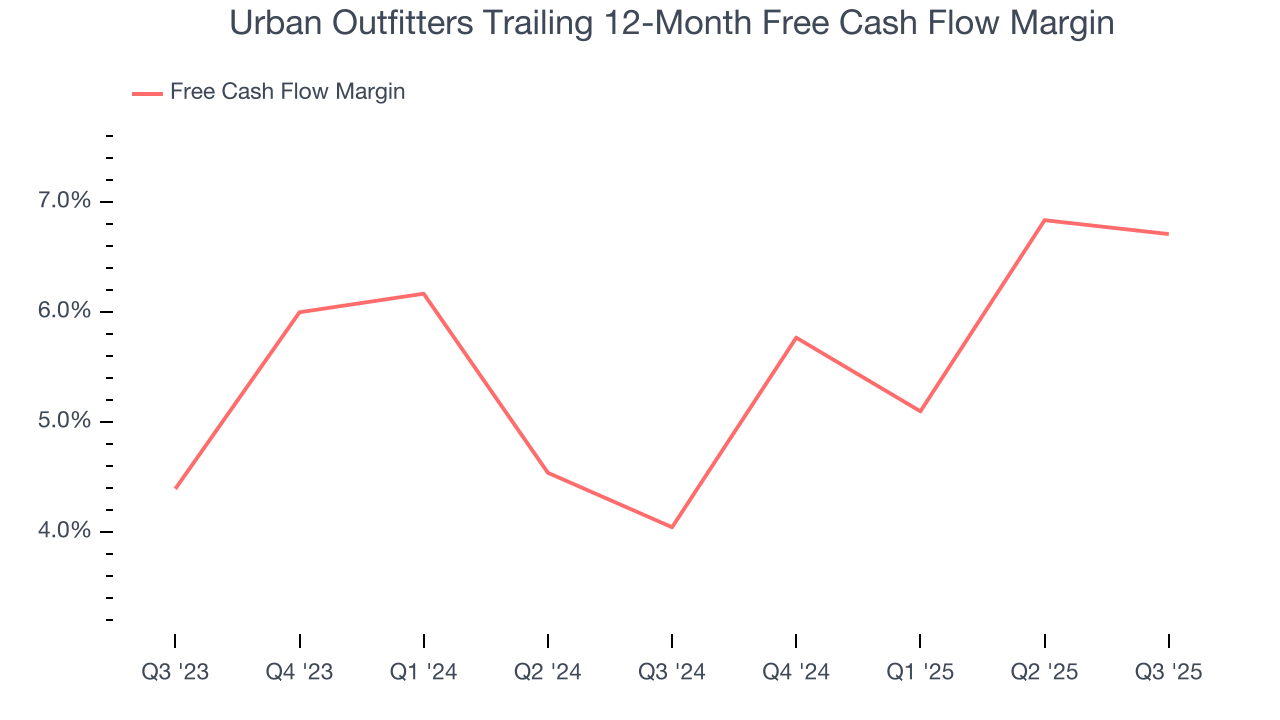

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Urban Outfitters has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 5.4% over the last two years, better than the broader consumer retail sector.

Taking a step back, we can see that Urban Outfitters’s margin expanded by 2.7 percentage points over the last year. This is encouraging because it gives the company more optionality.

Urban Outfitters burned through $22.76 million of cash in Q3, equivalent to a negative 1.5% margin. The company’s cash burn was similar to its $26.65 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Urban Outfitters historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 12.2%, somewhat low compared to the best consumer retail companies that consistently pump out 25%+.

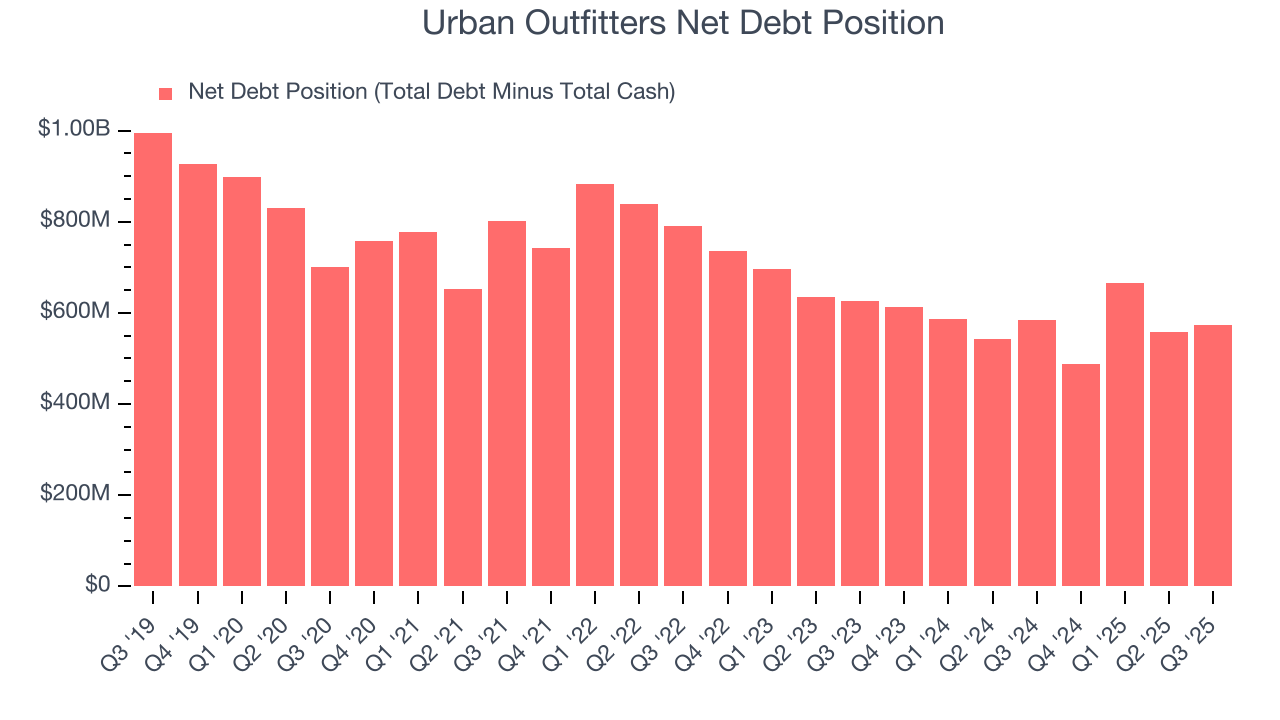

11. Balance Sheet Assessment

Urban Outfitters reported $611.7 million of cash and $1.18 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $702.7 million of EBITDA over the last 12 months, we view Urban Outfitters’s 0.8× net-debt-to-EBITDA ratio as safe. We also see its $33.24 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Urban Outfitters’s Q3 Results

We were impressed by how significantly Urban Outfitters blew past analysts’ EBITDA expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 14.8% to $78.43 immediately following the results.

13. Is Now The Time To Buy Urban Outfitters?

Updated: January 24, 2026 at 9:27 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Urban Outfitters.

Urban Outfitters is a fine business. Although its revenue growth was mediocre over the last three years, its marvelous same-store sales growth is on another level. And while its gross margins make it more difficult to reach positive operating profits compared to other consumer retail businesses, its EPS growth over the last three years has been fantastic.

Urban Outfitters’s P/E ratio based on the next 12 months is 12.4x. When scanning the consumer retail space, Urban Outfitters trades at a fair valuation. If you trust the business and its direction, this is an ideal time to buy.

Wall Street analysts have a consensus one-year price target of $85.25 on the company (compared to the current share price of $67.10), implying they see 27.1% upside in buying Urban Outfitters in the short term.