Viavi Solutions (VIAV)

We aren’t fans of Viavi Solutions. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Viavi Solutions Will Underperform

Once known as JDS Uniphase before its 2015 rebranding, Viavi Solutions (NASDAQ:VIAV) provides testing, monitoring and assurance solutions for telecommunications, cloud, enterprise, military, and other critical networks and infrastructure.

- Incremental sales over the last five years were much less profitable as its earnings per share fell by 3.1% annually while its revenue grew

- Muted 2.3% annual revenue growth over the last five years shows its demand lagged behind its industrials peers

- On the bright side, its projected revenue growth of 27.3% for the next 12 months is above its two-year trend, pointing to accelerating demand

Viavi Solutions doesn’t live up to our standards. Our attention is focused on better businesses.

Why There Are Better Opportunities Than Viavi Solutions

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Viavi Solutions

Viavi Solutions is trading at $26.33 per share, or 27.5x forward P/E. This multiple rich for the business quality. Not a great combination.

Paying up for elite businesses with strong earnings potential is better than investing in lower-quality companies with shaky fundamentals. That’s how you avoid big downside over the long term.

3. Viavi Solutions (VIAV) Research Report: Q4 CY2025 Update

Network testing solutions company Viavi Solutions (NASDAQ:VIAV) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 36.4% year on year to $369.3 million. On top of that, next quarter’s revenue guidance ($393 million at the midpoint) was surprisingly good and 10% above what analysts were expecting. Its non-GAAP profit of $0.22 per share was 17.2% above analysts’ consensus estimates.

Viavi Solutions (VIAV) Q4 CY2025 Highlights:

- Revenue: $369.3 million vs analyst estimates of $365.4 million (36.4% year-on-year growth, 1.1% beat)

- Adjusted EPS: $0.22 vs analyst estimates of $0.19 (17.2% beat)

- Adjusted EBITDA: $31.6 million vs analyst estimates of $75.07 million (8.6% margin, 57.9% miss)

- Revenue Guidance for Q1 CY2026 is $393 million at the midpoint, above analyst estimates of $357.2 million

- Adjusted EPS guidance for Q1 CY2026 is $0.23 at the midpoint, above analyst estimates of $0.15

- Operating Margin: 3.1%, down from 8.2% in the same quarter last year

- Market Capitalization: $4.62 billion

Company Overview

Once known as JDS Uniphase before its 2015 rebranding, Viavi Solutions (NASDAQ:VIAV) provides testing, monitoring and assurance solutions for telecommunications, cloud, enterprise, military, and other critical networks and infrastructure.

Viavi's business is organized into two distinct segments. The Network and Service Enablement (NSE) segment offers comprehensive tools that help telecom providers, data centers, and equipment manufacturers build, test, and maintain modern networks. Their portfolio includes instruments for testing fiber optics, wireless infrastructure, and cloud networks—essential for ensuring reliable connectivity in today's data-driven world.

The Optical Security and Performance Products (OSP) segment leverages the company's expertise in light management technologies for specialized applications. One notable application is anti-counterfeiting technology—Viavi's color-shifting pigments protect the banknotes of over 100 countries worldwide. This segment also produces optical filters for 3D sensing applications used in consumer electronics, advanced automotive systems, and industrial equipment.

A telecommunications service provider might use Viavi's testing equipment to verify that a newly installed 5G cell tower meets performance specifications, while a central bank could incorporate Viavi's optical variable pigments into currency designs to make counterfeiting more difficult. The company generates revenue through both equipment sales and ongoing service contracts with a diverse customer base that includes major telecom providers like AT&T and Verizon, network equipment manufacturers such as Cisco and Ericsson, and government agencies worldwide.

4. Inspection Instruments

Measurement and inspection instrument companies may enjoy more steady demand because products such as water meters are non-discretionary and mandated for replacement at predictable intervals. In the last decade, digitization and data collection have driven innovation in the space, leading to incremental sales. But like the broader industrials sector, measurement and inspection instrument companies are at the whim of economic cycles. Interest rates, for example, can greatly impact civil, commercial, and residential construction projects that drive demand.

Viavi's competitors in the network testing market include Anritsu, EXFO, Keysight Technologies, NetScout Systems, and Spirent Communications. In the optical security and performance products space, they compete with companies like Giesecke & Devrient, Merck KGA, Materion, and Coherent.

5. Revenue Growth

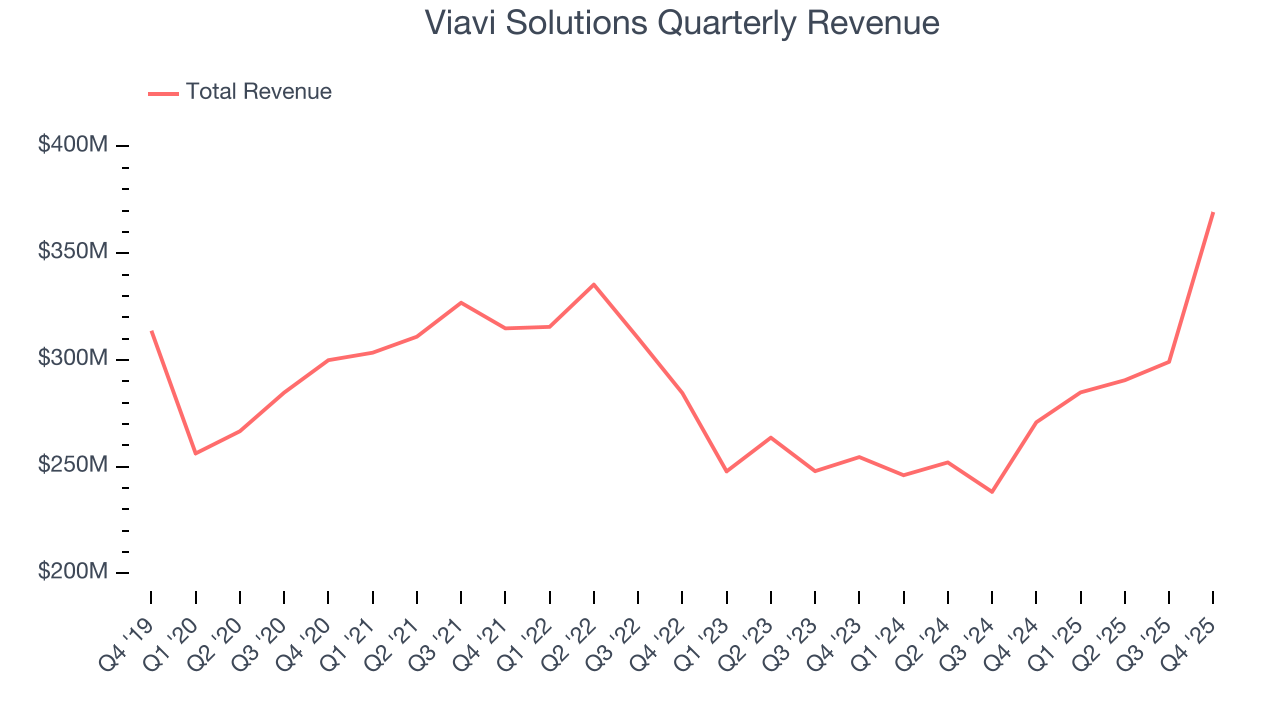

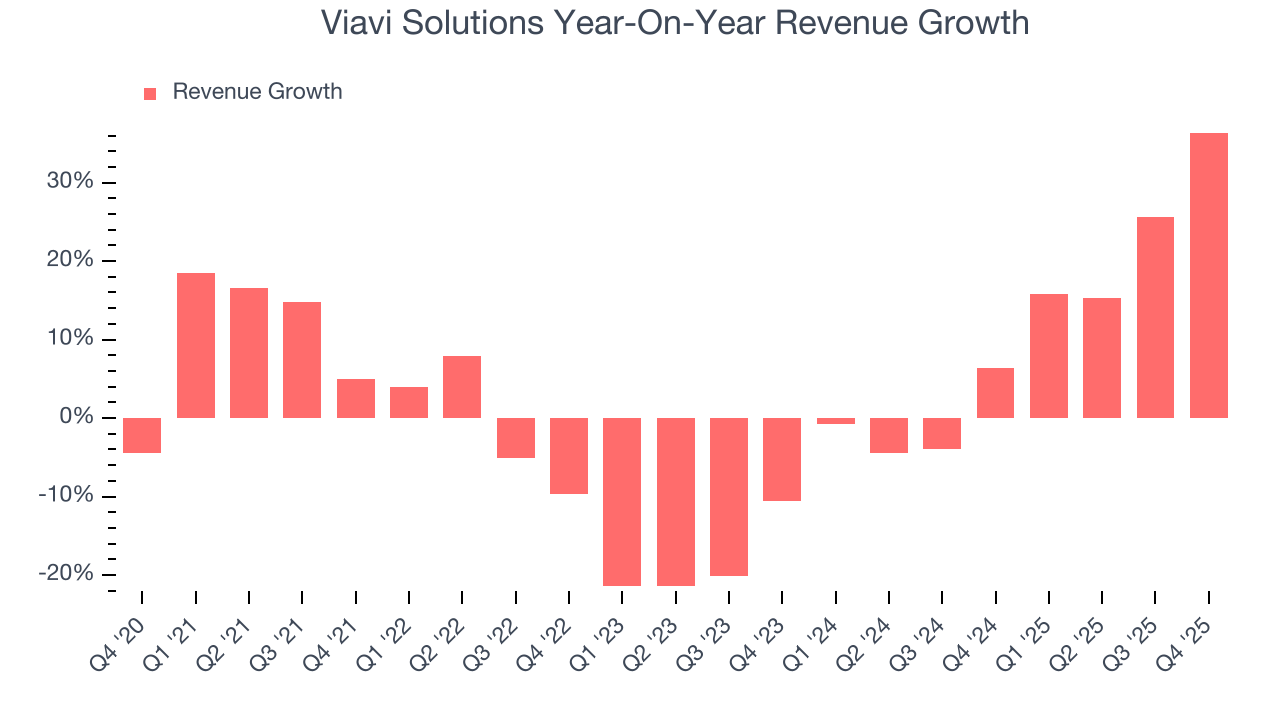

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Viavi Solutions’s sales grew at a sluggish 2.3% compounded annual growth rate over the last five years. This was below our standards and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Viavi Solutions’s annualized revenue growth of 10.8% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

This quarter, Viavi Solutions reported wonderful year-on-year revenue growth of 36.4%, and its $369.3 million of revenue exceeded Wall Street’s estimates by 1.1%. Company management is currently guiding for a 38% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 18.6% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and implies its newer products and services will spur better top-line performance.

6. Gross Margin & Pricing Power

For industrials businesses, cost of sales is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics in the short term and a company’s purchasing power and scale over the long term.

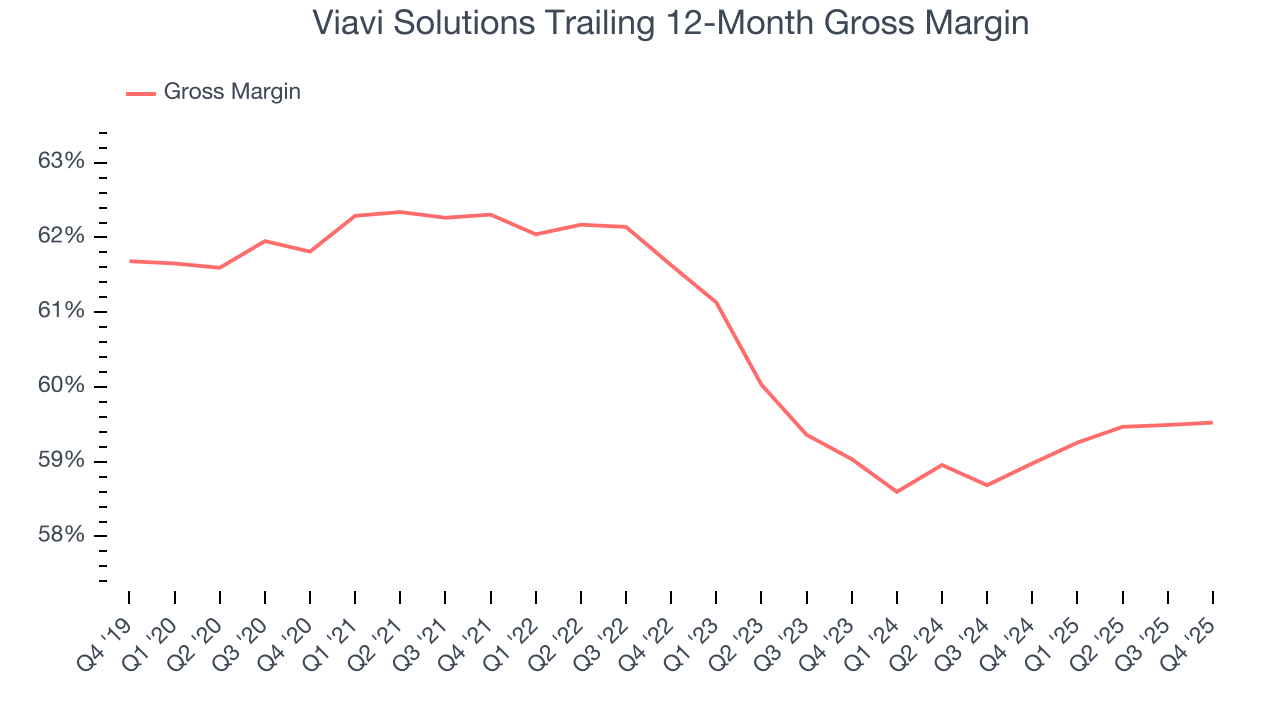

Viavi Solutions has best-in-class unit economics for an industrials company, enabling it to invest in areas such as research and development. Its margin also signals it sells differentiated products, not commodities. As you can see below, it averaged an elite 60.4% gross margin over the last five years. That means Viavi Solutions only paid its suppliers $39.60 for every $100 in revenue.

Viavi Solutions produced a 60.4% gross profit margin in Q4, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

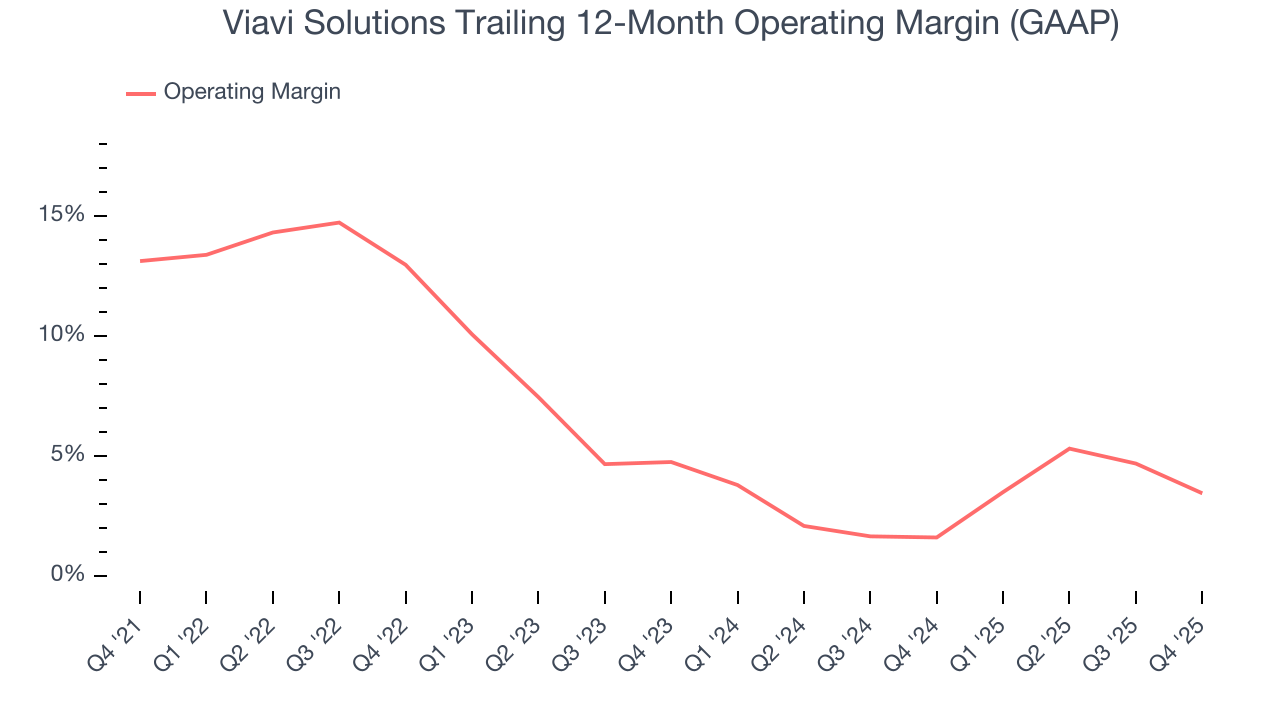

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Viavi Solutions was profitable over the last five years but held back by its large cost base. Its average operating margin of 7.5% was weak for an industrials business. This result is surprising given its high gross margin as a starting point.

Analyzing the trend in its profitability, Viavi Solutions’s operating margin decreased by 9.7 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Viavi Solutions’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Viavi Solutions generated an operating margin profit margin of 3.1%, down 5.1 percentage points year on year. Since Viavi Solutions’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

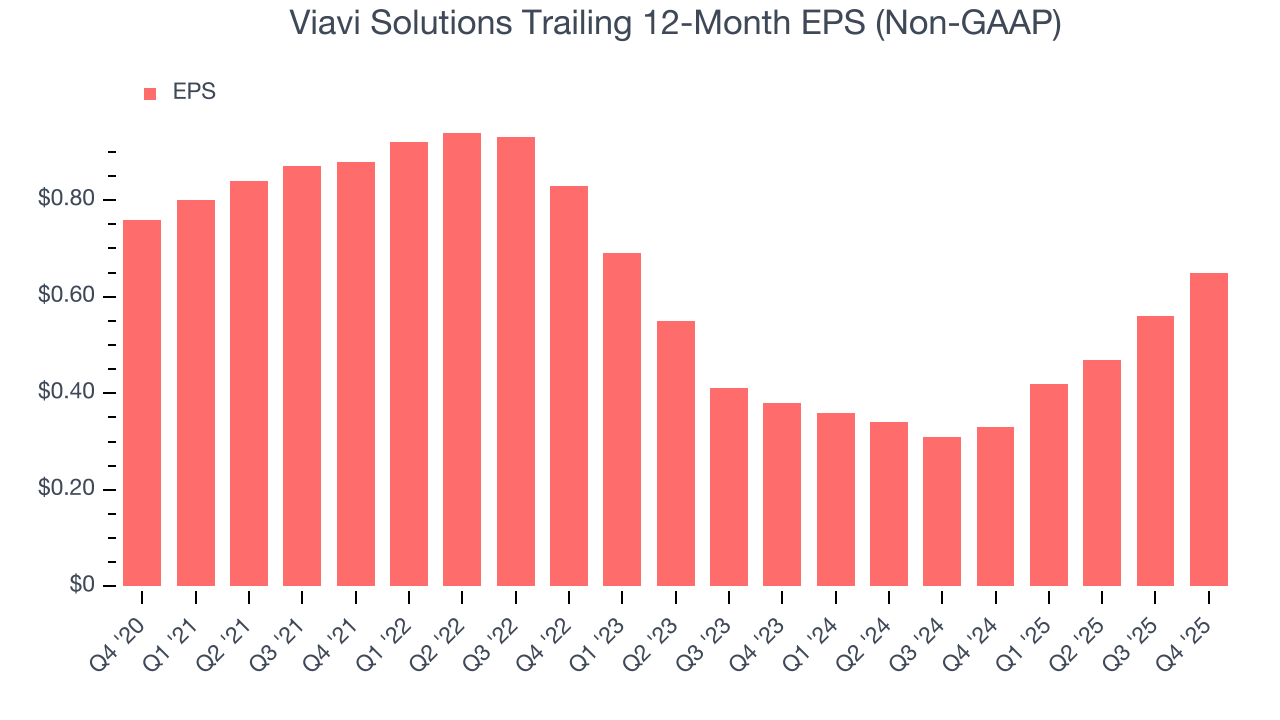

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Viavi Solutions, its EPS declined by 3.1% annually over the last five years while its revenue grew by 2.3%. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

We can take a deeper look into Viavi Solutions’s earnings to better understand the drivers of its performance. As we mentioned earlier, Viavi Solutions’s operating margin declined by 9.7 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Viavi Solutions, its two-year annual EPS growth of 30.8% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

In Q4, Viavi Solutions reported adjusted EPS of $0.22, up from $0.13 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Viavi Solutions’s full-year EPS of $0.65 to grow 13.5%.

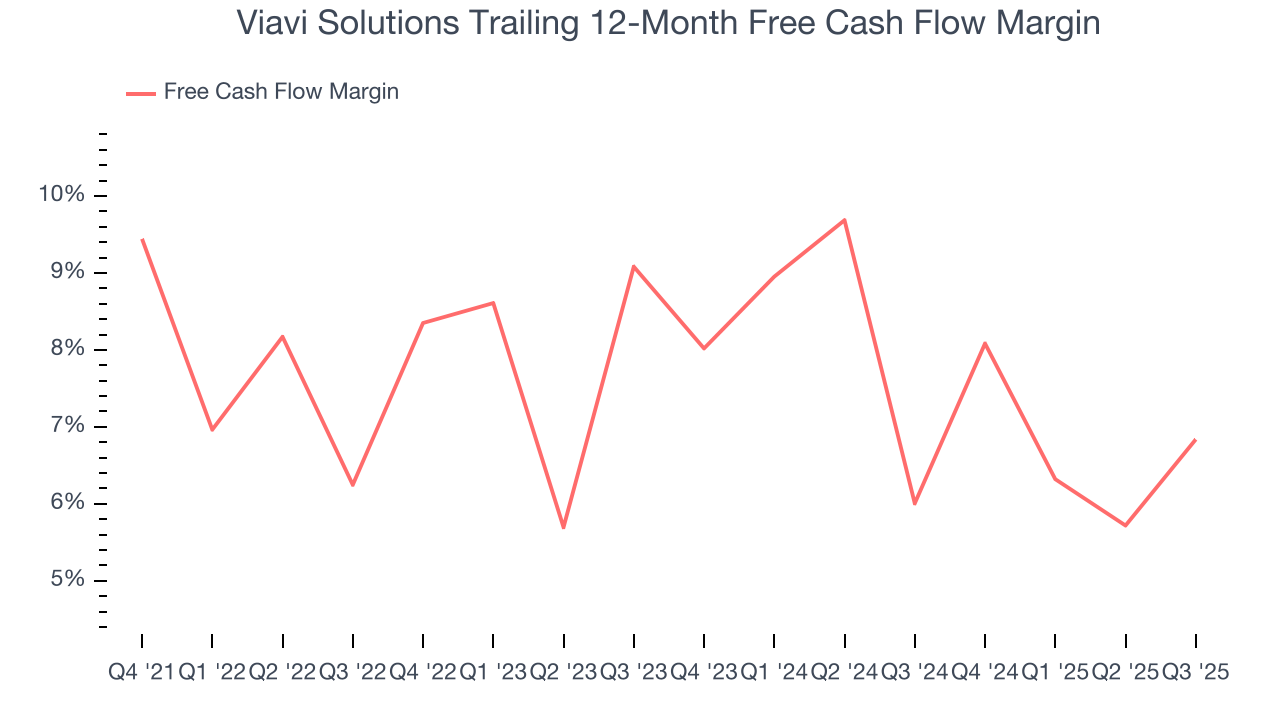

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Viavi Solutions has shown impressive cash profitability, enabling it to ride out cyclical downturns more easily while maintaining its investments in new and existing offerings. The company’s free cash flow margin averaged 7.9% over the last five years, better than the broader industrials sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that Viavi Solutions’s margin dropped by 7.4 percentage points during that time. Continued declines could signal it is in the middle of an investment cycle.

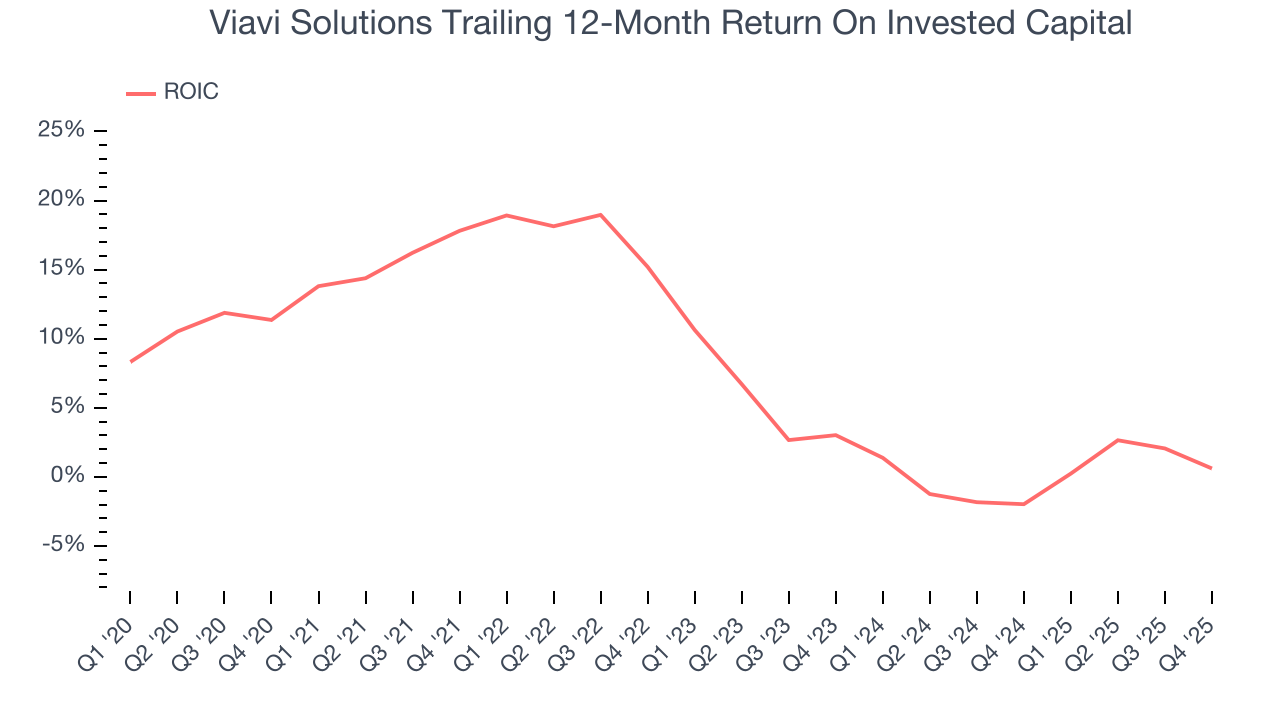

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Viavi Solutions historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.9%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Viavi Solutions’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

11. Balance Sheet Assessment

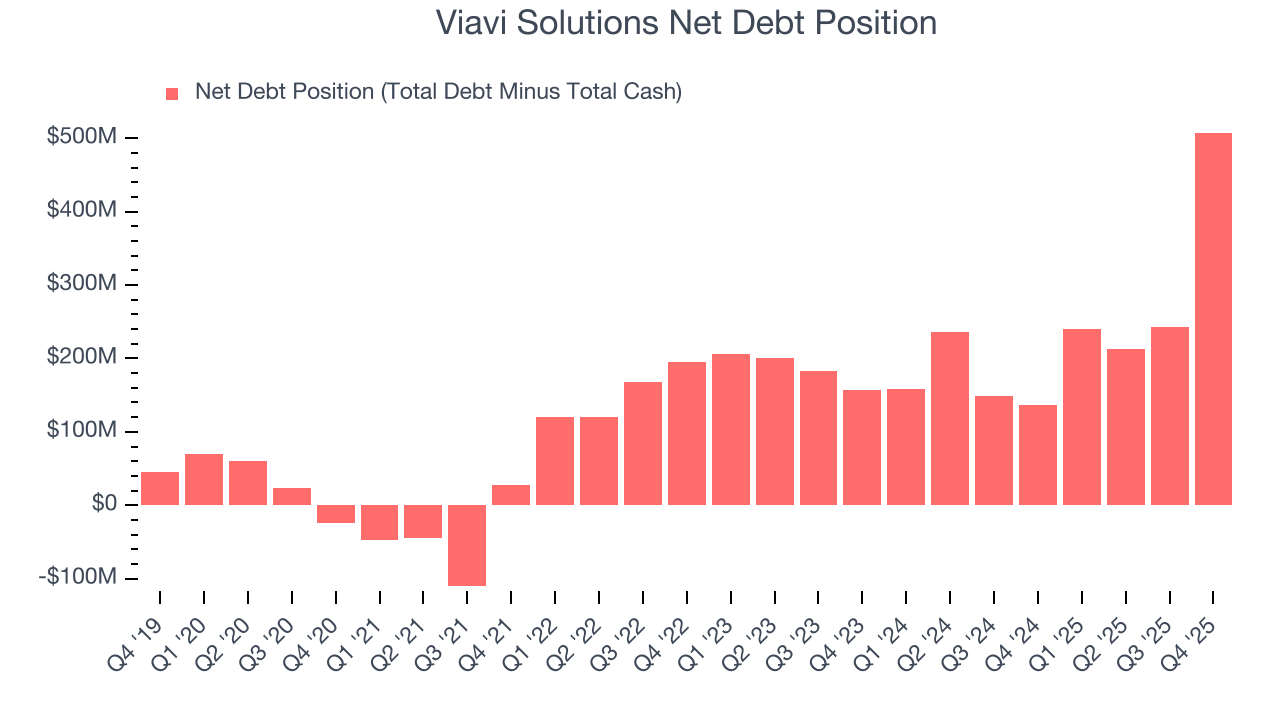

Viavi Solutions reported $767.4 million of cash and $1.28 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $196.7 million of EBITDA over the last 12 months, we view Viavi Solutions’s 2.6× net-debt-to-EBITDA ratio as safe. We also see its $38.1 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Viavi Solutions’s Q4 Results

We were impressed by Viavi Solutions’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also glad its revenue guidance for next quarter trumped Wall Street’s estimates. On the other hand, its EBITDA missed. Overall, this print had some key positives. The stock traded up 2.7% to $21.61 immediately following the results.

13. Is Now The Time To Buy Viavi Solutions?

Updated: February 17, 2026 at 12:06 AM EST

When considering an investment in Viavi Solutions, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Viavi Solutions’s business quality ultimately falls short of our standards. First off, its revenue growth was weak over the last five years. While its admirable gross margins indicate the mission-critical nature of its offerings, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its declining EPS over the last five years makes it a less attractive asset to the public markets.

Viavi Solutions’s P/E ratio based on the next 12 months is 27.5x. Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $26.07 on the company (compared to the current share price of $26.33).