Vicor (VICR)

Vicor is interesting. It generates heaps of profits that are consistently reinvested, creating a virtuous cycle of returns.― StockStory Analyst Team

1. News

2. Summary

Why Vicor Is Interesting

Founded by a researcher at the Massachusetts Institute of Technology, Vicor (NASDAQ:VICR) provides electrical power conversion and delivery products for a range of industries.

- Performance over the past five years shows its incremental sales were extremely profitable, as its annual earnings per share growth of 45.5% outpaced its revenue gains

- Demand for the next 12 months is expected to accelerate above its two-year trend as Wall Street forecasts robust revenue growth of 21%

- A drawback is its sales pipeline suggests its future revenue growth may not meet our standards as its average backlog growth of 5.4% for the past two years was weak

Vicor shows some signs of a high-quality business. The stock is up 63.9% since the start of the year.

Why Should You Watch Vicor

High Quality

Investable

Underperform

Why Should You Watch Vicor

At $191.50 per share, Vicor trades at 66.3x forward P/E. The market has high expectations, which are reflected in the premium multiple. This can result in short-term volatility if anything (e.g. a quarterly earnings miss) remotely dampens those hopes.

Vicor can improve its fundamentals over time by putting up good numbers quarter after quarter, year after year. Once that happens, we’ll be happy to recommend the stock.

3. Vicor (VICR) Research Report: Q4 CY2025 Update

Power conversion and control solutions provider Vicor Corporation (NASDAQ:VICR) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 11.5% year on year to $107.3 million. Its GAAP profit of $1.01 per share was significantly above analysts’ consensus estimates.

Vicor (VICR) Q4 CY2025 Highlights:

- Revenue: $107.3 million vs analyst estimates of $107.8 million (11.5% year-on-year growth, in line)

- EPS (GAAP): $1.01 vs analyst estimates of $0.37 (significant beat)

- Operating Margin: 14.6%, up from 10% in the same quarter last year

- Backlog: $176.9 million at quarter end, up 13.8% year on year

- Market Capitalization: $6.95 billion

Company Overview

Founded by a researcher at the Massachusetts Institute of Technology, Vicor (NASDAQ:VICR) provides electrical power conversion and delivery products for a range of industries.

The company specializes in power solutions for demanding applications across various industries. Vicor's product portfolio includes both advanced and traditional "brick" products. The company categorizes its offerings into two main product lines: Advanced Products and Brick Products.

Advanced Products represent Vicor's more creative solutions, often used to implement its proprietary Factorized Power Architecture (FPA). These products are particularly well-suited for high-performance computing applications, including artificial intelligence and data centers. Brick Products, on the other hand, consist of more traditional integrated power converters used in conventional power systems architectures across a variety of industries.

The company has been experiencing a shift towards a higher percentage of revenue from Advanced Products. Vicor sells its products through multiple channels, including a direct sales force, independent authorized distributors, and authorized stocking distributors worldwide. The company also generates some revenue from licensing its intellectual property, although this has historically represented a small portion of overall revenue.

The company operates a primary manufacturing facility in Andover, Massachusetts, where it produces both Brick Products and Advanced Products. Vicor has also invested in advanced manufacturing processes, including electroplating techniques for its SM-ChiP modules.

4. Electronic Components

Like many equipment and component manufacturers, electronic components companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include data centers and telecommunications, which can benefit companies whose optical and transceiver offerings fit those markets. But like the broader industrials sector, these companies are also at the whim of economic cycles. Consumer spending, for example, can greatly impact these companies’ volumes.

Competitors of Vicor include Texas Instruments (NASDAQ:TXN), Analog Devices (NASDAQ:ADI), and Infineon Technologies (ETR:IFX).

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Vicor’s 8.8% annualized revenue growth over the last five years was decent. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Vicor’s recent performance shows its demand has slowed as its annualized revenue growth of 5.7% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

We can better understand the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Vicor’s backlog reached $176.9 million in the latest quarter and averaged 5.4% year-on-year growth over the last two years. Because this number is in line with its revenue growth, we can see the company effectively balanced its new order intake and fulfillment processes.

This quarter, Vicor’s year-on-year revenue growth was 11.5%, and its $107.3 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.6% over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and implies its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

6. Gross Margin & Pricing Power

For industrials businesses, cost of sales is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics in the short term and a company’s purchasing power and scale over the long term.

Vicor has best-in-class unit economics for an industrials company, enabling it to invest in areas such as research and development. Its margin also signals it sells differentiated products, not commodities. As you can see below, it averaged an elite 51% gross margin over the last five years. That means Vicor only paid its suppliers $49.01 for every $100 in revenue.

This quarter, Vicor’s gross profit margin was 55.4% , marking a 3 percentage point increase from 52.4% in the same quarter last year. Vicor’s full-year margin has also been trending up over the past 12 months, increasing by 6.1 percentage points. If this move continues, it could suggest a less competitive environment where the company has better pricing power and leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Vicor has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 12.5%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Vicor’s operating margin rose by 4 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, Vicor generated an operating margin profit margin of 14.6%, up 4.6 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

8. Earnings Per Share

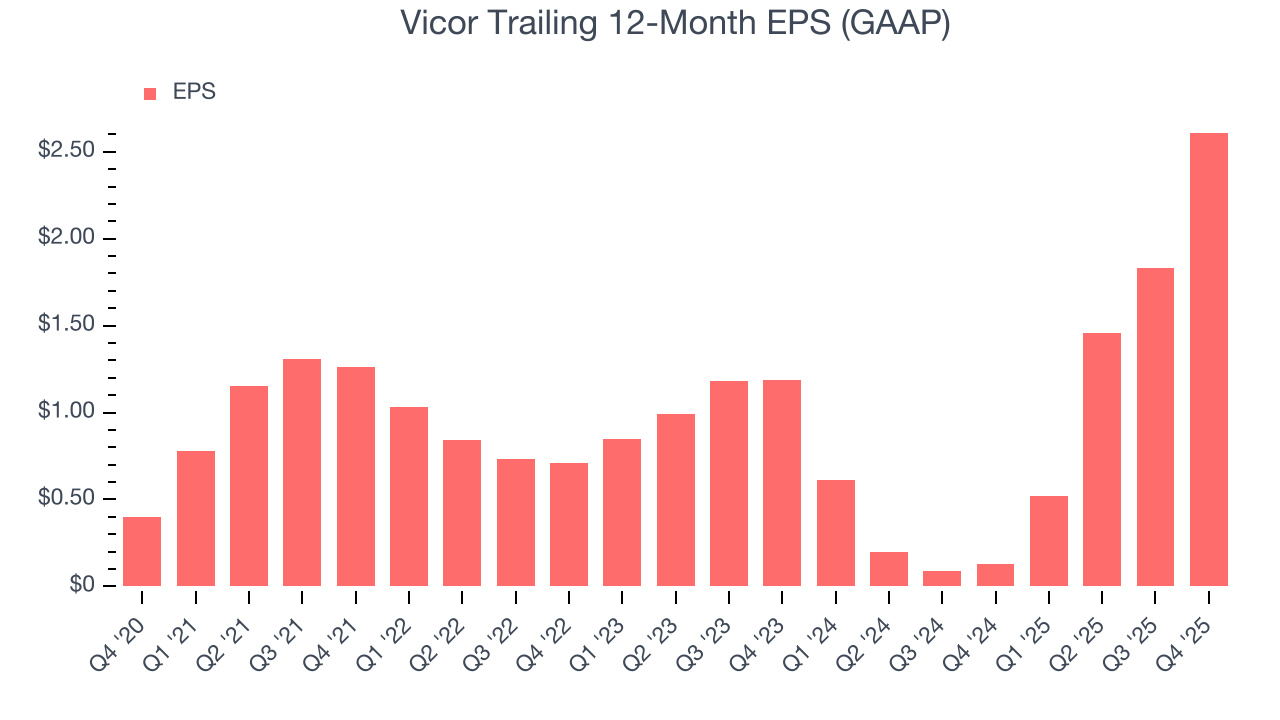

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Vicor’s EPS grew at an astounding 45.5% compounded annual growth rate over the last five years, higher than its 8.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Vicor’s earnings to better understand the drivers of its performance. As we mentioned earlier, Vicor’s operating margin expanded by 4 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Vicor, its two-year annual EPS growth of 48.1% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, Vicor reported EPS of $1.01, up from $0.23 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Vicor’s full-year EPS of $2.61 to shrink by 33%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Vicor has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 7.7% over the last five years, slightly better than the broader industrials sector.

Taking a step back, we can see that Vicor’s margin expanded by 28.1 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Vicor’s five-year average ROIC was 20.5%, placing it among the best industrials companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Uneventfully, Vicor’s ROIC has stayed the same over the last few years. Rising returns would be ideal, but this is still a noteworthy feat since they're already high.

11. Key Takeaways from Vicor’s Q4 Results

It was good to see Vicor beat analysts’ EPS expectations this quarter. On the other hand, its revenue was in line. Overall, we think this was a solid quarter with some key areas of upside. The market seemed to be hoping for more, and the stock traded down 4.7% to $145.84 immediately following the results.

12. Is Now The Time To Buy Vicor?

Updated: February 24, 2026 at 10:37 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Vicor.

For starters, its revenue growth was good over the last five years and is expected to accelerate over the next 12 months. And while its projected EPS for the next year is lacking, its admirable gross margins indicate the mission-critical nature of its offerings. On top of that, Vicor’s rising cash profitability gives it more optionality.

Vicor’s P/E ratio based on the next 12 months is 66.3x. At this valuation, there’s a lot of good news priced in. Vicor is a good one to add to your watchlist - there are companies featuring superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $196.25 on the company (compared to the current share price of $191.50).