Wix (WIX)

We’re cautious of Wix. Its weak revenue growth and gross margin show it not only lacks demand but also decent unit economics.― StockStory Analyst Team

1. News

2. Summary

Why Wix Is Not Exciting

Powering over 263 million registered users worldwide with its AI-driven tools, Wix (NASDAQ:WIX) provides a cloud-based platform that helps individuals and businesses create and manage professional websites without requiring coding skills.

- Operating margin improvement of 1.9 percentage points over the last year demonstrates its ability to scale efficiently

- Steep infrastructure costs and weaker unit economics for a software company are reflected in its low gross margin of 68.5%

- A consolation is that its impressive free cash flow profitability enables the company to fund new investments or reward investors with share buybacks/dividends

Wix falls short of our quality standards. Our attention is focused on better businesses.

Why There Are Better Opportunities Than Wix

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Wix

At $70.79 per share, Wix trades at 1.8x forward price-to-sales. This sure is a cheap multiple, but you get what you pay for.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Wix (WIX) Research Report: Q3 CY2025 Update

Website building platform Wix (NASDAQ:WIX) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 13.6% year on year to $505.2 million. The company expects next quarter’s revenue to be around $526 million, close to analysts’ estimates. Its non-GAAP profit of $1.68 per share was 12.6% above analysts’ consensus estimates.

Wix (WIX) Q3 CY2025 Highlights:

- Revenue: $505.2 million vs analyst estimates of $502.3 million (13.6% year-on-year growth, 0.6% beat)

- Adjusted EPS: $1.68 vs analyst estimates of $1.49 (12.6% beat)

- Adjusted Operating Income: $89.93 million vs analyst estimates of $95.97 million (17.8% margin, 6.3% miss)

- Revenue Guidance for Q4 CY2025 is $526 million at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: -1.5%, down from 5.8% in the same quarter last year

- Free Cash Flow Margin: 25.2%, down from 30.1% in the previous quarter

- Market Capitalization: $7.07 billion

Company Overview

Powering over 263 million registered users worldwide with its AI-driven tools, Wix (NASDAQ:WIX) provides a cloud-based platform that helps individuals and businesses create and manage professional websites without requiring coding skills.

The Wix platform offers two main website creation products: Wix Editor for users with basic to average technical skills, and Wix Studio for professionals and agencies. Both leverage an extensive suite of AI-powered tools, including an AI Website Builder that generates complete websites through conversational prompts, AI text and image generators, and specialized design assistants.

Beyond website creation, Wix provides comprehensive business solutions tailored to specific industries. These include Wix Stores for e-commerce, Wix Bookings for appointment scheduling, Wix Restaurants for food establishments, and specialized applications for events, fitness, hotels, and creative professionals. The company also offers Velo by Wix, a development environment that enables users to extend website functionality without extensive coding knowledge.

Wix operates on a freemium business model. Its free tier provides access to website creation tools with Wix branding and domain restrictions, while premium subscriptions remove these limitations and unlock additional features. Revenue also comes from complementary services such as Payments by Wix (payment processing), domain registration, email marketing, and business app solutions.

The company's cloud infrastructure handles hosting, security, and scalability concerns, allowing users to focus on content and design rather than technical maintenance. This approach has made Wix particularly popular among small businesses, freelancers, and organizations seeking a professional online presence without significant technical investment or ongoing development costs.

4. E-commerce Software

While e-commerce has been around for over two decades and enjoyed meaningful growth, its overall penetration of retail still remains low. Only around $1 in every $5 spent on retail purchases comes from digital orders, leaving over 80% of the retail market still ripe for online disruption. It is these large swathes of the retail where e-commerce has not yet taken hold that drives the demand for various e-commerce software solutions.

Wix competes with other website building platforms like Squarespace (NYSE:SQSP), Shopify (NYSE:SHOP) for e-commerce, WordPress.com by Automattic (private), GoDaddy (NYSE:GDDY), and Webflow (private).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Wix grew its sales at a 16.2% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the software sector, which enjoys a number of secular tailwinds.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Wix’s recent performance shows its demand has slowed as its annualized revenue growth of 12.9% over the last two years was below its five-year trend.

This quarter, Wix reported year-on-year revenue growth of 13.6%, and its $505.2 million of revenue exceeded Wall Street’s estimates by 0.6%. Company management is currently guiding for a 14.2% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 13.9% over the next 12 months, similar to its two-year rate. This projection is underwhelming and implies its newer products and services will not accelerate its top-line performance yet.

6. Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Wix’s billings came in at $514.5 million in Q3, and over the last four quarters, its growth slightly lagged the sector as it averaged 13.7% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in acquiring/retaining customers.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Wix is quite efficient at acquiring new customers, and its CAC payback period checked in at 32.1 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

8. Gross Margin & Pricing Power

For software companies like Wix, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Wix’s gross margin is worse than the software industry average, giving it less room than its competitors to hire new talent that can expand its products and services. As you can see below, it averaged a 68.5% gross margin over the last year. Said differently, Wix had to pay a chunky $31.54 to its service providers for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Wix has seen gross margins improve by 2.5 percentage points over the last 2 year, which is very good in the software space.

This quarter, Wix’s gross profit margin was 68.3%, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

9. Operating Margin

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

Wix has managed its cost base well over the last year. It demonstrated solid profitability for a software business, producing an average operating margin of 5.7%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Wix’s operating margin rose by 1.9 percentage points over the last two years, as its sales growth gave it operating leverage.

This quarter, Wix generated an operating margin profit margin of negative 1.5%, down 7.3 percentage points year on year. Since Wix’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

10. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Wix has shown robust cash profitability, driven by its cost-effective customer acquisition strategy that enables it to invest in new products and services rather than sales and marketing. The company’s free cash flow margin averaged 28.5% over the last year, quite impressive for a software business.

Wix’s free cash flow clocked in at $127.3 million in Q3, equivalent to a 25.2% margin. The company’s cash profitability regressed as it was 3.5 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts’ consensus estimates show they’re expecting Wix’s free cash flow margin of 28.5% for the last 12 months to remain the same.

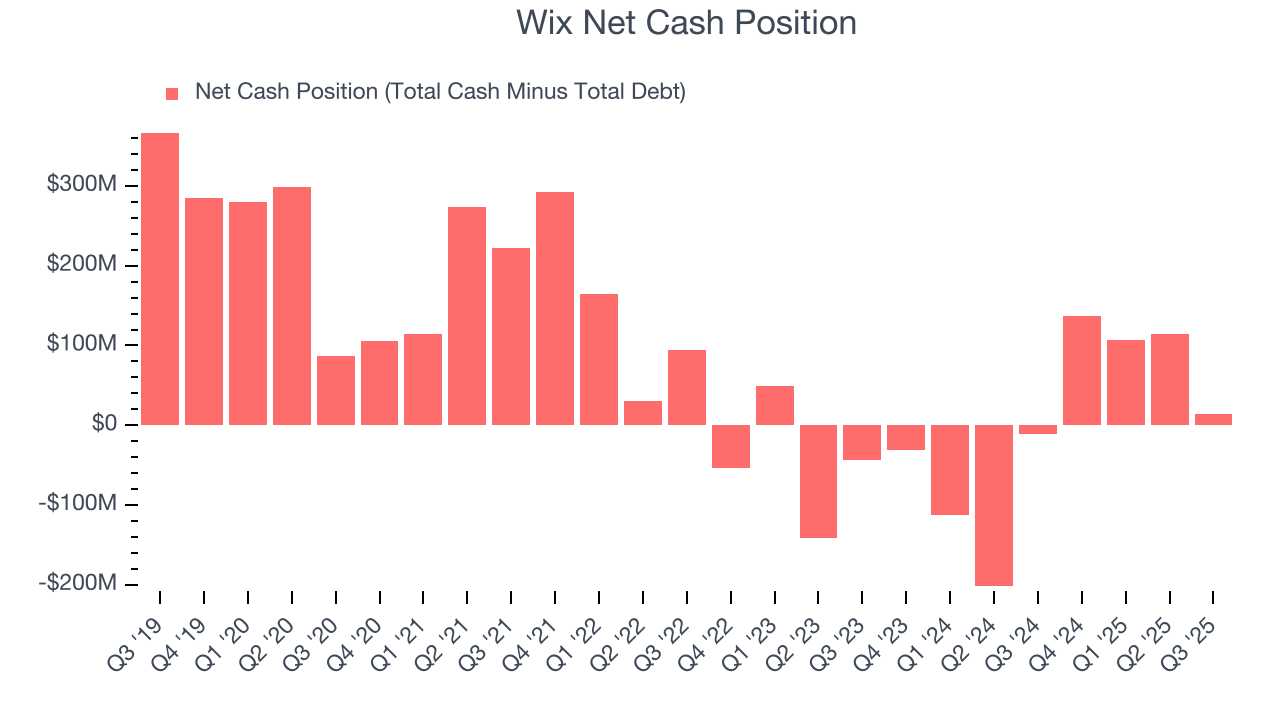

11. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

Wix is a profitable, well-capitalized company with $1.58 billion of cash and $1.57 billion of debt on its balance sheet. This $13.63 million net cash position gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Wix’s Q3 Results

Revenue beat slightly but operating income missed. Revenue guidance for next quarter was just in line. Zooming out, we think this was a mixed quarter. Investors were likely hoping for more, and shares traded down 5.6% to $119.75 immediately after reporting.

13. Is Now The Time To Buy Wix?

Updated: March 1, 2026 at 9:20 PM EST

Are you wondering whether to buy Wix or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Wix isn’t a terrible business, but it isn’t one of our picks. First off, its revenue growth was a little slower over the last five years, and analysts expect its demand to deteriorate over the next 12 months. While its bountiful generation of free cash flow empowers it to invest in growth initiatives, the downside is its expanding operating margin shows it’s becoming more efficient at building and selling its software. On top of that, its gross margin is below our standards.

Wix’s price-to-sales ratio based on the next 12 months is 1.8x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $154.70 on the company (compared to the current share price of $70.79).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.