Zebra (ZBRA)

We’re skeptical of Zebra. Its weak sales growth and declining returns on capital show its demand and profits are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think Zebra Will Underperform

Taking its name from the black and white stripes of barcodes, Zebra Technologies (NASDAQ:ZBRA) provides barcode scanners, mobile computers, RFID systems, and other data capture technologies that help businesses track assets and optimize operations.

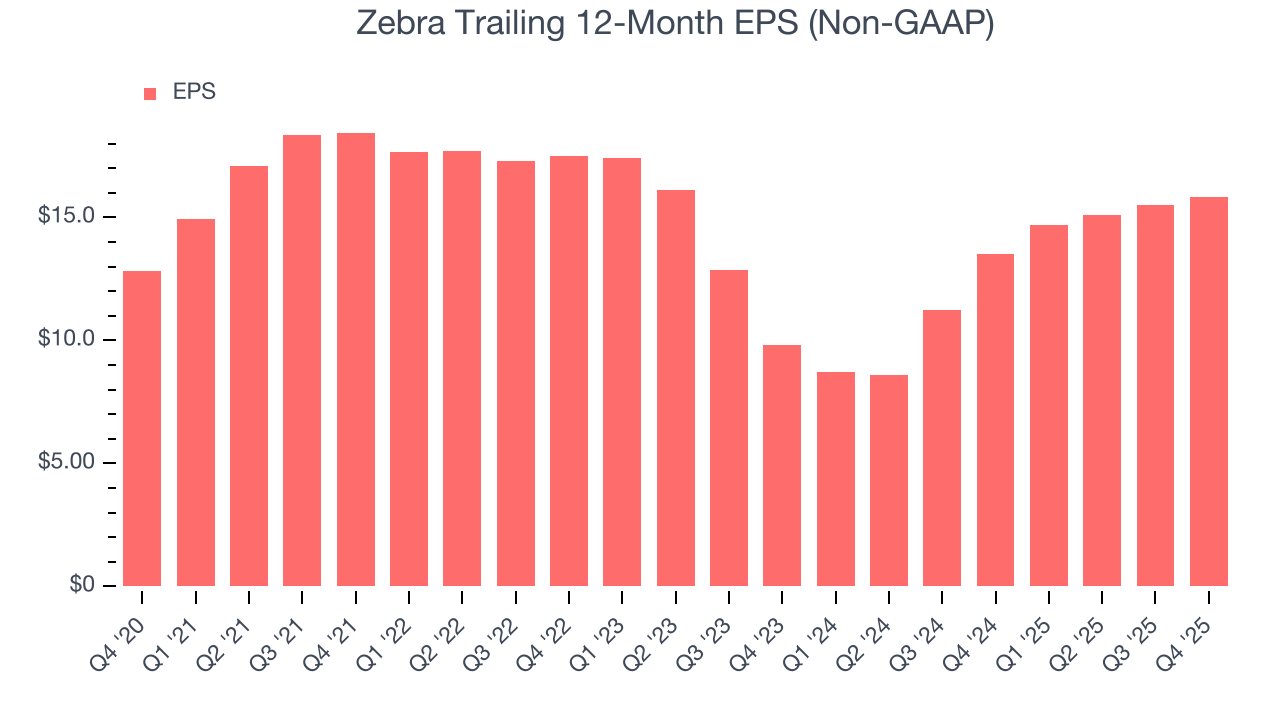

- Earnings growth over the last five years fell short of the peer group average as its EPS only increased by 5.4% annually

- Muted 3.9% annual revenue growth over the last five years shows its demand lagged behind its business services peers

- A silver lining is that its disciplined cost controls and effective management have materialized in a strong adjusted operating margin

Zebra doesn’t pass our quality test. We see more attractive opportunities in the market.

Why There Are Better Opportunities Than Zebra

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Zebra

Zebra’s stock price of $251.82 implies a valuation ratio of 15x forward P/E. Zebra’s valuation may seem like a bargain, especially when stacked up against other business services companies. We remind you that you often get what you pay for, though.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Zebra (ZBRA) Research Report: Q4 CY2025 Update

Enterprise data capture company Zebra Technologies (NASDAQ:ZBRA) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 10.6% year on year to $1.48 billion. On top of that, next quarter’s revenue guidance ($1.48 billion at the midpoint) was surprisingly good and 3.2% above what analysts were expecting. Its non-GAAP profit of $4.33 per share was in line with analysts’ consensus estimates.

Zebra (ZBRA) Q4 CY2025 Highlights:

- Revenue: $1.48 billion vs analyst estimates of $1.46 billion (10.6% year-on-year growth, 1.2% beat)

- Adjusted EPS: $4.33 vs analyst estimates of $4.33 (in line)

- Adjusted EBITDA: $326 million vs analyst estimates of $322.6 million (22.1% margin, 1.1% beat)

- Revenue Guidance for Q1 CY2026 is $1.48 billion at the midpoint, above analyst estimates of $1.43 billion

- Adjusted EPS guidance for the upcoming financial year 2026 is $18 at the midpoint, beating analyst estimates by 2.1%

- Operating Margin: 9.4%, down from 16.9% in the same quarter last year

- Free Cash Flow Margin: 22.2%, similar to the same quarter last year

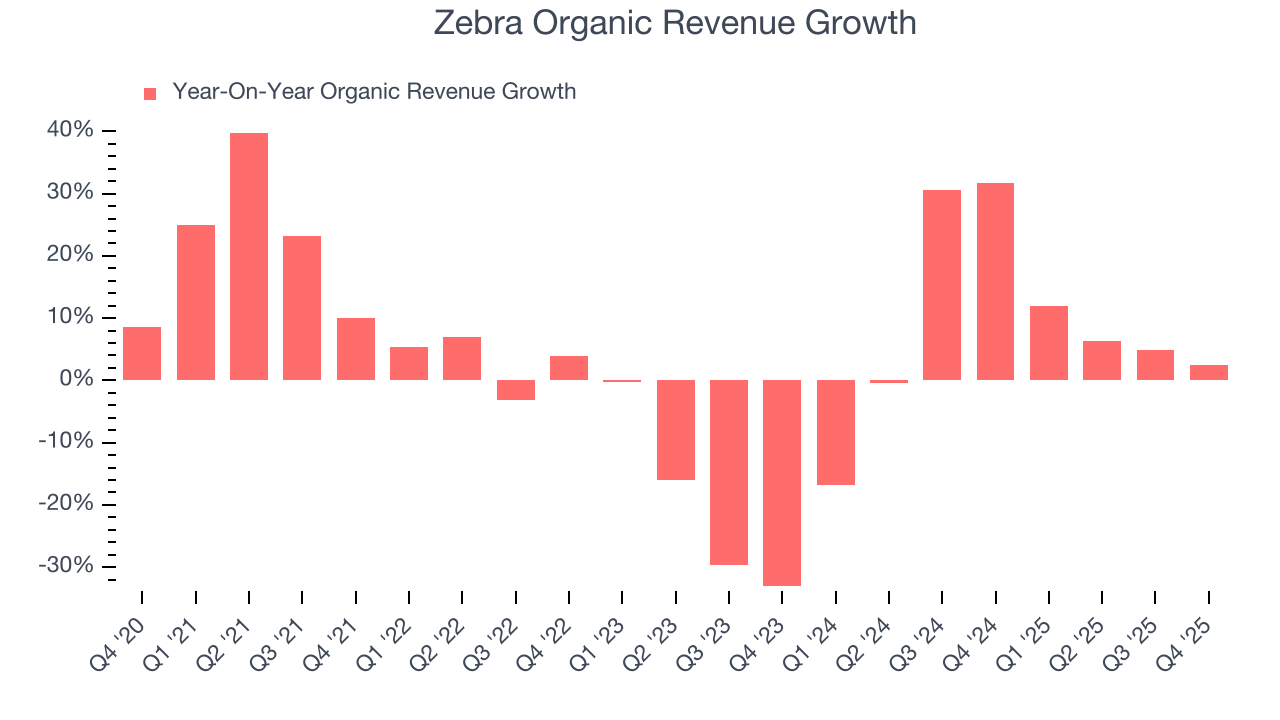

- Organic Revenue rose 2.5% year on year (beat)

- Market Capitalization: $12.79 billion

Company Overview

Taking its name from the black and white stripes of barcodes, Zebra Technologies (NASDAQ:ZBRA) provides barcode scanners, mobile computers, RFID systems, and other data capture technologies that help businesses track assets and optimize operations.

Zebra's technology serves as the backbone of modern inventory management and logistics systems across retail, manufacturing, healthcare, and transportation industries. The company's hardware portfolio includes rugged mobile computers that withstand harsh environments, barcode printers that produce labels and identification cards, RFID readers that can track hundreds of items simultaneously without line-of-sight, and machine vision systems that automate quality inspection.

For example, when a retail associate scans inventory with a Zebra handheld device, the data flows instantly to inventory management systems, helping prevent stockouts and improving customer satisfaction. In healthcare settings, Zebra's wristband printers and mobile computers help ensure patients receive the correct medications and treatments by enabling accurate identification and data capture at the point of care.

Beyond hardware, Zebra offers software solutions that analyze operational data to optimize workflows and improve productivity. Its portfolio includes workforce management applications, task management systems, and analytics platforms that transform raw data into actionable insights. The company also provides a range of services including maintenance, technical support, and professional services to help customers implement and maintain their systems.

Zebra makes money by selling its hardware devices, software subscriptions, supplies (like labels and ribbons), and service contracts. It reaches customers primarily through a network of distributors, value-added resellers, and independent software vendors, though it also sells directly to select large customers. With operations in over 100 facilities worldwide and a partner network spanning approximately 176 countries, Zebra has established a global footprint serving enterprises of all sizes.

4. Specialized Technology

Companies in this sector, especially if they invest wisely, could see demand tailwinds as the world moves towards more IoT (Internet of Things), automation, and analytics. Enterprises across most industries will balk at taking these journeys solo and will enlist companies with expertise and scale in these areas. However, headwinds could include rising competition from larger technology firms, as digitization lowers barriers to entry in the space. Additionally, companies in the space will likely face evolving regulatory scrutiny over data privacy, particularly for surveillance and security technologies. This could make companies have to continually pivot and invest.

Zebra Technologies competes with Honeywell (NASDAQ:HON) and Datalogic in the barcode scanning and mobile computing markets, Avery Dennison (NYSE:AVY) and Sato in printing solutions, and Impinj (NASDAQ:PI) in RFID technology. In the machine vision space, it faces competition from Cognex (NASDAQ:CGNX) and Keyence.

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $5.40 billion in revenue over the past 12 months, Zebra is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because finding new avenues for growth becomes difficult when you already have a substantial market presence. For Zebra to boost its sales, it likely needs to adjust its prices, launch new offerings, or lean into foreign markets.

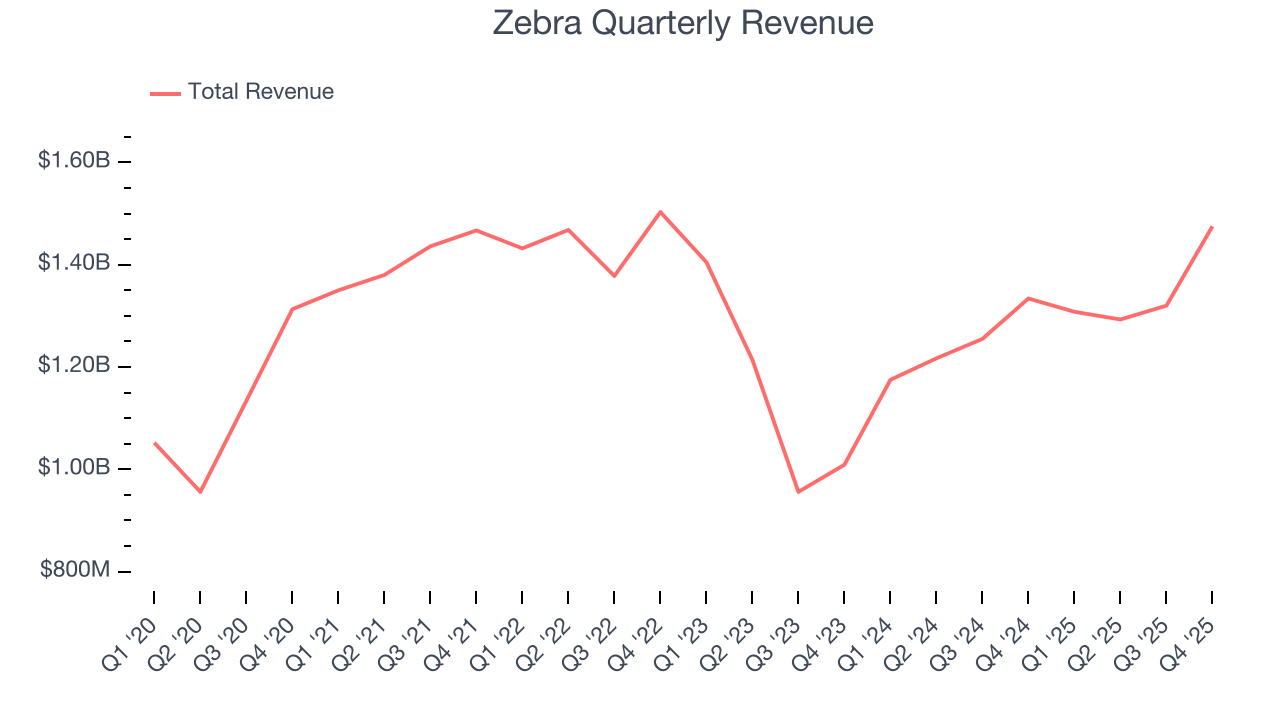

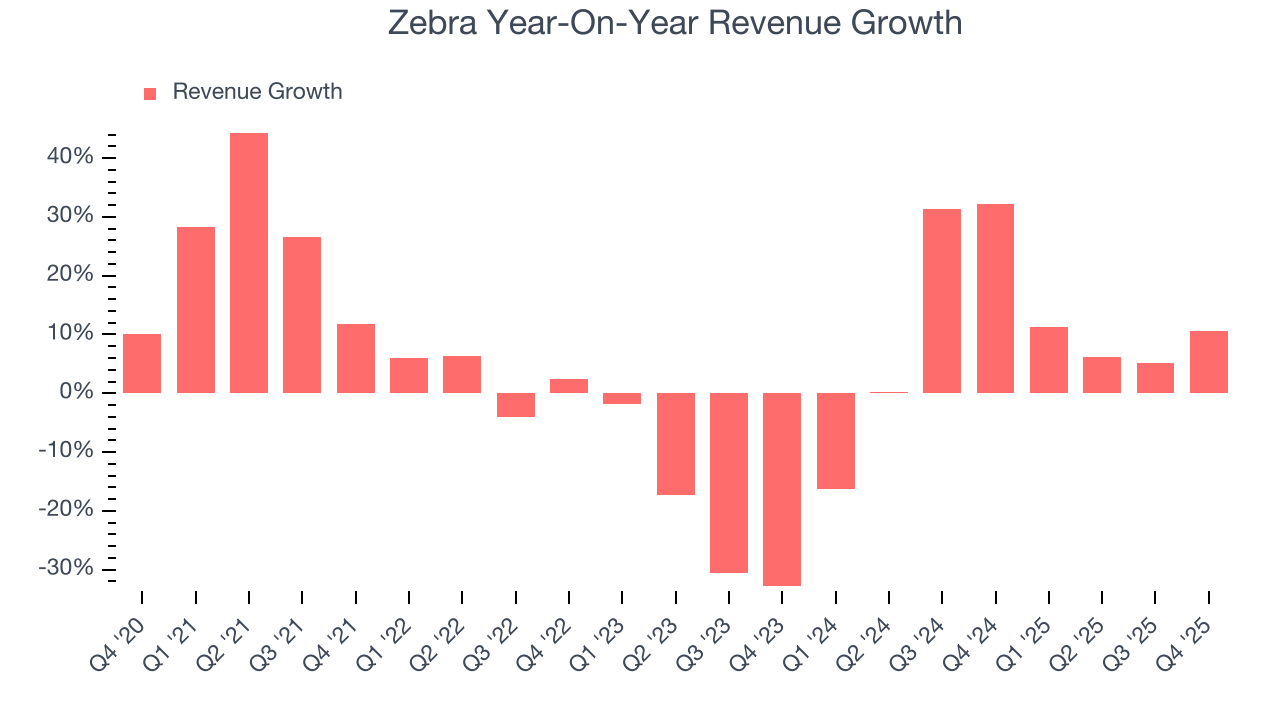

As you can see below, Zebra grew its sales at a tepid 3.9% compounded annual growth rate over the last five years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Zebra’s annualized revenue growth of 8.5% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

Zebra also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Zebra’s organic revenue averaged 8.8% year-on-year growth. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Zebra reported year-on-year revenue growth of 10.6%, and its $1.48 billion of revenue exceeded Wall Street’s estimates by 1.2%. Company management is currently guiding for a 13% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 9.4% over the next 12 months, similar to its two-year rate. This projection is admirable and implies the market sees success for its products and services.

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

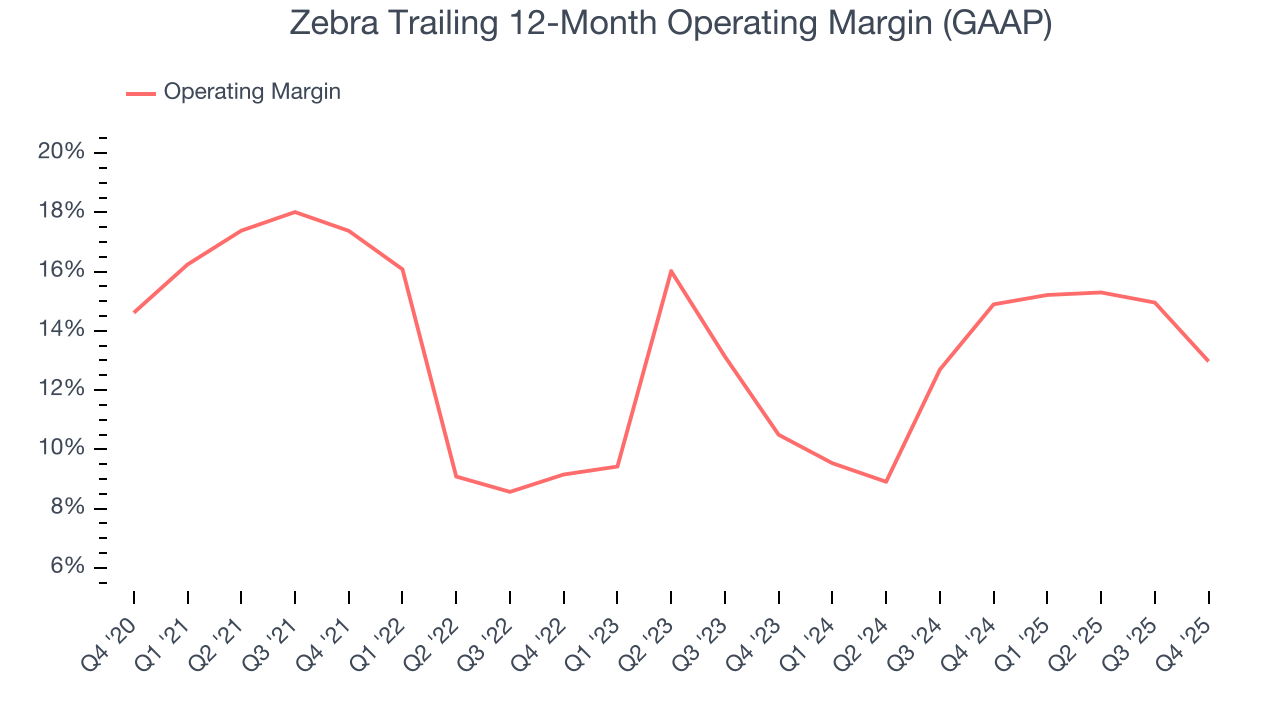

Zebra has managed its cost base well over the last five years. It demonstrated solid profitability for a business services business, producing an average operating margin of 13%.

Looking at the trend in its profitability, Zebra’s operating margin decreased by 4.4 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Zebra generated an operating margin profit margin of 9.4%, down 7.4 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Zebra’s unimpressive 4.3% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Zebra’s two-year annual EPS growth of 27.1% was fantastic and topped its 8.5% two-year revenue growth.

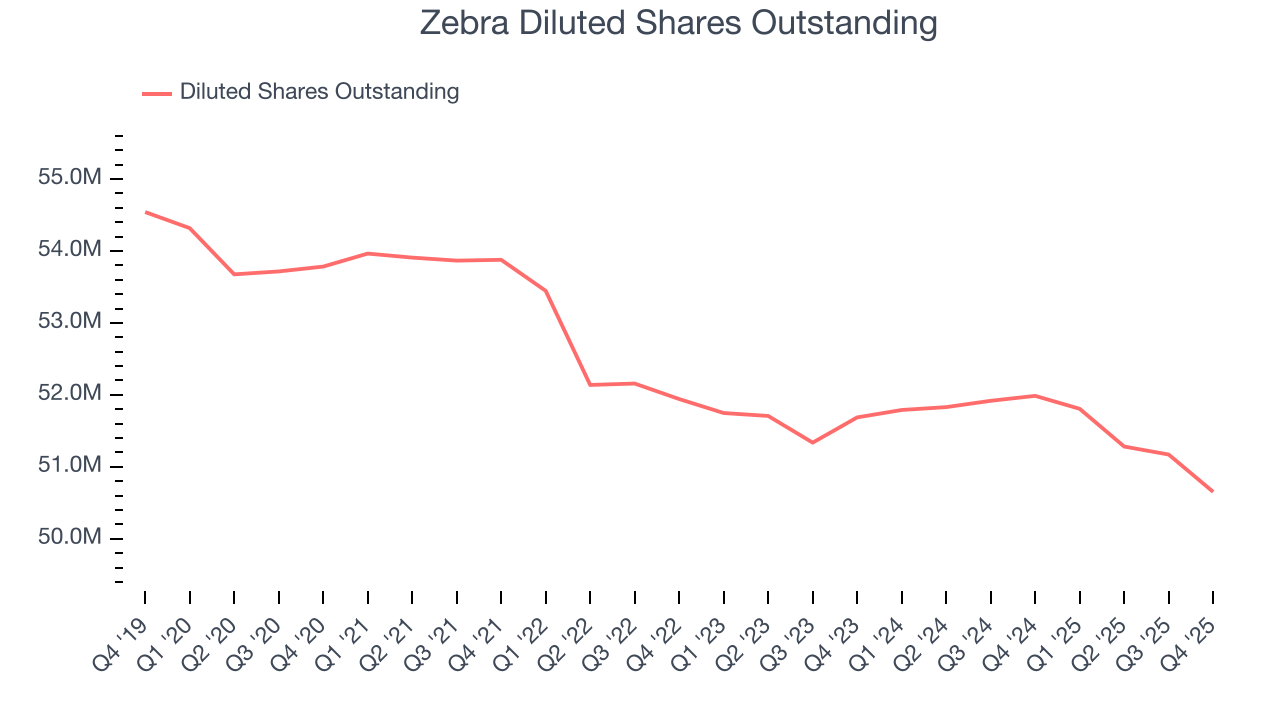

Diving into the nuances of Zebra’s earnings can give us a better understanding of its performance. While we mentioned earlier that Zebra’s operating margin declined this quarter, a two-year view shows its margin has expandedwhile its share count has shrunk 2%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q4, Zebra reported adjusted EPS of $4.33, up from $4 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Zebra’s full-year EPS of $15.84 to grow 11.2%.

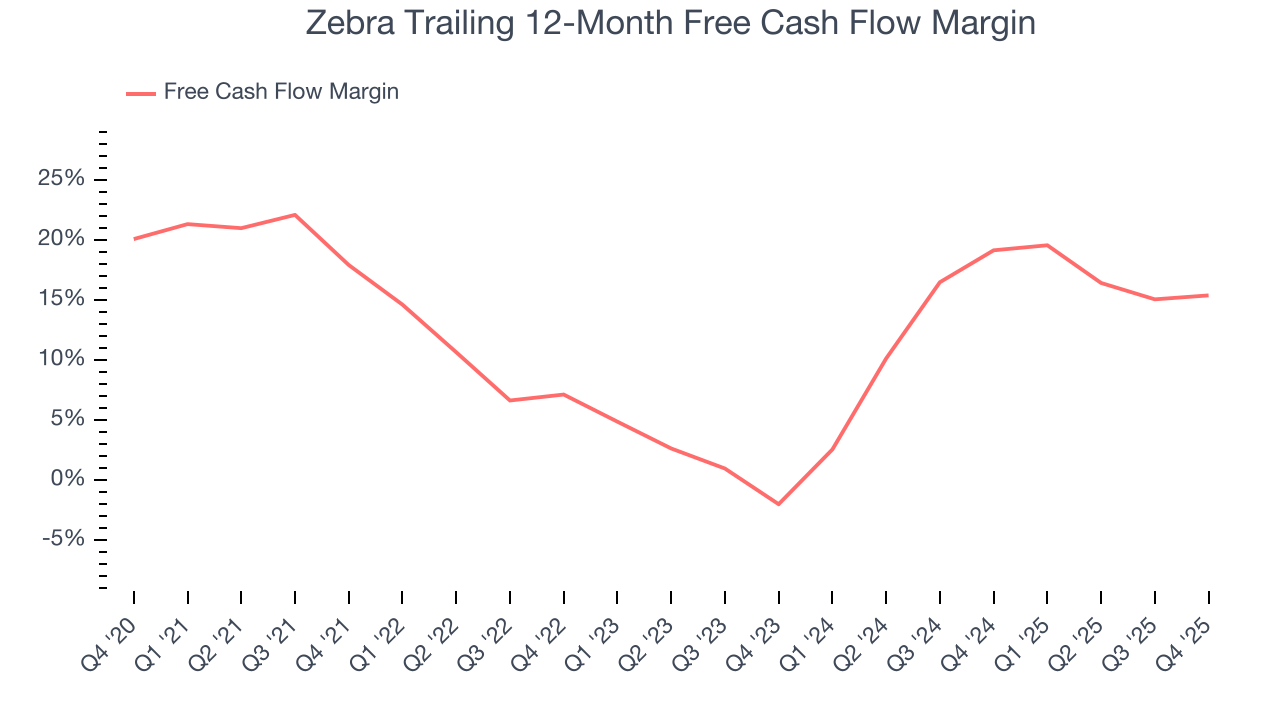

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Zebra has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 11.8% over the last five years, quite impressive for a business services business.

Taking a step back, we can see that Zebra’s margin dropped by 2.5 percentage points during that time. Continued declines could signal it is in the middle of an investment cycle.

Zebra’s free cash flow clocked in at $327 million in Q4, equivalent to a 22.2% margin. This cash profitability was in line with the comparable period last year and above its five-year average.

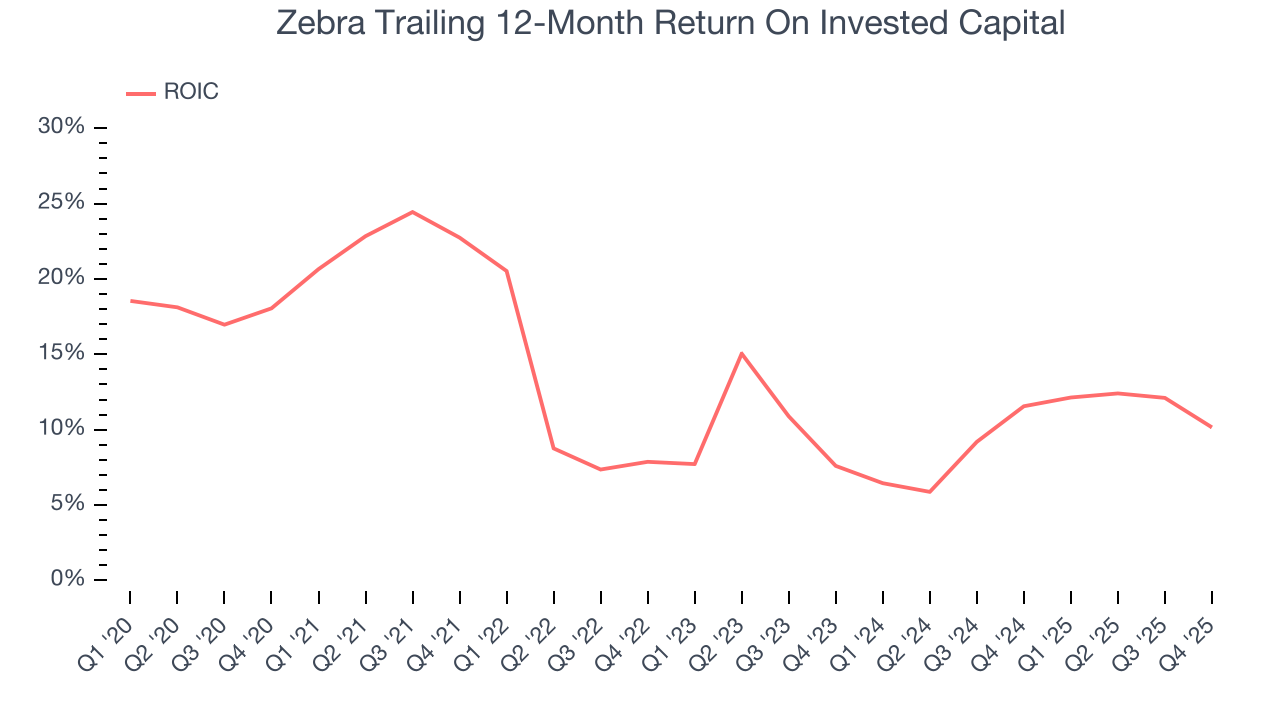

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Zebra’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 12%, slightly better than typical business services business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Zebra’s ROIC averaged 4.5 percentage point decreases each year. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

10. Balance Sheet Assessment

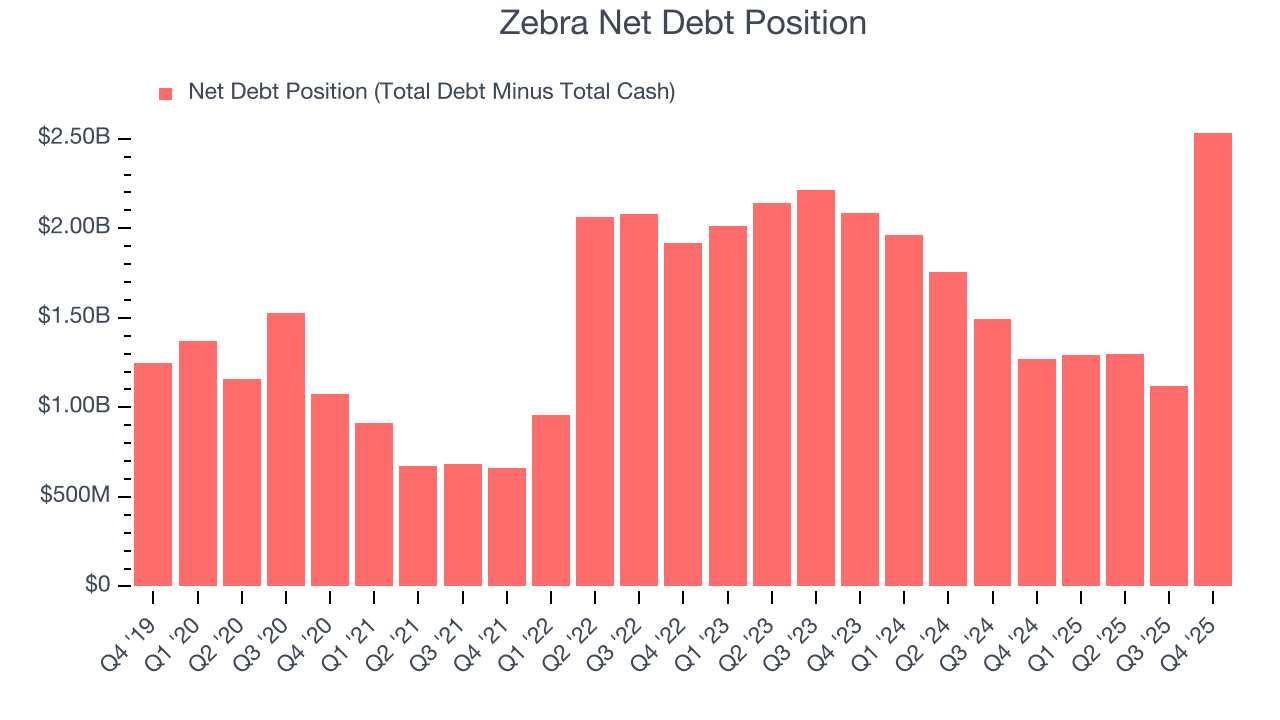

Zebra reported $125 million of cash and $2.66 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.17 billion of EBITDA over the last 12 months, we view Zebra’s 2.2× net-debt-to-EBITDA ratio as safe. We also see its $108 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Zebra’s Q4 Results

We were impressed by Zebra’s optimistic revenue guidance for next quarter, which blew past analysts’ expectations. We were also happy its organic revenue narrowly outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 4.4% to $263.52 immediately after reporting.

12. Is Now The Time To Buy Zebra?

Updated: February 12, 2026 at 6:48 AM EST

Before investing in or passing on Zebra, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Zebra isn’t a bad business, but we have other favorites. Although its revenue growth was uninspiring over the last five years, its growth over the next 12 months is expected to be higher. And while Zebra’s declining operating margin shows the business has become less efficient, its strong free cash flow generation allows it to invest in growth initiatives while maintaining an ample cushion.

Zebra’s P/E ratio based on the next 12 months is 14.3x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $338.18 on the company (compared to the current share price of $263.52).