Accel Entertainment (ACEL)

We wouldn’t buy Accel Entertainment. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Accel Entertainment Will Underperform

Established in Illinois, Accel Entertainment (NYSE:ACEL) is a provider of electronic gaming machines and interactive amusement terminals to bars and entertainment venues.

- Sales trends were unexciting over the last two years as its 6.5% annual growth was below the typical consumer discretionary company

- Poor expense management has led to an operating margin that is below the industry average

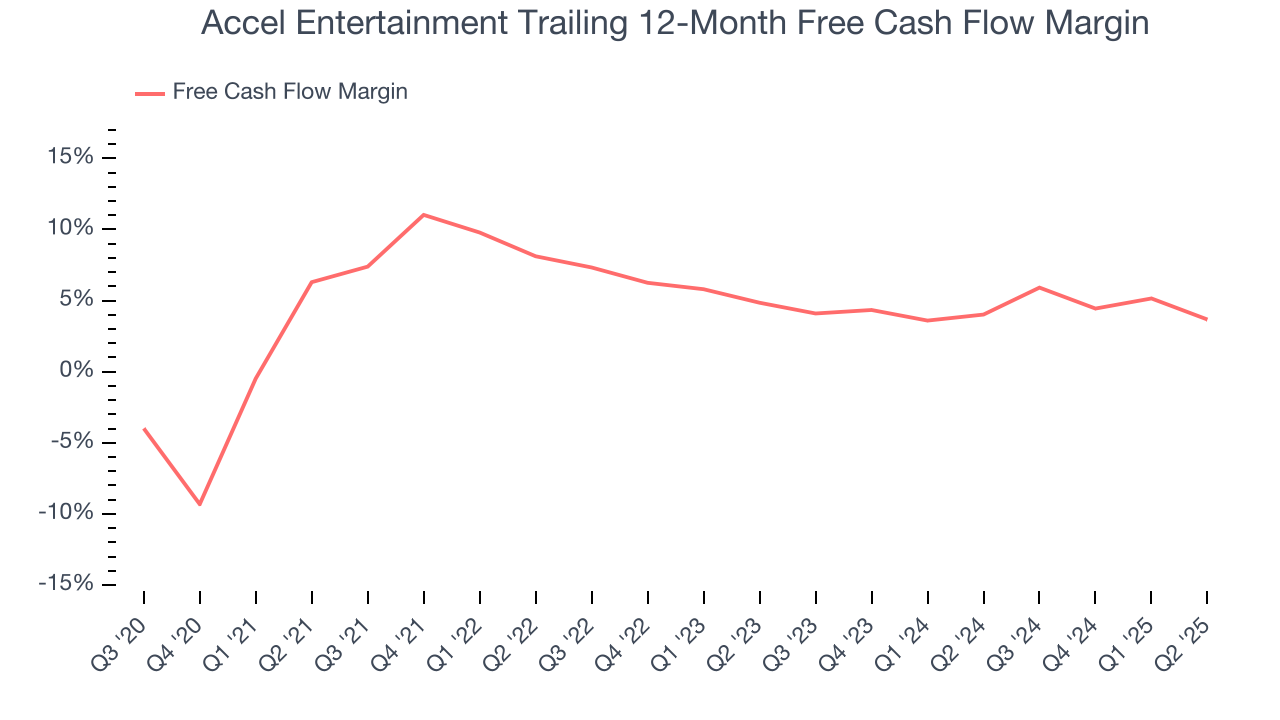

- Ability to fund investments or reward shareholders with increased buybacks or dividends is restricted by its weak free cash flow margin of 4.8% for the last two years

Accel Entertainment doesn’t meet our quality standards. We see more attractive opportunities in the market.

Why There Are Better Opportunities Than Accel Entertainment

Why There Are Better Opportunities Than Accel Entertainment

Accel Entertainment is trading at $11.29 per share, or 13.3x forward P/E. Accel Entertainment’s multiple may seem like a great deal among consumer discretionary peers, but we think there are valid reasons why it’s this cheap.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Accel Entertainment (ACEL) Research Report: Q3 CY2025 Update

Slot machine and terminal operator Accel Entertainment (NYSE:ACEL) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 9.1% year on year to $329.7 million. Its GAAP profit of $0.16 per share was 15.6% above analysts’ consensus estimates.

Accel Entertainment (ACEL) Q3 CY2025 Highlights:

- Revenue: $329.7 million vs analyst estimates of $328 million (9.1% year-on-year growth, 0.5% beat)

- EPS (GAAP): $0.16 vs analyst estimates of $0.14 (15.6% beat)

- Adjusted EBITDA: $51.17 million vs analyst estimates of $50.51 million (15.5% margin, 1.3% beat)

- Operating Margin: 7.7%, in line with the same quarter last year

- Video Gaming Terminals Sold: 27,714, up 1,985 year on year

- Market Capitalization: $842.1 million

Company Overview

Established in Illinois, Accel Entertainment (NYSE:ACEL) is a provider of electronic gaming machines and interactive amusement terminals to bars and entertainment venues.

Accel Entertainment was founded to capitalize on new legislation in Illinois that permitted video gaming terminals (VGTs) in licensed non-casino locations such as bars, restaurants, and truck stops. This strategic move allowed the company to establish a foothold in a niche market, providing gaming solutions in environments different from traditional casinos.

The company specializes in providing an array of electronic gaming machines tailored for use in various entertainment settings. By offering engaging gaming experiences, it addresses the needs of venue owners seeking to enhance their customers' entertainment options. This service diversifies the entertainment experience for patrons and provides an additional revenue stream for venue operators.

Accel Entertainment’s revenue model is built on partnerships with venue operators. The company installs gaming machines at partner locations and participates in revenue share agreements, where it gets paid depending on how much money its machines win per day. This model is mutually beneficial as operators do not have to purchase these expensive machines outright, which can cost north of $10,000.

4. Gaming Solutions

Gaming solution companies operate in a dynamic and evolving market, and the digital transformation of the gaming industry presents significant opportunities for innovation and growth, whether it be immersive slot machine terminals or mobile sports betting. However, the gaming solution industry is not without its challenges. Regulatory compliance is a crucial consideration as companies must navigate a complex and often fragmented regulatory landscape across different jurisdictions. Changes in regulations can impact product offerings, operational practices, and market access, requiring companies to maintain flexibility and adaptability in their business strategies. Additionally, the competitive nature of the industry necessitates continuous investment in research and development to stay ahead of competitors and meet evolving consumer demands.

Competitors in the video gaming terminal (VGT) market include Everi Holdings (NYSE:EVRI), PlayAGS (NYSE:AGS), and Inspired Entertainment (NASDAQ:INSE)

5. Revenue Growth

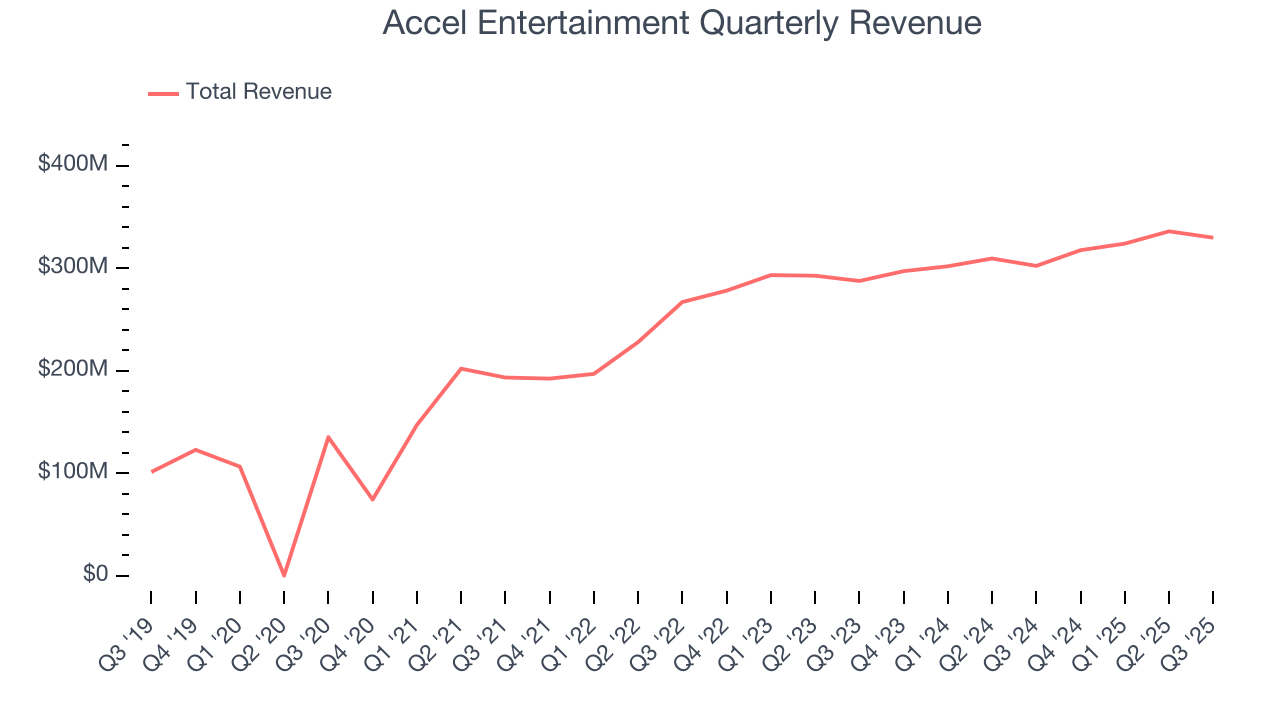

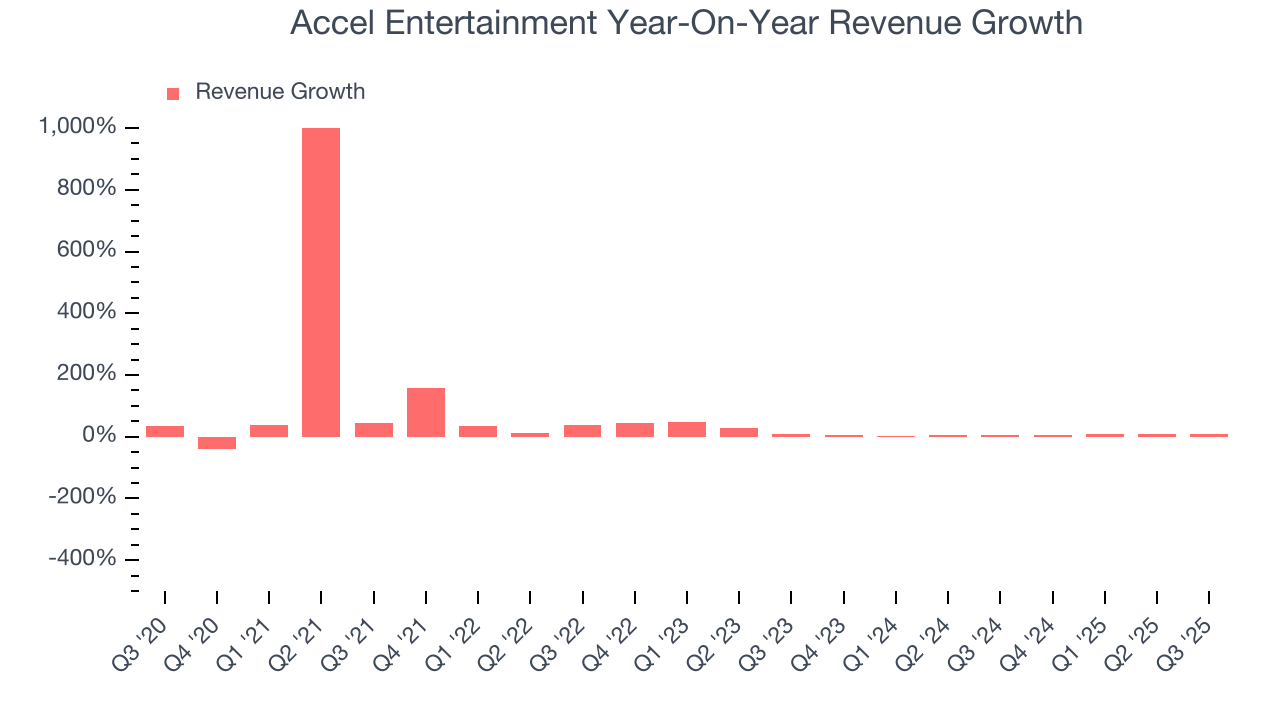

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Accel Entertainment grew its sales at an exceptional 29.1% compounded annual growth rate. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Accel Entertainment’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 6.5% over the last two years was well below its five-year trend.

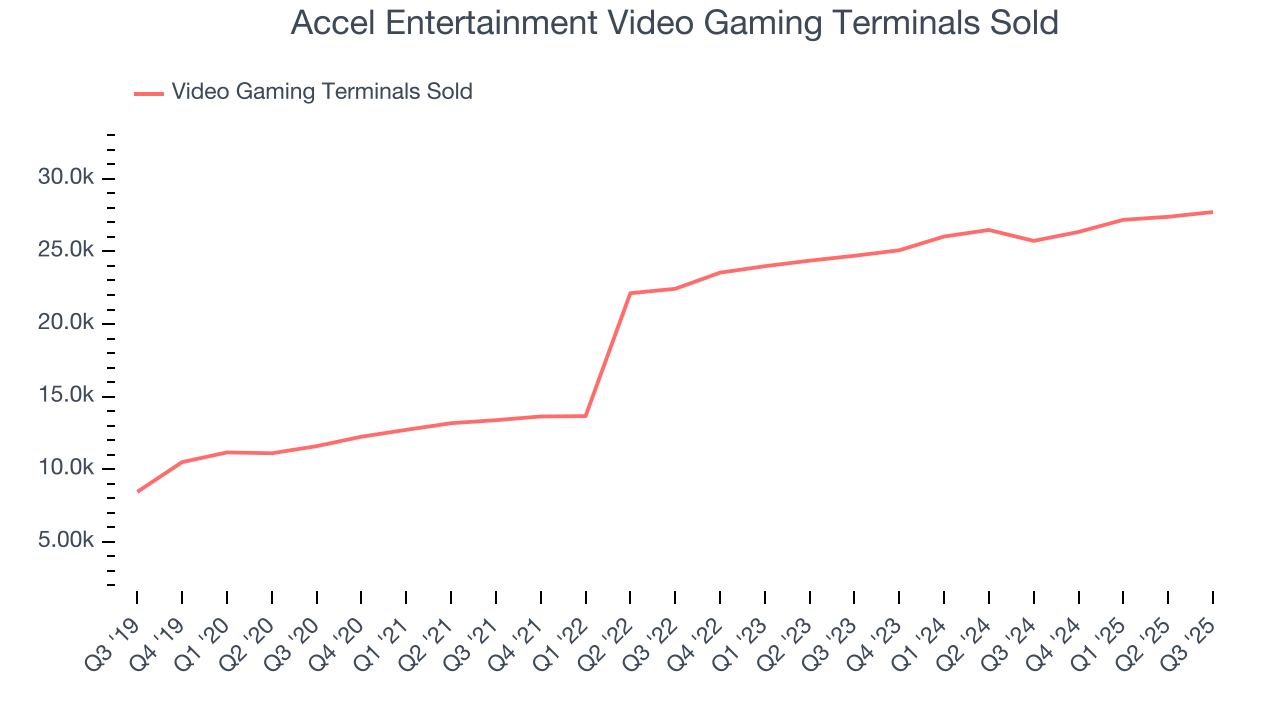

Accel Entertainment also discloses its number of video gaming terminals sold, which reached 27,714 in the latest quarter. Over the last two years, Accel Entertainment’s video gaming terminals sold averaged 6.1% year-on-year growth. Because this number aligns with its revenue growth during the same period, we can see the company’s monetization was fairly consistent.

This quarter, Accel Entertainment reported year-on-year revenue growth of 9.1%, and its $329.7 million of revenue exceeded Wall Street’s estimates by 0.5%.

Looking ahead, sell-side analysts expect revenue to grow 4.9% over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and implies its products and services will face some demand challenges.

6. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

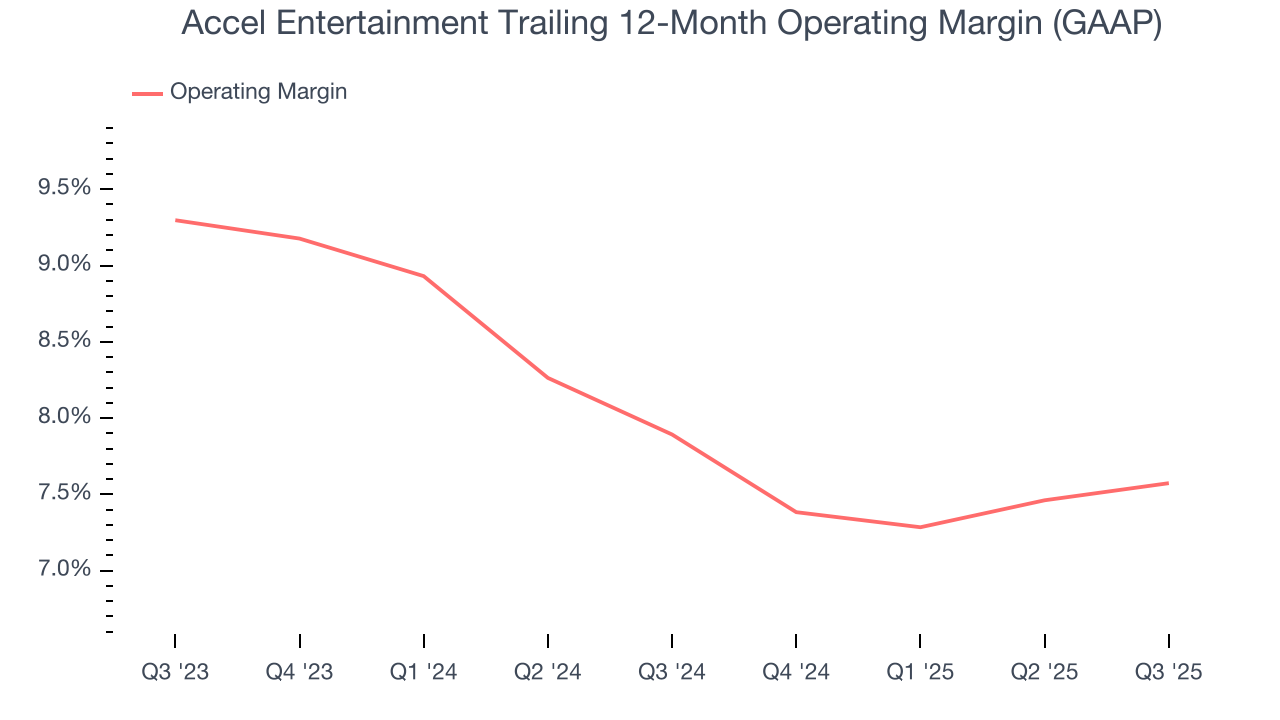

Accel Entertainment’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 7.7% over the last two years. This profitability was paltry for a consumer discretionary business and caused by its suboptimal cost structure.

This quarter, Accel Entertainment generated an operating margin profit margin of 7.7%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

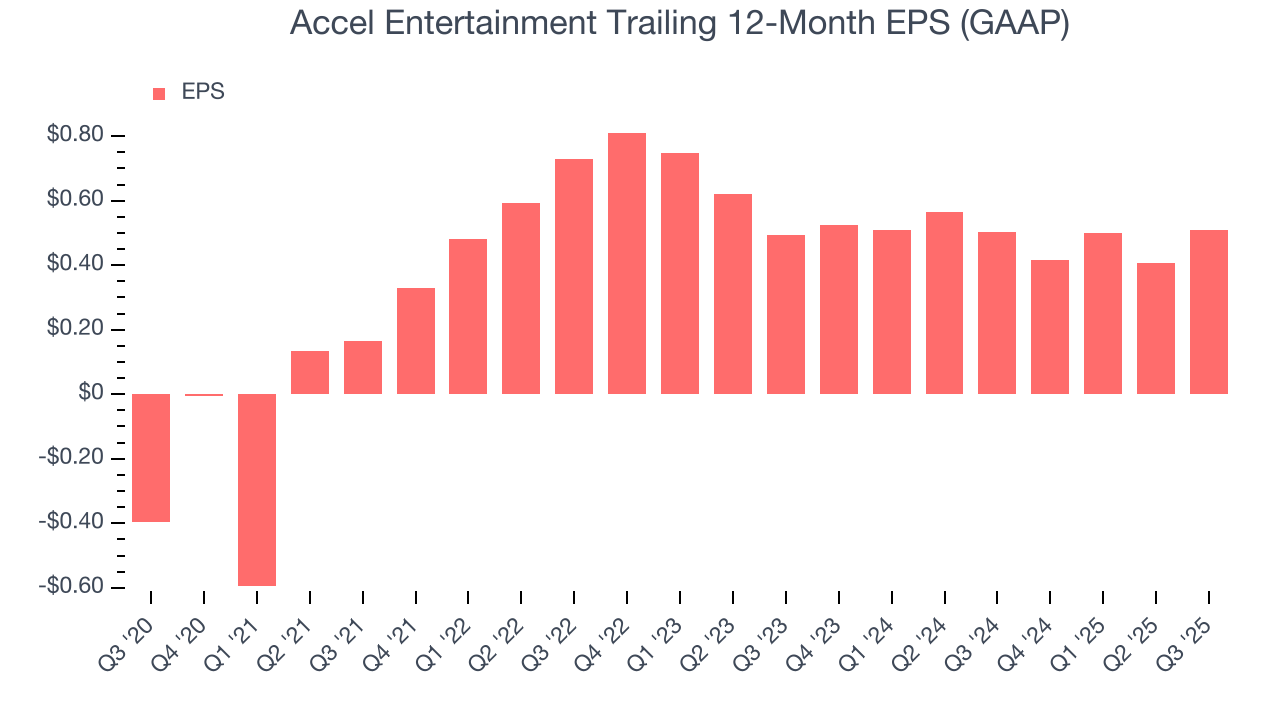

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Accel Entertainment’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q3, Accel Entertainment reported EPS of $0.16, up from $0.06 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Accel Entertainment has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.9%, lousy for a consumer discretionary business.

9. Return on Invested Capital (ROIC)

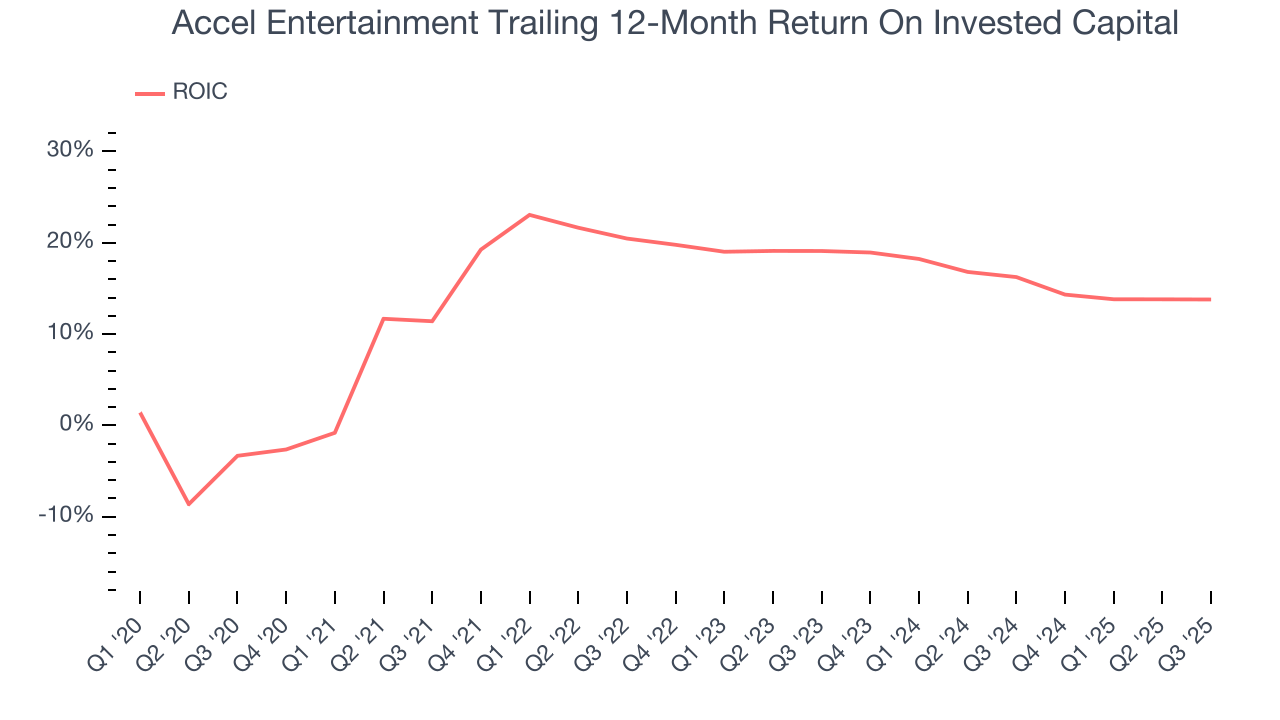

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Accel Entertainment’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 16.2%, slightly better than typical consumer discretionary business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Uneventfully, Accel Entertainment’s ROIC has stayed the same over the last few years. Given the company’s underwhelming financial performance in other areas, we’d like to see its returns improve before recommending the stock.

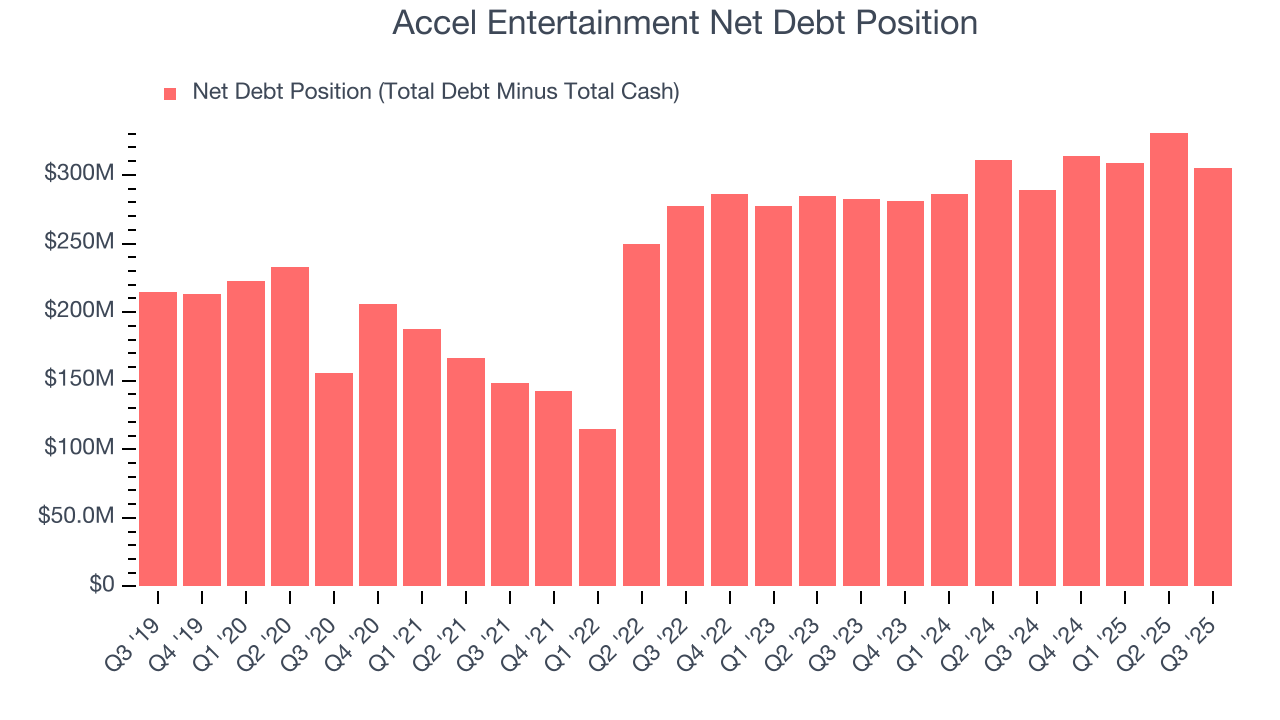

10. Balance Sheet Assessment

Accel Entertainment reported $290.2 million of cash and $595.4 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $201.2 million of EBITDA over the last 12 months, we view Accel Entertainment’s 1.5× net-debt-to-EBITDA ratio as safe. We also see its $18.58 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Accel Entertainment’s Q3 Results

It was good to see Accel Entertainment beat analysts’ EPS expectations this quarter. We were also glad its number of video gaming terminals sold outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 2.4% to $10.16 immediately following the results.

12. Is Now The Time To Buy Accel Entertainment?

Updated: January 24, 2026 at 9:50 PM EST

Before investing in or passing on Accel Entertainment, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Accel Entertainment falls short of our quality standards. For starters, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its spectacular EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its number of video gaming terminals sold has disappointed. On top of that, its projected EPS for the next year is lacking.

Accel Entertainment’s P/E ratio based on the next 12 months is 13.3x. While this valuation is fair, the upside isn’t great compared to the potential downside. There are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $15.17 on the company (compared to the current share price of $11.29).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.