Archer-Daniels-Midland (ADM)

We wouldn’t buy Archer-Daniels-Midland. Its low returns on capital and plummeting sales suggest it struggles to generate demand and profits, a red flag.― StockStory Analyst Team

1. News

2. Summary

Why We Think Archer-Daniels-Midland Will Underperform

Transforming crops from the world's most productive agricultural regions into everyday essentials, Archer-Daniels-Midland (NYSE:ADM) processes and transports agricultural commodities like grains and oilseeds while manufacturing ingredients for food, beverages, feed, and industrial applications.

- Sales tumbled by 7.5% annually over the last three years, showing consumer trends are working against its favor

- Easily substituted products (and therefore stiff competition) result in an inferior gross margin of 6.5% that must be offset through higher volumes

- Earnings per share have dipped by 24.2% annually over the past three years, which is concerning because stock prices follow EPS over the long term

Archer-Daniels-Midland doesn’t fulfill our quality requirements. We believe there are better businesses elsewhere.

Why There Are Better Opportunities Than Archer-Daniels-Midland

Why There Are Better Opportunities Than Archer-Daniels-Midland

Archer-Daniels-Midland is trading at $69.49 per share, or 16.9x forward P/E. Archer-Daniels-Midland’s multiple may seem like a great deal among consumer staples peers, but we think there are valid reasons why it’s this cheap.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Archer-Daniels-Midland (ADM) Research Report: Q4 CY2025 Update

Agricultural supply chain giant Archer-Daniels-Midland (NYSE:ADM) missed Wall Street’s revenue expectations in Q4 CY2025, with sales falling 13.7% year on year to $18.56 billion. Its non-GAAP profit of $0.87 per share was 9.2% above analysts’ consensus estimates.

Archer-Daniels-Midland (ADM) Q4 CY2025 Highlights:

- Revenue: $18.56 billion vs analyst estimates of $21.24 billion (13.7% year-on-year decline, 12.6% miss)

- Adjusted EPS: $0.87 vs analyst estimates of $0.80 (9.2% beat)

- Operating Margin: 2.6%, in line with the same quarter last year

- Market Capitalization: $32.72 billion

Company Overview

Transforming crops from the world's most productive agricultural regions into everyday essentials, Archer-Daniels-Midland (NYSE:ADM) processes and transports agricultural commodities like grains and oilseeds while manufacturing ingredients for food, beverages, feed, and industrial applications.

ADM operates through three main business segments. The Ag Services and Oilseeds segment sources, transports, and processes oilseeds like soybeans and canola into vegetable oils and protein meals. These products become ingredients in everything from salad oils and margarine to renewable diesel and livestock feed. The Carbohydrate Solutions segment converts corn and wheat into sweeteners, starches, syrups, and ethanol. This division also focuses on carbon capture initiatives to produce lower-emission alternatives to fossil-fuel-based materials. The Nutrition segment creates specialty ingredients including plant-based proteins, flavors, fiber, and probiotics for human consumption, as well as feed and supplements for livestock and pets.

A farmer might sell soybeans to ADM, which then transports them via its network of elevators, trucks, barges, and ships to processing facilities. There, the soybeans are crushed into oil that might become cooking oil for restaurants or meal that becomes feed for dairy cows. ADM's global infrastructure connects agricultural supply with demand across continents, serving food manufacturers, livestock producers, fuel companies, and industrial customers. The company makes money by purchasing raw agricultural commodities, adding value through processing and logistics, and selling the resulting products at higher margins.

4. Ingredients, Flavors & Fragrances

Ingredients, flavors, and fragrances companies supply essential components to food, beverage, personal care, and household product manufacturers. These firms develop proprietary formulations that enhance taste, scent, and texture, creating customer stickiness through specialized expertise and regulatory-approved ingredient portfolios. Tailwinds include growing consumer demand for natural and clean-label products, expansion in emerging markets, and innovation in plant-based and functional ingredients. However, headwinds persist from volatile raw material costs, particularly for agricultural and petrochemical inputs. Regulatory scrutiny over synthetic additives and fragrance allergens poses compliance challenges, while consolidation among major customers increases pricing pressure and negotiating leverage against suppliers.

ADM's competitors include other global agricultural processors and traders such as Bunge Global (NYSE:BG), Cargill (privately held), Louis Dreyfus Company (privately held), and Wilmar International (SGX:F34), in which ADM holds a 22.5% stake.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

With $80.27 billion in revenue over the past 12 months, Archer-Daniels-Midland is one of the most widely recognized consumer staples companies. Its influence over consumers gives it negotiating leverage with distributors, enabling it to pick and choose where it sells its products (a luxury many don’t have). However, its scale is a double-edged sword because it’s harder to find incremental growth when your existing brands have penetrated most of the market. To accelerate sales, Archer-Daniels-Midland likely needs to optimize its pricing or lean into new products and international expansion.

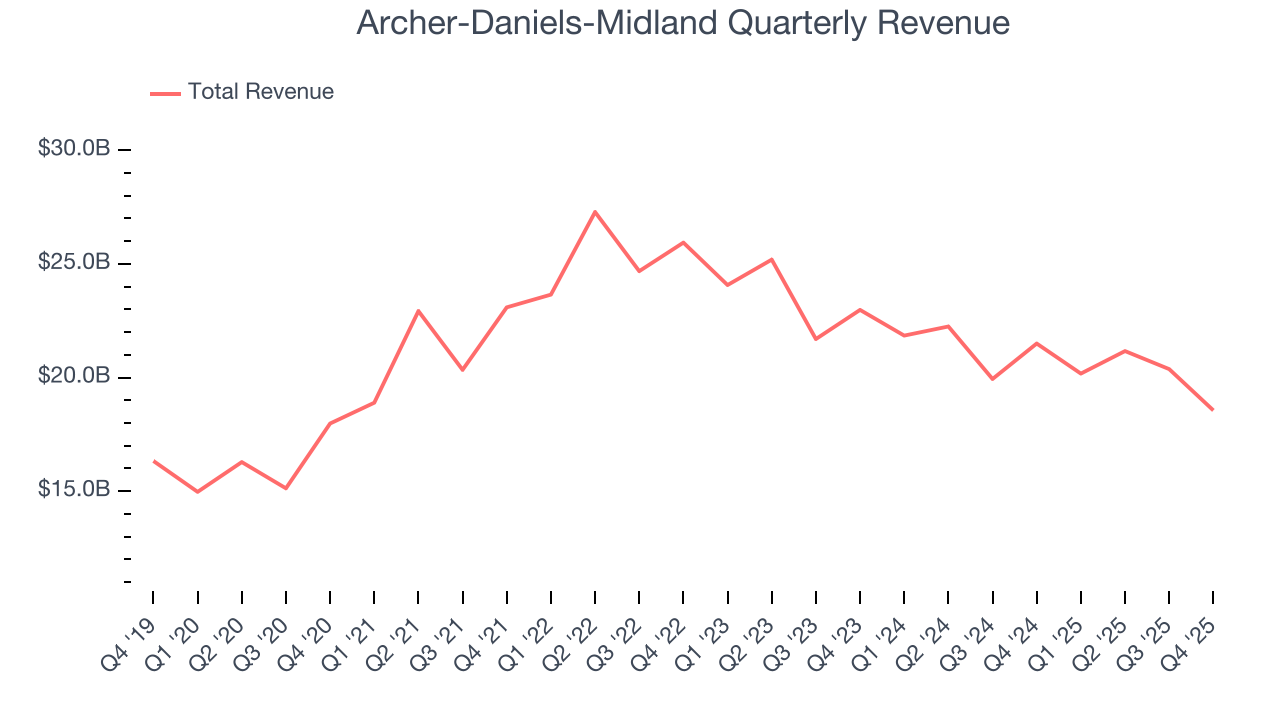

As you can see below, Archer-Daniels-Midland’s demand was weak over the last three years. Its sales fell by 7.5% annually, a tough starting point for our analysis.

This quarter, Archer-Daniels-Midland missed Wall Street’s estimates and reported a rather uninspiring 13.7% year-on-year revenue decline, generating $18.56 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 9.1% over the next 12 months, an acceleration versus the last three years. This projection is particularly healthy for a company of its scale and suggests its newer products will spur better top-line performance.

6. Gross Margin & Pricing Power

All else equal, we prefer higher gross margins because they usually indicate that a company sells more differentiated products, has a stronger brand, and commands pricing power.

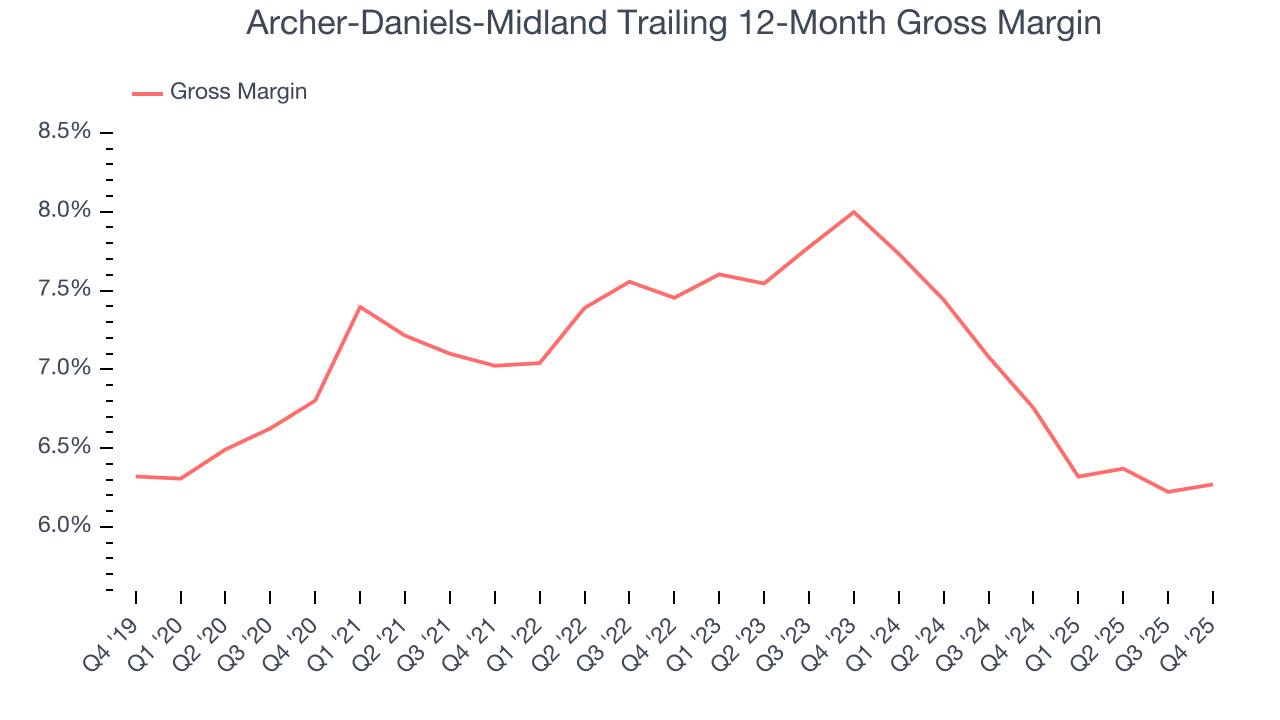

Archer-Daniels-Midland has bad unit economics for a consumer staples company, signaling it operates in a competitive market and lacks pricing power because its products can be substituted. As you can see below, it averaged a 6.5% gross margin over the last two years. Said differently, for every $100 in revenue, a chunky $93.48 went towards paying for raw materials, production of goods, transportation, and distribution.

Archer-Daniels-Midland produced a 6.5% gross profit margin in Q4, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

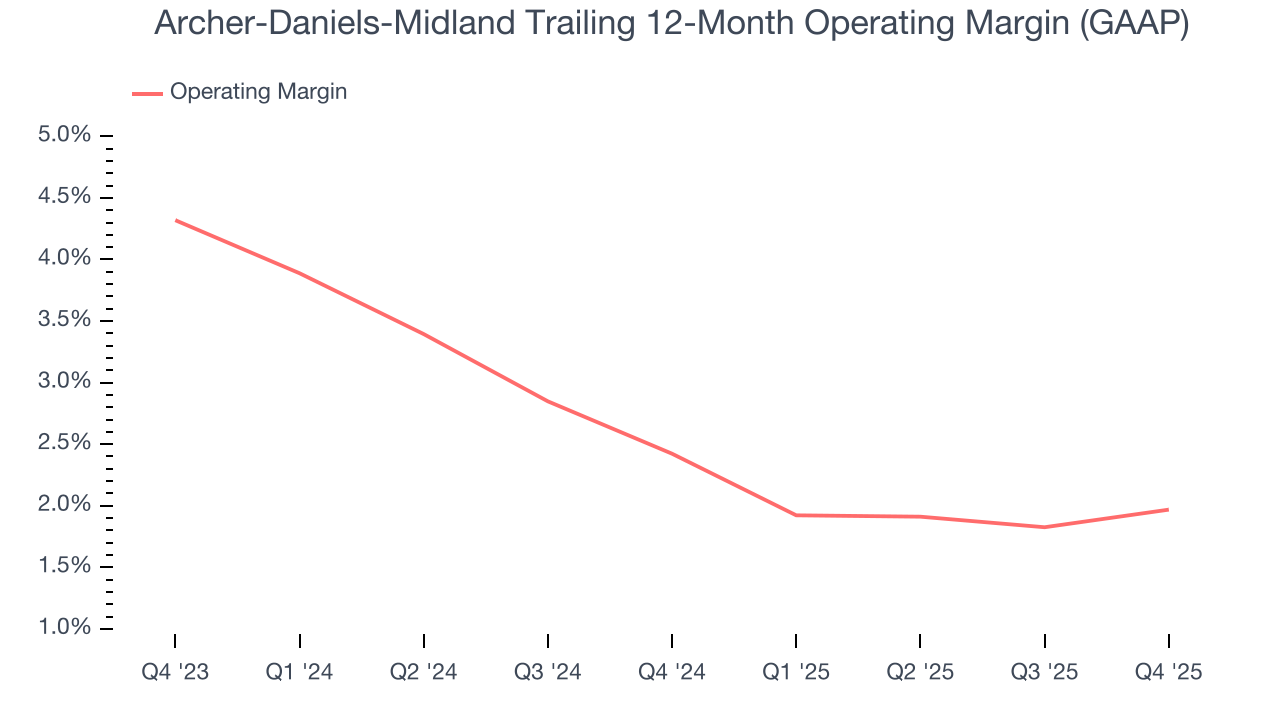

Archer-Daniels-Midland’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 2.2% over the last two years. This profitability was lousy for a consumer staples business and caused by its suboptimal cost structureand low gross margin.

Analyzing the trend in its profitability, Archer-Daniels-Midland’s operating margin might fluctuated slightly but has generally stayed the same over the last year, which doesn’t help its cause.

In Q4, Archer-Daniels-Midland generated an operating margin profit margin of 2.6%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

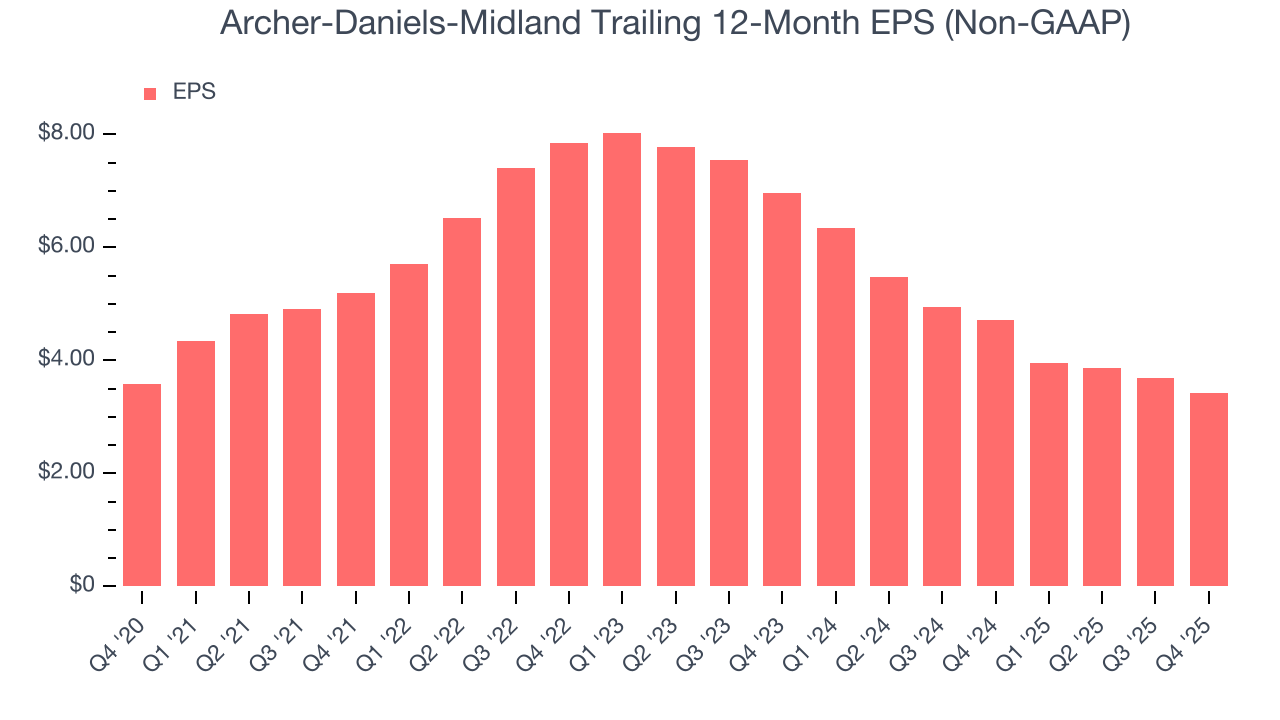

Sadly for Archer-Daniels-Midland, its EPS declined by 24.2% annually over the last three years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

In Q4, Archer-Daniels-Midland reported adjusted EPS of $0.87, down from $1.14 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 9.2%. Over the next 12 months, Wall Street expects Archer-Daniels-Midland’s full-year EPS of $3.42 to grow 26.8%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

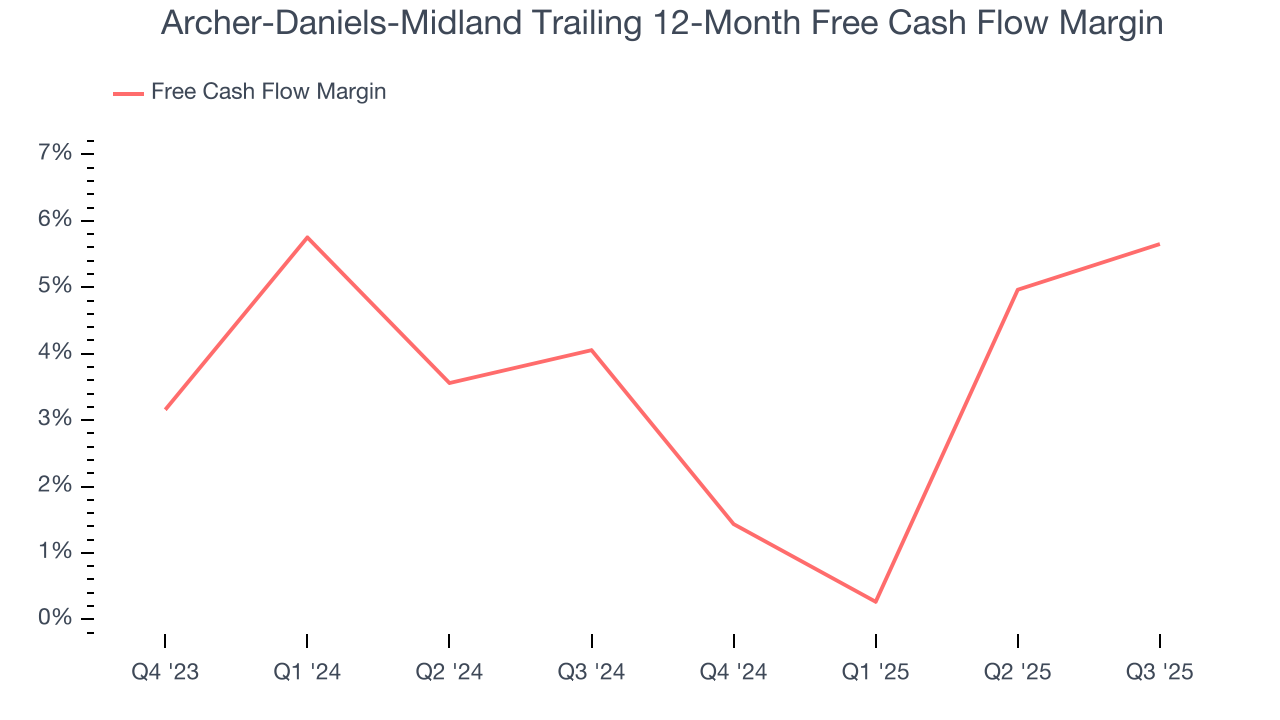

Archer-Daniels-Midland has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.1%, subpar for a consumer staples business.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

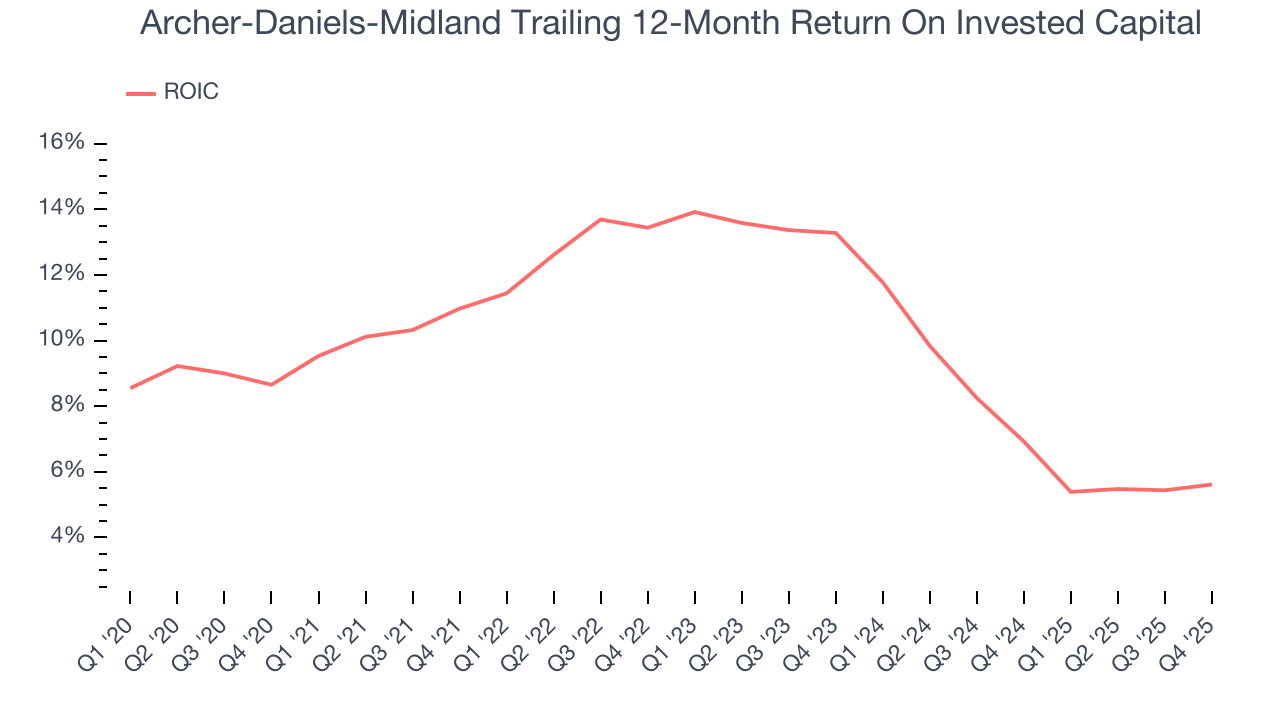

Archer-Daniels-Midland’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 10%, slightly better than typical consumer staples business.

11. Balance Sheet Assessment

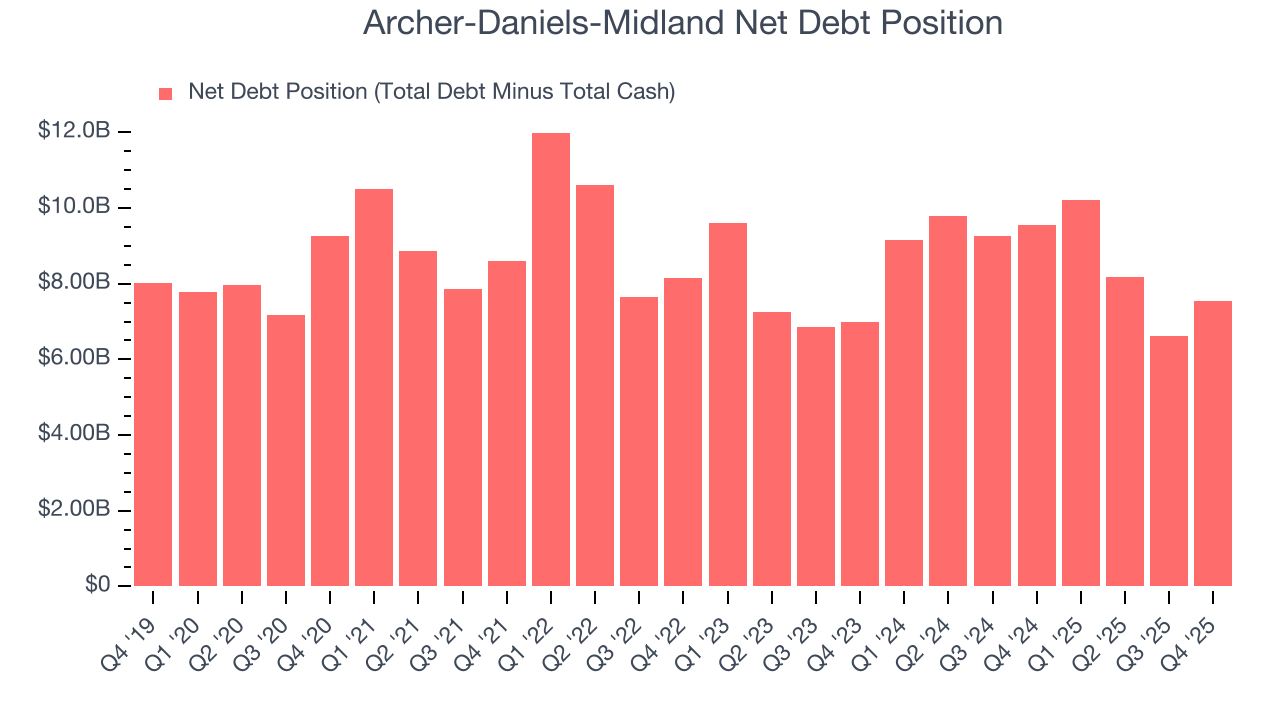

Archer-Daniels-Midland reported $865 million of cash and $8.41 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $3.66 billion of EBITDA over the last 12 months, we view Archer-Daniels-Midland’s 2.1× net-debt-to-EBITDA ratio as safe. We also see its $140 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Archer-Daniels-Midland’s Q4 Results

We were impressed by how significantly Archer-Daniels-Midland blew past analysts’ gross margin expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its revenue missed. Overall, this was a softer quarter. The stock traded down 3.4% to $65.79 immediately after reporting.

13. Is Now The Time To Buy Archer-Daniels-Midland?

Updated: February 13, 2026 at 12:02 AM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

We cheer for all companies serving everyday consumers, but in the case of Archer-Daniels-Midland, we’ll be cheering from the sidelines. First off, its revenue has declined over the last three years. While its unparalleled brand awareness makes it a household name consumers consistently turn to, the downside is its declining EPS over the last three years makes it a less attractive asset to the public markets. On top of that, its gross margins make it more challenging to reach positive operating profits compared to other consumer staples businesses.

Archer-Daniels-Midland’s P/E ratio based on the next 12 months is 16.9x. This valuation tells us a lot of optimism is priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $60.09 on the company (compared to the current share price of $69.49), implying they don’t see much short-term potential in Archer-Daniels-Midland.